444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America water enhancers market represents a dynamic and rapidly evolving segment within the broader beverage industry, characterized by innovative products designed to transform plain water into flavorful, functional beverages. This market encompasses liquid concentrates, powder mixes, tablets, and drops that consumers add to water to enhance taste, nutritional value, and functional benefits. Market growth has been particularly robust, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years, driven by increasing health consciousness and demand for convenient hydration solutions.

Consumer preferences in North America have shifted significantly toward healthier beverage alternatives, with water enhancers emerging as a preferred choice for individuals seeking to reduce sugar intake while maintaining flavor variety. The market spans across the United States, Canada, and Mexico, with the United States commanding approximately 78% of the regional market share. Product innovation continues to drive market expansion, with manufacturers introducing enhanced formulations featuring vitamins, minerals, electrolytes, and natural ingredients to meet diverse consumer needs.

Distribution channels have diversified considerably, encompassing traditional retail outlets, online platforms, convenience stores, and specialty health food retailers. The market’s resilience has been demonstrated through consistent growth patterns, even during challenging economic periods, as consumers increasingly prioritize health and wellness in their daily routines.

The North America water enhancers market refers to the commercial ecosystem encompassing the production, distribution, and consumption of concentrated flavor and functional additives designed to enhance plain water. These products enable consumers to customize their hydration experience by adding taste, nutrients, and functional benefits to water without the calories and artificial ingredients typically found in traditional flavored beverages.

Water enhancers represent a category of beverage additives that transform ordinary water into personalized drinks through concentrated formulations. The market includes various product formats such as liquid drops, powder sachets, effervescent tablets, and squeeze bottles containing concentrated flavoring agents, vitamins, minerals, and other functional ingredients. Consumer control over flavor intensity and nutritional content distinguishes water enhancers from pre-mixed beverages, offering unprecedented customization in hydration solutions.

Market participants include established beverage companies, specialized nutrition brands, and emerging startups focused on innovative hydration solutions. The sector serves health-conscious consumers, fitness enthusiasts, busy professionals, and individuals seeking convenient alternatives to sugary drinks while maintaining adequate daily fluid intake.

Market dynamics in the North America water enhancers sector reflect a convergence of health trends, convenience demands, and innovative product development. The market has experienced substantial growth momentum, with natural and organic formulations capturing approximately 42% of consumer preference in recent surveys. Key market drivers include rising health awareness, increasing diabetes prevalence, growing fitness culture, and consumer desire for customizable beverage experiences.

Competitive landscape features both multinational corporations and specialized brands competing through product differentiation, flavor innovation, and functional benefit enhancement. Distribution strategies have evolved to encompass omnichannel approaches, with online sales representing a growing 28% of total market volume. Consumer demographics span multiple age groups, with millennials and Generation Z showing particularly strong adoption rates for innovative water enhancement products.

Market challenges include regulatory compliance, ingredient sourcing sustainability, and competition from alternative beverage categories. However, opportunities abound in emerging segments such as immunity-boosting formulations, energy-enhancing variants, and environmentally sustainable packaging solutions. Future growth prospects remain positive, supported by continued innovation and expanding consumer acceptance of functional beverages.

Consumer behavior analysis reveals significant insights into North America water enhancer adoption patterns and preferences. MarkWide Research data indicates that flavor variety remains the primary purchase driver, with consumers seeking diverse taste experiences to maintain hydration interest. Health positioning has become increasingly important, with products featuring added vitamins, electrolytes, and natural ingredients gaining substantial market traction.

Key market insights include:

Health consciousness trends represent the primary catalyst driving North America water enhancer market expansion. Consumer awareness regarding sugar-related health risks has intensified, with individuals actively seeking alternatives to traditional soft drinks and flavored beverages. The growing prevalence of diabetes, obesity, and metabolic disorders has created substantial demand for low-calorie, sugar-free hydration solutions that maintain taste appeal.

Lifestyle factors significantly influence market growth, particularly the increasing pace of modern life and demand for convenient nutrition solutions. Busy professionals and active individuals appreciate the portability and customization options offered by water enhancers, enabling them to maintain proper hydration while managing demanding schedules. Fitness culture expansion has further amplified demand, with gym-goers and athletes seeking functional hydration products that support performance and recovery.

Product innovation momentum continues driving market expansion through the introduction of specialized formulations targeting specific consumer needs. Functional ingredients such as electrolytes, vitamins, antioxidants, and adaptogens have broadened market appeal beyond basic flavoring, creating opportunities for premium positioning and expanded usage occasions. Natural ingredient trends have prompted manufacturers to develop clean-label formulations using organic flavors, plant-based sweeteners, and sustainably sourced components.

Economic factors also support market growth, as water enhancers often provide cost-effective alternatives to purchasing pre-flavored beverages. Value proposition becomes particularly compelling for families and frequent consumers who can achieve significant savings while maintaining beverage variety and nutritional benefits.

Regulatory challenges present significant constraints for North America water enhancer market participants, particularly regarding health claims, ingredient approvals, and labeling requirements. FDA regulations governing dietary supplements and functional foods create compliance complexities that can delay product launches and increase development costs. Cross-border regulations between the United States, Canada, and Mexico add additional layers of complexity for companies seeking regional market expansion.

Consumer skepticism regarding artificial ingredients and chemical additives poses ongoing challenges for market growth. Clean label demands require manufacturers to reformulate products using natural alternatives, often resulting in higher production costs and potential taste or stability compromises. Ingredient transparency expectations have intensified, with consumers demanding detailed information about sourcing, processing methods, and potential health impacts.

Competition intensity from alternative beverage categories creates market share pressures, particularly from ready-to-drink functional beverages, flavored waters, and traditional soft drinks. Market saturation in certain segments has led to pricing pressures and reduced profit margins, challenging smaller manufacturers’ ability to compete effectively against established brands with superior distribution networks and marketing resources.

Supply chain vulnerabilities have become increasingly apparent, particularly regarding specialized ingredients, packaging materials, and international sourcing dependencies. Cost inflation for raw materials, transportation, and energy has pressured manufacturers to balance cost management with quality maintenance and competitive pricing strategies.

Emerging health trends create substantial opportunities for North America water enhancer market expansion, particularly in functional nutrition segments. Immunity support formulations have gained significant consumer interest, with products featuring vitamin C, zinc, elderberry, and other immune-boosting ingredients showing strong market potential. Mental wellness positioning represents another growth avenue, with adaptogens, nootropics, and stress-reducing compounds appealing to health-conscious consumers.

Demographic expansion opportunities exist in underserved market segments, including children’s formulations, senior-focused products, and specialized athletic performance enhancers. Pediatric market potential remains largely untapped, with opportunities for developing age-appropriate formulations that encourage healthy hydration habits while meeting parental approval for ingredient safety and nutritional value.

Sustainability initiatives present significant market differentiation opportunities, with environmentally conscious consumers increasingly prioritizing eco-friendly packaging, carbon-neutral production, and sustainable ingredient sourcing. Circular economy principles can be integrated through refillable packaging systems, biodegradable materials, and partnership programs that reduce environmental impact while building brand loyalty.

Technology integration offers innovative market expansion possibilities through smart packaging, personalized nutrition platforms, and digital engagement strategies. Customization technologies could enable consumers to create personalized flavor and nutrient profiles based on individual health goals, dietary restrictions, and taste preferences, creating premium market segments with higher profit potential.

Supply and demand equilibrium in the North America water enhancers market reflects complex interactions between consumer preferences, manufacturing capabilities, and competitive pressures. Demand patterns show seasonal variations, with peak consumption occurring during warmer months when hydration needs increase. Supply chain optimization has become critical for maintaining market competitiveness, with manufacturers investing in flexible production systems capable of responding to rapid demand fluctuations.

Price dynamics demonstrate the market’s maturation, with premium products commanding higher margins while value-oriented segments experience pricing pressures. Cost structure analysis reveals that ingredient costs represent approximately 35% of total production expenses, making raw material procurement strategies crucial for maintaining profitability. Distribution costs have increased due to omnichannel requirements and direct-to-consumer shipping demands.

Innovation cycles continue accelerating, with product development timelines shortening to meet rapidly evolving consumer expectations. Market responsiveness has become a key competitive advantage, with successful companies demonstrating ability to quickly adapt formulations, packaging, and marketing strategies based on emerging trends and consumer feedback.

Competitive dynamics feature both collaboration and rivalry, with companies forming strategic partnerships for ingredient sourcing, technology development, and market access while competing intensely for consumer attention and retail shelf space. Market consolidation trends suggest potential for merger and acquisition activity as companies seek scale advantages and expanded product portfolios.

Comprehensive market analysis for the North America water enhancers sector employs multi-faceted research approaches combining quantitative data collection, qualitative consumer insights, and industry expert consultations. Primary research methodologies include consumer surveys, focus groups, in-depth interviews with industry stakeholders, and retail audit studies to capture real-time market dynamics and emerging trends.

Data collection strategies encompass both traditional and digital research techniques, utilizing online surveys, social media sentiment analysis, e-commerce platform monitoring, and mobile app-based consumer behavior tracking. Sample sizes are designed to ensure statistical significance across key demographic segments, geographic regions, and product categories within the North American market scope.

Secondary research integration incorporates industry reports, regulatory filings, patent databases, trade publication analysis, and competitive intelligence gathering to provide comprehensive market context. Triangulation methods validate findings across multiple data sources, ensuring accuracy and reliability of market insights and projections.

Analytical frameworks employ advanced statistical modeling, trend analysis, and predictive algorithms to identify market patterns, growth drivers, and future opportunities. Quality assurance protocols include peer review processes, data verification procedures, and continuous methodology refinement to maintain research standards and credibility.

United States market dominance characterizes the North America water enhancers landscape, with American consumers demonstrating the highest adoption rates and product diversity preferences. Regional consumption patterns show particular strength in health-conscious metropolitan areas, with California, New York, and Texas leading in market penetration. Distribution infrastructure in the United States provides comprehensive market coverage through established retail networks, e-commerce platforms, and specialty health food channels.

Canadian market dynamics reflect similar health trends but with distinct regulatory requirements and consumer preferences for natural, locally-sourced ingredients. Bilingual labeling requirements and provincial regulations create additional complexity for market entry, while consumer acceptance of functional beverages continues growing steadily. Market share distribution shows Canada representing approximately 18% of regional volume, with strong growth potential in urban centers.

Mexican market emergence presents significant growth opportunities, driven by increasing urbanization, rising disposable incomes, and growing health awareness among middle-class consumers. Cultural preferences for bold flavors and natural ingredients align well with water enhancer product positioning, while expanding retail infrastructure supports market accessibility. Growth projections indicate Mexico could achieve double-digit expansion rates as market education and product availability improve.

Cross-border trade dynamics facilitate regional market integration, with manufacturers leveraging USMCA trade agreements to optimize production and distribution strategies. Regional supply chains are increasingly integrated, enabling cost efficiencies and improved market responsiveness across North American markets.

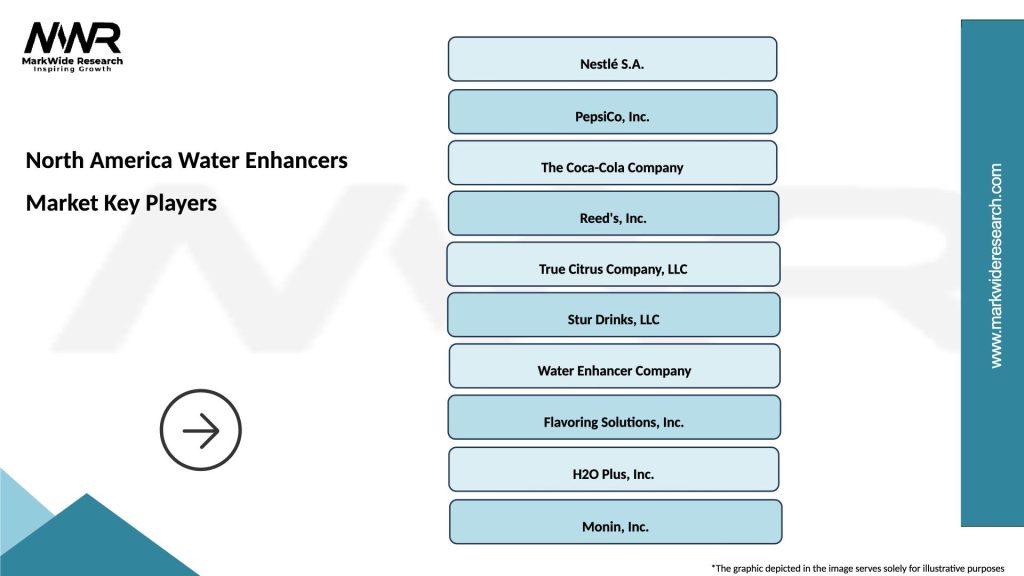

Market leadership positions in the North America water enhancers sector are held by a combination of established beverage giants and specialized nutrition companies. Competitive strategies focus on product innovation, brand building, distribution expansion, and strategic partnerships to capture market share and build consumer loyalty.

Key market participants include:

Competitive differentiation strategies emphasize unique value propositions, including proprietary flavor systems, functional ingredient combinations, sustainable packaging solutions, and targeted marketing approaches. Innovation leadership remains crucial for maintaining market position, with companies investing significantly in research and development to create next-generation products.

Product format segmentation reveals diverse consumer preferences across multiple water enhancer categories, each serving specific usage occasions and consumer needs. Liquid concentrates dominate market share due to convenience and flavor intensity control, while powder formats appeal to consumers seeking portion control and extended shelf life benefits.

By Product Type:

By Flavor Category:

By Distribution Channel:

Functional enhancement categories demonstrate varying growth trajectories and consumer adoption patterns within the North America water enhancers market. Vitamin-enriched products show consistent demand growth, with consumers increasingly seeking convenient methods to supplement daily nutritional intake through hydration routines. Electrolyte formulations have gained substantial traction among fitness enthusiasts and active professionals seeking enhanced hydration efficiency.

Energy enhancement segments represent high-growth opportunities, with caffeine-infused water enhancers appealing to consumers seeking alternatives to traditional energy drinks and coffee beverages. Natural energy ingredients such as green tea extract, guarana, and B-vitamins provide sustained energy without artificial stimulants, addressing health-conscious consumer preferences.

Immunity support categories have experienced accelerated growth, particularly following increased health awareness trends. Vitamin C formulations lead this segment, while zinc, elderberry, and echinacea additions provide additional immune system support positioning. Antioxidant-rich variants featuring superfruits and botanical extracts appeal to consumers seeking comprehensive wellness benefits.

Digestive health segments emerge as specialized growth areas, with probiotics, prebiotics, and digestive enzymes being incorporated into water enhancer formulations. Gut health awareness drives consumer interest in functional hydration products that support digestive wellness while providing flavor variety and convenience benefits.

Manufacturers benefit from the North America water enhancers market through multiple value creation opportunities, including premium pricing potential for functional formulations, reduced production costs compared to ready-to-drink beverages, and flexible manufacturing scalability. Product differentiation capabilities enable companies to create unique market positions through proprietary ingredient combinations, innovative packaging solutions, and targeted consumer segment strategies.

Retailers gain advantages through high-margin product categories, compact shelf space requirements, extended shelf life reducing inventory risks, and strong consumer demand driving consistent sales velocity. Cross-merchandising opportunities allow retailers to position water enhancers alongside complementary products such as bottled water, fitness accessories, and health supplements to increase basket size and customer engagement.

Consumers receive value through cost-effective flavor variety, customizable taste intensity, portable convenience for active lifestyles, and functional health benefits integrated into daily hydration routines. Personalization benefits enable individuals to tailor their beverage experience according to specific preferences, dietary requirements, and health goals while maintaining proper hydration levels.

Healthcare stakeholders recognize water enhancers as tools for encouraging adequate fluid intake among patients, particularly those who struggle with plain water consumption. Nutritional supplementation through enhanced water products can support treatment protocols and wellness programs while improving patient compliance with hydration recommendations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement represents a dominant trend shaping North America water enhancer product development, with consumers increasingly demanding transparency in ingredient sourcing, processing methods, and nutritional content. Natural flavor systems derived from real fruits, herbs, and botanicals are replacing artificial alternatives, while organic certifications provide additional credibility for health-conscious consumers. Simplification strategies focus on reducing ingredient lists while maintaining taste quality and functional benefits.

Personalization technology integration emerges as a significant trend, with companies exploring smart packaging, mobile app connectivity, and customized formulation services. Individual health profiling could enable consumers to receive personalized recommendations based on dietary needs, fitness goals, and taste preferences. Subscription models are gaining traction, providing convenient recurring delivery while building customer loyalty and predictable revenue streams.

Sustainability initiatives are becoming increasingly important, with manufacturers investing in recyclable packaging, carbon-neutral production, and sustainable ingredient sourcing. Circular economy principles are being integrated through refillable packaging systems, biodegradable materials, and partnership programs with environmental organizations. Consumer activism around environmental issues is driving brand differentiation through sustainability positioning.

Functional ingredient innovation continues expanding beyond traditional vitamins and minerals to include adaptogens, nootropics, probiotics, and plant-based compounds. MWR analysis indicates that immunity support formulations have achieved remarkable 45% growth rates in consumer adoption, while stress-reduction and mental wellness products represent emerging opportunities for market expansion.

Product launch activities have intensified across the North America water enhancers market, with established brands and new entrants introducing innovative formulations targeting specific consumer needs. Immunity-focused launches have dominated recent product introductions, featuring vitamin C, zinc, elderberry, and other immune-supporting ingredients in response to heightened health awareness.

Strategic partnerships between water enhancer manufacturers and ingredient suppliers have increased, focusing on exclusive access to novel functional components, sustainable sourcing agreements, and co-development initiatives. Technology collaborations with packaging companies are producing innovative delivery systems, including smart packaging with freshness indicators and portion control mechanisms.

Acquisition activity has accelerated as larger companies seek to expand product portfolios and access specialized market segments. Vertical integration strategies are being pursued by some manufacturers to control ingredient sourcing, reduce costs, and ensure quality consistency throughout the supply chain.

Regulatory developments include updated guidelines for health claims, ingredient safety assessments, and labeling requirements that impact product development and marketing strategies. Industry standardization efforts are progressing to establish quality benchmarks and testing protocols for functional water enhancer products.

Market entry strategies for new participants should focus on differentiated positioning through unique functional benefits, superior taste profiles, or underserved consumer segments. Niche market targeting offers better opportunities for establishing market presence compared to direct competition with established brands in mainstream segments. Partnership approaches with established distributors or retailers can accelerate market access while reducing initial investment requirements.

Innovation priorities should emphasize clean label formulations, sustainable packaging solutions, and functional ingredient combinations that address specific health concerns. Consumer research investment is crucial for understanding evolving preferences, usage patterns, and unmet needs that can guide product development decisions. Digital marketing strategies should leverage social media platforms, influencer partnerships, and content marketing to build brand awareness and consumer education.

Supply chain optimization recommendations include diversifying ingredient suppliers, investing in flexible manufacturing capabilities, and developing contingency plans for disruption management. Quality assurance systems should be robust enough to ensure consistent product performance while meeting regulatory requirements across different jurisdictions.

Long-term positioning strategies should consider sustainability leadership, technology integration, and global expansion opportunities as the market matures. Brand building investments in consumer education, loyalty programs, and community engagement will become increasingly important for maintaining competitive advantages in a crowded marketplace.

Growth projections for the North America water enhancers market remain optimistic, supported by continued health consciousness trends, product innovation momentum, and expanding consumer acceptance. Market maturation is expected to drive consolidation among smaller players while creating opportunities for specialized brands with unique value propositions. Technology integration will likely accelerate, enabling personalized nutrition solutions and enhanced consumer engagement.

Demographic shifts toward aging populations and increasing health awareness across all age groups support long-term market expansion. Functional nutrition trends are expected to intensify, with consumers seeking more sophisticated health benefits from their beverage choices. Sustainability requirements will become increasingly important for market success, driving innovation in packaging, sourcing, and production methods.

Regulatory evolution may create both challenges and opportunities, with potential for more stringent health claim requirements balanced by possible recognition of functional food categories. International expansion opportunities exist for successful North American brands seeking growth in emerging markets with similar consumer trends and regulatory frameworks.

Innovation directions are likely to focus on personalized nutrition, sustainable packaging, novel functional ingredients, and technology-enabled consumer experiences. Market segmentation will continue evolving, with specialized products targeting specific health conditions, lifestyle needs, and demographic groups creating premium positioning opportunities for innovative companies.

The North America water enhancers market represents a dynamic and rapidly evolving sector within the broader beverage industry, characterized by strong growth momentum, continuous innovation, and expanding consumer acceptance. Market fundamentals remain solid, supported by health consciousness trends, convenience demands, and the unique value proposition of customizable hydration solutions that enable consumers to personalize their beverage experience while maintaining nutritional goals.

Competitive dynamics continue evolving as established beverage companies and specialized nutrition brands compete through product differentiation, functional ingredient innovation, and strategic positioning. Growth opportunities abound in emerging segments such as immunity support, mental wellness, and sustainability-focused products, while traditional flavor and convenience benefits maintain strong consumer appeal across diverse demographic groups.

Future success in this market will depend on companies’ ability to balance innovation with consumer education, sustainability with profitability, and market expansion with operational efficiency. The North America water enhancers market is well-positioned for continued growth, offering significant opportunities for stakeholders who can effectively navigate regulatory requirements, consumer preferences, and competitive pressures while delivering superior value through innovative, health-focused hydration solutions.

What is Water Enhancers?

Water enhancers are concentrated liquid or powdered products designed to add flavor, nutrients, or other functional benefits to water. They are popular among consumers looking for healthier beverage options without added sugars or calories.

What are the key players in the North America Water Enhancers Market?

Key players in the North America Water Enhancers Market include companies like Nestlé, The Coca-Cola Company, and PepsiCo, which offer a variety of flavored water products and enhancers, among others.

What are the main drivers of growth in the North America Water Enhancers Market?

The growth of the North America Water Enhancers Market is driven by increasing health consciousness among consumers, a rising demand for low-calorie beverages, and the convenience of portable flavoring options for on-the-go hydration.

What challenges does the North America Water Enhancers Market face?

Challenges in the North America Water Enhancers Market include intense competition among brands, potential regulatory scrutiny regarding health claims, and consumer skepticism about artificial ingredients in some products.

What opportunities exist in the North America Water Enhancers Market?

Opportunities in the North America Water Enhancers Market include the development of organic and natural flavor enhancers, expansion into new distribution channels, and the introduction of functional beverages that cater to specific health needs.

What trends are shaping the North America Water Enhancers Market?

Trends in the North America Water Enhancers Market include a growing preference for plant-based ingredients, innovative packaging solutions, and the rise of personalized nutrition, where consumers seek products tailored to their individual health goals.

North America Water Enhancers Market

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Enhancers, Powder Enhancers, Concentrated Drops, Flavor Infusions |

| End User | Households, Fitness Centers, Restaurants, Beverage Manufacturers |

| Distribution Channel | Online Retail, Supermarkets, Health Stores, Direct Sales |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Water Enhancers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at