444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America protection relays market represents a critical segment of the electrical infrastructure industry, encompassing sophisticated devices that safeguard electrical systems from faults, overloads, and other potentially damaging conditions. Protection relays serve as the intelligent guardians of power systems, automatically detecting abnormal conditions and initiating corrective actions to prevent equipment damage and maintain system stability. The market has experienced robust growth, driven by increasing investments in grid modernization, renewable energy integration, and industrial automation across the United States, Canada, and Mexico.

Market dynamics indicate substantial expansion opportunities, with the sector benefiting from aging electrical infrastructure replacement needs and growing emphasis on smart grid technologies. The region’s commitment to enhancing power system reliability and efficiency has positioned protection relays as essential components in modern electrical networks. Current market trends show a 6.8% CAGR growth trajectory, reflecting strong demand across utility, industrial, and commercial applications.

Technological advancement continues to reshape the protection relays landscape, with digital and microprocessor-based solutions gaining significant market traction. The integration of communication capabilities, advanced analytics, and remote monitoring features has transformed traditional protection schemes into intelligent, interconnected systems. Regional market share distribution shows the United States commanding approximately 72% of the North American market, followed by Canada and Mexico with growing contributions to overall market expansion.

The North America protection relays market refers to the comprehensive ecosystem of electrical protection devices, systems, and services designed to detect, isolate, and respond to fault conditions in power systems across the United States, Canada, and Mexico. Protection relays are sophisticated electronic or electromechanical devices that monitor electrical parameters such as current, voltage, frequency, and power flow, automatically initiating protective actions when predetermined thresholds are exceeded or abnormal conditions are detected.

Market scope encompasses various relay technologies including electromechanical, static, and digital protection relays, along with associated communication systems, software platforms, and maintenance services. These devices play crucial roles in maintaining power system stability, preventing equipment damage, ensuring personnel safety, and minimizing service interruptions across diverse applications ranging from utility transmission networks to industrial manufacturing facilities.

Protection relay systems function as the nervous system of electrical networks, providing rapid fault detection, selective isolation of faulty sections, and coordination with other protective devices to maintain overall system integrity. The market includes primary protection, backup protection, and auxiliary relay functions, each serving specific roles in comprehensive protection schemes that safeguard valuable electrical assets and ensure reliable power delivery to end consumers.

Market performance in North America’s protection relays sector demonstrates strong momentum driven by infrastructure modernization initiatives, regulatory compliance requirements, and technological innovation. The region’s mature electrical grid infrastructure presents both replacement opportunities for aging equipment and upgrade demands for enhanced functionality and performance capabilities.

Key growth drivers include increasing renewable energy penetration requiring advanced protection schemes, growing industrial automation demanding reliable power protection, and utility investments in smart grid technologies. The market benefits from favorable regulatory frameworks promoting grid reliability and resilience, particularly following extreme weather events that have highlighted the importance of robust electrical protection systems.

Technology trends show accelerating adoption of digital protection relays offering superior accuracy, flexibility, and communication capabilities compared to traditional electromechanical alternatives. Digital relay adoption has reached approximately 78% of new installations, reflecting industry preference for advanced features including self-monitoring, event recording, and remote configuration capabilities.

Competitive landscape features established global manufacturers alongside specialized regional players, with market consolidation trends creating opportunities for technology integration and expanded service offerings. The sector’s evolution toward integrated protection and control solutions positions leading companies to capture greater value from comprehensive system approaches rather than standalone device sales.

Market insights reveal several critical factors shaping the North American protection relays landscape:

Technology adoption patterns indicate strong preference for multifunctional relays combining protection, control, and monitoring capabilities in single devices. This trend toward integration reduces installation complexity, improves system coordination, and provides enhanced value propositions for end users across utility and industrial applications.

Primary market drivers propelling growth in the North American protection relays sector include infrastructure modernization needs, regulatory requirements, and technological advancement opportunities. The region’s electrical grid infrastructure, much of which was constructed decades ago, requires systematic upgrades to meet current reliability standards and accommodate modern power system requirements.

Renewable energy integration serves as a significant growth catalyst, with solar and wind installations creating complex protection challenges that traditional relay systems cannot adequately address. Renewable capacity additions have increased protection relay requirements by approximately 35% annually in regions with high clean energy penetration, driving demand for advanced protection solutions capable of handling bidirectional power flows and variable generation patterns.

Industrial sector expansion contributes substantially to market growth, with manufacturing facilities requiring reliable power protection to prevent costly production interruptions. The increasing sophistication of industrial processes and growing reliance on automation systems have elevated the importance of comprehensive electrical protection schemes that can respond rapidly to fault conditions while minimizing unnecessary shutdowns.

Utility modernization programs represent another key driver, with electric utilities investing heavily in smart grid technologies that require advanced protection and control capabilities. These investments are motivated by regulatory requirements for improved reliability, customer expectations for enhanced service quality, and operational efficiency objectives that can be achieved through intelligent protection systems.

Market restraints affecting the North American protection relays sector include high initial investment costs, technical complexity challenges, and skilled workforce limitations. The transition from traditional electromechanical relays to advanced digital systems requires substantial capital expenditures that can strain utility and industrial budgets, particularly for smaller organizations with limited financial resources.

Technical complexity associated with modern protection relay systems presents implementation challenges, requiring specialized knowledge for proper design, configuration, and maintenance. The increasing sophistication of protection schemes, while offering enhanced capabilities, also creates potential points of failure and demands higher levels of technical expertise from operating personnel.

Cybersecurity concerns have emerged as significant market restraints, with utilities and industrial facilities expressing caution about implementing networked protection systems that could potentially be vulnerable to cyber attacks. These concerns have slowed adoption rates in some market segments and increased costs associated with implementing robust security measures.

Regulatory compliance complexity can also constrain market growth, with evolving standards and requirements creating uncertainty for end users and manufacturers. The need to comply with multiple regulatory frameworks across different jurisdictions adds complexity and cost to protection relay implementations, particularly for large-scale utility applications spanning multiple states or provinces.

Market opportunities in the North American protection relays sector are abundant, driven by emerging technologies, evolving customer needs, and supportive policy environments. The ongoing digital transformation of electrical systems creates substantial opportunities for innovative protection solutions that can integrate seamlessly with modern power system architectures.

Smart grid development presents significant growth opportunities, with utilities seeking protection relays that can support advanced grid management functions including demand response, distributed energy resource integration, and real-time system optimization. These applications require protection devices with enhanced communication capabilities and intelligent decision-making algorithms.

Microprocessor-based relay adoption continues to expand, offering opportunities for manufacturers to develop increasingly sophisticated solutions with advanced features such as adaptive protection settings, predictive maintenance capabilities, and integrated cybersecurity measures. Digital relay market penetration is expected to reach 85% of total installations within the next five years.

Service sector growth represents another significant opportunity, with end users increasingly seeking comprehensive support services including system design, commissioning, maintenance, and training. The complexity of modern protection systems creates demand for specialized services that can help organizations maximize the value of their protection relay investments while ensuring optimal system performance and reliability.

Market dynamics in the North American protection relays sector reflect the interplay between technological innovation, regulatory requirements, and evolving customer expectations. The transition from traditional protection schemes to intelligent, networked systems is reshaping competitive landscapes and creating new value propositions for market participants.

Technology convergence represents a key dynamic, with protection relays increasingly incorporating control, monitoring, and communication functions that were previously handled by separate devices. This convergence trend is driving market consolidation as companies seek to offer comprehensive solutions rather than standalone products, creating opportunities for integrated system providers.

Customer expectations continue to evolve toward solutions that provide not only reliable protection but also operational insights, predictive maintenance capabilities, and seamless integration with existing systems. Advanced analytics adoption in protection relay applications has grown by approximately 42% annually, reflecting increasing demand for data-driven operational optimization.

Competitive dynamics are characterized by ongoing innovation in relay technologies, with manufacturers investing heavily in research and development to differentiate their offerings. The market rewards companies that can demonstrate superior performance, reliability, and total cost of ownership advantages, while also providing comprehensive support services and technical expertise to their customers.

Research methodology for analyzing the North American protection relays market employs a comprehensive approach combining primary research, secondary data analysis, and industry expert consultations. The methodology ensures accurate market assessment and reliable insights for stakeholders across the protection relay value chain.

Primary research activities include structured interviews with key market participants including relay manufacturers, utility companies, industrial end users, and system integrators. These interviews provide firsthand insights into market trends, technology preferences, purchasing decisions, and future requirements that shape market development trajectories.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and technical publications to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market segments and geographic regions while maintaining analytical rigor and objectivity.

Data validation processes include cross-referencing multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to ensure data accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to deliver actionable insights that support informed decision-making by market participants and stakeholders.

Regional analysis of the North American protection relays market reveals distinct characteristics and growth patterns across the United States, Canada, and Mexico. Each country presents unique market dynamics influenced by regulatory frameworks, infrastructure development needs, and economic conditions.

United States market dominates the regional landscape, accounting for the majority of protection relay installations and representing the most mature market segment. The U.S. market benefits from extensive electrical infrastructure, stringent reliability standards, and significant utility investments in grid modernization programs. Utility sector spending on protection systems has increased by approximately 28% over the past three years, driven by aging infrastructure replacement needs and smart grid initiatives.

Canadian market demonstrates steady growth supported by resource sector development, renewable energy projects, and infrastructure modernization initiatives. The country’s vast geography and harsh climate conditions create unique requirements for robust, reliable protection systems capable of operating in challenging environments. Mining and oil and gas industries represent significant market segments driving demand for specialized protection solutions.

Mexican market shows strong growth potential driven by industrial expansion, energy sector reforms, and infrastructure development projects. The country’s growing manufacturing sector and increasing foreign investment create opportunities for protection relay suppliers, while ongoing electrical grid modernization efforts support market expansion across utility applications.

Competitive landscape in the North American protection relays market features a mix of global technology leaders and specialized regional players, each competing on the basis of technology innovation, product reliability, and customer service capabilities. Market leadership positions are established through comprehensive product portfolios, strong technical support, and proven track records in critical applications.

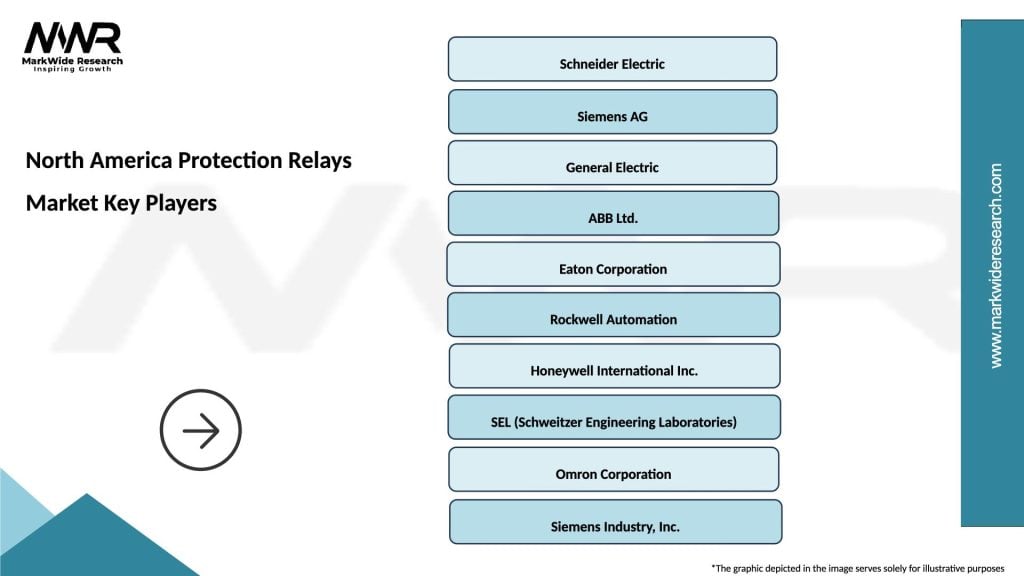

Leading market participants include:

Competitive strategies emphasize technology differentiation, with companies investing heavily in research and development to advance relay capabilities and introduce innovative features. Market leaders focus on developing comprehensive solutions that combine protection, control, and monitoring functions while providing superior customer support and technical expertise.

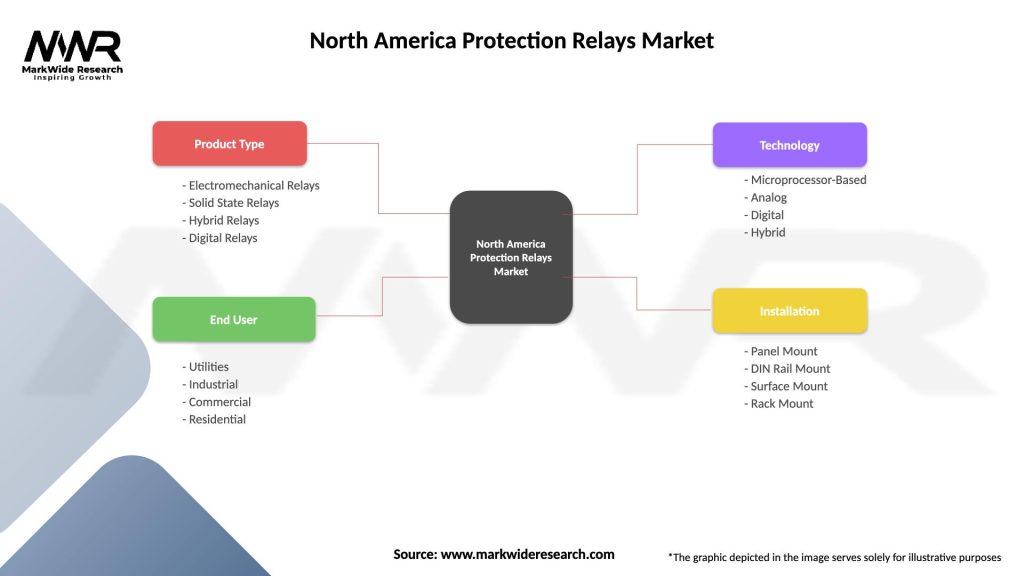

Market segmentation of the North American protection relays sector reveals diverse applications and technology categories, each serving specific customer needs and market requirements. Segmentation analysis provides insights into growth opportunities and competitive dynamics across different market segments.

By Technology:

By Voltage Level:

By Application:

Category-wise insights reveal distinct trends and growth patterns across different protection relay segments, with digital technologies leading market expansion while traditional electromechanical solutions maintain presence in specific niche applications.

Digital Protection Relays represent the dominant growth category, offering advanced features including adaptive protection settings, comprehensive event recording, and integrated communication capabilities. These devices provide superior accuracy, flexibility, and diagnostic capabilities compared to traditional alternatives, making them preferred choices for new installations and system upgrades.

Transmission Protection applications demand the highest performance levels, with utilities seeking relays capable of handling complex protection schemes, high-speed fault clearing, and seamless coordination with other protective devices. Transmission relay replacement rates have accelerated to approximately 12% annually as utilities modernize aging infrastructure.

Industrial Protection categories focus on motor protection, feeder protection, and generator protection applications where reliability and fast response times are critical for preventing costly production interruptions. Industrial customers increasingly prefer multifunctional relays that combine protection, control, and monitoring capabilities in single devices.

Distribution Protection segments emphasize cost-effective solutions that provide reliable protection for medium and low voltage networks while offering communication capabilities for integration with distribution management systems. These applications balance performance requirements with economic considerations to deliver optimal value propositions.

Key benefits for industry participants and stakeholders in the North American protection relays market encompass operational improvements, cost reductions, and enhanced system reliability that justify investments in advanced protection technologies.

For Utilities:

For Industrial Users:

For Manufacturers:

SWOT Analysis of the North American protection relays market provides comprehensive assessment of internal strengths and weaknesses alongside external opportunities and threats affecting market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market key trends shaping the North American protection relays sector reflect technological advancement, changing customer requirements, and evolving industry dynamics that influence product development and market strategies.

Digital Transformation continues as the dominant trend, with utilities and industrial customers increasingly adopting digital protection relays that offer superior performance, flexibility, and communication capabilities. This transformation is driven by the need for more intelligent, adaptive protection systems that can respond to complex grid conditions and integrate seamlessly with modern power system architectures.

Cybersecurity Integration has emerged as a critical trend, with manufacturers incorporating robust security features into protection relay designs to address growing concerns about cyber threats to critical infrastructure. Cybersecurity feature adoption has increased by approximately 58% in new relay installations, reflecting heightened awareness of security risks.

Artificial Intelligence Integration represents an emerging trend, with advanced protection relays beginning to incorporate machine learning algorithms for predictive maintenance, adaptive protection settings, and enhanced fault analysis capabilities. These AI-enhanced systems promise to improve protection performance while reducing maintenance requirements and operational costs.

Sustainability Focus is gaining importance, with customers increasingly considering environmental factors in protection relay selection decisions. Manufacturers are responding by developing more energy-efficient designs, using sustainable materials, and implementing environmentally responsible manufacturing processes.

Key industry developments in the North American protection relays market reflect ongoing innovation, strategic partnerships, and technology advancement initiatives that shape competitive dynamics and market evolution.

Technology Innovation continues to drive industry development, with manufacturers introducing next-generation protection relays featuring enhanced communication protocols, improved cybersecurity measures, and advanced analytics capabilities. Recent developments include relays with integrated edge computing capabilities that enable real-time data processing and decision-making at the device level.

Strategic Partnerships between protection relay manufacturers and software companies are creating integrated solutions that combine hardware reliability with advanced analytics and visualization capabilities. These partnerships enable comprehensive protection and asset management solutions that provide greater value to end users.

Regulatory Developments continue to influence market dynamics, with new standards for cybersecurity, communication protocols, and performance requirements driving product development and market adoption patterns. MarkWide Research analysis indicates that regulatory compliance requirements have influenced approximately 67% of recent protection relay purchases.

Market Consolidation activities include mergers and acquisitions that combine complementary technologies and market positions to create stronger competitive platforms. These consolidation trends are reshaping the competitive landscape and creating opportunities for integrated solution providers.

Analyst suggestions for stakeholders in the North American protection relays market emphasize strategic positioning, technology investment, and customer relationship development to capitalize on growth opportunities and navigate market challenges effectively.

For Manufacturers: Focus on developing comprehensive solution portfolios that combine protection, control, and monitoring capabilities while investing in cybersecurity features and communication technologies. Establish strong service capabilities to support complex protection system implementations and provide ongoing customer support throughout system lifecycles.

For Utilities: Develop long-term protection system modernization strategies that align with smart grid initiatives and regulatory requirements. Consider total cost of ownership factors including maintenance, training, and operational benefits when evaluating protection relay investments. Prioritize cybersecurity measures and ensure adequate staff training for advanced protection technologies.

For Industrial Users: Evaluate protection system requirements holistically, considering not only immediate protection needs but also future expansion plans and integration requirements. Invest in training programs to ensure personnel can effectively operate and maintain advanced protection systems. Consider partnering with experienced system integrators for complex protection scheme implementations.

For Investors: Focus on companies with strong technology portfolios, established customer relationships, and comprehensive service capabilities. Consider the impact of regulatory trends, cybersecurity requirements, and smart grid development on market opportunities and competitive positioning.

Future outlook for the North American protection relays market indicates continued growth driven by infrastructure modernization, technology advancement, and evolving customer requirements. The market is positioned for sustained expansion as utilities and industrial customers increasingly recognize the value of advanced protection technologies.

Technology evolution will continue toward more intelligent, adaptive protection systems that can respond dynamically to changing grid conditions and provide enhanced operational insights. AI-enabled protection systems are expected to capture approximately 25% market share within the next decade, representing a significant shift toward more sophisticated protection capabilities.

Market growth projections indicate robust expansion across all major segments, with digital protection relays maintaining their position as the fastest-growing category. The increasing complexity of power systems, driven by renewable energy integration and distributed generation, will create sustained demand for advanced protection solutions.

Industry transformation toward integrated protection and control solutions will continue, with manufacturers developing comprehensive platforms that address multiple customer needs through single, coordinated systems. This evolution will create opportunities for companies that can successfully integrate hardware, software, and service capabilities to deliver superior customer value.

Regional development patterns suggest continued U.S. market leadership while Canada and Mexico present significant growth opportunities driven by infrastructure development and industrial expansion. MWR forecasts indicate that emerging market segments including microgrids, energy storage integration, and electric vehicle infrastructure will create new applications for specialized protection relay solutions.

The North America protection relays market represents a dynamic and growing sector characterized by technological innovation, evolving customer requirements, and substantial growth opportunities. The market’s evolution from traditional electromechanical devices to sophisticated digital systems reflects broader trends toward intelligent, connected electrical infrastructure that can support modern power system requirements.

Market fundamentals remain strong, supported by aging infrastructure replacement needs, regulatory requirements for improved reliability, and growing investments in smart grid technologies. The increasing complexity of power systems, driven by renewable energy integration and distributed generation, creates sustained demand for advanced protection solutions that can handle complex operating conditions while providing enhanced operational insights.

Technology trends toward digitalization, artificial intelligence integration, and cybersecurity enhancement position the market for continued innovation and growth. Companies that can successfully combine advanced technology capabilities with comprehensive service offerings and strong customer relationships are well-positioned to capitalize on emerging opportunities and maintain competitive advantages in this evolving market landscape.

Strategic success in the North American protection relays market requires focus on customer needs, technology innovation, and comprehensive solution development that addresses the full spectrum of protection, control, and monitoring requirements. As the market continues to evolve, stakeholders who can adapt to changing requirements while maintaining focus on reliability, performance, and value creation will achieve sustainable growth and market leadership positions.

What is Protection Relays?

Protection relays are devices used in electrical systems to detect faults and initiate corrective actions, ensuring the safety and reliability of power distribution. They play a crucial role in protecting equipment and maintaining system stability.

What are the key players in the North America Protection Relays Market?

Key players in the North America Protection Relays Market include Siemens, Schneider Electric, and ABB, which are known for their innovative solutions and extensive product portfolios in electrical protection. Other notable companies include Eaton and GE, among others.

What are the main drivers of the North America Protection Relays Market?

The main drivers of the North America Protection Relays Market include the increasing demand for reliable power supply, the growth of renewable energy sources, and the need for advanced grid management solutions. Additionally, the rising focus on infrastructure upgrades contributes to market growth.

What challenges does the North America Protection Relays Market face?

Challenges in the North America Protection Relays Market include the high cost of advanced protection systems and the complexity of integrating new technologies with existing infrastructure. Additionally, the shortage of skilled professionals in the field poses a significant challenge.

What opportunities exist in the North America Protection Relays Market?

Opportunities in the North America Protection Relays Market include the increasing adoption of smart grid technologies and the growing emphasis on energy efficiency. Furthermore, the expansion of electric vehicle infrastructure presents new avenues for protection relay applications.

What trends are shaping the North America Protection Relays Market?

Trends shaping the North America Protection Relays Market include the integration of IoT technologies for enhanced monitoring and control, the shift towards digital relays, and the increasing focus on cybersecurity in electrical systems. These trends are driving innovation and improving system reliability.

North America Protection Relays Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electromechanical Relays, Solid State Relays, Hybrid Relays, Digital Relays |

| End User | Utilities, Industrial, Commercial, Residential |

| Technology | Microprocessor-Based, Analog, Digital, Hybrid |

| Installation | Panel Mount, DIN Rail Mount, Surface Mount, Rack Mount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Protection Relays Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at