444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America pharmaceutical plastic packaging market represents a critical component of the healthcare supply chain, encompassing innovative packaging solutions designed to protect, preserve, and deliver pharmaceutical products safely to end consumers. This dynamic market spans across the United States, Canada, and Mexico, serving as a cornerstone for pharmaceutical manufacturers, biotechnology companies, and healthcare providers seeking reliable packaging solutions.

Market dynamics indicate robust growth driven by increasing pharmaceutical production, stringent regulatory requirements, and rising demand for advanced drug delivery systems. The region’s pharmaceutical plastic packaging sector has experienced significant expansion, with growth rates reaching 6.2% CAGR over recent years, reflecting the industry’s commitment to innovation and quality assurance.

Key market characteristics include the adoption of sustainable packaging materials, integration of smart packaging technologies, and compliance with evolving regulatory frameworks. The market encompasses various packaging formats including bottles, vials, syringes, blister packs, and specialized containers designed for specific pharmaceutical applications.

Regional leadership in pharmaceutical manufacturing has positioned North America as a significant hub for packaging innovation, with companies investing heavily in research and development to create packaging solutions that enhance drug stability, patient compliance, and supply chain efficiency.

The North America pharmaceutical plastic packaging market refers to the comprehensive ecosystem of plastic-based packaging solutions specifically designed for pharmaceutical and biotechnology products across the United States, Canada, and Mexico. This market encompasses the design, manufacturing, and distribution of specialized plastic containers, closures, and packaging systems that ensure drug safety, efficacy, and regulatory compliance.

Pharmaceutical plastic packaging serves multiple critical functions including product protection from environmental factors, contamination prevention, dosage accuracy, tamper evidence, and patient safety assurance. These packaging solutions must meet stringent quality standards established by regulatory bodies such as the FDA, Health Canada, and COFEPRIS.

Market scope includes primary packaging that directly contacts pharmaceutical products, secondary packaging for product grouping and protection, and tertiary packaging for distribution and logistics. The sector encompasses both prescription and over-the-counter medications, biologics, vaccines, and specialized pharmaceutical formulations.

Strategic market positioning reveals that North America’s pharmaceutical plastic packaging sector maintains a leadership role in global healthcare packaging innovation. The market demonstrates consistent growth momentum driven by increasing pharmaceutical production volumes, aging population demographics, and expanding biotechnology sectors across the region.

Key growth drivers include rising chronic disease prevalence, increasing generic drug production, and growing demand for biologics and biosimilars. The market benefits from advanced manufacturing capabilities, robust regulatory frameworks, and strong research and development infrastructure supporting packaging innovation.

Technology integration has become a defining characteristic, with 42% of manufacturers implementing smart packaging solutions including RFID tracking, temperature monitoring, and anti-counterfeiting features. This technological advancement enhances supply chain visibility and patient safety while supporting regulatory compliance requirements.

Sustainability initiatives are reshaping market dynamics, with pharmaceutical companies increasingly adopting eco-friendly packaging materials and circular economy principles. The shift toward sustainable packaging solutions reflects growing environmental consciousness and regulatory pressure for reduced environmental impact.

Market segmentation analysis reveals diverse opportunities across multiple pharmaceutical categories and packaging formats. The following key insights highlight critical market dynamics:

Demographic transformation serves as a primary market driver, with North America’s aging population creating sustained demand for pharmaceutical products and associated packaging solutions. The region’s demographic shift toward older age groups correlates directly with increased medication usage and specialized packaging requirements for senior-friendly designs.

Chronic disease prevalence continues expanding across North America, driving demand for long-term medication packaging solutions. Conditions such as diabetes, cardiovascular disease, and respiratory disorders require specialized packaging that maintains drug stability over extended periods while ensuring patient compliance through user-friendly designs.

Biotechnology advancement represents a significant growth catalyst, with biologic medications requiring sophisticated packaging solutions to maintain product integrity. These advanced therapeutics demand temperature-controlled packaging, specialized barrier properties, and precise dosing mechanisms that traditional packaging cannot provide.

Regulatory evolution continuously shapes market dynamics, with agencies implementing enhanced safety requirements, serialization mandates, and environmental regulations. These regulatory changes drive innovation in packaging design while creating opportunities for companies that can deliver compliant solutions efficiently.

Healthcare digitization is transforming packaging requirements, with 38% of pharmaceutical companies integrating digital health technologies into their packaging strategies. Smart packaging solutions that connect with mobile applications and healthcare systems are becoming increasingly important for patient engagement and adherence monitoring.

Regulatory complexity poses significant challenges for pharmaceutical plastic packaging manufacturers, with multiple jurisdictions maintaining different requirements for materials, testing, and documentation. The complexity of navigating FDA, Health Canada, and Mexican regulatory frameworks can create barriers to market entry and increase compliance costs.

Raw material volatility affects market stability, with plastic resin prices subject to fluctuations based on petroleum markets, supply chain disruptions, and global economic conditions. These price variations can impact profitability and require manufacturers to develop flexible pricing strategies and supply chain diversification.

Environmental concerns create pressure for sustainable packaging solutions, potentially limiting traditional plastic packaging options. Growing environmental awareness among consumers and regulatory bodies is driving demand for biodegradable and recyclable alternatives, which may require significant investment in new technologies and manufacturing processes.

Competition intensity from global manufacturers creates pricing pressure and market share challenges for regional players. International competition, particularly from Asian manufacturers offering lower-cost solutions, requires North American companies to differentiate through quality, innovation, and service excellence.

Technology investment requirements for advanced packaging solutions can strain smaller manufacturers’ resources. The need for sophisticated equipment, quality control systems, and research and development capabilities creates barriers for companies seeking to compete in high-value market segments.

Sustainable packaging innovation presents substantial growth opportunities as pharmaceutical companies seek environmentally responsible packaging solutions. The development of biodegradable plastics, recyclable materials, and reduced packaging designs aligns with corporate sustainability goals while meeting regulatory requirements for environmental protection.

Smart packaging integration offers significant potential for value creation through enhanced patient engagement and supply chain optimization. Technologies such as NFC chips, QR codes, and sensor integration enable real-time monitoring, authentication, and patient adherence tracking, creating new revenue streams and competitive advantages.

Personalized medicine packaging represents an emerging opportunity as pharmaceutical companies develop targeted therapies for specific patient populations. Small-batch production and customized packaging solutions for personalized medications require specialized capabilities that can command premium pricing.

E-commerce expansion creates demand for packaging solutions optimized for direct-to-consumer delivery. The growth of online pharmacy services and home healthcare delivery requires packaging that ensures product integrity during shipping while providing user-friendly opening experiences for patients.

Emerging therapeutic areas such as gene therapy, cell therapy, and advanced biologics require innovative packaging solutions that can maintain product stability under extreme conditions. These cutting-edge treatments often require specialized packaging that can command higher margins and establish long-term customer relationships.

Supply chain evolution is reshaping market dynamics as pharmaceutical companies prioritize supply chain resilience and local sourcing capabilities. Recent global disruptions have highlighted the importance of diversified supplier networks and regional manufacturing capacity, creating opportunities for North American packaging manufacturers to strengthen their market positions.

Innovation cycles are accelerating as companies invest in research and development to create next-generation packaging solutions. The integration of advanced materials, smart technologies, and sustainable designs requires continuous innovation to meet evolving customer needs and regulatory requirements.

Consolidation trends are evident as larger packaging companies acquire specialized manufacturers to expand their capabilities and market reach. This consolidation creates economies of scale while potentially reducing competition in certain market segments.

Customer relationship dynamics are shifting toward long-term partnerships as pharmaceutical companies seek integrated packaging solutions rather than transactional supplier relationships. This trend favors packaging manufacturers that can provide comprehensive services including design, manufacturing, and regulatory support.

Technology adoption rates vary significantly across market segments, with 55% of large pharmaceutical companies implementing advanced packaging technologies compared to smaller manufacturers who may lag in adoption due to resource constraints.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry executives, packaging manufacturers, pharmaceutical companies, and regulatory experts across North America to gather firsthand market intelligence.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and trade publications to identify market trends, competitive dynamics, and technological developments. This approach ensures comprehensive coverage of market factors influencing the pharmaceutical plastic packaging sector.

Data validation processes include cross-referencing multiple sources, statistical analysis, and expert review to ensure accuracy and reliability of market findings. Quantitative data is verified through multiple channels to provide confidence in growth projections and market sizing estimates.

Regional analysis methodology incorporates country-specific factors including regulatory environments, healthcare systems, and economic conditions that influence pharmaceutical packaging demand. This granular approach enables accurate assessment of regional market opportunities and challenges.

Trend analysis utilizes historical data patterns, current market indicators, and forward-looking assessments to identify emerging opportunities and potential market disruptions. This methodology supports strategic planning and investment decision-making for market participants.

United States market leadership is evident through the country’s dominant position in pharmaceutical production and packaging innovation. The U.S. represents approximately 78% of regional market share, driven by the presence of major pharmaceutical companies, advanced manufacturing capabilities, and robust regulatory frameworks supporting innovation.

California and New Jersey emerge as key manufacturing hubs, hosting numerous pharmaceutical and packaging companies that benefit from proximity to research institutions, skilled workforce availability, and established supply chain networks. These states demonstrate particular strength in biologics packaging and advanced drug delivery systems.

Canada’s market contribution reflects the country’s strong pharmaceutical sector and growing biotechnology industry. Canadian manufacturers focus on specialized packaging solutions for biologics and generic medications, with particular strength in cold-chain packaging technologies required for temperature-sensitive products.

Mexico’s expanding role in pharmaceutical manufacturing creates opportunities for packaging suppliers, particularly in generic drug production and contract manufacturing services. The country’s strategic location and cost advantages make it an attractive destination for pharmaceutical packaging operations serving both domestic and export markets.

Cross-border trade dynamics influence regional market structure, with 23% of packaging materials crossing national borders within North America. This integration creates opportunities for supply chain optimization while requiring compliance with multiple regulatory frameworks.

Market leadership is characterized by a mix of global packaging giants and specialized pharmaceutical packaging companies that compete across different market segments and geographic regions. The competitive environment emphasizes innovation, quality, and regulatory compliance as key differentiating factors.

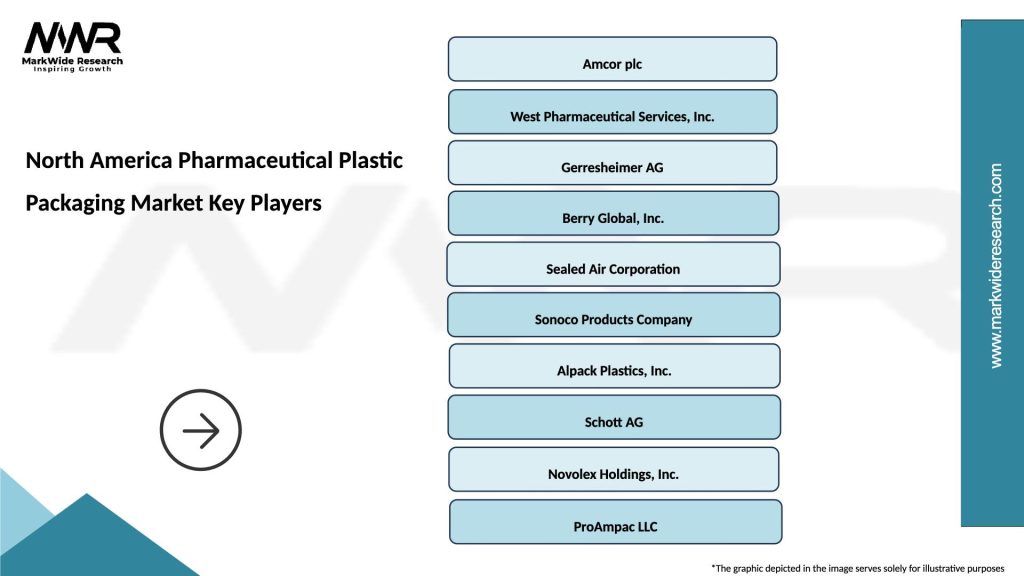

Leading market participants include:

Competitive strategies focus on technological innovation, strategic acquisitions, and geographic expansion to capture market share and enhance customer relationships. Companies are investing heavily in research and development to create advanced packaging solutions that meet evolving pharmaceutical industry needs.

Innovation leadership drives competitive advantage, with companies developing smart packaging technologies, sustainable materials, and specialized solutions for emerging therapeutic areas. Patent portfolios and proprietary technologies serve as important competitive moats in this technology-intensive market.

By Product Type:

By Material Type:

By Application:

Prescription medication packaging represents the largest market category, driven by complex drug formulations requiring specialized packaging solutions. This segment benefits from higher margins due to stringent quality requirements and customized packaging designs that ensure product integrity and patient safety.

Biologics packaging demonstrates the highest growth potential, with 8.4% annual growth rate reflecting the expanding biotechnology sector and increasing adoption of biologic therapies. These products require sophisticated packaging solutions including temperature control, specialized barrier properties, and sterile manufacturing environments.

Generic drug packaging emphasizes cost efficiency while maintaining quality standards, creating opportunities for manufacturers that can deliver high-volume, standardized packaging solutions. This segment benefits from increasing generic drug adoption and patent expirations of branded medications.

Over-the-counter packaging focuses on consumer appeal and convenience, requiring packaging designs that attract retail customers while ensuring product protection and regulatory compliance. This segment benefits from growing consumer health awareness and self-medication trends.

Specialty pharmaceutical packaging serves niche therapeutic areas with unique packaging requirements, often commanding premium pricing due to specialized capabilities and limited competition. These applications include orphan drugs, personalized medicines, and advanced drug delivery systems.

Pharmaceutical manufacturers benefit from advanced packaging solutions that ensure product integrity, regulatory compliance, and patient safety while optimizing supply chain efficiency. Modern packaging technologies enable better inventory management, reduced product loss, and enhanced brand protection through anti-counterfeiting features.

Healthcare providers gain advantages through packaging solutions that improve medication administration accuracy, reduce dosing errors, and enhance patient compliance. Smart packaging technologies provide real-time information about medication usage and patient adherence, supporting better clinical outcomes.

Patients and consumers benefit from packaging innovations that improve medication accessibility, safety, and convenience. Child-resistant closures, easy-open designs for elderly patients, and clear labeling systems enhance medication safety while improving user experience.

Regulatory agencies benefit from packaging solutions that enhance drug traceability, reduce counterfeiting, and improve supply chain transparency. Serialization technologies and tamper-evident packaging support regulatory oversight while protecting public health.

Supply chain partners gain efficiency through packaging designs optimized for transportation, storage, and handling. Standardized packaging formats, improved stacking capabilities, and reduced packaging waste contribute to supply chain cost reduction and environmental sustainability.

Packaging manufacturers benefit from growing market demand, technological advancement opportunities, and long-term customer relationships. The pharmaceutical packaging sector offers stable demand patterns and opportunities for value-added services that support business growth and profitability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation is reshaping the pharmaceutical plastic packaging landscape, with companies increasingly adopting circular economy principles and developing biodegradable packaging materials. This trend reflects growing environmental consciousness among consumers and regulatory pressure for reduced environmental impact, with 67% of pharmaceutical companies implementing sustainability initiatives in their packaging strategies.

Smart packaging adoption continues accelerating as companies integrate digital technologies to enhance patient engagement and supply chain visibility. Technologies such as NFC chips, QR codes, and sensor integration enable real-time monitoring, authentication, and patient adherence tracking, creating new value propositions for packaging manufacturers.

Personalized medicine packaging is emerging as pharmaceutical companies develop targeted therapies for specific patient populations. This trend requires flexible packaging solutions capable of handling small-batch production while maintaining quality standards and regulatory compliance.

Cold chain optimization becomes increasingly important as biologic medications require temperature-controlled packaging throughout the supply chain. Advanced insulation materials, phase change materials, and temperature monitoring systems are becoming standard requirements for biologic packaging solutions.

Serialization and traceability requirements are driving investment in track-and-trace technologies that enable product authentication and supply chain transparency. These technologies help combat counterfeiting while supporting regulatory compliance and patient safety initiatives.

Child-resistant and senior-friendly designs are gaining prominence as packaging manufacturers develop solutions that balance safety requirements with accessibility for elderly patients. This trend reflects demographic changes and growing awareness of medication safety issues.

Regulatory harmonization efforts across North America are streamlining compliance requirements and reducing barriers to cross-border trade. Recent initiatives by regulatory agencies to align standards and requirements are creating opportunities for packaging manufacturers to develop standardized solutions for the regional market.

Sustainability partnerships between pharmaceutical companies and packaging manufacturers are driving innovation in eco-friendly packaging solutions. These collaborations focus on developing recyclable materials, reducing packaging waste, and implementing circular economy principles throughout the supply chain.

Technology investments in advanced manufacturing capabilities are enhancing production efficiency and quality control. Companies are implementing Industry 4.0 technologies including automation, artificial intelligence, and predictive maintenance to optimize manufacturing processes and reduce costs.

Strategic acquisitions are reshaping the competitive landscape as larger companies acquire specialized manufacturers to expand their capabilities and market reach. Recent consolidation activity has created larger, more diversified packaging companies with enhanced service offerings.

Research collaborations between packaging manufacturers, pharmaceutical companies, and academic institutions are accelerating innovation in packaging technologies. These partnerships focus on developing next-generation materials, smart packaging solutions, and sustainable alternatives to traditional plastic packaging.

Supply chain localization initiatives are gaining momentum as companies seek to reduce dependence on global supply chains and enhance resilience. Recent global disruptions have highlighted the importance of regional manufacturing capabilities and diversified supplier networks.

Investment prioritization should focus on sustainable packaging technologies and smart packaging solutions that align with long-term market trends. MarkWide Research analysis indicates that companies investing in these areas are better positioned for future growth and competitive advantage.

Strategic partnerships with pharmaceutical companies can provide stable revenue streams and collaborative innovation opportunities. Packaging manufacturers should seek long-term relationships that enable joint development of specialized solutions and shared investment in advanced technologies.

Geographic expansion within North America can capture regional growth opportunities and diversify market exposure. Companies should consider establishing manufacturing presence in key pharmaceutical hubs to enhance customer proximity and supply chain efficiency.

Technology integration should emphasize solutions that provide measurable value to pharmaceutical customers, including improved patient outcomes, regulatory compliance, and supply chain efficiency. Companies should prioritize technologies with clear return on investment and customer adoption potential.

Sustainability initiatives should be integrated into core business strategies rather than treated as separate initiatives. Companies that embed sustainability into their value proposition are better positioned to meet evolving customer requirements and regulatory expectations.

Talent development in specialized areas such as regulatory affairs, materials science, and digital technologies is essential for maintaining competitive advantage. Companies should invest in workforce development to support innovation and customer service excellence.

Market evolution toward sustainable and intelligent packaging solutions will continue shaping industry dynamics over the next decade. The integration of environmental responsibility with technological advancement creates opportunities for companies that can deliver innovative solutions meeting both sustainability and performance requirements.

Growth projections indicate sustained expansion driven by demographic trends, pharmaceutical innovation, and evolving healthcare delivery models. The market is expected to maintain robust growth rates of 6.8% annually through the forecast period, supported by increasing pharmaceutical production and advancing packaging technologies.

Technology convergence will create new packaging categories that combine traditional protection functions with digital capabilities, patient engagement features, and environmental sustainability. These hybrid solutions represent significant opportunities for value creation and market differentiation.

Regulatory evolution will continue influencing market development, with agencies implementing enhanced requirements for sustainability, serialization, and patient safety. Companies that proactively adapt to regulatory changes will maintain competitive advantages and market access.

Supply chain transformation will emphasize resilience, sustainability, and digitalization as key success factors. According to MWR projections, companies with advanced supply chain capabilities will capture disproportionate market share and profitability growth.

Innovation acceleration in materials science, manufacturing technologies, and digital integration will create new market opportunities while potentially disrupting existing business models. Companies must balance investment in current capabilities with preparation for future technological shifts.

The North America pharmaceutical plastic packaging market represents a dynamic and essential component of the healthcare ecosystem, characterized by continuous innovation, regulatory complexity, and evolving customer requirements. Market participants face both significant opportunities and challenges as they navigate changing demographics, technological advancement, and sustainability imperatives.

Strategic success in this market requires balancing traditional packaging excellence with emerging capabilities in smart technologies, sustainable materials, and personalized solutions. Companies that can effectively integrate these diverse requirements while maintaining quality standards and regulatory compliance are positioned for long-term growth and market leadership.

Future market development will be shaped by the convergence of sustainability, digitalization, and personalization trends that are transforming pharmaceutical packaging from a commodity function to a strategic differentiator. The companies that recognize and adapt to these trends will capture the greatest opportunities in this evolving market landscape.

What is Pharmaceutical Plastic Packaging?

Pharmaceutical Plastic Packaging refers to the use of plastic materials to package pharmaceutical products, ensuring their safety, integrity, and efficacy. This type of packaging is crucial for protecting medications from environmental factors and contamination.

What are the key players in the North America Pharmaceutical Plastic Packaging Market?

Key players in the North America Pharmaceutical Plastic Packaging Market include Amcor plc, West Pharmaceutical Services, Inc., and Berry Global, Inc. These companies are known for their innovative packaging solutions and extensive product portfolios, among others.

What are the growth factors driving the North America Pharmaceutical Plastic Packaging Market?

The North America Pharmaceutical Plastic Packaging Market is driven by factors such as the increasing demand for advanced drug delivery systems, the rise in chronic diseases requiring long-term medication, and the growing focus on patient safety and compliance.

What challenges does the North America Pharmaceutical Plastic Packaging Market face?

Challenges in the North America Pharmaceutical Plastic Packaging Market include stringent regulatory requirements, the need for sustainable packaging solutions, and the high costs associated with advanced packaging technologies.

What opportunities exist in the North America Pharmaceutical Plastic Packaging Market?

Opportunities in the North America Pharmaceutical Plastic Packaging Market include the development of eco-friendly packaging materials, the integration of smart packaging technologies, and the expansion of e-commerce in the pharmaceutical sector.

What trends are shaping the North America Pharmaceutical Plastic Packaging Market?

Trends in the North America Pharmaceutical Plastic Packaging Market include the increasing adoption of biodegradable plastics, the use of tamper-evident packaging, and the growing emphasis on personalized medicine, which requires specialized packaging solutions.

North America Pharmaceutical Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Blisters, Pouches, Jars |

| Material | Polyethylene, Polypropylene, PVC, PET |

| End User | Pharmaceutical Companies, Contract Manufacturers, Research Institutions, Hospitals |

| Packaging Type | Primary Packaging, Secondary Packaging, Tertiary Packaging, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Pharmaceutical Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at