444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America portable generator market represents a dynamic and rapidly expanding sector driven by increasing demand for reliable backup power solutions across residential, commercial, and industrial applications. This market encompasses a diverse range of portable power generation equipment designed to provide temporary or emergency electricity during outages, outdoor activities, and remote operations. Market growth has been particularly robust, with the sector experiencing a 6.8% CAGR over recent years as consumers and businesses increasingly prioritize energy security and independence.

Regional dynamics within North America show significant variation, with the United States commanding the largest market share at approximately 78% of total demand, followed by Canada and Mexico. The market’s expansion is fueled by frequent extreme weather events, aging electrical infrastructure, and growing awareness of the importance of backup power systems. Technological advancements in generator efficiency, fuel systems, and smart connectivity features have further enhanced market appeal, making portable generators more accessible and user-friendly for diverse consumer segments.

Industry transformation is evident through the integration of cleaner fuel technologies, including propane, natural gas, and battery-powered systems, alongside traditional gasoline models. This diversification reflects evolving consumer preferences for environmentally conscious solutions and regulatory pressures for reduced emissions. The market demonstrates strong resilience and adaptability, positioning itself as an essential component of North America’s distributed energy landscape.

The North America portable generator market refers to the comprehensive ecosystem of manufacturers, distributors, and end-users involved in the production, sale, and utilization of mobile power generation equipment across the United States, Canada, and Mexico. These systems are specifically designed for temporary power supply applications, offering flexibility and mobility that distinguishes them from stationary backup generators.

Portable generators encompass various power output ranges, fuel types, and technological configurations, serving applications from small residential backup needs to large commercial and industrial temporary power requirements. The market includes conventional internal combustion engine generators, inverter generators, solar-powered units, and hybrid systems that combine multiple power sources for enhanced reliability and efficiency.

Market participants range from established multinational corporations to specialized regional manufacturers, creating a competitive landscape that drives innovation and price optimization. Distribution channels include traditional retail outlets, online platforms, rental companies, and direct manufacturer sales, ensuring broad market accessibility across diverse geographic and demographic segments throughout North America.

Strategic market positioning reveals the North America portable generator market as a critical component of the region’s energy resilience infrastructure, experiencing sustained growth driven by multiple converging factors. The market demonstrates exceptional adaptability to changing consumer needs, technological innovations, and regulatory requirements while maintaining strong profitability across key segments.

Key growth drivers include increasing frequency of power outages due to extreme weather events, with approximately 42% of consumers reporting multiple outages annually, rising adoption of outdoor recreational activities, and expanding commercial applications in construction, events, and emergency services. The residential segment continues to dominate market demand, representing roughly 55% of total sales volume, while commercial and industrial applications show the fastest growth rates.

Technological evolution has significantly enhanced product appeal through improved fuel efficiency, reduced noise levels, smart connectivity features, and cleaner emission profiles. Market leaders are investing heavily in research and development to address consumer demands for more sustainable, user-friendly, and reliable power solutions. The competitive landscape remains fragmented but consolidating, with top manufacturers capturing increasing market share through strategic acquisitions and expanded distribution networks.

Future prospects indicate continued market expansion supported by infrastructure modernization needs, growing energy independence awareness, and technological advancements in battery storage and renewable energy integration. Regional variations in market development reflect different regulatory environments, climate patterns, and economic conditions across North American markets.

Market segmentation analysis reveals distinct patterns in consumer behavior and product preferences across different applications and geographic regions. The following insights provide comprehensive understanding of market dynamics:

Climate-related power disruptions serve as the primary catalyst for portable generator market expansion across North America. Increasing frequency and severity of extreme weather events, including hurricanes, ice storms, wildfires, and severe thunderstorms, have heightened awareness of electrical grid vulnerabilities and the need for reliable backup power solutions. Infrastructure aging compounds these challenges, with many regional power grids operating beyond their designed lifespan and requiring extensive modernization investments.

Consumer lifestyle changes significantly influence market demand patterns, particularly the growing popularity of outdoor recreational activities such as camping, RV travel, and outdoor events. The rise of remote work arrangements has also increased home-based power reliability requirements, with professionals seeking uninterrupted electricity access for home offices and digital connectivity needs. Energy independence awareness continues to grow among consumers who view portable generators as essential components of personal emergency preparedness strategies.

Technological advancement in generator design and functionality drives market appeal through improved user experience, enhanced reliability, and expanded application possibilities. Modern portable generators offer features such as electric start systems, fuel gauges, low-oil shutdowns, and parallel connectivity options that make them more accessible to non-technical users. Smart technology integration enables remote monitoring and control capabilities that align with consumer expectations for connected devices.

Economic factors including rising electricity costs and increasing property values motivate consumers to invest in backup power solutions that protect valuable electronics, prevent food spoilage, and maintain comfortable living conditions during outages. Insurance considerations also influence purchasing decisions as some policies offer premium reductions for homes equipped with backup power systems.

High initial investment costs represent a significant barrier to market penetration, particularly for higher-capacity units that can adequately power entire homes or commercial facilities. Many consumers view portable generators as discretionary purchases, leading to delayed buying decisions and price sensitivity that limits premium product adoption. Ongoing operational expenses including fuel costs, maintenance requirements, and storage considerations add to the total cost of ownership and may deter budget-conscious consumers.

Safety concerns surrounding portable generator operation continue to challenge market growth, with carbon monoxide poisoning risks, fire hazards, and electrical safety issues requiring extensive consumer education and regulatory oversight. Noise pollution restrictions in residential areas limit generator usage options and may prevent adoption in densely populated communities where backup power needs are significant.

Environmental regulations increasingly restrict emissions from internal combustion engines, requiring manufacturers to invest in cleaner technologies that may increase product costs and complexity. Fuel storage and handling requirements create additional challenges for consumers, particularly in urban environments where gasoline storage may be restricted or impractical.

Technical complexity associated with proper generator sizing, installation, and maintenance can overwhelm non-technical consumers, leading to improper usage or underutilization of equipment capabilities. Seasonal demand fluctuations create inventory management challenges for retailers and may result in supply shortages during peak demand periods or excess inventory during slower sales periods.

Clean energy integration presents substantial growth opportunities as manufacturers develop hybrid systems combining traditional generators with solar panels, battery storage, and fuel cells. These integrated solutions appeal to environmentally conscious consumers while providing enhanced reliability and reduced operating costs. Battery technology advancement enables development of quiet, emission-free portable power stations that can serve indoor applications and noise-sensitive environments.

Smart grid integration opportunities emerge as utilities explore distributed energy resources and demand response programs that could incorporate portable generators as grid-connected assets. Internet of Things connectivity enables advanced monitoring, predictive maintenance, and remote management capabilities that enhance user experience and reduce service costs.

Emerging market segments including electric vehicle charging, outdoor hospitality, and mobile medical services create new application opportunities for specialized portable power solutions. Rental and sharing economy models offer alternatives to ownership that can expand market reach to price-sensitive consumers and occasional users.

International expansion within North America, particularly in underserved rural and remote communities, provides growth potential as infrastructure development and economic growth increase power reliability requirements. Government incentive programs for emergency preparedness and clean energy adoption could stimulate market demand through tax credits, rebates, or financing assistance.

Service and maintenance opportunities represent recurring revenue streams for manufacturers and dealers, with potential for subscription-based maintenance programs and extended warranty offerings that enhance customer relationships and profitability.

Supply chain dynamics within the North America portable generator market reflect complex interactions between global manufacturing capabilities, regional distribution networks, and local service requirements. Manufacturing concentration in Asia for key components creates potential vulnerability to trade disruptions while offering cost advantages that enable competitive pricing strategies.

Competitive intensity varies significantly across market segments, with established brands maintaining strong positions in traditional gasoline generators while newer entrants challenge incumbents in battery-powered and smart-enabled product categories. Innovation cycles are accelerating as manufacturers respond to evolving consumer preferences and regulatory requirements through enhanced product features and performance capabilities.

Distribution channel evolution reflects changing consumer shopping behaviors, with online sales gaining market share while traditional retail channels adapt through enhanced service offerings and demonstration capabilities. Inventory management becomes increasingly critical as seasonal demand patterns and supply chain uncertainties require sophisticated forecasting and stocking strategies.

Regulatory landscape changes influence product development priorities and market entry strategies, with emissions standards, safety requirements, and noise regulations varying across jurisdictions within North America. Consumer education needs drive marketing investments and dealer training programs as manufacturers seek to address safety concerns and promote proper equipment usage.

Economic sensitivity affects market demand patterns, with discretionary purchases like portable generators showing correlation to consumer confidence levels and disposable income trends. Weather pattern influences create unpredictable demand spikes that challenge supply chain planning and inventory management across the market ecosystem.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into North America portable generator market dynamics. Primary research activities include extensive surveys of end-users across residential, commercial, and industrial segments to understand purchasing behavior, product preferences, and satisfaction levels with current solutions.

Industry expert interviews provide qualitative insights from manufacturers, distributors, retailers, and service providers throughout the value chain. These discussions reveal strategic priorities, competitive dynamics, and emerging trends that quantitative data alone cannot capture. Focus group sessions with target consumers explore decision-making processes, feature preferences, and barriers to adoption across different demographic and geographic segments.

Secondary research analysis incorporates government statistics, industry association reports, trade publications, and academic studies to establish market context and validate primary research findings. Market sizing methodologies utilize multiple approaches including top-down analysis from related markets and bottom-up calculations based on unit sales and pricing data.

Competitive intelligence gathering involves systematic monitoring of manufacturer announcements, product launches, pricing strategies, and distribution partnerships to understand market positioning and strategic directions. Regulatory analysis examines current and proposed legislation affecting product standards, emissions requirements, and safety regulations across North American jurisdictions.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review panels, and statistical verification methods. Trend analysis techniques identify emerging patterns and forecast future market developments based on historical data and leading indicators.

United States market leadership reflects the country’s large population, frequent weather-related power outages, and strong consumer purchasing power that drives demand across all generator categories. Regional variations within the US show highest adoption rates in hurricane-prone southeastern states, tornado-prone central regions, and areas with aging electrical infrastructure. California and Texas represent the largest state markets due to population density and specific power reliability challenges including wildfire-related outages and grid instability.

Canadian market characteristics differ significantly from US patterns, with demand concentrated in provinces experiencing harsh winter weather and remote communities with limited grid connectivity. Ontario and Quebec lead provincial markets due to population concentration and frequent ice storm events that cause extended power outages. Rural and cottage country applications drive substantial demand for portable generators as backup power and off-grid solutions.

Mexico’s emerging market shows rapid growth potential as economic development increases consumer purchasing power and infrastructure reliability concerns drive backup power adoption. Industrial and commercial applications currently dominate Mexican demand patterns, with residential adoption expected to accelerate as middle-class expansion continues. Regional economic disparities create varied market development patterns across different Mexican states and urban versus rural areas.

Cross-border trade dynamics influence market competition and pricing strategies, with manufacturers optimizing production and distribution networks to serve the entire North American market efficiently. Regulatory harmonization efforts aim to standardize safety and emissions requirements across the region while respecting national sovereignty over energy and environmental policies.

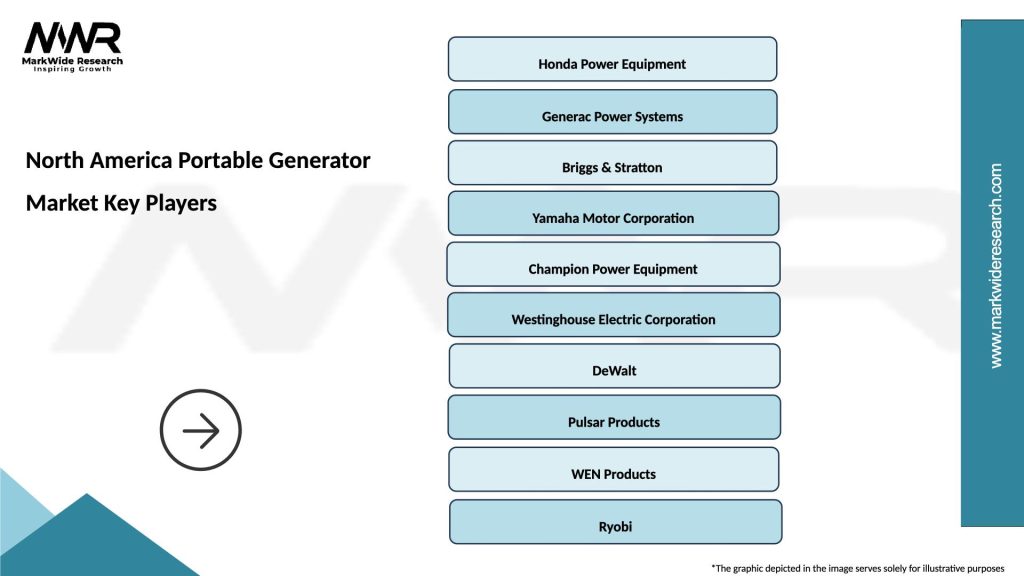

Market leadership in the North America portable generator sector is distributed among several established manufacturers who have built strong brand recognition and distribution networks over decades of operation. The competitive environment demonstrates both stability among top players and dynamic innovation as companies respond to evolving consumer needs and technological opportunities.

Competitive strategies vary significantly across market participants, with established players leveraging brand strength and distribution advantages while newer entrants focus on innovation, pricing, and niche market segments. Strategic partnerships between manufacturers and retailers, rental companies, and service providers create competitive advantages through enhanced market access and customer support capabilities.

Power output segmentation reveals distinct market categories serving different application requirements and consumer preferences. Small portable generators under 3,000 watts target basic residential backup needs and recreational applications, offering affordability and portability advantages. Medium-capacity units ranging from 3,000 to 8,000 watts serve whole-house backup applications and small commercial needs, representing the largest market segment by volume and revenue.

Fuel type segmentation shows traditional gasoline generators maintaining market leadership while alternative fuel options gain traction among specific consumer segments:

Application-based segmentation demonstrates diverse market requirements across end-user categories:

Residential category dominance reflects widespread consumer awareness of power outage risks and growing investment in home emergency preparedness. Suburban homeowners represent the core market segment, with adoption rates reaching 35% in high-risk weather regions where frequent outages justify generator investments. Feature preferences in residential applications emphasize automatic start capabilities, fuel efficiency, and quiet operation to minimize neighborhood disturbance.

Commercial segment growth is driven by construction industry expansion, outdoor event popularity, and emergency service requirements. Rental market penetration in commercial applications reaches approximately 60% of total demand as businesses prefer flexible access over ownership for occasional power needs. Reliability and durability take priority over initial cost considerations in commercial purchasing decisions.

Recreational market evolution shows increasing sophistication as consumers demand generators that enhance outdoor experiences without compromising environmental quality. Inverter technology adoption in recreational applications exceeds 70% of new purchases due to clean power output requirements for sensitive electronics and reduced noise levels for camping applications.

Industrial applications focus on mission-critical backup power and temporary installations requiring high reliability and extended runtime capabilities. Maintenance service contracts are standard in industrial applications, with 85% of purchases including professional service agreements to ensure optimal performance and minimize downtime risks.

Emerging categories include electric vehicle charging applications, mobile medical services, and disaster response operations that require specialized power solutions with unique performance characteristics and regulatory compliance requirements.

Manufacturers benefit from strong market demand growth driven by infrastructure vulnerabilities and consumer awareness of backup power importance. Product differentiation opportunities through technology innovation, fuel efficiency improvements, and smart connectivity features enable premium pricing strategies and market share expansion. Recurring revenue streams from parts, service, and extended warranties provide stable income sources that complement cyclical equipment sales.

Distributors and retailers enjoy healthy profit margins and growing market demand that supports business expansion and inventory investment. Seasonal demand patterns create opportunities for strategic inventory management and promotional activities that maximize profitability. Service revenue opportunities through installation, maintenance, and repair services enhance customer relationships and provide additional income streams.

End-users gain significant value through enhanced energy security, property protection, and lifestyle continuity during power outages. Technology improvements deliver better user experiences through easier operation, improved reliability, and enhanced safety features. Fuel efficiency advances reduce operating costs while environmental improvements align with sustainability preferences.

Rental companies benefit from growing demand for temporary power solutions in commercial and industrial applications. Fleet utilization rates remain strong across diverse applications, supporting profitable operations and equipment investment. Service expertise becomes a competitive advantage as customers seek comprehensive power solutions rather than equipment-only transactions.

Service providers find expanding opportunities in installation, maintenance, and repair services as the installed base of portable generators grows. Specialized expertise in generator systems creates barriers to entry and supports premium pricing for professional services. Emergency response capabilities provide additional revenue opportunities during severe weather events and natural disasters.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification and battery integration represent the most significant technological trend reshaping the portable generator market. Lithium-ion battery systems are increasingly incorporated into hybrid generators that combine traditional fuel engines with battery storage for enhanced efficiency and reduced emissions. Pure battery generators gain market acceptance for indoor applications and noise-sensitive environments where traditional generators cannot operate.

Smart connectivity features become standard across product categories as consumers expect Internet of Things integration in all appliances. Mobile app control enables remote monitoring, automatic start/stop functions, and maintenance alerts that enhance user experience and equipment reliability. Predictive maintenance capabilities use sensor data and analytics to optimize service schedules and prevent unexpected failures.

Fuel diversification accelerates as manufacturers respond to environmental concerns and fuel availability challenges. Propane and natural gas options expand across product lines while dual-fuel and tri-fuel systems provide operational flexibility that appeals to preparedness-minded consumers. Biofuel compatibility emerges as manufacturers explore renewable fuel options for traditional generator engines.

Noise reduction technology advances through improved engine design, enhanced enclosures, and inverter technology that enables quieter operation without sacrificing power output. Community acceptance improves as generators become less disruptive to neighbors during extended outages. Regulatory compliance with local noise ordinances expands market opportunities in densely populated areas.

Modular and scalable systems allow consumers to customize power capacity based on specific needs and budget constraints. Parallel connectivity options enable multiple smaller units to work together, providing flexibility and redundancy that appeals to both residential and commercial users. Expandable battery systems offer similar scalability for electric generator solutions.

Manufacturing capacity expansion across North America reflects growing market confidence and supply chain localization trends. Major manufacturers are investing in new production facilities and equipment upgrades to meet increasing demand while reducing dependence on overseas suppliers. Automation and robotics integration in manufacturing processes improves quality consistency and production efficiency.

Strategic acquisitions and partnerships reshape competitive dynamics as companies seek to expand product portfolios, distribution networks, and technological capabilities. Vertical integration efforts by leading manufacturers aim to control key components and reduce supply chain vulnerabilities. Technology licensing agreements enable smaller companies to access advanced features and manufacturing processes.

Regulatory developments include updated emissions standards, safety requirements, and noise regulations that influence product design and market access. Government incentive programs for emergency preparedness and clean energy adoption create new market opportunities while supporting consumer adoption. International trade agreements affect component sourcing strategies and export opportunities.

Distribution channel evolution continues with online sales growth, direct-to-consumer strategies, and enhanced retail partnerships. Rental market expansion creates new business models and customer access points while providing alternatives to ownership for occasional users. Service network development improves customer support and maintenance capabilities across geographic markets.

Research and development investments focus on breakthrough technologies including fuel cells, advanced battery systems, and artificial intelligence integration. University partnerships and government research grants support innovation in clean energy technologies and smart grid integration capabilities. Patent activity increases as companies seek to protect intellectual property and establish competitive advantages.

Market participants should prioritize investment in clean technology development to address growing environmental concerns and regulatory requirements. Battery integration strategies offer significant differentiation opportunities while positioning companies for long-term market evolution toward electrification. Hybrid system development provides immediate market opportunities while building capabilities for future technology transitions.

Distribution strategy optimization requires balancing traditional retail relationships with direct-to-consumer opportunities and online channel development. Service capability enhancement through training programs, tool investments, and network expansion creates competitive advantages and recurring revenue streams. Customer education initiatives address safety concerns and promote proper equipment usage to reduce liability risks and enhance brand reputation.

Geographic expansion within underserved North American markets offers growth opportunities with lower competitive intensity than established regions. Rural and remote community focus aligns with infrastructure development trends and government initiatives for energy access improvement. International market exploration provides long-term growth options as global demand for backup power solutions increases.

Product portfolio diversification across power output ranges, fuel types, and application segments reduces market risk while capturing broader customer bases. Rental market participation through partnerships or direct investment provides access to commercial customers and recurring revenue opportunities. Smart technology integration becomes essential for maintaining competitiveness and meeting evolving consumer expectations.

Supply chain resilience requires diversification of component sources and strategic inventory management to address potential disruptions. Vertical integration consideration for critical components may provide cost advantages and quality control benefits. Sustainability initiatives throughout operations and product lifecycle enhance brand positioning and regulatory compliance.

Market expansion prospects remain robust as infrastructure vulnerabilities persist and consumer awareness of backup power importance continues growing. MarkWide Research analysis indicates sustained growth momentum driven by climate change impacts, aging electrical grids, and evolving consumer lifestyle requirements. Technology convergence between traditional generators and renewable energy systems creates new product categories and market opportunities.

Electrification trends will reshape product development priorities over the next decade, with battery-powered and hybrid systems gaining market share while traditional generators evolve to meet stricter environmental standards. Smart grid integration capabilities become increasingly important as utilities explore distributed energy resources and demand response programs. Energy storage integration enables generators to provide grid services beyond emergency backup applications.

Regional market development shows varying patterns across North America, with the United States maintaining leadership while Canada and Mexico offer significant growth potential. Rural electrification initiatives and infrastructure modernization programs create opportunities for portable power solutions in underserved communities. Cross-border trade facilitation enhances market integration and competitive dynamics throughout the region.

Competitive landscape evolution will likely feature continued consolidation among smaller players while technology leaders maintain market positions through innovation and service excellence. New market entrants from adjacent industries may challenge established players with disruptive technologies and business models. Partnership strategies between manufacturers, utilities, and technology companies create new value propositions and market access opportunities.

Long-term sustainability requires industry adaptation to environmental regulations, consumer preferences, and technological capabilities that favor cleaner, smarter, and more efficient power generation solutions. Circular economy principles including product lifecycle management, recycling programs, and sustainable manufacturing practices become competitive differentiators and regulatory requirements.

The North America portable generator market demonstrates exceptional resilience and growth potential driven by fundamental infrastructure challenges, evolving consumer needs, and technological innovation opportunities. Market dynamics reflect a mature industry undergoing transformation as traditional power generation technologies integrate with clean energy solutions and smart connectivity features to meet changing customer expectations.

Strategic positioning for market success requires balanced investment in proven technologies and emerging innovations while maintaining focus on customer safety, environmental responsibility, and operational excellence. Competitive advantages increasingly depend on comprehensive solutions that combine reliable equipment, professional services, and advanced features rather than product specifications alone.

Future market development will be shaped by regulatory evolution, technology convergence, and infrastructure modernization trends that create both challenges and opportunities for industry participants. Successful companies will demonstrate adaptability to changing market conditions while maintaining core competencies in power generation technology and customer service excellence. The market’s continued expansion reflects its essential role in North America’s energy resilience infrastructure and consumer preparedness strategies.

What is Portable Generator?

A portable generator is a compact, mobile power source that provides electricity for various applications, including outdoor events, construction sites, and emergency backup during power outages.

What are the key players in the North America Portable Generator Market?

Key players in the North America Portable Generator Market include Honda Power Equipment, Generac Holdings, and Briggs & Stratton, among others.

What are the main drivers of growth in the North America Portable Generator Market?

The growth of the North America Portable Generator Market is driven by increasing demand for reliable power sources during emergencies, rising outdoor recreational activities, and the expansion of the construction industry.

What challenges does the North America Portable Generator Market face?

Challenges in the North America Portable Generator Market include regulatory compliance regarding emissions, competition from alternative energy sources, and the high initial cost of advanced models.

What opportunities exist in the North America Portable Generator Market?

Opportunities in the North America Portable Generator Market include advancements in battery technology, the growing trend of off-grid living, and increasing investments in renewable energy solutions.

What trends are shaping the North America Portable Generator Market?

Trends in the North America Portable Generator Market include the rise of inverter generators for quieter operation, the integration of smart technology for remote monitoring, and a shift towards more environmentally friendly fuel options.

North America Portable Generator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Inverter Generators, Standby Generators, Portable Generators, Solar Generators |

| Fuel Type | Gasoline, Diesel, Propane, Natural Gas |

| End User | Residential, Commercial, Industrial, Emergency Services |

| Power Rating | 1-3 kW, 4-7 kW, 8-10 kW, Above 10 kW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Portable Generator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at