444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Norway electric vehicle charging equipment market stands as a global benchmark for sustainable transportation infrastructure, representing one of the most mature and sophisticated charging ecosystems worldwide. Norway’s exceptional commitment to electric mobility has resulted in the highest per capita electric vehicle adoption rate globally, driving unprecedented demand for comprehensive charging solutions across residential, commercial, and public sectors.

Market dynamics in Norway reflect a unique combination of government incentives, environmental consciousness, and technological innovation that has created an optimal environment for charging infrastructure development. The country’s ambitious goal of achieving 100% electric vehicle sales by 2025 has accelerated investment in charging equipment, making Norway a testing ground for next-generation charging technologies and business models.

Infrastructure development has progressed rapidly, with charging equipment installations growing at a remarkable 28% annually, supported by both public initiatives and private sector investments. The market encompasses various charging solutions, from residential wall-mounted units to ultra-fast highway charging stations, each serving specific user needs and contributing to the comprehensive charging network that supports Norway’s electric vehicle ecosystem.

Technological advancement remains a key characteristic of the Norwegian market, with early adoption of smart charging solutions, renewable energy integration, and advanced payment systems. The market’s maturity provides valuable insights for other regions transitioning to electric mobility, demonstrating how policy support, infrastructure investment, and consumer acceptance can create a thriving charging equipment market.

The Norway electric vehicle charging equipment market refers to the comprehensive ecosystem of hardware, software, and services designed to provide electrical energy to battery electric vehicles and plug-in hybrid vehicles throughout Norway. This market encompasses all charging infrastructure components, from basic residential chargers to sophisticated commercial and public charging networks that enable widespread electric vehicle adoption.

Charging equipment in the Norwegian context includes various power levels and connector types, ranging from slow AC charging for overnight residential use to rapid DC fast charging for commercial and highway applications. The market covers hardware manufacturers, software providers, installation services, network operators, and maintenance services that collectively support the country’s electric vehicle charging infrastructure.

Market scope extends beyond simple equipment sales to include comprehensive charging solutions that integrate renewable energy sources, smart grid technologies, and advanced user interfaces. Norwegian charging equipment market represents a mature ecosystem where technology innovation, environmental sustainability, and user convenience converge to create world-leading charging infrastructure solutions.

Norway’s electric vehicle charging equipment market demonstrates exceptional growth momentum, driven by the country’s leadership in electric vehicle adoption and comprehensive policy support for sustainable transportation. The market has evolved from basic charging solutions to sophisticated smart charging ecosystems that integrate renewable energy, grid management, and user-centric services.

Key market drivers include Norway’s aggressive electric vehicle incentives, abundant renewable energy resources, and strong environmental consciousness among consumers. The government’s commitment to phasing out internal combustion engine vehicles has created sustained demand for charging infrastructure, with charging point installations increasing by 35% annually across all segments.

Technological innovation characterizes the Norwegian market, with early adoption of bidirectional charging, smart grid integration, and renewable energy optimization. The market benefits from high consumer purchasing power, supportive regulatory frameworks, and established partnerships between automotive manufacturers, energy companies, and technology providers.

Market segmentation reveals strong growth across residential, commercial, and public charging sectors, with particular strength in workplace charging solutions and destination charging at retail locations. The market’s maturity provides a blueprint for other regions, demonstrating how coordinated policy support and private sector investment can create comprehensive charging infrastructure.

Strategic market insights reveal several critical factors driving Norway’s charging equipment market success:

Market maturity in Norway provides valuable insights for global charging equipment deployment, demonstrating how coordinated ecosystem development can accelerate electric vehicle adoption and create sustainable business opportunities for charging infrastructure providers.

Government policy support represents the primary driver of Norway’s charging equipment market, with comprehensive incentives that make electric vehicles financially attractive compared to conventional alternatives. The elimination of purchase taxes, reduced tolls, free parking, and access to bus lanes create compelling value propositions that drive electric vehicle adoption and subsequent charging infrastructure demand.

Environmental consciousness among Norwegian consumers provides strong market support, with sustainability considerations influencing purchasing decisions across all demographic segments. The country’s commitment to carbon neutrality and environmental leadership creates social pressure and personal motivation for electric vehicle adoption, directly translating to charging equipment demand.

Abundant renewable energy resources, particularly hydroelectric power, provide cost-effective and environmentally sustainable energy for charging operations. This renewable energy advantage reduces operating costs for charging station operators while supporting Norway’s environmental objectives, creating favorable economics for charging infrastructure investment.

Technological innovation drives market evolution, with Norwegian companies and research institutions developing advanced charging solutions that improve user experience, grid integration, and operational efficiency. Smart charging technologies, renewable energy integration, and advanced payment systems enhance the value proposition of charging equipment investments.

High consumer purchasing power enables rapid adoption of electric vehicles and associated charging solutions, with Norwegian households demonstrating willingness to invest in home charging equipment and premium charging services. This economic capacity supports market growth across all charging segments and price points.

High initial investment costs for charging infrastructure represent a significant market restraint, particularly for fast-charging stations that require substantial capital expenditure for equipment, installation, and grid connection. These upfront costs can limit market entry for smaller operators and slow infrastructure deployment in less profitable locations.

Grid capacity limitations in certain areas constrain charging infrastructure expansion, requiring costly grid upgrades to support high-power charging installations. These infrastructure constraints can delay project implementation and increase total investment requirements, particularly in rural areas with limited electrical infrastructure.

Seasonal demand variations create operational challenges for charging station operators, with reduced usage during winter months affecting revenue generation and return on investment calculations. The seasonal nature of some charging locations requires careful business model design to ensure year-round viability.

Technology standardization challenges continue to impact market development, with evolving charging standards and connector types creating uncertainty for infrastructure investments. Rapid technological advancement can lead to equipment obsolescence concerns, affecting long-term investment decisions.

Regulatory complexity surrounding grid connection, safety standards, and operational requirements can slow project development and increase compliance costs. Navigating multiple regulatory frameworks and approval processes adds time and expense to charging infrastructure projects.

Smart charging integration presents significant opportunities for market expansion, with advanced technologies enabling grid optimization, renewable energy utilization, and demand response services. These intelligent charging solutions create additional revenue streams while providing valuable grid services, enhancing the business case for charging infrastructure investment.

Workplace charging expansion offers substantial growth potential as employers recognize the benefits of providing charging facilities for employees. This segment benefits from predictable usage patterns, dedicated parking spaces, and potential for load management, creating attractive investment opportunities for charging equipment providers.

Destination charging development at retail locations, hotels, and entertainment venues creates new market segments with unique value propositions. These installations can enhance customer experience while generating additional revenue for property owners, driving demand for specialized charging solutions.

Bidirectional charging technology opens new market opportunities by enabling electric vehicles to provide grid services and energy storage capabilities. This vehicle-to-grid functionality creates additional value streams and supports grid stability, representing a significant growth opportunity for advanced charging equipment.

Rural area expansion presents opportunities to extend charging infrastructure coverage to underserved regions, supported by government initiatives and improving technology economics. Rural charging installations can serve local communities while supporting long-distance travel, expanding the total addressable market for charging equipment.

Competitive dynamics in Norway’s charging equipment market reflect a mature ecosystem with established players and emerging innovators competing across different market segments. The market benefits from healthy competition that drives innovation, improves service quality, and reduces costs for end users while maintaining sustainable business models for operators.

Supply chain evolution has adapted to support rapid market growth, with local manufacturing capabilities, efficient distribution networks, and specialized installation services. The market’s maturity has enabled the development of comprehensive supply chains that can respond quickly to changing demand patterns and technological requirements.

Customer behavior patterns demonstrate sophisticated understanding of charging options, with users selecting appropriate charging solutions based on specific needs, locations, and usage patterns. This market sophistication drives demand for diverse charging solutions and premium services, supporting market segmentation and specialization.

Technology integration continues to reshape market dynamics, with charging equipment increasingly connected to smart grid systems, renewable energy sources, and digital service platforms. These integrations create network effects that enhance value propositions while establishing competitive advantages for technology leaders.

Regulatory evolution adapts to market maturity, with policies shifting from basic incentives to sophisticated frameworks that support grid integration, interoperability, and service quality. This regulatory sophistication enables more complex business models while maintaining consumer protection and market stability.

Comprehensive market analysis employs multiple research methodologies to provide accurate and actionable insights into Norway’s electric vehicle charging equipment market. The research approach combines quantitative data analysis, qualitative stakeholder interviews, and industry expert consultations to develop a complete understanding of market dynamics and future trends.

Primary research activities include structured interviews with charging equipment manufacturers, installation companies, network operators, and end users to gather firsthand insights into market conditions, challenges, and opportunities. These primary sources provide current market intelligence and forward-looking perspectives that inform strategic analysis.

Secondary research analysis incorporates government statistics, industry reports, company financial data, and regulatory documents to establish market baselines and validate primary research findings. This comprehensive data collection ensures research accuracy and provides historical context for market trend analysis.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify key growth drivers. These analytical approaches enable robust market projections while accounting for various factors that could influence future market development.

Quality assurance processes include data verification, source validation, and expert review to ensure research reliability and accuracy. Multiple validation steps confirm research findings and support confident market analysis and strategic recommendations.

Oslo metropolitan area dominates the Norwegian charging equipment market, accounting for approximately 45% of total installations due to high population density, extensive electric vehicle adoption, and concentrated commercial activity. The capital region benefits from advanced grid infrastructure, supportive municipal policies, and strong consumer demand that drives continuous market expansion.

Bergen and western regions represent significant market segments with 22% market share, supported by strong environmental consciousness, renewable energy resources, and growing electric vehicle adoption. These areas benefit from hydroelectric power availability and progressive local policies that encourage charging infrastructure development.

Trondheim and central regions contribute 18% of market activity, with particular strength in workplace charging and public infrastructure development. The presence of technology companies and research institutions drives innovation in charging solutions while creating demand for advanced charging equipment.

Northern regions present unique market characteristics with 15% market representation, facing challenges from extreme weather conditions and lower population density while benefiting from strong government support for infrastructure development. Cold climate considerations drive demand for specialized charging equipment designed for harsh operating conditions.

Rural and remote areas comprise the remaining market segments, with growing importance as charging networks expand to provide comprehensive coverage. These regions benefit from targeted government programs and innovative business models that make charging infrastructure economically viable in low-density areas.

Market leadership in Norway’s charging equipment sector includes both international technology companies and specialized Nordic providers that understand local market requirements:

Competitive differentiation focuses on technology innovation, service quality, network coverage, and integration capabilities. Companies compete on charging speed, reliability, user experience, and total cost of ownership while developing specialized solutions for different market segments.

Strategic partnerships between equipment manufacturers, energy companies, automotive brands, and property developers create comprehensive solutions that address complex customer needs while expanding market reach and capabilities.

By Power Level:

By Application:

By Connector Type:

Residential charging equipment represents the largest market segment, driven by high electric vehicle ownership rates and supportive policies for home charging installations. This category benefits from smart charging adoption rates of 68%, with consumers increasingly selecting connected solutions that optimize energy costs and grid impact while providing convenient home charging.

Commercial workplace charging demonstrates strong growth momentum as employers recognize the benefits of providing charging facilities for employees. This segment shows particular strength in technology companies, government offices, and large corporations that view charging benefits as employee retention tools while supporting sustainability objectives.

Public fast charging infrastructure continues expanding to support long-distance travel and urban charging needs. This category emphasizes reliability, payment convenience, and charging speed, with operators investing in redundant systems and premium user experiences to differentiate their services in competitive markets.

Destination charging solutions at retail locations, hotels, and entertainment venues create new revenue opportunities while enhancing customer experience. These installations often feature longer dwell times that accommodate slower charging speeds while providing additional services and amenities.

Fleet charging systems serve commercial and municipal vehicle fleets with specialized solutions that optimize operational efficiency, reduce total cost of ownership, and support fleet electrification strategies. This segment requires sophisticated load management and scheduling capabilities to maximize fleet availability while minimizing energy costs.

Equipment manufacturers benefit from Norway’s mature market that provides testing grounds for new technologies, established distribution channels, and sophisticated customers who drive product innovation. The market’s stability and growth trajectory create predictable revenue streams while supporting research and development investments.

Energy companies leverage charging infrastructure to diversify revenue streams, optimize grid utilization, and support renewable energy integration. MarkWide Research analysis indicates that energy companies participating in charging markets achieve 15% higher customer retention rates while developing new service capabilities.

Property owners enhance asset values and tenant satisfaction by providing charging facilities, with residential properties showing increased marketability and commercial properties attracting environmentally conscious tenants. Charging infrastructure can differentiate properties in competitive markets while generating additional revenue streams.

Automotive manufacturers support vehicle sales by ensuring adequate charging infrastructure availability, reducing range anxiety concerns that can limit electric vehicle adoption. Partnerships with charging providers enable integrated customer experiences that enhance brand loyalty and customer satisfaction.

Government entities achieve environmental objectives, reduce air pollution, and support economic development through charging infrastructure investments. Public charging networks enable broader electric vehicle adoption while demonstrating leadership in sustainable transportation solutions.

End consumers benefit from convenient, reliable, and cost-effective charging options that support electric vehicle ownership while providing flexibility for different travel patterns and lifestyle needs. Advanced charging solutions offer energy cost optimization and grid services that can generate additional value.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart charging adoption accelerates across all market segments, with intelligent systems providing grid optimization, renewable energy integration, and cost optimization capabilities. These advanced solutions enable demand response services while improving user convenience through automated charging scheduling and energy management.

Bidirectional charging technology emerges as a significant trend, enabling electric vehicles to provide grid services and energy storage capabilities. This vehicle-to-grid functionality creates new revenue opportunities for vehicle owners while supporting grid stability and renewable energy integration.

Ultra-fast charging deployment expands along major transportation corridors, with charging speeds reaching 350kW and higher to support long-distance travel and reduce charging times. These high-power installations require advanced cooling systems and grid infrastructure while providing premium user experiences.

Integrated energy services combine charging with solar power generation, energy storage, and grid services to create comprehensive energy solutions. These integrated systems optimize total energy costs while providing backup power capabilities and supporting renewable energy utilization.

Subscription-based services gain popularity as charging providers offer unlimited charging plans, premium services, and integrated mobility solutions. These service models provide predictable revenue streams for operators while offering convenience and cost certainty for users.

Wireless charging development advances with pilot projects and commercial deployments exploring inductive charging solutions for static and dynamic applications. While still emerging, wireless charging technology promises enhanced convenience and automated charging capabilities.

Major infrastructure investments continue expanding Norway’s charging network, with both public and private sector commitments to comprehensive coverage including rural areas and highway corridors. Recent investments focus on ultra-fast charging capabilities and smart grid integration to support growing electric vehicle adoption.

Technology partnerships between automotive manufacturers, energy companies, and technology providers create integrated solutions that enhance user experience while optimizing system performance. These collaborations enable comprehensive charging ecosystems that address diverse customer needs and market segments.

Regulatory developments establish new standards for charging infrastructure interoperability, safety, and grid integration. Recent regulations focus on ensuring open access, standardized payment systems, and data sharing requirements that promote competition while protecting consumer interests.

International expansion by Norwegian charging companies leverages domestic expertise to enter global markets, particularly in other Nordic countries and regions with similar environmental objectives. This expansion creates new growth opportunities while spreading Norwegian charging technology and business models internationally.

Research initiatives advance next-generation charging technologies including wireless charging, ultra-fast charging, and advanced grid integration capabilities. Norwegian research institutions and companies collaborate on innovative solutions that maintain the country’s technology leadership in electric vehicle charging.

Corporate sustainability programs drive workplace charging adoption as companies integrate electric vehicle support into environmental and employee benefit strategies. These programs create new market opportunities while supporting broader sustainability objectives and employee satisfaction goals.

Strategic market positioning should focus on technology differentiation and service quality rather than price competition alone, as Norwegian consumers demonstrate willingness to pay premium prices for superior charging experiences. Companies should invest in smart charging capabilities, reliability improvements, and integrated energy services to maintain competitive advantages.

Geographic expansion strategies should prioritize underserved rural areas and emerging commercial segments where competition remains limited and government support continues. MWR analysis suggests that early movers in rural markets can establish sustainable competitive positions while supporting national coverage objectives.

Technology investment priorities should emphasize bidirectional charging capabilities, ultra-fast charging systems, and smart grid integration to prepare for future market requirements. Companies should balance current market needs with emerging technology trends to maintain long-term competitiveness.

Partnership development with automotive manufacturers, energy companies, and property developers can create comprehensive solutions that address complex customer needs while expanding market reach. Strategic alliances enable resource sharing and risk mitigation while accelerating market penetration.

Service model innovation should explore subscription services, integrated mobility solutions, and value-added services that create recurring revenue streams while enhancing customer loyalty. These service models can differentiate offerings while improving financial performance and customer relationships.

International market preparation should leverage Norwegian market experience to identify export opportunities in regions with similar environmental objectives and policy frameworks. Norwegian companies can capitalize on their advanced technology and proven business models to enter global markets.

Market evolution toward smart, integrated charging ecosystems will continue accelerating, with charging infrastructure becoming increasingly connected to renewable energy systems, grid management platforms, and digital service networks. This integration creates new value propositions while supporting Norway’s broader energy transition objectives.

Technology advancement will focus on ultra-fast charging capabilities, wireless charging solutions, and bidirectional energy flow systems that enable electric vehicles to serve as distributed energy resources. These innovations will enhance user convenience while creating new revenue opportunities for charging infrastructure operators.

Market maturation will shift competitive focus from basic infrastructure deployment to service quality, user experience, and integrated energy solutions. Companies will differentiate through technology innovation, customer service excellence, and comprehensive charging ecosystems rather than simple equipment provision.

Geographic expansion will continue extending charging infrastructure to rural areas and specialized applications, supported by improving technology economics and targeted government programs. This expansion will ensure comprehensive coverage while creating new market opportunities for specialized charging solutions.

International influence of Norwegian charging technology and business models will grow as other regions adopt similar environmental objectives and policy frameworks. Norwegian companies are positioned to export expertise and technology to global markets seeking to replicate Norway’s electric vehicle success.

Regulatory evolution will establish more sophisticated frameworks for grid integration, interoperability, and service quality while maintaining competitive markets and consumer protection. These regulations will enable more complex business models while ensuring market stability and continued innovation.

Norway’s electric vehicle charging equipment market represents a global success story that demonstrates how coordinated policy support, technology innovation, and market development can create thriving sustainable transportation infrastructure. The market’s maturity provides valuable insights for other regions while continuing to drive innovation in charging technology and business models.

Market fundamentals remain strong, supported by continued electric vehicle adoption, government policy commitment, and ongoing technology advancement. The combination of environmental consciousness, renewable energy resources, and sophisticated consumers creates sustainable demand for charging infrastructure while encouraging continued innovation and investment.

Future growth prospects focus on smart charging integration, rural area expansion, and international market development as Norwegian companies leverage domestic expertise to capture global opportunities. The market’s evolution toward integrated energy services and bidirectional charging capabilities positions Norway at the forefront of next-generation charging technology development.

Strategic implications for market participants emphasize the importance of technology leadership, service quality, and comprehensive solutions that address diverse customer needs. Success in Norway’s mature market requires sophisticated understanding of customer requirements, regulatory frameworks, and technology trends while maintaining operational excellence and financial sustainability.

What is Electric Vehicle Charging Equipment?

Electric Vehicle Charging Equipment refers to the devices and infrastructure used to charge electric vehicles, including home chargers, public charging stations, and fast chargers. These systems are essential for supporting the growing adoption of electric vehicles and ensuring their efficient operation.

What are the key players in the Norway Electric Vehicle Charging Equipment Market?

Key players in the Norway Electric Vehicle Charging Equipment Market include companies like Fortum, Circle K, and ABB. These companies are involved in the development and deployment of charging infrastructure to support the increasing number of electric vehicles on the road, among others.

What are the growth factors driving the Norway Electric Vehicle Charging Equipment Market?

The growth of the Norway Electric Vehicle Charging Equipment Market is driven by factors such as government incentives for electric vehicle adoption, increasing environmental awareness, and advancements in charging technology. Additionally, the expansion of charging networks is crucial for enhancing consumer confidence in electric vehicle usage.

What challenges does the Norway Electric Vehicle Charging Equipment Market face?

The Norway Electric Vehicle Charging Equipment Market faces challenges such as the high initial costs of installation and the need for standardization across different charging systems. Furthermore, the limited availability of charging stations in certain areas can hinder the widespread adoption of electric vehicles.

What opportunities exist in the Norway Electric Vehicle Charging Equipment Market?

Opportunities in the Norway Electric Vehicle Charging Equipment Market include the potential for innovative charging solutions, such as wireless charging and smart grid integration. Additionally, partnerships between public and private sectors can enhance the development of extensive charging networks.

What trends are shaping the Norway Electric Vehicle Charging Equipment Market?

Trends shaping the Norway Electric Vehicle Charging Equipment Market include the rise of ultra-fast charging stations and the integration of renewable energy sources into charging infrastructure. Moreover, the increasing use of mobile apps for locating charging stations is enhancing user convenience.

Norway Electric Vehicle Charging Equipment Market

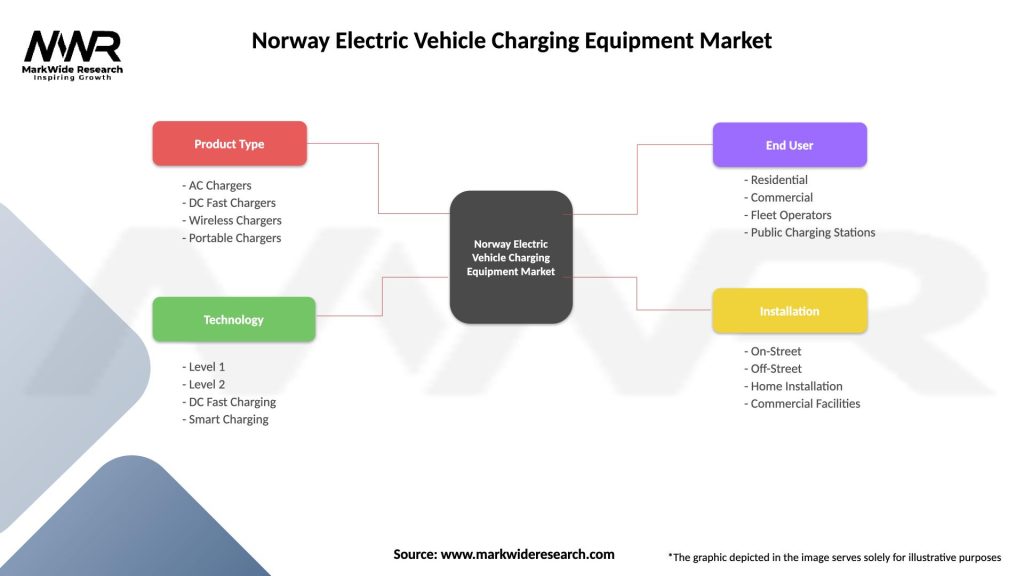

| Segmentation Details | Description |

|---|---|

| Product Type | AC Chargers, DC Fast Chargers, Wireless Chargers, Portable Chargers |

| Technology | Level 1, Level 2, DC Fast Charging, Smart Charging |

| End User | Residential, Commercial, Fleet Operators, Public Charging Stations |

| Installation | On-Street, Off-Street, Home Installation, Commercial Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Norway Electric Vehicle Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at