444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America ready-to-drink (RTD) beverages market represents one of the most dynamic and rapidly evolving segments within the broader beverage industry. This comprehensive market encompasses a diverse range of products including RTD teas, coffees, energy drinks, functional beverages, alcoholic RTD cocktails, and premium bottled beverages that cater to the increasingly busy lifestyles of North American consumers. The market has experienced remarkable transformation driven by changing consumer preferences toward convenience, health consciousness, and premium quality offerings.

Market dynamics indicate substantial growth potential across multiple beverage categories, with the RTD segment demonstrating resilience and adaptability to emerging consumer trends. The convenience factor remains a primary driver, as consumers increasingly seek beverages that align with their on-the-go lifestyles while maintaining quality and nutritional value. Innovation in packaging, flavor profiles, and functional ingredients has positioned RTD beverages as a preferred choice among millennials and Generation Z consumers who prioritize both convenience and health benefits.

Regional distribution shows strong market penetration across the United States and Canada, with urban centers leading consumption patterns. The market exhibits a compound annual growth rate (CAGR) of approximately 6.8%, reflecting robust consumer demand and continuous product innovation. Premium positioning has become increasingly important as consumers demonstrate willingness to pay higher prices for organic, natural, and functionally enhanced RTD beverages that deliver superior taste and health benefits.

The North America ready-to-drink beverages market refers to the comprehensive industry segment encompassing all pre-packaged, shelf-stable or refrigerated beverages that require no preparation before consumption. These products are manufactured, processed, and packaged for immediate consumption, offering consumers maximum convenience while maintaining product quality, safety, and nutritional integrity throughout the supply chain.

RTD beverages include both alcoholic and non-alcoholic options, ranging from traditional soft drinks and juices to innovative functional beverages, craft cocktails, premium teas, specialty coffees, and health-focused drinks. The market definition encompasses products sold through various retail channels including supermarkets, convenience stores, vending machines, online platforms, and foodservice establishments across the United States and Canada.

Product categories within this market span multiple beverage types, each targeting specific consumer needs and preferences. The definition includes carbonated soft drinks, still beverages, energy and sports drinks, RTD tea and coffee products, functional and wellness beverages, and the rapidly growing segment of alcoholic RTD cocktails and seltzers that have gained significant market traction in recent years.

The North America RTD beverages market demonstrates exceptional growth momentum driven by evolving consumer lifestyles, increasing health consciousness, and demand for convenient, high-quality beverage options. Market analysis reveals significant opportunities across multiple product segments, with particular strength in functional beverages, premium RTD coffees, and alcoholic RTD cocktails that cater to sophisticated consumer palates and lifestyle preferences.

Key market drivers include the growing trend toward health and wellness, with approximately 72% of consumers actively seeking beverages with functional benefits such as enhanced hydration, energy boost, or nutritional supplementation. The convenience factor remains paramount, as busy lifestyles drive demand for grab-and-go beverage solutions that maintain quality and taste without requiring preparation time or specialized equipment.

Innovation leadership has emerged as a critical success factor, with leading brands investing heavily in product development, sustainable packaging solutions, and premium ingredient sourcing. The market shows strong potential for continued expansion, supported by favorable demographic trends, increasing disposable income, and growing acceptance of premium-priced RTD beverages that deliver superior value propositions to discerning consumers.

Competitive dynamics reveal a market characterized by both established beverage giants and innovative startup companies that challenge traditional product categories with disruptive offerings. The landscape includes significant investment in brand building, distribution network expansion, and strategic partnerships that enhance market reach and consumer accessibility across diverse retail channels throughout North America.

Consumer behavior analysis reveals fundamental shifts in beverage consumption patterns, with RTD products gaining market share at the expense of traditional fountain drinks and home-prepared beverages. The following insights highlight critical market dynamics:

Market penetration shows particularly strong growth in urban markets where consumers demonstrate higher disposable income and greater willingness to experiment with innovative RTD products. Demographic analysis indicates that millennials and Generation Z consumers represent the primary growth drivers, accounting for approximately 58% of premium RTD beverage purchases across North America.

Lifestyle transformation represents the primary catalyst driving RTD beverage market expansion across North America. Modern consumers increasingly prioritize convenience without compromising quality, creating substantial demand for beverages that seamlessly integrate into busy daily routines while delivering superior taste and functional benefits that support health and wellness objectives.

Health and wellness trends continue to reshape consumer preferences, with growing awareness of nutrition labels, ingredient transparency, and functional benefits driving demand for RTD beverages that offer more than basic refreshment. Consumers actively seek products containing natural ingredients, reduced sugar content, added vitamins, probiotics, and other functional components that support overall health and well-being.

Demographic shifts play a crucial role in market growth, as younger consumers demonstrate strong preference for RTD products over traditional beverage preparation methods. Urbanization trends contribute to market expansion, with city dwellers showing higher consumption rates of premium RTD beverages due to lifestyle demands and greater exposure to innovative product offerings through diverse retail channels.

Innovation in product development drives continuous market expansion through the introduction of novel flavors, functional ingredients, and packaging solutions that enhance consumer experience. Technology advancement in beverage processing, preservation, and packaging enables manufacturers to deliver superior product quality while extending shelf life and maintaining nutritional integrity throughout the distribution process.

Economic factors including rising disposable income and changing spending patterns support premium RTD beverage consumption, as consumers demonstrate willingness to invest in high-quality, convenient beverage solutions that align with their lifestyle preferences and health goals. Work-from-home trends have also contributed to increased RTD consumption as consumers seek convenient refreshment options during extended home-based work periods.

Price sensitivity remains a significant challenge for RTD beverage market expansion, particularly in price-conscious consumer segments where premium RTD products compete directly with lower-cost alternatives including tap water, home-brewed beverages, and traditional soft drinks. Economic downturns and inflation can negatively impact consumer willingness to purchase higher-priced RTD products, potentially limiting market growth in certain demographic segments.

Health concerns related to sugar content, artificial ingredients, and preservatives in some RTD beverages create consumer hesitation and regulatory scrutiny that can impact market growth. Regulatory challenges including labeling requirements, health claims restrictions, and taxation policies on certain beverage categories may increase compliance costs and limit marketing flexibility for RTD beverage manufacturers.

Environmental concerns regarding packaging waste and sustainability practices increasingly influence consumer purchasing decisions, with environmentally conscious consumers potentially avoiding RTD products with non-recyclable or excessive packaging. Supply chain disruptions can impact product availability and increase costs, particularly for RTD beverages requiring specialized ingredients or packaging materials.

Market saturation in certain product categories creates intense competition and pressure on profit margins, making it challenging for new entrants to establish market presence. Seasonal demand fluctuations can impact sales consistency, particularly for certain RTD beverage categories that experience significant seasonal variation in consumer demand patterns.

Distribution challenges including refrigeration requirements, shelf-life limitations, and complex logistics can increase operational costs and limit market reach for certain RTD beverage products. Consumer education requirements for new functional ingredients or health benefits may slow adoption rates and increase marketing costs for innovative RTD products.

Functional beverage expansion presents substantial growth opportunities as consumers increasingly seek RTD products that deliver specific health benefits beyond basic hydration. The growing interest in immunity support, mental clarity, energy enhancement, and digestive health creates opportunities for innovative RTD formulations that address these specific consumer needs through targeted functional ingredients and scientifically backed health claims.

Premium market positioning offers significant potential for brands that can successfully communicate superior quality, artisanal production methods, and unique value propositions to discerning consumers willing to pay premium prices for exceptional RTD beverage experiences. Craft and artisanal segments show particular promise as consumers seek authentic, small-batch products that offer distinctive flavors and production stories.

E-commerce expansion creates new distribution opportunities for RTD beverage brands, enabling direct-to-consumer sales, subscription models, and personalized product offerings that enhance customer relationships and improve profit margins. Digital marketing capabilities allow brands to target specific consumer segments with tailored messaging and product recommendations that drive trial and repeat purchases.

Sustainable packaging innovation presents opportunities for brands to differentiate through environmentally responsible packaging solutions that appeal to eco-conscious consumers while potentially reducing long-term packaging costs. Plant-based and organic segments continue to show strong growth potential as consumers increasingly prioritize natural ingredients and sustainable production practices.

International expansion within North America, particularly in underserved rural markets and emerging demographic segments, offers growth opportunities for established RTD brands. Partnership opportunities with fitness centers, workplaces, and educational institutions can create new distribution channels and increase brand visibility among target consumer groups.

Supply and demand equilibrium in the North America RTD beverages market reflects complex interactions between consumer preferences, production capabilities, and distribution networks. Market dynamics demonstrate strong demand growth across multiple product categories, with supply chains adapting to accommodate increased volume requirements and evolving quality standards that meet sophisticated consumer expectations.

Competitive intensity continues to increase as both established beverage companies and innovative startups compete for market share through product differentiation, pricing strategies, and marketing investments. Brand loyalty patterns show that consumers are willing to switch brands for superior products, creating opportunities for companies that consistently deliver innovation and quality improvements.

Pricing dynamics reveal consumer acceptance of premium pricing for RTD beverages that deliver clear value propositions through superior taste, functional benefits, or sustainable practices. Market consolidation trends indicate ongoing merger and acquisition activity as larger companies seek to acquire innovative brands and expand their RTD product portfolios to capture emerging market opportunities.

Technology integration increasingly influences market dynamics through improved production efficiency, enhanced product quality, and innovative packaging solutions that extend shelf life and improve consumer convenience. Regulatory environment continues to evolve with new requirements for labeling, health claims, and environmental compliance that impact product development and marketing strategies.

Consumer engagement patterns show increasing importance of social media presence, influencer partnerships, and experiential marketing in driving brand awareness and product trial. Seasonal fluctuations create predictable demand patterns that enable manufacturers to optimize production planning and inventory management while capitalizing on peak consumption periods through targeted marketing campaigns.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the North America RTD beverages market. Primary research includes extensive consumer surveys, focus groups, and in-depth interviews with industry stakeholders including manufacturers, distributors, retailers, and consumers across diverse demographic segments and geographic regions.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, company financial statements, and regulatory filings to provide comprehensive market context and validate primary research findings. Data triangulation methods ensure research accuracy by cross-referencing multiple data sources and employing statistical validation techniques to confirm market insights and projections.

Quantitative analysis includes statistical modeling, trend analysis, and market sizing calculations based on production data, sales figures, and consumption patterns across various RTD beverage categories. Qualitative research provides deeper insights into consumer motivations, brand perceptions, and emerging trends that influence purchasing decisions and market development.

Industry expert interviews with beverage industry executives, product development specialists, marketing professionals, and retail buyers provide insider perspectives on market dynamics, competitive strategies, and future growth opportunities. Market monitoring includes ongoing tracking of new product launches, pricing changes, promotional activities, and competitive developments that impact market conditions.

Geographic analysis examines regional variations in consumer preferences, distribution patterns, and market penetration across the United States and Canada. Demographic segmentation analyzes consumption patterns across age groups, income levels, lifestyle categories, and geographic regions to identify target market opportunities and growth potential.

United States market dominates the North America RTD beverages landscape, representing approximately 85% of regional consumption due to its large population, diverse consumer base, and well-established distribution infrastructure. Major metropolitan areas including New York, Los Angeles, Chicago, and Houston demonstrate particularly strong demand for premium and functional RTD beverages, driven by higher disposable income and greater exposure to innovative product offerings.

California leads in RTD beverage innovation and consumption, with the state’s health-conscious culture and diverse population creating strong demand for organic, functional, and premium RTD products. Texas and Florida show robust growth in RTD consumption, particularly in energy drinks and functional beverages that appeal to active lifestyles and warm climate preferences.

Canadian market demonstrates steady growth with particular strength in RTD coffee and tea products that align with traditional beverage preferences while offering modern convenience. Ontario and Quebec represent the largest Canadian markets, with urban centers like Toronto, Montreal, and Vancouver showing strong adoption of premium RTD beverages and innovative product categories.

Regional preferences vary significantly across North America, with southern states showing higher consumption of sweet tea and energy drinks, while northern regions demonstrate stronger preference for RTD coffee and functional beverages. Seasonal patterns influence regional consumption, with warmer climates maintaining more consistent year-round demand compared to northern regions that experience seasonal fluctuations.

Distribution networks vary by region, with urban areas benefiting from diverse retail channels including specialty stores, premium grocers, and convenience stores, while rural areas rely more heavily on traditional supermarket and mass retail channels. E-commerce penetration shows regional variation, with urban markets demonstrating higher online RTD beverage purchasing rates compared to rural areas that maintain stronger preference for traditional retail shopping.

Market leadership in the North America RTD beverages sector includes both multinational beverage corporations and innovative specialty brands that compete across multiple product categories and price points. The competitive environment demonstrates significant investment in product innovation, brand building, and distribution network expansion to capture growing market opportunities.

Competitive strategies include aggressive product innovation, premium positioning, sustainable packaging initiatives, and strategic partnerships with retailers and distributors. Brand differentiation focuses on unique flavor profiles, functional benefits, packaging innovation, and targeted marketing campaigns that resonate with specific consumer segments and lifestyle preferences.

Market consolidation continues through mergers, acquisitions, and strategic partnerships as larger companies seek to acquire innovative brands and expand their RTD product portfolios. Investment in technology and production capabilities enables companies to improve efficiency, quality, and speed-to-market for new product launches.

Product category segmentation reveals diverse RTD beverage types that cater to different consumer needs, preferences, and consumption occasions. Each segment demonstrates unique growth patterns, competitive dynamics, and consumer demographics that influence marketing strategies and product development priorities.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

RTD Coffee segment demonstrates exceptional growth potential driven by increasing consumer appreciation for specialty coffee and demand for convenient, high-quality coffee experiences. Premium positioning has become increasingly important as consumers seek artisanal flavors, organic ingredients, and sustainable sourcing practices that justify higher price points compared to traditional coffee preparation methods.

Energy drinks category maintains strong market position with approximately 23% market share across the RTD beverages sector, driven by consistent demand from younger consumers and active lifestyle enthusiasts. Innovation focuses on natural ingredients, reduced sugar formulations, and functional benefits that extend beyond basic energy enhancement to include mental clarity and physical performance improvement.

Functional beverages represent the fastest-growing category within the RTD market, with consumers increasingly seeking products that deliver specific health benefits including immunity support, digestive health, stress reduction, and enhanced hydration. Product innovation in this segment includes probiotics, adaptogens, vitamins, and minerals that address specific wellness concerns and lifestyle needs.

RTD Tea segment benefits from growing health consciousness and preference for natural ingredients, with particular strength in green tea, herbal blends, and kombucha products that offer both refreshment and functional benefits. Premium positioning focuses on organic certification, unique flavor combinations, and traditional brewing methods that appeal to discerning consumers seeking authentic tea experiences.

Alcoholic RTD cocktails show remarkable growth momentum as consumers seek convenient alternatives to traditional cocktail preparation while maintaining quality and taste expectations. Innovation opportunities include craft spirits, unique flavor profiles, and premium ingredients that differentiate products in an increasingly competitive market segment.

Sports drinks category maintains steady growth through continuous product innovation and expansion beyond traditional athletic applications to include general hydration and wellness positioning. Natural ingredients and reduced sugar formulations address health-conscious consumer preferences while maintaining functional efficacy for active lifestyles.

Manufacturers benefit from growing market demand that supports increased production volumes, improved economies of scale, and enhanced profitability across diverse RTD beverage categories. Innovation opportunities enable companies to differentiate products, command premium pricing, and build strong brand loyalty among target consumer segments through unique value propositions and superior product experiences.

Retailers gain from high-margin RTD beverage sales that generate strong profit contributions while attracting customers to stores and increasing basket size through complementary purchases. Category management opportunities allow retailers to optimize shelf space allocation, pricing strategies, and promotional activities that maximize revenue and customer satisfaction across RTD beverage segments.

Distributors benefit from consistent demand patterns and growing market size that support stable revenue streams and business expansion opportunities. Logistics efficiency improvements through advanced inventory management and route optimization enable distributors to reduce costs while improving service levels to retail customers and end consumers.

Consumers receive significant value through convenient access to high-quality beverages that support busy lifestyles while delivering superior taste, functional benefits, and health advantages compared to traditional beverage alternatives. Product variety ensures that consumers can find RTD options that match their specific preferences, dietary requirements, and lifestyle needs across multiple price points and quality levels.

Investors find attractive opportunities in the RTD beverages market through strong growth prospects, expanding consumer base, and continuous innovation that drives market expansion and profitability. Market stability and resilience during economic fluctuations provide investors with reliable returns and long-term growth potential across diverse RTD beverage segments and geographic markets.

Suppliers benefit from increased demand for ingredients, packaging materials, and production equipment that supports the growing RTD beverages industry. Partnership opportunities with RTD manufacturers enable suppliers to develop specialized products and services that meet specific industry requirements while building long-term business relationships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness focus continues to drive RTD beverage innovation with consumers increasingly seeking products that deliver functional benefits beyond basic refreshment. Clean label trends emphasize natural ingredients, minimal processing, and transparent sourcing practices that appeal to health-conscious consumers willing to pay premium prices for superior quality and nutritional value.

Sustainability initiatives gain importance as environmentally conscious consumers prioritize brands that demonstrate commitment to sustainable packaging, responsible sourcing, and environmental stewardship. Circular economy principles influence packaging design and material selection, with companies investing in recyclable, biodegradable, and reduced-packaging solutions that minimize environmental impact.

Personalization trends enable RTD beverage companies to offer customized products and experiences through direct-to-consumer channels, subscription services, and data-driven product recommendations. Technology integration includes smart packaging, QR codes, and mobile apps that enhance consumer engagement and provide additional value beyond the core beverage product.

Premium positioning becomes increasingly important as consumers demonstrate willingness to pay higher prices for artisanal, craft, and specialty RTD beverages that offer unique flavors, superior ingredients, and authentic brand stories. Limited edition releases and seasonal offerings create excitement and urgency that drive trial and repeat purchases among target consumer segments.

Functional ingredient innovation includes adaptogens, nootropics, probiotics, and plant-based proteins that address specific consumer health and wellness goals. Flavor exploration incorporates exotic fruits, botanical extracts, and international flavor profiles that provide unique taste experiences and differentiate products in competitive market segments.

Convenience enhancement through improved packaging design, portion control, and on-the-go consumption features that support busy lifestyles and active consumer preferences. Multi-functional packaging includes resealable containers, portion control features, and sustainable materials that add value while reducing environmental impact.

Product innovation acceleration has intensified across the RTD beverages industry with companies launching new products at unprecedented rates to capture emerging consumer trends and market opportunities. Functional beverage launches have increased significantly, with manufacturers introducing products containing probiotics, adaptogens, CBD, and other wellness-focused ingredients that address specific health concerns and lifestyle needs.

Strategic partnerships between RTD beverage companies and technology firms enable advanced product development, improved manufacturing efficiency, and enhanced consumer engagement through digital platforms and data analytics. Acquisition activity continues as larger beverage companies acquire innovative startup brands to expand their product portfolios and access new consumer segments.

Sustainability investments include significant capital allocation toward environmentally responsible packaging solutions, renewable energy adoption, and sustainable ingredient sourcing practices that align with consumer values and regulatory requirements. Carbon neutrality commitments from major RTD beverage companies demonstrate industry leadership in environmental stewardship and long-term sustainability planning.

Manufacturing technology upgrades enable improved product quality, extended shelf life, and enhanced production efficiency through advanced processing equipment and quality control systems. Supply chain optimization includes investment in logistics technology, inventory management systems, and distribution network expansion that improve product availability and reduce costs.

Regulatory compliance initiatives address evolving requirements for product labeling, health claims, and environmental standards through comprehensive compliance programs and industry collaboration. Research and development investments focus on ingredient innovation, flavor development, and functional benefit validation through scientific studies and consumer testing programs.

Digital transformation includes e-commerce platform development, social media marketing enhancement, and data analytics capabilities that improve customer insights and marketing effectiveness. Direct-to-consumer expansion enables RTD beverage companies to build stronger customer relationships while improving profit margins through reduced distribution costs.

MarkWide Research recommends that RTD beverage companies prioritize investment in functional ingredient research and development to capitalize on growing consumer demand for health and wellness products. Innovation focus should emphasize natural, scientifically validated ingredients that deliver measurable health benefits while maintaining superior taste and quality standards that justify premium pricing strategies.

Sustainability initiatives represent critical investment priorities for long-term market success, with companies advised to implement comprehensive environmental programs that address packaging waste, carbon emissions, and sustainable sourcing practices. Consumer communication about sustainability efforts should be transparent and authentic to build trust and brand loyalty among environmentally conscious consumers.

Digital marketing expansion should focus on social media engagement, influencer partnerships, and content marketing strategies that resonate with younger consumer demographics who drive RTD beverage growth. E-commerce capabilities require significant investment to compete effectively in online retail channels and capture direct-to-consumer opportunities that improve profit margins.

Geographic expansion within North America should target underserved markets and demographic segments that offer growth potential for RTD beverage products. Distribution partnerships with regional retailers and specialty channels can accelerate market penetration while reducing capital requirements for independent distribution network development.

Product portfolio diversification across multiple RTD beverage categories reduces market risk while capturing opportunities in high-growth segments such as functional beverages, premium coffee, and alcoholic RTD cocktails. Brand building investments should focus on authentic storytelling, quality positioning, and consumer education that differentiates products in competitive market environments.

Supply chain resilience requires investment in alternative sourcing strategies, inventory management systems, and logistics capabilities that ensure product availability during disruptions while maintaining cost efficiency. Quality control enhancement through advanced testing and monitoring systems protects brand reputation while ensuring consistent product quality across all distribution channels.

Market growth prospects for the North America RTD beverages industry remain exceptionally positive, with continued expansion expected across multiple product categories and consumer segments. Demographic trends support sustained growth as younger consumers maintain strong preference for convenient, high-quality RTD products throughout their lifecycle, while older consumers increasingly adopt RTD beverages for health and convenience benefits.

Innovation acceleration will continue driving market expansion through breakthrough ingredients, advanced packaging solutions, and personalized product offerings that address evolving consumer needs and preferences. Functional beverages are projected to achieve compound annual growth rates exceeding 9.2% as consumers increasingly prioritize health and wellness benefits in their beverage choices.

Technology integration will enhance product development capabilities, manufacturing efficiency, and consumer engagement through artificial intelligence, data analytics, and smart packaging solutions that create competitive advantages and improve customer experiences. Sustainability leadership will become increasingly important for market success as environmental concerns influence consumer purchasing decisions and regulatory requirements.

Premium market segments show exceptional growth potential as consumers demonstrate continued willingness to pay higher prices for superior quality, unique flavors, and functional benefits that align with their lifestyle preferences and health goals. Artisanal and craft positioning will create opportunities for smaller brands to compete effectively against larger competitors through differentiated products and authentic brand stories.

Global expansion opportunities for successful North American RTD brands will drive additional growth as companies leverage proven products and marketing strategies in international markets. E-commerce growth will continue accelerating, with online sales projected to represent approximately 15% of total RTD beverage sales within the next five years, creating new opportunities for direct-to-consumer engagement and personalized marketing.

Regulatory evolution will influence product development and marketing strategies as governments implement new requirements for health claims, environmental compliance, and consumer protection. Industry consolidation through mergers and acquisitions will continue as companies seek to achieve scale advantages, expand product portfolios, and access new distribution channels and consumer segments.

The North America ready-to-drink beverages market represents one of the most dynamic and innovative segments in the global beverage industry, driven by evolving consumer preferences, health consciousness trends, and demand for convenient consumption solutions across the region. Market dynamics across the United States, Canada, and Mexico demonstrate exceptional growth potential supported by premiumization trends, functional ingredient integration, and expanding distribution channels including e-commerce and convenience retail formats. Innovation leadership and brand diversification continue driving market evolution and consumer engagement throughout North American beverage markets.

Strategic positioning in this competitive landscape requires understanding diverse consumer demographics, regional taste preferences, and health trends that influence purchasing decisions across North American markets. Companies that prioritize natural ingredients, sustainable packaging solutions, and targeted nutritional benefits will be best positioned to capture opportunities in this rapidly evolving sector. Digital marketing strategies and direct-to-consumer channels have become essential for building brand loyalty and reaching health-conscious millennials and Gen Z consumers.

Innovation excellence in functional beverages, plant-based formulations, and low-sugar alternatives positions North America as a global hub for next-generation RTD product development. Manufacturing capabilities and supply chain optimization ensure consistent product quality and nationwide distribution reach across diverse retail channels. Health trend integration including immunity support, energy enhancement, and wellness-focused formulations aligns with increasing consumer sophistication and lifestyle adaptation preferences.

The competitive environment will continue intensifying as both established beverage giants and innovative startup brands compete for market share in this high-growth category. Sustained success will require ongoing investment in product innovation, sustainable practices, and consumer engagement strategies to meet increasingly sophisticated taste preferences and health expectations. Consumer-centric approaches emphasizing transparency, authentic ingredients, and personalized nutrition solutions will become increasingly critical differentiators in this vibrant and rapidly expanding North America ready-to-drink beverages market.

What is Ready-to-Drink (RTD) Beverages?

Ready-to-Drink (RTD) Beverages are pre-packaged drinks that are ready for consumption without the need for preparation. They include a variety of products such as iced teas, flavored waters, and alcoholic beverages, catering to the convenience-seeking consumer.

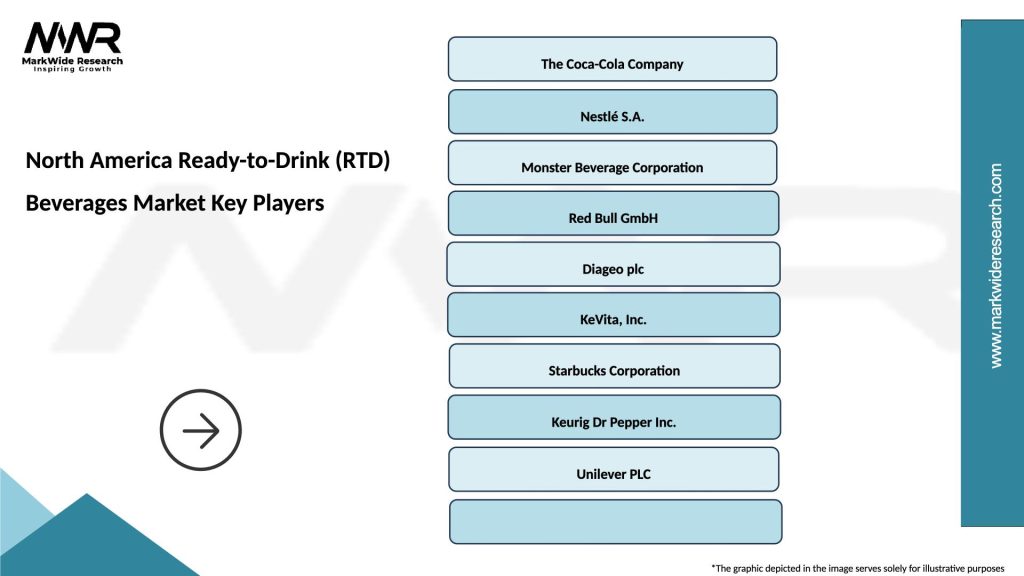

What are the key players in the North America Ready-to-Drink (RTD) Beverages Market?

Key players in the North America Ready-to-Drink (RTD) Beverages Market include The Coca-Cola Company, PepsiCo, and Diageo, among others. These companies are known for their extensive product lines and innovative marketing strategies.

What are the growth factors driving the North America Ready-to-Drink (RTD) Beverages Market?

The growth of the North America Ready-to-Drink (RTD) Beverages Market is driven by increasing consumer demand for convenience, a rise in health-conscious choices, and the popularity of on-the-go consumption. Additionally, innovative flavors and packaging are attracting a broader audience.

What challenges does the North America Ready-to-Drink (RTD) Beverages Market face?

The North America Ready-to-Drink (RTD) Beverages Market faces challenges such as intense competition, regulatory hurdles, and changing consumer preferences. Additionally, concerns over health impacts from sugar and artificial ingredients can affect market growth.

What opportunities exist in the North America Ready-to-Drink (RTD) Beverages Market?

Opportunities in the North America Ready-to-Drink (RTD) Beverages Market include the expansion of product lines to include organic and low-calorie options, as well as the potential for growth in e-commerce sales. The increasing trend of premiumization also presents avenues for innovation.

What trends are shaping the North America Ready-to-Drink (RTD) Beverages Market?

Trends shaping the North America Ready-to-Drink (RTD) Beverages Market include the rise of functional beverages that offer health benefits, the incorporation of sustainable packaging, and the growing popularity of craft and artisanal drinks. These trends reflect changing consumer preferences towards healthier and environmentally friendly options.

North America Ready-to-Drink (RTD) Beverages Market

| Segmentation Details | Description |

|---|---|

| Product Type | Tea, Coffee, Juice, Carbonated Drinks |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| Customer Type | Millennials, Gen Z, Working Professionals, Health-Conscious Consumers |

| Packaging Type | Bottles, Cans, Tetra Packs, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Ready-to-Drink (RTD) Beverages Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at