444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Norway offshore oil and gas decommissioning market is a crucial sector in the energy industry. Decommissioning refers to the process of dismantling and removing offshore oil and gas platforms and infrastructure that have reached the end of their productive lives. Norway, with its extensive offshore oil and gas reserves, has a significant need for decommissioning activities.

Meaning

Offshore oil and gas decommissioning involves the safe and environmentally responsible removal of offshore platforms, pipelines, and associated infrastructure. As oil and gas fields reach the end of their economic lives, decommissioning becomes necessary to ensure the long-term sustainability of the marine environment. It involves activities such as well plugging, facility removal, and site remediation.

Executive Summary

The Norway offshore oil and gas decommissioning market is experiencing steady growth due to the maturing oil and gas fields in the Norwegian Continental Shelf (NCS). As many platforms and infrastructure reach the end of their life cycles, decommissioning activities are essential to maintain environmental standards and ensure the sustainable use of offshore resources. This report provides an in-depth analysis of the market dynamics, key trends, opportunities, and challenges in the Norway offshore oil and gas decommissioning market.

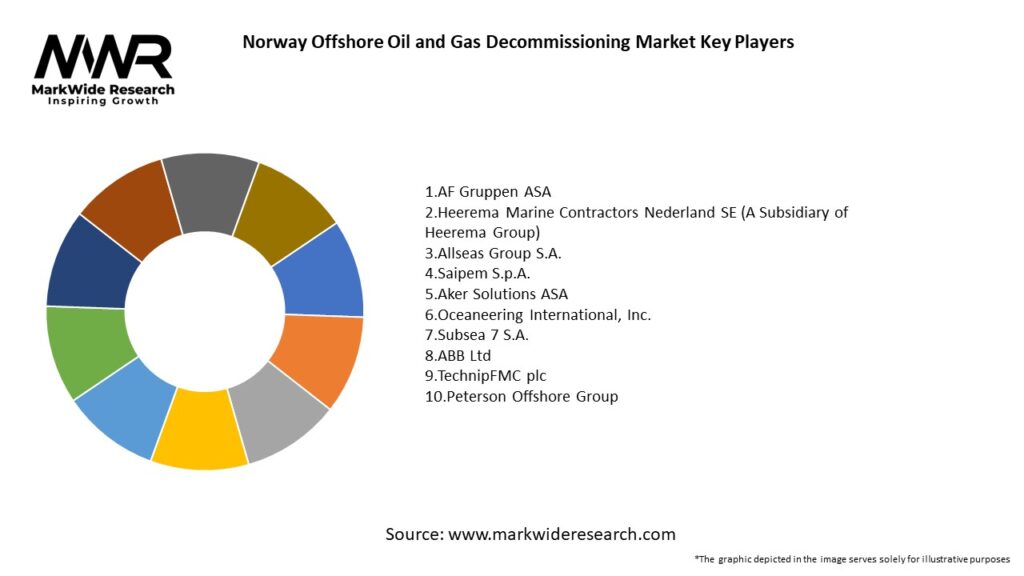

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

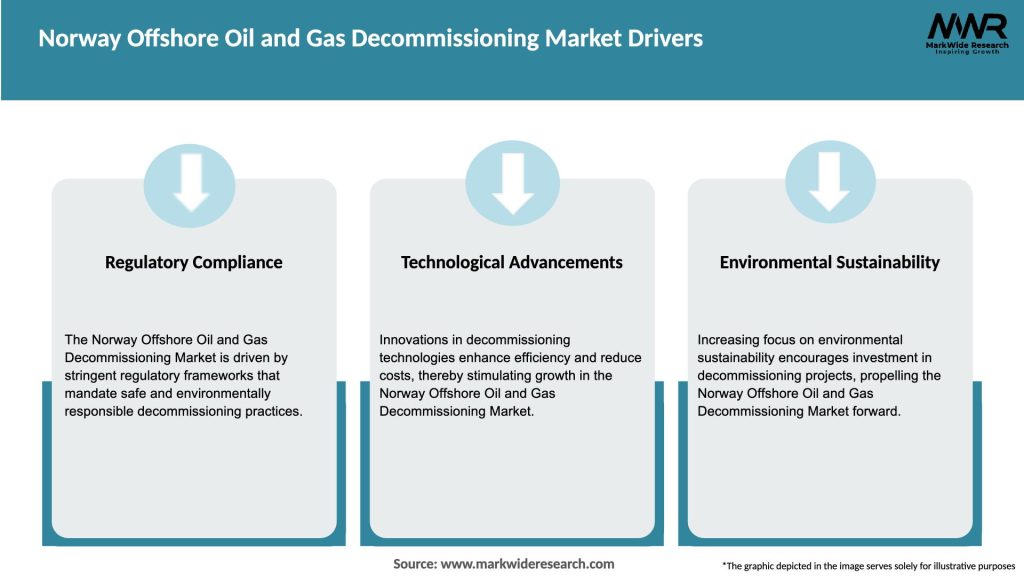

The Norway offshore oil and gas decommissioning market is driven by a combination of regulatory requirements, technological advancements, and the aging infrastructure. While strict environmental regulations and the need for compliance provide a push for decommissioning activities, technological advancements enable more efficient and cost-effective decommissioning operations. However, the high cost and technical challenges associated with decommissioning act as restraining factors. The market offers opportunities for collaboration, knowledge sharing, and service innovation.

Regional Analysis

The Norway offshore oil and gas decommissioning market is primarily concentrated in the Norwegian Continental Shelf (NCS). The NCS is home to numerous oil and gas fields that have been in production for several decades. As these fields reach the end of their productive lives, decommissioning activities are becoming more prevalent in the region. The NCS provides favorable conditions for decommissioning due to its well-developed infrastructure, skilled workforce, and robust regulatory framework.

Competitive Landscape

Leading Companies in Norway Offshore Oil and Gas Decommissioning Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

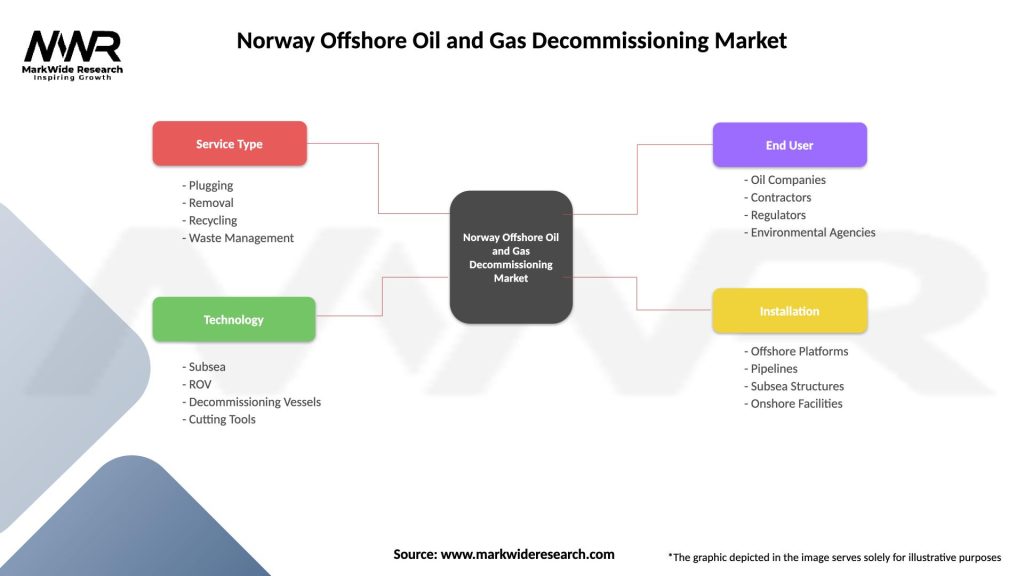

Segmentation

The Norway offshore oil and gas decommissioning market can be segmented based on the type of infrastructure being decommissioned, such as platforms, pipelines, and subsea structures. It can also be segmented based on the decommissioning methods employed, including complete removal, partial removal, and in-place decommissioning.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both short-term and long-term impacts on the Norway offshore oil and gas decommissioning market. In the short term, the pandemic disrupted operations and caused delays in decommissioning projects due to travel restrictions and reduced workforce availability. However,the long-term impact of the pandemic has also brought some positive changes to the market. It has accelerated the adoption of digital technologies and remote working practices, enabling more efficient and cost-effective decommissioning operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Norway offshore oil and gas decommissioning market is optimistic. As more oil and gas fields in the Norwegian Continental Shelf reach the end of their productive lives, decommissioning activities will continue to increase. The market will witness further technological advancements, cost optimizations, and environmental stewardship. Collaboration and knowledge sharing among industry players will play a crucial role in driving innovation and efficiency.

Conclusion

The Norway offshore oil and gas decommissioning market is a vital sector in the energy industry. With the maturing oil and gas fields in the Norwegian Continental Shelf, decommissioning activities are becoming increasingly necessary. Strict environmental regulations, aging infrastructure, and technological advancements drive the market. While high costs and technical challenges pose restraints, collaboration, innovation, and adherence to regulatory changes offer opportunities. The market’s future looks promising, with a focus on sustainability, circular economy approaches, and digitalization. Continued collaboration, knowledge sharing, and adaptation to regulatory changes will be crucial for success in the Norway offshore oil and gas decommissioning market.

What is Offshore Oil and Gas Decommissioning?

Offshore oil and gas decommissioning refers to the process of safely closing down and removing offshore oil and gas facilities, including platforms and pipelines, after they are no longer in use. This process is essential for environmental protection and involves various stages such as site assessment, removal, and site restoration.

What are the key players in the Norway Offshore Oil and Gas Decommissioning Market?

Key players in the Norway Offshore Oil and Gas Decommissioning Market include Equinor, Aker Solutions, and TechnipFMC, which are involved in various aspects of decommissioning projects. These companies provide services ranging from engineering and project management to the actual dismantling of offshore structures, among others.

What are the main drivers of the Norway Offshore Oil and Gas Decommissioning Market?

The main drivers of the Norway Offshore Oil and Gas Decommissioning Market include the aging of offshore infrastructure, regulatory requirements for environmental safety, and the increasing focus on sustainable energy practices. Additionally, the transition towards renewable energy sources is prompting operators to decommission older facilities.

What challenges does the Norway Offshore Oil and Gas Decommissioning Market face?

The Norway Offshore Oil and Gas Decommissioning Market faces challenges such as high costs associated with decommissioning projects, complex regulatory frameworks, and the technical difficulties of safely removing large structures from the seabed. These factors can lead to delays and increased project budgets.

What opportunities exist in the Norway Offshore Oil and Gas Decommissioning Market?

Opportunities in the Norway Offshore Oil and Gas Decommissioning Market include the development of innovative technologies for decommissioning processes, increased investment in sustainable practices, and the potential for repurposing decommissioned sites for renewable energy projects. These factors can enhance the efficiency and sustainability of decommissioning efforts.

What trends are shaping the Norway Offshore Oil and Gas Decommissioning Market?

Trends shaping the Norway Offshore Oil and Gas Decommissioning Market include the adoption of advanced technologies such as robotics and automation for decommissioning tasks, a growing emphasis on environmental sustainability, and collaborative efforts among industry stakeholders to share best practices. These trends are driving improvements in safety and efficiency.

Norway Offshore Oil and Gas Decommissioning Market

| Segmentation Details | Description |

|---|---|

| Service Type | Plugging, Removal, Recycling, Waste Management |

| Technology | Subsea, ROV, Decommissioning Vessels, Cutting Tools |

| End User | Oil Companies, Contractors, Regulators, Environmental Agencies |

| Installation | Offshore Platforms, Pipelines, Subsea Structures, Onshore Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Norway Offshore Oil and Gas Decommissioning Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at