444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America waste recycling services market represents a dynamic and rapidly evolving sector that has become increasingly critical to environmental sustainability and circular economy initiatives across the United States, Canada, and Mexico. Market dynamics indicate substantial growth driven by stringent environmental regulations, corporate sustainability commitments, and growing consumer awareness about waste management practices. The region demonstrates significant market expansion with recycling rates improving by approximately 12% annually across major metropolitan areas.

Regional leadership in waste recycling services encompasses comprehensive collection, processing, and material recovery operations that serve residential, commercial, and industrial sectors. The market benefits from advanced sorting technologies, automated processing facilities, and innovative material recovery techniques that enhance operational efficiency. Technology adoption has accelerated significantly, with smart waste management systems experiencing 35% growth in implementation across North American municipalities.

Market participants include established waste management companies, specialized recycling service providers, and emerging technology-driven solutions that optimize collection routes and processing capabilities. The sector demonstrates resilience through economic cycles while adapting to changing regulatory frameworks and evolving consumer preferences for sustainable waste management practices.

The North America waste recycling services market refers to the comprehensive ecosystem of companies, technologies, and processes dedicated to collecting, sorting, processing, and transforming waste materials into reusable resources across the United States, Canada, and Mexico. This market encompasses residential curbside collection programs, commercial waste management services, industrial recycling solutions, and specialized processing facilities that convert various waste streams into valuable secondary materials.

Service categories within this market include paper and cardboard recycling, plastic material recovery, metal scrap processing, glass recycling, electronic waste management, organic waste composting, and construction debris recycling. The market operates through integrated supply chains that connect waste generators with processing facilities and end-market manufacturers who utilize recycled materials in their production processes.

Operational scope extends beyond traditional collection and processing to include waste stream analysis, contamination reduction programs, customer education initiatives, and technology-enabled optimization of recycling operations. Modern waste recycling services incorporate advanced sorting technologies, artificial intelligence-driven quality control systems, and data analytics platforms that maximize material recovery rates while minimizing operational costs.

Strategic positioning of the North America waste recycling services market reflects strong fundamentals driven by regulatory mandates, corporate sustainability initiatives, and increasing public awareness of environmental responsibility. The market demonstrates robust growth potential with recycling infrastructure investments expanding by 18% annually across major urban centers. Key market drivers include extended producer responsibility legislation, circular economy adoption, and technological innovations that improve processing efficiency and material quality.

Competitive landscape features established waste management corporations alongside innovative technology companies that provide smart collection systems, automated sorting solutions, and data-driven optimization platforms. Market consolidation continues as larger players acquire specialized recycling operations to expand service capabilities and geographic coverage. Regional variations in recycling rates and regulatory requirements create diverse market opportunities across different states and provinces.

Future growth prospects remain positive with increasing focus on plastic waste reduction, electronic waste management, and organic waste diversion programs. The market benefits from growing corporate commitments to zero-waste initiatives and sustainable packaging solutions that drive demand for high-quality recycled materials. Technology integration continues to enhance operational efficiency while reducing contamination rates and improving material recovery outcomes.

Market intelligence reveals several critical insights that shape the North America waste recycling services landscape:

Environmental regulations serve as the primary catalyst driving North America waste recycling services market expansion. Federal, state, and provincial governments continue implementing comprehensive waste diversion mandates that require municipalities and businesses to achieve specific recycling targets. Extended producer responsibility legislation is particularly influential, requiring manufacturers to take greater accountability for product lifecycle management and end-of-life disposal costs.

Corporate sustainability initiatives represent another significant growth driver as companies across industries establish ambitious zero-waste goals and circular economy commitments. Major retailers, manufacturers, and technology companies are investing heavily in recycling partnerships and sustainable packaging solutions that reduce environmental impact while meeting consumer expectations for responsible business practices.

Technological advancement continues accelerating market growth through innovations in automated sorting systems, artificial intelligence applications, and data analytics platforms that optimize collection routes and processing efficiency. These technologies enable recycling service providers to handle larger volumes while improving material quality and reducing operational costs. Smart waste management systems provide real-time monitoring capabilities that enhance service delivery and customer satisfaction.

Economic incentives including tax credits, grants, and subsidies for recycling infrastructure development are encouraging private sector investment in modern processing facilities and collection systems. Additionally, volatile commodity markets for virgin materials are making recycled alternatives increasingly cost-competitive, driving demand from manufacturers seeking stable supply chains and predictable pricing.

Contamination challenges represent a significant restraint affecting the North America waste recycling services market, as improper sorting by consumers and businesses reduces material quality and increases processing costs. High contamination rates in residential recycling streams require extensive manual sorting and cleaning processes that impact operational efficiency and profitability. Education gaps regarding proper recycling practices continue limiting material recovery potential across many communities.

Infrastructure limitations constrain market growth in certain regions where aging processing facilities lack capacity to handle increasing waste volumes or accommodate new material streams. The substantial capital requirements for modern recycling equipment and facility upgrades create barriers for smaller operators while limiting expansion opportunities in underserved markets.

Market volatility for recycled commodities creates uncertainty for service providers who depend on stable pricing to maintain profitable operations. Fluctuating demand from end-market manufacturers and competition from low-cost virgin materials can significantly impact revenue streams and investment planning. Global trade dynamics affecting recycled material exports add additional complexity to market planning and operations.

Regulatory complexity across different jurisdictions creates compliance challenges for multi-state operators who must navigate varying requirements for collection, processing, and reporting. Inconsistent standards between municipalities can increase operational costs and limit economies of scale that would otherwise improve service efficiency and affordability.

Emerging waste streams present substantial growth opportunities for North America waste recycling services providers, particularly in electronic waste management, textile recycling, and organic waste processing. The rapid growth of e-commerce and consumer electronics creates increasing volumes of packaging materials and electronic devices requiring specialized recycling services. Textile waste diversion represents an underserved market segment with significant potential as fashion industry sustainability initiatives gain momentum.

Technology partnerships offer opportunities for traditional recycling companies to enhance service capabilities through collaboration with technology providers specializing in artificial intelligence, robotics, and data analytics. These partnerships can improve sorting accuracy, reduce labor costs, and enable new service offerings that differentiate providers in competitive markets.

Corporate service expansion represents a high-value opportunity as businesses seek comprehensive waste management solutions that support sustainability reporting and regulatory compliance. Customized recycling programs for specific industries such as healthcare, hospitality, and manufacturing can command premium pricing while building long-term customer relationships.

Geographic expansion into underserved rural and suburban markets offers growth potential for established providers with the infrastructure and expertise to develop new collection routes and processing capabilities. Public-private partnerships with municipalities seeking to improve recycling rates while managing costs create opportunities for innovative service delivery models and long-term contracts.

Supply chain integration is reshaping the North America waste recycling services market as companies seek to control more aspects of the recycling process from collection through end-market sales. Vertical integration strategies enable better quality control, improved margins, and enhanced customer service while reducing dependence on third-party processors and commodity brokers.

Competitive intensity continues increasing as new entrants leverage technology advantages to challenge established players, while consolidation among traditional operators creates larger, more efficient service providers. Market dynamics favor companies that can demonstrate superior operational efficiency, technology integration, and customer service capabilities across diverse geographic markets.

Customer expectations are evolving toward more comprehensive waste management solutions that include detailed reporting, contamination reduction support, and sustainability consulting services. Service providers must adapt their offerings to meet growing demand for transparency, data analytics, and customized programs that support corporate sustainability goals.

Regulatory evolution continues influencing market dynamics as governments implement new requirements for recycling rates, material recovery targets, and extended producer responsibility programs. According to MarkWide Research analysis, regulatory changes are driving 22% annual growth in demand for specialized recycling services across major metropolitan areas. These regulatory shifts create both opportunities and challenges for market participants who must adapt operations while maintaining profitability.

Comprehensive market analysis for the North America waste recycling services market employs multiple research methodologies to ensure accurate and reliable insights. Primary research includes structured interviews with industry executives, municipal waste management officials, and technology providers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of government databases, industry association reports, regulatory filings, and academic studies that provide quantitative data on recycling rates, infrastructure capacity, and market performance metrics. Financial analysis of publicly traded companies provides insights into revenue trends, profitability patterns, and investment priorities across the sector.

Data validation processes include cross-referencing multiple sources, conducting expert interviews for verification, and applying statistical analysis techniques to ensure data accuracy and reliability. Market sizing calculations utilize bottom-up and top-down approaches that account for regional variations in service delivery models and pricing structures.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on regulatory developments, technology adoption patterns, and economic indicators that influence waste generation and recycling demand. Scenario modeling evaluates potential market outcomes under different regulatory and economic conditions to provide comprehensive market intelligence.

United States market dominates the North America waste recycling services sector, accounting for approximately 78% of regional activity driven by large population centers, established infrastructure, and comprehensive regulatory frameworks. California, New York, and Texas lead in recycling service demand due to stringent environmental regulations and high waste generation volumes. West Coast states demonstrate particularly strong growth in organic waste recycling and advanced material recovery programs.

Canadian market represents approximately 18% of regional market share with strong provincial government support for recycling initiatives and extended producer responsibility programs. Ontario and British Columbia lead in service adoption with comprehensive municipal recycling programs and growing corporate sustainability initiatives. Federal initiatives supporting circular economy development are driving investment in recycling infrastructure and technology adoption.

Mexico market accounts for the remaining 4% of regional activity but demonstrates rapid growth potential as urbanization increases and environmental awareness expands. Major cities including Mexico City, Guadalajara, and Monterrey are implementing modern waste management systems that include comprehensive recycling components. Foreign investment in recycling infrastructure is accelerating market development and technology transfer.

Regional variations in recycling rates, regulatory requirements, and infrastructure development create diverse market opportunities and challenges. Rural areas across all three countries present underserved markets with growth potential, while urban centers focus on efficiency improvements and technology integration to handle increasing waste volumes.

Market leadership in North America waste recycling services is characterized by a mix of large integrated waste management companies and specialized recycling service providers that compete across different market segments and geographic regions.

Competitive strategies focus on technology integration, geographic expansion, and service diversification to capture market share and improve operational efficiency. Companies are investing heavily in automated sorting systems, data analytics platforms, and customer service technologies that differentiate their offerings in competitive markets.

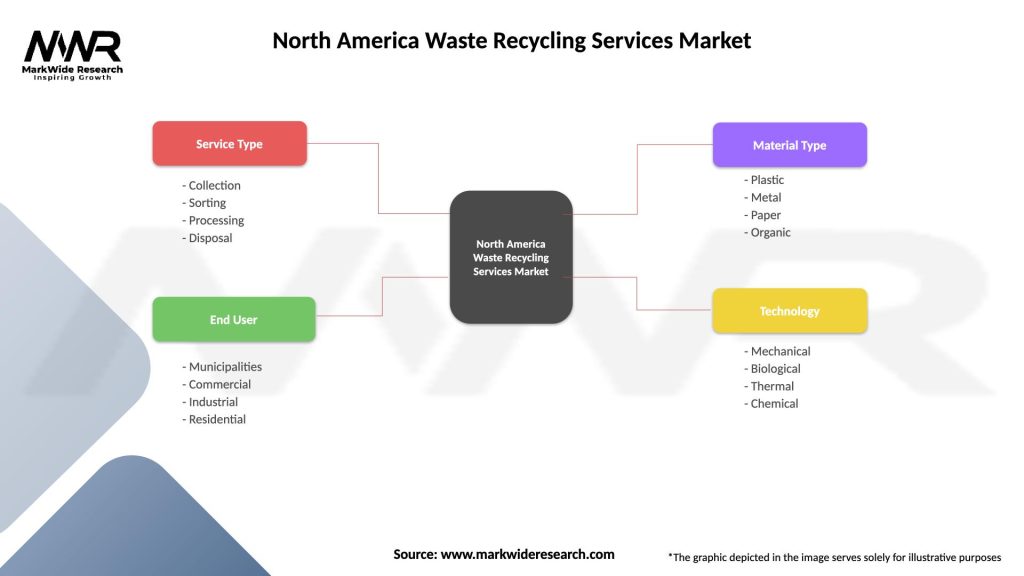

By Service Type:

By Material Type:

By End User:

Paper and cardboard recycling represents the largest segment by volume in the North America waste recycling services market, benefiting from well-established collection infrastructure and strong end-market demand from packaging manufacturers. E-commerce growth has significantly increased corrugated cardboard volumes, while office paper recycling faces challenges from digitization trends reducing paper consumption.

Plastic recycling services demonstrate strong growth potential despite processing challenges related to material contamination and limited end-market applications for certain plastic types. Bottle deposit programs in several states have improved PET recycling rates, while innovative chemical recycling technologies are expanding processing capabilities for mixed plastic streams.

Electronic waste management represents a rapidly growing category driven by consumer electronics replacement cycles and corporate IT equipment upgrades. Specialized processing requirements and valuable material recovery opportunities make e-waste recycling an attractive high-margin service segment for qualified providers.

Organic waste processing is emerging as a significant growth category as municipalities implement food waste diversion programs and businesses seek sustainable disposal alternatives. Composting operations and anaerobic digestion facilities are expanding to handle increasing organic waste volumes while producing valuable soil amendments and renewable energy.

Service providers benefit from stable revenue streams through long-term municipal contracts and corporate partnerships that provide predictable cash flows and growth opportunities. Advanced recycling operations can achieve higher margins through improved material quality and direct end-market relationships that eliminate commodity broker fees.

Municipalities achieve cost savings through efficient waste diversion programs that reduce landfill disposal fees while meeting regulatory compliance requirements. Comprehensive recycling services help communities achieve sustainability goals and improve environmental performance metrics that support grant funding and public support.

Corporate customers gain access to detailed reporting and analytics that support sustainability initiatives and regulatory compliance while reducing waste management costs through optimized collection schedules and contamination reduction programs. Brand reputation benefits from demonstrated environmental responsibility enhance customer loyalty and stakeholder relationships.

Environmental stakeholders benefit from reduced landfill disposal, decreased virgin material consumption, and lower greenhouse gas emissions associated with material recovery and reprocessing. Circular economy development supports long-term environmental sustainability goals while creating economic value from waste streams.

End-market manufacturers gain access to stable supplies of recycled materials that reduce dependence on volatile virgin material markets while supporting corporate sustainability commitments. Quality recycled materials can provide cost advantages and supply chain resilience benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is revolutionizing North America waste recycling services through implementation of IoT sensors, route optimization software, and customer mobile applications that improve service delivery and operational efficiency. Smart bin technology enables real-time monitoring of collection needs while reducing unnecessary truck rolls and fuel consumption.

Circular economy adoption is driving demand for closed-loop recycling systems where materials are continuously reprocessed into new products without quality degradation. Major brands are establishing take-back programs and sustainable packaging initiatives that create dedicated recycling streams and guaranteed end-market demand.

Artificial intelligence integration in sorting facilities is improving material identification accuracy and reducing contamination rates while enabling processing of previously non-recyclable materials. Robotic sorting systems are addressing labor shortages while increasing processing speed and consistency across operations.

Extended producer responsibility legislation is expanding across North American jurisdictions, requiring manufacturers to take greater accountability for product lifecycle management and recycling costs. This trend is creating new revenue opportunities for recycling service providers while improving material recovery economics.

Sustainability reporting requirements are increasing demand for detailed data analytics and tracking systems that enable corporate customers to measure and report environmental impact metrics. Blockchain technology is being explored for material traceability and certification of recycled content claims.

Infrastructure investments continue expanding across North America as both public and private sectors commit significant capital to modern recycling facilities and collection systems. Recent facility openings in major metropolitan areas incorporate advanced sorting technologies and increased processing capacity to handle growing waste volumes.

Technology partnerships between traditional waste management companies and technology providers are accelerating innovation in automated sorting, route optimization, and customer service platforms. These collaborations are enabling rapid deployment of advanced capabilities across existing operations.

Regulatory developments including new extended producer responsibility laws and recycling mandates are reshaping market dynamics and creating opportunities for specialized service providers. MWR analysis indicates that regulatory changes are driving 28% growth in demand for compliance consulting and specialized recycling services.

Merger and acquisition activity remains active as companies seek to expand geographic coverage, add specialized capabilities, and achieve economies of scale in competitive markets. Recent transactions focus on technology integration and market consolidation in fragmented regional markets.

Sustainability initiatives from major corporations are creating new market opportunities for customized recycling programs and comprehensive waste management services. Fortune 500 companies are establishing ambitious zero-waste goals that require innovative service delivery models and advanced material recovery capabilities.

Technology investment should be prioritized by recycling service providers seeking competitive advantages in efficiency, quality, and customer service. Companies should focus on automated sorting systems, data analytics platforms, and customer-facing technologies that differentiate their service offerings while improving operational performance.

Market consolidation opportunities should be evaluated carefully as fragmented regional markets present acquisition targets that can provide geographic expansion and operational synergies. Strategic acquisitions should focus on companies with complementary capabilities, established customer relationships, and modern infrastructure assets.

Service diversification into high-value segments such as electronic waste management, organic waste processing, and corporate sustainability consulting can improve margins while reducing dependence on commodity-sensitive traditional recycling services. Specialized services command premium pricing and create stronger customer relationships.

Partnership development with technology companies, municipalities, and corporate customers should be pursued to create integrated service delivery models that provide comprehensive waste management solutions. Long-term partnerships can provide revenue stability while enabling investment in advanced capabilities.

Geographic expansion into underserved markets should be considered as urbanization and environmental awareness increase demand for professional recycling services. Rural and suburban markets present growth opportunities for companies with the infrastructure and expertise to develop new service territories.

Long-term growth prospects for the North America waste recycling services market remain positive driven by increasing environmental awareness, regulatory mandates, and corporate sustainability commitments. MarkWide Research projects continued expansion with recycling rates expected to improve by 15% over the next five years as infrastructure investments and technology adoption accelerate.

Technology evolution will continue transforming industry operations through artificial intelligence, robotics, and data analytics applications that improve efficiency while reducing costs. Advanced sorting technologies will enable processing of previously non-recyclable materials while improving quality of recovered materials for end-market applications.

Regulatory environment is expected to become increasingly supportive with expanded extended producer responsibility programs, higher recycling mandates, and incentives for infrastructure development. Federal initiatives supporting circular economy development will provide additional growth catalysts for market participants.

Market consolidation will likely continue as companies seek economies of scale and comprehensive service capabilities to compete effectively in evolving markets. Successful companies will combine operational efficiency with technology integration and customer service excellence to capture market share.

Emerging opportunities in electronic waste management, textile recycling, and organic waste processing will create new revenue streams for innovative service providers. Companies that can adapt quickly to changing waste streams and regulatory requirements will achieve competitive advantages in dynamic markets.

North America waste recycling services market demonstrates strong fundamentals and positive growth trajectory supported by regulatory mandates, corporate sustainability initiatives, and advancing technology capabilities. The market benefits from established infrastructure, growing environmental awareness, and increasing demand for comprehensive waste management solutions across residential, commercial, and industrial sectors.

Key success factors for market participants include technology integration, operational efficiency, service diversification, and strategic partnerships that create competitive advantages while meeting evolving customer needs. Companies that can effectively combine traditional recycling expertise with innovative technology solutions will be best positioned for long-term success.

Future market development will be shaped by continued regulatory evolution, technology advancement, and changing waste generation patterns that create both opportunities and challenges for service providers. The transition toward circular economy principles and sustainable material management practices will drive continued growth and innovation across the recycling services sector, making this an attractive market for investment and expansion initiatives.

What is Waste Recycling Services?

Waste Recycling Services refer to the processes and activities involved in collecting, processing, and recycling waste materials to reduce environmental impact and promote sustainability. This includes the recycling of materials such as paper, plastics, metals, and electronics.

What are the key players in the North America Waste Recycling Services Market?

Key players in the North America Waste Recycling Services Market include Waste Management, Republic Services, and Veolia North America. These companies provide a range of recycling services and solutions to various industries, including residential, commercial, and industrial sectors, among others.

What are the main drivers of the North America Waste Recycling Services Market?

The main drivers of the North America Waste Recycling Services Market include increasing environmental awareness, government regulations promoting recycling, and the growing demand for sustainable waste management solutions. Additionally, the rise in urbanization contributes to higher waste generation, necessitating effective recycling services.

What challenges does the North America Waste Recycling Services Market face?

Challenges in the North America Waste Recycling Services Market include contamination of recyclable materials, fluctuating commodity prices for recycled materials, and the need for advanced technology to improve recycling efficiency. These factors can hinder the effectiveness and profitability of recycling operations.

What opportunities exist in the North America Waste Recycling Services Market?

Opportunities in the North America Waste Recycling Services Market include the development of innovative recycling technologies, expansion of recycling programs in underserved areas, and increased collaboration between public and private sectors. These factors can enhance recycling rates and promote circular economy initiatives.

What trends are shaping the North America Waste Recycling Services Market?

Trends shaping the North America Waste Recycling Services Market include the adoption of smart waste management technologies, increased focus on e-waste recycling, and the implementation of zero-waste initiatives by municipalities. These trends reflect a growing commitment to sustainability and resource conservation.

North America Waste Recycling Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Collection, Sorting, Processing, Disposal |

| End User | Municipalities, Commercial, Industrial, Residential |

| Material Type | Plastic, Metal, Paper, Organic |

| Technology | Mechanical, Biological, Thermal, Chemical |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Waste Recycling Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at