444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America smokeless indoor grills market represents a rapidly expanding segment within the broader kitchen appliance industry, driven by evolving consumer preferences for healthier cooking methods and convenient indoor grilling solutions. Market dynamics indicate substantial growth potential as consumers increasingly seek alternatives to traditional outdoor grilling that can be used year-round regardless of weather conditions. The market encompasses various product categories including electric smokeless grills, infrared technology grills, and advanced ventilation systems designed to eliminate smoke production during indoor cooking.

Consumer adoption rates have accelerated significantly, with approximately 68% of households expressing interest in smokeless grilling technology according to recent consumer surveys. This growing demand stems from urbanization trends, smaller living spaces, and the desire for healthier cooking methods that reduce fat content while maintaining the authentic grilled flavor profile. Technology advancements in heating elements, temperature control systems, and smoke reduction mechanisms have enhanced product performance and user experience across all market segments.

Regional distribution shows strong market penetration across major metropolitan areas, with the United States accounting for approximately 78% market share within North America, followed by Canada at 18% and Mexico representing the remaining 4%. The market benefits from established retail infrastructure, strong consumer purchasing power, and increasing awareness of health-conscious cooking alternatives that align with modern lifestyle preferences.

The North America smokeless indoor grills market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of specialized grilling appliances designed to operate indoors without producing visible smoke or excessive odors. These innovative cooking devices utilize advanced heating technologies, efficient ventilation systems, and specialized cooking surfaces to replicate outdoor grilling experiences within indoor environments while maintaining optimal air quality and user comfort.

Smokeless indoor grills incorporate various technological approaches including infrared heating elements, electric coil systems, and advanced drip tray mechanisms that prevent fat and grease from creating smoke during the cooking process. The market includes countertop models, built-in units, and portable designs that cater to diverse consumer needs ranging from apartment dwellers to commercial food service establishments seeking versatile cooking solutions.

Market momentum in the North America smokeless indoor grills sector demonstrates robust expansion driven by changing consumer lifestyles, health consciousness, and technological innovations that enhance cooking convenience. The market benefits from strong demographic trends including urbanization, smaller living spaces, and year-round grilling preferences that traditional outdoor equipment cannot accommodate effectively.

Key growth drivers include increasing health awareness, with approximately 72% of consumers prioritizing low-fat cooking methods, and the convenience factor of indoor grilling that eliminates weather dependencies. Product innovation continues to drive market evolution through improved heating technologies, enhanced smoke reduction capabilities, and user-friendly features that appeal to both novice and experienced home cooks.

Competitive dynamics feature established kitchen appliance manufacturers alongside specialized grilling technology companies, creating a diverse product landscape that serves multiple price points and feature requirements. The market demonstrates strong retail presence across traditional appliance stores, e-commerce platforms, and specialty cooking equipment retailers, ensuring broad consumer accessibility and market penetration opportunities.

Consumer behavior analysis reveals significant shifts toward indoor cooking solutions that maintain outdoor grilling authenticity while providing year-round accessibility. The following insights highlight critical market dynamics:

Health and wellness trends serve as primary market drivers, with consumers increasingly seeking cooking methods that reduce fat content while maintaining nutritional value and flavor quality. The growing awareness of health benefits associated with grilled foods, combined with the convenience of indoor cooking, creates strong demand momentum across all demographic segments.

Urbanization patterns significantly influence market growth as more consumers live in apartments, condominiums, and urban housing with limited outdoor space or grilling restrictions. This demographic shift necessitates indoor alternatives that provide similar cooking experiences without violating lease agreements or building regulations regarding outdoor grilling equipment.

Technological advancements in heating elements, smoke reduction systems, and temperature control mechanisms enhance product appeal and performance reliability. These innovations address traditional concerns about indoor grilling including smoke production, odor generation, and uneven cooking results that previously limited market adoption.

Lifestyle convenience factors drive consumer preference for appliances that enable year-round grilling regardless of weather conditions, seasonal limitations, or outdoor space availability. The ability to grill indoors provides cooking flexibility that aligns with busy schedules and diverse meal preparation needs throughout the year.

High initial investment costs present barriers to market entry for price-sensitive consumers, particularly for premium models featuring advanced technology and enhanced capabilities. The cost differential between basic and feature-rich models can limit adoption among budget-conscious households seeking affordable grilling alternatives.

Limited cooking capacity compared to traditional outdoor grills restricts appeal among consumers who frequently cook for large groups or prefer extensive grilling sessions. The compact nature of indoor grills, while suitable for small households, may not meet the needs of families or individuals who regularly entertain guests.

Power consumption concerns regarding electricity usage and utility costs may deter environmentally conscious consumers or those seeking energy-efficient cooking solutions. High-wattage requirements for effective indoor grilling can result in increased electricity bills that impact long-term ownership costs.

Consumer skepticism about smoke reduction effectiveness and authentic grilling results creates market resistance among traditional outdoor grilling enthusiasts. Overcoming preconceptions about indoor grilling limitations requires extensive consumer education and demonstration of product capabilities.

Smart technology integration presents significant opportunities for market expansion through connectivity features, mobile app controls, and automated cooking programs that appeal to tech-savvy consumers. The incorporation of IoT capabilities, voice control compatibility, and recipe integration can differentiate products and command premium pricing.

Commercial market penetration offers substantial growth potential in restaurants, food trucks, catering services, and institutional kitchens seeking versatile cooking equipment. The ability to provide grilled food options without traditional ventilation requirements opens new market segments and revenue streams.

Product diversification opportunities include specialized models for specific cooking applications, dietary requirements, and space constraints. Developing niche products for health-conscious consumers, small space living, and specific cooking techniques can capture underserved market segments.

Sustainability positioning through energy-efficient designs, recyclable materials, and reduced environmental impact can appeal to environmentally conscious consumers and align with corporate sustainability initiatives. Green technology integration and eco-friendly manufacturing processes create competitive advantages in the evolving market landscape.

Supply chain dynamics in the North America smokeless indoor grills market reflect complex interactions between component suppliers, manufacturers, distributors, and retailers that influence product availability, pricing, and market accessibility. The market benefits from established appliance manufacturing infrastructure and efficient distribution networks that support broad market coverage and consumer reach.

Innovation cycles drive continuous product development as manufacturers compete to introduce enhanced features, improved performance, and differentiated capabilities. The rapid pace of technological advancement creates opportunities for market leaders while challenging existing players to maintain competitive positioning through ongoing research and development investments.

Consumer education initiatives play crucial roles in market development by addressing misconceptions about indoor grilling capabilities and demonstrating product benefits. Effective marketing strategies that highlight health advantages, convenience factors, and performance capabilities help overcome traditional resistance to indoor grilling alternatives.

Seasonal demand patterns influence inventory management, production planning, and marketing strategies as consumer interest typically peaks during winter months when outdoor grilling becomes less practical. Understanding these cyclical trends enables manufacturers and retailers to optimize resource allocation and maximize sales opportunities throughout the year.

Primary research methodologies employed in analyzing the North America smokeless indoor grills market include comprehensive consumer surveys, industry expert interviews, and retail channel assessments that provide direct insights into market trends, consumer preferences, and competitive dynamics. These approaches ensure accurate representation of current market conditions and emerging opportunities.

Secondary research sources encompass industry publications, trade association reports, government statistics, and manufacturer data that support quantitative analysis and market sizing activities. The integration of multiple data sources enhances research reliability and provides comprehensive market understanding across all key segments and geographic regions.

Market validation techniques include cross-referencing data from multiple sources, conducting follow-up interviews with key stakeholders, and analyzing historical trends to ensure accuracy and reliability of research findings. This rigorous approach minimizes potential biases and enhances the credibility of market insights and projections.

Analytical frameworks utilize statistical modeling, trend analysis, and comparative assessments to identify market patterns, growth drivers, and competitive positioning factors. These methodologies enable accurate forecasting and strategic recommendations that support informed decision-making by industry participants and stakeholders.

United States market dominance reflects strong consumer purchasing power, established retail infrastructure, and high adoption rates of innovative kitchen appliances. The market benefits from diverse demographic segments including urban professionals, health-conscious consumers, and apartment dwellers who drive demand for convenient indoor grilling solutions.

Canadian market characteristics demonstrate growing interest in smokeless indoor grills driven by harsh winter climates that limit outdoor grilling seasons and increasing urbanization in major metropolitan areas. The market shows particular strength in provinces with extreme weather conditions where year-round indoor cooking alternatives provide significant value propositions.

Regional preferences vary across North America with different emphasis on product features, price points, and cooking capabilities. MarkWide Research analysis indicates that northern regions show higher adoption rates during winter months, while southern markets maintain more consistent demand patterns throughout the year due to varied seasonal cooking preferences.

Distribution channel effectiveness differs by region with e-commerce platforms showing stronger performance in urban areas while traditional retail stores maintain importance in suburban and rural markets. Understanding these regional variations enables manufacturers and retailers to optimize their market approach and resource allocation strategies.

Market leadership in the North America smokeless indoor grills sector features established kitchen appliance manufacturers alongside specialized grilling technology companies that compete across multiple product categories and price segments. The competitive environment encourages continuous innovation and feature enhancement to maintain market positioning.

Key market participants include:

Competitive strategies emphasize product differentiation through technology innovation, feature enhancement, and targeted marketing approaches that address specific consumer segments and cooking preferences. Companies invest significantly in research and development to maintain competitive advantages and capture market share growth opportunities.

Product type segmentation reveals diverse market categories serving different consumer needs and cooking preferences. The market encompasses various technologies and designs that cater to specific applications and user requirements:

By Technology:

By Application:

By Price Range:

Electric smokeless grills dominate market share due to their accessibility, ease of use, and effective smoke reduction capabilities. These products appeal to mainstream consumers seeking convenient indoor grilling solutions without complex installation requirements or specialized ventilation systems. The category benefits from continuous technology improvements and competitive pricing strategies.

Infrared technology grills represent the fastest-growing segment with approximately 15% annual growth rate driven by superior cooking performance and enhanced smoke reduction capabilities. These advanced products command premium pricing while delivering exceptional cooking results that closely replicate outdoor grilling experiences.

Contact grills maintain strong market presence through their versatility and convenience features that appeal to busy consumers seeking quick cooking solutions. The dual-surface design enables faster cooking times while maintaining food quality and reducing overall meal preparation effort.

Portable models show increasing demand among consumers seeking flexible cooking options for various settings including small apartments, offices, and recreational activities. The emphasis on compact design and lightweight construction creates opportunities for market expansion beyond traditional home kitchen applications.

Manufacturers benefit from expanding market opportunities driven by changing consumer lifestyles and increasing demand for convenient cooking solutions. The market provides platforms for technology innovation, product differentiation, and premium pricing strategies that enhance profitability and competitive positioning.

Retailers gain from strong consumer interest and growing market demand that drives sales volume and revenue growth across multiple distribution channels. The product category offers attractive margins and opportunities for value-added services including extended warranties and customer support programs.

Consumers receive significant value through access to convenient, healthy cooking alternatives that provide year-round grilling capabilities without outdoor space requirements. The technology enables healthier meal preparation while maintaining flavor quality and cooking convenience that aligns with modern lifestyle preferences.

Technology suppliers find opportunities in developing advanced heating elements, smoke reduction systems, and smart connectivity features that enhance product performance and user experience. The market supports innovation investments and creates demand for specialized components and manufacturing capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart connectivity integration emerges as a dominant trend with manufacturers incorporating Wi-Fi capabilities, mobile app controls, and voice assistant compatibility. These features enable remote monitoring, automated cooking programs, and integration with smart home ecosystems that appeal to technology-oriented consumers seeking enhanced convenience and control.

Health-focused design innovations emphasize fat reduction capabilities, non-stick surfaces that require minimal oil, and cooking methods that preserve nutritional content. Manufacturers increasingly highlight health benefits in marketing strategies while developing products that support various dietary preferences including low-fat, keto, and plant-based cooking requirements.

Compact and portable designs address urban living constraints and changing lifestyle patterns that prioritize flexibility and space efficiency. The trend toward smaller living spaces drives demand for appliances that provide maximum functionality while minimizing counter space requirements and storage needs.

Multi-functional capabilities expand beyond traditional grilling to include baking, roasting, and warming functions that maximize appliance utility and value proposition. Consumers increasingly prefer versatile cooking solutions that replace multiple single-purpose appliances while maintaining cooking quality and convenience.

Technology partnerships between appliance manufacturers and heating element specialists drive innovation in smoke reduction systems and cooking performance enhancement. These collaborations enable rapid development of advanced features while sharing research and development costs across multiple product lines and market segments.

Retail channel expansion includes increased presence in home improvement stores, specialty cooking retailers, and online marketplaces that broaden consumer accessibility and market reach. The diversification of distribution channels enables manufacturers to target different consumer segments while optimizing inventory management and sales strategies.

Product certification programs through independent testing organizations enhance consumer confidence and product credibility while establishing industry standards for performance, safety, and environmental impact. These initiatives support market growth by addressing consumer concerns and establishing quality benchmarks.

Sustainability initiatives focus on energy efficiency improvements, recyclable material usage, and reduced packaging waste that align with corporate responsibility goals and consumer environmental preferences. MWR analysis indicates that sustainability considerations increasingly influence purchasing decisions across all market segments.

Market entry strategies should emphasize product differentiation through unique features, competitive pricing, and targeted marketing approaches that address specific consumer segments. New entrants should focus on underserved niches or innovative technologies that provide clear advantages over established products while building brand recognition and consumer trust.

Investment priorities should concentrate on research and development activities that enhance smoke reduction capabilities, improve cooking performance, and integrate smart technology features. Companies should allocate resources toward understanding consumer preferences and developing products that address evolving market needs and lifestyle changes.

Partnership opportunities exist with technology companies, retail chains, and component suppliers that can accelerate market penetration and product development timelines. Strategic alliances enable resource sharing, risk mitigation, and access to specialized expertise that supports competitive positioning and market expansion.

Consumer education initiatives should address misconceptions about indoor grilling capabilities while demonstrating product benefits and cooking techniques. Effective marketing strategies that include cooking demonstrations, recipe development, and influencer partnerships can overcome traditional resistance and accelerate market adoption.

Market growth projections indicate continued expansion driven by urbanization trends, health consciousness, and technology advancement that enhance product appeal and performance capabilities. The market is expected to maintain robust growth momentum with projected CAGR of 8.2% over the next five years as consumer adoption accelerates across all demographic segments.

Technology evolution will focus on artificial intelligence integration, predictive cooking algorithms, and enhanced connectivity features that provide personalized cooking experiences. Future products will likely incorporate machine learning capabilities that adapt to individual preferences while optimizing cooking results and energy efficiency.

Market expansion opportunities include commercial applications, international markets, and specialized product categories that serve specific dietary requirements or cooking techniques. The growing food service industry and increasing global awareness of healthy cooking methods create substantial growth potential beyond traditional residential markets.

Sustainability integration will become increasingly important as consumers prioritize environmental considerations in purchasing decisions. Future product development will emphasize energy efficiency, recyclable materials, and reduced environmental impact while maintaining cooking performance and user convenience that drive market demand.

The North America smokeless indoor grills market demonstrates exceptional growth potential driven by evolving consumer preferences, technological innovations, and changing lifestyle patterns that favor convenient, healthy cooking solutions. Market dynamics indicate strong momentum across all segments with particular strength in urban markets where space constraints and year-round cooking needs create substantial demand for indoor grilling alternatives.

Key success factors include continuous technology innovation, effective consumer education, and strategic positioning that addresses specific market segments and cooking preferences. Companies that invest in research and development while building strong brand recognition and distribution networks are well-positioned to capture market share and achieve sustainable growth in this expanding market opportunity.

The market outlook remains highly positive with MarkWide Research projecting continued expansion driven by health consciousness, urbanization trends, and technology advancement that enhance product capabilities and consumer appeal. Strategic focus on innovation, quality, and consumer education will determine long-term success in this dynamic and rapidly evolving market landscape.

What is Smokeless Indoor Grills?

Smokeless indoor grills are cooking appliances designed to grill food indoors without producing smoke, making them suitable for use in apartments and homes. They typically use electric heating elements and non-stick surfaces to achieve grilling results similar to outdoor grills.

What are the key players in the North America Smokeless Indoor Grills Market?

Key players in the North America Smokeless Indoor Grills Market include companies like George Foreman, Philips, and Cuisinart, which offer a variety of models catering to different consumer needs. These companies focus on innovation and quality to maintain a competitive edge, among others.

What are the growth factors driving the North America Smokeless Indoor Grills Market?

The growth of the North America Smokeless Indoor Grills Market is driven by increasing consumer demand for convenient cooking solutions, a rise in health-conscious eating habits, and the popularity of indoor grilling as a year-round cooking method. Additionally, advancements in technology have improved grill efficiency and safety.

What challenges does the North America Smokeless Indoor Grills Market face?

Challenges in the North America Smokeless Indoor Grills Market include competition from traditional cooking methods, consumer skepticism regarding the effectiveness of smokeless technology, and potential regulatory hurdles related to safety standards. These factors can impact market growth and consumer adoption.

What opportunities exist in the North America Smokeless Indoor Grills Market?

Opportunities in the North America Smokeless Indoor Grills Market include the potential for product innovation, such as smart grills with app connectivity, and expanding into new consumer segments like millennials and urban dwellers. Additionally, increasing interest in home cooking presents a favorable environment for market expansion.

What trends are shaping the North America Smokeless Indoor Grills Market?

Trends shaping the North America Smokeless Indoor Grills Market include a growing focus on health and wellness, leading to the development of grills that require less oil and promote healthier cooking methods. Furthermore, the integration of smart technology and eco-friendly materials is becoming increasingly popular among consumers.

North America Smokeless Indoor Grills Market

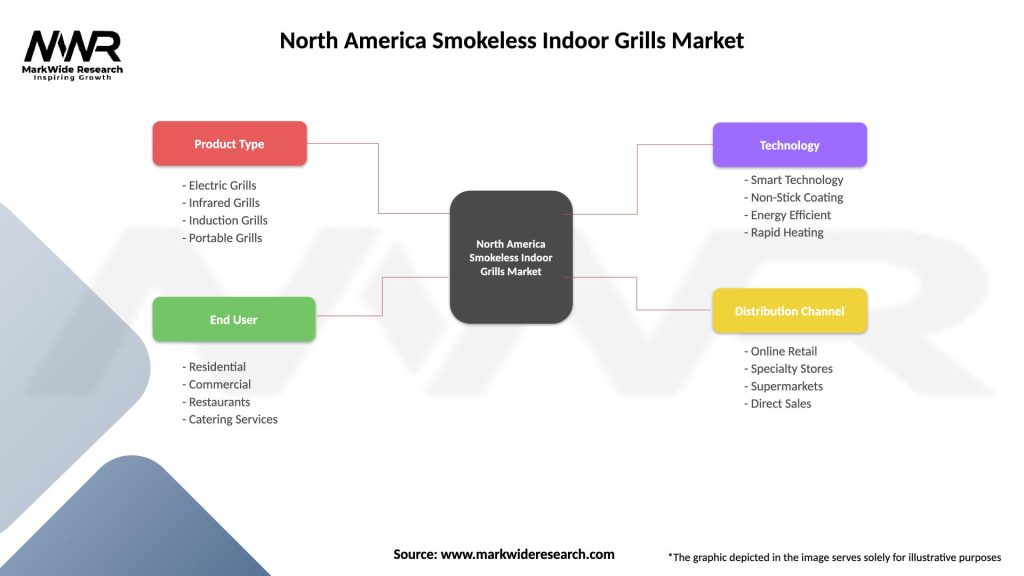

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Grills, Infrared Grills, Induction Grills, Portable Grills |

| End User | Residential, Commercial, Restaurants, Catering Services |

| Technology | Smart Technology, Non-Stick Coating, Energy Efficient, Rapid Heating |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Smokeless Indoor Grills Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at