444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America real estate brokerage market represents a dynamic and evolving sector that serves as the backbone of property transactions across the United States and Canada. This comprehensive market encompasses traditional brokerage services, digital platforms, and innovative technology-driven solutions that facilitate residential and commercial property transactions. Market dynamics indicate robust growth driven by demographic shifts, technological advancement, and changing consumer preferences in property buying and selling behaviors.

Regional market characteristics demonstrate significant variations across metropolitan areas, with major cities like New York, Los Angeles, Toronto, and Vancouver leading transaction volumes. The market has experienced substantial transformation through digital disruption, with online platforms and mobile applications revolutionizing how consumers interact with real estate professionals. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% over the forecast period, driven by population growth, urbanization trends, and technological innovation.

Technology integration has become a defining characteristic of the modern brokerage landscape, with artificial intelligence, virtual reality, and big data analytics reshaping service delivery models. The market encompasses full-service brokerages, discount brokerages, and emerging hybrid models that combine traditional expertise with digital efficiency. Consumer behavior patterns show increasing demand for transparent pricing, streamlined processes, and enhanced digital experiences throughout the property transaction journey.

The North America real estate brokerage market refers to the comprehensive ecosystem of licensed professionals, firms, and technology platforms that facilitate property transactions between buyers and sellers across residential and commercial real estate segments. This market encompasses traditional full-service brokerages, discount brokerages, online platforms, and hybrid service models that provide varying levels of support throughout the property transaction process.

Core market components include licensed real estate agents, broker-dealers, multiple listing services (MLS), transaction management platforms, and supporting technology infrastructure. The market operates within a highly regulated environment governed by state and provincial licensing requirements, professional standards, and consumer protection regulations. Service delivery models range from comprehensive full-service offerings that include marketing, negotiation, and transaction management to limited-service options focused on specific transaction elements.

Market participants include national franchise networks, regional brokerages, independent agents, and technology-enabled platforms that connect consumers directly with real estate professionals. The ecosystem supports various stakeholder groups including homebuyers, sellers, investors, commercial property owners, and institutional clients seeking professional real estate services across diverse property types and transaction complexities.

Market leadership in the North America real estate brokerage sector is characterized by a mix of established franchise networks, regional powerhouses, and innovative technology platforms disrupting traditional service models. The market demonstrates resilience through economic cycles while adapting to changing consumer expectations and technological capabilities. Digital transformation has accelerated significantly, with 78% of consumers now beginning their property search online before engaging with real estate professionals.

Competitive dynamics reflect ongoing consolidation among traditional brokerages alongside the emergence of technology-driven disruptors offering alternative service models. Major market participants continue investing heavily in digital platforms, customer relationship management systems, and data analytics capabilities to enhance service delivery and operational efficiency. Commission structures face increasing pressure from discount brokerages and technology platforms offering reduced-fee alternatives to traditional full-service models.

Regional variations demonstrate distinct market characteristics, with urban centers experiencing higher transaction volumes and more competitive pricing pressures compared to suburban and rural markets. The market benefits from favorable demographic trends including millennial homebuying activity, population migration patterns, and continued urbanization across major metropolitan areas. Technology adoption rates show 85% of brokerages now utilizing cloud-based transaction management systems to improve operational efficiency and client communication.

Consumer preference shifts toward digital-first experiences have fundamentally altered how real estate brokerages deliver services and engage with clients throughout the transaction process. The market demonstrates increasing segmentation between premium full-service offerings and cost-effective limited-service alternatives, creating opportunities for specialized service providers targeting specific consumer segments.

Demographic trends serve as primary growth catalysts for the North America real estate brokerage market, with millennial generation homebuying activity reaching peak levels and driving sustained transaction volume growth. Population migration patterns toward suburban and secondary metropolitan areas have expanded market opportunities beyond traditional urban centers, creating demand for brokerage services in previously underserved markets.

Technology advancement continues accelerating market evolution through enhanced digital platforms, artificial intelligence applications, and mobile-first service delivery models that improve operational efficiency and customer experience. The integration of virtual reality, augmented reality, and 3D visualization technologies has transformed property marketing and buyer engagement processes, enabling more effective remote property evaluation and decision-making.

Economic factors including historically low interest rates, employment growth, and wealth accumulation have supported robust housing market activity and increased demand for professional real estate services. Investment activity from both domestic and international buyers has expanded market opportunities, particularly in commercial real estate segments and high-value residential markets across major metropolitan areas.

Regulatory changes promoting market transparency and consumer protection have increased demand for professional expertise and compliance support throughout property transactions. The complexity of modern real estate transactions, including environmental assessments, financing requirements, and legal documentation, reinforces the value proposition of experienced brokerage professionals in facilitating successful property transfers.

Commission pressure from discount brokerages and technology platforms offering reduced-fee alternatives continues challenging traditional full-service brokerage models, forcing established firms to justify premium pricing through enhanced service delivery and demonstrated value creation. Market saturation in certain metropolitan areas has intensified competition among real estate professionals, leading to reduced profit margins and increased marketing expenditures.

Regulatory complexity across different states and provinces creates operational challenges for multi-jurisdictional brokerages, requiring significant compliance investments and specialized expertise to navigate varying legal requirements. Technology implementation costs associated with digital platform development, data security, and system integration represent substantial capital investments that may strain smaller brokerage operations.

Economic volatility and market cyclicality expose the brokerage industry to periodic downturns that significantly impact transaction volumes and revenue generation. Consumer behavior changes toward self-service options and direct property transactions through online platforms threaten traditional intermediary roles, requiring brokerages to demonstrate unique value propositions.

Talent acquisition challenges in attracting and retaining qualified real estate professionals have intensified as market competition increases and alternative career opportunities expand. The industry faces ongoing challenges related to professional training, licensing requirements, and maintaining service quality standards across diverse market conditions and transaction complexities.

Technology integration presents significant opportunities for brokerages to differentiate services through advanced digital platforms, artificial intelligence applications, and enhanced customer experience delivery. Market expansion into underserved geographic regions and demographic segments offers growth potential for brokerages willing to invest in specialized service capabilities and local market expertise.

Commercial real estate segments demonstrate substantial growth opportunities as businesses adapt to changing workplace requirements and investment patterns shift toward alternative property types. International investment flows into North American real estate markets create opportunities for brokerages specializing in cross-border transactions and foreign investor services.

Ancillary services including property management, mortgage brokerage, and real estate investment advisory present revenue diversification opportunities for traditional brokerages seeking to expand service offerings. Data monetization through market analytics, consumer insights, and predictive modeling capabilities offers new revenue streams for brokerages with substantial transaction databases.

Partnership opportunities with technology companies, financial institutions, and service providers enable brokerages to enhance capabilities while sharing development costs and market risks. The growing importance of environmental, social, and governance (ESG) factors in real estate decisions creates opportunities for brokerages developing specialized expertise in sustainable property transactions and green building certifications.

Competitive intensity within the North America real estate brokerage market continues escalating as traditional players face challenges from technology-enabled disruptors offering alternative service models and pricing structures. Market fragmentation remains high despite ongoing consolidation efforts, with thousands of independent brokerages and agents competing alongside national franchise networks and emerging digital platforms.

Technology disruption has fundamentally altered market dynamics through the introduction of artificial intelligence, machine learning, and automated valuation models that enhance operational efficiency and decision-making capabilities. Consumer empowerment through enhanced access to market data and property information has shifted negotiating dynamics and increased expectations for transparent, value-added services from real estate professionals.

Regulatory evolution continues shaping market dynamics through new disclosure requirements, consumer protection measures, and professional standards that influence operational procedures and service delivery models. Economic sensitivity remains a defining characteristic of market dynamics, with transaction volumes and pricing structures closely correlated to broader economic conditions, interest rate environments, and consumer confidence levels.

Innovation cycles demonstrate accelerating pace as market participants invest in digital transformation initiatives, customer experience enhancements, and operational efficiency improvements. The market exhibits increasing polarization between premium full-service providers and cost-effective limited-service alternatives, creating opportunities for specialized positioning and niche market development.

Comprehensive market analysis employed multiple research methodologies including primary data collection through industry surveys, expert interviews, and stakeholder consultations across diverse market segments and geographic regions. Secondary research incorporated analysis of industry reports, regulatory filings, company financial statements, and market intelligence databases to establish baseline market understanding and trend identification.

Quantitative analysis utilized statistical modeling techniques to project market growth rates, segment performance, and competitive positioning across different service categories and regional markets. Qualitative assessment incorporated expert opinions, industry best practices, and strategic analysis to understand market dynamics, competitive strategies, and future development trajectories.

Data validation processes ensured accuracy and reliability through cross-referencing multiple sources, expert review, and consistency checking across different analytical frameworks. Market segmentation analysis examined performance variations across service types, geographic regions, property categories, and customer segments to identify growth opportunities and competitive advantages.

Trend analysis incorporated historical performance data, current market indicators, and forward-looking projections to establish comprehensive understanding of market evolution and future development potential. The research methodology emphasized practical insights and actionable intelligence to support strategic decision-making by market participants and stakeholders.

United States market dominates the North America real estate brokerage sector, accounting for approximately 89% of regional transaction volume and demonstrating diverse characteristics across different metropolitan areas and state markets. California, Texas, and Florida represent the largest state markets by transaction volume, driven by population growth, economic development, and favorable demographic trends supporting sustained housing market activity.

Northeast corridor including New York, Boston, and Washington D.C. demonstrates high-value transaction characteristics with premium service offerings and sophisticated market participants. Western markets show strong technology adoption rates and innovative service delivery models, reflecting the region’s entrepreneurial culture and tech industry influence on business practices.

Canadian market represents approximately 11% of regional activity with concentration in major metropolitan areas including Toronto, Vancouver, and Montreal. Regulatory differences between Canadian provinces and U.S. states create distinct operational requirements and market characteristics that influence service delivery models and competitive strategies.

Cross-border opportunities continue expanding as international investment flows increase and technology platforms enable more efficient transaction processing across national boundaries. Regional specialization trends show increasing focus on local market expertise, with successful brokerages developing deep knowledge of specific geographic areas and property types to differentiate their service offerings.

Market leadership reflects a diverse competitive environment combining established franchise networks, regional powerhouses, and innovative technology platforms disrupting traditional service models. National franchise systems maintain significant market presence through brand recognition, standardized processes, and comprehensive agent support programs.

Competitive strategies increasingly focus on technology differentiation, customer experience enhancement, and operational efficiency improvements to maintain market position and profitability. Innovation initiatives include artificial intelligence implementation, mobile platform development, and integrated service delivery models that combine traditional expertise with digital capabilities.

Service type segmentation demonstrates distinct market characteristics across full-service brokerages, discount brokerages, and hybrid service models that combine traditional expertise with technology-enabled efficiency. Property type segmentation shows residential markets accounting for approximately 82% of transaction volume, with commercial real estate representing the remaining market share.

By Service Model:

By Property Type:

Geographic segmentation reveals significant variations in market characteristics, with urban centers demonstrating higher transaction volumes and more competitive pricing pressures compared to suburban and rural markets.

Residential brokerage services continue dominating market activity with sustained growth driven by demographic trends, lifestyle changes, and favorable financing conditions. Technology integration has transformed residential service delivery through virtual tours, electronic documentation, and enhanced communication platforms that improve customer experience and operational efficiency.

Commercial real estate brokerage demonstrates specialized expertise requirements and higher transaction values, creating opportunities for brokerages with deep market knowledge and institutional client relationships. Investment property services show growing importance as individual and institutional investors seek professional guidance for portfolio development and asset management.

Luxury market segments require specialized marketing capabilities, international reach, and sophisticated client service standards that command premium pricing and generate higher profit margins. First-time homebuyer services represent significant growth opportunities as millennials enter peak homebuying years and require educational support throughout the transaction process.

Relocation services demonstrate steady demand from corporate clients and individuals relocating for employment opportunities, requiring specialized expertise in multiple market areas and comprehensive support services. New construction sales offer partnership opportunities with developers and builders seeking professional marketing and sales support for residential and commercial projects.

Professional real estate agents benefit from enhanced technology platforms, comprehensive training programs, and marketing support systems that improve productivity and client satisfaction levels. Brokerage firms gain competitive advantages through operational efficiency improvements, cost reduction opportunities, and enhanced service delivery capabilities that differentiate their market positioning.

Consumer benefits include improved access to market information, streamlined transaction processes, and enhanced transparency throughout property buying and selling experiences. Technology integration provides consumers with convenient digital tools, real-time communication capabilities, and comprehensive property data to support informed decision-making.

Market efficiency improvements result from better information flow, reduced transaction costs, and enhanced matching between buyers and sellers through advanced search and recommendation algorithms. Professional development opportunities enable real estate professionals to expand expertise, increase earning potential, and build sustainable career paths within the evolving industry landscape.

Stakeholder value creation occurs through improved market liquidity, reduced transaction friction, and enhanced price discovery mechanisms that benefit all participants in real estate markets. Innovation benefits include new service delivery models, alternative pricing structures, and specialized offerings that address diverse consumer needs and preferences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation acceleration continues reshaping service delivery models through artificial intelligence, machine learning, and automated processes that enhance efficiency and customer experience. Mobile-first strategies demonstrate increasing importance as consumers expect seamless smartphone access to property information, communication tools, and transaction management capabilities.

Sustainability focus reflects growing consumer interest in environmentally responsible properties and energy-efficient buildings, creating opportunities for brokerages developing green real estate expertise. Data analytics utilization enables more sophisticated market analysis, pricing strategies, and customer targeting approaches that improve business outcomes and competitive positioning.

Virtual reality integration transforms property marketing and buyer engagement through immersive experiences that reduce physical showing requirements and expand market reach. Blockchain technology exploration offers potential improvements in transaction security, documentation, and settlement processes, though widespread adoption remains in early stages.

Subscription-based models emerge as alternatives to traditional commission structures, providing predictable revenue streams and different value propositions for consumers. Artificial intelligence applications show 67% adoption rates among leading brokerages for customer service, property valuation, and market analysis functions, demonstrating the technology’s growing importance in competitive differentiation.

Merger and acquisition activity continues consolidating market share among regional brokerages seeking scale advantages and technology capabilities to compete with national networks. Technology partnerships between traditional brokerages and proptech companies accelerate innovation adoption and service enhancement initiatives across the industry.

Regulatory developments including new disclosure requirements and consumer protection measures influence operational procedures and compliance investments across market participants. Commission structure evolution reflects ongoing pressure from alternative service models and consumer demand for transparent, value-based pricing approaches.

International expansion efforts by major brokerage networks create global service capabilities and cross-border referral opportunities for domestic market participants. Workforce development initiatives address talent acquisition challenges through enhanced training programs, technology tools, and career development support systems.

Sustainability integration includes green building certifications, energy efficiency assessments, and environmental impact considerations becoming standard components of property marketing and valuation processes. Data security investments respond to increasing cybersecurity threats and regulatory requirements for protecting consumer information throughout digital transaction processes.

MarkWide Research analysis indicates that successful market participants should prioritize technology investment and digital transformation initiatives to maintain competitive positioning in an increasingly sophisticated marketplace. Strategic recommendations emphasize the importance of developing specialized expertise in high-growth segments while maintaining operational efficiency through process automation and system integration.

Market positioning strategies should focus on clear value proposition development that differentiates services from low-cost alternatives while demonstrating measurable benefits to consumers. Technology adoption requires careful evaluation of return on investment and integration capabilities to ensure successful implementation and user adoption across agent networks.

Geographic expansion opportunities should be evaluated based on demographic trends, economic development patterns, and competitive landscape analysis to identify markets with favorable growth potential. Partnership development with technology providers, financial institutions, and service companies can enhance capabilities while sharing development costs and market risks.

Professional development investments in agent training, certification programs, and continuing education support long-term competitive advantages and service quality maintenance. Customer experience enhancement through digital tools, communication platforms, and streamlined processes addresses evolving consumer expectations and competitive pressures from technology-enabled alternatives.

Market growth projections indicate continued expansion driven by favorable demographic trends, technology advancement, and evolving consumer preferences toward professional real estate services. Technology integration will accelerate with artificial intelligence adoption expected to reach 85% of major brokerages within the next five years, fundamentally transforming service delivery and operational efficiency.

Competitive landscape evolution suggests increasing polarization between premium full-service providers and cost-effective technology-enabled alternatives, creating opportunities for specialized positioning and niche market development. Consumer behavior changes toward digital-first experiences will continue driving innovation in mobile platforms, virtual services, and automated transaction processing.

Regulatory developments are expected to enhance market transparency and consumer protection while potentially increasing compliance costs and operational complexity for market participants. International investment flows will create ongoing opportunities for brokerages developing cross-border expertise and global service capabilities.

MWR projections suggest the market will experience continued consolidation among smaller players while technology-driven disruptors gain market share through innovative service models and competitive pricing strategies. Sustainability considerations will become increasingly important as environmental awareness influences property selection and valuation processes across all market segments.

The North America real estate brokerage market stands at a pivotal transformation point, balancing traditional service excellence with technological innovation to meet evolving consumer expectations and competitive pressures. Market dynamics demonstrate resilience through economic cycles while adapting to digital disruption and changing demographic patterns that reshape service delivery requirements and business models.

Technology integration has emerged as a critical success factor, enabling enhanced customer experiences, operational efficiency improvements, and competitive differentiation in an increasingly crowded marketplace. Professional expertise remains valuable as transaction complexity increases and consumers seek trusted guidance through sophisticated property markets and regulatory environments.

Future success will depend on market participants’ ability to combine traditional relationship-building skills with advanced technology capabilities, creating hybrid service models that deliver superior value propositions. The market’s continued evolution toward greater transparency, efficiency, and customer-centricity positions well-adapted brokerages for sustained growth and profitability in the dynamic North America real estate brokerage market landscape.

What is Real Estate Brokerage?

Real estate brokerage refers to the business of helping clients buy, sell, or lease properties. Brokers and agents facilitate transactions, provide market insights, and assist with negotiations in the real estate sector.

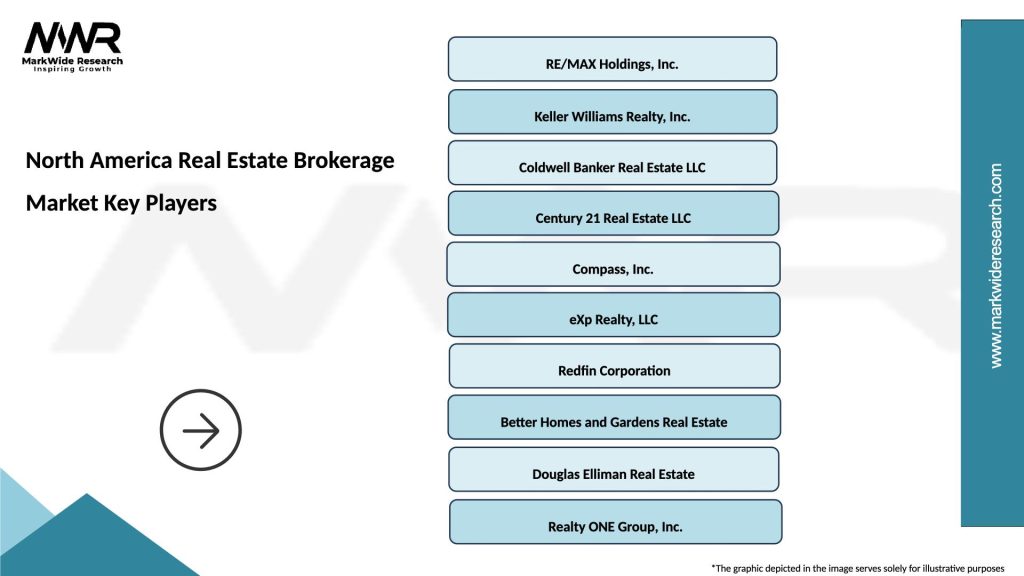

What are the key players in the North America Real Estate Brokerage Market?

Key players in the North America Real Estate Brokerage Market include Keller Williams Realty, RE/MAX, and Coldwell Banker. These companies are known for their extensive networks and comprehensive services in residential and commercial real estate, among others.

What are the main drivers of growth in the North America Real Estate Brokerage Market?

The main drivers of growth in the North America Real Estate Brokerage Market include increasing urbanization, rising disposable incomes, and a growing demand for residential properties. Additionally, technological advancements in property listings and virtual tours are enhancing consumer engagement.

What challenges does the North America Real Estate Brokerage Market face?

Challenges in the North America Real Estate Brokerage Market include regulatory changes, market saturation, and fluctuating interest rates. These factors can impact transaction volumes and profitability for brokerage firms.

What opportunities exist in the North America Real Estate Brokerage Market?

Opportunities in the North America Real Estate Brokerage Market include the expansion of online platforms and the integration of artificial intelligence in property management. Additionally, the growing trend of remote work is influencing residential property demand in suburban areas.

What trends are shaping the North America Real Estate Brokerage Market?

Trends shaping the North America Real Estate Brokerage Market include the rise of digital marketing strategies, increased focus on sustainability in property development, and the use of big data analytics for market predictions. These trends are transforming how brokerages operate and engage with clients.

North America Real Estate Brokerage Market

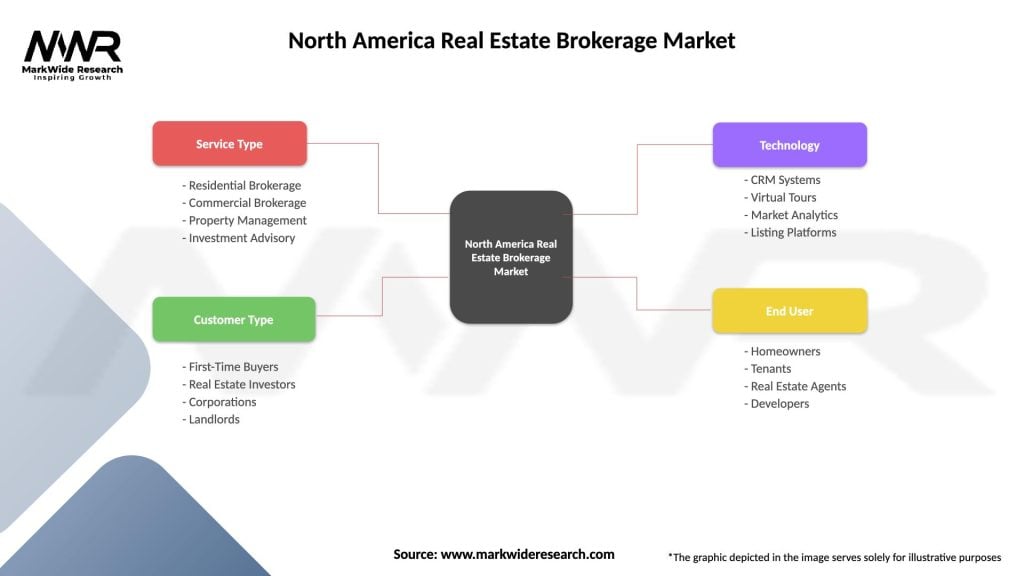

| Segmentation Details | Description |

|---|---|

| Service Type | Residential Brokerage, Commercial Brokerage, Property Management, Investment Advisory |

| Customer Type | First-Time Buyers, Real Estate Investors, Corporations, Landlords |

| Technology | CRM Systems, Virtual Tours, Market Analytics, Listing Platforms |

| End User | Homeowners, Tenants, Real Estate Agents, Developers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Real Estate Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at