444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Norway Oilfield Equipment Rental Services Market is a critical component of the offshore oil and gas sector, providing essential equipment and services for exploration, drilling, production, and maintenance activities in the North Sea.

Meaning

Oilfield Equipment Rental Services provide temporary access to a wide range of specialized machinery and tools for oil and gas exploration and production. Companies in this sector offer equipment such as drilling rigs, pumps, well-testing units, and downhole tools on a rental basis. This allows oil and gas operators to access the latest technology without the upfront cost of purchasing equipment. These services streamline operations, enhance flexibility, and optimize costs for oilfield projects. By renting equipment as needed, companies can efficiently manage their resources and respond dynamically to changing project requirements in the dynamic oil and gas industry.

Executive Summary

Oilfield equipment rental services in Norway are instrumental in ensuring the smooth operation of offshore oil and gas projects, optimizing costs, and adhering to stringent safety and environmental regulations.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

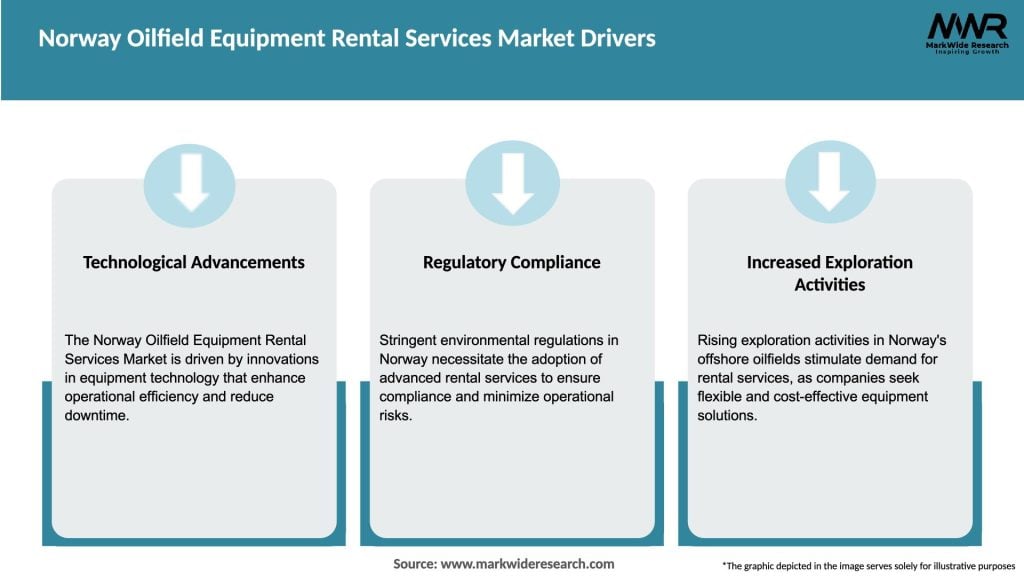

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Norway Oilfield Equipment Rental Services Market is driven by offshore exploration activities and the need for cost-effective solutions. However, market volatility and logistical challenges are factors to consider.

Regional Analysis

The Norwegian Continental Shelf is a key region for offshore oil and gas activities, with a high concentration of equipment rental services in areas such as the North Sea and the Barents Sea.

Competitive Landscape

Leading Companies in Norway Oilfield Equipment Rental Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on equipment type and service offerings.

Equipment Types:

Service Offerings:

Category-specific Insights

Drilling and Completion Equipment: Rental of drilling rigs, wellheads, and related equipment is crucial for exploration and well development.

Production Equipment: Rental services offer production platforms, pumps, and separators to maintain efficient production operations.

Subsea Equipment: Subsea rental equipment includes remotely operated vehicles (ROVs), umbilicals, and manifolds for subsea field development and maintenance.

Key Benefits for Industry Participants and Stakeholders

For Operators:

For Rental Providers:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic disrupted supply chains and temporarily reduced offshore activities. However, the resilience of the oil and gas industry and the strategic importance of Norway’s offshore resources have mitigated long-term impacts.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Norway Oilfield Equipment Rental Services Market is expected to continue evolving in response to offshore exploration activities, the green energy transition, and digitalization trends. While challenges exist, the market’s strategic importance in supporting Norway’s offshore resources ensures a positive outlook.

Conclusion

The Norway Oilfield Equipment Rental Services Market is a cornerstone of the nation’s offshore oil and gas industry, providing essential support for exploration, production, and safety. As Norway navigates the transition towards renewable energy, equipment rental services are diversifying into new sectors while embracing digitalization to optimize operations. Despite market fluctuations and logistical challenges, the market’s future remains promising, ensuring its continued role in supporting Norway’s offshore endeavors.

What is Oilfield Equipment Rental Services?

Oilfield Equipment Rental Services refer to the provision of specialized equipment and tools for oil and gas exploration and production, allowing companies to access necessary resources without the need for significant capital investment. This includes drilling rigs, pumps, and other essential machinery used in various stages of oilfield operations.

What are the key players in the Norway Oilfield Equipment Rental Services Market?

Key players in the Norway Oilfield Equipment Rental Services Market include companies like Aker Solutions, Halliburton, and Schlumberger, which provide a range of rental equipment and services tailored to the oil and gas industry, among others.

What are the growth factors driving the Norway Oilfield Equipment Rental Services Market?

The Norway Oilfield Equipment Rental Services Market is driven by factors such as increasing offshore exploration activities, the need for cost-effective solutions in oil production, and advancements in drilling technologies that enhance operational efficiency.

What challenges does the Norway Oilfield Equipment Rental Services Market face?

Challenges in the Norway Oilfield Equipment Rental Services Market include fluctuating oil prices, regulatory compliance issues, and the high costs associated with maintaining and upgrading rental equipment to meet industry standards.

What opportunities exist in the Norway Oilfield Equipment Rental Services Market?

Opportunities in the Norway Oilfield Equipment Rental Services Market include the growing demand for sustainable and environmentally friendly equipment, the expansion of renewable energy projects, and the potential for technological innovations that improve equipment efficiency.

What trends are shaping the Norway Oilfield Equipment Rental Services Market?

Trends in the Norway Oilfield Equipment Rental Services Market include the increasing adoption of digital technologies for equipment management, a shift towards modular and flexible rental solutions, and a focus on enhancing safety and environmental performance in oilfield operations.

Norway Oilfield Equipment Rental Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Drilling Equipment, Well Testing, Production Services, Maintenance Services |

| End User | Exploration Companies, Production Firms, Service Providers, Contractors |

| Technology | Hydraulic Systems, Automation Solutions, Monitoring Equipment, Safety Systems |

| Application | Offshore Operations, Onshore Operations, Subsea Activities, Environmental Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Norway Oilfield Equipment Rental Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at