444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America secondary packaging market represents a dynamic and rapidly evolving sector that plays a crucial role in protecting, containing, and transporting products across diverse industries. Secondary packaging encompasses the outer layer of packaging that groups primary packages together, providing additional protection during distribution and enhancing brand visibility at retail locations. This market has experienced substantial growth driven by increasing e-commerce activities, rising consumer demand for sustainable packaging solutions, and evolving retail landscapes across the United States, Canada, and Mexico.

Market dynamics in North America reflect a sophisticated ecosystem where manufacturers, retailers, and consumers increasingly prioritize packaging efficiency, sustainability, and cost-effectiveness. The region’s secondary packaging market demonstrates remarkable resilience and adaptability, with companies investing heavily in innovative materials, advanced manufacturing technologies, and automated packaging systems. Growth projections indicate the market is expanding at a CAGR of 4.2%, driven by robust demand from food and beverage, pharmaceutical, personal care, and consumer electronics sectors.

Regional leadership in packaging innovation positions North America as a global benchmark for secondary packaging solutions. The market encompasses various packaging formats including corrugated boxes, folding cartons, rigid boxes, flexible packaging, and specialty containers designed to meet specific industry requirements. Technological advancement continues to reshape the landscape, with smart packaging, digital printing, and sustainable materials gaining significant traction among manufacturers and end-users alike.

The North America secondary packaging market refers to the comprehensive industry segment focused on producing, distributing, and utilizing packaging materials and solutions that serve as the outer protective layer for grouped primary packages. Secondary packaging functions as an intermediary between primary packaging (direct product contact) and tertiary packaging (bulk transportation), providing essential protection, branding opportunities, and logistical efficiency throughout the supply chain.

Functional characteristics of secondary packaging include product protection during handling and transportation, brand communication and marketing appeal, inventory management facilitation, and retail display optimization. This packaging category encompasses diverse materials such as corrugated cardboard, paperboard, plastic films, rigid plastics, and composite materials engineered to meet specific performance requirements across various industries and applications.

Market scope extends beyond traditional packaging functions to include value-added services such as custom design, digital printing, smart packaging integration, and sustainable material development. The industry serves multiple stakeholders including consumer goods manufacturers, pharmaceutical companies, food processors, e-commerce retailers, and logistics providers who rely on secondary packaging solutions to ensure product integrity and enhance customer experience.

Strategic analysis of the North America secondary packaging market reveals a robust and diversified industry positioned for sustained growth across multiple sectors. The market demonstrates strong fundamentals driven by increasing consumer spending, expanding e-commerce penetration, and growing emphasis on sustainable packaging solutions. Key performance indicators show consistent demand growth with e-commerce segment contributing 28% of total market expansion, reflecting the digital transformation of retail commerce.

Competitive landscape features established packaging giants alongside innovative startups developing next-generation solutions. Major market participants continue investing in manufacturing capacity expansion, technology upgrades, and sustainable material development to maintain competitive advantages. Innovation focus centers on lightweight materials, enhanced barrier properties, recyclable substrates, and smart packaging technologies that provide real-time product information and supply chain visibility.

Market segmentation analysis indicates corrugated packaging maintains the largest market share, followed by folding cartons and flexible packaging solutions. The food and beverage sector represents the primary end-user segment, accounting for significant demand volume, while pharmaceutical and personal care industries demonstrate the highest growth rates. Regional distribution shows the United States commanding 78% market share, with Canada and Mexico contributing 15% and 7% respectively.

Market intelligence reveals several critical insights shaping the North America secondary packaging landscape. Consumer behavior shifts toward online shopping have fundamentally altered packaging requirements, with increased demand for protective, lightweight, and visually appealing packaging solutions that enhance unboxing experiences while minimizing environmental impact.

Primary growth drivers propelling the North America secondary packaging market encompass diverse economic, technological, and consumer-related factors. E-commerce expansion represents the most significant catalyst, with online retail growth creating unprecedented demand for protective packaging solutions that ensure product integrity during shipping while providing memorable unboxing experiences that enhance brand loyalty and customer satisfaction.

Sustainability imperatives increasingly influence packaging decisions as consumers, regulators, and corporations prioritize environmental responsibility. This trend drives innovation in recyclable materials, biodegradable substrates, and circular economy packaging solutions. Consumer awareness regarding environmental impact has reached 73% adoption rate for sustainable packaging preferences, compelling manufacturers to develop eco-friendly alternatives without compromising functionality or cost-effectiveness.

Technological advancement continues reshaping packaging capabilities through digital printing, smart packaging integration, and automated manufacturing systems. These innovations enable mass customization, real-time supply chain tracking, and enhanced consumer engagement while reducing production costs and improving operational efficiency. Industry 4.0 integration facilitates predictive maintenance, quality control optimization, and demand forecasting accuracy that supports just-in-time manufacturing strategies.

Regulatory compliance requirements across pharmaceutical, food safety, and consumer protection domains drive demand for specialized packaging solutions featuring tamper-evident seals, barrier properties, and traceability capabilities. These regulations ensure product authenticity, consumer safety, and supply chain transparency while creating opportunities for packaging innovation and value-added services.

Market challenges facing the North America secondary packaging industry include several interconnected factors that may constrain growth potential and profitability. Raw material volatility represents a persistent concern, with fluctuating prices for petroleum-based plastics, paper pulp, and specialty chemicals creating uncertainty in cost structures and profit margins for packaging manufacturers and end-users alike.

Environmental regulations while driving innovation, also impose compliance costs and operational constraints that particularly impact smaller manufacturers lacking resources for extensive research and development investments. Regulatory complexity across different states and provinces creates additional challenges for companies operating multi-regional distribution networks, requiring specialized expertise and administrative overhead.

Labor shortages in manufacturing and logistics sectors affect packaging production capacity and distribution efficiency. Skilled workforce availability remains limited, with manufacturing employment gaps reaching 15% in specialized packaging operations, constraining expansion plans and operational optimization initiatives across the industry.

Supply chain disruptions continue impacting material availability, transportation costs, and delivery schedules. These challenges necessitate increased inventory holding, alternative sourcing strategies, and supply chain diversification that add complexity and costs to packaging operations while potentially affecting customer service levels and market responsiveness.

Emerging opportunities in the North America secondary packaging market present significant potential for growth and innovation across multiple dimensions. Sustainable packaging development offers substantial opportunities as companies seek alternatives to traditional materials, creating demand for bio-based polymers, recycled content integration, and innovative barrier technologies that maintain product protection while reducing environmental impact.

Smart packaging integration represents a transformative opportunity enabling enhanced consumer engagement, supply chain visibility, and product authentication. Technology adoption rates indicate 42% annual growth in smart packaging implementations, with applications ranging from temperature monitoring and freshness indicators to interactive marketing campaigns and anti-counterfeiting solutions.

E-commerce specialization creates opportunities for packaging companies to develop tailored solutions addressing unique requirements of online retail, including protective packaging for fragile items, subscription box designs, and return-friendly packaging systems. Market expansion in direct-to-consumer channels offers packaging providers opportunities to work directly with brands seeking differentiation through innovative packaging experiences.

Pharmaceutical sector growth driven by aging demographics and healthcare expansion creates demand for specialized packaging solutions featuring child-resistant closures, tamper-evident seals, and temperature-controlled packaging systems. Regulatory compliance requirements in pharmaceutical packaging command premium pricing and long-term customer relationships that provide stable revenue streams and growth opportunities.

Market dynamics in the North America secondary packaging sector reflect complex interactions between supply-side innovations, demand-side requirements, and external environmental factors. Competitive intensity continues increasing as traditional packaging companies face challenges from specialized startups, technology providers, and vertically integrated manufacturers seeking to capture value across the packaging supply chain.

Innovation cycles accelerate as companies invest in research and development to address evolving customer needs, regulatory requirements, and sustainability objectives. Technology convergence between packaging, digital printing, and smart materials creates new product categories and business models that blur traditional industry boundaries while opening opportunities for differentiation and value creation.

Customer relationships evolve toward strategic partnerships as packaging providers offer comprehensive solutions including design services, supply chain optimization, and sustainability consulting. Value proposition expansion beyond basic packaging functionality enables companies to command premium pricing while building stronger customer loyalty and market positioning.

Market consolidation trends continue as larger companies acquire specialized capabilities, regional players, and technology startups to enhance competitive positioning. Merger and acquisition activity reflects strategic efforts to achieve scale economies, expand geographic reach, and integrate complementary technologies that strengthen market presence and operational efficiency.

Comprehensive research methodology employed in analyzing the North America secondary packaging market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, packaging manufacturers, end-user companies, and supply chain stakeholders to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, trade publications, and academic studies to establish market baselines and identify emerging trends. Data triangulation methods validate findings across multiple sources while ensuring consistency and reliability of market projections and strategic recommendations.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth, segment performance, and competitive dynamics. Market sizing methodology incorporates bottom-up and top-down approaches to validate market estimates and ensure comprehensive coverage of all relevant market segments and geographic regions.

Qualitative assessment provides context and interpretation for quantitative findings through expert interviews, focus groups, and industry workshops. This approach enables deeper understanding of market drivers, customer behavior patterns, and strategic implications that inform actionable business recommendations and investment decisions.

Regional market analysis reveals distinct characteristics and growth patterns across North America’s secondary packaging landscape. United States market dominance stems from large consumer base, advanced manufacturing infrastructure, and robust e-commerce ecosystem that drives packaging innovation and demand growth. The U.S. market demonstrates particular strength in sustainable packaging development, smart technology integration, and pharmaceutical packaging specialization.

Canadian market dynamics reflect strong emphasis on sustainable packaging solutions, driven by progressive environmental regulations and consumer preferences. Market growth in Canada shows 5.1% annual expansion, supported by thriving food processing industry, expanding e-commerce sector, and increasing pharmaceutical manufacturing activities. Canadian companies demonstrate leadership in bio-based packaging materials and circular economy initiatives.

Mexican market expansion benefits from growing manufacturing sector, increasing consumer spending, and expanding retail infrastructure. USMCA trade agreement facilitates cross-border packaging supply chains while encouraging investment in local manufacturing capabilities. Mexico’s strategic location enables cost-effective packaging production for North American markets while supporting export-oriented industries.

Cross-border integration creates opportunities for regional packaging companies to optimize supply chains, share best practices, and leverage complementary capabilities. Trade relationships facilitate technology transfer, joint ventures, and strategic partnerships that strengthen the overall North American packaging ecosystem while enhancing competitiveness in global markets.

Competitive landscape in the North America secondary packaging market features diverse players ranging from multinational corporations to specialized regional manufacturers. Market leadership positions are held by companies demonstrating strong capabilities in innovation, manufacturing scale, customer service, and sustainability initiatives that differentiate their offerings in increasingly competitive markets.

Competitive strategies focus on innovation, sustainability, operational excellence, and customer partnership development. Companies invest heavily in research and development, manufacturing automation, and digital capabilities to maintain competitive advantages while addressing evolving customer requirements and market dynamics.

Market segmentation analysis provides detailed insights into various categories within the North America secondary packaging market. Material-based segmentation reveals corrugated packaging maintaining the largest market share due to versatility, cost-effectiveness, and recyclability, while flexible packaging demonstrates the highest growth rates driven by e-commerce and convenience applications.

By Material Type:

By End-Use Industry:

Category analysis reveals distinct trends and opportunities across different secondary packaging segments. Corrugated packaging category demonstrates resilience and adaptability, with manufacturers investing in high-definition printing capabilities, structural design innovation, and sustainable material development. Market penetration reaches 68% adoption rate across e-commerce applications, reflecting superior protective capabilities and cost-effectiveness.

Folding carton segment experiences growth driven by premium positioning, enhanced graphics capabilities, and sustainable substrate options. Brand differentiation requirements in competitive consumer markets drive demand for innovative structural designs, special effects printing, and interactive packaging features that enhance consumer engagement and purchase decisions.

Flexible packaging category shows remarkable growth potential with annual expansion of 6.3%, supported by lightweight characteristics, barrier property improvements, and cost advantages in transportation and storage. Innovation focus centers on recyclable films, bio-based materials, and smart packaging integration that addresses sustainability concerns while maintaining functional performance.

Rigid plastic segment serves specialized applications requiring durability, chemical resistance, and reusability characteristics. Market opportunities exist in pharmaceutical packaging, industrial applications, and premium consumer products where performance requirements justify higher material costs and specialized manufacturing processes.

Industry participants in the North America secondary packaging market realize multiple benefits through strategic positioning and operational excellence. Packaging manufacturers benefit from stable demand growth, opportunities for value-added services, and potential for premium pricing through innovation and sustainability leadership. Revenue diversification across multiple end-user industries provides resilience against sector-specific downturns while enabling cross-selling opportunities.

End-user companies gain competitive advantages through strategic packaging partnerships that enhance brand positioning, reduce total cost of ownership, and improve supply chain efficiency. Sustainability benefits include reduced environmental impact, improved corporate social responsibility positioning, and compliance with evolving regulatory requirements that support long-term business viability.

Supply chain stakeholders including logistics providers, retailers, and distributors benefit from packaging innovations that improve handling efficiency, reduce damage rates, and enhance inventory management capabilities. Operational improvements translate to cost savings, improved customer satisfaction, and competitive advantages in service delivery and market responsiveness.

Technology providers and equipment manufacturers find expanding opportunities in packaging automation, digital printing systems, and smart packaging technologies. Market growth in these segments supports innovation investment, partnership development, and market expansion strategies that create value for all ecosystem participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the North America secondary packaging market. Circular economy principles drive development of recyclable, compostable, and bio-based packaging materials that reduce environmental impact while maintaining functional performance. Consumer demand for sustainable packaging reaches 81% preference rate, compelling companies to prioritize environmental considerations in product development and marketing strategies.

Digital integration accelerates across packaging applications, with smart packaging technologies enabling enhanced consumer engagement, supply chain transparency, and product authentication. QR codes, NFC chips, and IoT sensors transform traditional packaging into interactive platforms that provide product information, marketing content, and supply chain data while supporting anti-counterfeiting initiatives.

Customization and personalization trends drive demand for flexible manufacturing capabilities and digital printing technologies that enable small-batch production and variable data printing. Mass customization allows brands to create targeted packaging designs for specific markets, seasons, or promotional campaigns while maintaining cost-effectiveness and operational efficiency.

Automation advancement continues transforming packaging manufacturing and fulfillment operations through robotics, artificial intelligence, and machine learning technologies. Industry 4.0 implementation enables predictive maintenance, quality control optimization, and demand forecasting that improve operational efficiency while reducing costs and enhancing customer service capabilities.

Recent industry developments highlight the dynamic nature of the North America secondary packaging market and emerging opportunities for growth and innovation. MarkWide Research analysis indicates significant investment in sustainable packaging technologies, with major companies announcing multi-billion dollar commitments to develop recyclable and bio-based packaging solutions over the next decade.

Strategic acquisitions continue reshaping the competitive landscape as companies seek to expand capabilities, enter new markets, and integrate complementary technologies. Vertical integration strategies enable packaging companies to control supply chains, improve cost structures, and offer comprehensive solutions that address evolving customer requirements and market dynamics.

Technology partnerships between packaging companies and digital technology providers accelerate smart packaging development and implementation. Collaborative innovation initiatives focus on developing next-generation packaging solutions that combine traditional protective functions with digital capabilities, sustainability features, and enhanced consumer experiences.

Regulatory developments across environmental protection, food safety, and pharmaceutical packaging create both challenges and opportunities for industry participants. Compliance requirements drive innovation in barrier materials, tamper-evident technologies, and traceability systems while creating market opportunities for specialized packaging solutions and services.

Strategic recommendations for North America secondary packaging market participants emphasize the importance of sustainability leadership, technology integration, and customer partnership development. Investment priorities should focus on sustainable material development, manufacturing automation, and digital capabilities that enable competitive differentiation and long-term market positioning.

Market expansion strategies should consider geographic diversification, end-user industry expansion, and value-added service development that reduce dependence on traditional packaging commodities while building stronger customer relationships. Partnership opportunities with technology providers, sustainability consultants, and supply chain specialists can accelerate innovation and market development initiatives.

Operational excellence remains critical for maintaining competitiveness in price-sensitive market segments while enabling investment in innovation and growth initiatives. Efficiency improvements through automation, lean manufacturing, and supply chain optimization provide resources for strategic investments while enhancing customer service capabilities and market responsiveness.

Sustainability integration should be viewed as a strategic imperative rather than a compliance requirement, with companies developing comprehensive environmental strategies that encompass material selection, manufacturing processes, and end-of-life considerations. Circular economy participation creates opportunities for new business models, customer partnerships, and market differentiation that support long-term growth and profitability.

Future market prospects for the North America secondary packaging industry appear highly favorable, with multiple growth drivers supporting sustained expansion across key market segments. Long-term projections indicate continued growth at 4.5% CAGR through 2030, driven by e-commerce expansion, sustainability initiatives, and technological innovation that create new market opportunities and value propositions.

Technology evolution will continue transforming packaging capabilities, with smart packaging, advanced materials, and automation technologies becoming standard features rather than premium options. Digital transformation enables new business models, customer engagement strategies, and operational efficiencies that support competitive positioning and market growth.

Sustainability leadership will increasingly determine market success as consumers, regulators, and corporate customers prioritize environmental responsibility in purchasing decisions. Circular economy integration creates opportunities for innovative companies to develop new products, services, and business models that address environmental challenges while generating profitable growth.

Market consolidation trends are expected to continue as companies seek scale advantages, technology capabilities, and geographic expansion through strategic acquisitions and partnerships. Industry structure evolution will likely favor companies with strong innovation capabilities, sustainability leadership, and comprehensive solution offerings that address complex customer requirements across multiple market segments.

The North America secondary packaging market stands at a transformative juncture, characterized by robust growth prospects, technological innovation, and sustainability imperatives that reshape industry dynamics and competitive landscapes. Market fundamentals remain strong, supported by diverse end-user industries, expanding e-commerce sector, and increasing consumer awareness of packaging’s role in product protection and environmental impact.

Strategic opportunities abound for companies willing to invest in sustainable technologies, digital capabilities, and customer partnership development that create competitive advantages and long-term value creation. Industry evolution toward circular economy principles, smart packaging integration, and operational excellence provides multiple pathways for growth and differentiation in increasingly competitive markets.

Success factors for future market leadership include sustainability innovation, technology integration, operational efficiency, and customer-centric solution development that addresses evolving requirements across diverse market segments. Companies that embrace these strategic imperatives while maintaining focus on cost competitiveness and service excellence are well-positioned to capitalize on emerging opportunities and achieve sustainable growth in the dynamic North America secondary packaging market.

What is Secondary Packaging?

Secondary packaging refers to the outer packaging that contains one or more primary packages. It serves to protect the product, provide branding, and facilitate handling and transportation, often seen in industries like food and beverage, pharmaceuticals, and consumer goods.

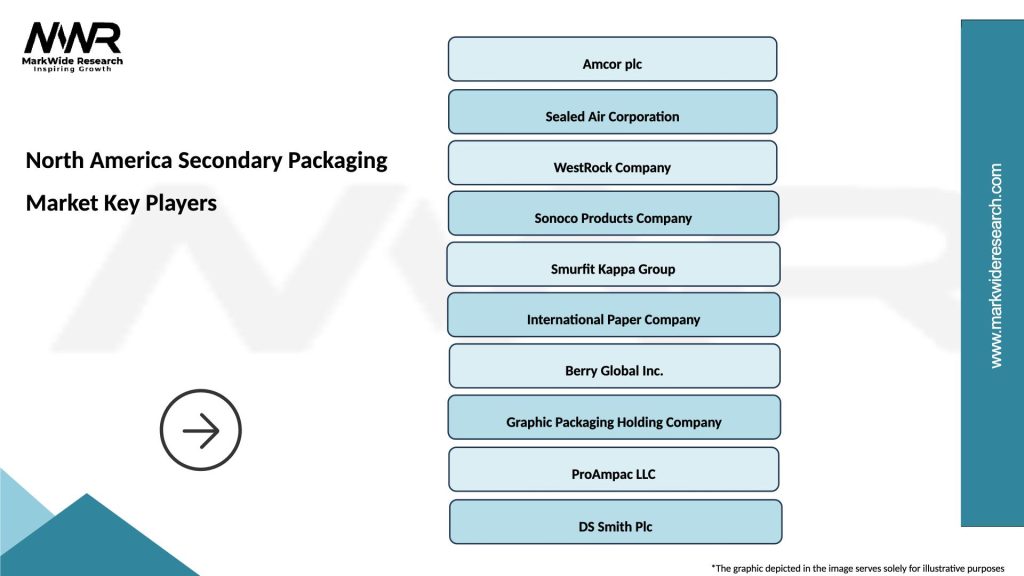

What are the key players in the North America Secondary Packaging Market?

Key players in the North America Secondary Packaging Market include Amcor plc, WestRock Company, Sealed Air Corporation, and Smurfit Kappa Group, among others. These companies are known for their innovative packaging solutions and extensive distribution networks.

What are the main drivers of the North America Secondary Packaging Market?

The main drivers of the North America Secondary Packaging Market include the growing demand for sustainable packaging solutions, the rise in e-commerce activities, and the increasing need for product safety and shelf life extension in various industries.

What challenges does the North America Secondary Packaging Market face?

Challenges in the North America Secondary Packaging Market include the rising costs of raw materials, regulatory compliance related to packaging waste, and the need for innovation to meet changing consumer preferences.

What opportunities exist in the North America Secondary Packaging Market?

Opportunities in the North America Secondary Packaging Market include the development of eco-friendly packaging materials, advancements in smart packaging technologies, and the expansion of online retail, which requires efficient packaging solutions.

What trends are shaping the North America Secondary Packaging Market?

Trends shaping the North America Secondary Packaging Market include the increasing focus on sustainability, the adoption of automation in packaging processes, and the integration of digital technologies for enhanced consumer engagement and tracking.

North America Secondary Packaging Market

| Segmentation Details | Description |

|---|---|

| Packaging Type | Boxes, Bags, Labels, Tapes |

| Material | Plastic, Paper, Metal, Glass |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Electronics |

| Technology | Flexographic, Digital, Gravure, Offset |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Secondary Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at