444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America thermal imaging system market represents a rapidly expanding sector driven by increasing demand across defense, industrial, healthcare, and commercial applications. This sophisticated technology captures infrared radiation to create visual representations of temperature variations, enabling enhanced surveillance, predictive maintenance, and diagnostic capabilities. The region’s market demonstrates robust growth momentum, with adoption rates accelerating at approximately 8.2% CAGR as organizations recognize the strategic advantages of thermal imaging solutions.

Market dynamics in North America are characterized by strong technological innovation, substantial defense spending, and growing industrial automation requirements. The United States leads regional demand, accounting for approximately 78% market share, while Canada contributes significantly through mining, oil and gas, and border security applications. Advanced manufacturing capabilities, coupled with extensive research and development investments, position North America as a global leader in thermal imaging technology advancement.

Key applications span multiple sectors, with defense and security representing the largest segment, followed by industrial monitoring, automotive safety systems, and medical diagnostics. The integration of artificial intelligence and machine learning capabilities enhances system performance, driving increased adoption across traditional and emerging use cases. Regional manufacturers continue investing in next-generation technologies, including higher resolution sensors, improved image processing algorithms, and enhanced connectivity features.

The North America thermal imaging system market refers to the comprehensive ecosystem of infrared imaging technologies, equipment, and services designed to detect, capture, and analyze thermal radiation patterns across various applications within the United States, Canada, and Mexico. These systems convert invisible infrared energy into visible images, enabling users to identify temperature differences, detect heat signatures, and monitor thermal patterns for security, maintenance, diagnostic, and operational purposes.

Thermal imaging systems encompass a wide range of products including handheld cameras, fixed surveillance systems, automotive integration modules, medical diagnostic equipment, and industrial monitoring solutions. The technology relies on sophisticated sensors, advanced optics, and intelligent processing algorithms to deliver accurate thermal data visualization. Modern systems integrate seamlessly with existing infrastructure, providing real-time monitoring capabilities and data analytics for enhanced decision-making processes.

Market expansion in North America’s thermal imaging sector reflects increasing recognition of infrared technology’s versatility and effectiveness across diverse applications. The region benefits from substantial defense investments, growing industrial automation adoption, and expanding healthcare technology integration. Key growth drivers include enhanced border security requirements, predictive maintenance initiatives, and automotive safety regulations mandating advanced driver assistance systems.

Technology advancement continues driving market evolution, with manufacturers developing higher resolution sensors, improved image processing capabilities, and enhanced connectivity features. Integration with artificial intelligence and machine learning algorithms enables automated threat detection, predictive analytics, and intelligent monitoring systems. The market demonstrates strong resilience and growth potential, supported by increasing awareness of thermal imaging benefits and expanding application possibilities.

Regional leadership positions North America as a global innovation hub for thermal imaging technology, with leading manufacturers investing heavily in research and development initiatives. The market shows promising growth trajectories across all major segments, with particular strength in defense, industrial, and automotive applications driving sustained demand expansion.

Strategic insights reveal several critical factors shaping the North America thermal imaging system market landscape:

Defense and security requirements serve as primary market drivers, with government agencies investing substantially in advanced surveillance and threat detection capabilities. Border security initiatives, military modernization programs, and homeland security enhancements create sustained demand for sophisticated thermal imaging solutions. The technology’s ability to operate effectively in challenging conditions, including darkness, adverse weather, and camouflaged environments, makes it indispensable for security applications.

Industrial automation trends significantly contribute to market growth as manufacturers seek improved operational efficiency and predictive maintenance capabilities. Thermal imaging systems enable early detection of equipment failures, energy loss identification, and process optimization opportunities. Industries including oil and gas, power generation, manufacturing, and chemical processing increasingly rely on thermal monitoring for safety, efficiency, and regulatory compliance purposes.

Automotive safety regulations drive substantial demand growth as vehicle manufacturers integrate thermal imaging into advanced driver assistance systems. Night vision capabilities, pedestrian detection, and collision avoidance systems utilize thermal imaging technology to enhance vehicle safety performance. The growing focus on autonomous vehicle development further accelerates adoption as thermal sensors provide critical environmental awareness capabilities.

Healthcare applications expand rapidly, particularly following increased awareness of non-contact temperature monitoring capabilities. Medical facilities adopt thermal imaging for fever screening, diagnostic imaging, and surgical guidance applications. The technology’s non-invasive nature and real-time monitoring capabilities make it valuable for various healthcare scenarios, driving sustained market growth in medical segments.

High implementation costs represent a significant market restraint, particularly for smaller organizations and emerging applications. Advanced thermal imaging systems require substantial capital investments, including equipment procurement, installation, training, and ongoing maintenance expenses. Cost considerations often limit adoption rates among price-sensitive market segments, despite the technology’s proven benefits and long-term value proposition.

Technical complexity challenges some potential users, requiring specialized knowledge for effective system operation and maintenance. Integration with existing infrastructure, calibration requirements, and data interpretation needs can create barriers to adoption. Organizations may need additional training, technical support, and expertise development to maximize thermal imaging system benefits, adding to overall implementation complexity.

Regulatory restrictions in certain applications, particularly export controls on advanced thermal imaging technology, can limit market expansion opportunities. International trade regulations and technology transfer restrictions may impact global market participation for North American manufacturers. Additionally, privacy concerns and regulatory compliance requirements in surveillance applications can create implementation challenges.

Competition from alternative technologies poses ongoing challenges as other sensing and monitoring solutions compete for market share. Visible light cameras, radar systems, and other detection technologies may offer cost advantages or specific performance benefits in certain applications, potentially limiting thermal imaging adoption in some market segments.

Emerging applications present substantial growth opportunities as thermal imaging technology finds new uses across diverse industries. Smart building management, renewable energy monitoring, agriculture optimization, and environmental monitoring represent expanding market segments. The technology’s versatility enables innovative applications that leverage thermal data for improved decision-making and operational efficiency.

Technology integration opportunities arise from combining thermal imaging with artificial intelligence, machine learning, and IoT connectivity. These integrations enable automated analysis, predictive capabilities, and remote monitoring solutions that enhance system value and market appeal. Cloud-based analytics, mobile connectivity, and intelligent processing create new service opportunities and recurring revenue models.

Commercial market expansion offers significant growth potential as thermal imaging costs decrease and awareness increases. Retail security, facility management, HVAC optimization, and building inspection applications represent growing commercial opportunities. Small and medium-sized businesses increasingly recognize thermal imaging benefits, expanding the addressable market beyond traditional large-scale applications.

International market development provides opportunities for North American manufacturers to expand global presence through technology exports and partnership arrangements. The region’s technological leadership and manufacturing capabilities position companies favorably for international market penetration, subject to regulatory compliance and competitive dynamics.

Supply chain dynamics significantly influence market development, with component availability, manufacturing capacity, and distribution networks affecting system availability and pricing. The thermal imaging industry relies on specialized sensors, optics, and processing components that require sophisticated manufacturing capabilities. Regional supply chain resilience and domestic manufacturing initiatives support market stability and growth sustainability.

Competitive dynamics drive continuous innovation and market evolution as manufacturers compete through technology advancement, cost optimization, and application-specific solutions. Market leaders invest heavily in research and development to maintain technological advantages, while emerging companies focus on niche applications and cost-effective solutions. This competitive environment accelerates innovation and benefits end users through improved products and competitive pricing.

Customer dynamics reflect increasing sophistication and specific requirements across different market segments. Defense customers prioritize performance and reliability, while commercial users emphasize cost-effectiveness and ease of use. Healthcare applications require regulatory compliance and precision, while industrial users focus on durability and integration capabilities. Understanding these diverse requirements drives product development and market positioning strategies.

Technology dynamics continue reshaping market opportunities through sensor improvements, processing enhancements, and integration capabilities. According to MarkWide Research analysis, technological advancement rates show approximately 15% annual improvement in key performance metrics, including resolution, sensitivity, and processing speed. These improvements expand application possibilities and drive market growth across multiple segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, technology experts, end users, and market participants across various segments and geographic regions. This direct engagement provides valuable insights into market trends, challenges, opportunities, and future development directions.

Secondary research encompasses detailed analysis of industry reports, government publications, academic studies, and company financial statements. This research foundation supports market sizing, trend analysis, and competitive landscape assessment. Data triangulation across multiple sources ensures accuracy and reliability of market insights and projections.

Market modeling utilizes sophisticated analytical techniques to project market growth, segment development, and regional trends. Statistical analysis, trend extrapolation, and scenario modeling provide comprehensive market forecasts and strategic insights. The methodology incorporates multiple variables including economic indicators, technology advancement rates, and regulatory developments.

Expert validation ensures research accuracy through consultation with industry specialists, technology experts, and market participants. This validation process confirms findings, identifies potential gaps, and enhances overall research quality and reliability.

United States market dominates North American thermal imaging demand, representing approximately 78% regional market share through substantial defense spending, advanced manufacturing capabilities, and diverse application requirements. The country benefits from leading technology companies, extensive research institutions, and strong government support for innovation initiatives. Key growth areas include border security, industrial automation, automotive safety, and healthcare applications.

California and Texas lead state-level demand through significant defense installations, technology companies, and industrial facilities. The aerospace and defense corridor supports substantial thermal imaging requirements, while technology hubs drive innovation and commercial applications. Manufacturing centers throughout the Midwest contribute significantly to industrial thermal imaging demand.

Canada represents approximately 18% regional market share, driven by mining operations, oil and gas industry requirements, and border security applications. The country’s harsh climate conditions and extensive natural resource operations create unique thermal imaging requirements. Government investments in Arctic sovereignty and resource monitoring support sustained market growth.

Mexico contributes approximately 4% regional market share through growing manufacturing sector adoption and border security applications. The country’s expanding automotive industry and increasing industrial automation drive thermal imaging demand. Cross-border security initiatives and manufacturing facility monitoring represent key growth areas.

Market leadership is characterized by several key players offering comprehensive thermal imaging solutions across multiple application segments:

Competitive strategies focus on technology innovation, application-specific solutions, and strategic partnerships. Companies invest heavily in research and development to maintain technological advantages while expanding into new market segments. Acquisition activities and strategic alliances enable market expansion and capability enhancement.

By Technology:

By Application:

By End User:

Defense and security segment maintains market leadership through substantial government investments and ongoing modernization programs. Advanced thermal imaging systems provide critical capabilities for surveillance, target acquisition, and threat detection applications. The segment benefits from continuous technology advancement requirements and long-term procurement contracts that ensure sustained demand growth.

Industrial applications demonstrate rapid growth as manufacturers recognize thermal imaging benefits for predictive maintenance and process optimization. Energy efficiency initiatives, safety regulations, and operational cost reduction drives support increased adoption. The segment shows particular strength in oil and gas, power generation, and manufacturing industries where thermal monitoring provides significant operational advantages.

Automotive integration represents the fastest-growing segment as vehicle manufacturers incorporate thermal imaging into advanced driver assistance systems. Night vision capabilities, pedestrian detection, and collision avoidance systems drive substantial demand growth. The segment benefits from safety regulations and consumer demand for enhanced vehicle safety features.

Healthcare applications expand rapidly through fever screening, diagnostic imaging, and surgical guidance systems. The segment demonstrates resilience and growth potential as healthcare facilities recognize thermal imaging benefits for non-contact monitoring and diagnostic capabilities. Medical device regulations and quality requirements drive demand for specialized healthcare thermal imaging solutions.

Manufacturers benefit from expanding market opportunities across diverse application segments and geographic regions. Technology advancement creates competitive advantages and premium pricing opportunities, while scale economies reduce production costs. Strategic partnerships and acquisition opportunities enable market expansion and capability enhancement.

End users gain significant operational advantages through improved monitoring capabilities, enhanced safety performance, and cost reduction opportunities. Thermal imaging systems provide early warning capabilities, predictive maintenance benefits, and operational efficiency improvements that justify investment costs and deliver long-term value.

Technology providers benefit from growing demand for integrated solutions combining thermal imaging with artificial intelligence, IoT connectivity, and cloud analytics. Service opportunities including installation, maintenance, and data analysis create recurring revenue streams and customer relationship enhancement.

Government agencies achieve enhanced security capabilities, improved border protection, and advanced surveillance systems through thermal imaging adoption. The technology supports national security objectives while providing cost-effective solutions for challenging operational environments.

Investors benefit from market growth potential, technology advancement opportunities, and diverse application segments that provide portfolio diversification and growth prospects. The market demonstrates resilience and long-term growth potential across multiple economic cycles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend enabling automated analysis, pattern recognition, and predictive capabilities. AI-powered thermal imaging systems provide intelligent monitoring, automated threat detection, and predictive maintenance insights that enhance system value and market appeal. This trend drives demand for advanced processing capabilities and software solutions.

Miniaturization advances enable thermal imaging integration into smaller devices and mobile applications. Compact sensors, improved optics, and efficient processing create opportunities for handheld devices, drone integration, and consumer applications. Size reduction trends expand market accessibility and enable new application possibilities.

Cloud connectivity and remote monitoring capabilities transform thermal imaging from standalone systems to connected solutions providing real-time data access and centralized management. Cloud-based analytics, mobile applications, and remote monitoring services create new business models and enhance customer value propositions.

Cost reduction trends through manufacturing improvements, scale economies, and technology advancement make thermal imaging accessible to broader market segments. MWR data indicates approximately 12% annual cost reduction in key thermal imaging components, expanding market opportunities across commercial and industrial applications.

Multi-sensor fusion combines thermal imaging with visible light, radar, and other sensing technologies to provide comprehensive situational awareness. This trend enhances system capabilities while creating opportunities for integrated solutions and strategic partnerships among technology providers.

Technology advancement continues through substantial research and development investments by leading manufacturers. Recent developments include higher resolution sensors, improved image processing algorithms, and enhanced connectivity features that expand application possibilities and improve system performance. These advancements drive market growth and competitive differentiation.

Strategic partnerships between thermal imaging manufacturers and technology companies create integrated solutions combining thermal sensors with artificial intelligence, IoT platforms, and cloud analytics. These collaborations enhance system capabilities while expanding market reach and customer value propositions.

Acquisition activities consolidate market capabilities and expand technology portfolios as companies seek to enhance competitive positions and market coverage. Recent acquisitions focus on specialized technologies, application expertise, and geographic expansion opportunities that strengthen market leadership positions.

Government initiatives support market development through defense modernization programs, border security enhancements, and infrastructure investment projects. These initiatives provide sustained demand and technology advancement opportunities that benefit the entire thermal imaging ecosystem.

Regulatory developments including safety standards, performance requirements, and application guidelines shape market development and create opportunities for compliant solutions. Industry standards development and certification programs enhance market credibility and customer confidence.

Market participants should focus on technology integration opportunities combining thermal imaging with artificial intelligence, machine learning, and IoT connectivity. These integrations create competitive advantages and enable new service-based business models that provide recurring revenue opportunities and enhanced customer relationships.

Investment strategies should emphasize commercial market expansion opportunities as cost reductions and awareness increases drive broader adoption. Small and medium-sized businesses represent significant growth potential as thermal imaging becomes more accessible and cost-effective for diverse applications.

Product development should prioritize user-friendly interfaces, simplified installation procedures, and integrated analytics capabilities that reduce technical complexity barriers. Solutions that combine ease of use with advanced capabilities will capture broader market segments and accelerate adoption rates.

Partnership opportunities with system integrators, software developers, and application specialists can expand market reach and enhance solution capabilities. Strategic alliances enable market penetration while leveraging complementary expertise and customer relationships.

Geographic expansion strategies should consider international market opportunities while navigating regulatory requirements and competitive dynamics. Export opportunities and international partnerships can drive growth beyond domestic markets.

Market growth prospects remain strong across all major segments, with particularly robust expansion expected in commercial applications, automotive integration, and healthcare systems. Technology advancement continues driving new application possibilities while cost reductions expand market accessibility. The market demonstrates resilience and sustained growth potential through diverse application segments and geographic markets.

Technology evolution will focus on artificial intelligence integration, enhanced connectivity, and improved performance capabilities. Next-generation systems will provide automated analysis, predictive capabilities, and seamless integration with existing infrastructure. These developments will expand market opportunities while enhancing customer value propositions.

Application expansion into emerging sectors including smart cities, environmental monitoring, and renewable energy will drive additional growth opportunities. The technology’s versatility enables innovative applications that leverage thermal data for improved decision-making and operational efficiency across diverse industries.

Regional development will benefit from continued defense investments, industrial automation adoption, and commercial market expansion. According to MarkWide Research projections, the market shows potential for sustained growth at approximately 8.5% CAGR through the forecast period, driven by technology advancement and expanding application opportunities.

Competitive dynamics will emphasize innovation, customer service, and integrated solutions as companies compete for market leadership. Success will depend on technology advancement, market understanding, and ability to deliver comprehensive solutions that meet diverse customer requirements across multiple application segments.

The North America thermal imaging system market demonstrates exceptional growth potential driven by diverse application requirements, continuous technology advancement, and expanding commercial adoption. Strong defense investments, industrial automation trends, and automotive safety regulations provide sustained demand across key market segments. The region’s technology leadership, manufacturing capabilities, and innovation ecosystem position it favorably for continued market expansion and global competitiveness.

Strategic opportunities abound through artificial intelligence integration, commercial market expansion, and international development initiatives. Companies that successfully navigate technology advancement, cost optimization, and market diversification will capture significant growth opportunities while building sustainable competitive advantages. The market’s resilience and growth potential across multiple economic cycles make it attractive for investors and industry participants seeking long-term value creation opportunities.

Future success will depend on continued innovation, customer-focused solutions, and strategic partnerships that enhance market reach and capability development. The thermal imaging industry in North America is well-positioned to maintain global leadership while capturing emerging opportunities across diverse application segments and geographic markets.

What is Thermal Imaging System?

Thermal Imaging System refers to technology that detects and measures infrared radiation emitted from objects, converting it into a visual image. This technology is widely used in various applications, including surveillance, building inspections, and medical diagnostics.

What are the key players in the North America Thermal Imaging System Market?

Key players in the North America Thermal Imaging System Market include FLIR Systems, Inc., Raytheon Technologies Corporation, and Teledyne Technologies Incorporated, among others. These companies are known for their innovative thermal imaging solutions across various sectors.

What are the growth factors driving the North America Thermal Imaging System Market?

The North America Thermal Imaging System Market is driven by increasing demand for advanced surveillance systems, growth in the automotive sector for driver assistance technologies, and rising applications in healthcare for diagnostic purposes.

What challenges does the North America Thermal Imaging System Market face?

Challenges in the North America Thermal Imaging System Market include high costs associated with advanced thermal imaging technologies and the need for skilled personnel to operate these systems. Additionally, competition from alternative technologies can hinder market growth.

What opportunities exist in the North America Thermal Imaging System Market?

Opportunities in the North America Thermal Imaging System Market include the expansion of smart city initiatives, increasing adoption of thermal imaging in industrial applications, and advancements in sensor technology that enhance imaging capabilities.

What trends are shaping the North America Thermal Imaging System Market?

Trends in the North America Thermal Imaging System Market include the integration of artificial intelligence for improved image analysis, the development of compact and portable thermal cameras, and the growing use of thermal imaging in environmental monitoring and energy efficiency assessments.

North America Thermal Imaging System Market

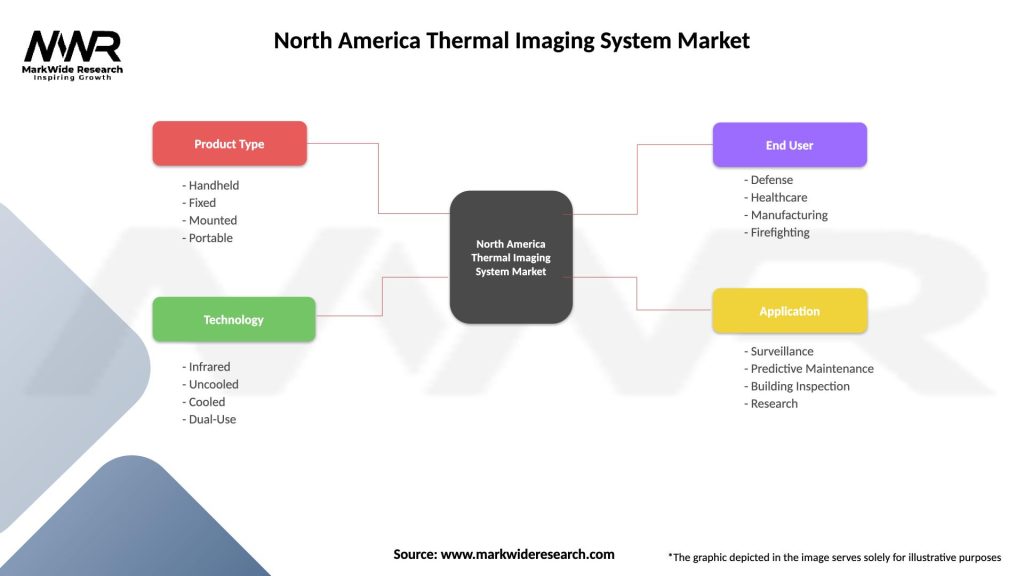

| Segmentation Details | Description |

|---|---|

| Product Type | Handheld, Fixed, Mounted, Portable |

| Technology | Infrared, Uncooled, Cooled, Dual-Use |

| End User | Defense, Healthcare, Manufacturing, Firefighting |

| Application | Surveillance, Predictive Maintenance, Building Inspection, Research |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Thermal Imaging System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at