444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America sugar free energy drinks market represents one of the most dynamic and rapidly evolving segments within the broader beverage industry. This market encompasses a diverse range of energy-boosting beverages that contain zero or minimal sugar content while maintaining the essential functional ingredients that consumers seek for enhanced performance and alertness. Market dynamics indicate substantial growth momentum driven by increasing health consciousness, rising demand for low-calorie alternatives, and evolving consumer preferences toward functional beverages.

Consumer behavior in North America has shifted significantly toward healthier beverage options, with sugar-free energy drinks experiencing remarkable adoption rates of approximately 8.5% annually across key demographic segments. The market encompasses various product categories including carbonated and non-carbonated formulations, natural and synthetic caffeine sources, and diverse flavor profiles designed to meet specific consumer preferences and lifestyle requirements.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 18%, and Mexico contributing the remaining 4%. This distribution reflects varying consumer preferences, regulatory environments, and market maturity levels across the North American region. The market continues to benefit from robust distribution networks, innovative product development, and strategic marketing initiatives targeting health-conscious consumers.

The North America sugar free energy drinks market refers to the commercial ecosystem encompassing the production, distribution, and consumption of energy-enhancing beverages that contain zero or minimal sugar content while delivering functional benefits through caffeine, vitamins, amino acids, and other performance-enhancing ingredients across the United States, Canada, and Mexico.

Product characteristics define these beverages as containing less than 5 calories per serving, utilizing artificial sweeteners or natural sugar alternatives, and maintaining energy-boosting properties through carefully formulated ingredient combinations. The market includes ready-to-drink formats, powder concentrates, and liquid concentrates designed for various consumption occasions and consumer preferences.

Functional benefits encompass enhanced mental alertness, improved physical performance, sustained energy release, and metabolic support without the caloric burden associated with traditional sugar-containing energy drinks. These products cater to fitness enthusiasts, working professionals, students, and health-conscious consumers seeking performance enhancement without compromising their dietary goals.

Market momentum in the North America sugar free energy drinks sector demonstrates exceptional growth potential driven by fundamental shifts in consumer behavior and increasing awareness of health implications associated with high-sugar beverages. The market benefits from strong demographic trends, particularly among millennials and Generation Z consumers who prioritize health and wellness in their purchasing decisions.

Key growth drivers include rising obesity concerns, increasing fitness culture adoption, growing demand for functional beverages, and expanding retail distribution channels. The market experiences particularly strong performance in urban areas where health-conscious consumers demonstrate higher willingness to pay premium prices for sugar-free alternatives. MarkWide Research analysis indicates that health and wellness trends contribute to approximately 65% of purchase decisions in this category.

Competitive dynamics feature established beverage giants alongside emerging specialized brands, creating a diverse marketplace with varied product offerings, pricing strategies, and marketing approaches. Innovation remains crucial for market success, with companies investing heavily in flavor development, ingredient optimization, and packaging solutions that appeal to target demographics.

Consumer preferences reveal several critical insights that shape market development and product innovation strategies:

Market segmentation reveals distinct consumer clusters with varying preferences, consumption patterns, and brand loyalties. Understanding these segments enables companies to develop targeted marketing strategies and product formulations that resonate with specific demographic groups and usage occasions.

Health and wellness trends represent the primary catalyst driving market expansion, with consumers increasingly seeking alternatives to high-sugar beverages that align with their health goals. The growing awareness of sugar’s role in obesity, diabetes, and other health conditions motivates consumers to seek functional beverages that provide energy without negative health implications.

Fitness culture proliferation across North America creates substantial demand for performance-enhancing beverages that support active lifestyles without compromising dietary objectives. The expansion of fitness facilities, group exercise programs, and personal wellness initiatives generates consistent demand for sugar-free energy solutions that complement workout routines and recovery protocols.

Demographic shifts favor market growth as younger generations demonstrate stronger preferences for health-conscious beverage choices. Millennials and Generation Z consumers exhibit higher willingness to pay premium prices for products that align with their values and lifestyle preferences, creating opportunities for innovative brands and premium product positioning.

Regulatory support through clear labeling requirements and health claim guidelines provides market stability and consumer confidence. Government initiatives promoting reduced sugar consumption and healthy lifestyle choices create favorable market conditions for sugar-free alternatives across various beverage categories.

Artificial sweetener concerns present significant challenges as some consumers remain skeptical about the safety and taste profiles of sugar substitutes commonly used in energy drink formulations. Negative perceptions regarding artificial ingredients can limit market penetration among health-conscious consumers who prefer completely natural products.

Price premium challenges affect market accessibility as sugar-free energy drinks typically command higher prices than traditional alternatives. The cost differential can limit adoption among price-sensitive consumer segments and restrict market expansion in certain demographic groups and geographic regions.

Taste profile limitations continue to challenge product developers as creating appealing flavors without sugar requires sophisticated formulation expertise and often results in taste profiles that differ significantly from traditional energy drinks. Consumer acceptance of these taste differences varies and can impact repeat purchase behavior.

Regulatory complexity surrounding caffeine content, health claims, and ingredient approvals creates compliance challenges for manufacturers and can slow product development and market entry processes. Varying regulations across different states and provinces add complexity to market expansion strategies.

Product innovation opportunities abound in areas such as natural sweetener integration, functional ingredient enhancement, and specialized formulations targeting specific consumer needs. The development of products featuring plant-based sweeteners, adaptogenic herbs, and personalized nutrition profiles presents significant growth potential for forward-thinking companies.

Distribution channel expansion offers substantial opportunities through e-commerce platforms, subscription services, and specialized retail partnerships. The growth of online grocery shopping and direct-to-consumer models creates new avenues for reaching target consumers and building brand loyalty through personalized experiences.

Demographic targeting presents opportunities to develop products specifically designed for underserved market segments including older adults seeking gentle energy solutions, women looking for beauty-enhancing formulations, and professionals requiring sustained cognitive performance support.

International expansion within North America, particularly in Mexico and smaller Canadian markets, offers growth opportunities for established brands seeking to leverage their success in primary markets. Cultural adaptation and localized marketing strategies can unlock significant market potential in these regions.

Supply chain evolution reflects increasing sophistication in ingredient sourcing, manufacturing processes, and distribution networks optimized for sugar-free formulations. Companies invest in specialized production capabilities and quality control systems to ensure consistent product quality and taste profiles across different batch productions.

Consumer education initiatives play crucial roles in market development as companies invest in educational marketing to help consumers understand the benefits of sugar-free formulations and address concerns about artificial ingredients. These efforts contribute to market expansion by building consumer confidence and driving trial behavior.

Competitive intensity continues to increase as new entrants recognize market opportunities and established players expand their sugar-free product portfolios. This competition drives innovation, improves product quality, and creates more diverse options for consumers while potentially pressuring profit margins across the industry.

Technology integration enhances market dynamics through improved manufacturing processes, better ingredient stability, and enhanced flavor delivery systems. Advanced formulation technologies enable companies to create products with superior taste profiles and functional benefits while maintaining sugar-free positioning.

Primary research methodologies employed in analyzing the North America sugar free energy drinks market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions with target demographic segments. These approaches provide valuable insights into consumer preferences, purchasing behavior, and market trends that inform strategic decision-making.

Secondary research components encompass analysis of industry reports, regulatory filings, company financial statements, and market intelligence databases to establish market sizing, competitive positioning, and growth trend analysis. This research foundation supports quantitative analysis and market forecasting activities.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert interviews, and cross-referencing with established industry benchmarks. Quality control measures include peer review processes and statistical validation of key findings to maintain research integrity and reliability.

Market modeling techniques utilize advanced statistical methods to project market growth, segment analysis, and competitive dynamics. These models incorporate various economic indicators, demographic trends, and industry-specific factors to provide comprehensive market outlook and strategic recommendations.

United States market dominates the North American landscape with approximately 78% market share, driven by high consumer awareness, extensive retail distribution, and strong marketing investments by major beverage companies. The market benefits from diverse demographic segments, established fitness culture, and favorable regulatory environment supporting functional beverage innovation.

California and Texas represent the largest state markets, accounting for approximately 35% of total consumption, reflecting their large populations, health-conscious consumer bases, and strong fitness cultures. These states also serve as testing grounds for new product launches and marketing strategies before national rollouts.

Canadian market contributes approximately 18% market share with distinct characteristics including preference for natural ingredients, bilingual labeling requirements, and seasonal consumption patterns influenced by climate variations. The market shows strong growth potential in urban centers including Toronto, Vancouver, and Montreal.

Mexican market represents emerging opportunities with 4% current market share but significant growth potential driven by increasing health awareness, expanding middle class, and growing fitness culture adoption. Market development requires cultural adaptation and localized marketing approaches to achieve success.

Market leadership features a combination of established beverage giants and innovative specialty brands competing across different market segments and price points:

Competitive strategies vary significantly across market participants, with some focusing on premium positioning and others emphasizing value propositions. Innovation remains crucial for maintaining competitive advantage, particularly in flavor development, functional ingredient integration, and packaging solutions.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Carbonated segment maintains market leadership through familiar taste profiles and established consumer preferences, though growth rates lag behind non-carbonated alternatives. Innovation focuses on flavor variety and functional ingredient enhancement while maintaining the traditional energy drink experience that consumers expect.

Non-carbonated category demonstrates the strongest growth momentum with approximately 12% annual growth, driven by consumer perception of healthier profiles and smoother taste experiences. This segment benefits from innovation in natural ingredients, botanical extracts, and wellness-focused formulations.

Energy shots segment appeals to consumers seeking maximum convenience and portion control, particularly popular among busy professionals and travelers. The segment faces challenges from higher per-ounce pricing but benefits from strong impulse purchase behavior and premium positioning opportunities.

Powder concentrates represent the fastest-growing category with 15% annual growth, driven by cost-effectiveness, customization options, and appeal to fitness enthusiasts who prefer controlling their intake levels. This segment benefits from e-commerce distribution and subscription model opportunities.

Manufacturers benefit from expanding market opportunities, premium pricing potential, and brand differentiation possibilities in the growing health-conscious beverage segment. The sugar-free positioning allows companies to tap into wellness trends while maintaining the functional benefits that drive energy drink consumption.

Retailers gain from higher profit margins, increased foot traffic from health-conscious consumers, and opportunities to develop private label products in this growing category. The premium pricing of sugar-free options typically provides better margins than traditional energy drinks.

Consumers receive functional energy benefits without the caloric burden and health concerns associated with high-sugar alternatives. The market provides options for maintaining active lifestyles, improving work performance, and supporting fitness goals without compromising dietary objectives.

Health professionals can recommend these products as alternatives to high-sugar energy drinks for patients seeking energy solutions that align with weight management and diabetic-friendly dietary requirements. The reduced sugar content addresses primary health concerns while maintaining functional benefits.

Investors find attractive opportunities in a growing market segment with strong demographic tailwinds, innovation potential, and premium pricing characteristics. The market offers exposure to health and wellness trends while benefiting from established energy drink consumption patterns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient integration represents the most significant trend as consumers increasingly seek products featuring plant-based sweeteners, organic caffeine sources, and botanical extracts. This trend drives product reformulation and premium positioning opportunities while addressing consumer concerns about artificial ingredients.

Functional enhancement beyond basic energy provision includes the integration of vitamins, minerals, adaptogens, and nootropics designed to provide comprehensive wellness benefits. Products featuring cognitive enhancement, stress reduction, and immune support capabilities demonstrate strong consumer appeal and premium pricing potential.

Personalization and customization emerge as key differentiators with companies offering products tailored to specific consumer needs, preferences, and lifestyle requirements. This includes gender-specific formulations, age-appropriate products, and activity-specific energy solutions that address particular use cases.

Sustainability focus influences packaging decisions, ingredient sourcing, and manufacturing processes as environmentally conscious consumers seek brands that align with their values. Companies invest in recyclable packaging, carbon-neutral production, and sustainable ingredient sourcing to appeal to eco-conscious demographics.

Digital engagement through social media marketing, influencer partnerships, and direct-to-consumer platforms becomes increasingly important for brand building and customer acquisition. MWR data indicates that digital marketing contributes to approximately 45% of brand awareness in this category.

Product innovation accelerates with major brands launching new formulations featuring natural sweeteners, enhanced functional benefits, and improved taste profiles. Recent developments include the introduction of stevia-sweetened options, collagen-enhanced formulations, and products specifically designed for different times of day.

Strategic partnerships between beverage companies and fitness brands, health organizations, and technology platforms create new distribution channels and marketing opportunities. These collaborations enhance brand credibility and provide access to targeted consumer segments through trusted partner networks.

Manufacturing investments in specialized production facilities and quality control systems support market growth and product consistency. Companies invest in advanced formulation technologies and packaging solutions that maintain product quality while reducing environmental impact.

Regulatory developments include updated labeling requirements, health claim guidelines, and ingredient approval processes that provide market clarity and consumer confidence. These developments support market growth by establishing clear standards and reducing regulatory uncertainty.

Product development focus should prioritize natural ingredient integration and taste optimization to address primary consumer concerns about artificial sweeteners and flavor profiles. Companies should invest in research and development to create products that deliver superior taste experiences while maintaining health positioning.

Market segmentation strategies should target specific demographic groups with tailored products and marketing messages that resonate with their unique needs and preferences. This includes developing products for women, older adults, and specific activity-based consumer segments that remain underserved.

Distribution channel diversification should emphasize e-commerce platforms, subscription services, and specialized retail partnerships that provide direct access to target consumers. Companies should develop omnichannel strategies that create consistent brand experiences across different touchpoints.

Brand positioning should emphasize health benefits, functional performance, and lifestyle alignment while addressing concerns about artificial ingredients through transparent communication and education initiatives. Building consumer trust through ingredient transparency and health claim substantiation remains crucial for long-term success.

Market trajectory indicates continued strong growth driven by persistent health and wellness trends, demographic shifts toward health-conscious consumption, and ongoing product innovation. The market is expected to maintain robust growth rates of approximately 9.2% CAGR over the next five years, supported by expanding consumer acceptance and distribution channel growth.

Innovation pipeline suggests significant developments in natural sweetener technology, functional ingredient integration, and personalized nutrition solutions. Companies investing in research and development capabilities will likely capture disproportionate market share as consumer preferences continue evolving toward more sophisticated and health-focused products.

Competitive landscape evolution will likely feature increased consolidation as larger companies acquire innovative smaller brands to expand their sugar-free portfolios. This consolidation may accelerate market development through increased marketing investments and distribution expansion while potentially reducing innovation diversity.

Consumer behavior trends suggest continued premiumization as health-conscious consumers demonstrate willingness to pay higher prices for products that align with their wellness goals. MarkWide Research projections indicate that premium segment growth will outpace overall market growth by approximately 3-4 percentage points annually.

The North America sugar free energy drinks market represents a dynamic and rapidly expanding segment within the broader beverage industry, driven by fundamental shifts in consumer behavior toward health-conscious choices and functional beverage consumption. The market benefits from strong demographic tailwinds, increasing health awareness, and growing fitness culture adoption across all age groups.

Key success factors for market participants include product innovation focused on natural ingredients and superior taste profiles, strategic distribution channel development, and effective consumer education initiatives that address concerns about artificial sweeteners. Companies that successfully balance health positioning with taste satisfaction while maintaining competitive pricing will likely capture the greatest market opportunities.

Future market development will be shaped by continued innovation in natural sweetener technology, functional ingredient integration, and personalized nutrition solutions. The market’s strong growth trajectory, supported by favorable demographic trends and increasing consumer acceptance, positions it as an attractive opportunity for both established beverage companies and innovative new entrants seeking to capitalize on the intersection of health, wellness, and functional performance.

What is Sugar Free Energy Drinks?

Sugar Free Energy Drinks are beverages designed to provide an energy boost without the added calories and sugar found in traditional energy drinks. They often contain caffeine, vitamins, and other ingredients aimed at enhancing physical and mental performance.

What are the key players in the North America Sugar Free Energy Drinks Market?

Key players in the North America Sugar Free Energy Drinks Market include Red Bull, Monster Beverage Corporation, and PepsiCo, among others. These companies are known for their innovative product offerings and strong market presence.

What are the main drivers of the North America Sugar Free Energy Drinks Market?

The main drivers of the North America Sugar Free Energy Drinks Market include the increasing health consciousness among consumers, the rising demand for low-calorie beverages, and the growing trend of fitness and active lifestyles. These factors contribute to the popularity of sugar-free options.

What challenges does the North America Sugar Free Energy Drinks Market face?

The North America Sugar Free Energy Drinks Market faces challenges such as regulatory scrutiny regarding health claims, competition from other beverage categories, and consumer skepticism about artificial sweeteners. These factors can impact market growth and consumer acceptance.

What opportunities exist in the North America Sugar Free Energy Drinks Market?

Opportunities in the North America Sugar Free Energy Drinks Market include the potential for product innovation, such as new flavors and functional ingredients, as well as expanding distribution channels. Additionally, targeting niche markets like athletes and health-conscious consumers can drive growth.

What trends are shaping the North America Sugar Free Energy Drinks Market?

Trends shaping the North America Sugar Free Energy Drinks Market include the rise of plant-based ingredients, the incorporation of nootropics for cognitive enhancement, and the increasing popularity of ready-to-drink formats. These trends reflect changing consumer preferences towards healthier and more functional beverages.

North America Sugar Free Energy Drinks Market

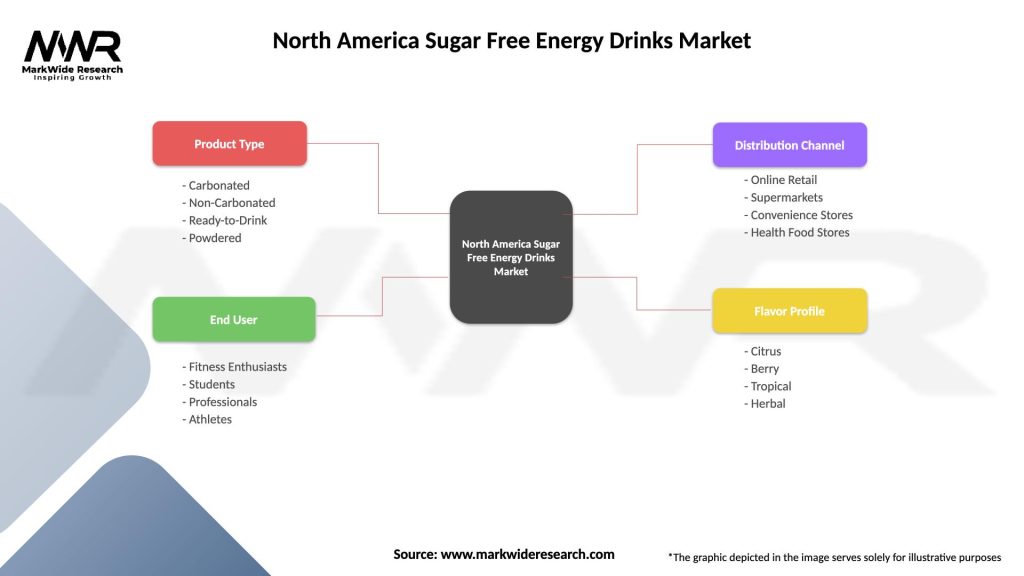

| Segmentation Details | Description |

|---|---|

| Product Type | Carbonated, Non-Carbonated, Ready-to-Drink, Powdered |

| End User | Fitness Enthusiasts, Students, Professionals, Athletes |

| Distribution Channel | Online Retail, Supermarkets, Convenience Stores, Health Food Stores |

| Flavor Profile | Citrus, Berry, Tropical, Herbal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Sugar Free Energy Drinks Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at