444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America sugar-free chewing gum market represents a dynamic and rapidly evolving segment within the broader confectionery industry. This market encompasses products manufactured without traditional sugar sweeteners, instead utilizing artificial sweeteners, natural sugar alternatives, and sugar alcohols to provide sweetness while maintaining oral health benefits. Market dynamics indicate robust growth driven by increasing health consciousness, rising awareness of dental hygiene, and growing consumer preference for functional food products.

Consumer behavior patterns show a significant shift toward healthier alternatives, with sugar-free chewing gum experiencing accelerated adoption across diverse demographic segments. The market demonstrates strong growth momentum with a projected compound annual growth rate of 4.2% through 2030, reflecting sustained consumer interest in health-conscious confectionery options. Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with substantial growth potential in urban centers.

Product innovation continues to drive market expansion, with manufacturers introducing advanced formulations featuring functional ingredients, enhanced flavors, and improved texture profiles. The integration of natural sweeteners, probiotics, and vitamin supplements has created new market opportunities, appealing to health-conscious consumers seeking multifunctional products. Distribution channels have evolved significantly, with online retail platforms capturing increasing market share alongside traditional convenience stores, supermarkets, and specialty health food retailers.

The North America sugar-free chewing gum market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of chewing gum products manufactured without conventional sugar sweeteners across the United States, Canada, and Mexico. This market segment specifically focuses on products utilizing alternative sweetening agents such as xylitol, sorbitol, aspartame, sucralose, and stevia to deliver sweetness while providing potential oral health benefits and reduced caloric content.

Market definition extends beyond simple product categorization to include the entire value chain from raw material sourcing and manufacturing processes to retail distribution and consumer consumption patterns. The scope encompasses various product formats including traditional stick gum, pellet gum, bubble gum variants, and specialized functional formulations designed for specific consumer needs such as teeth whitening, breath freshening, and stress relief.

Industry classification positions sugar-free chewing gum within the broader confectionery sector while maintaining distinct characteristics that differentiate it from traditional sugar-containing products. This market segment addresses growing consumer demand for healthier snacking alternatives, oral care products, and functional foods that provide benefits beyond basic nutrition and enjoyment.

Market performance in the North American sugar-free chewing gum sector demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer preferences toward healthier lifestyle choices. The market has experienced consistent expansion, with annual growth rates maintaining steady momentum despite economic uncertainties and changing retail landscapes. Consumer adoption patterns indicate increasing penetration across all age demographics, with particularly strong growth among millennials and Generation Z consumers.

Key market drivers include rising health consciousness, increased awareness of sugar-related health issues, growing emphasis on oral hygiene, and expanding product innovation in functional ingredients. Technological advancement in sweetener formulations has enabled manufacturers to develop products that closely mimic traditional sugar-sweetened alternatives while providing additional health benefits. The market benefits from regulatory support for sugar reduction initiatives and dental health promotion programs.

Competitive dynamics reveal a market characterized by both established multinational corporations and innovative smaller companies introducing specialized products. Market consolidation trends show larger companies acquiring innovative brands to expand their product portfolios and market reach. Future prospects remain highly favorable, with projected growth driven by continued health trend adoption, product innovation, and expanding distribution channels including e-commerce platforms.

Consumer behavior analysis reveals several critical insights driving market evolution and growth patterns. Primary motivations for sugar-free chewing gum consumption include oral health maintenance, weight management support, and desire for guilt-free indulgence options. Research indicates that 67% of consumers actively seek sugar-free alternatives when purchasing chewing gum products, demonstrating strong market preference for healthier options.

Health consciousness trends represent the primary catalyst driving North American sugar-free chewing gum market expansion. Consumer awareness regarding the negative health impacts of excessive sugar consumption has reached unprecedented levels, with dental health concerns, diabetes prevention, and weight management serving as key motivational factors. Medical recommendations from dental professionals increasingly include sugar-free gum as part of comprehensive oral care routines, legitimizing the product category beyond traditional confectionery positioning.

Demographic shifts contribute significantly to market growth, with aging populations seeking products that support oral health maintenance and younger consumers embracing preventive health measures. Lifestyle changes associated with increased urbanization, longer working hours, and on-the-go consumption patterns create sustained demand for convenient, portable products that provide functional benefits. The integration of wellness trends into everyday consumer products has elevated sugar-free chewing gum from occasional treats to daily health-supporting items.

Regulatory environment increasingly favors sugar reduction initiatives, with government health agencies promoting reduced sugar consumption through public awareness campaigns and policy recommendations. Educational initiatives by dental associations and health organizations continue to reinforce the benefits of sugar-free alternatives, creating a supportive market environment. Insurance industry recognition of preventive oral care measures has indirectly supported market growth by validating the health benefits associated with sugar-free gum consumption.

Cost considerations present significant challenges for market expansion, as sugar-free formulations typically require more expensive sweetening agents and specialized manufacturing processes compared to traditional sugar-containing products. Price sensitivity among certain consumer segments limits market penetration, particularly in price-conscious demographics where traditional alternatives remain more affordable. Manufacturing complexity associated with alternative sweeteners can result in higher production costs that must be balanced against consumer willingness to pay premium prices.

Taste perception challenges continue to affect market growth, as some consumers report dissatisfaction with artificial sweetener aftertastes or texture differences compared to sugar-sweetened alternatives. Consumer education remains necessary to overcome misconceptions about artificial sweeteners and their safety profiles, with some market segments maintaining resistance based on outdated or inaccurate information. Regulatory concerns regarding certain artificial sweeteners in specific jurisdictions can create market uncertainty and limit product formulation options.

Competition from alternative products poses ongoing challenges, including sugar-free mints, breath strips, and other oral care products that provide similar benefits. Market saturation in certain segments creates intense price competition and margin pressure for manufacturers. Supply chain complexities associated with specialized sweetener ingredients can create procurement challenges and cost volatility that affects overall market stability and growth predictability.

Product innovation opportunities present substantial potential for market expansion through the development of functional formulations that address specific consumer needs beyond basic sweetness and oral care. Natural sweetener integration offers significant growth potential, with stevia, monk fruit, and other plant-based alternatives appealing to consumers seeking clean-label products. Probiotic incorporation represents an emerging opportunity to position sugar-free chewing gum as a functional food product supporting digestive and oral health simultaneously.

Demographic expansion opportunities exist in underserved market segments, including children’s products with parental health approval, senior-focused formulations addressing age-related oral health concerns, and specialized products for diabetic consumers. Geographic expansion within North America shows potential in rural markets and smaller urban centers where penetration remains below metropolitan area levels. E-commerce growth creates opportunities for direct-to-consumer sales, subscription models, and personalized product offerings.

Partnership opportunities with dental professionals, healthcare providers, and wellness brands can expand market reach and credibility. Private label development for major retailers offers growth potential while reducing marketing costs and increasing distribution efficiency. Sustainable packaging innovation addresses growing environmental concerns while differentiating products in competitive markets. International expansion beyond North America presents long-term growth opportunities as global health consciousness trends continue developing.

Supply chain dynamics in the North American sugar-free chewing gum market reflect complex interactions between raw material availability, manufacturing capacity, and distribution efficiency. Sweetener supply represents a critical component, with manufacturers developing strategic relationships with suppliers of xylitol, sorbitol, and other alternative sweetening agents to ensure consistent quality and pricing. Manufacturing flexibility has become increasingly important as companies adapt to changing consumer preferences and seasonal demand fluctuations.

Demand patterns show interesting seasonal variations, with increased consumption during back-to-school periods, holiday seasons, and summer months when outdoor activities and social interactions peak. Consumer purchasing behavior indicates growing preference for bulk purchasing and subscription models, particularly among loyal brand users. Retail dynamics continue evolving with traditional convenience store sales maintaining strength while online channels capture increasing market share of approximately 15% annually.

Competitive dynamics demonstrate ongoing consolidation trends as larger companies acquire innovative smaller brands to expand their product portfolios and market reach. Innovation cycles have accelerated, with new product launches occurring more frequently to maintain consumer interest and market share. Pricing dynamics reflect the balance between premium positioning for health benefits and competitive pressure from traditional alternatives, with successful brands maintaining price premiums of 20-30% over sugar-containing products.

Comprehensive market analysis for the North American sugar-free chewing gum market employs multiple research methodologies to ensure accuracy, reliability, and actionable insights. Primary research components include extensive consumer surveys, focus groups, and in-depth interviews with key industry stakeholders including manufacturers, distributors, retailers, and end consumers. Survey methodology encompasses both online and telephone interviews with representative samples across diverse demographic segments, geographic regions, and consumption patterns.

Secondary research incorporates analysis of industry reports, company financial statements, regulatory filings, and trade association data to provide comprehensive market context and validation. Data triangulation methods ensure consistency across multiple information sources while identifying potential discrepancies or market anomalies. Quantitative analysis includes statistical modeling, trend analysis, and forecasting techniques to project future market developments and growth patterns.

Qualitative research methods provide deeper insights into consumer motivations, brand perceptions, and emerging market trends through ethnographic studies and behavioral observation. Expert interviews with industry leaders, dental professionals, and nutrition specialists offer professional perspectives on market dynamics and future opportunities. Market validation processes include cross-referencing findings with established industry benchmarks and conducting follow-up research to confirm key insights and projections.

United States market dominates the North American sugar-free chewing gum landscape, representing the largest consumption base and most mature market development. Regional preferences vary significantly, with West Coast consumers showing stronger preference for natural sweetener formulations while East Coast markets demonstrate higher acceptance of traditional artificial sweeteners. Urban markets typically show higher penetration rates and willingness to pay premium prices for innovative formulations, while rural areas maintain stronger preference for established brands and value-oriented products.

Canadian market dynamics reflect similar health consciousness trends with unique regulatory considerations and consumer preferences for bilingual packaging and locally-sourced ingredients where possible. Market penetration in Canada shows strong growth potential, particularly in major metropolitan areas including Toronto, Vancouver, and Montreal. Seasonal consumption patterns in Canada show interesting variations related to climate differences and cultural preferences for winter comfort foods versus summer refreshment products.

Mexican market represents emerging opportunities within the North American region, with growing middle-class populations and increasing health awareness driving demand for sugar-free alternatives. Cultural adaptation remains important for market success, with flavor preferences and consumption occasions differing from US and Canadian patterns. Distribution challenges in Mexico include infrastructure limitations and the need for temperature-controlled storage in certain regions, affecting product quality and shelf life considerations.

Market leadership in the North American sugar-free chewing gum sector is characterized by a mix of established multinational corporations and innovative specialty companies. Competitive positioning strategies vary significantly, with some companies focusing on mass market appeal through extensive distribution and competitive pricing, while others pursue premium positioning through innovative formulations and targeted marketing approaches.

Innovation strategies among leading companies include investment in research and development for new sweetener combinations, functional ingredient integration, and sustainable packaging solutions. Marketing approaches increasingly emphasize health benefits, professional endorsements, and lifestyle integration rather than traditional confectionery positioning.

Product segmentation within the North American sugar-free chewing gum market reveals distinct categories based on formulation, functionality, and target consumer groups. Sweetener-based segmentation represents a primary classification method, with products categorized by their primary sweetening agents and associated consumer preferences. Format segmentation includes traditional stick gum, pellet varieties, bubble gum formulations, and specialty shapes designed for specific consumption occasions.

By Sweetener Type:

By Application:

Premium natural category represents the fastest-growing segment within the North American sugar-free chewing gum market, driven by consumer demand for clean-label products and natural ingredient formulations. Market performance in this category shows annual growth rates exceeding 8.5%, significantly outpacing traditional artificial sweetener products. Consumer willingness to pay premium prices for natural formulations has enabled manufacturers to maintain higher profit margins while investing in continued innovation.

Functional wellness category demonstrates strong growth potential through the integration of additional health-supporting ingredients beyond basic sweetening. Probiotic-enhanced products show particular promise, with early market entrants reporting positive consumer response and repeat purchase rates. Vitamin-fortified formulations appeal to consumers seeking convenient ways to supplement their daily nutrition while enjoying familiar products.

Traditional artificial sweetener category maintains substantial market share through competitive pricing and widespread availability, though growth rates have moderated compared to natural alternatives. Value positioning remains important for price-sensitive consumers, while product improvements focus on taste enhancement and texture optimization. Brand loyalty in this category tends to be strong among established consumers, creating opportunities for line extensions and flavor innovations.

Manufacturers benefit from the North American sugar-free chewing gum market through multiple value creation opportunities including premium pricing potential, brand differentiation possibilities, and expanding consumer base adoption. Production efficiency improvements through specialized equipment and process optimization enable cost management while maintaining product quality standards. Innovation opportunities provide competitive advantages through proprietary formulations and unique product positioning strategies.

Retailers gain significant advantages through sugar-free chewing gum category management, including higher profit margins compared to traditional confectionery products and increased customer traffic from health-conscious consumers. Cross-merchandising opportunities with oral care products and health supplements create additional revenue streams and improved customer shopping experiences. Private label development offers retailers opportunities to build brand loyalty while capturing higher margins.

Consumers receive substantial value through improved oral health outcomes, reduced caloric intake, and enhanced convenience in maintaining daily wellness routines. Health benefits include potential reduction in dental decay risk, support for weight management goals, and integration with overall healthy lifestyle choices. Product variety ensures consumers can find formulations that meet their specific taste preferences, dietary requirements, and functional needs.

Healthcare professionals benefit from evidence-based products they can recommend to patients seeking oral health improvement strategies. Dental practitioners particularly value sugar-free gum as a complementary tool for patient education and preventive care programs. Nutritionists and dietitians appreciate having low-calorie alternatives to recommend for clients managing weight or blood sugar concerns.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient integration represents the most significant trend shaping the North American sugar-free chewing gum market, with consumers increasingly seeking products formulated with plant-based sweeteners and recognizable ingredients. Stevia adoption has accelerated significantly, with manufacturers developing improved formulations that minimize bitter aftertastes while maintaining sweetness intensity. Clean label positioning has become essential for premium product success, driving reformulation efforts across major brands.

Functional enhancement trends show growing consumer interest in products that provide benefits beyond basic sweetening and breath freshening. Probiotic incorporation represents an emerging trend with significant potential, as manufacturers explore ways to deliver beneficial bacteria through chewing gum formats. Vitamin and mineral fortification appeals to consumers seeking convenient supplementation methods, while stress-relief formulations incorporating adaptogens and calming ingredients address modern lifestyle concerns.

Sustainability initiatives increasingly influence consumer purchasing decisions, with eco-friendly packaging becoming a competitive differentiator. Biodegradable gum base development represents a significant innovation opportunity, addressing environmental concerns about traditional synthetic gum disposal. Ethical sourcing of ingredients and carbon-neutral manufacturing processes appeal to environmentally conscious consumers willing to pay premium prices for sustainable products.

Personalization trends emerge through customizable flavor combinations, targeted formulations for specific health needs, and subscription services delivering personalized product selections. Digital engagement strategies include mobile apps for tracking oral health benefits and gamification elements that encourage consistent usage patterns.

Recent industry developments demonstrate accelerating innovation and strategic positioning within the North American sugar-free chewing gum market. MarkWide Research analysis indicates that major manufacturers have significantly increased research and development investments, with innovation spending rising by 25% over the past two years. Merger and acquisition activity has intensified as larger companies seek to acquire innovative smaller brands with specialized formulations and loyal consumer bases.

Technology advancement in sweetener blending has enabled manufacturers to create more palatable formulations that closely mimic sugar-sweetened alternatives while maintaining health benefits. Manufacturing process improvements have reduced production costs for certain alternative sweeteners, making premium formulations more accessible to broader consumer segments. Quality control innovations ensure consistent flavor delivery and texture throughout product shelf life.

Regulatory developments include updated guidelines for health claims related to oral care benefits and clearer labeling requirements for artificial sweetener content. Industry partnerships with dental associations have strengthened, providing credible endorsements and educational resources for consumer awareness campaigns. Sustainability initiatives have gained momentum, with several major manufacturers announcing commitments to carbon-neutral production and recyclable packaging by specific target dates.

Distribution evolution includes expanded presence in health food stores, pharmacy chains, and online marketplaces, reflecting the product category’s transition from traditional confectionery to health and wellness positioning. International expansion efforts by North American companies have accelerated, with several brands establishing manufacturing and distribution partnerships in emerging markets.

Strategic recommendations for North American sugar-free chewing gum market participants emphasize the importance of balancing innovation with cost management while building sustainable competitive advantages. Product development priorities should focus on natural sweetener formulations and functional ingredient integration, as these segments demonstrate the strongest growth potential and consumer willingness to pay premium prices. Brand positioning strategies should emphasize health benefits and professional endorsements rather than traditional confectionery messaging.

Market entry strategies for new participants should consider niche positioning through specialized formulations addressing specific consumer needs such as diabetic-friendly products, children’s oral health, or senior-focused formulations. Partnership opportunities with healthcare providers, dental professionals, and wellness brands offer efficient paths to market credibility and consumer trust building. Distribution strategy should prioritize omnichannel approaches that combine traditional retail presence with direct-to-consumer online sales capabilities.

Investment priorities should include manufacturing flexibility to accommodate changing consumer preferences, supply chain diversification to manage ingredient cost volatility, and marketing programs that educate consumers about health benefits. Sustainability initiatives represent both consumer demand response and long-term cost management opportunities through improved operational efficiency. Technology adoption in areas such as consumer data analytics and personalized marketing can provide competitive advantages in increasingly crowded markets.

Risk management strategies should address regulatory changes, raw material price volatility, and competitive pressure from both traditional confectionery companies and new health-focused entrants. Geographic diversification within North America can help balance regional economic variations and consumer preference differences.

Market projections for the North American sugar-free chewing gum sector indicate sustained growth momentum through the next decade, driven by fundamental demographic and lifestyle trends that support continued category expansion. Consumer behavior evolution suggests permanent shifts toward health-conscious purchasing decisions, creating stable demand foundations for sugar-free alternatives. MWR forecasting models project continued market growth with compound annual growth rates maintaining 4-6% ranges through 2030, reflecting mature market dynamics with ongoing innovation opportunities.

Innovation trajectories point toward increasingly sophisticated formulations incorporating multiple functional benefits, personalized nutrition approaches, and sustainable ingredient sourcing. Natural sweetener adoption is expected to accelerate significantly, with stevia and monk fruit formulations potentially capturing 40% market share within five years. Functional ingredient integration will likely expand beyond current probiotic and vitamin offerings to include adaptogens, nootropics, and other wellness-supporting compounds.

Distribution evolution will continue favoring omnichannel approaches, with e-commerce platforms expected to capture 25% of total sales by 2028. Subscription models and personalized product offerings will likely gain traction among loyal consumers seeking convenience and customization. International expansion opportunities remain significant, with North American companies well-positioned to capitalize on global health consciousness trends.

Regulatory environment developments will likely support continued market growth through sugar reduction initiatives and oral health promotion programs. Sustainability requirements will increasingly influence product development and packaging decisions, creating opportunities for companies that proactively address environmental concerns while maintaining product quality and consumer appeal.

The North America sugar-free chewing gum market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental shifts in consumer health consciousness and lifestyle preferences. Market analysis reveals a mature yet innovative industry successfully transitioning from traditional confectionery positioning to health and wellness focus, creating sustainable competitive advantages for companies that effectively balance innovation with cost management and consumer education.

Key success factors include natural ingredient integration, functional benefit enhancement, and strategic distribution channel development that reaches health-conscious consumers through both traditional retail and emerging digital platforms. Industry participants who invest in research and development, build credible health positioning, and maintain operational flexibility will be best positioned to capitalize on continued market expansion opportunities.

Future prospects remain highly favorable, with demographic trends, regulatory support, and technological advancement creating multiple growth drivers that should sustain market momentum through the next decade. Strategic focus on sustainability, personalization, and functional innovation will likely determine long-term competitive success in this evolving and increasingly important market segment within the broader North American consumer goods landscape.

What is Sugar-free Chewing Gum?

Sugar-free chewing gum is a type of gum that does not contain sugar and is often sweetened with sugar substitutes like xylitol or aspartame. It is popular for its dental benefits and is commonly used to freshen breath and reduce cravings.

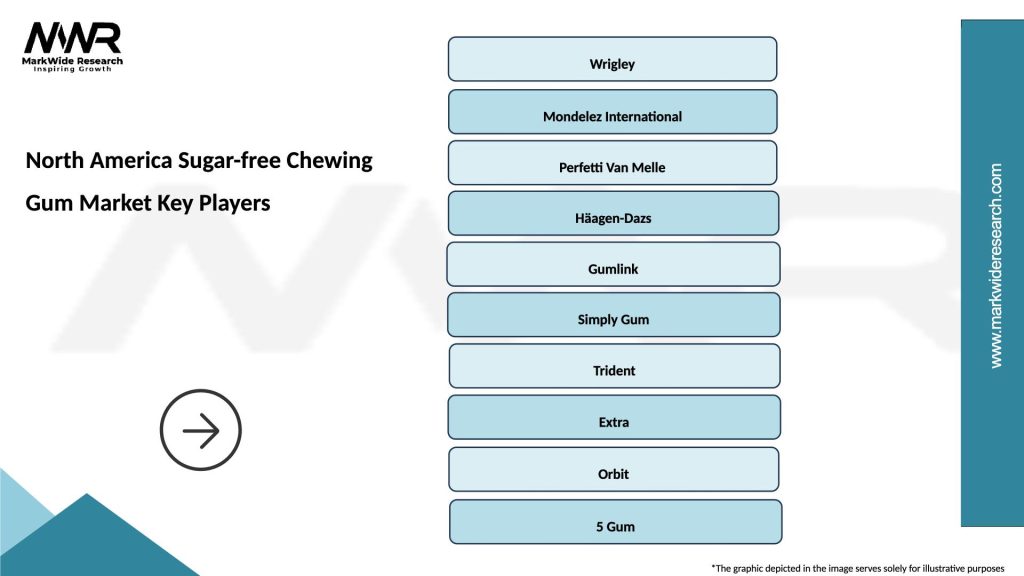

What are the key players in the North America Sugar-free Chewing Gum Market?

Key players in the North America Sugar-free Chewing Gum Market include Wrigley, Mondelez International, and Hershey’s, which offer a variety of sugar-free options to cater to health-conscious consumers, among others.

What are the growth factors driving the North America Sugar-free Chewing Gum Market?

The growth of the North America Sugar-free Chewing Gum Market is driven by increasing health awareness, rising demand for low-calorie snacks, and the popularity of sugar substitutes among consumers looking to reduce sugar intake.

What challenges does the North America Sugar-free Chewing Gum Market face?

Challenges in the North America Sugar-free Chewing Gum Market include competition from other snack options, potential health concerns related to artificial sweeteners, and fluctuating raw material prices affecting production.

What opportunities exist in the North America Sugar-free Chewing Gum Market?

Opportunities in the North America Sugar-free Chewing Gum Market include the introduction of innovative flavors, the expansion of product lines targeting specific demographics, and the growing trend of functional gums that offer additional health benefits.

What trends are shaping the North America Sugar-free Chewing Gum Market?

Trends in the North America Sugar-free Chewing Gum Market include a shift towards natural and organic ingredients, increased focus on sustainability in packaging, and the rise of online sales channels as consumers seek convenience.

North America Sugar-free Chewing Gum Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bubble Gum, Mint Gum, Fruit-flavored Gum, Herbal Gum |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| End User | Adults, Teenagers, Children, Health-conscious Consumers |

| Flavor Profile | Mint, Fruit, Cinnamon, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Sugar-free Chewing Gum Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at