444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America silica sand market is a thriving sector within the region’s industrial landscape. Silica sand, also known as industrial sand, is a key raw material used in various industries such as glass manufacturing, foundry, construction, chemicals, and oil and gas. It is composed of high-quality quartz grains that have undergone extensive processing to meet the specific requirements of different applications.

Meaning

Silica sand is a granular material composed of quartz grains derived from the weathering and erosion of rocks over thousands of years. It is primarily composed of silicon dioxide (SiO2) and is known for its high purity and chemical inertness. Silica sand is valued for its physical and chemical properties, making it suitable for a wide range of industrial applications.

Executive Summary

The North America silica sand market has been witnessing steady growth in recent years, driven by increasing demand from end-use industries. The market is characterized by a strong presence of key players and a well-established supply chain network. The COVID-19 pandemic had a temporary impact on the market, but it quickly recovered as industries resumed operations. The market is expected to continue its growth trajectory in the coming years, driven by factors such as infrastructure development, rising construction activities, and the expanding oil and gas sector.

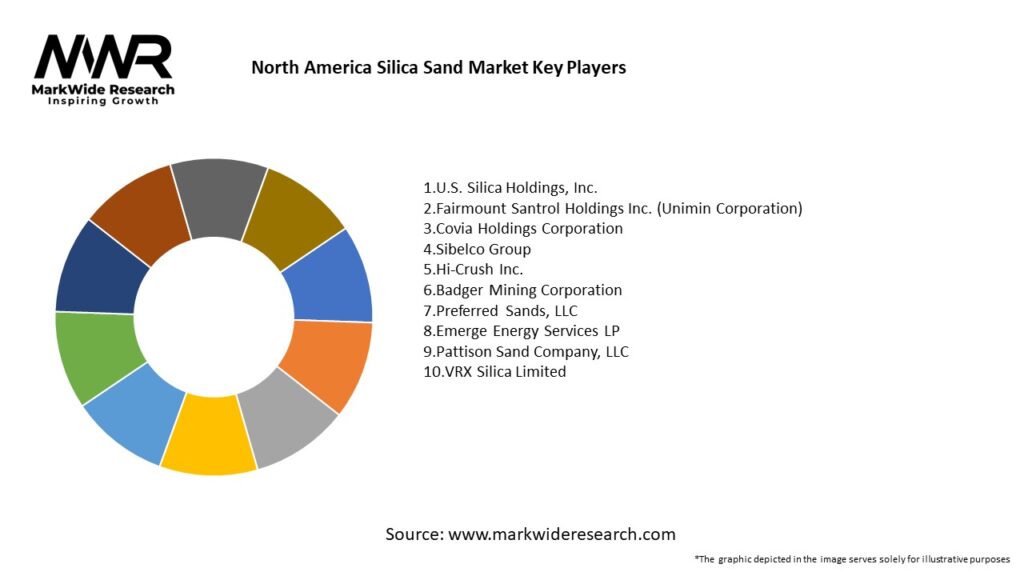

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America silica sand market is characterized by intense competition among key players. These players are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and capacity expansions to strengthen their market position. Additionally, companies are investing in research and development activities to develop new products and improve existing processes.

The market is also influenced by factors such as raw material availability, government regulations, and economic conditions. The fluctuating prices of raw materials and energy resources can impact the profitability of silica sand manufacturers. Government regulations related to mining, environmental protection, and worker safety also play a significant role in shaping the market dynamics.

Regional Analysis

The North America silica sand market is divided into several key regions, including the United States, Canada, and Mexico. The United States holds the largest market share in the region, driven by the presence of a robust construction industry, well-established glass manufacturing sector, and the shale gas boom. Canada and Mexico also contribute to the market growth, with their growing industrial activities and infrastructure development projects.

Competitive Landscape

Leading Companies in the North America Silica Sand Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America silica sand market can be segmented based on application and end-use industry. By application, the market can be categorized into glass manufacturing, foundry, construction, chemicals, oil and gas, and others. By end-use industry, the market can be segmented into automotive, building and construction, packaging, oil and gas, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a temporary impact on the North America silica sand market. The implementation of lockdown measures and restrictions on industrial activities disrupted the supply chain and led to a decline in demand from key end-use industries such as construction and automotive.

However, as economies reopened and industries resumed operations, the market quickly recovered. The construction sector witnessed a strong rebound, supported by government stimulus packages and infrastructure development projects. The glass manufacturing industry also rebounded as demand for glass products recovered.

The pandemic highlighted the importance of resilient supply chains and the need for sustainable practices. Industry participants are now focusing on enhancing their supply chain capabilities and adopting measures to mitigate future disruptions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America silica sand market is expected to witness steady growth in the coming years. The construction industry will continue to drive the demand for silica sand, supported by infrastructure development projects and the demand for sustainable building materials.

The glass manufacturing industry will also play a significant role in market growth, driven by the automotive, packaging, and construction sectors. The expanding oil and gas industry, particularly in shale gas extraction, will further fuel the demand for silica sand.

Technological advancements and research and development initiatives will contribute to product innovation and process improvements. Sustainable mining practices and the development of high-purity silica sand for niche applications will be key focus areas for industry participants.

Conclusion

The North America silica sand market presents lucrative opportunities for industry participants. By embracing sustainable practices, investing in research and development, and focusing on customer needs, companies can thrive in this dynamic market landscape.

What is silica sand in the context of the North America Silica Sand Market?

Silica sand is a granular material composed of finely divided quartz crystals, primarily used in various industrial applications such as glass manufacturing, foundry casting, and hydraulic fracturing.

Who are the key players in the North America Silica Sand Market?

Key players in the North America Silica Sand Market include U.S. Silica Holdings, Fairmount Santrol, Hi-Crush Partners, and Covia Holdings, among others.

What are the main drivers of growth in the North America Silica Sand Market?

The growth of the North America Silica Sand Market is driven by the increasing demand for hydraulic fracturing in the oil and gas industry, the expansion of the construction sector, and the rising use of silica sand in glass production.

What challenges does the North America Silica Sand Market face?

Challenges in the North America Silica Sand Market include environmental regulations affecting mining operations, competition from alternative materials, and fluctuations in demand from key industries.

What opportunities exist in the North America Silica Sand Market?

Opportunities in the North America Silica Sand Market include the growing demand for high-purity silica sand in advanced manufacturing processes, innovations in mining technology, and the expansion of renewable energy projects requiring silica sand.

What trends are shaping the North America Silica Sand Market?

Trends in the North America Silica Sand Market include a shift towards sustainable mining practices, increased investment in infrastructure projects, and the development of specialty silica products for niche applications.

North America Silica Sand Market Segmentation:

| Segment | Segmentation Details |

|---|---|

| Mesh Size | Below 70 mesh, 70-120 mesh, Above 120 mesh |

| End-Use | Glass Manufacturing, Foundry, Oil & Gas, Others |

| Region | North America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Silica Sand Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at