444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America road assistance insurance market provides coverage and assistance services to drivers in the event of vehicle breakdowns, accidents, and emergencies while on the road. These insurance products offer peace of mind to motorists by providing timely roadside assistance, towing services, and other support in unexpected situations, contributing to road safety and driver satisfaction.

Meaning

Road assistance insurance in North America refers to insurance policies that offer coverage and support services to drivers facing vehicle-related emergencies and breakdowns while traveling on roads. These insurance products typically include services such as towing, tire changes, fuel delivery, lockout assistance, and emergency repairs to help drivers get back on the road quickly and safely.

Executive Summary

The North America road assistance insurance market is experiencing steady growth, driven by increasing vehicle ownership, rising demand for convenience and safety services, and the need for reliable roadside assistance solutions. Key market insights, including consumer preferences, technological advancements, and competitive dynamics, are essential for insurance providers to tailor their offerings and capture market opportunities effectively.

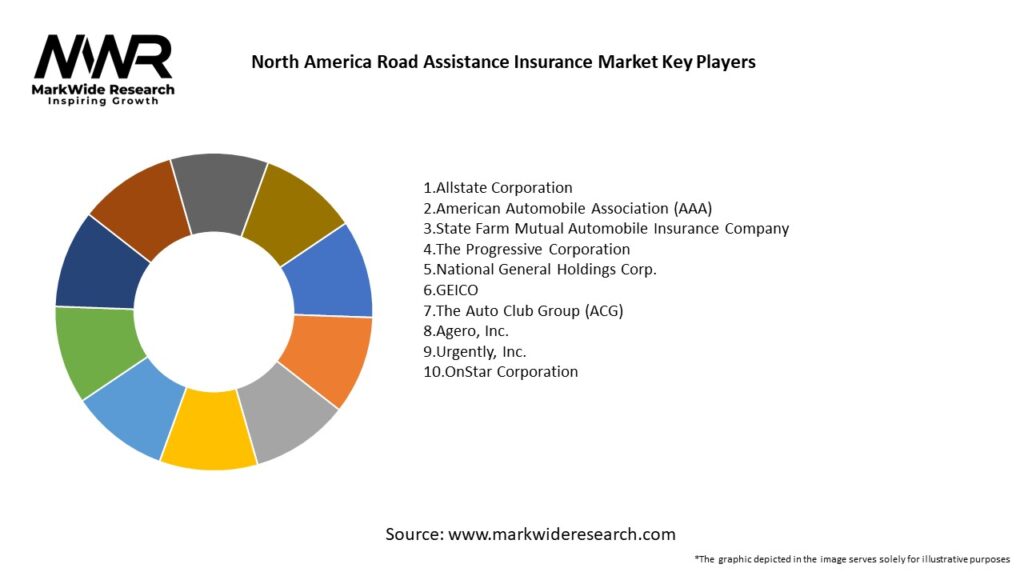

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

Regional Analysis

Competitive Landscape

Leading Companies in the North America Road Assistance Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America Road Assistance Insurance Market can be segmented based on:

Category-wise Insights

Different categories within the market include:

Key Benefits for Industry Participants and Stakeholders

The North America Road Assistance Insurance Market offers several benefits:

SWOT Analysis

A SWOT analysis of the North America Road Assistance Insurance Market highlights strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Key trends influencing the North America Road Assistance Insurance Market include:

Covid-19 Impact

The COVID-19 pandemic has impacted the North America Road Assistance Insurance Market in the following ways:

Key Industry Developments

Recent developments in the North America Road Assistance Insurance Market include:

Analyst Suggestions

Analysts recommend the following strategies for stakeholders in the North America Road Assistance Insurance Market:

Future Outlook

The North America Road Assistance Insurance Market is expected to continue growing, driven by increasing vehicle ownership, technological advancements, and rising consumer demand for personalized services. Key factors influencing the market include innovations in technology, expansion of service offerings, and the focus on customer experience. Stakeholders should invest in technology, expand service coverage, and foster partnerships to capitalize on future opportunities and drive success in the road assistance insurance sector.

Conclusion

The North America Road Assistance Insurance Market represents a dynamic and evolving sector characterized by technological advancements, increasing vehicle ownership, and rising consumer demand for personalized services. As the market continues to develop, stakeholders should focus on innovation, strategic partnerships, and customization efforts to capitalize on growth opportunities and enhance service delivery. The ongoing progress in technology, investment, and market trends will play a key role in shaping the future of road assistance insurance in North America.

What is Road Assistance Insurance?

Road Assistance Insurance provides coverage for drivers in the event of vehicle breakdowns, accidents, or emergencies. It typically includes services such as towing, fuel delivery, and locksmith assistance.

What are the key players in the North America Road Assistance Insurance Market?

Key players in the North America Road Assistance Insurance Market include AAA, Allstate, and Geico, among others. These companies offer various road assistance plans tailored to meet the needs of different drivers.

What are the main drivers of growth in the North America Road Assistance Insurance Market?

The growth of the North America Road Assistance Insurance Market is driven by increasing vehicle ownership, rising consumer awareness about safety, and the growing demand for convenient roadside services.

What challenges does the North America Road Assistance Insurance Market face?

Challenges in the North America Road Assistance Insurance Market include high competition among providers, fluctuating insurance regulations, and the need for continuous technological advancements to meet customer expectations.

What opportunities exist in the North America Road Assistance Insurance Market?

Opportunities in the North America Road Assistance Insurance Market include the integration of telematics for real-time assistance, partnerships with automotive manufacturers, and the expansion of services to include electric vehicle support.

What trends are shaping the North America Road Assistance Insurance Market?

Trends in the North America Road Assistance Insurance Market include the rise of mobile apps for service requests, increased focus on customer experience, and the adoption of AI-driven solutions for efficient service delivery.

North America Road Assistance Insurance Market

| Segmentation Details | Description |

|---|---|

| Service Type | Towing, Fuel Delivery, Tire Change, Lockout Service |

| Customer Type | Individual Drivers, Fleet Operators, Commercial Vehicles, Motorcyclists |

| Coverage Type | Basic Coverage, Premium Coverage, Family Plans, Pay-Per-Use |

| Vehicle Type | Passenger Cars, SUVs, Trucks, Vans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at