444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America surveillance IP camera market represents a rapidly expanding sector within the broader security technology landscape, driven by increasing security concerns, technological advancements, and growing adoption across various industries. IP surveillance cameras have emerged as the preferred choice for modern security systems, offering superior image quality, remote accessibility, and advanced analytics capabilities compared to traditional analog systems.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.5% over the forecast period. This growth trajectory reflects the increasing demand for sophisticated security solutions across residential, commercial, and industrial applications. Digital transformation initiatives and the integration of artificial intelligence technologies are further accelerating market expansion.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 22% market presence. The dominance of the U.S. market stems from extensive infrastructure development, higher security spending, and widespread adoption of advanced surveillance technologies across various sectors including retail, healthcare, transportation, and government facilities.

Technology adoption rates demonstrate a significant shift toward IP-based solutions, with network cameras accounting for over 85% of new installations. This transition reflects the superior capabilities of IP cameras, including high-definition video quality, scalability, and integration with modern security management systems.

The North America surveillance IP camera market refers to the comprehensive ecosystem encompassing the design, manufacturing, distribution, and deployment of Internet Protocol-based video surveillance cameras across the United States and Canada. These advanced security devices utilize network infrastructure to transmit high-quality video data, enabling real-time monitoring, recording, and analysis of surveillance footage.

IP surveillance cameras represent a significant technological advancement over traditional analog systems, offering digital video transmission, remote accessibility, and integration capabilities with modern security platforms. The market encompasses various camera types, including dome cameras, bullet cameras, PTZ cameras, and specialized variants designed for specific applications and environmental conditions.

Market scope includes hardware components, software solutions, installation services, and ongoing maintenance support. The ecosystem supports diverse applications ranging from residential security systems to large-scale enterprise deployments, critical infrastructure protection, and smart city initiatives throughout North America.

Market performance in North America demonstrates exceptional growth momentum, driven by increasing security awareness, technological innovation, and expanding application areas. The surveillance IP camera sector has established itself as a critical component of modern security infrastructure, with adoption rates accelerating across multiple industry verticals.

Key growth drivers include rising crime rates in urban areas, increasing regulatory compliance requirements, and the growing emphasis on workplace safety and asset protection. Technological advancements such as artificial intelligence integration, edge computing capabilities, and enhanced video analytics are creating new market opportunities and driving replacement cycles.

Competitive landscape features a mix of established global players and innovative regional manufacturers, with companies focusing on product differentiation through advanced features, competitive pricing, and comprehensive service offerings. Market consolidation trends are evident as larger players acquire specialized technology companies to expand their capabilities and market reach.

Future prospects remain highly positive, with emerging technologies like 5G connectivity, cloud-based storage solutions, and advanced analytics platforms expected to drive continued market expansion. Investment levels in security infrastructure are projected to increase significantly, supporting sustained market growth throughout the forecast period.

Strategic insights reveal several critical factors shaping the North America surveillance IP camera market landscape:

Primary market drivers propelling growth in the North America surveillance IP camera market include escalating security concerns across various sectors and the continuous evolution of surveillance technology capabilities.

Security imperatives represent the fundamental driver, with increasing crime rates, terrorism threats, and workplace violence incidents creating sustained demand for advanced surveillance solutions. Retail shrinkage concerns, estimated to cost retailers billions annually, drive significant investment in comprehensive surveillance systems.

Regulatory requirements across industries mandate enhanced security measures and documentation capabilities. Healthcare facilities require surveillance systems for patient safety and regulatory compliance, while financial institutions must maintain comprehensive security monitoring to meet banking regulations and protect against fraud.

Technological advancement continues driving market expansion through improved capabilities and cost-effectiveness. High-definition video quality, enhanced low-light performance, and advanced analytics features make IP cameras increasingly attractive compared to traditional alternatives.

Infrastructure modernization initiatives across North America create opportunities for large-scale surveillance system deployments. Smart city projects incorporate extensive surveillance networks for traffic management, public safety, and urban planning applications.

Insurance incentives encourage surveillance system adoption through premium reductions and improved claim processing. Many insurance providers offer significant discounts for properties equipped with comprehensive surveillance systems, creating additional economic incentives for adoption.

Market challenges facing the North America surveillance IP camera sector include privacy concerns, high implementation costs, and technical complexity issues that may limit adoption in certain segments.

Privacy regulations present significant constraints, with increasing legislative scrutiny regarding surveillance system deployment and data collection practices. GDPR-style regulations and state-level privacy laws create compliance challenges for system operators and may limit deployment options in certain applications.

Implementation costs remain a barrier for smaller organizations and residential users, particularly for comprehensive systems requiring professional installation and ongoing maintenance. Total cost of ownership considerations include hardware, software licensing, installation, and ongoing support expenses.

Technical complexity challenges organizations lacking internal IT expertise, as IP camera systems require network infrastructure, cybersecurity measures, and ongoing system management. Integration difficulties with existing security systems may require significant additional investment and technical expertise.

Cybersecurity vulnerabilities create concerns about system security and potential unauthorized access to surveillance data. Network-connected devices present potential entry points for cyberattacks, requiring robust security measures and ongoing monitoring.

Bandwidth limitations in certain areas may restrict the deployment of high-definition IP camera systems, particularly in rural locations or older buildings with limited network infrastructure capacity.

Emerging opportunities in the North America surveillance IP camera market span multiple dimensions, from technological innovation to new application areas and evolving customer requirements.

Artificial intelligence integration presents substantial growth opportunities through advanced video analytics, automated threat detection, and predictive security capabilities. Machine learning algorithms enable sophisticated pattern recognition and behavioral analysis, creating value-added services and premium product offerings.

Edge computing capabilities offer opportunities for real-time processing and reduced bandwidth requirements, particularly valuable for large-scale deployments. Local processing capabilities reduce latency and improve system responsiveness while addressing privacy concerns through reduced data transmission.

5G network deployment creates opportunities for enhanced mobile surveillance applications and improved connectivity for remote locations. Wireless connectivity options expand deployment possibilities and reduce installation complexity in challenging environments.

Vertical market expansion into sectors like agriculture, construction, and environmental monitoring presents new growth avenues. Specialized applications require customized solutions and create opportunities for premium pricing and differentiated offerings.

Subscription-based models offer recurring revenue opportunities through cloud storage, analytics services, and ongoing support packages. Software-as-a-Service approaches reduce upfront costs for customers while creating predictable revenue streams for providers.

Market dynamics in the North America surveillance IP camera sector reflect the complex interplay between technological innovation, regulatory requirements, competitive pressures, and evolving customer expectations.

Supply chain considerations significantly impact market dynamics, with global component sourcing, manufacturing capacity, and logistics challenges affecting product availability and pricing. Semiconductor shortages and supply chain disruptions have created periodic constraints on production capacity and delivery timelines.

Competitive intensity continues increasing as new entrants leverage technological innovations to challenge established players. Price competition remains significant in commodity segments, while premium features and specialized applications command higher margins.

Customer behavior evolution shows increasing sophistication in system requirements and expectations for integrated solutions. End users increasingly demand comprehensive platforms combining hardware, software, and services rather than standalone products.

Technology lifecycle acceleration requires continuous innovation and product development investment. Rapid obsolescence of older technologies creates both challenges and opportunities for market participants.

Partnership strategies become increasingly important as companies seek to combine complementary capabilities and expand market reach. Strategic alliances between hardware manufacturers, software developers, and service providers create comprehensive solution offerings.

Research approach for analyzing the North America surveillance IP camera market employs comprehensive methodologies combining primary research, secondary data analysis, and industry expert consultations to ensure accurate and actionable insights.

Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, system integrators, and end users across various market segments. Survey methodologies capture quantitative data on market trends, purchasing behaviors, and technology preferences.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure and competitive dynamics. Data triangulation techniques ensure consistency and reliability across multiple information sources.

Market modeling approaches utilize statistical analysis and forecasting techniques to project future market trends and growth patterns. Scenario analysis considers multiple potential outcomes based on varying assumptions about key market drivers and constraints.

Industry validation processes involve expert review and stakeholder feedback to ensure research findings accurately reflect market realities and provide actionable insights for decision-making purposes.

Regional distribution across North America reveals distinct market characteristics and growth patterns, with the United States maintaining dominant market position while Canada demonstrates strong growth potential in specific segments.

United States market represents the largest segment, driven by extensive commercial and industrial infrastructure, high security spending, and widespread technology adoption. California leads state-level demand due to technology industry concentration and stringent security requirements, followed by Texas and New York with significant commercial and financial sector presence.

Canadian market shows robust growth momentum, particularly in urban centers like Toronto, Vancouver, and Montreal. Government initiatives supporting smart city development and infrastructure modernization drive significant surveillance system deployments across major metropolitan areas.

Growth patterns vary by region, with western states showing higher adoption rates for advanced analytics and AI-enabled systems, while eastern regions focus more on traditional security applications and regulatory compliance requirements.

Market penetration rates indicate significant opportunities in underserved segments, particularly in rural areas and smaller metropolitan regions where surveillance system adoption remains below national averages.

According to MarkWide Research analysis, regional growth rates show the Pacific Northwest experiencing the highest growth at 15.2% annually, driven by technology sector expansion and increasing security awareness.

Competitive environment in the North America surveillance IP camera market features a diverse mix of global technology leaders, specialized security companies, and emerging innovative players competing across multiple dimensions including technology, pricing, and service capabilities.

Market leaders include established companies with comprehensive product portfolios and extensive distribution networks:

Competitive strategies focus on product differentiation through advanced features, vertical market specialization, and comprehensive service offerings. Innovation investments in artificial intelligence, edge computing, and cybersecurity capabilities drive competitive positioning.

Market segmentation analysis reveals distinct categories based on technology type, application area, end-user industry, and deployment model, each presenting unique growth opportunities and competitive dynamics.

By Technology Type:

By Resolution:

By Application:

Category analysis provides detailed insights into specific market segments, revealing growth patterns, competitive dynamics, and emerging opportunities across different product and application categories.

Commercial Segment: Represents the largest market category, driven by retail security requirements, office building surveillance, and hospitality industry applications. Loss prevention initiatives and employee safety concerns drive significant investment in comprehensive surveillance systems.

Residential Segment: Shows rapid growth momentum as home security awareness increases and system costs decrease. DIY installation options and smartphone integration capabilities make IP cameras increasingly accessible to residential users.

Industrial Segment: Focuses on facility protection, process monitoring, and safety compliance applications. Manufacturing facilities utilize surveillance systems for security, quality control, and operational efficiency purposes.

Government Segment: Encompasses public safety applications, critical infrastructure protection, and law enforcement support systems. Smart city initiatives drive large-scale deployments for traffic management and public security.

Healthcare Segment: Emphasizes patient safety, asset protection, and regulatory compliance requirements. Privacy considerations require specialized solutions balancing security needs with patient confidentiality.

Education Segment: Addresses campus security concerns and emergency response capabilities. School safety initiatives drive investment in comprehensive surveillance and access control systems.

Industry participants across the North America surveillance IP camera market ecosystem realize significant benefits through participation in this dynamic and growing sector.

Manufacturers benefit from sustained demand growth, technological innovation opportunities, and expanding application areas. Revenue diversification through software and services offerings creates recurring income streams and improved customer relationships.

Distributors and Resellers gain from increasing market demand, product portfolio expansion opportunities, and value-added service offerings. Technical expertise development enables premium pricing and stronger customer relationships.

System Integrators benefit from growing complexity in surveillance deployments requiring professional installation and integration services. Recurring maintenance and support contracts provide stable revenue streams.

End Users realize significant benefits including:

Technology Partners benefit from integration opportunities with surveillance systems, creating new revenue channels and expanding market reach through ecosystem participation.

Strategic assessment of the North America surveillance IP camera market reveals key strengths, weaknesses, opportunities, and threats shaping industry dynamics and future prospects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends in the North America surveillance IP camera market reflect technological evolution, changing customer requirements, and evolving security landscapes driving industry transformation.

Artificial Intelligence Integration represents the most significant trend, with AI-powered analytics enabling automated threat detection, behavioral analysis, and predictive security capabilities. Machine learning algorithms continuously improve system performance and reduce false alarm rates.

Edge Computing Adoption accelerates as organizations seek to reduce bandwidth requirements and improve response times. Local processing capabilities enable real-time analysis while addressing privacy concerns through reduced data transmission.

Cloud-Based Solutions gain traction as organizations embrace Software-as-a-Service models for surveillance system management. Hybrid deployments combining on-premise and cloud components offer flexibility and scalability.

Mobile Integration becomes standard as users demand smartphone accessibility and remote monitoring capabilities. Mobile applications provide real-time alerts, video streaming, and system control functionality.

Cybersecurity Focus intensifies with enhanced encryption, secure authentication, and network protection measures becoming standard features. Zero-trust security models influence system design and deployment practices.

Sustainability Initiatives drive demand for energy-efficient systems and environmentally responsible manufacturing practices. Power-over-Ethernet capabilities reduce installation complexity and energy consumption.

Industry developments demonstrate the dynamic nature of the North America surveillance IP camera market, with continuous innovation, strategic partnerships, and market expansion initiatives shaping competitive dynamics.

Technology Advancements include the introduction of 8K resolution cameras, enhanced low-light performance capabilities, and advanced video compression technologies reducing storage and bandwidth requirements. Thermal imaging integration expands application possibilities in challenging environmental conditions.

Strategic Acquisitions reshape the competitive landscape as larger companies acquire specialized technology providers to expand capabilities and market reach. Vertical integration strategies combine hardware, software, and services under unified platforms.

Partnership Agreements between camera manufacturers and software providers create comprehensive solution offerings. Technology alliances enable integration with complementary security systems and building management platforms.

Regulatory Developments influence product design and deployment practices, with privacy legislation requiring enhanced data protection capabilities and user consent mechanisms. Cybersecurity standards mandate improved security features and vulnerability management practices.

Market Expansion initiatives include entry into new vertical markets and geographic regions. Specialized solutions for healthcare, education, and critical infrastructure applications drive product development investments.

Investment Activity remains strong with venture capital and private equity funding supporting innovative startups developing next-generation surveillance technologies and analytics platforms.

Strategic recommendations for market participants focus on positioning for long-term success in the evolving North America surveillance IP camera market landscape.

Technology Investment priorities should emphasize artificial intelligence capabilities, edge computing integration, and cybersecurity enhancements. Research and development spending in these areas will determine competitive positioning and market share growth.

Market Positioning strategies should focus on vertical market specialization and solution differentiation rather than competing solely on price. Value-added services and comprehensive platforms create sustainable competitive advantages.

Partnership Development becomes increasingly important for accessing complementary technologies and expanding market reach. Strategic alliances with software providers, system integrators, and technology partners enable comprehensive solution offerings.

Customer Education initiatives should address privacy concerns, cybersecurity best practices, and total cost of ownership considerations. Thought leadership in emerging technologies builds credibility and market influence.

Geographic Expansion opportunities exist in underserved markets and emerging application areas. Rural markets and specialized industries present growth potential for companies with appropriate solutions and go-to-market strategies.

Regulatory Compliance preparation requires proactive engagement with evolving privacy and cybersecurity requirements. Compliance capabilities become competitive differentiators in regulated industries and government applications.

Future prospects for the North America surveillance IP camera market remain highly positive, with multiple growth drivers supporting sustained expansion and technological evolution throughout the forecast period.

Market growth projections indicate continued robust expansion, with MWR forecasting sustained double-digit growth rates driven by technology adoption, application expansion, and infrastructure modernization initiatives. Compound annual growth rates are expected to maintain momentum above 12% annually through the next five years.

Technology evolution will focus on artificial intelligence integration, with advanced analytics capabilities becoming standard features rather than premium options. Edge computing deployment will accelerate, enabling real-time processing and reducing infrastructure requirements.

Application expansion into new vertical markets and use cases will drive market diversification and growth. Smart city initiatives, environmental monitoring, and specialized industrial applications present significant opportunities for market expansion.

Competitive dynamics will continue evolving with technology innovation, strategic partnerships, and market consolidation shaping industry structure. Solution providers offering comprehensive platforms combining hardware, software, and services will gain competitive advantages.

Investment levels in surveillance infrastructure are projected to increase significantly, driven by security concerns, regulatory requirements, and operational efficiency initiatives. Government spending on public safety and critical infrastructure protection will support market growth.

Emerging technologies including 5G connectivity, quantum computing, and advanced materials will create new possibilities for surveillance system capabilities and deployment models, ensuring continued market evolution and growth opportunities.

Market assessment reveals the North America surveillance IP camera market as a dynamic and rapidly expanding sector with strong fundamentals supporting continued growth and innovation. Technology advancement, increasing security awareness, and expanding application areas create a favorable environment for sustained market expansion.

Key success factors for market participants include technology innovation, vertical market specialization, and comprehensive solution offerings that address evolving customer requirements. Artificial intelligence integration and cybersecurity capabilities will become essential competitive differentiators in the evolving market landscape.

Growth opportunities span multiple dimensions, from emerging technologies and new application areas to underserved market segments and geographic expansion possibilities. Strategic positioning and continuous innovation will determine long-term success in this competitive and rapidly evolving market.

Industry outlook remains highly positive, with robust demand drivers, technological innovation, and expanding application areas supporting sustained growth throughout the forecast period. The North America surveillance IP camera market represents a compelling opportunity for companies positioned to capitalize on evolving security requirements and technological capabilities.

What is Surveillance IP Camera?

Surveillance IP Cameras are digital video cameras that transmit data over a network, allowing for remote monitoring and recording. They are widely used in security systems for various applications, including residential, commercial, and public safety.

What are the key players in the North America Surveillance IP Camera Market?

Key players in the North America Surveillance IP Camera Market include Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems, among others.

What are the main drivers of growth in the North America Surveillance IP Camera Market?

The main drivers of growth in the North America Surveillance IP Camera Market include increasing security concerns, advancements in technology such as AI and cloud storage, and the rising demand for smart home solutions.

What challenges does the North America Surveillance IP Camera Market face?

Challenges in the North America Surveillance IP Camera Market include privacy concerns, regulatory compliance issues, and the high costs associated with installation and maintenance.

What opportunities exist in the North America Surveillance IP Camera Market?

Opportunities in the North America Surveillance IP Camera Market include the integration of IoT technologies, the expansion of smart city initiatives, and the growing demand for advanced analytics in surveillance systems.

What trends are shaping the North America Surveillance IP Camera Market?

Trends shaping the North America Surveillance IP Camera Market include the shift towards wireless cameras, the adoption of AI for enhanced image recognition, and the increasing use of cloud-based storage solutions.

North America Surveillance IP Camera Market

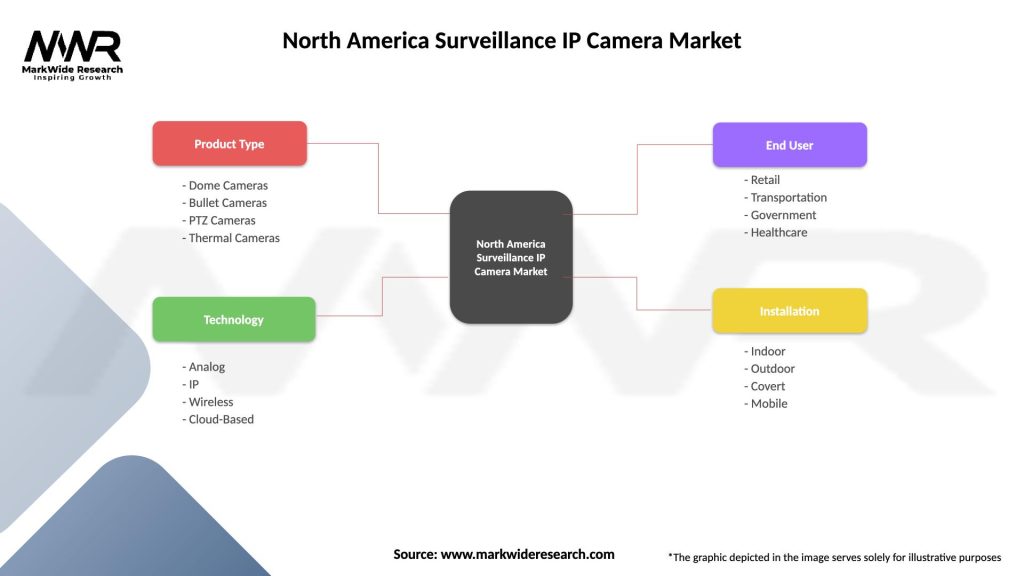

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, Thermal Cameras |

| Technology | Analog, IP, Wireless, Cloud-Based |

| End User | Retail, Transportation, Government, Healthcare |

| Installation | Indoor, Outdoor, Covert, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Surveillance IP Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at