444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America road freight transportation market represents a critical backbone of the continental economy, facilitating the movement of goods across vast distances and connecting manufacturers, retailers, and consumers. This dynamic sector encompasses various transportation modes including full truckload (FTL), less-than-truckload (LTL), and specialized freight services that collectively support the region’s robust supply chain infrastructure.

Market dynamics indicate substantial growth potential driven by increasing e-commerce activities, manufacturing resurgence, and evolving consumer demands. The sector demonstrates remarkable resilience, adapting to technological innovations such as autonomous vehicles, electric trucks, and advanced logistics management systems. Current trends show the market expanding at a steady 4.2% CAGR, reflecting strong underlying demand across diverse industry verticals.

Regional distribution reveals significant concentration in major industrial corridors, with the United States commanding approximately 85% market share while Canada contributes 12% and Mexico accounts for the remaining 3%. This distribution reflects the varying levels of industrial development and infrastructure maturity across the three nations, with cross-border trade representing an increasingly important growth driver.

The North America road freight transportation market refers to the comprehensive ecosystem of commercial vehicle operations dedicated to moving cargo via highways, roads, and surface transportation networks across the United States, Canada, and Mexico. This market encompasses various service categories including contract transportation, common carrier services, and private fleet operations that collectively facilitate the movement of manufactured goods, raw materials, and consumer products.

Core components of this market include trucking companies of all sizes, from large national carriers to regional and local operators, along with supporting infrastructure such as freight terminals, distribution centers, and logistics hubs. The market also encompasses specialized segments including refrigerated transport, hazardous materials handling, and oversized cargo movement, each requiring specific equipment and regulatory compliance.

Strategic positioning within the North American economy makes road freight transportation an indispensable component of regional commerce, supporting industries ranging from automotive manufacturing to retail distribution. The sector’s evolution reflects broader economic trends, technological advancement, and changing consumer behaviors that collectively drive demand for efficient, reliable transportation services.

Key performance indicators demonstrate the market’s robust health, with capacity utilization rates maintaining strong levels despite periodic fluctuations in demand. The integration of digital technologies has enhanced operational efficiency, with many carriers reporting 15-20% improvement in route optimization and fuel efficiency through advanced telematics and fleet management systems.

Competitive dynamics showcase a fragmented landscape where large national carriers coexist with thousands of smaller operators, creating opportunities for specialization and niche market development. This diversity enables the market to serve varied customer needs while maintaining competitive pricing and service quality across different segments.

Fundamental trends shaping the North America road freight transportation market reveal several critical insights that define current and future market dynamics:

Economic expansion across North America continues to fuel demand for road freight transportation services, with manufacturing output and consumer spending driving cargo volumes. The resurgence of domestic manufacturing creates additional transportation requirements as companies relocate production facilities closer to end markets, reducing dependence on international supply chains.

E-commerce proliferation represents a transformative force within the market, generating unprecedented demand for flexible delivery solutions and specialized transportation services. Online retailers require sophisticated logistics networks capable of handling diverse product categories, seasonal fluctuations, and evolving customer expectations for rapid delivery times.

Infrastructure development initiatives across the region support market growth through improved highway systems, expanded port facilities, and enhanced intermodal connections. These investments reduce transportation costs, improve service reliability, and enable carriers to expand their operational reach while maintaining competitive service levels.

Regulatory harmonization efforts, particularly through trade agreements like USMCA, facilitate cross-border freight movement and create opportunities for carriers to expand their service territories. Streamlined customs procedures and standardized safety regulations reduce operational complexity and enable more efficient international transportation services.

Driver shortage challenges represent the most significant constraint facing the North America road freight transportation market, with industry estimates suggesting a shortage affecting approximately 30% of carrier capacity. This shortage drives up labor costs, limits growth potential, and forces carriers to implement innovative recruitment and retention strategies.

Regulatory compliance costs continue to burden carriers, particularly smaller operators who lack economies of scale to absorb the expenses associated with electronic logging devices, drug testing programs, and safety monitoring systems. These requirements, while improving safety and operational standards, create financial pressures that can limit market participation.

Fuel price volatility creates ongoing operational challenges, as transportation companies must balance competitive pricing with fluctuating energy costs. While fuel surcharge mechanisms provide some protection, rapid price changes can disrupt profitability and complicate long-term contract negotiations.

Infrastructure limitations in certain regions constrain operational efficiency, with aging highway systems, inadequate parking facilities, and congested urban areas creating bottlenecks that increase transit times and operational costs. These challenges are particularly acute in high-density metropolitan areas where freight movement competes with passenger traffic.

Technology integration presents substantial opportunities for carriers to enhance operational efficiency and service quality. Advanced route optimization software, predictive maintenance systems, and real-time tracking capabilities enable companies to reduce costs while improving customer satisfaction and competitive positioning.

Sustainability initiatives create new market segments focused on environmentally responsible transportation. Companies investing in electric vehicles, alternative fuels, and carbon-neutral operations can differentiate their services and access premium pricing from environmentally conscious customers.

Specialized services offer opportunities for carriers to develop niche expertise in high-value segments such as temperature-controlled transport, pharmaceutical logistics, and hazardous materials handling. These specialized markets typically offer higher margins and more stable customer relationships compared to general freight services.

Cross-border expansion provides growth opportunities as trade relationships strengthen and regulatory barriers diminish. Carriers with expertise in international operations can capitalize on increasing trade volumes and serve customers seeking integrated North American transportation solutions.

Supply and demand equilibrium within the North America road freight transportation market reflects complex interactions between economic activity, carrier capacity, and operational efficiency. Current market conditions show capacity utilization rates maintaining healthy levels around 95%, indicating strong demand while preserving pricing power for carriers.

Competitive pressures drive continuous innovation and service improvement as carriers seek to differentiate their offerings. This competition benefits customers through improved service quality, competitive pricing, and expanded service options, while challenging carriers to maintain profitability through operational excellence.

Seasonal fluctuations create predictable patterns of demand variation, with peak shipping periods during holiday seasons and agricultural harvest times. Carriers must balance capacity planning with these cyclical demands while maintaining service quality during both peak and off-peak periods.

Technology disruption continues reshaping market dynamics as new solutions emerge for fleet management, customer communication, and operational optimization. Early adopters of advanced technologies often achieve competitive advantages through improved efficiency and enhanced service capabilities.

Comprehensive analysis of the North America road freight transportation market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, carrier operators, and logistics professionals to gather firsthand insights into market conditions and trends.

Secondary research incorporates analysis of government transportation statistics, industry association reports, and regulatory filings to establish quantitative baselines and validate market trends. This approach ensures comprehensive coverage of market segments and geographic regions within the scope of analysis.

Data validation processes include cross-referencing multiple sources, statistical analysis of trends, and expert review to ensure accuracy and reliability of market insights. MarkWide Research employs rigorous quality control measures to maintain the highest standards of research integrity and analytical precision.

Market modeling techniques incorporate econometric analysis, trend extrapolation, and scenario planning to develop forward-looking insights and growth projections. These methodologies enable comprehensive understanding of market dynamics and future development patterns.

United States dominance within the North American market reflects the country’s large economy, extensive highway infrastructure, and diverse industrial base. The U.S. market encompasses major freight corridors connecting manufacturing centers, ports, and population centers, with particularly strong activity along the Interstate Highway System and key trade routes.

Canadian market characteristics include longer average haul distances, seasonal variations due to weather conditions, and strong integration with U.S. supply chains. Canadian carriers often specialize in resource transportation and cross-border services, leveraging the country’s natural resource base and strategic geographic position.

Mexican market development shows rapid growth potential driven by manufacturing expansion, particularly in automotive and electronics sectors. The country’s integration into North American supply chains creates opportunities for carriers serving maquiladora operations and cross-border trade routes.

Cross-border integration continues strengthening as trade agreements facilitate freight movement and carriers develop integrated service networks. This integration creates opportunities for specialized carriers while challenging traditional operators to expand their geographic capabilities and regulatory expertise.

Market structure within the North America road freight transportation sector reflects a highly fragmented competitive environment with thousands of carriers ranging from large national operators to small local companies. This diversity creates a dynamic marketplace where companies compete on service quality, pricing, and specialized capabilities.

Leading carriers maintain competitive advantages through extensive network coverage, advanced technology systems, and comprehensive service offerings:

Service type segmentation reveals distinct market categories serving different customer needs and operational requirements:

By Service Type:

By Equipment Type:

By End-User Industry:

Full Truckload services represent the largest segment by volume, serving customers with sufficient cargo to justify dedicated vehicle capacity. This segment benefits from operational simplicity and direct routing, enabling competitive pricing and reliable service delivery. FTL carriers focus on efficiency optimization through advanced routing algorithms and fuel management systems.

Less-than-Truckload operations require sophisticated network management and consolidation expertise to achieve profitability. LTL carriers invest heavily in terminal infrastructure and sorting technology to efficiently combine shipments while maintaining service quality. This segment shows strong growth potential driven by e-commerce and small business shipping needs.

Specialized transportation categories command premium pricing through expertise in handling unique cargo requirements. Temperature-controlled transport serves growing demand from pharmaceutical and food industries, while hazardous materials transportation requires specialized equipment and regulatory compliance expertise.

Cross-border services represent a high-growth category benefiting from increased North American trade integration. Carriers specializing in international operations develop expertise in customs procedures, documentation requirements, and regulatory compliance across multiple jurisdictions.

Carriers benefit from diverse revenue opportunities across multiple market segments, enabling risk diversification and growth potential. Advanced technology adoption provides competitive advantages through improved operational efficiency, with many carriers achieving 12-18% cost reduction through fleet optimization and route planning systems.

Shippers gain access to comprehensive transportation solutions that support supply chain optimization and customer service enhancement. Reliable freight transportation enables businesses to maintain lean inventory levels, reduce warehousing costs, and respond quickly to market demand fluctuations.

Economic development benefits include job creation, infrastructure investment, and enhanced regional connectivity. The road freight industry supports millions of direct and indirect jobs while facilitating commerce that drives broader economic growth and competitiveness.

Technology providers find substantial opportunities in developing solutions for fleet management, logistics optimization, and operational efficiency. The industry’s embrace of digital transformation creates demand for innovative software, hardware, and service solutions that enhance carrier capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the industry as carriers invest in technology solutions for operational optimization and customer service enhancement. Artificial intelligence and machine learning applications enable predictive maintenance, demand forecasting, and route optimization that improve efficiency while reducing costs.

Sustainability focus drives adoption of alternative fuel vehicles, emission reduction strategies, and environmentally responsible operational practices. Carriers report achieving 20-25% fuel efficiency improvement through aerodynamic equipment, driver training, and route optimization technologies.

Last-mile innovation responds to e-commerce growth with specialized delivery solutions including urban consolidation centers, electric delivery vehicles, and flexible delivery options. These innovations address consumer expectations for convenient, fast delivery while managing urban congestion and environmental concerns.

Autonomous vehicle development progresses toward commercial deployment, with several carriers testing self-driving trucks on specific routes. While full automation remains years away, driver assistance technologies already enhance safety and efficiency in current operations.

Merger and acquisition activity continues reshaping the competitive landscape as carriers seek scale advantages and expanded service capabilities. Recent consolidation creates larger, more diversified companies capable of serving national customers while maintaining regional expertise and service quality.

Infrastructure investment programs across North America support long-term market growth through highway improvements, bridge replacements, and capacity expansion projects. These investments reduce transportation costs and improve service reliability while creating opportunities for carrier network optimization.

Regulatory developments include updated safety standards, environmental requirements, and cross-border facilitation measures. MWR analysis indicates these changes generally support market professionalization while creating compliance challenges for smaller operators.

Technology partnerships between carriers and solution providers accelerate innovation adoption and capability development. These collaborations enable rapid deployment of advanced systems while sharing development costs and implementation risks among industry participants.

Strategic recommendations for industry participants emphasize the importance of technology investment, operational efficiency, and service differentiation in maintaining competitive advantage. Carriers should prioritize digital transformation initiatives that enhance customer experience while reducing operational costs and improving asset utilization.

Market positioning strategies should focus on developing specialized capabilities in high-growth segments such as e-commerce logistics, cross-border transportation, and sustainable freight solutions. These segments offer premium pricing opportunities and more stable customer relationships compared to commodity freight services.

Operational excellence remains critical for long-term success, with emphasis on driver recruitment and retention, equipment optimization, and network efficiency. Companies achieving superior operational metrics typically outperform competitors in profitability and customer satisfaction measures.

Partnership development enables carriers to expand service capabilities without significant capital investment. Strategic alliances with technology providers, logistics companies, and complementary service providers create opportunities for enhanced customer value and market reach expansion.

Growth projections for the North America road freight transportation market indicate continued expansion driven by economic development, e-commerce growth, and infrastructure investment. MarkWide Research analysis suggests the market will maintain steady growth momentum with projected expansion at approximately 4.5% annually over the next five years.

Technology integration will accelerate, with autonomous vehicles, electric trucks, and advanced analytics becoming increasingly prevalent in carrier operations. These technologies promise significant efficiency improvements and cost reductions while addressing labor shortage challenges and environmental concerns.

Market consolidation trends are expected to continue as carriers seek scale advantages and enhanced service capabilities. This consolidation will likely create larger, more sophisticated operators while preserving opportunities for specialized niche players serving specific market segments.

Sustainability requirements will intensify, driving adoption of clean technologies and environmentally responsible operational practices. Carriers investing early in sustainable transportation solutions will likely achieve competitive advantages and access premium market segments focused on environmental responsibility.

The North America road freight transportation market represents a dynamic and essential component of the continental economy, demonstrating remarkable resilience and adaptability in the face of evolving challenges and opportunities. Current market conditions reflect strong underlying demand driven by economic growth, e-commerce expansion, and evolving supply chain requirements that collectively support continued sector development.

Strategic positioning within this market requires careful attention to technology adoption, operational efficiency, and service differentiation as competitive pressures intensify and customer expectations evolve. Successful carriers will be those that embrace innovation while maintaining focus on fundamental operational excellence and customer service quality.

Future success in the North America road freight transportation market will depend on the industry’s ability to address critical challenges including driver shortages, regulatory compliance, and environmental sustainability while capitalizing on opportunities presented by technological advancement and market growth. Companies that successfully navigate these dynamics will be well-positioned to participate in the sector’s continued evolution and expansion.

What is Road Freight Transportation?

Road Freight Transportation refers to the movement of goods and cargo via trucks and other vehicles on road networks. It plays a crucial role in supply chain logistics, facilitating the delivery of products across various industries such as retail, manufacturing, and agriculture.

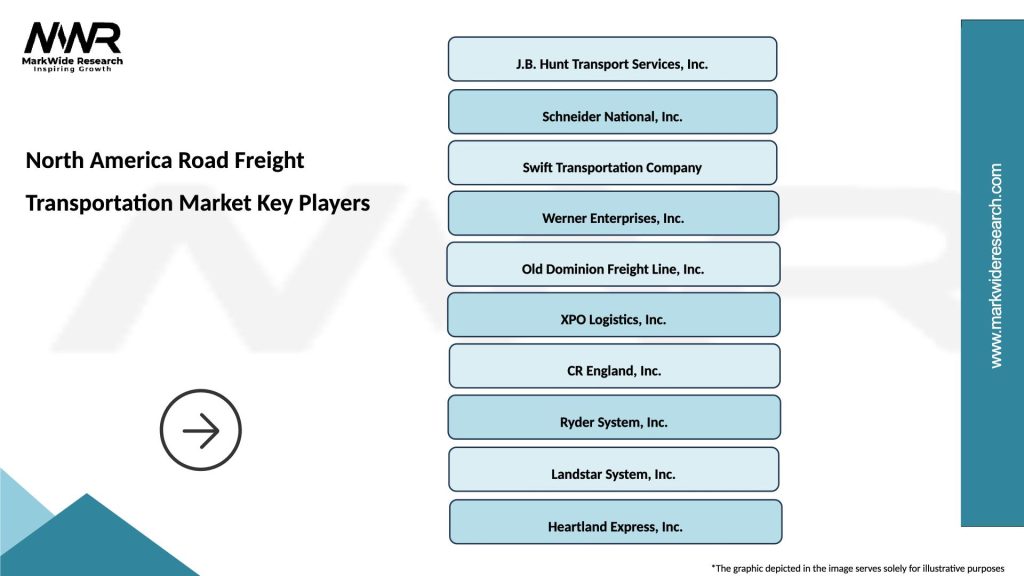

What are the key players in the North America Road Freight Transportation Market?

Key players in the North America Road Freight Transportation Market include companies like J.B. Hunt Transport Services, Schneider National, and XPO Logistics, among others. These companies provide a range of services including long-haul trucking, logistics management, and freight brokerage.

What are the main drivers of the North America Road Freight Transportation Market?

The main drivers of the North America Road Freight Transportation Market include the growth of e-commerce, increasing demand for just-in-time delivery, and the expansion of manufacturing activities. These factors contribute to a higher volume of freight movement on roadways.

What challenges does the North America Road Freight Transportation Market face?

Challenges in the North America Road Freight Transportation Market include rising fuel costs, driver shortages, and regulatory compliance issues. These factors can impact operational efficiency and profitability for transportation companies.

What opportunities exist in the North America Road Freight Transportation Market?

Opportunities in the North America Road Freight Transportation Market include advancements in technology such as autonomous vehicles and route optimization software. Additionally, the growing emphasis on sustainability presents avenues for eco-friendly transportation solutions.

What trends are shaping the North America Road Freight Transportation Market?

Trends shaping the North America Road Freight Transportation Market include the increasing adoption of digital freight platforms, the integration of IoT for real-time tracking, and a shift towards more sustainable practices. These trends are transforming how freight is managed and delivered.

North America Road Freight Transportation Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Trucks, Trailers, Vans, Buses |

| Service Type | Full Truckload, Less Than Truckload, Intermodal, Expedited |

| End User | Retail, Manufacturing, Construction, Agriculture |

| Fuel Type | Diesel, Gasoline, Electric, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Road Freight Transportation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at