444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America phase change materials market represents a rapidly evolving sector within the advanced materials industry, characterized by innovative thermal energy storage solutions that are transforming multiple applications across commercial, residential, and industrial segments. Phase change materials (PCMs) have emerged as critical components in energy-efficient building systems, electronics cooling, textiles, and renewable energy storage applications throughout the United States, Canada, and Mexico.

Market dynamics indicate robust growth driven by increasing emphasis on energy efficiency, sustainability initiatives, and stringent building codes across North American jurisdictions. The region’s commitment to reducing carbon emissions and enhancing energy conservation has positioned PCM technology as an essential solution for thermal management challenges. Current adoption rates show 23% annual growth in building integration applications, while electronics cooling segments demonstrate 18% expansion in thermal management solutions.

Regional distribution reveals the United States commanding approximately 72% market share, followed by Canada with 19%, and Mexico contributing 9% to the overall North American landscape. The concentration reflects advanced research infrastructure, established manufacturing capabilities, and progressive regulatory frameworks supporting sustainable building technologies and energy storage innovations.

The North America phase change materials market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and application of substances that absorb and release thermal energy during phase transitions between solid and liquid states. These materials provide efficient thermal energy storage and temperature regulation capabilities across diverse industrial and consumer applications.

Phase change materials function by storing latent heat energy during melting processes and releasing this energy during solidification, enabling precise temperature control and energy conservation in various systems. The market encompasses organic PCMs including paraffins and fatty acids, inorganic materials such as salt hydrates, and advanced eutectic compounds designed for specific temperature ranges and applications.

Commercial applications span building envelope systems, HVAC equipment, electronics thermal management, textiles, packaging, and renewable energy storage solutions. The technology’s versatility enables integration into construction materials, electronic devices, automotive components, and industrial processes requiring precise thermal regulation and energy efficiency optimization.

Strategic market positioning reveals North America as a leading global hub for phase change materials innovation, driven by substantial investments in research and development, favorable regulatory environments, and strong demand from energy-conscious industries. The region’s mature industrial infrastructure and technological expertise have established competitive advantages in advanced PCM formulations and application technologies.

Key growth drivers include escalating energy costs, stringent building energy codes, expanding electronics miniaturization trends, and increasing adoption of renewable energy systems requiring efficient thermal storage solutions. Government incentives supporting green building initiatives contribute approximately 31% of market expansion, while private sector investments in energy efficiency drive additional growth momentum.

Market segmentation demonstrates diversified applications with building and construction representing the largest segment, followed by electronics and telecommunications, textiles, and transportation applications. Emerging opportunities in data center cooling, electric vehicle thermal management, and concentrated solar power systems present significant growth potential for specialized PCM solutions.

Competitive landscape features established chemical companies, specialized PCM manufacturers, and innovative startups developing next-generation thermal management solutions. Strategic partnerships between material suppliers and end-user industries accelerate product development and market penetration across diverse application segments.

Technological advancement represents the primary catalyst driving market evolution, with continuous innovations in PCM formulations, encapsulation techniques, and integration methods expanding application possibilities and performance characteristics. Advanced manufacturing processes enable customized thermal properties and enhanced durability for specific industry requirements.

Market maturity indicators suggest the North American PCM sector is transitioning from early adoption to mainstream integration across multiple industries. Standardization efforts and performance certification programs enhance market confidence and accelerate commercial deployment of PCM technologies.

Energy efficiency mandates across North American jurisdictions create compelling demand for phase change materials as building codes become increasingly stringent and energy performance standards evolve. Federal and state-level initiatives promoting sustainable construction practices drive adoption of PCM-integrated building systems and components.

Rising energy costs motivate commercial and residential property owners to invest in thermal management solutions that reduce heating and cooling expenses while maintaining occupant comfort. PCM technology offers attractive return on investment through reduced energy consumption and peak demand management capabilities.

Electronics miniaturization trends create thermal management challenges that traditional cooling methods cannot adequately address, positioning PCMs as essential solutions for high-performance computing, mobile devices, and advanced electronics applications. The semiconductor industry’s continued evolution drives demand for innovative thermal interface materials.

Climate change awareness and corporate sustainability commitments accelerate adoption of energy-efficient technologies across industries. Organizations seeking to reduce carbon footprints and achieve environmental goals increasingly incorporate PCM solutions into their operations and product offerings.

Government incentives including tax credits, rebates, and grants for energy-efficient building systems and renewable energy projects support PCM market growth. Public sector procurement programs and green building certification requirements further stimulate demand for advanced thermal management technologies.

High initial costs associated with PCM materials and integration systems present significant barriers to widespread adoption, particularly in price-sensitive market segments. The premium pricing of advanced PCM formulations compared to conventional thermal management solutions limits market penetration in cost-conscious applications.

Technical complexity in PCM selection, system design, and integration requires specialized expertise that may not be readily available across all market segments. The need for customized solutions and application-specific engineering increases implementation complexity and project timelines.

Performance limitations including thermal cycling degradation, subcooling effects, and phase separation challenges affect long-term reliability and effectiveness of certain PCM formulations. Material stability concerns and maintenance requirements may deter adoption in critical applications requiring consistent performance.

Limited awareness among potential end-users regarding PCM benefits, applications, and implementation strategies restricts market growth. Educational initiatives and demonstration projects are necessary to overcome knowledge gaps and misconceptions about phase change technology.

Regulatory uncertainties surrounding building codes, safety standards, and environmental regulations create hesitation among manufacturers and end-users considering PCM investments. Evolving standards and certification requirements may impact product development and market entry strategies.

Emerging applications in electric vehicle thermal management present substantial growth opportunities as automotive manufacturers seek efficient solutions for battery temperature control and cabin climate management. The expanding electric vehicle market creates demand for specialized PCM formulations optimized for automotive environments.

Data center expansion across North America drives demand for innovative cooling solutions that reduce energy consumption and improve operational efficiency. PCM technology offers potential for significant energy savings in server cooling and facility thermal management applications.

Smart building integration represents a transformative opportunity as Internet of Things (IoT) technologies enable intelligent thermal management systems incorporating PCMs. Advanced building automation systems can optimize PCM performance and maximize energy efficiency benefits.

Renewable energy storage applications offer significant potential as solar and wind power installations require efficient thermal storage solutions. Concentrated solar power systems and grid-scale energy storage projects present opportunities for large-scale PCM deployment.

Textile innovations in smart fabrics and temperature-regulating clothing create new market segments for PCM integration. Athletic wear, medical textiles, and protective clothing applications demonstrate growing interest in thermoregulating materials.

Supply chain evolution reflects increasing vertical integration among PCM manufacturers seeking to control quality, reduce costs, and accelerate innovation cycles. Strategic partnerships between material suppliers and application developers enhance product development capabilities and market responsiveness.

Technology convergence with nanotechnology, advanced materials science, and smart systems creates opportunities for next-generation PCM solutions with enhanced performance characteristics. Research collaborations between universities, government laboratories, and private companies accelerate innovation and commercialization processes.

Market consolidation trends indicate strategic acquisitions and mergers as established companies seek to expand PCM capabilities and market reach. Vertical integration strategies enable comprehensive solution offerings and improved customer service capabilities.

Regional specialization emerges as different North American markets develop expertise in specific PCM applications and technologies. Climate variations and regulatory differences drive regional customization of products and solutions.

Investment patterns show increasing venture capital and private equity interest in PCM technology companies, particularly those developing innovative applications and manufacturing processes. Government research funding supports fundamental research and technology development initiatives.

Comprehensive market analysis employs multiple research methodologies including primary interviews with industry executives, technical experts, and end-users across diverse application segments. Secondary research encompasses patent analysis, scientific literature review, and regulatory document examination to understand technology trends and market dynamics.

Data collection strategies include structured surveys of PCM manufacturers, distributors, and end-users to quantify market size, growth rates, and competitive positioning. Industry conference participation and trade show analysis provide insights into emerging technologies and market trends.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project future market development and identify growth opportunities. Regional analysis considers climate variations, regulatory differences, and economic factors affecting PCM adoption patterns.

Validation processes involve cross-referencing multiple data sources, expert interviews, and industry feedback to ensure accuracy and reliability of market assessments. Continuous monitoring of market developments and technology advances maintains current and relevant analysis.

United States market leadership stems from advanced research infrastructure, established manufacturing capabilities, and progressive building codes supporting energy efficiency initiatives. California, Texas, and New York represent the largest state markets, driven by stringent energy regulations and substantial construction activity.

Canadian market development focuses on cold climate applications and energy efficiency solutions for residential and commercial buildings. Government incentives for green building technologies and renewable energy projects support PCM adoption across provinces, with Ontario and British Columbia leading market growth.

Mexican market expansion reflects growing industrial development and increasing awareness of energy efficiency benefits. Manufacturing sector growth and foreign investment in automotive and electronics industries create opportunities for PCM integration in industrial applications.

Regional climate variations influence PCM selection and application strategies, with northern regions emphasizing heating applications and southern areas focusing on cooling solutions. Seasonal temperature fluctuations and extreme weather events drive demand for thermal management systems.

Cross-border collaboration in research and development accelerates technology advancement and market development. Academic partnerships and joint ventures facilitate knowledge transfer and commercialization of innovative PCM solutions across North American markets.

Market leadership encompasses established chemical companies, specialized PCM manufacturers, and innovative technology developers competing across diverse application segments. Strategic positioning varies from broad-based material suppliers to niche application specialists.

Competitive strategies emphasize product innovation, application development, and strategic partnerships to expand market reach and enhance customer value propositions. Research and development investments focus on improving PCM performance, reducing costs, and developing new applications.

Market differentiation occurs through specialized formulations, custom engineering services, and integrated system solutions. Companies leverage technical expertise and application knowledge to create competitive advantages in specific market segments.

By Material Type:

By Application:

By Temperature Range:

By End-User Industry:

Building and Construction Applications represent the largest market segment, driven by energy efficiency requirements and green building initiatives. PCM integration in walls, ceilings, and HVAC systems provides passive thermal regulation and reduces energy consumption. Advanced encapsulation techniques enable seamless integration into conventional building materials.

Electronics Thermal Management demonstrates rapid growth as device miniaturization and performance increases create thermal challenges. PCM solutions offer compact, passive cooling capabilities for processors, batteries, and power electronics. According to MarkWide Research analysis, electronics applications show 26% annual growth in PCM adoption.

Textile Applications encompass smart fabrics, athletic wear, and protective clothing with temperature-regulating properties. Microencapsulated PCMs integrated into fibers provide comfort enhancement and thermal protection. Military and first responder applications drive development of specialized thermoregulating textiles.

Transportation Segment includes automotive thermal management, shipping temperature control, and aerospace applications. Electric vehicle battery cooling and cabin climate control represent significant growth opportunities as automotive electrification accelerates across North America.

Energy Storage Applications focus on renewable energy systems, particularly concentrated solar power and grid-scale thermal storage. PCM technology enables efficient energy capture, storage, and release in solar thermal installations and industrial waste heat recovery systems.

Manufacturers benefit from expanding market opportunities across diverse application segments, enabling revenue diversification and growth. PCM technology offers differentiation opportunities and premium pricing potential for companies developing innovative thermal management solutions.

End-users realize significant energy cost savings, improved comfort, and enhanced system performance through PCM integration. Building owners achieve reduced heating and cooling expenses while maintaining occupant comfort and meeting sustainability goals.

Technology developers access growing markets for specialized PCM formulations and application systems. Research and development investments create intellectual property assets and competitive advantages in emerging application areas.

Investors participate in a rapidly growing market with strong fundamentals driven by energy efficiency trends and regulatory support. PCM technology companies offer attractive investment opportunities with potential for substantial returns.

Environmental stakeholders benefit from reduced energy consumption and carbon emissions through widespread PCM adoption. The technology supports sustainability goals and climate change mitigation efforts across multiple industries.

Strengths:

Weaknesses:

Opportunities:

Threats:

Nanotechnology Integration enhances PCM performance through improved heat transfer, stability, and thermal conductivity. Nanoparticle additives and advanced encapsulation techniques create next-generation materials with superior characteristics for demanding applications.

Smart System Integration combines PCMs with sensors, controls, and automation systems to optimize thermal management performance. Internet of Things connectivity enables real-time monitoring and adaptive control of PCM-based systems.

Sustainable Formulations emphasize bio-based and recyclable PCM materials to address environmental concerns and sustainability requirements. Green chemistry approaches develop environmentally friendly alternatives to traditional PCM formulations.

Application Diversification expands PCM use beyond traditional building applications into electronics, textiles, automotive, and industrial segments. Cross-industry technology transfer accelerates innovation and market development.

Manufacturing Automation improves PCM production efficiency, quality control, and cost competitiveness. Advanced manufacturing processes enable customized formulations and large-scale production capabilities.

Strategic partnerships between PCM manufacturers and end-user industries accelerate product development and market penetration. Collaborative research initiatives focus on application-specific solutions and performance optimization.

Technology licensing agreements enable broader commercialization of advanced PCM formulations and manufacturing processes. Intellectual property sharing facilitates market expansion and technology adoption across diverse applications.

Manufacturing capacity expansion reflects growing market demand and confidence in PCM technology adoption. New production facilities and equipment investments support increased output and improved cost competitiveness.

Regulatory approvals for PCM materials in building codes and safety standards remove barriers to adoption and enhance market confidence. Standardization efforts facilitate broader acceptance and implementation of PCM technologies.

Research breakthroughs in material science and thermal management create opportunities for next-generation PCM solutions with enhanced performance and expanded application possibilities.

Market participants should focus on application-specific product development and customer education to accelerate adoption and market penetration. Targeted marketing strategies and demonstration projects can effectively communicate PCM benefits and build market confidence.

Investment priorities should emphasize research and development, manufacturing capability enhancement, and strategic partnerships to maintain competitive positioning. Technology advancement and cost reduction initiatives are essential for long-term market success.

Geographic expansion strategies should consider regional climate variations, regulatory requirements, and market maturity levels. Customized approaches for different North American markets can optimize penetration and growth opportunities.

Collaboration initiatives with academic institutions, government laboratories, and industry partners can accelerate innovation and technology commercialization. Joint research projects and knowledge sharing enhance competitive capabilities.

Sustainability focus should guide product development and marketing strategies as environmental considerations become increasingly important to customers and regulators. Green chemistry approaches and lifecycle assessments support market positioning.

Market trajectory indicates continued robust growth driven by energy efficiency mandates, technological advancement, and expanding application opportunities. The North American PCM market is positioned for sustained expansion across multiple industry segments over the next decade.

Technology evolution will focus on enhanced performance characteristics, reduced costs, and improved integration methods. Advanced materials science and nanotechnology integration will create next-generation PCM solutions with superior capabilities.

Application expansion into emerging sectors including electric vehicles, data centers, and renewable energy storage will drive significant growth opportunities. MWR projections suggest these segments will contribute 42% of market growth over the forecast period.

Regulatory support through building codes, energy efficiency standards, and sustainability initiatives will continue driving PCM adoption. Government incentives and public sector procurement programs will support market development.

Global competitiveness of North American PCM manufacturers will strengthen through continued innovation, manufacturing excellence, and strategic market positioning. The region’s technological leadership and market expertise create sustainable competitive advantages.

The North America phase change materials market represents a dynamic and rapidly expanding sector with substantial growth potential across diverse application segments. Strong fundamentals including energy efficiency mandates, technological innovation, and expanding market awareness position the region for continued leadership in PCM technology development and commercialization.

Strategic opportunities in emerging applications such as electric vehicle thermal management, data center cooling, and renewable energy storage offer significant potential for market participants. The convergence of sustainability trends, regulatory support, and technological advancement creates favorable conditions for accelerated PCM adoption.

Market challenges including cost considerations, technical complexity, and awareness limitations require focused attention from industry participants. Educational initiatives, demonstration projects, and continued innovation will be essential for overcoming barriers and achieving widespread market penetration.

Future success in the North American PCM market will depend on companies’ ability to develop application-specific solutions, build strategic partnerships, and maintain technological leadership. The market’s evolution toward mainstream adoption across multiple industries presents substantial opportunities for growth and value creation in the years ahead.

What is Phase Change Materials?

Phase Change Materials (PCMs) are substances that absorb and release thermal energy during the process of melting and freezing. They are used in various applications, including thermal energy storage, temperature control in buildings, and in textiles for temperature regulation.

What are the key players in the North America Phase Change Materials Market?

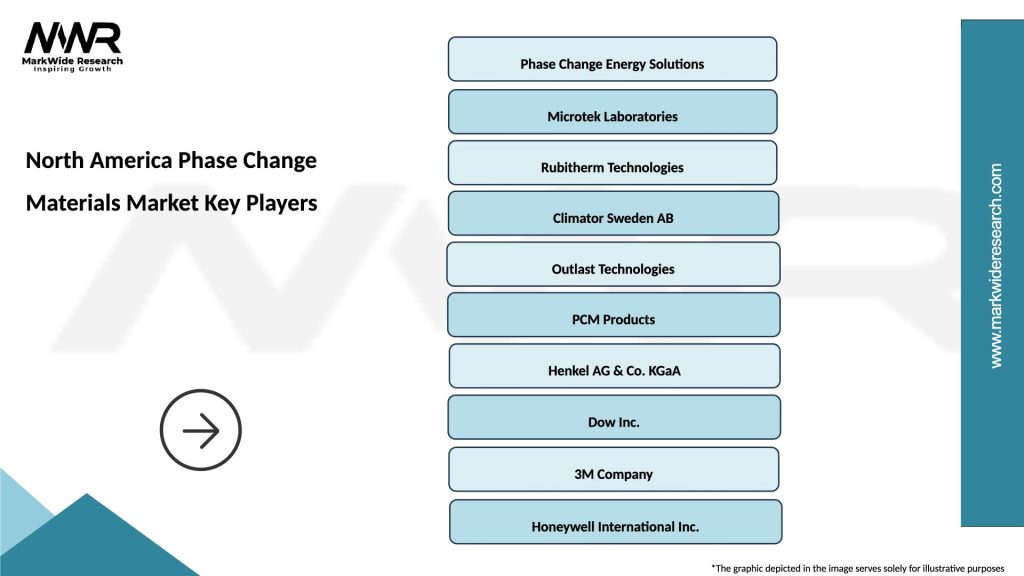

Key players in the North America Phase Change Materials Market include BASF SE, Honeywell International Inc., and Phase Change Energy Solutions, among others.

What are the main drivers of the North America Phase Change Materials Market?

The main drivers of the North America Phase Change Materials Market include the growing demand for energy-efficient solutions, increasing adoption of renewable energy technologies, and the rising need for temperature regulation in various industries such as construction and electronics.

What challenges does the North America Phase Change Materials Market face?

Challenges in the North America Phase Change Materials Market include high production costs, limited awareness among end-users, and competition from alternative thermal management solutions.

What opportunities exist in the North America Phase Change Materials Market?

Opportunities in the North America Phase Change Materials Market include advancements in PCM technology, increasing investments in smart building solutions, and the potential for new applications in sectors like automotive and aerospace.

What trends are shaping the North America Phase Change Materials Market?

Trends shaping the North America Phase Change Materials Market include the integration of PCMs in building materials for energy efficiency, the development of bio-based PCMs, and the growing interest in sustainable construction practices.

North America Phase Change Materials Market

| Segmentation Details | Description |

|---|---|

| Product Type | Organic, Inorganic, Bio-based, Hybrid |

| Application | Building Materials, Thermal Energy Storage, Electronics Cooling, HVAC Systems |

| End User | Construction, Automotive, Electronics, Renewable Energy |

| Form | Microcapsules, Macroencapsulated, Slurries, Powders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Phase Change Materials Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at