444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America wireless monitoring and surveillance market represents a rapidly evolving sector driven by increasing security concerns, technological advancements, and the growing adoption of Internet of Things (IoT) devices. This comprehensive market encompasses wireless security cameras, sensors, monitoring systems, and integrated surveillance solutions that provide real-time monitoring capabilities across residential, commercial, and industrial applications. Market growth is accelerated by rising crime rates, regulatory compliance requirements, and the need for remote monitoring capabilities in various sectors.

Technological innovation continues to reshape the wireless monitoring landscape, with advanced features such as artificial intelligence integration, cloud-based storage solutions, and enhanced video analytics driving market expansion. The market benefits from increasing adoption rates of smart home technologies, with wireless surveillance systems experiencing a 12.5% annual growth rate in residential applications. Commercial sectors are increasingly investing in comprehensive wireless monitoring solutions to protect assets, ensure employee safety, and maintain operational efficiency.

Regional dynamics show the United States leading market adoption, followed by Canada, with both countries demonstrating strong demand for advanced wireless surveillance technologies. The market is characterized by continuous technological evolution, with manufacturers focusing on developing more sophisticated, user-friendly, and cost-effective wireless monitoring solutions to meet diverse customer requirements across multiple industry verticals.

The North America wireless monitoring and surveillance market refers to the comprehensive ecosystem of wireless-enabled security and monitoring technologies designed to provide real-time surveillance, threat detection, and asset protection across residential, commercial, and industrial environments. This market encompasses a wide range of products including wireless security cameras, motion sensors, access control systems, alarm systems, and integrated monitoring platforms that utilize wireless communication technologies such as Wi-Fi, cellular networks, and proprietary wireless protocols.

Wireless monitoring systems eliminate the need for extensive wiring infrastructure, offering greater flexibility in installation and deployment while providing reliable surveillance capabilities. These systems typically feature remote access capabilities, allowing users to monitor their properties and assets from anywhere using smartphones, tablets, or computer interfaces. Advanced features include real-time alerts, video analytics, cloud storage integration, and artificial intelligence-powered threat detection capabilities.

Market applications span across multiple sectors including residential security, retail surveillance, industrial monitoring, healthcare facilities, educational institutions, and government installations. The technology enables continuous monitoring of premises, detection of unauthorized access, tracking of valuable assets, and provision of evidence for security incidents, making it an essential component of modern security infrastructure.

Market dynamics in the North America wireless monitoring and surveillance sector demonstrate robust growth potential driven by escalating security concerns, technological advancements, and increasing adoption of smart technologies. The market is experiencing significant transformation as traditional wired surveillance systems are being replaced by more flexible and cost-effective wireless alternatives. Key growth drivers include rising crime rates, regulatory compliance requirements, and the growing demand for remote monitoring capabilities across various industry sectors.

Technology integration plays a crucial role in market evolution, with artificial intelligence, machine learning, and cloud computing technologies enhancing the capabilities of wireless monitoring systems. The market benefits from increasing consumer awareness of security technologies, with residential adoption rates growing at 15.2% annually. Commercial applications continue to drive substantial market demand, particularly in retail, healthcare, and manufacturing sectors where comprehensive surveillance solutions are essential for operational security.

Competitive landscape features a mix of established security technology companies and innovative startups developing next-generation wireless monitoring solutions. Market participants are focusing on product differentiation through advanced features, improved user interfaces, and integration capabilities with existing security infrastructure. Future growth prospects remain positive, supported by ongoing technological innovations, expanding application areas, and increasing investment in security infrastructure across North America.

Strategic market insights reveal several critical trends shaping the North America wireless monitoring and surveillance landscape. The following key insights provide comprehensive understanding of market dynamics:

Primary market drivers propelling growth in the North America wireless monitoring and surveillance market stem from multiple interconnected factors that create sustained demand for advanced security solutions. Rising security concerns across residential and commercial sectors continue to drive adoption of comprehensive wireless monitoring systems, with property crime rates influencing investment decisions in security infrastructure.

Technological advancement serves as a fundamental driver, with improvements in wireless communication technologies, battery life, and video quality making wireless surveillance systems more reliable and cost-effective. The integration of artificial intelligence capabilities enables advanced features such as facial recognition, behavior analysis, and predictive threat detection, adding significant value to wireless monitoring solutions.

Regulatory requirements in various industries mandate comprehensive surveillance and monitoring systems, particularly in healthcare, financial services, and critical infrastructure sectors. Insurance incentives for businesses and homeowners who install advanced security systems create additional financial motivation for market adoption. The growing remote work trend has increased demand for residential security solutions, with homeowners seeking to protect unattended properties during extended absences.

Cost considerations favor wireless solutions over traditional wired systems due to reduced installation complexity and lower infrastructure requirements. The scalability advantages of wireless systems allow users to expand their monitoring capabilities incrementally, making advanced surveillance technology accessible to organizations with varying budget constraints and security requirements.

Market restraints in the North America wireless monitoring and surveillance sector present challenges that may limit growth potential and adoption rates across certain market segments. Privacy concerns represent a significant constraint, with increasing consumer awareness of data collection and surveillance practices creating resistance to comprehensive monitoring systems, particularly in residential applications.

Technical limitations of wireless technologies, including potential signal interference, bandwidth constraints, and battery life considerations, can impact system reliability and performance. Cybersecurity vulnerabilities associated with wireless communication protocols create concerns about unauthorized access to surveillance systems and potential data breaches, requiring ongoing investment in security measures and system updates.

Initial investment costs for comprehensive wireless monitoring systems can be substantial, particularly for small businesses and residential users seeking advanced features and professional installation services. Regulatory compliance requirements regarding data storage, privacy protection, and surveillance practices create additional complexity and costs for system deployment and operation.

Integration challenges with existing security infrastructure and legacy systems can complicate adoption decisions and increase implementation costs. Maintenance requirements for wireless systems, including battery replacement, software updates, and equipment servicing, create ongoing operational considerations that may deter some potential users from adopting wireless surveillance technologies.

Emerging opportunities in the North America wireless monitoring and surveillance market present substantial growth potential across multiple application areas and technology segments. Smart city initiatives across major metropolitan areas create demand for integrated wireless surveillance systems that can monitor traffic, public safety, and infrastructure conditions while providing real-time data to municipal authorities.

Industrial IoT integration offers significant opportunities for wireless monitoring solutions in manufacturing, logistics, and energy sectors where real-time monitoring of equipment, processes, and environmental conditions is critical for operational efficiency. Healthcare applications present growing opportunities for patient monitoring, facility security, and compliance with healthcare regulations through specialized wireless surveillance systems.

Artificial intelligence integration creates opportunities for developing advanced analytics capabilities that can provide predictive insights, automated threat detection, and intelligent alert systems. Edge computing technologies enable local processing of surveillance data, reducing bandwidth requirements and improving response times for critical security events.

Subscription-based service models offer opportunities for recurring revenue streams through cloud storage, monitoring services, and system maintenance contracts. Vertical market specialization allows companies to develop tailored solutions for specific industries such as retail, education, transportation, and government sectors, each with unique monitoring requirements and regulatory considerations.

Market dynamics in the North America wireless monitoring and surveillance sector reflect complex interactions between technological innovation, regulatory requirements, competitive pressures, and evolving customer expectations. Technology evolution continues to drive market transformation, with next-generation wireless standards enabling higher data transmission rates, improved reliability, and enhanced security features that expand application possibilities.

Competitive intensity is increasing as traditional security companies face competition from technology startups and consumer electronics manufacturers entering the surveillance market. This competition drives innovation while putting pressure on pricing and profit margins. Customer expectations are evolving toward more user-friendly interfaces, seamless integration capabilities, and comprehensive mobile access to monitoring systems.

Supply chain considerations impact market dynamics, with semiconductor shortages and component availability affecting product development timelines and pricing strategies. Regulatory changes regarding privacy protection, data storage, and surveillance practices influence product design and market positioning strategies for wireless monitoring solutions.

Economic factors including interest rates, business investment levels, and consumer spending patterns affect market demand across different segments. Technological convergence with other smart technologies such as home automation, access control, and communication systems creates opportunities for integrated solutions while increasing complexity in product development and market positioning.

Research methodology for analyzing the North America wireless monitoring and surveillance market employs a comprehensive multi-source approach combining primary and secondary research techniques to ensure accuracy and reliability of market insights. Primary research includes structured interviews with industry executives, technology developers, system integrators, and end-users across residential, commercial, and industrial segments to gather firsthand insights about market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, regulatory documents, and trade publications to establish market context and validate primary research findings. Market sizing methodologies utilize bottom-up and top-down approaches, analyzing installation data, shipment volumes, and adoption rates across different application segments and geographic regions.

Technology assessment involves evaluation of wireless communication standards, security protocols, and emerging technologies that impact market development. Competitive analysis includes examination of company strategies, product portfolios, market positioning, and financial performance of key market participants.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis of market data. Forecasting models incorporate historical trends, technology adoption curves, regulatory impacts, and economic factors to project future market development scenarios with appropriate confidence intervals and sensitivity analysis.

Regional market dynamics across North America demonstrate distinct patterns of adoption and growth in wireless monitoring and surveillance technologies. United States market dominates the regional landscape, accounting for approximately 78% market share, driven by high security awareness, substantial commercial investment, and advanced technology infrastructure supporting widespread wireless surveillance deployment.

California and Texas lead state-level adoption with significant investments in smart city initiatives and commercial security infrastructure. Northeast corridor including New York, New Jersey, and Massachusetts shows strong demand for advanced wireless monitoring solutions in urban environments with high population density and security requirements.

Canadian market represents approximately 18% regional market share, with growth concentrated in major metropolitan areas including Toronto, Vancouver, and Montreal. Government initiatives supporting smart city development and infrastructure modernization drive adoption of wireless surveillance technologies in Canadian municipalities.

Rural markets across both countries present growing opportunities for wireless monitoring solutions due to limited wired infrastructure and increasing security concerns in remote locations. Border security applications create specialized demand for long-range wireless surveillance systems capable of monitoring extensive perimeters and remote areas. Climate considerations influence product requirements, with systems designed to operate reliably in extreme weather conditions common across northern regions of North America.

Competitive landscape in the North America wireless monitoring and surveillance market features a diverse mix of established security technology companies, consumer electronics manufacturers, and innovative technology startups. Market leaders maintain competitive advantages through comprehensive product portfolios, established distribution networks, and strong brand recognition among commercial and residential customers.

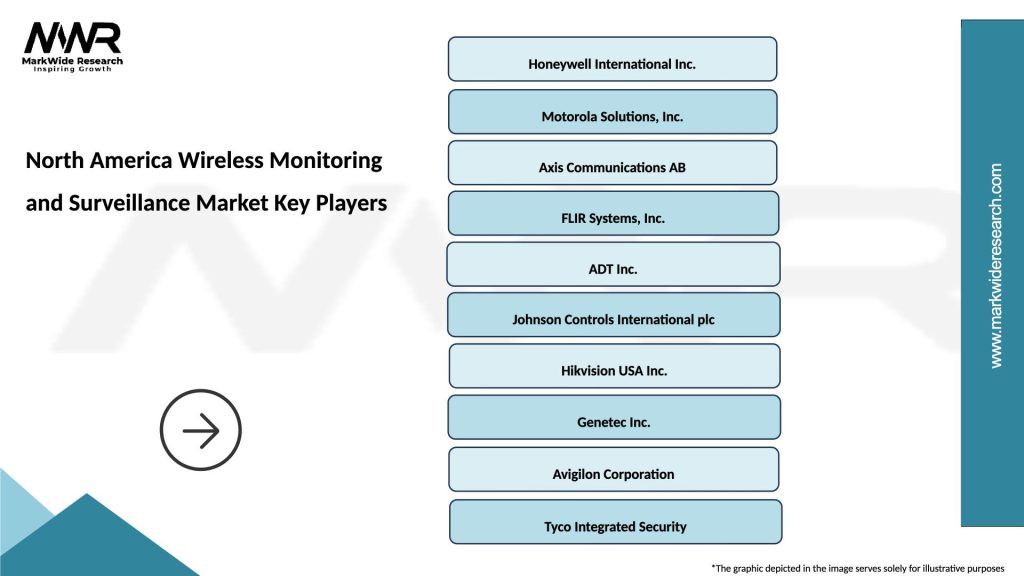

Key market participants include:

Competitive strategies focus on product innovation, strategic partnerships, and vertical market specialization to differentiate offerings and capture market share in specific application segments.

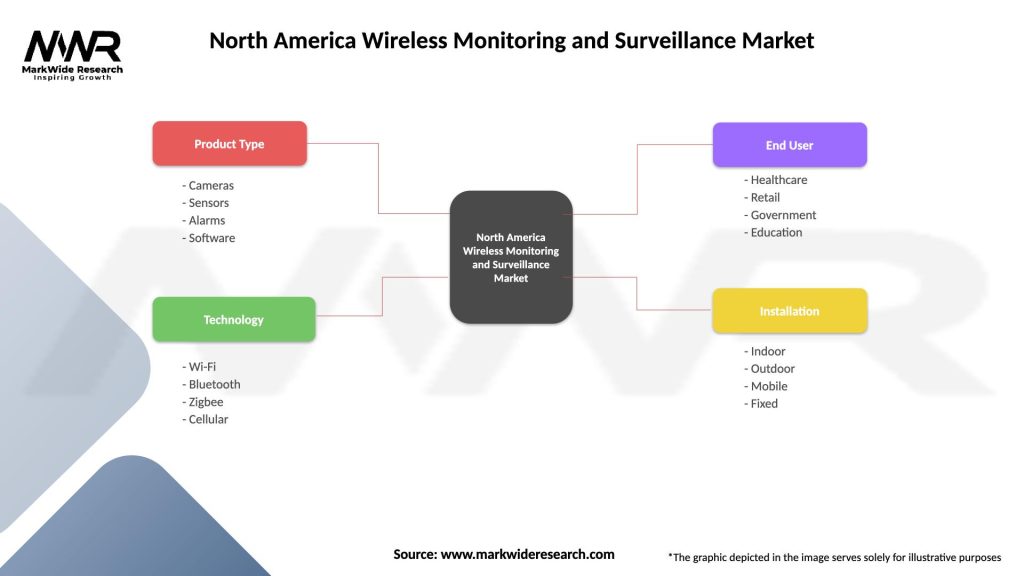

Market segmentation analysis reveals distinct categories within the North America wireless monitoring and surveillance market, each characterized by unique requirements, growth patterns, and competitive dynamics. Product segmentation encompasses various technology categories and application-specific solutions that serve different market needs.

By Product Type:

By Technology:

By Application:

Category-wise analysis provides detailed insights into specific segments of the North America wireless monitoring and surveillance market, revealing unique growth patterns, technological requirements, and competitive dynamics within each category.

Wireless Security Cameras represent the largest market category, driven by declining hardware costs and improving video quality capabilities. High-definition cameras with 4K resolution and advanced night vision capabilities are experiencing 22% adoption growth in commercial applications. Battery-powered cameras offer installation flexibility in locations without power infrastructure, while solar-powered options provide sustainable operation for remote monitoring applications.

Wireless Sensor Networks demonstrate strong growth in industrial and commercial applications where comprehensive environmental monitoring is required. IoT integration enables sensors to provide real-time data on temperature, humidity, air quality, and other environmental factors beyond traditional security monitoring. Predictive maintenance applications utilize wireless sensors to monitor equipment condition and prevent costly failures.

Wireless Access Control Systems benefit from increasing adoption of smart building technologies and mobile credential systems. Smartphone-based access eliminates the need for physical keys or cards while providing detailed access logs and remote management capabilities. Biometric integration enhances security while maintaining user convenience through fingerprint and facial recognition technologies.

Wireless Video Analytics represents the fastest-growing category, with artificial intelligence capabilities enabling automated threat detection, behavior analysis, and operational insights that extend beyond traditional security applications.

Industry participants in the North America wireless monitoring and surveillance market realize substantial benefits through strategic positioning in this growing technology sector. Revenue diversification opportunities enable companies to expand beyond traditional security products into comprehensive monitoring solutions that serve multiple market segments and application areas.

Technology integration benefits allow companies to leverage existing capabilities in wireless communications, video processing, and software development to create innovative surveillance solutions. Recurring revenue opportunities through subscription-based services, cloud storage, and maintenance contracts provide stable income streams that complement traditional product sales.

Market expansion potential enables companies to serve new customer segments and geographic markets through wireless technologies that overcome infrastructure limitations of traditional wired systems. Partnership opportunities with telecommunications providers, system integrators, and technology companies create channels for market access and capability enhancement.

Stakeholder benefits extend to end users who gain enhanced security capabilities, operational insights, and cost-effective monitoring solutions. Investors benefit from market growth potential and technology innovation opportunities in the expanding wireless surveillance sector. Society benefits through improved public safety, crime prevention, and emergency response capabilities enabled by advanced wireless monitoring systems.

Economic benefits include job creation in technology development, manufacturing, installation, and maintenance services supporting the wireless surveillance industry across North America.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the North America wireless monitoring and surveillance landscape reflect evolving technology capabilities, changing customer expectations, and emerging application requirements. Artificial intelligence integration represents the most significant trend, with machine learning algorithms enabling automated threat detection, behavior analysis, and predictive security capabilities that extend beyond traditional surveillance functions.

Cloud-based solutions continue gaining adoption as organizations seek to reduce infrastructure costs while improving scalability and accessibility of surveillance systems. Edge computing integration enables local processing of video and sensor data, reducing bandwidth requirements while improving response times for critical security events.

Mobile-first design approaches prioritize smartphone and tablet interfaces, with user experience optimization making wireless surveillance systems more accessible to non-technical users. Integration trends focus on connecting surveillance systems with other smart building technologies including access control, lighting, and HVAC systems for comprehensive facility management.

Sustainability considerations drive development of energy-efficient wireless devices and solar-powered systems that reduce environmental impact while expanding deployment possibilities. Privacy-by-design approaches address growing consumer concerns through built-in data protection features and transparent privacy controls. According to MarkWide Research analysis, subscription-based service models are experiencing 28% growth as customers prefer operational expense models over large capital investments.

Recent industry developments demonstrate the dynamic nature of the North America wireless monitoring and surveillance market, with significant technological advances and strategic initiatives shaping competitive positioning and market evolution. 5G network deployment across major metropolitan areas enables new capabilities for wireless surveillance systems including higher resolution video streaming, real-time analytics, and massive sensor network connectivity.

Artificial intelligence partnerships between surveillance companies and technology firms accelerate development of intelligent monitoring capabilities. Major acquisitions in the industry consolidate market positions while bringing together complementary technologies and market access capabilities.

Regulatory developments including updated privacy protection requirements influence product design and deployment strategies across the industry. Cybersecurity enhancements address growing concerns about wireless system vulnerabilities through improved encryption, authentication, and network security protocols.

Product innovations include development of ultra-low-power wireless devices, advanced video analytics capabilities, and integrated IoT platforms that combine surveillance with operational monitoring functions. Market expansion initiatives by major companies include new distribution partnerships, vertical market specialization, and geographic expansion strategies to capture growth opportunities in emerging application areas.

Technology standardization efforts aim to improve interoperability between different wireless surveillance systems and platforms, reducing integration complexity for end users and system integrators.

Strategic recommendations for market participants in the North America wireless monitoring and surveillance sector focus on positioning for sustained growth while addressing evolving customer requirements and competitive challenges. Technology investment priorities should emphasize artificial intelligence capabilities, cybersecurity enhancements, and user experience improvements that differentiate products in increasingly competitive markets.

Market positioning strategies should focus on vertical specialization and application-specific solutions rather than generic surveillance products. Partnership development with telecommunications providers, system integrators, and technology companies can accelerate market access and capability development while reducing investment requirements.

Product development recommendations include emphasis on ease of installation, mobile-first design, and integration capabilities with existing security infrastructure. Service model innovation through subscription-based offerings, managed services, and comprehensive support packages can create recurring revenue streams and strengthen customer relationships.

Geographic expansion strategies should consider regional differences in regulatory requirements, customer preferences, and competitive dynamics. Cybersecurity investment is essential for maintaining customer trust and meeting regulatory requirements in an increasingly connected surveillance environment.

MWR analysis suggests that companies focusing on integrated solutions combining multiple wireless technologies and applications will achieve stronger market positions than those offering standalone products. Customer education initiatives can accelerate adoption by addressing privacy concerns and demonstrating value propositions of advanced wireless surveillance technologies.

Future market outlook for the North America wireless monitoring and surveillance sector indicates sustained growth driven by technological innovation, expanding application areas, and increasing security awareness across residential and commercial segments. Technology evolution will continue transforming market capabilities, with artificial intelligence, 5G connectivity, and edge computing enabling new surveillance applications and improved system performance.

Market expansion is expected across multiple dimensions including geographic coverage, application diversity, and customer segments. Smart city initiatives will drive substantial demand for integrated wireless surveillance systems that support public safety, traffic management, and infrastructure monitoring requirements. Industrial IoT integration will create opportunities for specialized monitoring solutions in manufacturing, logistics, and energy sectors.

Competitive dynamics will intensify as technology companies, telecommunications providers, and traditional security firms compete for market share in high-growth segments. Consolidation trends may accelerate as companies seek to acquire complementary technologies and market access capabilities.

Regulatory evolution will continue influencing market development, with privacy protection requirements and cybersecurity standards shaping product design and deployment practices. Economic factors including business investment levels and consumer spending patterns will affect market growth rates across different segments and geographic regions.

Long-term growth projections remain positive, with the market expected to maintain robust expansion supported by ongoing technological innovation, expanding security requirements, and increasing adoption of wireless technologies across North America.

The North America wireless monitoring and surveillance market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by technological innovation, increasing security concerns, and expanding application opportunities. Market fundamentals remain strong, supported by robust demand across residential, commercial, and industrial segments, while technological advances in artificial intelligence, wireless communications, and cloud computing continue expanding system capabilities and market potential.

Strategic opportunities abound for companies that can successfully navigate evolving customer requirements, regulatory challenges, and competitive pressures while delivering innovative solutions that address real-world security and monitoring needs. Technology integration trends favor companies developing comprehensive platforms that combine multiple wireless technologies with advanced analytics and user-friendly interfaces.

Market outlook indicates continued expansion across multiple dimensions, with smart city initiatives, industrial IoT applications, and consumer security awareness driving sustained demand for wireless surveillance solutions. Success factors for market participants include focus on cybersecurity, user experience optimization, vertical market specialization, and strategic partnerships that accelerate market access and capability development. The North America wireless monitoring and surveillance market will continue serving as a critical component of modern security infrastructure while evolving to meet emerging challenges and opportunities in an increasingly connected world.

What is Wireless Monitoring and Surveillance?

Wireless Monitoring and Surveillance refers to the use of wireless technology to monitor and secure environments through various devices such as cameras, sensors, and alarms. This technology is widely used in sectors like security, healthcare, and environmental monitoring.

What are the key players in the North America Wireless Monitoring and Surveillance Market?

Key players in the North America Wireless Monitoring and Surveillance Market include companies like Honeywell, Axis Communications, and ADT Inc., which provide a range of solutions for security and monitoring applications, among others.

What are the main drivers of growth in the North America Wireless Monitoring and Surveillance Market?

The growth of the North America Wireless Monitoring and Surveillance Market is driven by increasing security concerns, advancements in wireless technology, and the rising adoption of smart home devices. Additionally, the demand for real-time monitoring solutions in various industries contributes to market expansion.

What challenges does the North America Wireless Monitoring and Surveillance Market face?

Challenges in the North America Wireless Monitoring and Surveillance Market include concerns over data privacy and security, high installation costs, and the complexity of integrating new technologies with existing systems. These factors can hinder widespread adoption and implementation.

What opportunities exist in the North America Wireless Monitoring and Surveillance Market?

Opportunities in the North America Wireless Monitoring and Surveillance Market include the growing demand for IoT-enabled devices, the expansion of smart city initiatives, and the increasing need for remote monitoring solutions in various sectors. These trends are expected to drive innovation and investment in the market.

What trends are shaping the North America Wireless Monitoring and Surveillance Market?

Trends shaping the North America Wireless Monitoring and Surveillance Market include the integration of artificial intelligence for enhanced analytics, the rise of cloud-based surveillance solutions, and the increasing use of drones for monitoring purposes. These innovations are transforming how surveillance is conducted.

North America Wireless Monitoring and Surveillance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Cameras, Sensors, Alarms, Software |

| Technology | Wi-Fi, Bluetooth, Zigbee, Cellular |

| End User | Healthcare, Retail, Government, Education |

| Installation | Indoor, Outdoor, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Wireless Monitoring and Surveillance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at