444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America vascular graft market represents a critical segment of the cardiovascular medical device industry, encompassing synthetic and biological conduits used to replace or bypass damaged blood vessels. This specialized market serves the growing demand for vascular reconstruction procedures across the United States and Canada, driven by an aging population and increasing prevalence of cardiovascular diseases. Market dynamics indicate robust growth potential, with the sector experiencing a 6.2% CAGR as healthcare providers increasingly adopt advanced graft technologies.

Regional distribution shows the United States commanding approximately 87% market share within North America, while Canada represents the remaining portion. The market encompasses various graft types including synthetic grafts, biological grafts, and biosynthetic alternatives, each serving specific clinical applications. Technological advancement continues to drive innovation, with manufacturers developing enhanced biocompatible materials and improved graft designs to reduce complications and extend patient outcomes.

Healthcare infrastructure across North America supports widespread adoption of vascular graft procedures, with major medical centers and specialized cardiovascular facilities driving demand. The market benefits from favorable reimbursement policies, advanced surgical techniques, and growing awareness of minimally invasive treatment options. Clinical applications span coronary artery bypass, peripheral vascular reconstruction, and dialysis access procedures, creating diverse revenue streams for market participants.

The North America vascular graft market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and clinical application of artificial blood vessel substitutes used in cardiovascular and peripheral vascular surgical procedures across the United States and Canada. These medical devices serve as conduits to restore blood flow when natural vessels are damaged, diseased, or require bypass.

Vascular grafts function as permanent or temporary replacements for blood vessels, manufactured from synthetic materials like polytetrafluoroethylene (PTFE) and polyethylene terephthalate (PET), or derived from biological sources including bovine, porcine, or human tissues. The market encompasses various graft configurations, diameters, and lengths designed to meet specific anatomical and clinical requirements across different vascular territories.

Clinical significance extends beyond simple vessel replacement, as modern vascular grafts incorporate advanced features such as antimicrobial coatings, enhanced flexibility, and improved biocompatibility. The market includes both established technologies and emerging innovations, reflecting the continuous evolution of vascular surgery techniques and patient care standards throughout North America.

Market fundamentals demonstrate strong growth trajectory for the North America vascular graft market, driven by demographic trends and technological advancement. The aging population, particularly the baby boomer generation, creates sustained demand for cardiovascular interventions, with peripheral artery disease affecting approximately 12% of adults over 65 years. This demographic shift, combined with rising diabetes prevalence and lifestyle-related cardiovascular risk factors, establishes a robust foundation for market expansion.

Technology evolution continues reshaping the competitive landscape, with manufacturers investing heavily in research and development to create next-generation graft solutions. Innovations include drug-eluting grafts, bioengineered materials, and hybrid designs that combine synthetic and biological components. These advancements address key clinical challenges such as graft infection, thrombosis, and long-term patency rates, driving adoption among cardiovascular surgeons.

Regulatory environment remains supportive, with the FDA maintaining streamlined approval pathways for innovative vascular graft technologies while ensuring patient safety. Market participants benefit from established reimbursement frameworks and growing acceptance of advanced graft technologies among healthcare providers. Strategic partnerships between device manufacturers and healthcare systems facilitate market penetration and clinical adoption of new technologies.

Competitive dynamics feature both established medical device companies and emerging innovators, creating a diverse ecosystem of technology solutions. Market leaders leverage extensive distribution networks, clinical evidence, and surgeon relationships to maintain market position, while newer entrants focus on niche applications and breakthrough technologies to gain market share.

Demographic drivers fundamentally shape market demand, with cardiovascular disease remaining the leading cause of mortality across North America. The intersection of aging demographics and lifestyle factors creates sustained demand for vascular intervention procedures, establishing a stable foundation for market growth.

Aging population serves as the primary market driver, with North America experiencing unprecedented demographic shifts as baby boomers enter their senior years. This population segment demonstrates significantly higher rates of cardiovascular disease, peripheral artery disease, and diabetes-related vascular complications, creating sustained demand for vascular graft procedures. Epidemiological trends indicate continued growth in target patient populations, with cardiovascular disease prevalence expected to increase substantially over the next decade.

Technological advancement drives market expansion through improved clinical outcomes and expanded treatment options. Modern vascular grafts offer enhanced biocompatibility, reduced infection rates, and improved long-term patency compared to earlier generations. Innovation cycles continue introducing breakthrough technologies such as drug-eluting grafts, bioengineered materials, and hybrid designs that address specific clinical challenges and expand procedural applications.

Healthcare infrastructure development across North America supports market growth through expanded access to specialized cardiovascular care. The proliferation of cardiac catheterization laboratories, hybrid operating rooms, and specialized vascular centers increases procedural capacity and drives adoption of advanced graft technologies. Medical education and training programs ensure adequate surgeon expertise to support market expansion.

Reimbursement stability provides crucial support for market growth, with both government and private payers recognizing the clinical value and cost-effectiveness of vascular graft procedures. Health economics research demonstrates favorable outcomes and reduced long-term healthcare costs associated with successful vascular reconstruction, supporting continued coverage policies and market expansion.

High procedural costs represent a significant market restraint, particularly for complex vascular reconstruction procedures requiring specialized grafts and extended hospital stays. Healthcare systems face increasing pressure to control costs while maintaining quality outcomes, potentially limiting adoption of premium graft technologies. Economic pressures on healthcare budgets may influence product selection and procedural volumes, particularly in cost-sensitive market segments.

Clinical complications associated with vascular graft procedures create ongoing challenges for market expansion. Issues such as graft infection, thrombosis, and anastomotic complications can result in poor patient outcomes and increased healthcare costs. Risk management concerns may influence surgeon preferences and institutional policies regarding graft selection and procedural approaches.

Regulatory complexity can delay market entry for innovative technologies, particularly those requiring extensive clinical trials and regulatory review. The stringent approval process, while ensuring patient safety, may limit the pace of innovation and market expansion. Compliance requirements also impose significant costs on manufacturers, potentially affecting product pricing and market accessibility.

Competition from alternative treatments poses ongoing challenges, as minimally invasive procedures such as angioplasty and stenting may reduce demand for surgical bypass procedures in certain patient populations. Treatment evolution toward less invasive approaches may impact traditional vascular graft applications, requiring market adaptation and technology innovation.

Emerging technologies present substantial opportunities for market expansion, particularly in areas such as bioengineered grafts, drug-eluting designs, and personalized medicine approaches. The development of grafts with enhanced biocompatibility and reduced immunogenic responses could significantly improve patient outcomes and expand clinical applications. Innovation potential in materials science and biotechnology continues opening new avenues for product development and market growth.

Expanding applications beyond traditional vascular surgery create new market opportunities, including use in trauma surgery, oncological reconstruction, and pediatric applications. The versatility of modern vascular grafts enables their use in diverse clinical scenarios, potentially expanding the addressable market. Clinical research continues identifying new applications and patient populations that could benefit from vascular graft technology.

Geographic expansion within North America presents opportunities for market growth, particularly in underserved rural areas and emerging healthcare markets. The development of regional cardiac centers and telemedicine capabilities could expand access to vascular graft procedures. Market penetration strategies focusing on secondary and tertiary markets may drive incremental growth and market share expansion.

Strategic partnerships between device manufacturers, healthcare systems, and research institutions create opportunities for collaborative innovation and market development. These relationships can accelerate technology development, facilitate clinical adoption, and expand market reach. Value-based care models provide opportunities for manufacturers to demonstrate clinical and economic value, potentially supporting premium pricing and market expansion.

Supply chain dynamics significantly influence market operations, with manufacturers maintaining complex global supply networks for raw materials and components. The specialized nature of vascular graft manufacturing requires stringent quality control and regulatory compliance throughout the supply chain. Manufacturing efficiency improvements and supply chain optimization continue driving cost reduction and market competitiveness.

Competitive intensity varies across different market segments, with established players maintaining strong positions in traditional applications while emerging companies focus on innovative technologies and niche markets. Market consolidation through mergers and acquisitions reshapes competitive dynamics and creates opportunities for portfolio expansion and market share growth.

Technology adoption patterns reflect the conservative nature of medical practice, with surgeons typically requiring extensive clinical evidence before adopting new technologies. Clinical validation through peer-reviewed research and real-world evidence plays a crucial role in driving technology adoption and market acceptance.

Pricing dynamics reflect the balance between innovation value and cost containment pressures from healthcare systems. Premium technologies command higher prices when supported by superior clinical outcomes, while commodity products compete primarily on cost. Value proposition development becomes increasingly important as healthcare systems focus on outcomes-based purchasing decisions.

Primary research methodologies employed in analyzing the North America vascular graft market include comprehensive surveys of cardiovascular surgeons, hospital administrators, and procurement specialists across major medical centers. These direct stakeholder interviews provide insights into clinical preferences, adoption patterns, and emerging market trends. Expert consultations with key opinion leaders in cardiovascular surgery and interventional cardiology inform market analysis and future projections.

Secondary research encompasses extensive analysis of published clinical literature, regulatory filings, company financial reports, and industry publications. This comprehensive data collection approach ensures thorough market understanding and validation of primary research findings. Database analysis of procedural volumes, reimbursement data, and demographic trends provides quantitative foundation for market assessment.

Market modeling techniques incorporate multiple data sources to develop comprehensive market size estimates and growth projections. Statistical analysis methods ensure data accuracy and reliability while accounting for market variables and uncertainties. Validation processes include cross-referencing multiple data sources and expert review to ensure research quality and accuracy.

Analytical frameworks employed include Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide comprehensive market understanding. These structured approaches ensure systematic evaluation of market dynamics and competitive factors. Scenario modeling explores potential market developments under different assumptions and external conditions.

United States market dominates the North American vascular graft landscape, accounting for approximately 87% of regional market share due to its large population, advanced healthcare infrastructure, and high cardiovascular disease prevalence. Major metropolitan areas including New York, Los Angeles, Chicago, and Houston serve as primary demand centers, with established cardiac surgery programs and specialized vascular centers driving procedural volumes. Regional variations exist in adoption patterns, with coastal and urban areas typically showing earlier adoption of innovative technologies.

Canadian market represents a smaller but significant portion of the North American market, characterized by universal healthcare coverage and centralized procurement processes. The Canadian healthcare system’s emphasis on cost-effectiveness influences product selection and adoption patterns, with provincial health authorities playing key roles in technology assessment and reimbursement decisions. Geographic challenges in serving remote populations create unique market dynamics and opportunities for specialized distribution networks.

State-level analysis within the United States reveals significant variations in market size and growth potential, with states having large elderly populations and high cardiovascular disease rates showing strongest demand. Florida, California, Texas, and New York represent the largest state markets, while emerging opportunities exist in states with growing populations and expanding healthcare infrastructure. Regulatory variations at the state level may influence market access and competitive dynamics.

Cross-border dynamics between the United States and Canada create opportunities for market integration and technology transfer, with some Canadian patients seeking treatment in U.S. facilities for specialized procedures. Regulatory harmonization efforts between FDA and Health Canada facilitate market access for innovative technologies across both countries.

Market leadership is distributed among several established medical device companies with strong cardiovascular portfolios and extensive clinical relationships. The competitive environment features both large multinational corporations and specialized vascular device companies, creating a diverse ecosystem of technology solutions and market approaches.

Competitive strategies vary among market participants, with some focusing on technological innovation and premium positioning while others emphasize cost-effectiveness and broad market coverage. Clinical evidence development and surgeon education programs serve as key competitive differentiators, with companies investing heavily in clinical trials and medical education initiatives.

By Material Type: The market segments into synthetic grafts, biological grafts, and biosynthetic alternatives, each serving specific clinical applications and patient populations. Synthetic grafts dominate market share due to availability, consistency, and cost-effectiveness, while biological grafts show growing adoption in applications requiring enhanced biocompatibility.

By Application: Clinical applications drive market segmentation, with coronary artery bypass representing the largest segment, followed by peripheral vascular reconstruction and dialysis access procedures. Each application has specific requirements for graft characteristics and performance.

By End User: Hospital systems, ambulatory surgery centers, and specialized cardiac facilities represent primary end-user segments, each with distinct purchasing patterns and requirements.

Synthetic Graft Category maintains market leadership through established clinical performance and cost-effectiveness advantages. PTFE-based grafts demonstrate excellent long-term durability and biocompatibility, making them preferred choices for many vascular applications. Innovation focus within this category includes enhanced surface treatments, antimicrobial coatings, and improved handling characteristics to address clinical challenges and improve surgical outcomes.

Biological Graft Category shows accelerating growth driven by superior biocompatibility and reduced immunogenic responses compared to synthetic alternatives. These products demonstrate particular advantages in infected fields and pediatric applications where growth potential is important. Processing innovations continue improving biological graft performance and shelf life while reducing costs and expanding clinical applications.

Coronary Application Category represents the most established and mature market segment, with well-defined clinical protocols and reimbursement pathways. Technology evolution focuses on improving long-term patency rates and reducing complications associated with coronary bypass procedures. Market growth in this category correlates closely with overall cardiac surgery volumes and demographic trends.

Peripheral Application Category demonstrates strong growth potential driven by increasing peripheral artery disease prevalence and expanding treatment options. Clinical advancement in peripheral vascular surgery techniques and growing awareness of treatment benefits drive market expansion in this category. The segment benefits from less invasive surgical approaches and improved patient outcomes.

Healthcare Providers benefit from access to advanced vascular graft technologies that improve patient outcomes and reduce complications. Modern grafts offer enhanced biocompatibility, reduced infection rates, and improved long-term patency, leading to better clinical results and reduced revision procedures. Operational efficiency improvements through standardized products and streamlined procurement processes help healthcare systems manage costs while maintaining quality care.

Patients experience improved outcomes through access to advanced graft technologies that offer better long-term performance and reduced complications. Enhanced biocompatibility and reduced immunogenic responses lead to improved quality of life and reduced need for repeat procedures. Treatment options continue expanding through technological innovation, providing personalized solutions for diverse clinical needs.

Surgeons benefit from improved product performance characteristics that enhance surgical outcomes and reduce procedural complexity. Advanced graft designs offer better handling properties, improved suturability, and enhanced clinical performance. Clinical support programs from manufacturers provide ongoing education and technical assistance to optimize surgical techniques and outcomes.

Manufacturers participate in a growing market with opportunities for innovation and differentiation through advanced technologies. Market expansion potential exists through geographic growth, new applications, and emerging technologies. Strong intellectual property protection and regulatory barriers create sustainable competitive advantages for innovative companies.

Healthcare Systems achieve improved cost-effectiveness through better clinical outcomes and reduced complications associated with advanced vascular graft technologies. Value-based care models reward improved outcomes, creating alignment between technology advancement and healthcare economics. Standardization opportunities reduce procurement complexity and administrative costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Bioengineering advancement represents a transformative trend in vascular graft development, with researchers developing grafts that promote natural tissue regeneration and integration. These next-generation products incorporate biological signals and scaffolding materials that encourage patient tissue growth, potentially eliminating long-term complications associated with permanent implants. Regenerative medicine approaches show promise for creating patient-specific grafts that offer superior biocompatibility and performance.

Drug-eluting technologies are gaining traction as manufacturers develop grafts that deliver therapeutic agents to prevent complications such as thrombosis and restenosis. These innovative products combine traditional graft functions with targeted drug delivery, potentially improving long-term outcomes and reducing the need for adjunctive therapies. Pharmaceutical integration creates new opportunities for combination products and enhanced clinical performance.

Minimally invasive approaches influence graft design and application, with manufacturers developing products optimized for endovascular and hybrid procedures. These techniques reduce patient trauma and recovery time while maintaining clinical effectiveness. Procedural innovation drives demand for specialized graft configurations and delivery systems adapted to minimally invasive techniques.

Personalized medicine trends are beginning to influence vascular graft selection and application, with growing recognition that patient-specific factors should guide treatment decisions. Precision medicine approaches may lead to customized graft solutions based on individual patient anatomy, genetics, and risk factors.

Digital health integration emerges as manufacturers explore opportunities to incorporate sensors and monitoring capabilities into vascular grafts, enabling real-time assessment of graft performance and early detection of complications. Connected healthcare technologies may transform post-operative monitoring and long-term patient management.

Regulatory approvals for innovative vascular graft technologies continue driving market evolution, with recent FDA clearances for next-generation products featuring enhanced biocompatibility and performance characteristics. These approvals validate technological advancement and create new market opportunities for manufacturers. Clinical trial completions provide evidence supporting expanded indications and improved outcomes for advanced graft technologies.

Strategic acquisitions reshape the competitive landscape as larger medical device companies acquire specialized vascular graft manufacturers to expand their portfolios and market presence. These transactions consolidate market share while providing acquired companies with resources for expanded research and development. Partnership agreements between manufacturers and healthcare systems facilitate technology adoption and clinical validation.

Manufacturing investments in advanced production capabilities enable companies to meet growing demand while improving product quality and consistency. Automation technologies and quality control systems enhance manufacturing efficiency and reduce costs, supporting market competitiveness and expansion.

Clinical research initiatives continue generating evidence supporting expanded applications and improved outcomes for vascular graft technologies. Real-world evidence studies provide valuable insights into long-term performance and cost-effectiveness, supporting reimbursement decisions and clinical adoption.

International expansion efforts by North American companies create opportunities for technology transfer and market growth, while international companies establish North American operations to access this important market. Global collaboration accelerates innovation and expands access to advanced technologies.

Innovation investment should focus on addressing key clinical challenges such as graft infection, thrombosis, and long-term patency to create meaningful competitive advantages. Companies that successfully develop solutions to these persistent problems will likely capture significant market share and premium pricing. Research priorities should emphasize biocompatibility enhancement and complication reduction to drive clinical adoption.

Market expansion strategies should target underserved geographic regions and emerging applications to drive growth beyond traditional market segments. MarkWide Research analysis indicates significant opportunities in rural markets and specialized applications that may offer less competitive pressure and higher growth potential. Strategic partnerships with regional healthcare systems can facilitate market penetration and adoption.

Clinical evidence development remains crucial for market success, with companies needing to invest in comprehensive clinical trials and real-world evidence studies to support product claims and reimbursement decisions. Outcomes research demonstrating superior clinical and economic value will become increasingly important as healthcare systems focus on value-based purchasing decisions.

Technology integration opportunities exist in combining vascular grafts with complementary technologies such as drug delivery systems, monitoring capabilities, and regenerative medicine approaches. These combination products may offer superior clinical outcomes and competitive differentiation. Digital health integration represents an emerging opportunity for enhanced patient monitoring and outcomes improvement.

Regulatory strategy should emphasize early engagement with regulatory authorities to streamline approval processes and reduce time to market for innovative technologies. Companies should leverage expedited pathways where appropriate while maintaining robust quality and safety standards. Global harmonization efforts can facilitate international expansion and reduce regulatory complexity.

Market trajectory indicates continued growth driven by demographic trends, technological advancement, and expanding clinical applications. The aging North American population will create sustained demand for vascular interventions, while innovation in graft technologies will expand treatment options and improve outcomes. Growth projections suggest the market will maintain a 6.8% CAGR over the next five years, supported by these fundamental drivers.

Technology evolution will likely focus on bioengineered solutions that promote natural tissue integration and regeneration, potentially revolutionizing long-term outcomes for vascular graft patients. MWR projections indicate that regenerative medicine approaches may capture 15-20% market share within the next decade as these technologies mature and gain clinical acceptance.

Market consolidation trends are expected to continue as larger medical device companies acquire specialized manufacturers to expand their vascular portfolios and market presence. This consolidation may accelerate innovation through increased research and development resources while potentially reducing competitive pressure in certain market segments. Strategic partnerships between manufacturers and healthcare systems will likely become more common as value-based care models gain adoption.

Regulatory landscape evolution may include streamlined approval pathways for innovative technologies while maintaining rigorous safety standards. Digital health integration and personalized medicine approaches may require new regulatory frameworks and approval processes, creating both opportunities and challenges for market participants.

Geographic expansion within North America presents ongoing opportunities, particularly in underserved rural markets and emerging healthcare systems. The development of regional cardiac centers and telemedicine capabilities may expand access to advanced vascular graft technologies and drive market growth in previously underserved areas.

The North America vascular graft market represents a dynamic and growing segment of the cardiovascular medical device industry, driven by compelling demographic trends, technological innovation, and expanding clinical applications. Market fundamentals remain strong, with an aging population creating sustained demand for vascular interventions while advanced healthcare infrastructure supports widespread adoption of innovative technologies.

Technological advancement continues reshaping the market landscape, with emerging solutions such as bioengineered grafts, drug-eluting technologies, and regenerative medicine approaches promising to improve patient outcomes and expand treatment options. These innovations address persistent clinical challenges while creating new opportunities for market differentiation and growth. Clinical evidence supporting superior outcomes will drive adoption and support premium pricing for advanced technologies.

Competitive dynamics feature both established market leaders and innovative emerging companies, creating a diverse ecosystem of technology solutions and market approaches. Success in this market requires strong clinical evidence, surgeon relationships, and continuous innovation to address evolving clinical needs. Strategic partnerships and market consolidation trends will likely continue reshaping the competitive landscape while accelerating technology development and market expansion.

The future outlook for the North America vascular graft market remains positive, with multiple growth drivers supporting continued expansion and innovation. Companies that successfully navigate regulatory requirements, develop compelling clinical evidence, and address key clinical challenges will be well-positioned to capture market opportunities and drive long-term success in this important healthcare market.

What is Vascular Graft?

Vascular grafts are medical devices used to replace or repair damaged blood vessels. They are commonly utilized in procedures such as bypass surgeries and vascular reconstructions.

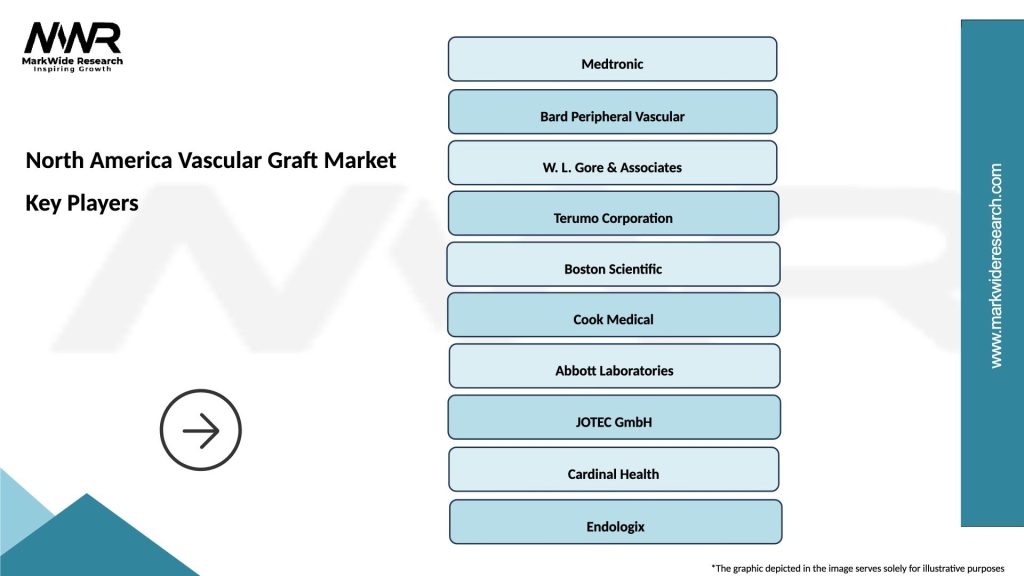

What are the key players in the North America Vascular Graft Market?

Key players in the North America Vascular Graft Market include Medtronic, Gore Medical, and Boston Scientific, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of the North America Vascular Graft Market?

The main drivers of the North America Vascular Graft Market include the increasing prevalence of cardiovascular diseases, advancements in surgical techniques, and a growing aging population requiring vascular interventions.

What challenges does the North America Vascular Graft Market face?

Challenges in the North America Vascular Graft Market include high costs associated with advanced graft technologies and stringent regulatory requirements that can delay product approvals.

What opportunities exist in the North America Vascular Graft Market?

Opportunities in the North America Vascular Graft Market include the development of bioengineered grafts and the expansion of minimally invasive surgical techniques, which can enhance patient outcomes.

What trends are shaping the North America Vascular Graft Market?

Trends in the North America Vascular Graft Market include the increasing adoption of hybrid grafts and the integration of smart technologies for better monitoring and patient management.

North America Vascular Graft Market

| Segmentation Details | Description |

|---|---|

| Product Type | Endovascular Grafts, Hemodialysis Grafts, Surgical Grafts, Stent Grafts |

| Material | Polyester, Polytetrafluoroethylene, Biologic Materials, Composite Materials |

| End User | Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Research Institutions |

| Application | Cardiovascular Surgery, Peripheral Vascular Surgery, Hemodialysis, Trauma Surgery |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Vascular Graft Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at