444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America proximity access control market represents a dynamic and rapidly evolving sector within the broader security technology landscape. This market encompasses sophisticated systems that utilize various proximity technologies including RFID cards, key fobs, mobile credentials, and biometric solutions to manage and control access to buildings, facilities, and secure areas. Market dynamics indicate robust growth driven by increasing security concerns, technological advancements, and the widespread adoption of smart building technologies across commercial, residential, and industrial sectors.

Regional market penetration varies significantly across North America, with the United States commanding approximately 78% market share, followed by Canada at 18%, and Mexico contributing the remaining 4%. The market demonstrates strong momentum with projected growth rates of 8.2% CAGR over the forecast period, reflecting the increasing integration of Internet of Things (IoT) technologies and cloud-based access management solutions.

Technology adoption patterns show a clear shift toward contactless and mobile-enabled solutions, particularly accelerated by post-pandemic security requirements and hygiene considerations. The market encompasses diverse applications ranging from corporate offices and healthcare facilities to educational institutions and government buildings, each presenting unique security challenges and technological requirements.

The North America proximity access control market refers to the comprehensive ecosystem of security technologies, systems, and services that enable automated access management through proximity-based authentication methods. These systems utilize various technologies including radio frequency identification (RFID), near-field communication (NFC), Bluetooth Low Energy (BLE), and biometric sensors to grant or deny access based on user credentials and authorization levels.

Core functionality involves the seamless integration of hardware components such as card readers, electronic locks, control panels, and software platforms that manage user databases, access permissions, and security protocols. The market encompasses both traditional proximity card systems and advanced mobile credential solutions that leverage smartphone technology for access control.

Market scope extends beyond simple door access to include comprehensive security ecosystems that integrate with video surveillance, intrusion detection, visitor management, and building automation systems. This holistic approach to security management represents the evolution from standalone access control to integrated security platforms that provide enhanced visibility, control, and operational efficiency.

Market leadership in the North America proximity access control sector is characterized by intense competition among established security technology providers and emerging innovative companies. The market demonstrates strong resilience and growth potential, driven by increasing security threats, regulatory compliance requirements, and the digital transformation of physical security infrastructure.

Key growth drivers include the widespread adoption of mobile credentials, which now represent approximately 35% of new installations, and the integration of artificial intelligence and machine learning capabilities for enhanced security analytics. Cloud-based access control solutions are experiencing particularly strong growth, with adoption rates increasing by 42% annually as organizations seek scalable and remotely manageable security solutions.

Market segmentation reveals diverse application areas with commercial buildings accounting for the largest share, followed by healthcare facilities, educational institutions, and government buildings. The residential sector is emerging as a significant growth opportunity, driven by smart home technology adoption and increasing security awareness among homeowners.

Technological innovation continues to reshape the market landscape, with contactless technologies, mobile integration, and biometric authentication driving next-generation access control solutions. The market is witnessing a fundamental shift from traditional card-based systems to comprehensive digital identity management platforms that support multiple authentication methods and provide enhanced user experiences.

Strategic market positioning reveals several critical insights that define the current and future landscape of proximity access control in North America:

Security threat landscape continues to evolve, creating sustained demand for advanced proximity access control solutions. Organizations across North America are investing heavily in security infrastructure to protect against both physical and cyber threats, driving market growth through increased adoption of sophisticated access management technologies.

Digital transformation initiatives within organizations are accelerating the adoption of smart building technologies and integrated security platforms. The convergence of physical and logical security systems creates opportunities for comprehensive access control solutions that provide unified management and enhanced operational efficiency.

Regulatory compliance requirements across various industries, including healthcare, finance, and government sectors, mandate robust access control systems with detailed audit trails and reporting capabilities. These compliance drivers create consistent demand for enterprise-grade proximity access control solutions that meet stringent security and documentation standards.

Workplace evolution and hybrid work models are reshaping access control requirements, with organizations needing flexible systems that can accommodate varying occupancy levels, temporary access needs, and remote management capabilities. This evolution drives demand for cloud-based solutions and mobile credential technologies.

Technology cost reduction and improved accessibility of advanced security technologies make proximity access control solutions more attractive to small and medium-sized businesses, expanding the addressable market beyond traditional enterprise customers.

Implementation complexity remains a significant challenge for organizations considering proximity access control system upgrades or new installations. The integration of new systems with existing infrastructure often requires substantial technical expertise and can result in operational disruptions during deployment phases.

Capital investment requirements for comprehensive access control systems can be substantial, particularly for large-scale deployments across multiple facilities. Organizations must balance security needs with budget constraints, often resulting in phased implementation approaches that may limit initial system capabilities.

Cybersecurity concerns surrounding connected access control systems create hesitation among security-conscious organizations. The potential for cyber attacks on networked security systems requires robust cybersecurity measures and ongoing security management, adding complexity and cost to system operations.

Legacy system integration challenges persist as organizations struggle to modernize existing access control infrastructure while maintaining operational continuity. Compatibility issues between new proximity technologies and established security systems can create technical barriers to adoption.

Privacy and data protection regulations create compliance challenges for access control systems that collect and store personal information. Organizations must navigate complex regulatory requirements while implementing systems that provide necessary security functionality without compromising user privacy rights.

Smart city initiatives across North America present substantial opportunities for proximity access control technology integration. Government investments in smart infrastructure create demand for scalable, interoperable access control solutions that can support public facilities, transportation systems, and municipal buildings.

Healthcare sector expansion offers significant growth potential as medical facilities require sophisticated access control systems to protect sensitive areas, manage staff credentials, and ensure patient safety. The healthcare market demands specialized solutions that integrate with existing medical systems and support compliance requirements.

Educational technology integration creates opportunities for access control solutions that support campus security, student safety, and facility management. Educational institutions are increasingly adopting comprehensive security platforms that integrate access control with emergency response and communication systems.

Residential market growth represents an emerging opportunity as smart home technology adoption increases and homeowners seek professional-grade security solutions. The residential proximity access control market is expanding beyond traditional high-end applications to include mainstream housing developments and apartment complexes.

Industrial automation convergence creates opportunities for access control systems that integrate with manufacturing and industrial processes. Industrial facilities require specialized solutions that support operational efficiency while maintaining strict security protocols for sensitive areas and equipment.

Competitive landscape dynamics in the North America proximity access control market are characterized by ongoing consolidation among traditional security providers and the emergence of technology-focused startups bringing innovative solutions to market. Established players are investing heavily in research and development to maintain market position while new entrants focus on disruptive technologies and user experience improvements.

Technology evolution cycles are accelerating, with new proximity technologies and authentication methods regularly entering the market. Organizations must balance the benefits of cutting-edge technology with the stability and reliability requirements of mission-critical security systems, creating dynamic market conditions that favor adaptable solution providers.

Customer expectations continue to evolve toward more intuitive, user-friendly access control experiences while maintaining high security standards. This dual requirement drives innovation in user interface design, mobile integration, and seamless authentication processes that reduce friction without compromising security effectiveness.

Supply chain considerations impact market dynamics as component availability and manufacturing capacity affect system pricing and deployment timelines. Global supply chain disruptions have highlighted the importance of diverse supplier relationships and local manufacturing capabilities for market stability.

Partnership ecosystems are becoming increasingly important as access control providers collaborate with technology partners, system integrators, and channel partners to deliver comprehensive solutions. These collaborative relationships enable market expansion and solution enhancement while providing customers with integrated security platforms.

Comprehensive market analysis for the North America proximity access control market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research activities include extensive interviews with industry executives, technology providers, system integrators, and end-user organizations across various sectors and geographic regions.

Secondary research components encompass detailed analysis of industry publications, regulatory filings, patent databases, and technology trend reports to identify market patterns and emerging opportunities. This research approach provides comprehensive coverage of market dynamics, competitive positioning, and technology evolution trends.

Data validation processes ensure research accuracy through triangulation of multiple data sources and verification of market insights with industry experts and market participants. Quantitative analysis is supported by qualitative insights to provide a complete understanding of market conditions and future prospects.

Market segmentation analysis utilizes detailed categorization of market participants, technology types, application areas, and geographic regions to provide granular insights into market structure and growth opportunities. This segmentation approach enables targeted analysis of specific market segments and their unique characteristics.

Forecasting methodologies combine historical market data with current trend analysis and expert projections to develop realistic market growth scenarios. Multiple forecasting models are employed to account for various market conditions and potential disruption factors that could impact future market development.

United States market dominance is evident across all proximity access control segments, with particularly strong adoption in commercial real estate, healthcare, and government sectors. The U.S. market benefits from advanced technology infrastructure, strong regulatory frameworks, and high security awareness among organizations and consumers.

California and Texas represent the largest state markets, driven by significant commercial development, technology industry presence, and large-scale infrastructure projects. These states demonstrate high adoption rates for advanced access control technologies and serve as testing grounds for innovative security solutions.

Canadian market characteristics show strong growth in urban centers including Toronto, Vancouver, and Montreal, with particular strength in healthcare and educational applications. Canadian organizations demonstrate preference for integrated security platforms that support bilingual requirements and comply with provincial privacy regulations.

Mexico market development is accelerating as economic growth drives commercial construction and infrastructure investment. The Mexican market shows increasing adoption of proximity access control technologies in manufacturing facilities, commercial buildings, and government installations, with growth rates exceeding 12% annually.

Regional technology preferences vary based on local requirements, with the United States leading in mobile credential adoption, Canada showing strong preference for cloud-based solutions, and Mexico focusing on cost-effective traditional proximity card systems with upgrade pathways to advanced technologies.

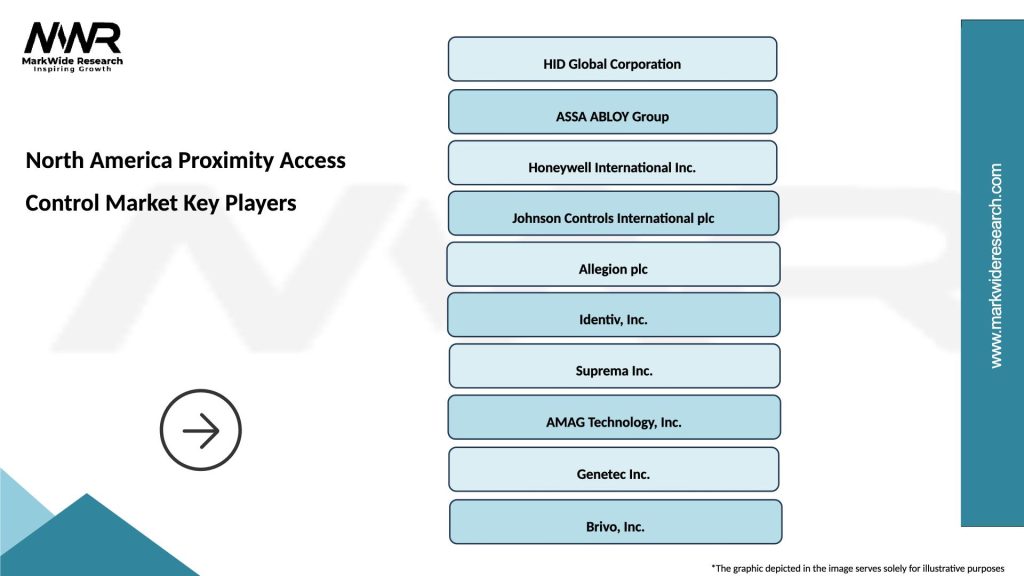

Market leadership in the North America proximity access control sector is distributed among several key players, each bringing unique strengths and market positioning:

Competitive differentiation occurs through technology innovation, integration capabilities, vertical market specialization, and customer service excellence. Leading providers invest heavily in research and development to maintain technological advantages while building comprehensive partner ecosystems to expand market reach.

Technology-based segmentation reveals distinct market categories with varying growth rates and adoption patterns:

Application-based segmentation demonstrates diverse market opportunities across various sectors:

Hardware category analysis reveals strong demand for next-generation proximity readers that support multiple technologies and provide enhanced connectivity options. Modern readers incorporate advanced encryption, wireless communication capabilities, and mobile device compatibility to support evolving security requirements.

Software platform insights show increasing preference for cloud-based access control management systems that provide scalability, remote administration, and integration capabilities. These platforms offer advanced analytics, real-time monitoring, and automated reporting features that enhance security operations and compliance management.

Service category growth is driven by increasing demand for professional installation, system integration, and ongoing maintenance services. Organizations recognize the importance of expert implementation and support services to maximize system performance and ensure long-term reliability.

Mobile credential category demonstrates the fastest growth rates as organizations adopt smartphone-based access solutions. This category benefits from user familiarity with mobile technology and the convenience of consolidated credential management through mobile applications.

Integration category expansion reflects the growing importance of access control systems that seamlessly connect with video surveillance, intrusion detection, visitor management, and building automation systems. Integrated solutions provide comprehensive security platforms with centralized management and enhanced operational efficiency.

End-user organizations benefit from proximity access control systems through enhanced security, improved operational efficiency, and reduced administrative overhead. These systems provide detailed audit trails, automated access management, and scalable security solutions that adapt to changing organizational needs.

System integrators gain opportunities to provide comprehensive security solutions that combine access control with other building systems, creating value-added services and recurring revenue streams. Integration expertise becomes a key differentiator in competitive markets.

Technology providers benefit from growing market demand and opportunities for innovation in proximity technologies, mobile integration, and cloud-based platforms. The market supports both established providers and emerging companies with innovative solutions.

Facility managers achieve improved building security, reduced key management complexity, and enhanced visitor management capabilities. Modern access control systems provide real-time visibility into facility access and support efficient space utilization management.

Security professionals gain access to advanced tools for threat detection, incident response, and security analytics. Proximity access control systems provide valuable data for security operations and support proactive security management strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Contactless technology acceleration has become a dominant trend, driven by hygiene concerns and user preference for touchless interactions. Organizations are rapidly adopting mobile credentials and contactless card technologies that eliminate physical contact with readers while maintaining security effectiveness.

Cloud-based platform adoption continues to accelerate as organizations seek scalable, remotely manageable access control solutions. Cloud platforms offer enhanced flexibility, automatic updates, and integration capabilities that support modern security operations and distributed workforce management.

Artificial intelligence integration is emerging as a key trend, with AI-powered analytics providing advanced threat detection, behavioral analysis, and predictive security capabilities. These intelligent systems can identify unusual access patterns and potential security threats in real-time.

Mobile-first design approaches are reshaping access control system development, with user interfaces and system management designed primarily for mobile devices. This trend reflects changing user expectations and the prevalence of mobile technology in daily operations.

Sustainability considerations are influencing product development and system design, with organizations seeking energy-efficient access control solutions that support environmental goals while maintaining security effectiveness. Green building certifications increasingly include security system efficiency requirements.

Strategic partnerships between access control providers and technology companies are accelerating innovation and market expansion. Recent collaborations focus on mobile credential platforms, cloud integration, and artificial intelligence capabilities that enhance system functionality and user experiences.

Acquisition activities continue to reshape the competitive landscape as established security companies acquire innovative startups and specialized technology providers. These acquisitions enable rapid technology integration and market expansion while consolidating industry expertise.

Product launches featuring advanced proximity technologies, mobile integration, and cloud-based management platforms demonstrate ongoing innovation in the market. New products focus on user experience improvements, enhanced security features, and simplified installation processes.

Regulatory developments including updated security standards and privacy requirements are influencing product development and market adoption patterns. Industry participants must adapt to evolving compliance requirements while maintaining system functionality and user convenience.

Technology standardization efforts are progressing to improve interoperability between different access control systems and technologies. Industry organizations are working to establish common protocols and standards that facilitate system integration and reduce implementation complexity.

MarkWide Research analysis indicates that organizations should prioritize access control systems that support multiple authentication methods and provide clear upgrade pathways to emerging technologies. This approach ensures long-term system viability while accommodating diverse user preferences and security requirements.

Investment strategies should focus on scalable platforms that can grow with organizational needs and integrate with existing security infrastructure. Organizations benefit from phased implementation approaches that allow for gradual system expansion and technology adoption without disrupting operations.

Technology selection criteria should emphasize cybersecurity features, integration capabilities, and vendor support quality over lowest initial cost. The total cost of ownership includes ongoing maintenance, support, and upgrade costs that significantly impact long-term system economics.

Vendor evaluation processes should include assessment of financial stability, technology roadmaps, and partner ecosystems to ensure sustainable long-term relationships. Organizations should prioritize vendors with proven track records and comprehensive support capabilities.

Implementation planning should include comprehensive user training, change management processes, and ongoing security awareness programs to maximize system effectiveness and user adoption. Successful deployments require attention to both technical and human factors.

Market growth projections indicate continued expansion of the North America proximity access control market, with particularly strong growth expected in mobile credential solutions and cloud-based platforms. MWR forecasts suggest that mobile credentials will achieve 55% market penetration within the next five years, driven by user preference and organizational efficiency benefits.

Technology evolution will continue toward more intelligent, integrated systems that provide comprehensive security and building management capabilities. The convergence of access control with IoT, artificial intelligence, and building automation systems will create new opportunities for enhanced functionality and operational efficiency.

Market expansion into new vertical segments and geographic regions will drive continued growth, with particular opportunities in healthcare, education, and residential markets. These sectors present unique requirements that will drive specialized product development and market segmentation.

Competitive dynamics will continue to evolve through technology innovation, strategic partnerships, and market consolidation. Organizations that successfully combine traditional security expertise with emerging technology capabilities will be best positioned for future success.

Regulatory influences will continue to shape market development through evolving security standards, privacy requirements, and compliance mandates. Industry participants must remain adaptable to changing regulatory environments while maintaining focus on customer needs and market opportunities.

The North America proximity access control market represents a dynamic and rapidly evolving sector with substantial growth opportunities driven by increasing security requirements, technological innovation, and changing workplace dynamics. Market participants benefit from strong demand across diverse vertical markets and geographic regions, supported by ongoing technology advancement and integration capabilities.

Strategic success factors include technology innovation, comprehensive integration capabilities, and strong customer support services that address the complex requirements of modern access control deployments. Organizations that effectively combine traditional security expertise with emerging technologies will be best positioned to capitalize on market opportunities and achieve sustainable competitive advantages.

Future market development will be characterized by continued technology convergence, expanded application areas, and enhanced user experiences that balance security effectiveness with operational convenience. The market outlook remains positive, with strong growth prospects supported by fundamental security needs and ongoing digital transformation initiatives across North America.

What is Proximity Access Control?

Proximity Access Control refers to a security system that allows entry to a facility or area through the use of proximity cards or devices. These systems are commonly used in commercial buildings, educational institutions, and government facilities to enhance security and manage access efficiently.

What are the key players in the North America Proximity Access Control Market?

Key players in the North America Proximity Access Control Market include HID Global, ASSA ABLOY, Johnson Controls, and Gallagher, among others. These companies are known for their innovative solutions and extensive product offerings in access control technologies.

What are the growth factors driving the North America Proximity Access Control Market?

The growth of the North America Proximity Access Control Market is driven by increasing security concerns, the rise in smart building technologies, and the demand for contactless access solutions. Additionally, the integration of IoT in security systems is enhancing operational efficiency.

What challenges does the North America Proximity Access Control Market face?

Challenges in the North America Proximity Access Control Market include the high initial installation costs and the complexity of integrating new systems with existing infrastructure. Additionally, concerns regarding data privacy and cybersecurity threats pose significant challenges.

What opportunities exist in the North America Proximity Access Control Market?

Opportunities in the North America Proximity Access Control Market include the growing adoption of mobile access solutions and advancements in biometric technologies. The increasing focus on workplace safety and security also presents significant growth potential.

What trends are shaping the North America Proximity Access Control Market?

Trends in the North America Proximity Access Control Market include the shift towards cloud-based access control systems and the integration of artificial intelligence for enhanced security features. Additionally, the demand for user-friendly mobile applications is on the rise.

North America Proximity Access Control Market

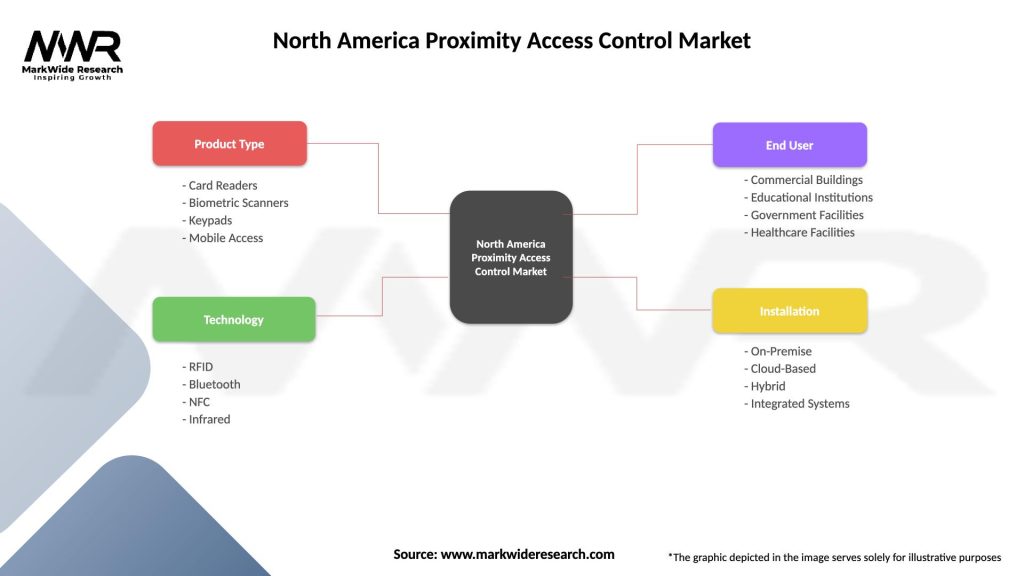

| Segmentation Details | Description |

|---|---|

| Product Type | Card Readers, Biometric Scanners, Keypads, Mobile Access |

| Technology | RFID, Bluetooth, NFC, Infrared |

| End User | Commercial Buildings, Educational Institutions, Government Facilities, Healthcare Facilities |

| Installation | On-Premise, Cloud-Based, Hybrid, Integrated Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Proximity Access Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at