444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America satellite attitude and orbit control system market represents a critical segment of the aerospace and defense industry, experiencing unprecedented growth driven by increasing satellite deployments and advancing space exploration initiatives. This sophisticated market encompasses the essential technologies that enable precise positioning, orientation, and orbital maintenance of satellites throughout their operational lifecycle.

Market dynamics indicate robust expansion across commercial, military, and scientific satellite applications. The region’s dominance in space technology development, coupled with substantial investments from both government agencies and private enterprises, has positioned North America as the global leader in satellite attitude and orbit control systems. Growth projections suggest the market will experience a compound annual growth rate of 8.2% through the forecast period, driven by next-generation satellite constellations and enhanced mission requirements.

Technological advancement continues to reshape the landscape, with innovations in miniaturization, artificial intelligence integration, and autonomous control systems driving market evolution. The increasing deployment of small satellites and CubeSats has created new opportunities for specialized attitude and orbit control solutions, while traditional large satellite missions demand increasingly sophisticated control systems for complex orbital maneuvers and precision positioning.

Regional leadership stems from the presence of major aerospace manufacturers, cutting-edge research institutions, and supportive government policies that foster innovation in space technologies. The United States maintains approximately 65% market share within North America, while Canada contributes significantly through specialized component manufacturing and advanced control algorithm development.

The North America satellite attitude and orbit control system market refers to the comprehensive ecosystem of technologies, components, and services designed to maintain precise satellite positioning and orientation in space. These systems encompass hardware components such as reaction wheels, thrusters, gyroscopes, and star trackers, along with sophisticated software algorithms that enable autonomous satellite control and mission execution.

Attitude control systems manage satellite orientation relative to Earth, sun, or other celestial references, ensuring optimal positioning for communication, observation, or scientific data collection. Orbit control systems maintain desired orbital parameters, compensate for atmospheric drag and gravitational perturbations, and execute orbital transfer maneuvers when required.

System integration combines multiple subsystems including sensors, actuators, control processors, and communication interfaces to create comprehensive solutions tailored to specific mission requirements. Modern systems increasingly incorporate machine learning capabilities and predictive algorithms to optimize fuel consumption and extend satellite operational lifespans.

Market expansion in North America’s satellite attitude and orbit control system sector reflects the region’s strategic focus on space dominance and technological leadership. The convergence of commercial space ventures, government modernization programs, and emerging applications in Earth observation and telecommunications drives sustained market growth.

Key growth drivers include the proliferation of satellite constellations for broadband internet services, increasing demand for Earth observation capabilities, and modernization of military satellite systems. The market benefits from technological innovation rates of 12% annually, with particular emphasis on autonomous control systems and AI-enhanced decision-making capabilities.

Competitive dynamics feature established aerospace giants alongside emerging technology companies specializing in miniaturized control systems for small satellites. The market structure supports both high-value, complex systems for large satellites and cost-effective solutions for constellation deployments.

Future prospects indicate continued expansion driven by next-generation satellite missions, lunar exploration programs, and the growing commercial space economy. Investment in research and development remains robust, with R&D spending representing 15% of total market activity across leading companies.

Strategic insights reveal several critical factors shaping the North America satellite attitude and orbit control system market landscape:

Market maturation demonstrates increasing standardization of interfaces and protocols, enabling greater interoperability between different satellite platforms and control systems. This standardization facilitates cost reduction and accelerates development timelines for new satellite missions.

Primary market drivers propelling growth in the North America satellite attitude and orbit control system market stem from multiple converging factors across commercial, government, and scientific sectors.

Commercial space expansion represents the most significant growth catalyst, with private companies launching thousands of satellites for broadband internet services, Earth observation, and communication applications. The deployment of mega-constellations requires sophisticated attitude and orbit control systems capable of autonomous operation and precise formation flying.

Government modernization programs drive substantial investment in next-generation military and intelligence satellites requiring advanced control capabilities. National security priorities emphasize resilient, jam-resistant control systems that can operate in contested space environments while maintaining mission effectiveness.

Technological advancement in sensor miniaturization, processing power, and software algorithms enables more capable control systems at reduced size, weight, and power consumption. These improvements make advanced attitude and orbit control accessible to smaller satellite platforms and emerging space applications.

Scientific mission requirements increasingly demand precise pointing accuracy and orbital stability for astronomy, Earth science, and planetary exploration missions. Advanced control systems enable complex mission profiles including formation flying, interferometry, and precision landing capabilities.

Cost reduction pressures throughout the space industry drive demand for more efficient, reliable control systems that minimize operational costs while extending satellite lifespans. Improved fuel efficiency and autonomous operation capabilities directly impact mission economics and profitability.

Market constraints affecting the North America satellite attitude and orbit control system sector present challenges that industry participants must navigate to maintain growth trajectories and competitive positioning.

High development costs associated with advanced control systems create barriers for smaller companies and limit market entry opportunities. The substantial investment required for research, testing, and qualification of space-rated components constrains innovation cycles and market expansion.

Regulatory complexity surrounding space operations, frequency allocations, and orbital debris mitigation creates compliance burdens that increase development timelines and costs. Evolving regulatory frameworks require continuous adaptation of control system designs and operational procedures.

Technical challenges in harsh space environments demand robust, radiation-hardened components that often lag behind terrestrial technology advances. The need for extensive testing and qualification processes extends development cycles and increases system costs.

Supply chain dependencies on specialized components and materials create vulnerabilities that can impact production schedules and system availability. Limited supplier bases for critical components such as reaction wheels and star trackers constrain market flexibility.

Skilled workforce shortages in specialized areas of satellite control system design and space systems engineering limit industry capacity for rapid expansion. Competition for qualified personnel drives up development costs and extends project timelines.

Emerging opportunities within the North America satellite attitude and orbit control system market present significant potential for growth and innovation across multiple application areas and technology segments.

Small satellite proliferation creates substantial opportunities for specialized control systems designed for CubeSats and small satellite platforms. The growing adoption of standardized small satellite buses drives demand for cost-effective, modular control solutions that can be rapidly integrated and deployed.

Lunar and deep space missions represent expanding market opportunities as government agencies and private companies pursue ambitious exploration programs. These missions require advanced control systems capable of operating in challenging environments with extended communication delays and limited ground support.

Commercial Earth observation markets continue expanding, driven by applications in agriculture, environmental monitoring, and disaster response. High-resolution imaging missions demand precise pointing accuracy and stability, creating opportunities for advanced attitude control systems.

Space manufacturing initiatives emerging in the commercial sector require specialized control systems for orbital factories and assembly platforms. These applications demand precise positioning capabilities and coordination between multiple spacecraft operating in close proximity.

Autonomous satellite servicing represents a growing market opportunity as operators seek to extend satellite lifespans and reduce operational costs. Servicing missions require sophisticated control systems for rendezvous, docking, and manipulation operations in orbit.

Dynamic market forces shaping the North America satellite attitude and orbit control system landscape reflect the complex interplay between technological advancement, competitive pressures, and evolving customer requirements across diverse space applications.

Innovation cycles accelerate as companies invest heavily in next-generation technologies including artificial intelligence, advanced materials, and miniaturized components. The integration of machine learning algorithms enables predictive maintenance and autonomous decision-making, reducing operational costs by 25-30% compared to traditional control approaches.

Competitive intensity increases as new entrants challenge established players with innovative solutions and disruptive business models. Traditional aerospace companies face pressure from agile startups specializing in small satellite control systems and software-defined solutions.

Customer expectations evolve toward greater system autonomy, reduced operational complexity, and improved cost-effectiveness. Mission operators increasingly demand plug-and-play solutions that minimize integration time and reduce ground support requirements.

Technology convergence between satellite control systems and terrestrial autonomous systems creates opportunities for cross-pollination of technologies and expertise. Advances in automotive and robotics industries contribute to improved sensors, processors, and control algorithms for space applications.

Market consolidation trends emerge as larger companies acquire specialized technology firms to enhance their control system capabilities and market reach. Strategic partnerships between established aerospace companies and innovative startups accelerate technology development and market penetration.

Comprehensive research methodology employed in analyzing the North America satellite attitude and orbit control system market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, technical specialists, and market participants across the satellite control system value chain. These discussions provide firsthand insights into market trends, technological developments, and competitive dynamics shaping the industry landscape.

Secondary research analysis encompasses review of industry publications, technical papers, patent filings, and regulatory documents to understand technology evolution and market structure. Government reports and space agency publications provide valuable data on mission requirements and procurement trends.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth and identify key trends. Quantitative analysis of historical data combined with qualitative insights from industry experts enables robust market projections and scenario planning.

Validation processes ensure data accuracy through cross-referencing multiple sources and verification with industry participants. Regular updates incorporate the latest market developments and technological advances to maintain current and relevant market intelligence.

Regional market distribution within North America reveals distinct patterns of development, investment, and technological leadership across the United States and Canada, with each country contributing unique strengths to the satellite attitude and orbit control system ecosystem.

United States dominance reflects the country’s substantial space program investments, large commercial space sector, and concentration of major aerospace manufacturers. The U.S. market accounts for approximately 78% of regional activity, driven by NASA programs, Department of Defense modernization initiatives, and thriving commercial space ventures in California, Texas, and Colorado.

California leadership stems from the concentration of space technology companies, research institutions, and venture capital funding in the region. Silicon Valley’s technology ecosystem contributes advanced software and artificial intelligence capabilities that enhance satellite control system performance and autonomy.

Canadian contributions focus on specialized component manufacturing, advanced control algorithms, and space robotics technologies. The Canadian Space Agency’s partnerships with industry drive innovation in autonomous satellite operations and precision control systems, representing approximately 22% of regional market activity.

Regional collaboration between U.S. and Canadian companies creates synergies in technology development and market access. Cross-border partnerships leverage complementary capabilities and shared expertise to develop comprehensive control system solutions for diverse satellite applications.

Geographic distribution of manufacturing and development activities reflects proximity to major space centers, research institutions, and customer bases. Emerging space hubs in states like Florida, Alabama, and Washington contribute to market growth and technological advancement.

Competitive dynamics in the North America satellite attitude and orbit control system market feature a diverse ecosystem of established aerospace giants, specialized technology companies, and emerging startups, each contributing unique capabilities and market approaches.

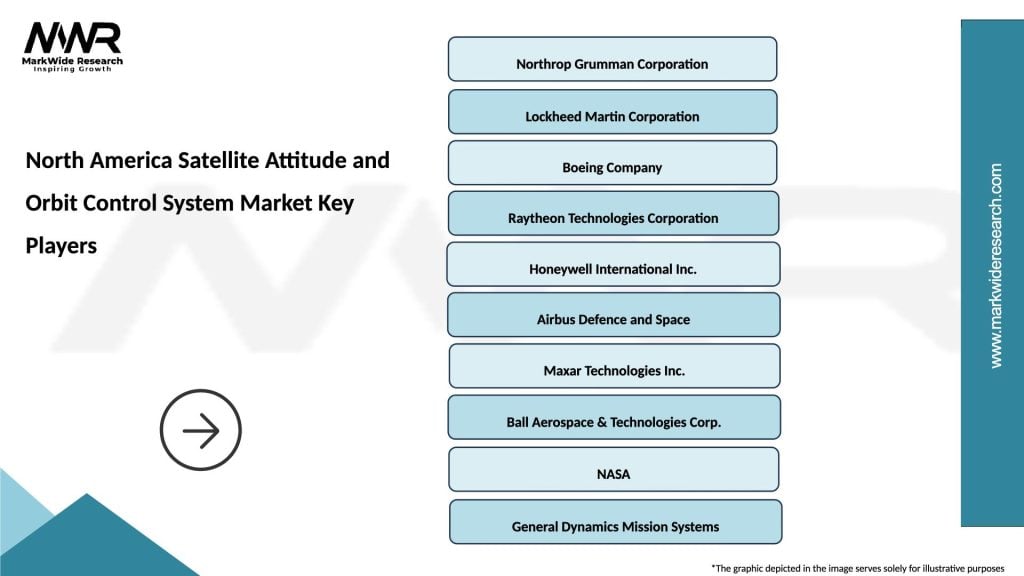

Market leaders include:

Competitive strategies emphasize technological differentiation, cost optimization, and customer-specific solutions. Companies invest heavily in research and development to maintain technological leadership while pursuing strategic partnerships to expand market reach and capabilities.

Innovation focus areas include artificial intelligence integration, autonomous operation capabilities, and miniaturization of control system components. Market participants compete on system performance, reliability, and total cost of ownership rather than initial purchase price alone.

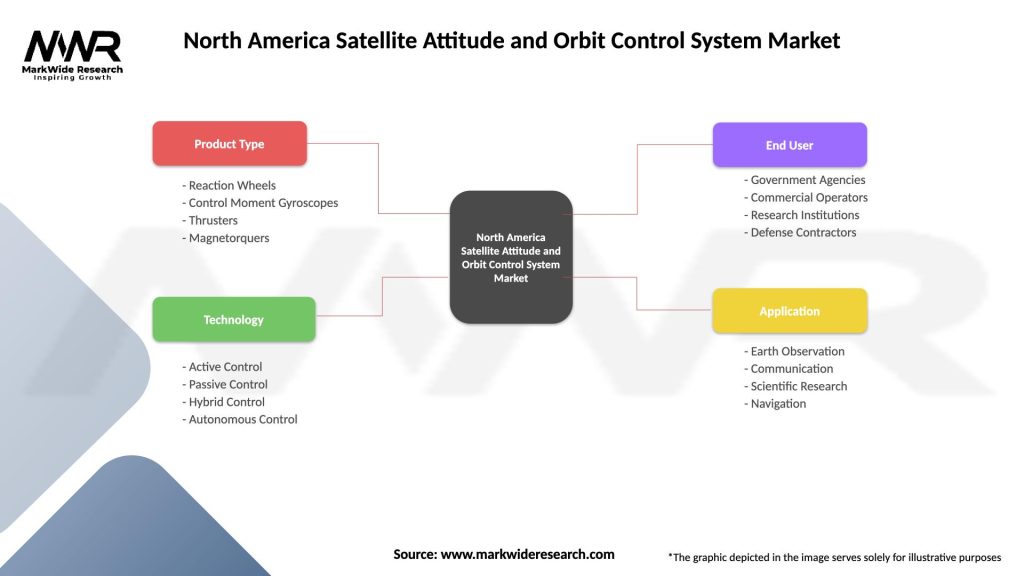

Market segmentation analysis reveals distinct categories within the North America satellite attitude and orbit control system market, each characterized by specific requirements, technologies, and growth patterns that shape overall market dynamics.

By Component Type:

By Satellite Size:

By Application:

Component category analysis reveals distinct growth patterns and technological trends across different elements of satellite attitude and orbit control systems, with each category contributing unique value propositions and market opportunities.

Sensor technologies experience rapid advancement driven by miniaturization and improved accuracy requirements. Star trackers represent the fastest-growing sensor category, with adoption rates increasing 18% annually as missions demand higher pointing accuracy. Advanced CMOS sensors and artificial intelligence-enhanced image processing enable more precise attitude determination while reducing power consumption and system complexity.

Actuator systems evolve toward greater efficiency and longer operational lifespans. Reaction wheel technology advances focus on magnetic bearing systems and improved momentum storage capabilities. Electric propulsion systems gain market share for orbit control applications, offering superior fuel efficiency and extended mission durations compared to traditional chemical thrusters.

Control electronics benefit from advances in space-qualified processors and radiation-hardened components. The integration of field-programmable gate arrays (FPGAs) enables flexible, reprogrammable control systems that can adapt to changing mission requirements throughout satellite operational lifespans.

Software solutions represent the fastest-growing market segment, with emphasis on autonomous operation capabilities and predictive maintenance algorithms. Machine learning integration enables adaptive control strategies that optimize system performance and extend component lifespans while reducing ground support requirements.

Industry participants and stakeholders in the North America satellite attitude and orbit control system market realize substantial benefits through technological advancement, market expansion, and strategic positioning within the growing space economy.

Satellite Operators benefit from:

System Manufacturers gain:

Government Agencies realize:

Comprehensive SWOT analysis of the North America satellite attitude and orbit control system market reveals strategic factors influencing market development and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends reshaping the North America satellite attitude and orbit control system market reflect broader changes in space technology, mission requirements, and industry structure that influence long-term market development.

Artificial Intelligence Integration emerges as a dominant trend, with AI adoption rates reaching 35% across new control system developments. Machine learning algorithms enable predictive maintenance, autonomous anomaly detection, and adaptive control strategies that optimize system performance while reducing operational costs and ground support requirements.

Miniaturization and Integration continue advancing as satellite platforms become smaller and more capable. System-on-chip solutions and highly integrated control units reduce size, weight, and power consumption while maintaining or improving performance capabilities. This trend particularly benefits small satellite applications and constellation deployments.

Software-Defined Systems gain prominence as operators seek greater flexibility and adaptability in satellite operations. Programmable control systems enable mission profile changes, performance optimization, and capability upgrades throughout satellite operational lifespans without hardware modifications.

Autonomous Operations become increasingly important as satellite constellations grow larger and more complex. Advanced autonomous capabilities reduce ground control requirements, enable faster response to anomalies, and support operations in communication-constrained environments such as deep space missions.

Sustainability Focus influences control system design as the industry addresses space debris concerns and end-of-life satellite disposal requirements. Control systems increasingly incorporate capabilities for precise deorbiting, collision avoidance, and responsible space operations.

Significant industry developments demonstrate the dynamic nature of the North America satellite attitude and orbit control system market, with major technological breakthroughs, strategic partnerships, and innovative solutions shaping market evolution.

Technology Breakthroughs include the development of next-generation star trackers with improved accuracy and reduced power consumption, advanced electric propulsion systems for precise orbit control, and AI-enhanced control algorithms that enable fully autonomous satellite operations. These innovations address growing demands for higher performance and reduced operational costs.

Strategic Partnerships between established aerospace companies and innovative startups accelerate technology development and market penetration. Collaborations focus on integrating cutting-edge technologies with proven space heritage to create comprehensive control system solutions for diverse applications.

Government Initiatives support market development through research funding, procurement programs, and regulatory frameworks that encourage innovation while ensuring mission success. Space Force establishment and NASA’s Artemis program create new requirements and opportunities for advanced control systems.

Commercial Investments in satellite constellation deployments drive demand for cost-effective, scalable control solutions. Major telecommunications and internet service providers invest billions in satellite infrastructure, creating substantial market opportunities for control system manufacturers.

International Collaborations expand market reach and technology sharing opportunities. Joint missions and technology development programs with international partners create new markets while advancing control system capabilities through shared expertise and resources.

Strategic recommendations from MarkWide Research analysis provide guidance for industry participants seeking to optimize their position in the evolving North America satellite attitude and orbit control system market landscape.

Technology Investment Priorities should focus on artificial intelligence integration, autonomous operation capabilities, and software-defined control systems. Companies investing in these areas position themselves for long-term competitive advantage as market demands shift toward greater autonomy and operational efficiency.

Market Positioning Strategies require differentiation through specialized capabilities rather than broad-based approaches. Success factors include deep expertise in specific application areas, strong customer relationships, and ability to provide integrated solutions that address complete mission requirements.

Partnership Development becomes increasingly important as market complexity grows and customer requirements become more sophisticated. Strategic alliances with complementary technology providers, satellite manufacturers, and mission operators create competitive advantages and market access opportunities.

International Expansion opportunities exist for North American companies with strong technology capabilities and established market positions. Export markets provide growth opportunities while diversifying revenue sources and reducing dependence on domestic market conditions.

Workforce Development investments are essential to address skilled labor shortages and maintain technological leadership. Companies should prioritize training programs, university partnerships, and talent retention strategies to ensure adequate human resources for continued growth and innovation.

Future market prospects for the North America satellite attitude and orbit control system sector indicate sustained growth driven by expanding space applications, technological advancement, and increasing commercial space activity throughout the forecast period.

Growth projections suggest the market will experience robust expansion with compound annual growth rates of 8.5% through 2030, driven by mega-constellation deployments, government modernization programs, and emerging applications in space manufacturing and tourism. The integration of advanced technologies will enable new mission capabilities while reducing operational costs.

Technology evolution will emphasize greater autonomy, improved efficiency, and enhanced reliability. Artificial intelligence and machine learning integration will become standard features, enabling predictive maintenance, autonomous anomaly response, and optimized mission operations with minimal ground intervention.

Market structure changes anticipate continued consolidation among traditional aerospace companies while new entrants focus on specialized niches and innovative technologies. The emergence of space-as-a-service business models will create new opportunities for control system providers to offer ongoing support and optimization services.

Application expansion into lunar missions, asteroid mining, and space manufacturing will create new requirements for advanced control systems capable of operating in challenging environments with extended communication delays. These applications will drive innovation in autonomous operation capabilities and robust system design.

Regulatory development will continue evolving to address growing space traffic, debris mitigation, and international coordination requirements. Control system designs will increasingly incorporate compliance capabilities for emerging regulatory frameworks while maintaining operational flexibility and mission effectiveness.

The North America satellite attitude and orbit control system market stands at the forefront of space technology advancement, driven by unprecedented growth in satellite deployments, technological innovation, and expanding commercial space activities. Market dynamics reflect the region’s leadership in space technology development and the critical importance of precise satellite control capabilities for diverse mission applications.

Market fundamentals remain strong, supported by substantial government investments, thriving commercial space ventures, and continuous technological advancement. The convergence of artificial intelligence, miniaturization, and autonomous systems creates new opportunities while addressing evolving customer requirements for greater efficiency and reduced operational complexity.

Competitive positioning requires strategic focus on technology differentiation, customer relationships, and integrated solution capabilities. Success in this market depends on balancing innovation with proven reliability while adapting to changing customer needs and emerging application areas.

Future success will favor companies that invest in advanced technologies, develop strategic partnerships, and maintain strong customer relationships while adapting to evolving market conditions. The North America satellite attitude and orbit control system market represents a critical component of the expanding space economy, with substantial opportunities for growth and innovation throughout the forecast period.

What is Satellite Attitude and Orbit Control System?

Satellite Attitude and Orbit Control System refers to the technology and processes used to control the orientation and position of satellites in space. This includes mechanisms for stabilization, maneuvering, and maintaining the desired orbit, which are critical for communication, Earth observation, and scientific missions.

What are the key players in the North America Satellite Attitude and Orbit Control System Market?

Key players in the North America Satellite Attitude and Orbit Control System Market include Northrop Grumman, Boeing, Lockheed Martin, and Honeywell, among others. These companies are involved in developing advanced systems for satellite control and navigation.

What are the growth factors driving the North America Satellite Attitude and Orbit Control System Market?

The growth of the North America Satellite Attitude and Orbit Control System Market is driven by increasing demand for satellite-based services, advancements in satellite technology, and the rising need for precise positioning in applications such as telecommunications and Earth monitoring.

What challenges does the North America Satellite Attitude and Orbit Control System Market face?

Challenges in the North America Satellite Attitude and Orbit Control System Market include the high costs associated with satellite launches and the complexity of developing reliable control systems. Additionally, regulatory hurdles and competition from emerging technologies pose significant challenges.

What opportunities exist in the North America Satellite Attitude and Orbit Control System Market?

Opportunities in the North America Satellite Attitude and Orbit Control System Market include the growing interest in small satellite technology and the potential for new applications in areas like space exploration and remote sensing. The increasing collaboration between private and public sectors also presents new avenues for growth.

What trends are shaping the North America Satellite Attitude and Orbit Control System Market?

Trends in the North America Satellite Attitude and Orbit Control System Market include the integration of artificial intelligence for improved control algorithms, the miniaturization of control systems for small satellites, and the development of more efficient propulsion systems to enhance maneuverability.

North America Satellite Attitude and Orbit Control System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Reaction Wheels, Control Moment Gyroscopes, Thrusters, Magnetorquers |

| Technology | Active Control, Passive Control, Hybrid Control, Autonomous Control |

| End User | Government Agencies, Commercial Operators, Research Institutions, Defense Contractors |

| Application | Earth Observation, Communication, Scientific Research, Navigation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Satellite Attitude and Orbit Control System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at