444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North and Central America proppant market refers to the demand and supply of proppants in the region. Proppants are granular substances, typically made of sand, ceramic, or resin-coated materials, that are used in hydraulic fracturing operations to keep the fractures open and allow for the efficient extraction of oil and gas from underground reservoirs. North and Central America have been witnessing significant growth in the proppant market due to the booming shale gas and oil exploration activities in the region.

Meaning

Proppants play a crucial role in hydraulic fracturing, also known as fracking. During the fracking process, a mixture of water, sand, and chemicals is injected into oil or gas wells under high pressure. The proppants, usually in the form of sand or ceramic beads, are added to the mixture to prop open the fractures created in the rock formation. This allows the oil or gas to flow more freely, enhancing the production rates and overall recovery of hydrocarbons from the well.

Executive Summary

The North and Central America proppant market has experienced significant growth in recent years, driven by the rising demand for oil and gas and the increasing exploration activities in shale reserves. The region has abundant shale resources, particularly in the United States, Canada, and Mexico, which has led to a surge in hydraulic fracturing operations. This, in turn, has fueled the demand for proppants in the market. The market is characterized by intense competition among key players, technological advancements, and evolving environmental regulations.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

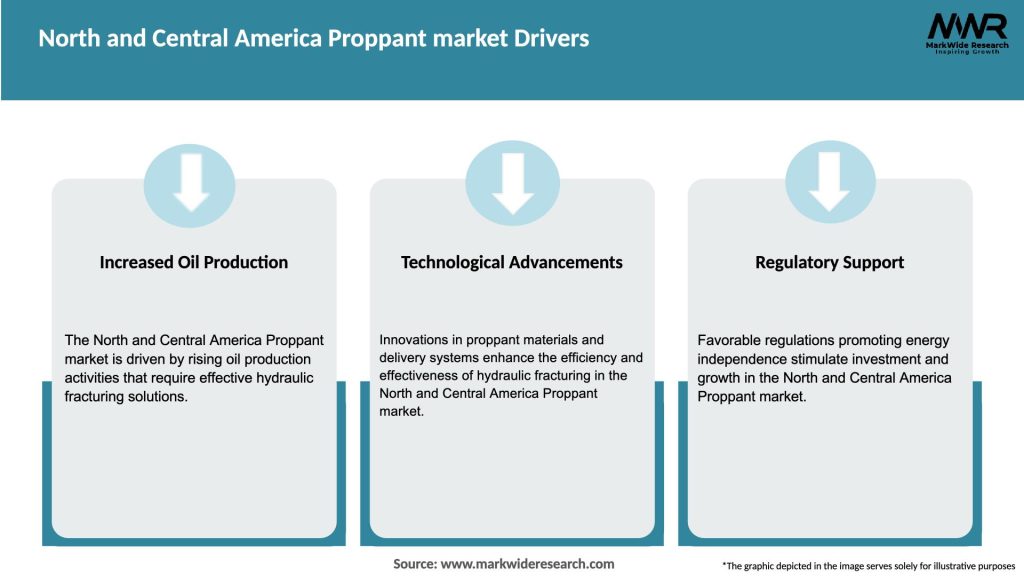

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North and Central America proppant market is characterized by dynamic factors that influence its growth and competitiveness. Key dynamics include:

Regional Analysis

The North and Central America proppant market can be segmented into several key regions, including the United States, Canada, Mexico, and other Central American countries. The United States dominates the market due to its extensive shale reserves and established fracking industry. Canada also holds significant market share, driven by its abundant oil sands resources. Mexico presents an emerging market with untapped shale exploration potential, while other Central American countries contribute to the overall regional market growth.

Competitive Landscape

Leading Companies in North and Central America Proppant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

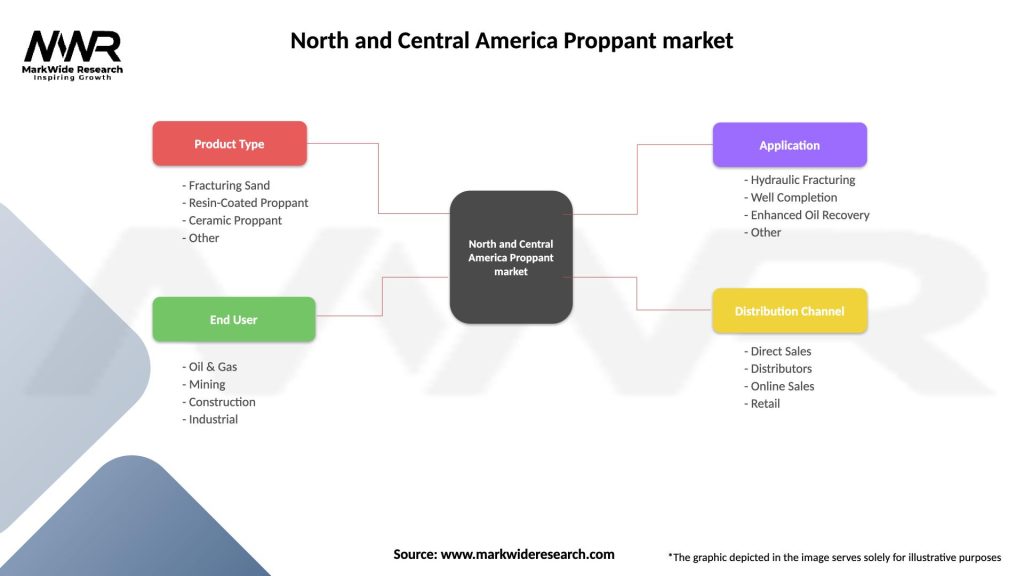

The North and Central America proppant market can be segmented based on type, application, and region.

By Type:

By Application:

By Region:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the North and Central America proppant market. The pandemic led to a decline in oil and gas demand, resulting in reduced drilling and hydraulic fracturing activities. This, in turn, affected the demand for proppants in the market. However, as the global economy recovers and oil and gas demand rebounds, the proppant market is expected to regain its growth trajectory. Industry participants have adapted to the challenges posed by the pandemic, implementing safety measures and adjusting their operations to ensure business continuity.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North and Central America proppant market is expected to witness steady growth in the coming years. The region’s abundant shale resources and increasing shale exploration activities will continue to drive the demand for proppants. Technological advancements in proppant manufacturing and hydraulic fracturing techniques will further enhance the market’s growth potential. However, the market will face challenges related to environmental concerns and evolving regulations. Proppant manufacturers that focus on sustainability, product innovation, and strategic collaborations will be well-positioned to capitalize on the market opportunities.

Conclusion

The North and Central America proppant market is experiencing significant growth due to the booming shale gas and oil exploration activities in the region. Proppants play a crucial role in hydraulic fracturing operations by propping open fractures and facilitating the extraction of oil and gas from underground reservoirs. The market is driven by factors such as increasing energy demand, technological advancements, favorable government policies, and infrastructure development. However, challenges related to environmental concerns, price volatility, and availability of alternatives exist. Industry participants and stakeholders can benefit from increased oil and gas production, market growth opportunities, technological advancements, and job creation.

What is Proppant?

Proppant refers to a material used in hydraulic fracturing to keep fractures open in the rock formation, allowing for the extraction of oil and gas. Common types of proppants include sand, resin-coated sand, and ceramic materials, which are essential in enhancing the productivity of wells.

What are the key players in the North and Central America Proppant market?

Key players in the North and Central America Proppant market include U.S. Silica Holdings, Inc., Carbo Ceramics Inc., and Hi-Crush Partners LP, among others. These companies are involved in the production and supply of various proppant materials used in hydraulic fracturing.

What are the growth factors driving the North and Central America Proppant market?

The North and Central America Proppant market is driven by the increasing demand for oil and gas, advancements in hydraulic fracturing technologies, and the growing number of shale gas projects. Additionally, the push for energy independence in the region contributes to market growth.

What challenges does the North and Central America Proppant market face?

The North and Central America Proppant market faces challenges such as environmental regulations, fluctuating oil prices, and competition from alternative energy sources. These factors can impact the demand for proppants and the overall profitability of companies in the sector.

What opportunities exist in the North and Central America Proppant market?

Opportunities in the North and Central America Proppant market include the expansion of unconventional oil and gas resources and the development of new proppant technologies. Additionally, increasing investments in infrastructure and energy projects can further enhance market prospects.

What trends are shaping the North and Central America Proppant market?

Trends in the North and Central America Proppant market include the rising use of resin-coated proppants, innovations in proppant materials, and a focus on sustainability practices. Companies are increasingly adopting eco-friendly solutions to meet regulatory requirements and consumer preferences.

North and Central America Proppant market

| Segmentation Details | Description |

|---|---|

| Product Type | Fracturing Sand, Resin-Coated Proppant, Ceramic Proppant, Other |

| End User | Oil & Gas, Mining, Construction, Industrial |

| Application | Hydraulic Fracturing, Well Completion, Enhanced Oil Recovery, Other |

| Distribution Channel | Direct Sales, Distributors, Online Sales, Retail |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North and Central America Proppant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at