444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America titanium dioxide market represents a critical segment of the global chemical industry, serving as the backbone for numerous applications across paints, coatings, plastics, and paper industries. This versatile white pigment has established itself as an indispensable component in manufacturing processes throughout the United States, Canada, and Mexico. Market dynamics indicate robust growth driven by increasing demand from construction, automotive, and consumer goods sectors.

Regional distribution shows the United States commanding approximately 78% market share within North America, followed by Canada at 15% and Mexico contributing 7%. The market demonstrates strong resilience with consistent growth patterns, supported by technological advancements in production processes and expanding application areas. Industrial consumption continues to rise, particularly in architectural coatings and plastic manufacturing sectors.

Manufacturing capabilities across North America have evolved significantly, with major production facilities concentrated in the Gulf Coast region and Great Lakes area. The market benefits from established supply chains, proximity to raw material sources, and advanced processing technologies. Growth projections indicate a steady compound annual growth rate of 4.2% through the forecast period, driven by recovering construction activities and increasing automotive production.

The North America titanium dioxide market refers to the comprehensive ecosystem encompassing production, distribution, and consumption of titanium dioxide (TiO2) across the United States, Canada, and Mexico. This market includes various grades of titanium dioxide, from rutile and anatase forms to specialized surface-treated variants designed for specific industrial applications.

Titanium dioxide serves as the world’s most widely used white pigment, providing exceptional opacity, brightness, and UV protection properties. The North American market specifically focuses on meeting regional demand through domestic production facilities and strategic imports, supporting industries ranging from architectural coatings to food-grade applications. Market participants include major chemical manufacturers, specialty pigment producers, distributors, and end-user industries that rely on titanium dioxide for their manufacturing processes.

Market fundamentals reveal a stable and growing North American titanium dioxide landscape characterized by strong domestic production capabilities and consistent demand patterns. The region’s market demonstrates resilience through economic cycles, supported by diverse application areas and technological innovations in production processes. Key growth drivers include recovering construction activities, expanding automotive manufacturing, and increasing demand for high-performance coatings.

Competitive dynamics show established market leaders maintaining strong positions while emerging players focus on specialty applications and sustainable production methods. The market benefits from mature supply chains, advanced logistics networks, and proximity to major end-user industries. Regional advantages include access to raw materials, established manufacturing infrastructure, and favorable regulatory environments supporting industrial growth.

Future prospects indicate continued expansion driven by infrastructure development, automotive sector recovery, and growing demand for environmentally friendly coating solutions. The market shows particular strength in architectural applications, with construction-related demand accounting for approximately 42% of total consumption. Innovation trends focus on developing enhanced performance grades and sustainable production technologies.

Strategic analysis reveals several critical insights shaping the North American titanium dioxide market landscape:

Construction sector recovery stands as the primary driver for North American titanium dioxide demand, with architectural coatings representing the largest consumption segment. The ongoing infrastructure development initiatives across the region, combined with residential construction growth, create sustained demand for high-quality paints and coatings. Market expansion benefits from increased focus on building aesthetics and durability requirements.

Automotive industry growth significantly contributes to market expansion, with titanium dioxide essential for automotive paints, plastics, and interior components. The shift toward electric vehicles and advanced automotive technologies creates new opportunities for specialized titanium dioxide grades. Performance requirements in automotive applications drive demand for premium pigment formulations with enhanced durability and color retention properties.

Regulatory compliance acts as a key market driver, with stringent environmental and safety standards requiring high-purity titanium dioxide in various applications. Food and pharmaceutical industries particularly benefit from these quality standards, creating demand for specialized grades. Consumer awareness regarding product safety and environmental impact further supports market growth for compliant titanium dioxide products.

Technological advancement in manufacturing processes enables production of enhanced performance grades, opening new application areas and market segments. Innovation in surface treatment technologies and particle size control creates opportunities for premium product positioning. Research initiatives focus on developing sustainable production methods and improving product performance characteristics.

Raw material price volatility presents significant challenges for North American titanium dioxide producers, with feedstock costs directly impacting production economics. Fluctuations in ilmenite and rutile prices create margin pressure and require careful supply chain management. Cost management becomes critical for maintaining competitive positioning in price-sensitive market segments.

Environmental regulations impose substantial compliance costs and operational constraints on titanium dioxide manufacturing facilities. Waste management requirements and emission control standards necessitate significant capital investments in environmental protection systems. Regulatory complexity across different jurisdictions adds administrative burden and operational challenges for market participants.

Competition from alternatives in certain applications limits market expansion opportunities, particularly in cost-sensitive segments where performance requirements are less stringent. Alternative pigments and fillers offer competitive pricing in specific applications. Market substitution risks require continuous innovation and value proposition enhancement to maintain market share.

Economic cyclicality affects demand patterns, particularly in construction and automotive sectors that represent major consumption areas. Economic downturns can significantly impact market volumes and pricing dynamics. Demand volatility requires flexible production capabilities and inventory management strategies to navigate market fluctuations effectively.

Specialty applications present significant growth opportunities for North American titanium dioxide producers, with increasing demand for high-performance grades in advanced coatings, plastics, and emerging technologies. The development of niche markets such as photocatalytic applications and advanced ceramics creates premium pricing opportunities. Innovation focus on specialized formulations enables market differentiation and value creation.

Sustainable production initiatives offer competitive advantages as environmental consciousness increases among end-users and regulatory bodies. Investment in clean production technologies and circular economy principles creates market positioning opportunities. Green chemistry approaches in titanium dioxide manufacturing align with sustainability trends and customer preferences.

Infrastructure development programs across North America create substantial demand opportunities for architectural coatings and construction materials containing titanium dioxide. Government initiatives supporting infrastructure modernization provide long-term market growth prospects. Public investment in transportation, utilities, and public buildings drives consistent demand for high-quality coating systems.

Export potential to emerging markets offers growth opportunities for North American producers leveraging their technological capabilities and quality standards. Strategic partnerships and market development initiatives can expand geographic reach. Global expansion strategies enable market diversification and revenue growth beyond regional boundaries.

Supply-demand balance in the North American titanium dioxide market demonstrates relative stability, with domestic production capacity generally meeting regional demand requirements. However, periodic supply constraints due to maintenance shutdowns or raw material availability can create temporary market tightness. Capacity utilization rates typically operate at 85-90% levels, indicating healthy market conditions.

Pricing dynamics reflect the interplay between raw material costs, production capacity, and demand patterns across different application segments. Premium grades command higher prices due to enhanced performance characteristics and specialized applications. Price differentiation strategies enable producers to optimize revenue across diverse market segments and customer requirements.

Trade patterns within North America show strong regional integration, with efficient transportation networks supporting product movement between production centers and consumption markets. Cross-border trade between the United States, Canada, and Mexico remains robust despite periodic trade policy adjustments. Logistics optimization continues to enhance market efficiency and cost competitiveness.

Innovation cycles drive market evolution through development of enhanced performance grades and new application areas. Research and development investments focus on improving product properties, reducing environmental impact, and expanding market opportunities. Technology transfer between academic institutions and industry participants accelerates innovation adoption and market development.

Comprehensive analysis of the North American titanium dioxide market employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research involves extensive interviews with industry executives, technical experts, and key stakeholders across the value chain. Data collection encompasses production statistics, consumption patterns, pricing trends, and competitive dynamics from authoritative industry sources.

Secondary research utilizes published industry reports, government statistics, trade association data, and company financial statements to validate primary findings and provide historical context. Market modeling techniques incorporate statistical analysis and forecasting methodologies to project future trends and growth patterns. Analytical frameworks consider multiple variables including economic indicators, regulatory changes, and technological developments.

Market segmentation analysis examines consumption patterns across different application areas, geographic regions, and customer segments to identify growth opportunities and competitive dynamics. Supply chain analysis evaluates raw material availability, production capacity, and distribution networks. Competitive intelligence assesses market positioning, strategic initiatives, and performance metrics of key market participants.

Quality assurance procedures include data triangulation, expert validation, and peer review processes to ensure research accuracy and reliability. Continuous monitoring of market developments enables real-time updates and trend identification. Research standards adhere to established industry practices and methodological rigor to provide actionable market insights.

United States market dominates North American titanium dioxide consumption, accounting for the majority of regional demand across all major application segments. The country benefits from established manufacturing infrastructure, diverse industrial base, and strong domestic demand from construction and automotive sectors. Production facilities are strategically located along the Gulf Coast and Great Lakes regions, leveraging proximity to raw materials and transportation networks.

Canadian market demonstrates steady growth driven by construction activities and industrial manufacturing, particularly in Ontario and Quebec provinces. The country’s market shows strong integration with U.S. supply chains while maintaining distinct regulatory requirements and market characteristics. Resource availability provides competitive advantages for domestic production and export opportunities.

Mexican market exhibits rapid growth potential supported by expanding manufacturing sector and increasing construction activities. The country benefits from competitive production costs and strategic location for serving both North American and Latin American markets. Industrial development in automotive and construction sectors drives increasing titanium dioxide consumption.

Regional integration through trade agreements and established business relationships creates synergies and market efficiencies across North America. Cross-border investment and technology transfer enhance regional competitiveness in global markets. Market coordination enables optimal resource allocation and supply chain optimization throughout the region.

Market leadership in North American titanium dioxide is characterized by several major players maintaining strong competitive positions through integrated operations and technological capabilities:

Competitive strategies emphasize operational excellence, product innovation, and customer relationship management to maintain market position. Companies invest in technology upgrades, capacity optimization, and sustainability initiatives to enhance competitiveness. Market differentiation occurs through specialized product grades, technical service capabilities, and supply chain reliability.

Strategic partnerships and joint ventures enable market participants to leverage complementary strengths and expand market reach. Collaboration with research institutions and technology providers accelerates innovation and product development. Industry consolidation trends create opportunities for market share gains and operational synergies.

By Application:

By Grade:

By End-User Industry:

Architectural coatings represent the largest consumption category, benefiting from residential and commercial construction growth across North America. This segment demands high-opacity, weather-resistant titanium dioxide grades that provide long-term durability and color retention. Performance requirements continue to evolve with increasing focus on environmental compliance and energy efficiency.

Industrial coatings serve specialized applications requiring enhanced chemical resistance, corrosion protection, and extreme weather durability. This category shows steady growth driven by infrastructure maintenance and industrial equipment manufacturing. Technical specifications often require customized formulations and specialized surface treatments.

Automotive applications demand premium titanium dioxide grades with exceptional color consistency, UV stability, and processing characteristics. The shift toward electric vehicles creates new opportunities for lightweight materials and advanced coating systems. Quality standards in automotive applications drive demand for the highest performance pigment grades.

Plastic applications span diverse industries from packaging to automotive components, requiring titanium dioxide grades optimized for processing conditions and end-use performance. This category benefits from growing plastic consumption and increasing performance requirements. Processing compatibility and dispersion characteristics become critical selection factors.

Manufacturers benefit from stable demand patterns and diverse application opportunities that provide revenue stability and growth potential. The North American market offers established supply chains, skilled workforce, and proximity to major consumption centers. Operational advantages include access to raw materials, advanced logistics networks, and favorable regulatory environments.

End-users gain access to high-quality titanium dioxide products with consistent supply reliability and technical support services. The competitive market environment ensures reasonable pricing and continuous product innovation. Performance benefits include enhanced product quality, improved processing efficiency, and access to specialized grades for specific applications.

Distributors and suppliers participate in a mature market with established trading relationships and efficient distribution networks. The market provides opportunities for value-added services and specialized product handling. Business stability comes from long-term customer relationships and predictable demand patterns.

Investors find attractive opportunities in a market characterized by steady cash flows, established competitive positions, and growth potential in emerging applications. The industry’s capital-intensive nature creates barriers to entry and supports stable market dynamics. Investment returns benefit from operational efficiency improvements and market expansion opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives are reshaping the North American titanium dioxide market, with producers investing in cleaner production technologies and circular economy principles. Companies focus on reducing environmental impact through process optimization, waste minimization, and energy efficiency improvements. Green manufacturing becomes a competitive differentiator and regulatory requirement.

Digital transformation enhances operational efficiency through advanced process control, predictive maintenance, and supply chain optimization. Industry 4.0 technologies enable real-time monitoring, quality control, and production planning improvements. Technology adoption accelerates competitive advantages and operational excellence.

Product innovation focuses on developing enhanced performance grades with improved opacity, durability, and processing characteristics. Surface treatment technologies and particle engineering create opportunities for premium product positioning. Research investments target new application areas and performance improvements.

Supply chain resilience becomes increasingly important as companies diversify sourcing strategies and build redundancy into their operations. Risk management approaches include strategic inventory management and supplier relationship optimization. Operational flexibility enables adaptation to market changes and supply disruptions.

Capacity expansions and facility upgrades represent significant industry investments aimed at meeting growing demand and improving operational efficiency. Major producers announce strategic capital projects to enhance production capabilities and product quality. Infrastructure investments support long-term market growth and competitive positioning.

Merger and acquisition activities reshape the competitive landscape as companies seek scale advantages and market consolidation opportunities. Strategic transactions focus on complementary capabilities, geographic expansion, and technology acquisition. Industry consolidation creates larger, more efficient market participants.

Regulatory developments influence market dynamics through environmental standards, safety requirements, and trade policies. Companies adapt operations to comply with evolving regulations while maintaining competitiveness. Compliance initiatives require significant investments in environmental protection and safety systems.

Technology partnerships between industry participants and research institutions accelerate innovation and product development. Collaborative research programs focus on sustainable production methods and advanced material properties. Innovation ecosystems enhance industry competitiveness and market development.

Strategic positioning recommendations emphasize the importance of operational excellence, product differentiation, and customer relationship management in maintaining competitive advantages. Companies should focus on developing specialized capabilities in high-growth market segments while optimizing core operations. Market leadership requires continuous investment in technology, quality, and customer service.

Investment priorities should target sustainability initiatives, digital transformation, and capacity optimization to ensure long-term competitiveness. Environmental compliance and clean technology adoption become essential for regulatory compliance and market acceptance. Capital allocation strategies must balance growth investments with operational efficiency improvements.

Market development opportunities exist in specialty applications, export markets, and emerging technologies requiring advanced titanium dioxide grades. Companies should evaluate partnership opportunities and strategic alliances to expand market reach. Growth strategies benefit from diversification across applications and geographic markets.

Risk management approaches should address supply chain vulnerabilities, regulatory changes, and market cyclicality through diversification and operational flexibility. According to MarkWide Research analysis, companies with robust risk management frameworks demonstrate superior performance during market downturns. Resilience building requires proactive planning and strategic preparation.

Long-term growth prospects for the North American titanium dioxide market remain positive, supported by infrastructure development, automotive sector recovery, and expanding specialty applications. The market is expected to maintain steady growth with increasing focus on high-performance grades and sustainable production methods. Growth trajectory indicates continued expansion at a compound annual growth rate of approximately 4.2% through the forecast period.

Technology evolution will drive market development through enhanced production processes, improved product performance, and new application areas. Innovation in surface treatment technologies and particle engineering creates opportunities for premium product positioning. Research initiatives focus on developing next-generation titanium dioxide grades with superior performance characteristics.

Market structure is likely to evolve through continued consolidation, strategic partnerships, and vertical integration initiatives. Companies will focus on building scale advantages and operational efficiencies to compete effectively. Competitive dynamics will emphasize differentiation through quality, service, and specialized capabilities.

Sustainability trends will increasingly influence market development as environmental regulations tighten and customer preferences shift toward eco-friendly products. MWR projections indicate that sustainable production methods will become standard industry practice, creating competitive advantages for early adopters. Environmental compliance will drive significant investments in clean technology and process optimization.

Market fundamentals support continued growth and development of the North American titanium dioxide market, with strong demand drivers across multiple application segments and established competitive advantages. The region benefits from mature infrastructure, technological leadership, and diverse industrial base that creates stability and growth opportunities. Strategic positioning of major market participants provides foundation for sustained market development.

Growth outlook remains positive despite challenges related to environmental regulations, raw material costs, and economic cyclicality. The market’s resilience through various economic cycles demonstrates underlying strength and adaptability. Innovation focus on specialty applications and sustainable production methods creates opportunities for value creation and market differentiation.

Industry evolution toward sustainability, digitalization, and operational excellence will shape future market dynamics and competitive positioning. Companies that successfully adapt to these trends while maintaining operational efficiency will achieve superior market performance. MarkWide Research analysis indicates that market leaders will continue to invest in technology, quality, and customer service to maintain competitive advantages in this dynamic and growing market.

What is Titanium Dioxide?

Titanium Dioxide is a white pigment widely used in various applications, including paints, coatings, plastics, and cosmetics, due to its excellent opacity and brightness.

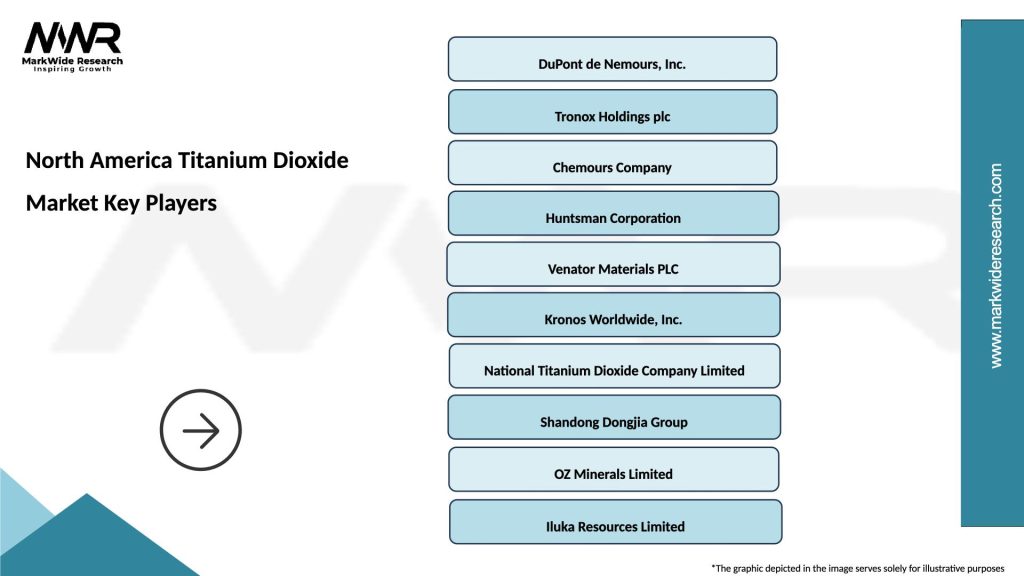

What are the key players in the North America Titanium Dioxide Market?

Key players in the North America Titanium Dioxide Market include DuPont, Tronox, and Chemours, which are known for their significant contributions to the production and supply of titanium dioxide.

What are the main drivers of the North America Titanium Dioxide Market?

The main drivers of the North America Titanium Dioxide Market include the growing demand for high-quality paints and coatings, increased use in the automotive industry, and the rising need for effective UV protection in various applications.

What challenges does the North America Titanium Dioxide Market face?

The North America Titanium Dioxide Market faces challenges such as fluctuating raw material prices, environmental regulations impacting production processes, and competition from alternative pigments.

What opportunities exist in the North America Titanium Dioxide Market?

Opportunities in the North America Titanium Dioxide Market include the development of innovative applications in the construction and packaging industries, as well as advancements in sustainable production methods.

What trends are shaping the North America Titanium Dioxide Market?

Trends shaping the North America Titanium Dioxide Market include a shift towards eco-friendly products, increased investment in research and development for enhanced performance, and the growing popularity of titanium dioxide in the cosmetics sector.

North America Titanium Dioxide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Rutile, Anatase, Blended, Others |

| Grade | Standard, High Purity, Food Grade, Industrial Grade |

| Application | Coatings, Plastics, Paper, Cosmetics |

| End Use Industry | Construction, Automotive, Electronics, Agriculture |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Titanium Dioxide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at