444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America roofing membranes market represents a critical component of the construction industry, experiencing substantial growth driven by increasing construction activities, infrastructure development, and rising awareness about energy-efficient building solutions. Roofing membranes serve as essential waterproofing barriers that protect buildings from weather elements while providing thermal insulation and energy efficiency benefits.

Market dynamics indicate robust expansion across residential, commercial, and industrial sectors, with the market demonstrating resilience despite economic fluctuations. The region’s focus on sustainable construction practices and stringent building codes has accelerated adoption of advanced membrane technologies. Growth rates consistently show positive trends, with the market expanding at a compound annual growth rate (CAGR) of 6.2% over the forecast period.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 22% market presence. The market encompasses various membrane types including thermoplastic polyolefin (TPO), ethylene propylene diene monomer (EPDM), polyvinyl chloride (PVC), and modified bitumen systems. Commercial applications account for the largest segment, representing nearly 45% of total market demand.

The North America roofing membranes market refers to the comprehensive industry encompassing the manufacturing, distribution, and installation of waterproof membrane systems designed to protect building structures from environmental elements while providing thermal insulation and energy efficiency benefits across residential, commercial, and industrial applications.

Roofing membranes are specialized materials engineered to create impermeable barriers on flat or low-slope roofing systems. These advanced materials combine durability, flexibility, and weather resistance to ensure long-term protection against water infiltration, UV radiation, temperature fluctuations, and mechanical stress. Modern membrane systems incorporate sophisticated polymer technologies that enhance performance characteristics including tear resistance, puncture resistance, and thermal stability.

Market scope encompasses single-ply membranes, modified bitumen systems, built-up roofing membranes, and liquid-applied membrane solutions. The industry serves diverse end-users including residential homeowners, commercial property developers, industrial facility operators, and institutional building managers seeking reliable roofing solutions that meet stringent performance standards and regulatory requirements.

Strategic analysis reveals the North America roofing membranes market positioned for sustained growth, driven by robust construction activity, infrastructure modernization initiatives, and increasing emphasis on energy-efficient building solutions. The market demonstrates strong fundamentals with consistent demand across multiple application segments and geographic regions.

Key growth drivers include rising commercial construction activity, increasing adoption of cool roofing technologies, and stringent building energy codes promoting high-performance membrane systems. Technology advancement in membrane formulations has resulted in products offering enhanced durability, improved installation efficiency, and superior long-term performance characteristics.

Market segmentation analysis indicates thermoplastic polyolefin (TPO) membranes leading with approximately 35% market share, followed by EPDM systems at 28% market presence. Commercial applications dominate demand patterns, while residential segment shows accelerating growth driven by renovation activities and new construction projects. Regional performance demonstrates consistent expansion across major metropolitan areas and secondary markets.

Competitive landscape features established manufacturers focusing on product innovation, strategic partnerships, and market expansion initiatives. Industry consolidation trends continue as companies seek to enhance market position through acquisitions and technology licensing agreements.

Market intelligence reveals several critical insights shaping the North America roofing membranes industry landscape. Primary insights demonstrate the market’s evolution toward high-performance, sustainable membrane solutions that address both immediate waterproofing needs and long-term energy efficiency objectives.

Primary market drivers propelling the North America roofing membranes market include robust construction industry growth, increasing focus on energy-efficient building solutions, and rising awareness about long-term roofing system performance. Construction activity across commercial, residential, and industrial sectors continues driving consistent membrane demand.

Energy efficiency mandates implemented by federal, state, and local governments are accelerating adoption of high-performance membrane systems that contribute to building energy savings. Cool roofing initiatives promote reflective membrane technologies that reduce cooling costs and environmental impact. These regulatory drivers create sustained demand for advanced membrane solutions.

Infrastructure modernization programs focusing on building renovation and retrofit projects generate significant membrane replacement demand. Aging building stock across North America requires systematic roof system upgrades, creating substantial market opportunities for membrane manufacturers and installation contractors.

Climate resilience concerns drive demand for membrane systems capable of withstanding extreme weather events including hurricanes, hailstorms, and temperature fluctuations. Insurance industry requirements increasingly specify high-performance membrane systems that demonstrate superior wind uplift resistance and impact durability.

Technological advancement in membrane formulations enables development of products offering enhanced performance characteristics, extended service life, and improved installation efficiency. Innovation drivers include polymer chemistry improvements, manufacturing process optimization, and integration of smart material technologies.

Market constraints affecting the North America roofing membranes industry include fluctuating raw material costs, skilled labor shortages, and intense price competition among manufacturers. Raw material volatility particularly impacts polymer-based membrane production costs, creating pricing pressures throughout the supply chain.

Installation challenges related to skilled labor availability continue constraining market growth potential. Technical expertise requirements for proper membrane installation and quality assurance limit the available contractor base, potentially delaying project completion and increasing installation costs.

Economic sensitivity of construction markets creates cyclical demand patterns that affect membrane sales volumes. Interest rate fluctuations and construction financing availability directly impact new building projects and renovation activities, influencing overall market demand.

Regulatory complexity across different jurisdictions creates compliance challenges for manufacturers and installers. Building code variations between states and municipalities require customized product specifications and installation procedures, increasing operational complexity and costs.

Competition intensity from alternative roofing systems including metal roofing, tile systems, and liquid-applied coatings creates market share pressure. Price sensitivity in certain market segments limits premium membrane adoption and constrains profit margins for manufacturers and distributors.

Emerging opportunities in the North America roofing membranes market include expanding applications in green building construction, integration with renewable energy systems, and development of smart membrane technologies. Sustainability trends create demand for eco-friendly membrane solutions that support LEED certification and environmental building standards.

Solar integration opportunities emerge as building owners seek membrane systems compatible with photovoltaic installations. Ballasted solar systems and mechanically attached solar arrays require specialized membrane solutions that accommodate equipment loads while maintaining waterproofing integrity.

Retrofit market expansion presents substantial growth potential as aging commercial and industrial buildings require roof system replacement. Energy efficiency upgrades drive demand for high-performance membrane systems that reduce building operating costs and improve occupant comfort.

Geographic expansion into secondary markets and rural areas offers growth opportunities as construction activity spreads beyond major metropolitan centers. Infrastructure development in emerging regions creates demand for reliable membrane solutions that meet local climate and performance requirements.

Technology innovation opportunities include development of self-healing membrane systems, integrated monitoring capabilities, and enhanced durability formulations. Smart building integration enables membrane systems to contribute to building automation and energy management systems.

Market dynamics in the North America roofing membranes industry reflect complex interactions between supply chain factors, technological advancement, regulatory requirements, and end-user preferences. Supply chain optimization initiatives focus on reducing lead times, improving product availability, and enhancing distribution efficiency.

Demand patterns demonstrate seasonal variations with peak activity during spring and summer construction seasons. Weather dependencies affect installation schedules and project timing, creating concentrated demand periods that challenge supply chain capacity and contractor availability.

Price dynamics reflect raw material cost fluctuations, manufacturing capacity utilization, and competitive positioning strategies. Value-based pricing models increasingly emphasize total cost of ownership including installation efficiency, energy savings, and extended service life benefits.

Innovation cycles drive product development timelines and market introduction strategies. Technology adoption rates vary across market segments, with commercial applications typically leading adoption of advanced membrane systems while residential markets show more gradual acceptance patterns.

Regulatory influences shape product specifications, installation requirements, and performance standards. Building code evolution creates opportunities for advanced membrane systems while potentially obsoleting older technologies that fail to meet updated requirements.

Research approach for analyzing the North America roofing membranes market employs comprehensive primary and secondary research methodologies to ensure accurate market assessment and reliable forecasting. Primary research includes extensive interviews with industry stakeholders including manufacturers, distributors, contractors, and end-users across diverse market segments.

Data collection methods encompass structured surveys, in-depth interviews, focus group discussions, and expert consultations with industry professionals possessing specialized knowledge of membrane technologies, market trends, and competitive dynamics. Secondary research involves analysis of industry publications, government statistics, trade association reports, and company financial disclosures.

Market sizing methodology utilizes bottom-up and top-down approaches to validate market estimates and ensure accuracy. Bottom-up analysis aggregates segment-specific data including product categories, application areas, and regional markets to develop comprehensive market assessments.

Forecasting models incorporate historical trend analysis, regression modeling, and scenario planning to project future market development. Validation processes include cross-referencing multiple data sources, expert review panels, and sensitivity analysis to ensure forecast reliability and accuracy.

Quality assurance procedures maintain data integrity through systematic verification processes, source authentication, and analytical consistency checks throughout the research process.

Regional market analysis reveals distinct patterns across North America, with the United States dominating market activity while Canada demonstrates steady growth in specific segments. United States market benefits from robust construction activity, favorable economic conditions, and supportive regulatory environment promoting energy-efficient building solutions.

Geographic distribution shows concentrated activity in major metropolitan areas including New York, Los Angeles, Chicago, Dallas, and Atlanta, where commercial construction and infrastructure development drive consistent membrane demand. Sunbelt regions demonstrate particularly strong growth due to population migration and business relocation trends.

Canadian market dynamics reflect distinct characteristics including harsh climate conditions that demand high-performance membrane systems, stringent building codes emphasizing energy efficiency, and growing focus on sustainable construction practices. Provincial variations create diverse market conditions with Ontario and British Columbia leading market activity.

Climate considerations significantly influence membrane selection and performance requirements across different regions. Northern regions require membrane systems capable of withstanding extreme temperature fluctuations and snow loads, while southern areas emphasize UV resistance and heat reflectivity characteristics.

Market maturity levels vary by region, with established markets showing steady replacement demand while emerging areas demonstrate higher growth rates driven by new construction activity and infrastructure development.

Competitive environment in the North America roofing membranes market features established manufacturers competing through product innovation, market expansion, and strategic partnerships. Market leaders maintain competitive advantages through comprehensive product portfolios, extensive distribution networks, and strong brand recognition.

Strategic initiatives include product line extensions, geographic expansion, acquisition activities, and technology licensing agreements. Innovation focus emphasizes development of high-performance membrane formulations, improved installation systems, and integrated building solutions.

Market segmentation analysis reveals diverse categories based on membrane type, application, installation method, and end-user requirements. Product segmentation encompasses thermoplastic membranes, thermoset membranes, modified bitumen systems, and liquid-applied solutions, each serving specific performance requirements and market applications.

By Membrane Type:

By Application:

By Installation Method:

Category analysis provides detailed insights into specific membrane types and their market performance characteristics. Thermoplastic membranes demonstrate strong growth driven by energy efficiency benefits, installation advantages, and long-term performance reliability.

TPO membrane systems continue gaining market share due to heat-reflective properties that reduce cooling costs and contribute to LEED certification requirements. Installation efficiency advantages including heat-weldable seams and lightweight characteristics appeal to contractors seeking productivity improvements.

EPDM membrane category maintains steady market presence based on proven performance history, competitive pricing, and broad contractor familiarity. Durability characteristics including UV resistance and flexibility across temperature ranges support long-term market demand.

PVC membrane systems serve specialized applications requiring chemical resistance, fire retardancy, and premium performance characteristics. Commercial kitchen applications and industrial facilities with chemical exposure represent key market segments for PVC membranes.

Modified bitumen category addresses markets requiring traditional installation methods while providing enhanced performance through polymer modification. Retrofit applications and regions with established contractor expertise support continued modified bitumen demand.

Liquid-applied membranes represent emerging category offering seamless application, complex geometry accommodation, and maintenance advantages. Growth potential exists in renovation projects and specialized applications requiring customized membrane solutions.

Industry participants in the North America roofing membranes market realize substantial benefits through participation in this growing sector. Manufacturers benefit from consistent demand patterns, opportunities for product innovation, and potential for market expansion across diverse application segments.

Distributor benefits include stable product demand, opportunities for value-added services, and potential for geographic expansion. Supply chain optimization initiatives enable distributors to improve inventory management, reduce carrying costs, and enhance customer service capabilities.

Contractor advantages encompass access to advanced membrane technologies, training and certification programs, and technical support services from manufacturers. Installation efficiency improvements through new membrane systems and application methods enhance contractor productivity and profitability.

Building owner benefits include reduced energy costs through high-performance membrane systems, extended roof service life, and improved building value. Energy efficiency gains from cool roofing membranes contribute to operational cost savings and environmental sustainability objectives.

End-user advantages encompass reliable waterproofing protection, improved indoor comfort conditions, and potential insurance premium reductions through high-performance roofing systems. Long-term value creation through durable membrane systems reduces lifecycle costs and maintenance requirements.

Environmental stakeholders benefit from sustainable membrane technologies that reduce building energy consumption, support recycling initiatives, and contribute to urban heat island mitigation efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the North America roofing membranes market include increasing adoption of sustainable membrane technologies, integration with renewable energy systems, and development of smart building solutions. Sustainability focus drives demand for recyclable membrane systems and environmentally responsible manufacturing processes.

Cool roofing trend continues gaining momentum as building owners seek energy-efficient solutions that reduce cooling costs and environmental impact. Reflective membrane technologies demonstrate measurable energy savings while contributing to LEED certification and green building standards.

Digital transformation initiatives include implementation of IoT-enabled monitoring systems that provide real-time membrane performance data. Predictive maintenance capabilities enable proactive roof system management and extended service life through optimized maintenance scheduling.

Installation innovation trends focus on self-adhering membrane systems, prefabricated components, and mechanized installation equipment that improve productivity and quality consistency. Labor efficiency improvements address skilled worker shortages while reducing installation time and costs.

Performance enhancement trends include development of hybrid membrane systems combining multiple technologies, enhanced puncture resistance formulations, and improved weather resistance characteristics. Durability improvements extend membrane service life and reduce lifecycle costs for building owners.

Recent industry developments demonstrate continued innovation and market evolution in the North America roofing membranes sector. Product launches include advanced TPO formulations with enhanced durability characteristics and improved installation efficiency features.

Strategic partnerships between membrane manufacturers and solar energy companies create integrated solutions for building-integrated photovoltaic systems. Technology collaboration initiatives focus on developing membrane systems optimized for solar installations while maintaining waterproofing integrity.

Manufacturing investments include facility expansions and production capacity increases to meet growing market demand. Automation initiatives improve manufacturing efficiency and product quality consistency while reducing production costs.

Acquisition activities continue as companies seek to expand market presence, acquire specialized technologies, and enhance distribution capabilities. Market consolidation trends create larger, more diversified companies with comprehensive product portfolios.

Regulatory developments include updated building codes emphasizing energy efficiency and extreme weather resistance. Industry standards evolution drives development of higher-performance membrane systems meeting enhanced requirements.

Sustainability initiatives include development of bio-based membrane materials, recycling programs for end-of-life membranes, and carbon footprint reduction efforts throughout the supply chain.

Strategic recommendations for North America roofing membranes market participants focus on innovation investment, market diversification, and operational efficiency improvements. MarkWide Research analysis suggests companies prioritize development of high-performance membrane systems that address evolving market requirements.

Product development priorities should emphasize energy efficiency characteristics, installation advantages, and long-term durability improvements. Technology investment in advanced polymer formulations and smart membrane capabilities positions companies for future market opportunities.

Market expansion strategies should target underserved geographic regions and emerging application segments including residential low-slope roofing and specialty industrial applications. Distribution network development enhances market coverage and customer service capabilities.

Partnership opportunities with solar energy companies, building automation providers, and green building consultants create value-added solutions that differentiate products in competitive markets. Collaboration initiatives enable access to new technologies and market segments.

Operational excellence initiatives should focus on supply chain optimization, manufacturing efficiency improvements, and quality management systems that ensure consistent product performance. Cost management strategies help maintain competitive pricing while preserving profit margins.

Sustainability integration throughout business operations addresses growing environmental concerns while creating competitive advantages in green building markets. Environmental initiatives support brand differentiation and regulatory compliance objectives.

Future market prospects for the North America roofing membranes industry remain positive, supported by continued construction activity, infrastructure modernization needs, and increasing emphasis on energy-efficient building solutions. Long-term growth projections indicate sustained market expansion at a CAGR of 6.2% through the forecast period.

Technology evolution will continue driving market development through advanced membrane formulations, smart building integration, and sustainable material innovations. Performance improvements in durability, energy efficiency, and installation characteristics will create competitive advantages for innovative manufacturers.

Market maturation in established segments will be offset by growth in emerging applications including residential low-slope roofing, green building systems, and integrated renewable energy solutions. Application diversification reduces market cyclicality and creates stable demand patterns.

Regulatory trends supporting energy efficiency and climate resilience will continue favoring high-performance membrane systems. Building code evolution creates opportunities for advanced technologies while potentially obsoleting older membrane systems.

Geographic expansion opportunities exist in secondary markets and rural areas experiencing construction growth. Market penetration strategies targeting underserved regions can drive incremental growth beyond established metropolitan markets.

MWR projections indicate the market will benefit from continued urbanization trends, infrastructure investment programs, and growing awareness of building energy efficiency benefits. Investment opportunities remain attractive for companies positioned to capitalize on evolving market dynamics and customer requirements.

Market assessment of the North America roofing membranes industry reveals a dynamic, growing sector characterized by technological innovation, diverse application opportunities, and strong fundamental drivers. Sustained growth prospects supported by construction industry expansion, energy efficiency mandates, and infrastructure modernization create favorable conditions for market participants.

Competitive advantages will increasingly depend on product innovation, operational efficiency, and market positioning strategies that address evolving customer requirements. Success factors include investment in advanced membrane technologies, development of comprehensive distribution networks, and establishment of strong contractor relationships.

Strategic priorities for industry participants should focus on sustainability integration, technology advancement, and market diversification initiatives that reduce cyclicality and enhance long-term growth potential. Innovation investment in high-performance membrane systems positions companies for continued market leadership.

Future opportunities encompass emerging applications in green building construction, integration with renewable energy systems, and development of smart membrane technologies that contribute to building automation systems. Market evolution toward higher-performance, more sustainable solutions creates differentiation opportunities for innovative manufacturers.

The North America roofing membranes market represents a compelling investment opportunity characterized by steady demand growth, technological advancement potential, and diverse application segments that provide stability and growth prospects for well-positioned industry participants.

What is Roofing Membranes?

Roofing membranes are waterproof layers used in roofing systems to protect buildings from water infiltration. They are typically made from materials such as thermoplastic, rubber, or bitumen and are essential for ensuring the longevity and durability of roofs.

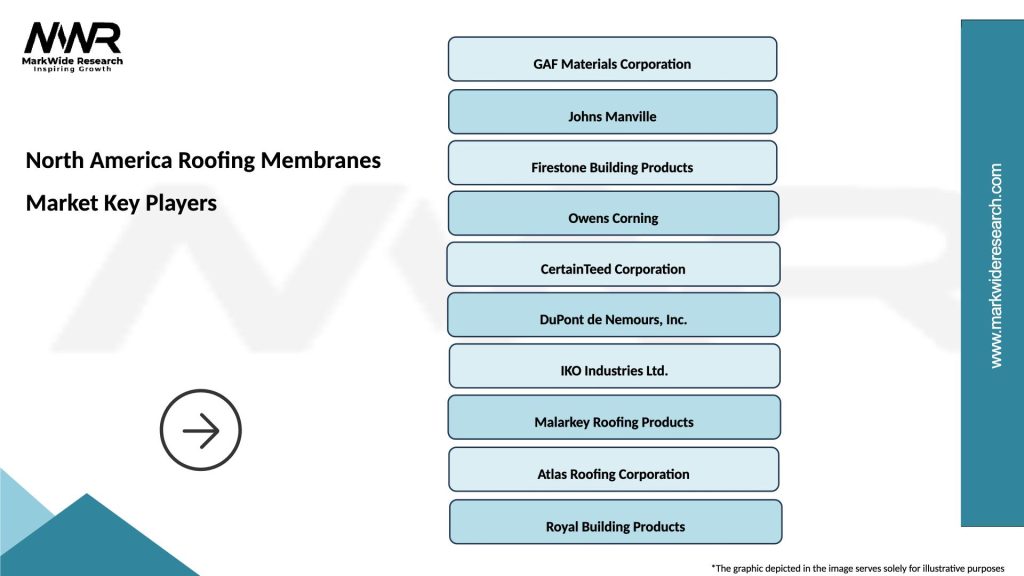

What are the key players in the North America Roofing Membranes Market?

Key players in the North America Roofing Membranes Market include GAF Materials Corporation, Johns Manville, and Carlisle Companies, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of the North America Roofing Membranes Market?

The main drivers of the North America Roofing Membranes Market include the increasing demand for energy-efficient roofing solutions and the growth of the construction industry. Additionally, the rising awareness of sustainable building practices is contributing to market growth.

What challenges does the North America Roofing Membranes Market face?

The North America Roofing Membranes Market faces challenges such as fluctuating raw material prices and stringent regulations regarding environmental impact. These factors can affect production costs and market stability.

What opportunities exist in the North America Roofing Membranes Market?

Opportunities in the North America Roofing Membranes Market include the development of advanced materials that enhance durability and energy efficiency. Additionally, the growing trend of green building certifications presents new avenues for market expansion.

What trends are shaping the North America Roofing Membranes Market?

Trends shaping the North America Roofing Membranes Market include the increasing adoption of cool roofing technologies and the integration of smart roofing systems. These innovations aim to improve energy efficiency and reduce urban heat islands.

North America Roofing Membranes Market

| Segmentation Details | Description |

|---|---|

| Product Type | EPDM, TPO, PVC, Modified Bitumen |

| Application | Commercial, Residential, Industrial, Institutional |

| Installation Method | Mechanically Attached, Fully Adhered, Ballasted, Liquid Applied |

| End User | Contractors, Architects, Building Owners, Developers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Roofing Membranes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at