444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America pressure pumping services market represents a critical component of the oil and gas industry, encompassing essential hydraulic fracturing, cementing, and stimulation services that enable efficient hydrocarbon extraction. This dynamic sector has experienced significant transformation driven by technological advancements, regulatory changes, and evolving energy demands across the United States and Canada. Market participants continue to invest heavily in advanced equipment and innovative techniques to enhance operational efficiency and environmental sustainability.

Regional dynamics indicate that the market maintains strong growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of approximately 6.2% over recent years. The Permian Basin, Bakken Formation, and Eagle Ford Shale remain primary drivers of demand, while Canadian oil sands operations contribute substantially to overall market activity. Technological innovations in hydraulic fracturing, including advanced proppant technologies and real-time monitoring systems, continue to reshape operational capabilities and cost structures.

Industry consolidation has emerged as a defining characteristic, with major service providers expanding their capabilities through strategic acquisitions and partnerships. The market demonstrates resilience despite commodity price volatility, supported by improved operational efficiencies and enhanced completion techniques that deliver superior well productivity. Environmental considerations increasingly influence service delivery approaches, driving adoption of cleaner technologies and sustainable practices across the sector.

The North America pressure pumping services market refers to the comprehensive ecosystem of specialized oilfield services that utilize high-pressure fluid injection techniques to enhance hydrocarbon extraction from unconventional and conventional reservoirs. These services encompass hydraulic fracturing, cementing operations, acidizing treatments, and various well stimulation techniques that optimize production capabilities and extend well life cycles.

Pressure pumping operations involve the deployment of sophisticated equipment including high-pressure pumps, blenders, chemical additives, and proppants to create fractures in reservoir rock formations. This process enables the flow of oil and natural gas from previously inaccessible or low-permeability formations. Service providers deliver integrated solutions that combine equipment, materials, and technical expertise to maximize extraction efficiency while maintaining operational safety and environmental compliance.

The market encompasses both land-based operations and offshore applications, with land-based services dominating the North American landscape due to extensive shale formations and unconventional resource development. Technology integration plays a crucial role, incorporating advanced data analytics, automation systems, and real-time monitoring capabilities to optimize treatment designs and operational outcomes.

Market fundamentals demonstrate robust growth potential driven by continued unconventional resource development and technological advancement across North America. The sector benefits from substantial infrastructure investments, regulatory stability, and increasing energy security priorities that support domestic production capabilities. Operational efficiency improvements have enabled service providers to maintain profitability while delivering enhanced value propositions to exploration and production companies.

Key growth drivers include expanding shale gas production, increasing oil recovery rates, and growing demand for energy independence. The market experiences approximately 75% of activity concentrated in major shale plays, with the remainder distributed across conventional formations and enhanced oil recovery projects. Technology adoption rates continue accelerating, with digital solutions and automation technologies gaining widespread acceptance among operators.

Competitive dynamics reflect ongoing consolidation trends, with leading service providers strengthening market positions through strategic acquisitions and capacity expansions. The sector maintains strong relationships with upstream operators while adapting to evolving environmental regulations and sustainability requirements. Investment patterns indicate continued capital allocation toward advanced equipment and technology development to maintain competitive advantages.

Strategic positioning within the North America pressure pumping services market reveals several critical insights that shape industry dynamics and future growth trajectories:

Primary growth catalysts propelling the North America pressure pumping services market include expanding unconventional resource development, technological innovation, and increasing energy security priorities. The shale revolution continues driving demand for specialized pressure pumping services, with operators seeking enhanced recovery rates and improved operational efficiency across major formations.

Technological advancement serves as a fundamental driver, with innovations in hydraulic fracturing techniques, proppant technologies, and completion designs enabling access to previously uneconomical reserves. Digital transformation initiatives enhance operational capabilities through real-time data analytics, predictive maintenance, and automated control systems that optimize treatment parameters and reduce operational risks.

Energy independence objectives at national and regional levels support continued investment in domestic oil and gas production capabilities. Government policies favoring domestic energy development create favorable operating environments for pressure pumping service providers. Infrastructure development including pipeline networks and processing facilities supports market expansion by enabling efficient resource transportation and processing.

Economic factors including improved drilling economics, enhanced well productivity, and optimized completion techniques drive operator demand for advanced pressure pumping services. The sector benefits from operational efficiency gains that reduce per-unit service costs while maintaining service quality and environmental compliance standards.

Operational challenges facing the North America pressure pumping services market include environmental regulations, commodity price volatility, and infrastructure constraints that impact service delivery and profitability. Regulatory compliance requirements continue expanding, necessitating substantial investments in environmental monitoring, waste management, and emission control technologies.

Environmental concerns regarding hydraulic fracturing operations create operational restrictions and public opposition in certain regions. Water usage requirements, waste disposal challenges, and potential groundwater contamination risks generate regulatory scrutiny and community resistance. Permitting delays and environmental impact assessments can extend project timelines and increase operational costs.

Market cyclicality linked to commodity price fluctuations creates demand volatility and pricing pressure on service providers. During periods of low oil and gas prices, operators reduce drilling activity and defer completion operations, directly impacting pressure pumping service demand. Capital intensity requirements for equipment maintenance and technology upgrades strain financial resources during market downturns.

Labor shortages and skilled workforce availability challenges impact operational capacity and service quality. The specialized nature of pressure pumping operations requires experienced technicians and engineers, creating competition for qualified personnel. Supply chain disruptions affecting proppant availability, chemical additives, and equipment components can constrain operational capabilities and increase costs.

Emerging opportunities within the North America pressure pumping services market encompass technological innovation, market expansion, and service diversification initiatives that create sustainable competitive advantages. Advanced completion techniques including multi-stage fracturing, enhanced proppant placement, and optimized fluid systems offer significant potential for improved well productivity and recovery rates.

Digital technology integration presents substantial opportunities for operational optimization and cost reduction. Artificial intelligence applications, machine learning algorithms, and predictive analytics enable real-time treatment optimization and equipment performance monitoring. Automation technologies reduce labor requirements while enhancing safety and operational consistency across service operations.

Geographic expansion opportunities exist in emerging shale formations and underdeveloped regions with significant hydrocarbon potential. International market expansion leveraging North American expertise and technology creates additional revenue streams and market diversification opportunities. Enhanced oil recovery applications in mature fields offer substantial market potential as operators seek to maximize existing asset value.

Sustainability initiatives including carbon capture technologies, renewable energy integration, and environmental remediation services align with evolving industry priorities and regulatory requirements. Partnership opportunities with technology companies, equipment manufacturers, and upstream operators enable collaborative innovation and market development initiatives.

Dynamic market forces shaping the North America pressure pumping services landscape reflect complex interactions between technological advancement, regulatory evolution, and competitive positioning. Supply and demand equilibrium fluctuates based on drilling activity levels, completion schedules, and operator capital allocation decisions that directly influence service utilization rates.

Competitive intensity remains elevated as service providers compete on technology capabilities, operational efficiency, and cost competitiveness. Market consolidation trends continue reshaping industry structure, with larger players acquiring specialized capabilities and regional operators to enhance service portfolios and geographic coverage. Pricing dynamics reflect supply-demand imbalances, with service rates experiencing volatility based on equipment availability and market activity levels.

Technology adoption cycles influence market dynamics as operators evaluate new completion techniques and service innovations. Performance metrics including well productivity improvements and operational efficiency gains drive technology acceptance and market penetration rates. Regulatory changes create both challenges and opportunities, requiring service providers to adapt operational practices while maintaining compliance standards.

Customer relationship dynamics emphasize long-term partnerships and integrated service delivery models. Contract structures evolve toward performance-based agreements that align service provider incentives with operator objectives. Market maturity indicators suggest continued evolution toward specialized service offerings and technology-driven differentiation strategies.

Comprehensive research approaches employed in analyzing the North America pressure pumping services market incorporate multiple data sources, analytical frameworks, and validation methodologies to ensure accuracy and reliability. Primary research activities include extensive interviews with industry executives, service providers, equipment manufacturers, and upstream operators to gather firsthand insights on market trends and operational dynamics.

Secondary research methodologies encompass analysis of industry publications, regulatory filings, financial reports, and technical literature to establish market context and validate primary findings. Data triangulation techniques ensure consistency across multiple information sources while identifying potential discrepancies or data gaps that require additional investigation.

Quantitative analysis incorporates statistical modeling, trend analysis, and forecasting methodologies to project market growth trajectories and identify key performance indicators. Qualitative assessment examines competitive positioning, technology adoption patterns, and regulatory impact scenarios to provide comprehensive market understanding.

Market segmentation analysis evaluates service categories, geographic regions, and customer segments to identify growth opportunities and competitive dynamics. Validation processes include expert review panels, industry feedback sessions, and cross-referencing with established market intelligence sources to ensure research quality and reliability.

United States market dominance characterizes the North America pressure pumping services landscape, with approximately 85% of regional activity concentrated within major shale formations including the Permian Basin, Bakken Formation, Eagle Ford Shale, and Marcellus Shale. The Permian Basin alone accounts for nearly 40% of total pressure pumping activity, driven by extensive horizontal drilling programs and multi-stage completion operations.

Texas operations represent the largest state-level market concentration, benefiting from favorable geology, established infrastructure, and supportive regulatory environments. North Dakota and Pennsylvania maintain significant market shares through continued Bakken and Marcellus development activities. Oklahoma, Colorado, and New Mexico contribute substantial activity levels across various unconventional formations.

Canadian market dynamics focus primarily on Alberta oil sands operations and British Columbia shale gas development, representing approximately 15% of regional market activity. Thermal recovery operations in oil sands require specialized pressure pumping services for steam injection and enhanced recovery applications. Montney and Duvernay formations drive increasing demand for hydraulic fracturing services in western Canada.

Regional infrastructure development varies significantly, with established pipeline networks and processing facilities supporting market growth in mature regions. Emerging areas require substantial infrastructure investments to support expanded pressure pumping operations and hydrocarbon transportation capabilities.

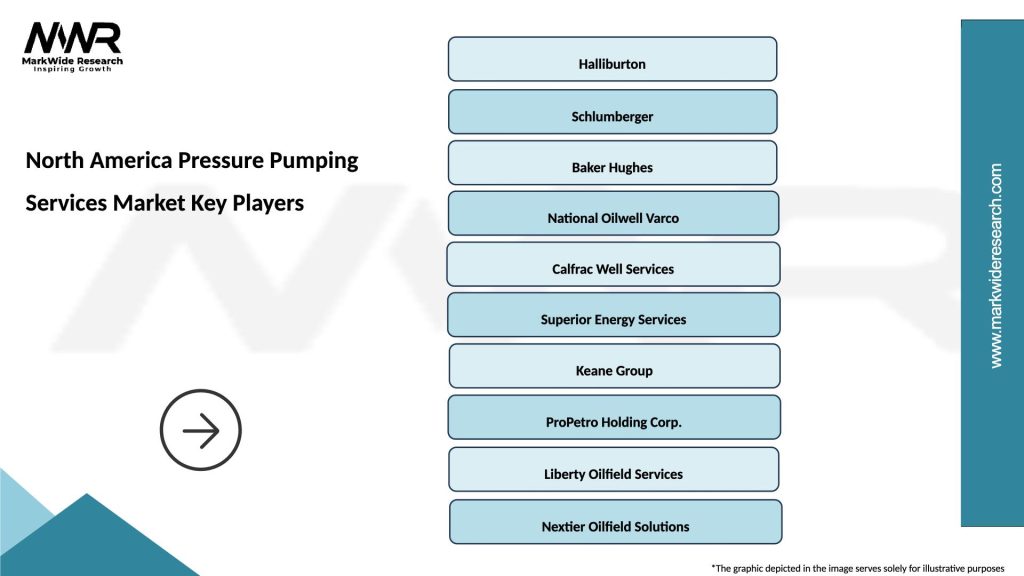

Market leadership within the North America pressure pumping services sector reflects a combination of operational scale, technological capabilities, and geographic coverage that enables comprehensive service delivery across major hydrocarbon-producing regions.

Competitive differentiation strategies emphasize technological innovation, operational efficiency, and customer relationship management. Market positioning reflects varying approaches from full-service integration to specialized niche capabilities that address specific customer requirements and operational challenges.

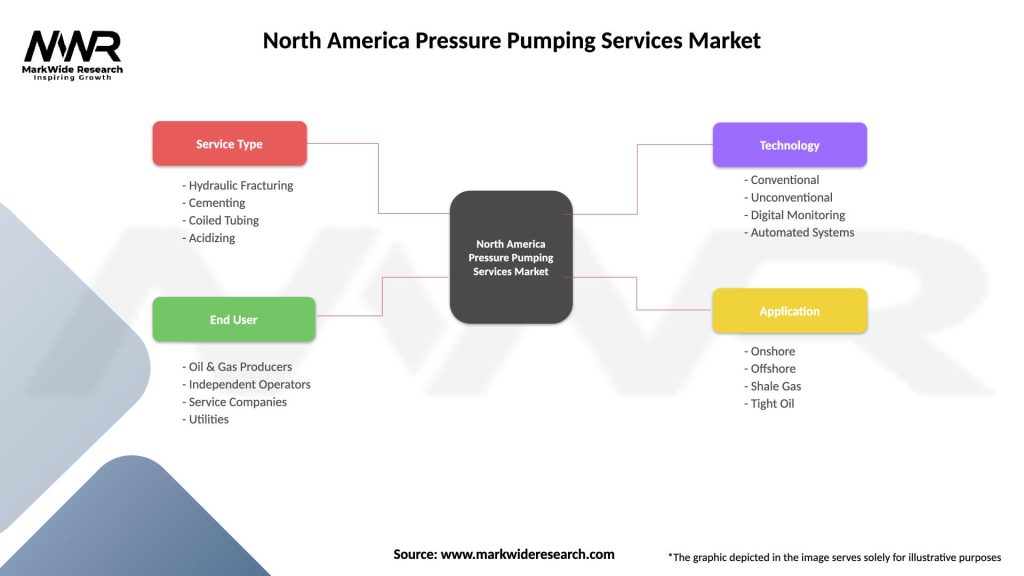

Service type segmentation within the North America pressure pumping services market encompasses multiple specialized categories that address diverse operational requirements and completion objectives:

By Service Type:

By Application:

By Well Type:

Hydraulic fracturing services dominate the North America pressure pumping market, representing approximately 70% of total service activity due to extensive unconventional resource development across major shale formations. Technology advancement in fracturing techniques includes enhanced proppant placement, optimized fluid systems, and real-time monitoring capabilities that improve treatment effectiveness and operational efficiency.

Cementing operations maintain steady demand driven by wellbore integrity requirements and regulatory compliance standards. Advanced cementing technologies including expandable cement systems, lightweight formulations, and specialized additives address challenging downhole conditions and enhance zonal isolation capabilities. Market growth reflects increasing well complexity and extended lateral lengths requiring sophisticated cementing solutions.

Acidizing treatments experience growing adoption as operators seek to maximize reservoir productivity and extend well life cycles. Chemical innovations including retarded acid systems, diverting agents, and specialized inhibitors enable effective stimulation in high-temperature and corrosive environments. Application diversity spans both matrix acidizing and fracture acidizing techniques tailored to specific reservoir characteristics.

Nitrogen services represent a specialized segment with applications in well testing, enhanced recovery, and completion operations. Technology integration combines nitrogen generation equipment with advanced delivery systems to optimize operational efficiency and reduce environmental impact. Market expansion reflects increasing adoption of nitrogen-assisted completion techniques and enhanced oil recovery applications.

Service providers benefit from substantial market opportunities driven by continued unconventional resource development and technological advancement. Revenue diversification through comprehensive service portfolios reduces market risk while enhancing customer relationships and competitive positioning. Technology leadership creates sustainable competitive advantages and premium pricing opportunities in specialized applications.

Upstream operators gain access to advanced completion technologies and operational expertise that maximize reservoir productivity and reduce development costs. Integrated service delivery streamlines operations while ensuring quality consistency and project coordination. Performance-based contracts align service provider incentives with operator objectives, creating value-sharing opportunities and risk mitigation.

Equipment manufacturers benefit from continued capital investment in advanced pressure pumping equipment and technology systems. Innovation partnerships with service providers drive product development and market penetration for next-generation technologies. Aftermarket services including maintenance, upgrades, and technical support create recurring revenue streams and customer loyalty.

Regional economies experience significant economic benefits through job creation, tax revenue generation, and local business development. Supply chain opportunities support numerous supporting industries including transportation, manufacturing, and professional services. Energy security benefits reduce import dependence while supporting domestic economic growth and industrial competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation initiatives represent the most significant trend reshaping the North America pressure pumping services market, with service providers investing heavily in artificial intelligence, machine learning, and IoT technologies. Real-time optimization capabilities enable dynamic treatment adjustments that maximize completion effectiveness while reducing operational costs and environmental impact.

Sustainability focus drives adoption of cleaner technologies, reduced water usage, and enhanced waste management practices across the industry. Electric fracturing equipment gains market acceptance as operators seek to reduce emissions and operational costs. Recycled water utilization increases significantly, with some operations achieving 90% water recycling rates through advanced treatment technologies.

Consolidation acceleration continues reshaping competitive dynamics as service providers pursue scale advantages and technology integration opportunities. Strategic partnerships between service companies, technology providers, and upstream operators create collaborative innovation platforms and risk-sharing arrangements.

Completion optimization trends emphasize enhanced proppant placement, improved fluid systems, and advanced monitoring technologies that maximize reservoir contact and production performance. Data analytics integration enables predictive maintenance, equipment optimization, and treatment design improvements that enhance operational reliability and cost effectiveness.

Technology breakthroughs in the North America pressure pumping services market include next-generation fracturing fluids, advanced proppant technologies, and automated control systems that enhance operational performance. MarkWide Research analysis indicates that digital technology adoption rates have accelerated significantly, with major service providers reporting 25-30% efficiency improvements through automation and real-time optimization systems.

Equipment modernization programs focus on high-efficiency pumping units, reduced emission systems, and enhanced safety features that meet evolving regulatory requirements. Electric fracturing fleets expand rapidly, with several major service providers committing to substantial equipment conversions over the next several years.

Strategic acquisitions reshape market structure as leading companies acquire specialized capabilities and regional expertise. Technology partnerships between service providers and software companies accelerate innovation in data analytics, artificial intelligence, and predictive maintenance applications.

Regulatory developments include updated environmental standards, enhanced safety requirements, and streamlined permitting processes in certain regions. Industry initiatives focus on environmental stewardship, community engagement, and sustainable development practices that address stakeholder concerns while maintaining operational effectiveness.

Strategic recommendations for North America pressure pumping services market participants emphasize technology investment, operational efficiency, and sustainability initiatives as key success factors. Service providers should prioritize digital transformation investments that enhance operational capabilities while reducing costs and environmental impact.

Technology adoption strategies should focus on proven solutions that deliver measurable performance improvements and competitive advantages. Automation investments offer substantial returns through reduced labor requirements, enhanced safety, and improved operational consistency. Data analytics capabilities enable predictive maintenance and optimization opportunities that enhance equipment reliability and utilization rates.

Market positioning recommendations emphasize differentiation through specialized capabilities, technology leadership, and customer relationship excellence. Geographic diversification reduces market risk while capturing growth opportunities in emerging formations and regions. Service integration strategies create value through comprehensive solutions that address customer operational challenges and objectives.

Sustainability initiatives should align with industry trends and regulatory requirements while creating competitive advantages and stakeholder value. Environmental technology investments position companies for long-term success in an evolving regulatory landscape while addressing community concerns and operator requirements.

Long-term growth prospects for the North America pressure pumping services market remain positive, supported by substantial unconventional resource endowment and continued technology advancement. Market evolution toward more efficient, environmentally sustainable operations creates opportunities for technology leaders and innovative service providers.

Technology integration will accelerate, with artificial intelligence, machine learning, and automation becoming standard operational components. MWR projections suggest that digital technology penetration rates will reach 80-85% across major service providers within the next five years, driven by proven efficiency gains and competitive advantages.

Consolidation trends will continue reshaping industry structure, with larger, more technologically advanced companies gaining market share through superior capabilities and operational scale. Service differentiation will increasingly focus on technology integration, environmental performance, and customer value creation rather than traditional cost competition.

Regulatory evolution will drive continued innovation in environmental technologies and sustainable practices. Market maturity indicators suggest transition toward specialized, high-value services that leverage advanced technologies and operational expertise to deliver superior customer outcomes and financial performance.

The North America pressure pumping services market demonstrates remarkable resilience and growth potential, driven by technological innovation, operational excellence, and substantial unconventional resource development opportunities. Market dynamics reflect ongoing transformation toward more efficient, sustainable, and technologically advanced service delivery models that create value for all stakeholders.

Competitive positioning increasingly emphasizes technology leadership, operational efficiency, and environmental stewardship as key differentiating factors. Service providers that successfully integrate digital technologies, maintain operational excellence, and adapt to evolving regulatory requirements will capture disproportionate market opportunities and financial returns.

The sector’s future trajectory points toward continued consolidation, technology advancement, and sustainability focus that will reshape competitive dynamics and operational practices. Investment priorities should emphasize proven technologies, operational capabilities, and strategic positioning that align with long-term industry trends and customer requirements, ensuring sustainable growth and competitive advantage in this dynamic and essential energy services market.

What is Pressure Pumping Services?

Pressure Pumping Services refer to the techniques and processes used to inject fluids into underground formations to enhance oil and gas recovery. This includes hydraulic fracturing and acidizing, which are essential for maximizing production in various reservoirs.

What are the key players in the North America Pressure Pumping Services Market?

Key players in the North America Pressure Pumping Services Market include Halliburton, Schlumberger, Baker Hughes, and Nabors Industries, among others. These companies provide a range of services and technologies to support oil and gas extraction.

What are the main drivers of the North America Pressure Pumping Services Market?

The main drivers of the North America Pressure Pumping Services Market include the increasing demand for energy, advancements in drilling technologies, and the need for enhanced oil recovery methods. These factors contribute to the growth of pressure pumping services in the region.

What challenges does the North America Pressure Pumping Services Market face?

The North America Pressure Pumping Services Market faces challenges such as regulatory restrictions, environmental concerns, and fluctuating oil prices. These factors can impact the operational efficiency and profitability of service providers.

What opportunities exist in the North America Pressure Pumping Services Market?

Opportunities in the North America Pressure Pumping Services Market include the expansion of unconventional oil and gas resources and the increasing adoption of sustainable practices. Companies are also exploring new technologies to improve efficiency and reduce environmental impact.

What trends are shaping the North America Pressure Pumping Services Market?

Trends shaping the North America Pressure Pumping Services Market include the integration of digital technologies, such as data analytics and automation, to optimize operations. Additionally, there is a growing focus on reducing the carbon footprint of pressure pumping activities.

North America Pressure Pumping Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Hydraulic Fracturing, Cementing, Coiled Tubing, Acidizing |

| End User | Oil & Gas Producers, Independent Operators, Service Companies, Utilities |

| Technology | Conventional, Unconventional, Digital Monitoring, Automated Systems |

| Application | Onshore, Offshore, Shale Gas, Tight Oil |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Pressure Pumping Services Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at