444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America water consumption market represents a critical infrastructure sector encompassing residential, commercial, industrial, and agricultural water usage across the United States, Canada, and Mexico. This comprehensive market involves water treatment facilities, distribution systems, consumption monitoring technologies, and conservation solutions that serve over 580 million people across the continent. The market demonstrates robust growth driven by increasing urbanization, industrial expansion, and heightened awareness of water scarcity issues.

Market dynamics indicate significant transformation as traditional water management approaches evolve toward smart water technologies and sustainable consumption practices. The sector experiences consistent demand growth of approximately 3.2% annually, reflecting population increases and economic development. Technological innovations in water metering, leak detection, and treatment processes are reshaping consumption patterns and operational efficiency across all market segments.

Regional variations characterize the North American landscape, with the southwestern United States facing acute water stress while the Great Lakes region maintains abundant freshwater resources. This geographic diversity creates distinct market opportunities for water conservation technologies, alternative sourcing solutions, and advanced treatment systems. Climate change impacts increasingly influence consumption patterns, driving demand for resilient water infrastructure and adaptive management strategies.

The North America water consumption market refers to the comprehensive ecosystem of water usage, distribution, treatment, and management services across residential, commercial, industrial, and agricultural sectors throughout the United States, Canada, and Mexico. This market encompasses all activities related to water procurement, processing, delivery, consumption monitoring, and conservation efforts that support economic activities and quality of life across the continent.

Water consumption in this context includes municipal water supply systems, private well usage, industrial process water, irrigation systems, and specialized applications such as cooling systems and manufacturing processes. The market integrates traditional infrastructure with emerging technologies including smart meters, IoT sensors, water recycling systems, and advanced treatment facilities that optimize consumption efficiency and resource sustainability.

Stakeholders within this market include water utilities, municipal governments, industrial users, agricultural operators, technology providers, and regulatory agencies working collectively to ensure reliable water access while promoting conservation and environmental stewardship. The market’s scope extends from source water management through end-user consumption and wastewater treatment, creating a comprehensive value chain that supports North American economic development and environmental sustainability.

North America’s water consumption market demonstrates remarkable resilience and adaptation as it addresses growing demand pressures while embracing technological innovation and sustainability principles. The market serves as a cornerstone of regional economic development, supporting diverse industries from agriculture and manufacturing to technology and services. Current consumption patterns reflect both traditional usage models and emerging efficiency-driven approaches that optimize resource utilization.

Key market drivers include population growth, industrial expansion, agricultural intensification, and increasing awareness of water scarcity challenges. The sector benefits from substantial infrastructure investments, technological advancement adoption rates of approximately 15% annually, and regulatory frameworks promoting conservation and quality standards. Smart water technologies gain significant traction, with adoption rates reaching 28% among major utilities as organizations seek operational efficiency and customer engagement improvements.

Market challenges encompass aging infrastructure, climate variability impacts, regulatory compliance costs, and the need for substantial capital investments in system upgrades and expansion. However, these challenges create opportunities for innovative solutions, public-private partnerships, and technology integration that enhance system performance and sustainability. The market’s evolution toward data-driven management and customer-centric services positions it for continued growth and modernization.

Strategic insights reveal the North America water consumption market’s transformation from traditional utility models toward integrated, technology-enabled service platforms. The following key insights demonstrate market dynamics and growth opportunities:

Population growth serves as the primary driver of water consumption demand across North America, with urban areas experiencing particularly rapid expansion that strains existing infrastructure capacity. Metropolitan regions require substantial system upgrades and expansion projects to accommodate growing residential and commercial water needs. Economic development in emerging markets creates additional demand for industrial and commercial water services, supporting business expansion and job creation.

Industrial expansion across manufacturing, technology, and energy sectors generates significant water consumption requirements for production processes, cooling systems, and facility operations. The growth of data centers, semiconductor manufacturing, and renewable energy projects creates specialized water demand that requires advanced treatment and recycling capabilities. Agricultural intensification drives irrigation system development and precision farming technologies that optimize crop yields while managing water resources efficiently.

Climate change adaptation necessitates resilient water infrastructure capable of managing variable precipitation patterns, extreme weather events, and changing seasonal demand cycles. Water utilities invest in diverse sourcing strategies, storage capacity expansion, and treatment technology upgrades to maintain service reliability. Regulatory requirements for water quality, environmental protection, and conservation standards drive technology adoption and operational improvements across all market segments.

Technological innovation enables new service models, operational efficiencies, and customer engagement opportunities that transform traditional water consumption patterns. Smart city initiatives integrate water management with broader urban planning and sustainability goals, creating synergies across municipal services and infrastructure systems.

Infrastructure aging presents significant challenges as many North American water systems operate with decades-old pipes, treatment facilities, and distribution networks requiring substantial capital investment for replacement and modernization. The estimated infrastructure replacement needs create financial burdens for utilities and municipalities while potentially disrupting service delivery during upgrade periods. Regulatory compliance costs associated with water quality standards, environmental protection requirements, and safety protocols impose ongoing operational expenses that impact system economics.

Climate variability introduces operational uncertainties as drought conditions, extreme precipitation events, and temperature fluctuations affect water availability and demand patterns. These environmental factors require adaptive management strategies and contingency planning that increase operational complexity and costs. Capital intensity of water infrastructure projects creates barriers for smaller utilities and communities seeking system improvements or expansion.

Technical complexity of modern water treatment and distribution systems requires specialized expertise and ongoing training investments that may strain organizational resources. The integration of digital technologies and automation systems demands technical capabilities that some utilities struggle to develop internally. Public acceptance of water rate increases necessary to fund infrastructure improvements and technology adoption can create political and social challenges for utility management.

Environmental constraints including water rights limitations, ecosystem protection requirements, and source water quality issues restrict operational flexibility and expansion opportunities in certain regions. These factors necessitate alternative sourcing strategies and advanced treatment technologies that increase system complexity and operational costs.

Smart water technology adoption creates substantial opportunities for utilities to improve operational efficiency, reduce water losses, and enhance customer service through real-time monitoring and data analytics. The integration of IoT sensors, advanced metering infrastructure, and predictive maintenance systems enables proactive system management and cost optimization. Water recycling and reuse technologies offer opportunities to develop alternative water sources that reduce dependence on traditional freshwater supplies while supporting environmental sustainability goals.

Public-private partnerships provide mechanisms for accelerating infrastructure development and technology deployment through shared investment and expertise. These collaborative models enable utilities to access private sector innovation and capital while maintaining public oversight and service quality standards. Energy efficiency integration allows water utilities to reduce operational costs while supporting broader sustainability objectives through renewable energy adoption and energy recovery systems.

Agricultural technology advancement creates opportunities for precision irrigation systems, soil moisture monitoring, and crop optimization technologies that improve water use efficiency while supporting food security objectives. The development of drought-resistant crops and alternative farming methods expands agricultural productivity while reducing water consumption requirements. Industrial water services present growth opportunities as manufacturing sectors seek specialized treatment, recycling, and process optimization solutions.

Climate resilience planning drives demand for adaptive infrastructure, alternative sourcing strategies, and emergency preparedness systems that ensure service continuity under changing environmental conditions. These investments create opportunities for technology providers and engineering services that support system resilience and reliability improvements.

Supply and demand dynamics in the North America water consumption market reflect complex interactions between population growth, economic development, environmental constraints, and technological capabilities. Regional variations in water availability create distinct market conditions, with water-abundant areas focusing on quality and efficiency while water-scarce regions prioritize conservation and alternative sourcing. Demand patterns show seasonal fluctuations with peak consumption during summer months reaching 35% above baseline levels in many regions.

Competitive dynamics involve both public utilities and private water companies seeking to optimize service delivery while managing costs and regulatory requirements. The market experiences consolidation trends as smaller utilities merge or partner with larger organizations to achieve operational efficiencies and technical capabilities. Technology adoption rates vary significantly across regions and utility sizes, with larger systems typically leading in smart water technology implementation.

Pricing dynamics reflect the balance between cost recovery needs, affordability concerns, and conservation incentives. Many utilities implement tiered pricing structures that encourage conservation while ensuring revenue adequacy for system maintenance and improvements. Investment dynamics show increasing private sector participation in water infrastructure development through various partnership models and financing mechanisms.

Regulatory dynamics continue evolving as agencies update standards for water quality, environmental protection, and system resilience. These changes influence technology adoption, operational practices, and investment priorities across the market. Innovation dynamics accelerate as utilities collaborate with technology providers to develop customized solutions for specific operational challenges and service improvement objectives.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into North America water consumption market dynamics, trends, and opportunities. The research approach integrates quantitative data analysis with qualitative insights from industry experts, utility managers, and technology providers to develop a complete market understanding. Primary research activities include structured interviews with key stakeholders, utility surveys, and technology provider assessments that capture current market conditions and future expectations.

Secondary research incorporates analysis of government databases, regulatory filings, industry reports, and academic studies that provide historical context and trend analysis. Water consumption data from municipal utilities, industrial users, and agricultural operators forms the foundation for market sizing and segmentation analysis. Data validation processes ensure accuracy through cross-referencing multiple sources and expert review of findings and conclusions.

Market modeling techniques incorporate demographic trends, economic indicators, climate data, and technology adoption patterns to project future market development scenarios. The methodology accounts for regional variations, seasonal patterns, and sector-specific consumption characteristics that influence market dynamics. Stakeholder engagement throughout the research process ensures findings reflect real-world market conditions and practical implementation considerations.

Quality assurance measures include peer review processes, data verification protocols, and methodology validation to maintain research integrity and reliability. The research framework adapts to emerging market developments and incorporates new data sources as they become available to ensure current and relevant market insights.

United States market dominates North American water consumption with approximately 78% of regional demand, driven by large population centers, extensive industrial activity, and diverse agricultural operations. The western states face particular water stress challenges that drive innovation in conservation technologies and alternative sourcing strategies. California leads in water recycling and efficiency technologies, while Texas focuses on groundwater management and drought resilience planning.

Canada’s market represents approximately 15% of regional consumption with abundant freshwater resources supporting both domestic needs and export opportunities. The country’s focus on sustainable water management and environmental protection creates opportunities for advanced treatment technologies and ecosystem preservation solutions. Ontario and Quebec account for the majority of Canadian consumption, while western provinces emphasize agricultural and energy sector water needs.

Mexico’s growing market comprises roughly 7% of regional consumption but demonstrates rapid growth driven by urbanization and industrial development. Water infrastructure modernization projects and quality improvement initiatives create substantial opportunities for technology providers and engineering services. Mexico City and other major metropolitan areas prioritize system efficiency and loss reduction programs.

Regional cooperation initiatives address cross-border water management challenges, particularly along the US-Mexico border and in Great Lakes regions. These collaborative efforts create opportunities for integrated planning, technology sharing, and joint infrastructure development projects. Climate adaptation strategies vary by region but increasingly emphasize resilience, diversification, and efficiency improvements across all market segments.

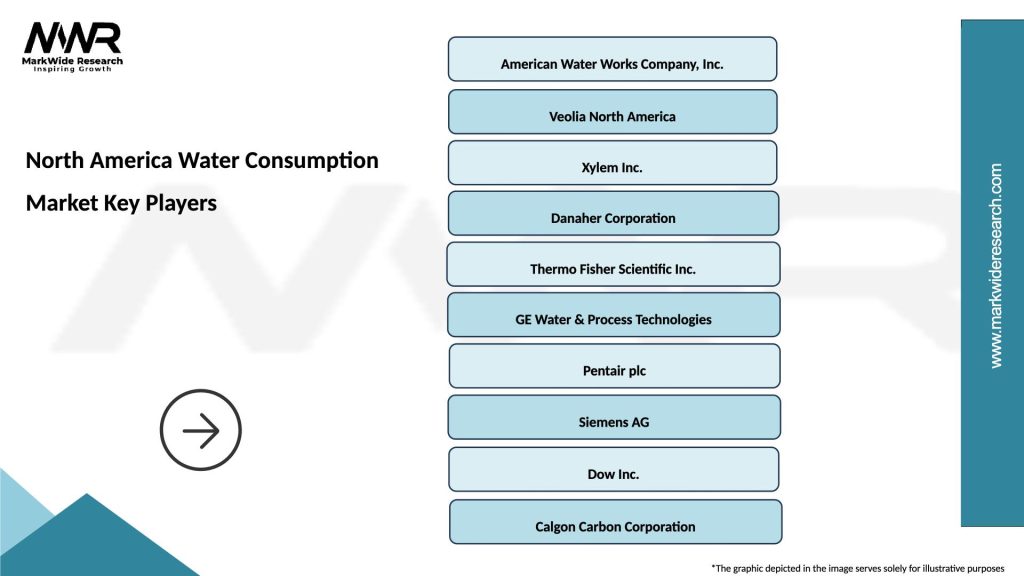

Market leadership in North America’s water consumption sector involves diverse organizations including public utilities, private water companies, technology providers, and engineering services firms. The competitive environment emphasizes service quality, operational efficiency, regulatory compliance, and customer satisfaction as key differentiators. Major players demonstrate strong market positions through comprehensive service offerings and geographic coverage:

Technology providers play increasingly important roles as utilities seek advanced solutions for system optimization, customer engagement, and operational efficiency. Competitive strategies focus on innovation, partnership development, and service differentiation that address specific regional and sector needs. Market consolidation trends continue as organizations seek scale advantages and technical capabilities through mergers and strategic partnerships.

By End-User Sector:

By Technology Type:

By Geographic Region:

Residential consumption patterns demonstrate increasing awareness of water conservation with households adopting efficient appliances and landscaping practices. Smart home technologies enable real-time consumption monitoring and leak detection that reduce waste and lower utility bills. Average residential consumption varies significantly by region, with southwestern households using 40% less water than national averages due to conservation measures and drought-resistant landscaping.

Commercial sector consumption focuses on operational efficiency and cost management through advanced building systems and water recycling technologies. Hotels, restaurants, and office buildings implement comprehensive water management programs that reduce consumption while maintaining service quality. Green building certifications drive adoption of water-efficient technologies and sustainable practices across commercial real estate development.

Industrial applications emphasize process optimization and environmental compliance through closed-loop systems and advanced treatment technologies. Manufacturing sectors achieve significant water savings through recycling and reuse programs that reduce both consumption and discharge requirements. Data centers represent a growing consumption category with specialized cooling requirements and opportunities for waste heat recovery integration.

Agricultural sector transformation includes precision irrigation systems, soil moisture monitoring, and crop selection strategies that optimize water use efficiency. Drip irrigation adoption increases water use efficiency by 30-50% compared to traditional flooding methods while supporting higher crop yields. Livestock operations implement water recycling and conservation technologies that reduce environmental impact while maintaining animal welfare standards.

Water utilities benefit from advanced technologies that improve operational efficiency, reduce system losses, and enhance customer service capabilities. Smart water systems enable predictive maintenance, real-time monitoring, and data-driven decision making that optimize resource allocation and system performance. Cost reduction opportunities through automation and efficiency improvements help utilities manage rate pressures while maintaining service quality standards.

Industrial users achieve significant operational advantages through water recycling, process optimization, and conservation technologies that reduce costs and environmental impact. Advanced treatment systems enable water reuse applications that decrease dependence on municipal supplies while supporting sustainability objectives. Regulatory compliance becomes more manageable through automated monitoring and reporting systems that ensure consistent adherence to quality and discharge standards.

Technology providers access expanding market opportunities as utilities and industrial users seek innovative solutions for efficiency, reliability, and sustainability challenges. The growing emphasis on smart water technologies creates demand for IoT sensors, data analytics platforms, and integrated management systems. Partnership opportunities with utilities and engineering firms enable technology companies to develop customized solutions and expand market reach.

Communities and consumers benefit from improved water quality, service reliability, and conservation programs that reduce costs and environmental impact. Smart metering and customer engagement platforms provide transparency and control over water consumption while supporting conservation behaviors. Economic development benefits from reliable water infrastructure that supports business growth and quality of life improvements in residential communities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the water industry as utilities implement smart meters, IoT sensors, and data analytics platforms that enable real-time system monitoring and optimization. These technologies improve operational efficiency while providing customers with detailed consumption information and conservation tools. Artificial intelligence and machine learning applications enhance predictive maintenance capabilities and system performance optimization.

Sustainability focus drives adoption of water recycling, renewable energy integration, and circular economy principles throughout the water value chain. Utilities increasingly emphasize environmental stewardship and climate resilience in operational planning and infrastructure development. Carbon footprint reduction becomes a priority as water systems account for significant energy consumption in treatment and distribution processes.

Customer engagement evolution includes mobile applications, online portals, and personalized conservation programs that empower consumers to manage their water usage effectively. Utilities develop comprehensive communication strategies that promote conservation behaviors and system awareness. Demand response programs help utilities manage peak consumption periods while providing customers with cost-saving opportunities.

Infrastructure resilience planning incorporates climate change adaptation, emergency preparedness, and system redundancy to ensure service continuity under challenging conditions. MarkWide Research analysis indicates that 62% of utilities prioritize resilience investments in their capital planning processes. Alternative sourcing strategies including groundwater development, water recycling, and desalination expand supply portfolio diversity and reliability.

Technology advancement continues transforming water consumption management through innovative treatment processes, smart infrastructure deployment, and integrated system optimization. Recent developments include advanced membrane technologies, energy recovery systems, and automated control platforms that improve efficiency and reduce operational costs. Blockchain applications emerge for water trading, quality verification, and supply chain transparency in water management operations.

Regulatory evolution includes updated drinking water standards, environmental protection requirements, and infrastructure resilience mandates that influence utility operations and investment priorities. New regulations address emerging contaminants, cybersecurity requirements, and climate adaptation planning. Federal infrastructure legislation provides substantial funding opportunities for water system improvements and modernization projects across North America.

Partnership expansion between public utilities and private technology companies accelerates innovation adoption and system modernization. These collaborations enable utilities to access cutting-edge technologies while maintaining public oversight and service quality standards. Regional cooperation initiatives address cross-jurisdictional water management challenges and resource sharing opportunities.

Investment trends show increasing private sector participation in water infrastructure through various financing models and partnership structures. Green financing mechanisms support sustainability-focused projects and environmental improvement initiatives. Venture capital investment in water technology startups reaches record levels as investors recognize market opportunities in efficiency and conservation solutions.

Strategic recommendations for water utilities emphasize technology adoption, customer engagement, and operational efficiency improvements that position organizations for long-term success. Utilities should prioritize smart water system implementation, starting with pilot projects that demonstrate value and build internal capabilities. Data analytics investment enables utilities to optimize operations, predict maintenance needs, and improve customer service through actionable insights.

Infrastructure planning should incorporate climate resilience, system redundancy, and adaptive capacity to address future challenges and service requirements. Utilities benefit from comprehensive asset management programs that prioritize investments based on risk assessment and performance optimization. Partnership development with technology providers and other utilities creates opportunities for shared expertise and cost-effective solution implementation.

Customer engagement strategies should leverage digital platforms and personalized communication to promote conservation behaviors and system awareness. MWR analysis suggests that utilities with comprehensive customer engagement programs achieve 18% higher conservation rates compared to traditional approaches. Rate structure optimization balances revenue adequacy with affordability and conservation incentives.

Innovation adoption requires systematic evaluation of emerging technologies and pilot testing to validate performance and cost-effectiveness. Utilities should develop innovation frameworks that encourage experimentation while managing implementation risks. Workforce development investments ensure organizations maintain technical capabilities necessary for modern water system operation and maintenance.

Market evolution toward integrated, technology-enabled water management systems will continue accelerating as utilities seek operational efficiency and customer service improvements. The next decade promises significant advancement in smart water technologies, with artificial intelligence and machine learning becoming standard components of system operation and optimization. Automation expansion will reduce operational costs while improving system reliability and response capabilities.

Sustainability integration will become increasingly important as utilities address climate change impacts and environmental stewardship responsibilities. Water recycling and reuse technologies will expand significantly, with recycled water usage projected to grow at 8.5% annually over the next five years. Renewable energy adoption in water operations will accelerate as utilities seek to reduce carbon footprints and operational costs.

Regional market development will reflect diverse water availability and regulatory environments, with water-scarce areas leading innovation in conservation and alternative sourcing technologies. Cross-border cooperation will expand as communities address shared water resources and climate adaptation challenges. Urban growth will drive substantial infrastructure investment in metropolitan areas requiring system expansion and modernization.

Technology convergence will create new opportunities for integrated solutions that combine water management with energy, telecommunications, and transportation systems. MarkWide Research projects that smart city integration will influence 45% of major water utility investment decisions by 2030. Customer expectations will continue evolving toward greater transparency, control, and sustainability in water services, driving continued innovation and service model development.

North America’s water consumption market stands at a critical juncture where traditional utility models evolve toward technology-enabled, sustainable service platforms that address growing demand while managing environmental and economic challenges. The market demonstrates remarkable resilience and adaptability as stakeholders embrace innovation, collaboration, and sustainability principles that ensure long-term water security and service quality across diverse regional conditions.

Technology transformation continues reshaping operational practices and customer relationships through smart water systems, data analytics, and automated management platforms that optimize efficiency and service delivery. The integration of digital technologies with traditional infrastructure creates opportunities for improved performance, cost management, and environmental stewardship that benefit all market participants and stakeholders.

Future success in the North America water consumption market will depend on continued innovation adoption, strategic partnerships, and adaptive management approaches that address evolving challenges while capitalizing on emerging opportunities. Organizations that prioritize technology integration, customer engagement, and sustainability will be best positioned to thrive in this dynamic and essential market sector that supports economic development and quality of life across the continent.

What is Water Consumption?

Water consumption refers to the total volume of water used by individuals, industries, and agriculture for various purposes, including drinking, irrigation, and manufacturing. It is a critical aspect of resource management and sustainability efforts.

What are the key players in the North America Water Consumption Market?

Key players in the North America Water Consumption Market include companies like Nestlé Waters, Coca-Cola, and PepsiCo, which are involved in bottled water production and distribution, among others.

What are the main drivers of the North America Water Consumption Market?

The main drivers of the North America Water Consumption Market include increasing population growth, rising awareness of water conservation, and the growing demand for bottled water and water-efficient technologies in agriculture.

What challenges does the North America Water Consumption Market face?

Challenges in the North America Water Consumption Market include water scarcity in certain regions, regulatory pressures regarding water usage, and the environmental impact of plastic waste from bottled water.

What opportunities exist in the North America Water Consumption Market?

Opportunities in the North America Water Consumption Market include the development of sustainable water management practices, innovations in water purification technologies, and the increasing trend towards eco-friendly packaging solutions.

What trends are shaping the North America Water Consumption Market?

Trends shaping the North America Water Consumption Market include a shift towards plant-based bottled water alternatives, increased investment in water recycling technologies, and a growing focus on corporate social responsibility in water usage.

North America Water Consumption Market

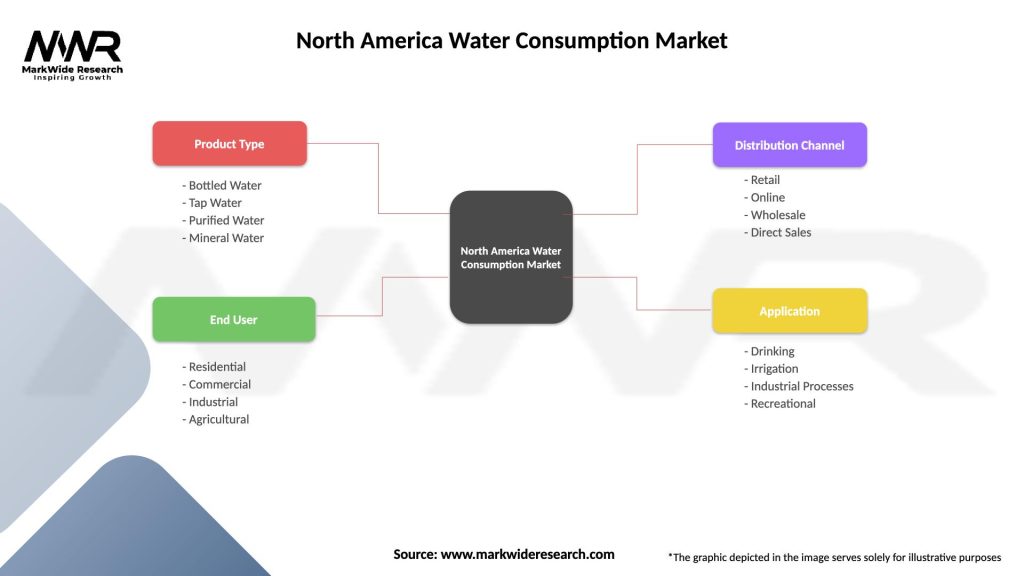

| Segmentation Details | Description |

|---|---|

| Product Type | Bottled Water, Tap Water, Purified Water, Mineral Water |

| End User | Residential, Commercial, Industrial, Agricultural |

| Distribution Channel | Retail, Online, Wholesale, Direct Sales |

| Application | Drinking, Irrigation, Industrial Processes, Recreational |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at