444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America self-adhesive labels market represents a dynamic and rapidly evolving sector within the broader packaging and labeling industry. This market encompasses a wide range of pressure-sensitive labels that adhere to various surfaces without the need for additional adhesives, water, or heat activation. The region’s robust manufacturing base, coupled with stringent regulatory requirements and growing consumer demand for product information transparency, has positioned North America as a leading market for self-adhesive labeling solutions.

Market dynamics in this sector are driven by diverse applications spanning food and beverage, pharmaceuticals, personal care, logistics, and industrial manufacturing. The market has experienced consistent growth, with projections indicating a compound annual growth rate (CAGR) of 4.8% through the forecast period. This growth trajectory reflects the increasing adoption of advanced labeling technologies, sustainable materials, and smart labeling solutions across various end-user industries.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 18%, and Mexico contributing 4% to the overall North American market. The dominance of the United States stems from its extensive manufacturing infrastructure, technological innovation capabilities, and large consumer base driving demand for labeled products across multiple sectors.

The North America self-adhesive labels market refers to the comprehensive ecosystem of pressure-sensitive labeling solutions designed to provide product identification, branding, information display, and regulatory compliance across diverse industries within the United States, Canada, and Mexico. These labels utilize specialized adhesive technologies that enable immediate bonding to target surfaces upon application pressure, eliminating the need for additional activation methods.

Self-adhesive labels encompass various material compositions including paper, film, and specialty substrates, each engineered with specific adhesive formulations to meet distinct application requirements. The market includes primary labels for direct product application, secondary labels for packaging and shipping, and specialty labels for unique applications such as security, tamper-evident, and variable information printing.

Market scope extends beyond traditional labeling to include smart labels incorporating RFID technology, QR codes, and other digital integration capabilities. This evolution reflects the growing demand for traceability, authentication, and consumer engagement features that modern labeling solutions must provide to remain competitive in today’s marketplace.

Market performance in the North American self-adhesive labels sector demonstrates remarkable resilience and consistent expansion across multiple application segments. The market benefits from strong fundamentals including robust end-user demand, technological innovation, and increasing regulatory requirements for product labeling and traceability.

Key growth drivers include the expanding e-commerce sector, which has increased demand for shipping and logistics labels by approximately 35% over recent years. Additionally, the pharmaceutical industry’s stringent serialization requirements and the food and beverage sector’s emphasis on product information transparency continue to fuel market expansion.

Technological advancement remains a critical success factor, with digital printing technologies enabling shorter run lengths, variable data printing, and enhanced customization capabilities. The integration of sustainable materials and eco-friendly adhesive formulations addresses growing environmental concerns while maintaining performance standards required by demanding applications.

Competitive landscape features established multinational corporations alongside innovative regional players, creating a dynamic environment that fosters continuous product development and market expansion. Strategic partnerships between label converters, material suppliers, and end-users drive collaborative innovation and market penetration strategies.

Market segmentation reveals distinct growth patterns across various application categories and material types. The following insights highlight critical market dynamics:

E-commerce expansion serves as a primary catalyst for market growth, with online retail sales driving unprecedented demand for shipping labels, product identification, and package tracking solutions. The surge in direct-to-consumer shipping has created new requirements for durable, weather-resistant labels capable of maintaining readability throughout complex logistics networks.

Regulatory compliance requirements across pharmaceutical, food and beverage, and chemical industries mandate comprehensive product labeling with specific information disclosure standards. These regulations drive consistent demand for high-quality, compliant labeling solutions that meet stringent durability and legibility requirements under various environmental conditions.

Brand differentiation strategies employed by consumer goods manufacturers increasingly rely on sophisticated labeling solutions to communicate product benefits, sustainability credentials, and brand messaging. Premium label materials and advanced printing technologies enable enhanced visual appeal and tactile experiences that influence purchasing decisions.

Supply chain visibility initiatives require comprehensive tracking and identification systems throughout manufacturing, distribution, and retail processes. Self-adhesive labels incorporating barcodes, QR codes, and RFID technology provide essential data capture capabilities supporting inventory management, loss prevention, and consumer engagement programs.

Automation adoption in manufacturing and packaging operations drives demand for labels optimized for high-speed application equipment. Consistent adhesive performance, dimensional stability, and reliable dispensing characteristics become critical factors in maintaining operational efficiency and product quality standards.

Raw material price volatility presents ongoing challenges for label manufacturers and converters, with fluctuating costs for paper, film substrates, and adhesive components impacting profit margins and pricing strategies. These cost pressures require careful supply chain management and long-term supplier relationships to maintain competitive positioning.

Environmental concerns regarding label waste and recyclability create pressure for sustainable alternatives, potentially increasing production costs and requiring significant research and development investments. The transition to eco-friendly materials may involve performance trade-offs that affect application suitability and customer acceptance.

Technological complexity associated with advanced labeling solutions requires substantial capital investments in equipment, training, and ongoing technical support. Smaller label converters may struggle to compete effectively in markets demanding sophisticated printing capabilities and digital integration features.

Regulatory compliance costs continue to increase as government agencies implement more stringent requirements for label content, materials, and performance characteristics. Meeting these evolving standards requires ongoing investment in testing, certification, and quality assurance processes that impact operational expenses.

Market consolidation pressures from large end-users seeking simplified supplier relationships and volume-based pricing create challenges for smaller market participants. The need for comprehensive service capabilities and geographic coverage may limit growth opportunities for regional players.

Smart labeling technologies present significant growth opportunities as Internet of Things (IoT) applications expand across consumer and industrial markets. Labels incorporating sensors, NFC chips, and interactive features enable new applications in product authentication, temperature monitoring, and consumer engagement that command premium pricing.

Sustainable packaging initiatives create demand for innovative label materials and adhesive formulations that support circular economy principles. Companies developing recyclable, compostable, or bio-based labeling solutions can capture market share from environmentally conscious brands and retailers.

Pharmaceutical serialization requirements continue expanding globally, creating opportunities for specialized label solutions supporting track-and-trace mandates. The complexity of these applications requires advanced printing capabilities and security features that justify higher margins and long-term customer relationships.

Industrial automation trends drive demand for labels optimized for robotic application systems and harsh operating environments. Developing specialized products for automotive, aerospace, and manufacturing applications can establish competitive advantages in high-value market segments.

Digital printing adoption enables new business models focused on short-run, customized labeling solutions for small and medium-sized enterprises. This technology democratizes access to high-quality labeling while creating opportunities for value-added services and faster turnaround times.

Supply chain integration continues evolving as label manufacturers seek closer relationships with raw material suppliers and end-users to optimize costs and improve service levels. Vertical integration strategies and strategic partnerships enable better control over quality, delivery, and innovation while reducing market volatility impacts.

Technology convergence between traditional labeling and digital printing creates new competitive dynamics as equipment manufacturers develop hybrid solutions combining conventional and digital capabilities. This convergence enables greater flexibility and efficiency while reducing capital investment requirements for label converters.

Customer consolidation trends require label suppliers to develop comprehensive service capabilities spanning multiple geographic regions and application categories. Success increasingly depends on ability to provide integrated solutions rather than individual products, driving industry consolidation and partnership formation.

Regulatory evolution continues shaping market requirements as government agencies implement new standards for sustainability, safety, and information disclosure. Staying ahead of regulatory changes requires ongoing investment in research and development while maintaining compliance with existing requirements.

Innovation cycles are accelerating as competitive pressures drive continuous product development and technology advancement. Companies must balance investment in breakthrough technologies with optimization of existing products to maintain market position while preparing for future opportunities.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including label manufacturers, converters, equipment suppliers, and end-users across diverse application segments. This approach provides direct insights into market trends, challenges, and opportunities from participants actively engaged in North American self-adhesive label markets.

Secondary research incorporates analysis of industry publications, trade association reports, government statistics, and company financial disclosures to establish market context and validate primary research findings. This comprehensive approach ensures accuracy and completeness of market intelligence while identifying emerging trends and competitive dynamics.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews with key stakeholders, and applying statistical analysis techniques to ensure research reliability and accuracy. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of market intelligence.

Market modeling utilizes advanced analytical techniques to project future market trends based on historical performance, current market dynamics, and identified growth drivers. These models incorporate various scenarios to provide comprehensive insights into potential market evolution under different economic and competitive conditions.

United States market dominance reflects the country’s extensive manufacturing base, large consumer population, and advanced regulatory framework driving consistent demand for self-adhesive labeling solutions. Key industrial clusters in the Midwest, Southeast, and West Coast regions support diverse application requirements across automotive, food processing, pharmaceutical, and consumer goods manufacturing.

California and Texas represent the largest state markets, with California’s technology sector and agricultural industry driving innovation in smart labeling and sustainable materials. Texas benefits from significant petrochemical, food processing, and logistics operations requiring high-volume labeling solutions for diverse applications.

Canadian market characteristics include strong demand from natural resources industries, food processing, and pharmaceutical manufacturing. The country’s bilingual labeling requirements create unique opportunities for specialized printing capabilities while environmental consciousness drives adoption of sustainable labeling materials.

Mexican market growth is accelerated by expanding manufacturing operations, particularly in automotive and electronics assembly, which require sophisticated labeling solutions for export markets. The country’s growing consumer goods sector and increasing regulatory requirements support steady demand expansion across multiple application categories.

Regional trade dynamics benefit from USMCA agreement provisions that facilitate cross-border commerce and supply chain integration. This regulatory framework enables efficient distribution of labeling materials and finished products while supporting collaborative relationships between regional market participants.

Market leadership is distributed among several multinational corporations with comprehensive product portfolios and extensive geographic coverage. The competitive environment features both large-scale manufacturers and specialized regional players serving niche applications and customer segments.

Competitive strategies focus on technological innovation, sustainable product development, and comprehensive service capabilities. Leading companies invest heavily in digital printing technologies, smart labeling solutions, and eco-friendly materials to maintain competitive advantages while expanding market reach.

By Material Type:

By Adhesive Type:

By Application:

By End-User:

Food and Beverage Labels represent the largest application category, driven by regulatory requirements for nutritional information, ingredient disclosure, and allergen warnings. This segment benefits from consistent demand growth as consumer awareness increases and regulatory standards become more stringent. Innovation focuses on sustainable materials, enhanced barrier properties, and smart labeling features supporting supply chain traceability.

Pharmaceutical Labels command premium pricing due to stringent quality requirements, serialization mandates, and specialized security features. The segment experiences steady growth driven by aging demographics, new drug introductions, and expanding track-and-trace regulations. Technical requirements include tamper-evident features, variable data printing, and compatibility with automated packaging equipment.

Personal Care Labels emphasize aesthetic appeal and brand differentiation through premium materials, special effects, and innovative printing techniques. Market growth reflects expanding product categories, increased consumer spending on personal care items, and growing demand for natural and organic product identification. Sustainability considerations drive adoption of recyclable materials and eco-friendly adhesives.

Logistics Labels experience rapid growth due to e-commerce expansion and supply chain complexity requiring comprehensive tracking and identification systems. This category includes shipping labels, inventory tags, and handling instructions that must perform reliably under diverse environmental conditions. Technology integration includes barcode printing, RFID compatibility, and weather-resistant materials.

Industrial Labels serve specialized applications requiring extreme durability, chemical resistance, and safety compliance features. Growth drivers include automation adoption, regulatory requirements for asset identification, and increasing emphasis on workplace safety. Technical specifications often require custom adhesive formulations and specialized substrates for harsh operating environments.

Manufacturers benefit from comprehensive labeling solutions that enhance product identification, support regulatory compliance, and enable brand differentiation strategies. Self-adhesive labels provide reliable application performance, consistent quality, and flexibility to accommodate diverse packaging formats and production requirements.

Retailers gain advantages through improved inventory management, enhanced product presentation, and support for private label programs. Advanced labeling solutions enable better supply chain visibility, reduced shrinkage, and improved customer experience through clear product information and attractive presentation.

Consumers receive enhanced product information, improved safety through clear labeling, and better product authentication capabilities. Smart labeling features enable access to additional product information, sustainability credentials, and interactive brand experiences that enhance purchasing confidence and satisfaction.

Label Converters access growing market opportunities through technological advancement, product innovation, and expanding application categories. Investment in digital printing capabilities, sustainable materials, and value-added services creates competitive advantages and higher margin opportunities.

Equipment Suppliers benefit from increasing automation adoption and demand for high-speed labeling systems. Technological advancement in printing equipment, application machinery, and inspection systems creates ongoing replacement and upgrade opportunities across diverse end-user industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents the most significant trend shaping market evolution, with manufacturers developing recyclable label materials, bio-based adhesives, and circular economy solutions. This trend reflects growing environmental consciousness among consumers and corporate sustainability commitments driving demand for eco-friendly labeling alternatives.

Digital Printing Adoption continues accelerating as technology costs decrease and capabilities expand, enabling shorter run lengths, variable data printing, and faster turnaround times. This trend democratizes access to high-quality labeling while supporting mass customization and personalization strategies across diverse market segments.

Smart Labeling Evolution incorporates advanced technologies including RFID, NFC, and QR codes to provide enhanced functionality beyond traditional identification and information display. These solutions enable supply chain traceability, consumer engagement, and product authentication capabilities that create new value propositions and revenue opportunities.

Automation Integration drives demand for labels optimized for high-speed application equipment and robotic handling systems. This trend requires consistent dimensional tolerances, reliable adhesive performance, and compatibility with vision inspection systems to maintain operational efficiency and quality standards.

Regulatory Compliance Expansion continues increasing across multiple industries, with new requirements for serialization, track-and-trace, and information disclosure driving consistent demand growth. These regulations create opportunities for specialized labeling solutions while requiring ongoing investment in compliance capabilities and quality assurance systems.

Technology Partnerships between label manufacturers and equipment suppliers are creating integrated solutions that optimize performance and reduce implementation complexity. These collaborations enable development of specialized products for emerging applications while providing customers with comprehensive support and service capabilities.

Sustainability Initiatives include major investments in recyclable materials research, renewable energy adoption, and waste reduction programs throughout the supply chain. Leading companies are establishing sustainability targets and developing eco-friendly product lines to meet growing environmental requirements and customer expectations.

Capacity Expansion projects focus on high-growth regions and emerging application categories, with significant investments in digital printing capabilities, specialty materials production, and automated manufacturing systems. These expansions support market growth while improving operational efficiency and customer service levels.

Acquisition Activity continues as larger companies seek to expand geographic coverage, acquire specialized technologies, and strengthen customer relationships through comprehensive service capabilities. Strategic acquisitions enable rapid market entry and technology integration while providing growth opportunities for acquired companies.

Regulatory Compliance investments include new testing facilities, quality assurance systems, and certification programs to meet evolving government requirements and industry standards. These investments ensure continued market access while supporting customer confidence in product quality and performance.

Investment Priorities should focus on sustainable material development, digital printing capabilities, and smart labeling technologies to capture emerging market opportunities. Companies must balance short-term profitability with long-term strategic positioning to maintain competitive advantages in evolving market conditions.

Partnership Strategies can accelerate market penetration and technology development through collaboration with equipment suppliers, raw material manufacturers, and end-users. Strategic alliances enable resource sharing, risk mitigation, and access to specialized expertise while reducing time-to-market for innovative solutions.

Geographic Expansion opportunities exist in underserved market segments and emerging application categories where specialized expertise and local presence create competitive advantages. MWR analysis indicates particular opportunities in pharmaceutical serialization and e-commerce logistics applications.

Technology Integration requires ongoing investment in research and development to stay ahead of evolving customer requirements and competitive pressures. Companies should prioritize technologies that provide clear value propositions and sustainable competitive advantages while maintaining compatibility with existing systems.

Sustainability Leadership can create significant competitive advantages as environmental consciousness increases among customers and regulatory requirements expand. Early investment in eco-friendly materials and processes positions companies to capture premium pricing and market share in growing sustainable packaging segments.

Market growth prospects remain positive with projected expansion driven by e-commerce growth, regulatory requirements, and technological innovation. The market is expected to maintain steady growth rates of approximately 4.8% CAGR through the forecast period, supported by diverse application categories and consistent end-user demand.

Technology evolution will continue transforming market dynamics as digital printing becomes more cost-effective and smart labeling capabilities expand. Integration of artificial intelligence, machine learning, and IoT technologies will create new applications and value propositions that drive market expansion and differentiation opportunities.

Sustainability requirements will increasingly influence purchasing decisions and regulatory compliance, creating opportunities for companies developing eco-friendly solutions while potentially disrupting traditional materials and processes. The transition to circular economy principles will require significant innovation and investment throughout the supply chain.

Regional dynamics may shift as manufacturing patterns evolve and trade relationships change, potentially creating new growth opportunities in underserved markets while requiring adaptation to changing customer requirements and competitive conditions. MarkWide Research projects continued United States market dominance with growing opportunities in Mexican manufacturing sectors.

Competitive landscape evolution will likely feature continued consolidation as companies seek scale advantages and comprehensive service capabilities. Success will increasingly depend on ability to provide integrated solutions, technological innovation, and sustainable practices that meet evolving customer requirements and regulatory standards.

The North America self-adhesive labels market demonstrates robust fundamentals and promising growth prospects driven by diverse application requirements, technological innovation, and expanding regulatory mandates. Market participants benefit from established infrastructure, advanced manufacturing capabilities, and strong customer relationships that support consistent demand and profitable operations.

Strategic success in this market requires balanced investment in traditional capabilities and emerging technologies, with particular emphasis on sustainability, digitalization, and smart labeling solutions. Companies that effectively navigate the transition to eco-friendly materials while maintaining performance standards and cost competitiveness will capture significant market opportunities.

Future market evolution will be shaped by continued e-commerce growth, regulatory expansion, and technological advancement that create new applications and value propositions. The integration of digital technologies, sustainable materials, and advanced manufacturing processes will define competitive advantages and market leadership in the evolving North America self-adhesive labels market landscape.

What is Self-Adhesive Labels?

Self-adhesive labels are labels that have a pressure-sensitive adhesive on one side, allowing them to stick to various surfaces without the need for additional glue. They are commonly used in packaging, shipping, and product labeling across various industries.

What are the key players in the North America Self-Adhesive Labels Market?

Key players in the North America Self-Adhesive Labels Market include Avery Dennison Corporation, CCL Industries, and UPM Raflatac, among others. These companies are known for their innovative label solutions and extensive product offerings.

What are the growth factors driving the North America Self-Adhesive Labels Market?

The growth of the North America Self-Adhesive Labels Market is driven by the increasing demand for packaging solutions in the e-commerce sector, the rise in consumer goods labeling, and advancements in printing technologies that enhance label quality.

What challenges does the North America Self-Adhesive Labels Market face?

Challenges in the North America Self-Adhesive Labels Market include the rising costs of raw materials, environmental concerns regarding plastic waste, and competition from alternative labeling solutions. These factors can impact profitability and market growth.

What opportunities exist in the North America Self-Adhesive Labels Market?

Opportunities in the North America Self-Adhesive Labels Market include the growing trend of sustainable packaging, the development of smart labels with RFID technology, and the expansion of online retail, which increases the need for efficient labeling solutions.

What trends are shaping the North America Self-Adhesive Labels Market?

Trends in the North America Self-Adhesive Labels Market include the shift towards eco-friendly materials, the integration of digital printing technologies, and the customization of labels to meet specific consumer needs. These trends are influencing product development and market strategies.

North America Self-Adhesive Labels Market

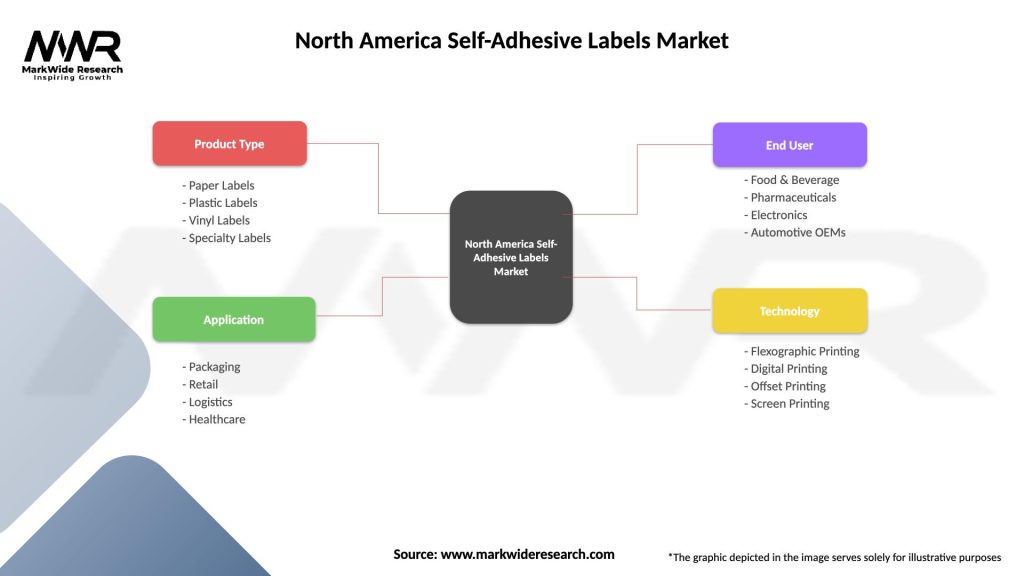

| Segmentation Details | Description |

|---|---|

| Product Type | Paper Labels, Plastic Labels, Vinyl Labels, Specialty Labels |

| Application | Packaging, Retail, Logistics, Healthcare |

| End User | Food & Beverage, Pharmaceuticals, Electronics, Automotive OEMs |

| Technology | Flexographic Printing, Digital Printing, Offset Printing, Screen Printing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Self-Adhesive Labels Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at