444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North Sea Region Oil & Gas Market represents one of the most mature and technologically advanced offshore energy sectors globally, spanning across the territorial waters of the United Kingdom, Norway, Denmark, Netherlands, Germany, and Belgium. This strategic maritime region has been a cornerstone of European energy security for over five decades, contributing significantly to regional energy independence and economic prosperity. Current market dynamics indicate a complex landscape characterized by mature field development, enhanced recovery techniques, and increasing focus on sustainability initiatives.

Market participants are navigating through a transformative period where traditional extraction methods are being supplemented by innovative technologies including digitalization, artificial intelligence, and advanced subsea systems. The region experiences approximately 65% of production coming from mature fields, necessitating sophisticated enhanced oil recovery techniques and life extension programs. Operational efficiency has become paramount as companies strive to maintain profitability while adhering to increasingly stringent environmental regulations.

Regional governments are implementing progressive policies that balance continued hydrocarbon production with ambitious climate targets, creating a unique market environment where traditional oil and gas operations coexist with renewable energy initiatives. The North Sea’s strategic importance extends beyond energy production, serving as a testing ground for emerging technologies that could revolutionize offshore operations globally.

The North Sea Region Oil & Gas Market refers to the comprehensive ecosystem of hydrocarbon exploration, production, processing, and distribution activities conducted within the North Sea basin, encompassing both offshore and onshore infrastructure supporting energy extraction operations across multiple European nations.

This market encompasses various segments including upstream exploration and production activities, midstream transportation and processing operations, and downstream refining and distribution networks. The region’s unique geological characteristics, featuring multiple sedimentary basins with proven hydrocarbon reserves, have established it as a premier offshore energy province. Market activities include conventional oil and gas extraction, unconventional resource development, enhanced recovery operations, and increasingly, carbon capture and storage initiatives.

Technological innovation defines the market’s operational framework, with companies deploying advanced drilling techniques, subsea production systems, and digital monitoring technologies to optimize resource extraction from challenging offshore environments. The market’s maturity is reflected in its sophisticated regulatory framework, established supply chain networks, and highly skilled workforce capable of executing complex offshore projects.

Strategic market positioning reveals the North Sea Region Oil & Gas Market as a critical component of European energy infrastructure, demonstrating remarkable resilience despite global energy transition pressures. The market exhibits sustained production levels through technological advancement and operational optimization, with companies achieving average production efficiency improvements of 15-20% through digital transformation initiatives.

Key market characteristics include a mature asset base requiring sophisticated life extension strategies, increasing integration of renewable energy technologies, and growing emphasis on environmental stewardship. The region’s operators are successfully implementing enhanced recovery techniques, resulting in extended field life cycles of 10-15 years beyond original projections. Investment patterns show a strategic shift toward high-return, low-carbon projects that align with regional sustainability objectives.

Market evolution is driven by the dual imperative of maintaining energy security while transitioning toward cleaner energy sources. This dynamic creates opportunities for innovative companies that can bridge traditional hydrocarbon operations with emerging energy technologies, positioning the North Sea as a potential hub for future energy systems integration.

Fundamental market insights reveal several critical trends shaping the North Sea Region Oil & Gas Market’s trajectory:

These insights collectively indicate a market in transition, where traditional operational excellence is being enhanced by innovative approaches to energy production and environmental responsibility.

Primary market drivers propelling the North Sea Region Oil & Gas Market include sustained energy demand, technological advancement, and strategic energy security considerations. European energy requirements continue to support robust demand for North Sea hydrocarbons, particularly as regional governments seek to reduce dependence on external energy sources. The market benefits from established infrastructure networks that provide cost-effective pathways for resource development and distribution.

Technological innovation serves as a fundamental driver, enabling operators to access previously uneconomical resources and extend the productive life of mature fields. Advanced drilling techniques, enhanced recovery methods, and digital optimization systems are creating new opportunities for resource extraction. Regulatory support for continued hydrocarbon production, balanced with environmental stewardship requirements, provides a stable operating framework that encourages long-term investment.

Economic factors including favorable fiscal regimes, established supply chains, and skilled workforce availability contribute to the market’s competitive position. The region’s strategic location provides excellent access to major European energy markets, while existing infrastructure reduces development costs for new projects. Energy transition dynamics are paradoxically driving investment in cleaner extraction technologies and hybrid energy systems that utilize existing offshore platforms.

Significant market restraints include increasing environmental regulations, resource depletion in mature fields, and growing pressure from renewable energy alternatives. Regulatory compliance costs are rising as governments implement stricter environmental standards, requiring substantial investments in emissions reduction technologies and environmental monitoring systems. The market faces challenges from aging infrastructure that requires continuous maintenance and eventual replacement, creating ongoing capital expenditure pressures.

Resource maturity presents fundamental challenges as many North Sea fields have been in production for decades, resulting in declining production rates and increasing extraction costs. Technical complexity associated with accessing remaining reserves often requires sophisticated and expensive technologies that may not be economically viable for all operators. Market volatility in global energy prices creates uncertainty that can impact investment decisions and project economics.

Social and political pressures related to climate change are influencing public policy and investment flows, potentially limiting future development opportunities. Competition from renewable energy sources is intensifying as these technologies become more cost-competitive and receive preferential policy support. The market also faces constraints from skilled workforce availability as younger professionals increasingly gravitate toward renewable energy careers.

Emerging opportunities within the North Sea Region Oil & Gas Market center on technological innovation, infrastructure repurposing, and energy transition leadership. Carbon capture and storage initiatives present significant opportunities for operators to leverage existing infrastructure and geological expertise for environmental benefit while generating new revenue streams. The region’s extensive pipeline networks and storage facilities position it advantageously for hydrogen production and distribution as part of the emerging hydrogen economy.

Digital transformation opportunities include implementing artificial intelligence, machine learning, and Internet of Things technologies to optimize operations and reduce costs. Enhanced recovery techniques using advanced chemical injection, thermal methods, and CO2 flooding can unlock additional reserves from mature fields. The market presents opportunities for offshore wind integration where existing platforms can support renewable energy infrastructure development.

Decommissioning services represent a growing market segment as older fields reach end-of-life, creating opportunities for specialized companies with expertise in safe and environmentally responsible facility removal. International expansion opportunities exist for North Sea operators to apply their technological expertise and operational experience in other offshore regions globally. Circular economy initiatives including waste-to-energy projects and materials recycling can create additional value streams from existing operations.

Complex market dynamics characterize the North Sea Region Oil & Gas Market, reflecting the interplay between traditional energy production requirements and evolving environmental expectations. Supply-demand equilibrium is influenced by regional energy consumption patterns, global price fluctuations, and seasonal demand variations. The market demonstrates resilience through diversification as operators expand into adjacent sectors including renewable energy and carbon management services.

Competitive dynamics are evolving as traditional oil and gas companies compete alongside renewable energy developers and technology service providers. Innovation cycles are accelerating as companies invest in research and development to maintain competitive advantages and meet regulatory requirements. The market experiences cyclical investment patterns influenced by commodity prices, regulatory changes, and technological breakthroughs.

Stakeholder relationships are becoming increasingly complex as operators must balance shareholder returns, regulatory compliance, environmental stewardship, and community expectations. Market consolidation trends are creating larger, more resilient entities capable of investing in long-term sustainability initiatives while maintaining operational excellence. Risk management strategies are evolving to address new challenges including climate-related risks, regulatory changes, and technological disruption.

Comprehensive research methodology employed for analyzing the North Sea Region Oil & Gas Market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research activities include structured interviews with industry executives, technical experts, regulatory officials, and market participants across all major North Sea countries. Field visits to operational facilities and participation in industry conferences provide firsthand insights into market conditions and emerging trends.

Secondary research components encompass analysis of government publications, industry reports, financial statements, regulatory filings, and technical literature from academic institutions and research organizations. Quantitative analysis utilizes statistical modeling, trend analysis, and comparative benchmarking to identify patterns and project future market developments. Qualitative assessment incorporates expert opinions, case study analysis, and scenario planning to understand market dynamics and potential disruptions.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research findings’ accuracy and reliability. Market segmentation analysis employs both top-down and bottom-up approaches to provide comprehensive coverage of all market components. The methodology incorporates real-time data monitoring to capture rapidly evolving market conditions and emerging opportunities.

United Kingdom sector dominates North Sea production with approximately 40% market share, benefiting from mature regulatory frameworks and extensive infrastructure networks. UK operations focus on maximizing recovery from aging fields while developing new discoveries in frontier areas. The region demonstrates strong capabilities in enhanced recovery techniques and decommissioning services, positioning it as a technology leader in mature field management.

Norwegian continental shelf represents roughly 35% of regional production, characterized by large-scale developments and advanced subsea technologies. Norway’s market benefits from stable political conditions, sophisticated regulatory oversight, and substantial sovereign wealth fund support for long-term development. The country leads in environmental stewardship and carbon management initiatives within the North Sea region.

Danish, Dutch, and German sectors collectively account for approximately 20% of market activity, with focus on smaller-scale developments and innovative technologies. These markets demonstrate strong integration between offshore oil and gas operations and renewable energy development. Belgium’s limited sector contributes around 5% of regional activity, primarily through strategic partnerships and shared infrastructure utilization. Each national sector exhibits unique characteristics influenced by domestic energy policies, regulatory frameworks, and market conditions.

Market leadership in the North Sea Region Oil & Gas Market is distributed among several major international energy companies and specialized regional operators:

Competitive differentiation occurs through technological innovation, operational efficiency, environmental performance, and strategic partnerships. Companies are increasingly collaborating on large-scale projects and sharing infrastructure to optimize costs and reduce environmental impact.

Market segmentation reveals distinct categories based on operational characteristics, geographical distribution, and resource types:

By Resource Type:

By Water Depth:

By Development Stage:

Upstream operations dominate market activity, representing the core of North Sea hydrocarbon extraction with focus on maximizing recovery from mature assets while developing new discoveries. Exploration activities are increasingly targeted toward high-impact prospects using advanced seismic technologies and geological modeling. Companies are achieving exploration success rates of 25-30% through improved prospect evaluation and risk assessment techniques.

Production optimization initiatives are yielding significant results as operators implement digital technologies and enhanced recovery methods. Subsea developments are becoming increasingly sophisticated, with tie-back projects connecting remote discoveries to existing infrastructure networks. Gas production is receiving renewed attention as European energy security concerns drive demand for domestic natural gas supplies.

Midstream infrastructure continues evolving to support changing production profiles and new development concepts. Pipeline networks are being optimized for bidirectional flow and multi-product transportation capabilities. Processing facilities are incorporating advanced separation technologies and emissions reduction systems to meet environmental standards. Storage capabilities are being expanded to accommodate production variability and market demand fluctuations.

Operational excellence provides industry participants with competitive advantages through reduced costs, improved safety performance, and enhanced environmental stewardship. Technology leadership enables companies to access challenging resources and extend field life, creating long-term value for shareholders and stakeholders. Regulatory compliance ensures sustainable operations while maintaining social license to operate in sensitive marine environments.

Economic benefits include substantial employment opportunities, tax revenue generation, and supply chain development across the North Sea region. Energy security advantages provide European nations with reduced dependence on energy imports and enhanced strategic autonomy. Innovation spillovers from North Sea operations benefit other industries through technology transfer and knowledge sharing.

Environmental stewardship initiatives demonstrate industry commitment to responsible resource development and climate change mitigation. Community engagement programs ensure local stakeholders benefit from offshore energy development through employment, training, and economic development opportunities. Infrastructure legacy creates long-term assets that can support future energy systems including renewable energy and carbon storage projects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the dominant trend reshaping North Sea operations through artificial intelligence, machine learning, and advanced analytics. Predictive maintenance systems are reducing operational downtime while automated drilling technologies are improving efficiency and safety performance. Companies are achieving operational cost reductions of 10-15% through comprehensive digitalization programs.

Environmental sustainability initiatives are becoming integral to operational strategies as companies implement carbon reduction technologies and circular economy principles. Electrification projects are reducing offshore emissions while renewable energy integration is creating hybrid energy systems. Carbon capture and storage developments are positioning the North Sea as a leader in climate change mitigation technologies.

Collaborative partnerships are increasing as companies share infrastructure, technology, and expertise to optimize costs and reduce risks. Supply chain innovation is improving logistics efficiency and reducing environmental impact through advanced planning systems and alternative fuel technologies. Workforce transformation programs are developing skills for the energy transition while maintaining operational excellence in traditional activities.

Recent industry developments highlight the North Sea’s evolution toward sustainable energy production and technological innovation. Major operators are announcing substantial investments in carbon capture and storage projects, with several large-scale initiatives receiving regulatory approval and financial backing. Electrification programs are connecting offshore platforms to onshore renewable energy sources, significantly reducing operational emissions.

Technological breakthroughs include deployment of autonomous underwater vehicles for inspection and maintenance, advanced subsea processing systems, and real-time reservoir monitoring technologies. MarkWide Research analysis indicates that these innovations are contributing to enhanced recovery rates of 5-10% across multiple field developments. Regulatory developments include updated environmental standards and streamlined approval processes for low-carbon projects.

Strategic partnerships are forming between traditional energy companies and renewable energy developers to create integrated energy systems. Decommissioning activities are accelerating with innovative approaches to facility removal and materials recycling. International expansion initiatives are applying North Sea expertise to offshore developments in other regions, creating new revenue opportunities for regional service providers.

Strategic recommendations for North Sea Region Oil & Gas Market participants emphasize the importance of balancing traditional operational excellence with energy transition leadership. Investment priorities should focus on technologies that enhance recovery from existing assets while reducing environmental impact. Companies should develop integrated energy strategies that leverage existing infrastructure for renewable energy and carbon management applications.

Operational optimization through digital transformation presents immediate opportunities for cost reduction and performance improvement. Partnership strategies should emphasize collaboration on large-scale projects and infrastructure sharing to optimize capital allocation. Workforce development programs must address evolving skill requirements while maintaining expertise in traditional offshore operations.

Risk management approaches should incorporate climate-related risks, regulatory changes, and market volatility into strategic planning processes. Innovation investments should target breakthrough technologies that could transform offshore energy production and position companies for long-term success. Stakeholder engagement strategies must address growing environmental concerns while demonstrating industry commitment to sustainable development.

Long-term market prospects for the North Sea Region Oil & Gas Market indicate continued evolution toward integrated energy systems that combine traditional hydrocarbon production with renewable energy and carbon management technologies. Production forecasts suggest sustained output levels through enhanced recovery techniques and new field developments, with technology-driven efficiency gains of 20-25% expected over the next decade.

Energy transition dynamics will create new opportunities for infrastructure utilization and technology application while maintaining the region’s strategic importance for European energy security. MWR projections indicate that carbon capture and storage capacity could represent 15-20% of regional infrastructure utilization by 2035. Hydrogen production initiatives are expected to leverage existing offshore platforms and pipeline networks for emerging energy systems.

Market transformation will be driven by continued technological innovation, evolving regulatory frameworks, and changing energy consumption patterns. Investment flows are expected to increasingly favor projects that demonstrate environmental sustainability and long-term viability. The North Sea’s role as a technology testbed for offshore energy innovations will continue supporting global industry development and knowledge transfer.

The North Sea Region Oil & Gas Market stands at a critical juncture where traditional energy production excellence meets the imperatives of environmental sustainability and energy transition. This comprehensive analysis reveals a market characterized by technological sophistication, operational maturity, and increasing integration with renewable energy systems. Market participants who successfully navigate the balance between maintaining production efficiency and embracing sustainable technologies will be best positioned for long-term success.

Strategic opportunities abound for companies that can leverage existing infrastructure and expertise while developing capabilities in emerging energy technologies. The region’s transformation into an integrated energy hub supporting both hydrocarbon production and renewable energy development represents a unique competitive advantage in the global energy landscape. Continued innovation in digital technologies, enhanced recovery methods, and environmental stewardship will drive market evolution and maintain the North Sea’s position as a premier offshore energy province.

Future success in the North Sea Region Oil & Gas Market will depend on companies’ ability to adapt to changing market conditions while maintaining operational excellence and environmental responsibility. The market’s evolution toward sustainable energy production models provides a blueprint for other offshore regions globally, reinforcing the North Sea’s role as a leader in responsible energy development and technological innovation.

What is Oil & Gas?

Oil & Gas refers to the natural resources extracted from the earth, primarily used for energy production and as raw materials in various industries. This includes crude oil, natural gas, and their derivatives, which are crucial for transportation, heating, and electricity generation.

What are the key players in the North Sea Region Oil & Gas Market?

Key players in the North Sea Region Oil & Gas Market include BP, Equinor, and TotalEnergies, which are involved in exploration, production, and distribution of oil and gas resources. These companies play significant roles in shaping the market dynamics and technological advancements in the region, among others.

What are the growth factors driving the North Sea Region Oil & Gas Market?

The growth of the North Sea Region Oil & Gas Market is driven by increasing energy demand, advancements in extraction technologies, and the need for energy security. Additionally, the transition towards cleaner energy sources is prompting investments in more efficient and sustainable oil and gas operations.

What challenges does the North Sea Region Oil & Gas Market face?

The North Sea Region Oil & Gas Market faces challenges such as fluctuating oil prices, regulatory pressures for environmental compliance, and the depletion of easily accessible reserves. These factors can impact profitability and investment in new projects.

What opportunities exist in the North Sea Region Oil & Gas Market?

Opportunities in the North Sea Region Oil & Gas Market include the development of offshore wind energy projects, carbon capture and storage technologies, and enhanced oil recovery techniques. These innovations can help diversify energy sources and improve sustainability in the region.

What trends are shaping the North Sea Region Oil & Gas Market?

Trends in the North Sea Region Oil & Gas Market include a shift towards digitalization and automation in operations, increased focus on sustainability, and collaboration between companies for shared technology development. These trends are influencing how companies operate and adapt to changing market conditions.

North Sea Region Oil & Gas Market

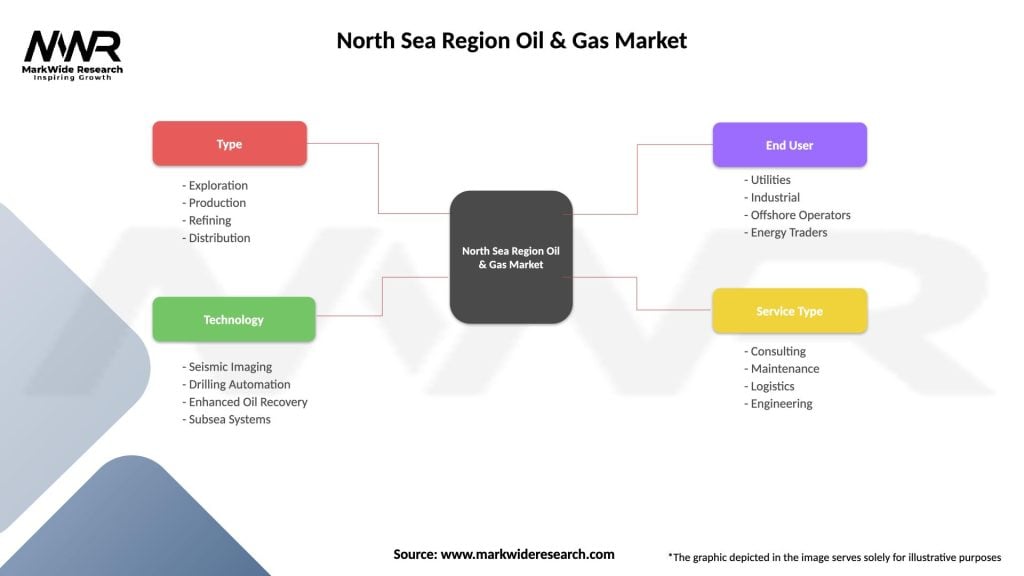

| Segmentation Details | Description |

|---|---|

| Type | Exploration, Production, Refining, Distribution |

| Technology | Seismic Imaging, Drilling Automation, Enhanced Oil Recovery, Subsea Systems |

| End User | Utilities, Industrial, Offshore Operators, Energy Traders |

| Service Type | Consulting, Maintenance, Logistics, Engineering |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North Sea Region Oil & Gas Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at