444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Norway data center power market represents a rapidly evolving sector driven by the country’s abundant renewable energy resources and strategic positioning as a Nordic digital hub. Norway’s unique advantages include access to hydroelectric power, favorable climate conditions for cooling, and robust infrastructure that supports sustainable data center operations. The market has experienced significant growth with adoption rates increasing by approximately 12.5% annually as organizations prioritize green computing solutions.

Market dynamics in Norway are particularly influenced by the country’s commitment to carbon neutrality and the availability of clean energy sources. The data center power infrastructure encompasses uninterruptible power supply systems, backup generators, power distribution units, and energy management solutions specifically designed for mission-critical applications. Regional advantages include stable grid connectivity, competitive electricity pricing, and government incentives that support sustainable technology investments.

Industry transformation is evident as hyperscale operators and enterprise customers increasingly recognize Norway’s potential as a sustainable data center destination. The market benefits from strategic geographic positioning that enables efficient connectivity to European markets while leveraging renewable energy resources that comprise over 98% of Norway’s electricity generation. This environmental advantage positions Norway as a preferred location for organizations seeking to reduce their carbon footprint while maintaining operational excellence.

The Norway data center power market refers to the comprehensive ecosystem of power infrastructure, equipment, and services that support data center operations throughout Norway, encompassing both traditional and renewable energy solutions designed to ensure reliable, efficient, and sustainable power delivery to computing facilities.

Power infrastructure components include primary electrical systems, backup power solutions, energy distribution networks, and monitoring technologies that collectively ensure continuous operation of data centers. The market encompasses various stakeholders including power equipment manufacturers, energy service providers, data center operators, and technology integrators who collaborate to deliver comprehensive power solutions.

Sustainable focus distinguishes Norway’s approach, emphasizing renewable energy integration, energy efficiency optimization, and environmental responsibility. The market addresses critical requirements for power reliability, scalability, and cost-effectiveness while supporting Norway’s broader sustainability objectives and digital transformation initiatives across multiple industry sectors.

Strategic positioning of Norway’s data center power market reflects the convergence of renewable energy abundance, technological innovation, and favorable regulatory environment. The market demonstrates robust expansion driven by increasing digitalization, cloud adoption, and sustainability mandates that favor clean energy solutions. Key growth drivers include government support for green technology, competitive energy costs, and strategic location advantages for serving European markets.

Market evolution is characterized by significant investments in power infrastructure modernization, with efficiency improvements reaching 15-20% through advanced power management systems and renewable energy integration. The sector benefits from Norway’s established expertise in energy management, combined with growing international recognition as a sustainable data center destination.

Competitive landscape features both established power equipment manufacturers and innovative technology providers specializing in renewable energy solutions. The market structure supports diverse deployment models, from edge computing facilities to large-scale hyperscale operations, each requiring tailored power solutions that align with specific operational requirements and sustainability objectives.

Primary market insights reveal several critical trends shaping Norway’s data center power landscape:

Renewable energy availability serves as the primary market driver, with Norway’s abundant hydroelectric resources providing clean, reliable, and cost-effective power for data center operations. This advantage becomes increasingly significant as organizations worldwide prioritize carbon footprint reduction and sustainable business practices. The availability of renewable energy at competitive rates creates compelling economic incentives for data center investment and expansion.

Digital transformation acceleration across Nordic and European markets drives increased demand for data center capacity and supporting power infrastructure. Organizations require reliable power solutions to support cloud migration, artificial intelligence workloads, and digital service delivery. The growing emphasis on data sovereignty and regulatory compliance further supports regional data center development and associated power infrastructure investments.

Government initiatives and policy support create favorable conditions for sustainable data center development. Tax incentives, streamlined permitting processes, and infrastructure investments demonstrate governmental commitment to positioning Norway as a leading sustainable technology hub. These supportive policies reduce barriers to entry and encourage long-term investments in power infrastructure and data center facilities.

Climate advantages provide natural cooling benefits that reduce power consumption and operational costs. Norway’s cool climate enables efficient free cooling strategies that can reduce overall energy consumption by 25-30% compared to warmer regions. This natural advantage, combined with renewable energy access, creates a compelling value proposition for energy-intensive computing operations.

High initial investment requirements for power infrastructure development can limit market entry for smaller operators and delay project implementation. The capital-intensive nature of robust power systems requires significant upfront investments in equipment, installation, and integration services. These financial barriers may restrict market participation and slow adoption rates among cost-sensitive organizations.

Technical complexity associated with integrating renewable energy sources and maintaining power reliability presents operational challenges. Grid stability considerations, backup power requirements, and load balancing complexities require specialized expertise and sophisticated management systems. The need for redundant systems and failover capabilities adds layers of complexity that can increase costs and implementation timelines.

Skilled workforce limitations may constrain market growth as demand for specialized technical expertise exceeds available talent pools. The intersection of data center operations and renewable energy systems requires unique skill combinations that are not widely available. Training and development programs require time and investment to build necessary competencies for market expansion.

Regulatory complexity surrounding energy markets, environmental compliance, and international data transfer requirements can create uncertainty and compliance burdens. Evolving regulations require ongoing monitoring and adaptation, potentially impacting operational strategies and investment decisions. The need to navigate multiple regulatory frameworks may slow decision-making processes and increase administrative overhead.

Hyperscale expansion presents significant opportunities as global cloud providers seek sustainable locations for large-scale data center deployments. Norway’s renewable energy advantages align perfectly with corporate sustainability commitments and environmental reporting requirements. The potential for attracting major hyperscale investments could transform the market landscape and drive substantial infrastructure development.

Edge computing growth creates opportunities for distributed power solutions that support localized data processing requirements. The proliferation of IoT applications, autonomous systems, and real-time analytics drives demand for edge infrastructure with reliable power systems. This trend supports market diversification and creates opportunities for innovative power solutions tailored to edge computing requirements.

Energy storage integration offers opportunities to enhance grid stability and optimize renewable energy utilization. Battery storage systems and other energy storage technologies can improve power reliability while supporting grid balancing services. The development of integrated energy storage solutions creates new revenue streams and enhances the value proposition of Norwegian data center locations.

International partnerships and cross-border connectivity initiatives create opportunities for regional data center hub development. Submarine cable investments and international connectivity projects position Norway as a strategic gateway for European and global data flows. These infrastructure developments support market expansion and attract international investment in power infrastructure and data center facilities.

Supply and demand dynamics in Norway’s data center power market reflect the interplay between abundant renewable energy resources and growing computational requirements. Energy supply stability from hydroelectric sources provides a competitive advantage, while increasing demand from digitalization initiatives creates market expansion opportunities. The balance between supply capacity and demand growth influences pricing strategies and investment priorities.

Technology evolution drives continuous improvements in power efficiency and system reliability. Advanced power management systems, smart grid integration, and predictive maintenance technologies enhance operational performance while reducing costs. According to MarkWide Research analysis, these technological advances contribute to efficiency improvements of 18-22% in modern data center power systems.

Competitive dynamics involve both traditional power equipment providers and innovative clean technology companies. Market differentiation increasingly focuses on sustainability credentials, energy efficiency, and integration capabilities rather than purely on cost considerations. The emphasis on environmental performance creates opportunities for specialized providers while challenging traditional approaches to power system design and operation.

Investment flows reflect growing confidence in Norway’s long-term potential as a sustainable data center destination. Capital allocation patterns show increasing emphasis on renewable energy integration and advanced power management capabilities. These investment trends support market maturation and infrastructure development while positioning Norway for continued growth in the global data center market.

Comprehensive research approach combines primary and secondary data sources to provide accurate market insights and trend analysis. Primary research includes interviews with industry stakeholders, data center operators, power equipment manufacturers, and energy service providers to gather firsthand perspectives on market conditions and future outlook.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate findings. Data triangulation methods ensure accuracy and reliability by cross-referencing multiple information sources and applying analytical frameworks to identify consistent patterns and trends.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to develop robust market projections. Quantitative analysis focuses on measurable metrics such as adoption rates, efficiency improvements, and capacity utilization while qualitative assessment addresses market dynamics, competitive positioning, and strategic implications.

Validation processes include expert review, stakeholder feedback, and comparative analysis with related markets to ensure research quality and relevance. Continuous monitoring of market developments and regular updates to analytical models maintain research currency and accuracy throughout the study period.

Oslo region dominates the Norwegian data center power market with approximately 45% market share, driven by proximity to international connectivity infrastructure and established business ecosystems. The capital region benefits from advanced grid infrastructure, skilled workforce availability, and proximity to major enterprises and government institutions. Ongoing infrastructure investments and urban development initiatives support continued market leadership.

Western Norway emerges as a significant growth region, leveraging abundant hydroelectric resources and strategic coastal locations for submarine cable landings. The region’s renewable energy concentration and industrial expertise create favorable conditions for large-scale data center development. Government support for regional development and infrastructure modernization enhances the area’s competitive positioning.

Northern Norway presents unique opportunities with exceptional cooling advantages and renewable energy access, though infrastructure limitations currently constrain development. The region’s extreme climate benefits can reduce cooling costs by up to 35-40% compared to temperate locations. Strategic investments in connectivity and power infrastructure could unlock significant potential for sustainable data center operations.

Central Norway offers balanced advantages including renewable energy access, moderate climate conditions, and developing connectivity infrastructure. The region’s strategic location provides potential for serving both domestic and international markets while benefiting from competitive energy costs and government development incentives. Growing recognition of the region’s potential supports infrastructure investment and market development initiatives.

Market leadership involves established power equipment manufacturers, renewable energy specialists, and integrated service providers competing across multiple market segments. The competitive environment emphasizes technological innovation, sustainability credentials, and comprehensive service capabilities rather than purely price-based competition.

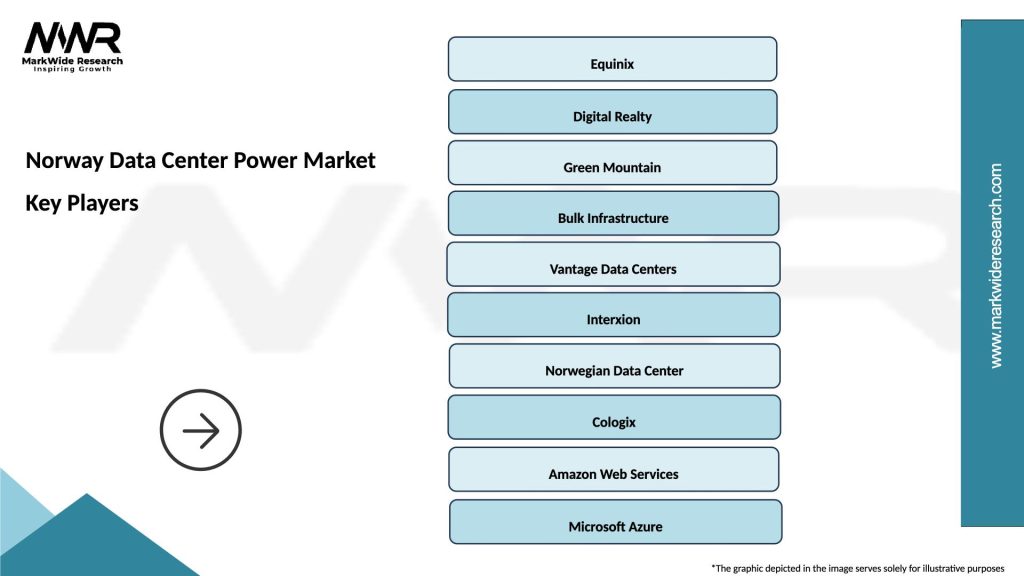

Key market participants include:

Competitive strategies increasingly focus on sustainability differentiation, with companies developing specialized solutions for renewable energy integration and carbon footprint reduction. Partnership approaches enable comprehensive service delivery while leveraging complementary capabilities across the value chain.

By Power Capacity:

By Power Source:

By Application:

Uninterruptible Power Supply (UPS) Systems represent the largest category within Norway’s data center power market, driven by critical reliability requirements and increasing power quality demands. Modern UPS technologies incorporate advanced battery management, predictive maintenance capabilities, and energy efficiency optimization features. The category benefits from growing adoption of lithium-ion battery technologies that offer improved performance and reduced maintenance requirements.

Power Distribution Units (PDUs) demonstrate strong growth as data centers require more sophisticated power monitoring and management capabilities. Intelligent PDUs provide real-time power consumption data, remote monitoring capabilities, and automated load balancing features. The category evolution toward smart power distribution supports operational efficiency improvements and predictive maintenance strategies.

Backup Power Generation maintains steady demand despite renewable energy abundance, as operators require redundant power systems for mission-critical applications. Diesel generators remain standard for emergency backup, while alternative technologies including fuel cells and battery storage systems gain market acceptance. The category focus shifts toward cleaner backup solutions and improved integration with renewable energy systems.

Energy Management Systems experience rapid growth as operators seek to optimize power consumption and reduce operational costs. Advanced analytics and artificial intelligence capabilities enable predictive optimization and automated power management. According to MWR research, sophisticated energy management systems can improve overall power efficiency by 12-15% through intelligent load balancing and optimization algorithms.

Data Center Operators benefit from reduced operational costs through access to competitively priced renewable energy and natural cooling advantages. Sustainability credentials enhance corporate reputation and support environmental reporting requirements while potentially reducing regulatory compliance costs. The stable political environment and robust infrastructure provide operational security and long-term investment protection.

Power Equipment Manufacturers gain access to a growing market with emphasis on advanced technology and sustainability features. Innovation opportunities arise from the need to integrate renewable energy sources and optimize power efficiency. The market’s focus on quality and reliability over pure cost considerations supports premium product positioning and higher margin opportunities.

Energy Service Providers can leverage Norway’s renewable energy abundance to develop competitive service offerings and expand market presence. Grid services opportunities include load balancing, energy storage, and demand response programs that create additional revenue streams. The growing data center market provides stable, long-term customers for energy services and infrastructure investments.

Technology Investors benefit from market growth driven by sustainable technology adoption and digital transformation trends. ESG alignment with renewable energy focus supports investment criteria and stakeholder expectations. The combination of stable regulatory environment and growing market demand creates attractive risk-adjusted return opportunities for infrastructure and technology investments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as the dominant trend, with operators increasingly prioritizing renewable energy sources and carbon-neutral operations. Environmental reporting requirements and corporate sustainability commitments drive demand for clean power solutions. The trend toward net-zero commitments creates competitive advantages for Norwegian data center locations and associated power infrastructure.

Edge Computing Expansion drives demand for distributed power solutions that support localized data processing requirements. 5G deployment and IoT proliferation require edge infrastructure with reliable power systems positioned closer to end users. This trend creates opportunities for smaller-scale power solutions and innovative deployment models that leverage Norway’s renewable energy advantages.

Artificial Intelligence Integration in power management systems enables predictive optimization and automated decision-making. Machine learning algorithms analyze power consumption patterns, predict equipment failures, and optimize energy utilization in real-time. The integration of AI technologies can improve power efficiency by 20-25% while reducing operational complexity and maintenance requirements.

Energy Storage Adoption accelerates as operators seek to optimize renewable energy utilization and enhance grid stability. Battery storage systems enable load shifting, peak shaving, and backup power capabilities while supporting grid balancing services. The trend toward integrated energy storage solutions creates new market segments and revenue opportunities for power infrastructure providers.

Infrastructure investments by major cloud providers signal growing confidence in Norway’s potential as a sustainable data center destination. Google’s announcement of data center investments in Norway demonstrates international recognition of the country’s renewable energy advantages and strategic positioning. These developments validate market potential and encourage additional investments in supporting power infrastructure.

Government initiatives including the National Transport Plan and digital infrastructure investments support data center market development. Submarine cable projects enhance international connectivity while power grid modernization initiatives improve reliability and capacity. These coordinated infrastructure developments create favorable conditions for continued market growth and international investment attraction.

Technology partnerships between Norwegian energy companies and international data center operators facilitate knowledge transfer and market development. Collaborative projects focus on renewable energy integration, energy efficiency optimization, and sustainable cooling solutions. These partnerships accelerate innovation and position Norway as a leader in sustainable data center technologies.

Regulatory developments including updated environmental standards and energy efficiency requirements shape market evolution. Policy frameworks supporting renewable energy adoption and carbon footprint reduction create competitive advantages for Norwegian locations. The alignment of regulatory requirements with market capabilities supports long-term growth and international competitiveness.

Strategic positioning recommendations emphasize leveraging Norway’s renewable energy advantages while addressing infrastructure and workforce development needs. Market participants should focus on developing comprehensive solutions that integrate renewable energy sources with advanced power management capabilities. Investment in local partnerships and expertise development will support long-term market success and competitive differentiation.

Technology investment priorities should focus on energy efficiency optimization, predictive maintenance capabilities, and renewable energy integration solutions. Innovation initiatives in areas such as energy storage, smart grid integration, and AI-powered power management create competitive advantages and market leadership opportunities. Companies should prioritize R&D investments that align with sustainability trends and operational efficiency requirements.

Market expansion strategies should emphasize international customer attraction while building domestic market capabilities. Partnership development with global data center operators and cloud service providers can accelerate market penetration and scale benefits. Focus on demonstrating sustainability credentials and operational advantages will support customer acquisition and retention efforts.

Workforce development initiatives require immediate attention to address skills shortages and support market growth. Training programs combining data center operations expertise with renewable energy knowledge will build necessary competencies. Collaboration with educational institutions and international partners can accelerate skills development and knowledge transfer processes.

Market trajectory indicates continued strong growth driven by increasing digitalization, sustainability requirements, and Norway’s competitive advantages in renewable energy and climate conditions. Long-term prospects remain highly positive as global trends toward carbon neutrality and sustainable business practices favor Norwegian data center locations. The market is projected to maintain robust expansion with growth rates potentially reaching 14-16% annually over the next five years.

Technology evolution will continue driving improvements in power efficiency, system reliability, and renewable energy integration capabilities. Advanced solutions incorporating artificial intelligence, energy storage, and smart grid technologies will become standard requirements rather than differentiating features. The convergence of these technologies creates opportunities for innovative service models and integrated solutions that optimize both performance and sustainability.

International recognition of Norway’s advantages will likely attract additional hyperscale investments and establish the country as a preferred European data center destination. Market maturation will support ecosystem development including specialized service providers, technology integrators, and supporting infrastructure. The evolution toward a comprehensive data center hub will create additional opportunities across the value chain.

Regulatory alignment with European Union sustainability requirements and global environmental standards will enhance Norway’s competitive positioning. Policy support for renewable energy adoption and digital infrastructure development will continue supporting market growth and international investment attraction. According to MarkWide Research projections, these favorable conditions position Norway for sustained market leadership in sustainable data center power solutions throughout the forecast period.

Norway’s data center power market represents a compelling intersection of renewable energy abundance, technological innovation, and strategic positioning that creates exceptional opportunities for sustainable growth. The market’s foundation on clean hydroelectric power, combined with natural cooling advantages and supportive government policies, establishes a competitive framework that aligns with global sustainability trends and corporate environmental commitments.

Market dynamics demonstrate strong fundamentals with multiple growth drivers including digitalization acceleration, hyperscale expansion, and increasing emphasis on carbon-neutral operations. The combination of abundant renewable energy resources, stable political environment, and developing infrastructure creates favorable conditions for continued market expansion and international investment attraction.

Strategic implications suggest that Norway is well-positioned to become a leading European data center destination, leveraging its unique advantages to attract global operators seeking sustainable solutions. The market’s evolution toward comprehensive power solutions incorporating advanced technologies, energy storage, and intelligent management systems creates opportunities for innovation and market leadership across multiple segments.

Future success will depend on continued investment in infrastructure development, workforce capabilities, and technology innovation while maintaining the competitive advantages that distinguish Norway’s market position. The convergence of favorable market conditions, supportive policies, and growing international recognition positions the Norway data center power market for sustained growth and leadership in the global transition toward sustainable digital infrastructure.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, including servers, storage, and networking equipment. It encompasses various aspects such as power distribution, backup systems, and energy efficiency measures.

What are the key players in the Norway Data Center Power Market?

Key players in the Norway Data Center Power Market include companies like Schneider Electric, ABB, and Siemens, which provide power management solutions and infrastructure for data centers. These companies focus on energy efficiency and reliability in their offerings, among others.

What are the growth factors driving the Norway Data Center Power Market?

The growth of the Norway Data Center Power Market is driven by the increasing demand for cloud computing services, the rise in data generation, and the need for energy-efficient solutions. Additionally, the expansion of digital services and the Internet of Things are contributing to this growth.

What challenges does the Norway Data Center Power Market face?

The Norway Data Center Power Market faces challenges such as high energy costs, regulatory compliance related to energy consumption, and the environmental impact of data centers. These factors can hinder the growth and sustainability of data center operations.

What opportunities exist in the Norway Data Center Power Market?

Opportunities in the Norway Data Center Power Market include advancements in renewable energy integration, the development of innovative cooling technologies, and the increasing focus on sustainability practices. These trends can enhance operational efficiency and reduce carbon footprints.

What trends are shaping the Norway Data Center Power Market?

Trends shaping the Norway Data Center Power Market include the adoption of modular data center designs, the implementation of artificial intelligence for power management, and a growing emphasis on energy efficiency. These innovations are transforming how data centers operate and manage power consumption.

Norway Data Center Power Market

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Power Distribution Units, Cooling Systems |

| End User | Telecommunications, Cloud Providers, Financial Services, Government |

| Technology | Liquid Cooling, Air Cooling, Modular Systems, Renewable Energy |

| Capacity | Below 1 MW, 1-5 MW, 5-10 MW, Above 10 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Norway Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at