444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America residential lighting control system market represents a rapidly evolving sector within the broader smart home automation industry. This dynamic market encompasses sophisticated technologies that enable homeowners to manage, customize, and optimize their residential lighting through various control mechanisms including wireless protocols, smartphone applications, and integrated home automation platforms. Market growth is driven by increasing consumer awareness of energy efficiency, rising adoption of smart home technologies, and growing demand for enhanced comfort and convenience in residential environments.

Regional dynamics across North America show particularly strong adoption rates in urban areas, with the United States leading market penetration at approximately 68% market share, followed by Canada with 22% market share, and Mexico contributing 10% market share. The market demonstrates robust expansion potential as consumers increasingly prioritize intelligent lighting solutions that offer both functional benefits and aesthetic enhancement capabilities.

Technology integration continues to advance rapidly, with wireless communication protocols such as Zigbee, Z-Wave, and WiFi-based systems gaining significant traction among residential users. The convergence of Internet of Things (IoT) technologies with traditional lighting infrastructure has created unprecedented opportunities for innovation and market expansion throughout the North American region.

The residential lighting control system market refers to the comprehensive ecosystem of technologies, devices, and solutions that enable automated and manual control of lighting fixtures within residential properties. These systems encompass a wide range of components including smart switches, dimmers, sensors, controllers, and integrated software platforms that work together to provide enhanced lighting management capabilities for homeowners.

Core functionality includes remote control capabilities, scheduling automation, energy monitoring, scene creation, and integration with broader home automation systems. Modern residential lighting control systems leverage advanced communication protocols to create seamless connectivity between various lighting elements, allowing users to customize their lighting environment according to specific preferences, activities, and time-based requirements.

System architecture typically involves centralized or distributed control mechanisms that can manage multiple lighting zones throughout a residence, providing granular control over individual fixtures or groups of lights while maintaining user-friendly interfaces through mobile applications, wall-mounted panels, or voice-activated assistants.

Market momentum in the North American residential lighting control system sector continues to accelerate, driven by technological advancements and changing consumer preferences toward smart home solutions. The market demonstrates strong growth trajectory with projected expansion at a compound annual growth rate of 12.4% through the forecast period, reflecting increasing adoption across diverse residential segments.

Key market drivers include rising energy consciousness among consumers, government initiatives promoting energy-efficient technologies, and declining costs of smart lighting components. The integration of artificial intelligence and machine learning capabilities into lighting control systems has created new opportunities for predictive automation and personalized user experiences.

Competitive landscape features both established lighting manufacturers and emerging technology companies, creating a dynamic environment for innovation and market expansion. Strategic partnerships between technology providers and traditional lighting companies have accelerated product development and market penetration across North American residential markets.

Regional analysis indicates strong market performance across major metropolitan areas, with particular strength in technology-forward regions such as California, New York, and Ontario. Rural market penetration remains an emerging opportunity as wireless infrastructure improvements expand coverage and reduce implementation barriers.

Technology adoption patterns reveal significant consumer preference for wireless-based lighting control solutions, with 78% of new installations utilizing wireless communication protocols rather than hardwired systems. This trend reflects growing demand for flexible, scalable solutions that can be easily installed and modified without extensive electrical work.

Energy efficiency mandates across North American jurisdictions continue to drive adoption of intelligent lighting control systems. Government initiatives promoting smart grid integration and energy conservation have created favorable regulatory environments that encourage residential investment in advanced lighting technologies. These policies often include rebates and incentives that reduce the initial cost barrier for consumers.

Consumer lifestyle evolution toward greater home automation and connectivity has fundamentally shifted expectations regarding residential lighting systems. Modern homeowners increasingly view lighting control as an essential component of smart home ecosystems, driving demand for integrated solutions that seamlessly connect with other automated systems including HVAC, security, and entertainment platforms.

Technology cost reduction has made sophisticated lighting control systems accessible to broader consumer segments. Manufacturing scale improvements and component standardization have significantly reduced system costs while simultaneously improving functionality and reliability, creating compelling value propositions for residential users.

Aesthetic customization demand reflects growing consumer interest in personalized living environments. Advanced lighting control systems enable users to create custom lighting scenes that enhance architectural features, support various activities, and adapt to changing preferences throughout different times of day or seasons.

Installation complexity remains a significant barrier for many potential users, particularly in older residential properties where electrical infrastructure may require substantial modifications. The need for professional installation services can significantly increase total system costs and create scheduling challenges that delay implementation timelines.

Interoperability challenges between different manufacturers’ systems continue to create consumer confusion and limit market expansion. The lack of universal standards across lighting control platforms can result in compatibility issues that restrict system flexibility and future upgrade options for homeowners.

Initial investment costs for comprehensive lighting control systems can be substantial, particularly for whole-home implementations. While long-term energy savings often justify the investment, the upfront capital requirement creates adoption barriers for price-sensitive consumer segments.

Technical complexity associated with advanced lighting control systems can overwhelm less tech-savvy consumers. The learning curve required to effectively utilize sophisticated features may discourage adoption among certain demographic groups, limiting overall market penetration potential.

Retrofit market expansion presents substantial growth opportunities as millions of existing North American homes represent potential upgrade candidates. The development of easier-to-install, wireless-based solutions specifically designed for retrofit applications could significantly accelerate market penetration in established residential areas.

Integration with renewable energy systems creates compelling opportunities for lighting control systems to optimize energy consumption patterns. Smart lighting that automatically adjusts based on solar panel output or battery storage levels can enhance overall home energy efficiency and appeal to environmentally conscious consumers.

Artificial intelligence integration offers potential for predictive lighting automation that learns user preferences and automatically adjusts lighting based on occupancy patterns, time of day, and activity recognition. These advanced capabilities could differentiate premium products and justify higher price points.

Commercial-residential crossover technologies developed for commercial applications can be adapted for residential use, bringing advanced features such as daylight harvesting, occupancy sensing, and energy analytics to home environments. This technology transfer could accelerate innovation and expand available feature sets.

Supply chain evolution continues to reshape the residential lighting control market as traditional lighting manufacturers collaborate with technology companies to develop integrated solutions. These partnerships combine lighting expertise with advanced control technologies, creating more comprehensive and user-friendly systems for residential applications.

Consumer education initiatives by manufacturers and utility companies are increasing awareness of lighting control benefits and capabilities. Demonstration programs, online resources, and professional training programs help overcome knowledge barriers that previously limited market adoption rates.

Regulatory landscape changes including updated building codes and energy efficiency standards are creating both opportunities and challenges for market participants. New construction requirements for smart-ready electrical infrastructure facilitate easier lighting control system installation while existing building upgrades may require additional compliance considerations.

Technology convergence trends are blurring traditional boundaries between lighting control, home automation, and building management systems. This convergence creates opportunities for comprehensive solutions while also increasing competitive pressure from adjacent market segments.

Primary research activities encompassed comprehensive surveys of residential lighting control system users, installers, and manufacturers across major North American markets. Data collection included structured interviews with industry executives, technical specialists, and end-users to gather insights on market trends, adoption patterns, and future requirements.

Secondary research analysis incorporated extensive review of industry publications, regulatory documents, patent filings, and company financial reports to establish market context and validate primary research findings. This approach ensured comprehensive coverage of market dynamics and competitive landscape factors.

Market sizing methodology utilized bottom-up analysis based on installation data, product shipments, and regional adoption rates to establish accurate market scope and growth projections. Cross-validation through multiple data sources ensured reliability and accuracy of market estimates.

Forecast modeling incorporated historical trends, regulatory impacts, technology adoption curves, and economic factors to develop robust projections for market growth and segment evolution. Scenario analysis addressed potential market disruptions and alternative development pathways.

United States market leadership reflects strong consumer adoption of smart home technologies and favorable regulatory environments in many states. California leads adoption rates due to aggressive energy efficiency mandates and high technology acceptance, while Texas and Florida show rapid growth driven by new construction activity and retrofit opportunities.

Canadian market development demonstrates steady growth with particular strength in urban centers such as Toronto, Vancouver, and Montreal. Provincial energy efficiency programs and federal smart grid initiatives support market expansion, while harsh winter conditions create demand for automated lighting systems that enhance comfort and security.

Mexican market emergence shows increasing potential as economic development and urbanization drive demand for modern residential amenities. Growing middle-class populations in major cities are beginning to adopt smart home technologies, creating opportunities for lighting control system providers to establish market presence.

Regional preferences vary significantly across North America, with northern regions showing higher adoption of automated systems for seasonal lighting adjustments, while southern markets focus more on energy efficiency and cooling load reduction through intelligent lighting management.

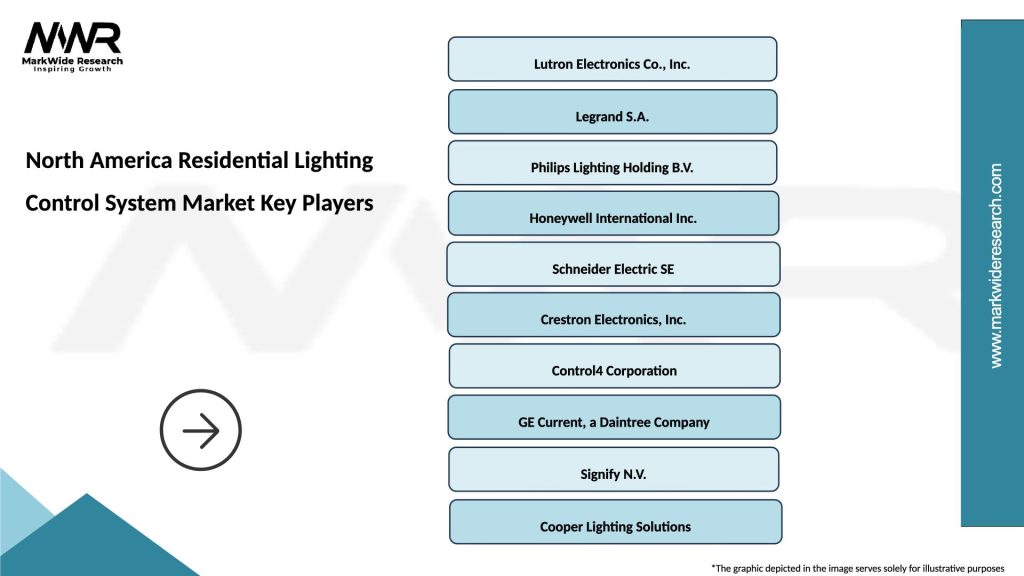

Market leadership is distributed among several key categories of companies, each bringing distinct strengths and market approaches to residential lighting control systems.

Competitive strategies focus on product differentiation through advanced features, ease of installation, and integration capabilities with popular smart home platforms. Companies are investing heavily in wireless technologies, mobile applications, and artificial intelligence to create compelling user experiences.

By Technology:

By Component:

By Application:

Wireless technology dominance continues to reshape the residential lighting control market, with wireless solutions accounting for approximately 74% of new installations. This preference reflects consumer demand for flexible, scalable systems that can be easily modified or expanded without extensive electrical work.

Smart switch popularity has emerged as a key market driver, offering consumers an accessible entry point into lighting control systems. These devices provide immediate functionality improvements while maintaining compatibility with existing lighting fixtures and electrical infrastructure.

Integration capabilities have become critical differentiators, with systems offering seamless connectivity to popular smart home platforms showing significantly higher adoption rates. Voice control integration and smartphone app functionality are now considered essential features rather than premium options.

Energy monitoring features are increasingly important to consumers, with systems providing detailed energy consumption analytics showing 38% higher customer satisfaction rates compared to basic control-only systems. This trend reflects growing environmental consciousness and desire for energy cost optimization.

Manufacturers benefit from expanding market opportunities as consumer adoption of smart home technologies accelerates. The shift toward integrated solutions creates opportunities for companies to develop comprehensive product portfolios that address multiple aspects of residential automation and control.

Installers and contractors gain access to new revenue streams through lighting control system installation and maintenance services. The technical complexity of advanced systems creates demand for professional expertise while recurring service opportunities provide ongoing business relationships with customers.

Utility companies benefit from reduced peak demand and improved grid stability as intelligent lighting systems enable better load management and energy efficiency. Demand response capabilities in advanced systems can provide valuable grid services during peak usage periods.

Homeowners realize multiple benefits including energy cost savings, enhanced comfort and convenience, improved security through automated lighting schedules, and increased property values through smart home technology integration. MarkWide Research analysis indicates that homes with comprehensive lighting control systems command premium resale values in many markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Voice control integration has become a dominant trend, with major voice assistant platforms driving consumer expectations for hands-free lighting control. This integration extends beyond simple on/off commands to include scene selection, dimming control, and schedule management through natural language interfaces.

Artificial intelligence adoption is enabling predictive lighting automation that learns user preferences and automatically adjusts lighting based on occupancy patterns, time of day, and activity recognition. These systems can optimize energy consumption while maintaining user comfort and convenience.

Circadian rhythm lighting represents an emerging trend that adjusts color temperature and intensity throughout the day to support natural sleep-wake cycles. This health-focused approach to lighting control appeals to wellness-conscious consumers and creates differentiation opportunities for premium products.

Energy analytics integration provides users with detailed insights into lighting energy consumption patterns, enabling informed decisions about usage optimization and system configuration. Real-time monitoring and historical analysis help users maximize energy savings and system efficiency.

Matter protocol adoption is revolutionizing interoperability in smart home systems, with major manufacturers committing to support this universal standard. This development promises to eliminate compatibility issues between different brands and platforms, potentially accelerating market adoption.

Edge computing integration is enabling more sophisticated local processing capabilities in lighting control systems, reducing dependence on cloud connectivity while improving response times and privacy protection. This trend addresses consumer concerns about data security and system reliability.

Sustainability initiatives by major manufacturers are driving development of environmentally responsible products and packaging. These efforts include recyclable materials, reduced packaging waste, and energy-efficient manufacturing processes that appeal to environmentally conscious consumers.

Partnership strategies between lighting manufacturers and technology companies continue to accelerate innovation and market expansion. These collaborations combine traditional lighting expertise with advanced control technologies to create more comprehensive and user-friendly solutions.

Market participants should prioritize user experience improvements through simplified installation processes and intuitive control interfaces. Reducing technical complexity while maintaining advanced functionality will be critical for expanding market adoption beyond early technology adopters.

Investment in interoperability standards and protocols will become increasingly important as consumers demand seamless integration between different smart home systems. Companies that embrace open standards and universal compatibility will likely gain competitive advantages in the evolving market landscape.

Focus on retrofit solutions represents a significant opportunity for market expansion, as existing homes vastly outnumber new construction projects. Developing products specifically designed for easy retrofit installation could unlock substantial market potential.

MWR analysis suggests that companies should invest in artificial intelligence and machine learning capabilities to enable predictive automation features that differentiate premium products and justify higher price points while delivering genuine value to users.

Market evolution toward more intelligent, integrated lighting control systems will continue as artificial intelligence capabilities mature and consumer expectations for smart home functionality increase. The convergence of lighting control with broader home automation systems will create more comprehensive and valuable solutions for residential users.

Technology advancement in wireless communication protocols, sensor capabilities, and user interfaces will drive continued innovation and market expansion. The development of more sophisticated yet user-friendly systems will help overcome current adoption barriers and expand market penetration.

Regulatory support for energy efficiency and smart grid integration will continue to provide favorable market conditions for lighting control system adoption. Government incentives and building code updates will likely accelerate market growth while driving innovation toward more efficient and capable systems.

Long-term growth prospects remain strong as the fundamental drivers of energy efficiency, convenience, and smart home integration continue to influence consumer preferences. The market is projected to maintain robust expansion with a compound annual growth rate exceeding 11% through the next decade, driven by technology improvements and expanding consumer awareness.

The North America residential lighting control system market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, consumer lifestyle changes, and regulatory support for energy efficiency. Strong market fundamentals including increasing smart home adoption, declining technology costs, and growing environmental consciousness create favorable conditions for continued expansion.

Key success factors for market participants include focus on user experience, interoperability standards, and innovative features that deliver genuine value to residential users. Companies that can effectively balance advanced functionality with ease of use while maintaining competitive pricing will be best positioned to capitalize on market opportunities.

Future market development will likely be characterized by increased integration with broader smart home ecosystems, enhanced artificial intelligence capabilities, and continued focus on energy efficiency and sustainability. The convergence of lighting control with other home automation systems will create more comprehensive solutions that address multiple aspects of residential comfort, security, and efficiency.

What is Residential Lighting Control System?

Residential lighting control systems are technologies that allow homeowners to manage and automate their lighting. These systems can include smart switches, dimmers, and sensors that enhance energy efficiency and convenience.

What are the key players in the North America Residential Lighting Control System Market?

Key players in the North America Residential Lighting Control System Market include Lutron Electronics, Philips Lighting, and Legrand, among others. These companies are known for their innovative solutions and extensive product offerings in lighting control.

What are the main drivers of growth in the North America Residential Lighting Control System Market?

The main drivers of growth in the North America Residential Lighting Control System Market include the increasing demand for energy-efficient solutions, the rise of smart home technologies, and consumer preferences for enhanced convenience and control over lighting.

What challenges does the North America Residential Lighting Control System Market face?

Challenges in the North America Residential Lighting Control System Market include the high initial costs of installation, the complexity of integrating various technologies, and potential consumer resistance to adopting new systems.

What opportunities exist in the North America Residential Lighting Control System Market?

Opportunities in the North America Residential Lighting Control System Market include the growing trend of home automation, advancements in wireless technology, and increasing consumer awareness of energy conservation.

What trends are shaping the North America Residential Lighting Control System Market?

Trends shaping the North America Residential Lighting Control System Market include the integration of IoT technology, the rise of voice-activated controls, and the development of energy management systems that optimize lighting usage.

North America Residential Lighting Control System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Switches, Dimmers, Sensors, Controllers |

| Technology | Zigbee, Z-Wave, Wi-Fi, Bluetooth |

| End User | Homeowners, Builders, Contractors, Designers |

| Installation | Retrofit, New Construction, DIY, Professional |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Residential Lighting Control System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at