444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Norway oil and gas EPC market represents a cornerstone of the nation’s energy infrastructure, encompassing engineering, procurement, and construction services for offshore and onshore petroleum projects. Norway’s position as one of Europe’s leading oil and gas producers has established a robust ecosystem of EPC contractors specializing in complex Arctic and North Sea operations. The market demonstrates remarkable resilience with sustained growth rates of 6.2% CAGR driven by continuous field developments and infrastructure modernization initiatives.

Market dynamics reflect Norway’s commitment to maintaining its energy leadership while transitioning toward sustainable practices. The EPC sector serves critical functions including platform construction, subsea installations, pipeline development, and facility upgrades across the Norwegian Continental Shelf. Technological advancement remains paramount, with contractors increasingly adopting digital solutions and automation technologies to enhance operational efficiency and safety standards.

Regional concentration centers around key industrial hubs including Stavanger, Bergen, and Trondheim, where major EPC contractors maintain strategic operations. The market benefits from government support through favorable regulatory frameworks and tax incentives that encourage continued investment in oil and gas infrastructure development.

The Norway oil and gas EPC market refers to the comprehensive sector encompassing engineering, procurement, and construction services specifically designed for petroleum industry projects within Norwegian territorial waters and onshore facilities. This market includes specialized contractors who provide end-to-end project delivery services for offshore platforms, subsea systems, processing facilities, and supporting infrastructure required for oil and gas exploration, production, and transportation activities.

EPC contractors in this market typically handle complex project phases from initial design and engineering through equipment procurement and final construction delivery. The sector encompasses both traditional oil and gas projects and emerging hybrid developments that integrate renewable energy components, reflecting Norway’s evolving energy landscape.

Norway’s oil and gas EPC market continues demonstrating robust performance despite global energy transition pressures, maintaining its position as a critical component of the nation’s economic foundation. The market exhibits strong fundamentals supported by ongoing field developments, infrastructure maintenance requirements, and technological innovation initiatives across the Norwegian Continental Shelf.

Key market drivers include sustained production from mature fields, new exploration activities in frontier areas, and increasing focus on operational efficiency improvements. The sector benefits from 67% of projects incorporating advanced digital technologies, enhancing project delivery capabilities and safety performance standards.

Competitive landscape features both international EPC giants and specialized Norwegian contractors, creating a dynamic environment that fosters innovation and technical excellence. Market participants increasingly emphasize sustainability integration, with 45% of new projects including carbon reduction technologies and environmental optimization measures.

Future prospects remain positive, supported by Norway’s long-term energy strategy and continued investment in offshore infrastructure development. The market anticipates sustained growth through strategic project pipelines and emerging opportunities in floating production systems and subsea technology advancement.

Strategic insights reveal several critical factors shaping the Norway oil and gas EPC market landscape:

Primary market drivers propelling the Norway oil and gas EPC sector include sustained production requirements from existing fields and continuous infrastructure development needs. Field maintenance and upgrade projects represent significant opportunities, as aging offshore installations require modernization to maintain operational efficiency and safety compliance.

Exploration activities in frontier regions, particularly in the Arctic and deeper North Sea areas, create substantial demand for specialized EPC services. These projects require advanced engineering solutions and construction capabilities tailored to challenging environmental conditions. Technological advancement serves as another key driver, with operators seeking innovative solutions to optimize production and reduce operational costs.

Government policy support through favorable tax regimes and regulatory frameworks encourages continued investment in oil and gas infrastructure. The Norwegian government’s commitment to maintaining energy security while pursuing environmental objectives creates balanced market conditions supporting EPC activity growth.

Energy transition initiatives paradoxically drive EPC demand as companies invest in cleaner production technologies and carbon capture solutions. This trend creates new project categories requiring specialized engineering and construction expertise, expanding market opportunities for qualified contractors.

Market constraints affecting the Norway oil and gas EPC sector include increasing environmental regulations and public pressure regarding fossil fuel development. Regulatory complexity continues expanding, requiring contractors to invest significantly in compliance capabilities and environmental management systems, potentially impacting project economics.

Cost pressures from volatile oil prices create challenges for project sanctioning and execution, leading to delayed investment decisions and compressed project margins. The high-cost operating environment in Norway, while supporting quality standards, can limit competitiveness compared to other global markets.

Skilled labor shortages in specialized technical areas pose ongoing challenges, particularly for complex offshore projects requiring extensive expertise. The aging workforce and competition from other industries for technical talent create recruitment and retention difficulties for EPC contractors.

Environmental activism and changing public sentiment toward fossil fuel development create uncertainty regarding long-term project viability. This uncertainty can impact investment decisions and project financing, potentially constraining market growth opportunities.

Significant opportunities emerge from Norway’s position as a technology leader in offshore engineering and construction. The expertise developed in challenging North Sea conditions creates export potential for Norwegian EPC contractors in similar harsh environment markets globally. Technology transfer and international project participation represent substantial growth avenues.

Carbon capture and storage projects present new market segments requiring specialized EPC capabilities. Norway’s leadership in CCS development creates opportunities for contractors to develop expertise in this emerging field while supporting national climate objectives.

Floating production systems and subsea technology advancement offer growth opportunities as operators seek more flexible and cost-effective development solutions. The increasing complexity of these systems requires advanced engineering and construction capabilities that Norwegian contractors are well-positioned to provide.

Renewable energy integration with oil and gas operations creates hybrid project opportunities combining traditional EPC expertise with clean energy technologies. This convergence enables contractors to diversify service offerings while supporting energy transition objectives.

Market dynamics in Norway’s oil and gas EPC sector reflect the interplay between traditional energy demands and evolving sustainability requirements. Project complexity continues increasing as operators pursue more challenging developments in deeper waters and harsh environments, requiring advanced engineering solutions and specialized construction techniques.

Competitive intensity remains high among EPC contractors, driving continuous improvement in project delivery capabilities and cost efficiency. Market participants increasingly differentiate through technology integration, safety performance, and environmental stewardship, with 78% of contractors investing significantly in digital transformation initiatives.

Supply chain optimization represents a critical dynamic, as contractors seek to balance local content requirements with global sourcing opportunities. The emphasis on Norwegian suppliers supports domestic economic objectives while potentially impacting project costs and delivery schedules.

Risk management capabilities become increasingly important as projects face greater technical, environmental, and regulatory challenges. Contractors with proven risk mitigation strategies and strong safety records maintain competitive advantages in project bidding and execution.

Comprehensive research methodology employed for analyzing the Norway oil and gas EPC market combines primary and secondary research approaches to ensure data accuracy and market insight reliability. Primary research includes extensive interviews with industry executives, project managers, and technical specialists across major EPC contractors and oil and gas operators.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and regulatory filings to establish market baseline data and trend identification. Data triangulation methods ensure information accuracy through cross-verification of multiple sources and expert validation.

Market modeling techniques incorporate historical performance data, current project pipelines, and forward-looking indicators to develop comprehensive market assessments. Statistical analysis methods identify correlation patterns and trend projections supporting strategic insights development.

Expert consultation with industry specialists provides qualitative insights complementing quantitative data analysis. This approach ensures research findings reflect practical market realities and emerging trend identification.

Regional distribution within Norway’s oil and gas EPC market demonstrates concentration around key industrial centers and offshore operational areas. Stavanger region maintains the largest market share at approximately 42% of total activity, serving as the primary hub for offshore oil and gas operations and supporting EPC services.

Bergen area represents the second-largest regional market, accounting for 28% of EPC activities, particularly strong in subsea technology and marine engineering services. The region benefits from established maritime industry infrastructure and specialized technical capabilities supporting complex offshore projects.

Trondheim region contributes 18% of market activity, focusing on technology development and research-intensive EPC services. The presence of leading technical universities and research institutions supports innovation in offshore engineering and construction methodologies.

Northern Norway represents an emerging market segment with 12% share, driven by increasing Arctic exploration activities and specialized cold-weather engineering requirements. This region offers growth potential as operators expand activities in frontier areas requiring specialized EPC capabilities.

Competitive landscape in Norway’s oil and gas EPC market features a mix of international contractors and specialized Norwegian companies, creating dynamic competition that drives innovation and service excellence. Market leadership positions are held by companies demonstrating strong track records in complex offshore project delivery.

Competitive differentiation increasingly focuses on technology integration, safety performance, and environmental stewardship capabilities. Companies investing in digital transformation and sustainability initiatives maintain stronger market positions and project win rates.

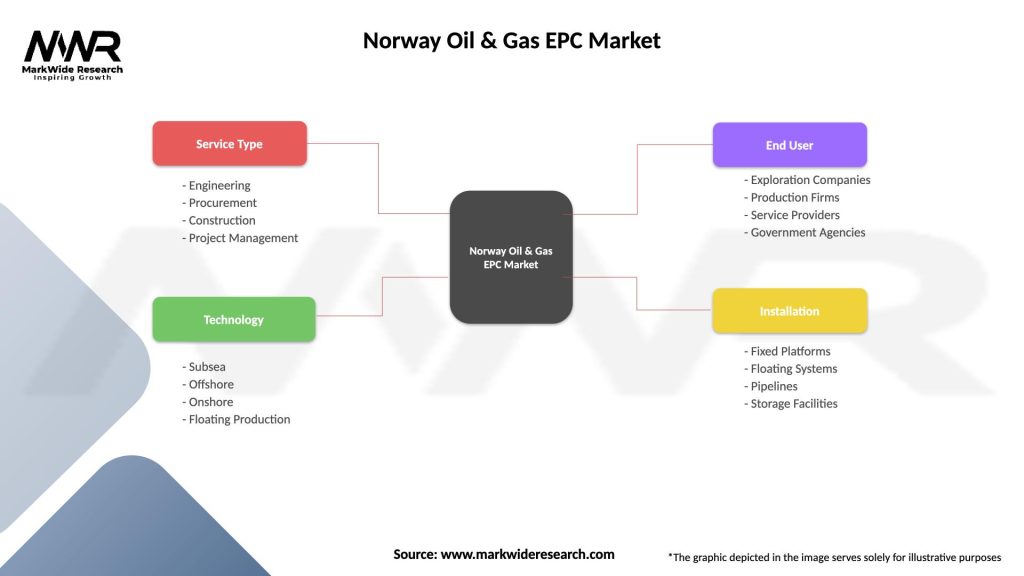

Market segmentation analysis reveals distinct categories within Norway’s oil and gas EPC sector, each characterized by specific technical requirements and market dynamics.

By Service Type:

By Application Area:

By Project Phase:

Offshore platform EPC represents the largest market category, driven by continuous development of North Sea oil and gas fields. This segment requires specialized expertise in harsh environment engineering and construction, with Norwegian contractors maintaining competitive advantages through extensive local experience and proven track records.

Subsea systems EPC demonstrates the highest growth potential, supported by increasing adoption of subsea production technologies and deepwater development activities. Technology innovation in this category focuses on enhanced reliability, remote operation capabilities, and reduced maintenance requirements.

Onshore facilities EPC provides stable market foundation through processing plant construction and terminal development projects. This category benefits from established supply chains and standardized construction methodologies, enabling efficient project delivery and competitive pricing.

Pipeline EPC services support critical infrastructure development connecting offshore production to onshore processing facilities. Projects in this category increasingly incorporate advanced materials and installation techniques to ensure long-term reliability and environmental protection.

Modification and upgrade projects represent growing market segments as aging infrastructure requires modernization to maintain operational efficiency and regulatory compliance. These projects often involve complex engineering challenges requiring specialized technical expertise and innovative solutions.

Industry participants in Norway’s oil and gas EPC market benefit from several strategic advantages supporting business growth and operational success. Technical expertise developed through challenging North Sea projects creates valuable capabilities applicable to global markets, enabling international expansion opportunities.

Stakeholder benefits include:

Technology advancement benefits all stakeholders through improved project efficiency, enhanced safety performance, and reduced environmental impact. The collaborative approach between operators, contractors, and suppliers fosters innovation and continuous improvement in project delivery capabilities.

Knowledge transfer from experienced professionals to younger generations ensures continuity of technical expertise and maintains Norway’s competitive position in global oil and gas markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Norway’s oil and gas EPC market, with contractors increasingly adopting advanced technologies to enhance project delivery capabilities. Building Information Modeling (BIM), artificial intelligence, and digital twin technologies are becoming standard tools for complex project management and execution.

Sustainability integration drives fundamental changes in project design and execution methodologies. EPC contractors increasingly incorporate environmental considerations throughout project lifecycles, with 85% of new projects including specific sustainability targets and carbon reduction measures.

Modularization trends continue gaining momentum as contractors seek to improve project efficiency and reduce offshore construction activities. Standardized modules fabricated onshore enable faster installation and reduced weather-related delays, improving overall project economics.

Collaborative partnerships between operators, contractors, and technology providers are becoming more strategic and long-term oriented. These alliances enable shared risk management, technology development, and capability building that benefits all participants.

Workforce development initiatives focus on attracting younger professionals and developing skills in emerging technologies. Companies invest significantly in training programs and educational partnerships to ensure adequate technical capabilities for future projects.

Recent industry developments highlight the dynamic nature of Norway’s oil and gas EPC market and emerging trends shaping future growth. Technology partnerships between major contractors and software companies are accelerating digital transformation initiatives across the sector.

Major project awards continue supporting market activity, with several significant offshore developments receiving final investment decisions. These projects demonstrate continued confidence in Norwegian oil and gas resources and the capabilities of local EPC contractors.

Sustainability initiatives are expanding rapidly, with multiple contractors announcing carbon neutrality commitments and environmental performance targets. According to MarkWide Research analysis, these initiatives are becoming critical factors in project selection and contractor evaluation processes.

International expansion activities by Norwegian EPC contractors are increasing, leveraging domestic expertise in global markets. Several companies have secured significant contracts in similar harsh environment regions, demonstrating the export potential of Norwegian capabilities.

Research and development investments continue growing, with industry participants collaborating on advanced technology development projects. These initiatives focus on automation, robotics, and environmental technologies that will define future project capabilities.

Strategic recommendations for Norway oil and gas EPC market participants emphasize the importance of balancing traditional capabilities with emerging technology adoption. Investment priorities should focus on digital transformation initiatives that enhance project delivery efficiency and competitive positioning.

Diversification strategies become increasingly important as the energy landscape evolves. EPC contractors should develop capabilities in adjacent markets including renewable energy, carbon capture, and environmental services to reduce dependence on traditional oil and gas projects.

Talent management requires immediate attention to address aging workforce challenges and skill gaps in emerging technologies. Companies should invest in comprehensive training programs and partnerships with educational institutions to ensure adequate technical capabilities.

International expansion opportunities should be pursued strategically, leveraging Norwegian expertise in harsh environment projects. Target markets with similar technical challenges and regulatory frameworks offer the best prospects for successful expansion.

Sustainability integration must become a core business strategy rather than an add-on consideration. Companies that successfully integrate environmental performance with technical excellence will maintain competitive advantages in evolving market conditions.

Future prospects for Norway’s oil and gas EPC market remain positive despite global energy transition pressures, supported by continued production from existing fields and new development opportunities. MWR projections indicate sustained market activity through the next decade, driven by infrastructure maintenance requirements and selective new project developments.

Technology evolution will continue reshaping market dynamics, with advanced digitalization and automation becoming standard requirements for project success. Contractors investing early in these capabilities will maintain competitive advantages and capture larger market shares.

Market growth is expected to maintain steady momentum with projected annual growth rates of 5.8% over the medium term. This growth will be supported by a combination of traditional oil and gas projects and emerging opportunities in carbon management and renewable energy integration.

Regulatory evolution will likely increase environmental requirements and safety standards, creating opportunities for contractors with advanced compliance capabilities. Companies that proactively adapt to changing regulations will benefit from reduced project risks and enhanced market positioning.

International opportunities for Norwegian EPC contractors are expected to expand significantly, particularly in Arctic regions and other harsh environment markets. The expertise developed in Norwegian waters provides valuable competitive advantages in similar global markets.

Norway’s oil and gas EPC market demonstrates remarkable resilience and adaptation capability in the face of evolving energy market dynamics. The sector’s foundation of technical excellence, regulatory compliance, and innovation leadership positions it well for continued success despite global energy transition pressures.

Market fundamentals remain strong, supported by ongoing production requirements, infrastructure development needs, and emerging opportunities in carbon management and environmental services. The combination of experienced contractors, advanced technology adoption, and supportive regulatory frameworks creates a favorable environment for sustained market growth.

Strategic positioning for future success requires balanced investment in traditional capabilities and emerging technologies. Companies that successfully navigate this transition while maintaining operational excellence will capture the greatest opportunities in Norway’s evolving energy landscape. The market’s proven ability to adapt and innovate ensures continued relevance in the global energy sector, making it an attractive destination for investment and development activities.

What is Oil & Gas EPC?

Oil & Gas EPC refers to the Engineering, Procurement, and Construction services specifically tailored for the oil and gas sector. This includes the design, sourcing of materials, and construction of facilities such as refineries, pipelines, and offshore platforms.

What are the key players in the Norway Oil & Gas EPC Market?

Key players in the Norway Oil & Gas EPC Market include Aker Solutions, KBR, TechnipFMC, and Subsea 7, among others. These companies are involved in various projects ranging from offshore oil field development to gas processing facilities.

What are the main drivers of the Norway Oil & Gas EPC Market?

The main drivers of the Norway Oil & Gas EPC Market include the increasing demand for energy, advancements in extraction technologies, and the need for infrastructure upgrades. Additionally, the push for sustainable energy solutions is influencing project designs and implementations.

What challenges does the Norway Oil & Gas EPC Market face?

The Norway Oil & Gas EPC Market faces challenges such as fluctuating oil prices, regulatory compliance, and environmental concerns. These factors can impact project viability and investment decisions.

What opportunities exist in the Norway Oil & Gas EPC Market?

Opportunities in the Norway Oil & Gas EPC Market include the development of renewable energy projects, digital transformation in operations, and the expansion of existing oil and gas infrastructure. Companies are increasingly looking to innovate and adapt to changing market conditions.

What trends are shaping the Norway Oil & Gas EPC Market?

Trends shaping the Norway Oil & Gas EPC Market include the integration of digital technologies, a focus on sustainability, and the shift towards more efficient project management practices. These trends are driving improvements in operational efficiency and reducing environmental impact.

Norway Oil & Gas EPC Market

| Segmentation Details | Description |

|---|---|

| Service Type | Engineering, Procurement, Construction, Project Management |

| Technology | Subsea, Offshore, Onshore, Floating Production |

| End User | Exploration Companies, Production Firms, Service Providers, Government Agencies |

| Installation | Fixed Platforms, Floating Systems, Pipelines, Storage Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Norway Oil & Gas EPC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at