444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America pharmaceutical glass packaging market represents a critical segment within the broader pharmaceutical packaging industry, serving as the backbone for drug safety and efficacy preservation across the United States, Canada, and Mexico. This specialized market encompasses various glass packaging solutions including vials, ampoules, cartridges, bottles, and prefilled syringes designed specifically for pharmaceutical applications. Market dynamics indicate robust growth driven by increasing pharmaceutical production, stringent regulatory requirements, and growing demand for biologics and biosimilars.

Regional leadership in pharmaceutical manufacturing has positioned North America as a dominant force in glass packaging innovation, with the market experiencing a compound annual growth rate of 6.8% over recent years. The region’s advanced healthcare infrastructure, coupled with significant investments in pharmaceutical research and development, continues to fuel demand for high-quality glass packaging solutions. Regulatory compliance remains a primary driver, as pharmaceutical companies increasingly prioritize packaging materials that meet stringent FDA and Health Canada standards.

Technology advancement has revolutionized the pharmaceutical glass packaging landscape, with manufacturers investing heavily in automated production processes, enhanced barrier properties, and innovative coating technologies. The market benefits from strong pharmaceutical industry presence, including major drug manufacturers, biotechnology companies, and contract manufacturing organizations that require reliable, sterile packaging solutions for their products.

The North America pharmaceutical glass packaging market refers to the comprehensive ecosystem of glass-based packaging solutions specifically designed, manufactured, and distributed for pharmaceutical applications across the United States, Canada, and Mexico. This market encompasses primary packaging materials that come into direct contact with pharmaceutical products, including injectable drugs, oral medications, biologics, and specialty therapeutics.

Glass packaging in pharmaceutical applications serves multiple critical functions beyond simple containment, including protection from environmental factors, maintenance of product sterility, prevention of chemical interactions, and compliance with regulatory standards. The market includes various glass types such as borosilicate glass, soda-lime glass, and specialty formulations designed for specific pharmaceutical requirements.

Market participants include glass manufacturers, pharmaceutical companies, contract packaging organizations, and regulatory bodies that collectively ensure the safety, efficacy, and quality of pharmaceutical products through appropriate packaging solutions. This interconnected ecosystem supports the entire pharmaceutical supply chain from drug development through patient delivery.

Strategic positioning within the North American pharmaceutical landscape has established glass packaging as an indispensable component of drug delivery systems, with market growth accelerating due to increasing pharmaceutical production and regulatory compliance requirements. The market demonstrates remarkable resilience and adaptability, responding effectively to evolving pharmaceutical industry needs while maintaining the highest standards of quality and safety.

Key growth drivers include the expanding biologics market, which requires specialized glass packaging solutions, increasing demand for prefilled syringes and injectable drug delivery systems, and growing emphasis on sustainable packaging alternatives. The market benefits from technological innovations in glass manufacturing processes, including enhanced surface treatments, improved break resistance, and advanced sterilization compatibility.

Competitive dynamics reveal a market characterized by both established global players and innovative regional manufacturers, with companies focusing on product differentiation through advanced manufacturing capabilities, regulatory expertise, and customer service excellence. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding product portfolios and geographic reach.

Future prospects remain highly favorable, with projected growth rates of 7.2% annually driven by pharmaceutical industry expansion, increasing healthcare spending, and growing demand for specialized drug delivery systems. The market is expected to benefit from continued investment in pharmaceutical research and development, particularly in areas such as personalized medicine and advanced therapeutics.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the North American pharmaceutical glass packaging market:

Pharmaceutical industry expansion serves as the primary catalyst for market growth, with increasing drug development activities, expanding therapeutic areas, and growing pharmaceutical manufacturing capacity driving sustained demand for glass packaging solutions. The North American pharmaceutical sector’s robust growth trajectory directly translates to increased requirements for high-quality packaging materials.

Regulatory requirements continue to intensify, with pharmaceutical companies facing increasingly stringent standards for product safety, efficacy, and quality. These regulatory pressures necessitate the use of premium glass packaging materials that can demonstrate compliance with evolving pharmaceutical standards and provide comprehensive documentation of quality assurance processes.

Biologics market expansion represents a significant growth driver, as these complex therapeutic products require specialized packaging solutions that can maintain product stability, prevent contamination, and ensure proper drug delivery. The growing prevalence of biologics in pharmaceutical portfolios creates substantial opportunities for advanced glass packaging applications.

Injectable drug delivery trends favor glass packaging solutions, particularly for prefilled syringes, cartridges, and vials used in self-administration devices. The convenience and safety advantages of these delivery systems drive increased adoption among healthcare providers and patients, supporting market growth.

Quality assurance priorities among pharmaceutical manufacturers emphasize the importance of packaging materials that can provide superior protection against environmental factors, chemical interactions, and contamination risks. Glass packaging’s proven track record in these areas makes it the preferred choice for critical pharmaceutical applications.

High manufacturing costs associated with pharmaceutical-grade glass packaging can present challenges for market participants, particularly smaller pharmaceutical companies and generic drug manufacturers operating under tight margin constraints. The specialized manufacturing processes, quality control requirements, and regulatory compliance costs contribute to elevated pricing structures.

Supply chain complexities in glass packaging manufacturing can create potential bottlenecks, particularly during periods of high demand or supply disruptions. The specialized nature of pharmaceutical glass packaging requires sophisticated manufacturing capabilities and extensive quality control processes that can limit production flexibility.

Alternative packaging materials present competitive challenges, with plastic and other synthetic materials offering certain advantages in terms of weight, breakage resistance, and manufacturing costs. Some pharmaceutical applications may favor alternative materials, potentially limiting glass packaging market share in specific segments.

Regulatory compliance costs can be substantial, requiring significant investments in quality management systems, documentation processes, and regulatory expertise. These compliance requirements may present barriers to entry for new market participants and increase operational costs for existing players.

Transportation and handling considerations related to glass packaging’s fragility can create logistical challenges and increase shipping costs. The need for specialized handling procedures and protective packaging during transportation adds complexity to supply chain operations.

Emerging therapeutic areas present substantial growth opportunities, particularly in personalized medicine, gene therapy, and advanced biologics that require specialized packaging solutions. These innovative therapeutic approaches often demand unique packaging characteristics that glass materials can effectively provide.

Sustainability initiatives within the pharmaceutical industry create opportunities for glass packaging manufacturers to emphasize the environmental advantages of glass materials, including recyclability, chemical inertness, and long-term stability. Growing corporate sustainability commitments favor packaging materials with favorable environmental profiles.

Technology advancement opportunities include development of enhanced glass formulations, improved surface treatments, and innovative packaging designs that can provide superior performance characteristics. Investment in research and development can create competitive advantages and open new market segments.

Geographic expansion within North America offers growth potential, particularly in underserved regions and emerging pharmaceutical manufacturing hubs. Strategic expansion initiatives can capture market share in developing pharmaceutical clusters and contract manufacturing locations.

Partnership opportunities with pharmaceutical companies, biotechnology firms, and contract manufacturing organizations can create long-term growth platforms. Strategic partnerships can provide access to new markets, technologies, and customer relationships while sharing development costs and risks.

Supply and demand equilibrium in the North American pharmaceutical glass packaging market reflects the complex interplay between pharmaceutical industry growth, manufacturing capacity, and regulatory requirements. Market dynamics indicate a balanced supply-demand relationship with periodic fluctuations based on pharmaceutical production cycles and new product launches.

Competitive intensity varies across different product segments, with specialized applications such as biologics packaging commanding premium pricing while commodity glass packaging faces more intense price competition. Market participants differentiate through quality, service, and technical capabilities rather than price alone.

Innovation cycles drive market evolution, with manufacturers investing in new technologies, materials, and manufacturing processes to meet evolving pharmaceutical industry requirements. The pace of innovation has accelerated in response to growing demand for specialized packaging solutions and regulatory compliance requirements.

Customer relationships play a crucial role in market dynamics, with pharmaceutical companies often establishing long-term partnerships with glass packaging suppliers to ensure supply security and quality consistency. These relationships create barriers to entry for new suppliers while providing stability for established market participants.

Regulatory influence significantly impacts market dynamics, with changes in pharmaceutical regulations affecting packaging requirements, quality standards, and compliance costs. Market participants must continuously adapt to evolving regulatory landscapes while maintaining operational efficiency.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights, combining primary research, secondary data analysis, and industry expert consultations. The research approach encompasses quantitative and qualitative analysis techniques to provide a complete market perspective.

Primary research activities include structured interviews with industry executives, pharmaceutical company representatives, regulatory experts, and market participants across the North American pharmaceutical glass packaging value chain. These interviews provide firsthand insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, trade publications, and academic research to validate primary findings and provide comprehensive market context. This approach ensures thorough coverage of market dynamics and competitive landscape factors.

Data validation processes employ triangulation techniques to verify research findings through multiple independent sources, ensuring accuracy and reliability of market insights. Cross-referencing of data sources helps identify potential discrepancies and provides confidence in research conclusions.

Market modeling utilizes advanced analytical techniques to project market trends, growth rates, and competitive dynamics based on historical data, current market conditions, and identified growth drivers. These models provide framework for understanding future market evolution and strategic planning.

United States dominance characterizes the North American pharmaceutical glass packaging market, with the country accounting for approximately 78% of regional market share due to its extensive pharmaceutical manufacturing base, advanced healthcare infrastructure, and significant research and development investments. The U.S. market benefits from the presence of major pharmaceutical companies, biotechnology firms, and contract manufacturing organizations.

Canada’s market position represents approximately 16% of regional market share, driven by a growing pharmaceutical sector, increasing healthcare spending, and supportive regulatory environment. Canadian pharmaceutical companies increasingly focus on biologics and specialty therapeutics, creating demand for advanced glass packaging solutions.

Mexico’s emerging role accounts for roughly 6% of regional market share but demonstrates the highest growth potential due to expanding pharmaceutical manufacturing capabilities, increasing foreign investment, and growing domestic pharmaceutical consumption. The country’s strategic location and cost advantages attract international pharmaceutical companies establishing manufacturing operations.

Regional trade dynamics facilitate cross-border movement of pharmaceutical glass packaging products, with established supply chains connecting manufacturers and pharmaceutical companies across North American markets. Trade agreements and regulatory harmonization efforts support efficient regional market integration.

Manufacturing concentration varies across the region, with the United States hosting the majority of advanced glass packaging manufacturing facilities, while Canada and Mexico focus on specific market segments and cost-effective production capabilities. This geographic distribution reflects each country’s competitive advantages and market positioning strategies.

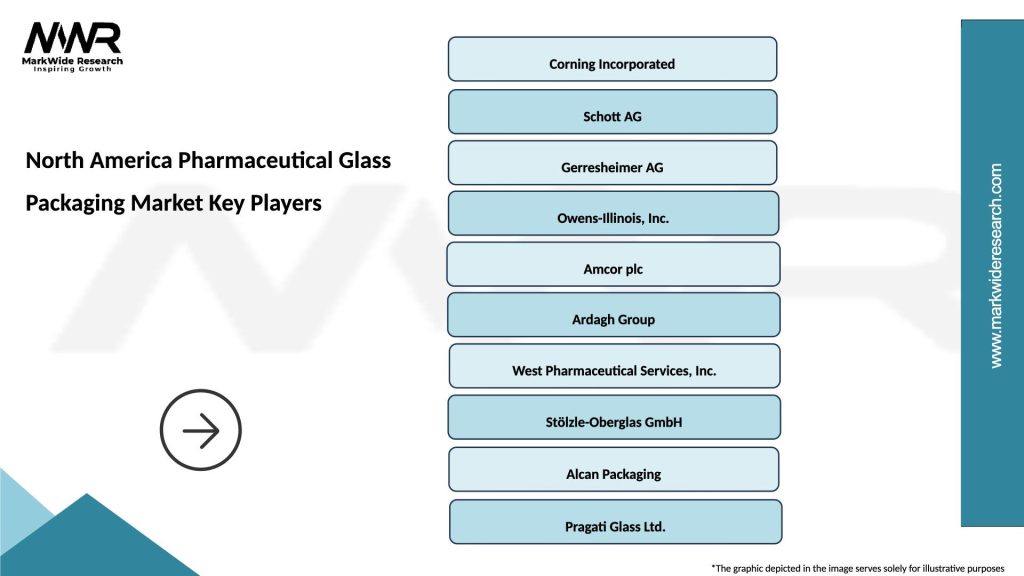

Market leadership in the North American pharmaceutical glass packaging sector is characterized by a mix of global corporations and specialized regional players, each bringing unique capabilities and market positioning strategies:

Competitive strategies focus on product innovation, quality excellence, regulatory compliance, and customer service differentiation. Market participants invest heavily in research and development, manufacturing technology upgrades, and strategic partnerships to maintain competitive advantages.

Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand product portfolios, geographic reach, and manufacturing capabilities. These strategic initiatives aim to create more comprehensive pharmaceutical packaging solutions and improve operational efficiency.

Product type segmentation reveals diverse pharmaceutical glass packaging applications across the North American market:

Application segmentation demonstrates varied pharmaceutical industry requirements:

End-user segmentation encompasses various pharmaceutical industry participants:

Borosilicate glass category dominates the pharmaceutical packaging market due to superior chemical resistance, thermal stability, and low expansion coefficient properties. This glass type demonstrates excellent compatibility with pharmaceutical products and maintains stability under various storage and transportation conditions, making it the preferred choice for critical pharmaceutical applications.

Soda-lime glass category serves cost-sensitive applications where chemical compatibility requirements are less stringent. This category offers manufacturing cost advantages while providing adequate protection for many pharmaceutical products, particularly in oral medication packaging applications.

Specialty glass formulations address unique pharmaceutical requirements, including enhanced barrier properties, improved break resistance, and specialized surface treatments. These advanced materials command premium pricing but provide superior performance characteristics for demanding pharmaceutical applications.

Coated glass products represent an emerging category that combines glass packaging benefits with enhanced performance characteristics through specialized surface treatments. These products offer improved chemical resistance and reduced particle generation while maintaining glass packaging advantages.

Prefilled syringe category demonstrates the highest growth potential, driven by increasing adoption of self-administration devices and biologics applications. This category benefits from convenience advantages and improved patient compliance while reducing medication errors and contamination risks.

Pharmaceutical companies benefit from glass packaging solutions that provide superior product protection, regulatory compliance assurance, and enhanced brand reputation. Glass packaging offers chemical inertness that prevents drug-package interactions while maintaining product efficacy throughout shelf life.

Healthcare providers advantage from glass packaging through improved medication safety, reduced contamination risks, and enhanced patient outcomes. The sterile nature of glass packaging supports infection control protocols while providing reliable drug delivery systems.

Patients benefit from glass packaging through improved medication safety, enhanced product quality, and convenient delivery systems. Glass packaging ensures drug integrity while supporting various administration methods including self-injection devices.

Regulatory agencies benefit from glass packaging’s proven track record of safety and compliance, facilitating drug approval processes and ensuring public health protection. Glass packaging provides predictable performance characteristics that support regulatory decision-making.

Manufacturing partners benefit from glass packaging through established supply chains, proven manufacturing processes, and reliable quality systems. Glass packaging offers scalable production capabilities that support pharmaceutical industry growth requirements.

Environmental stakeholders benefit from glass packaging’s recyclability, chemical stability, and reduced environmental impact compared to alternative materials. Glass packaging supports sustainability initiatives while maintaining pharmaceutical industry requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Prefilled syringe adoption represents the most significant trend in pharmaceutical glass packaging, with healthcare systems increasingly favoring these convenient delivery systems for their safety advantages and patient compliance benefits. This trend demonstrates sustained growth momentum across therapeutic areas including vaccines, biologics, and specialty medications.

Sustainability integration drives innovation in glass packaging design and manufacturing processes, with companies developing more environmentally friendly production methods and emphasizing glass packaging’s recyclability advantages. Pharmaceutical companies increasingly incorporate environmental considerations into packaging selection decisions.

Smart packaging technologies emerge as pharmaceutical companies seek enhanced tracking, authentication, and patient engagement capabilities. Integration of digital technologies with traditional glass packaging creates opportunities for value-added solutions that support pharmaceutical supply chain management and patient care.

Personalized medicine growth creates demand for smaller batch sizes and specialized packaging solutions that can accommodate unique therapeutic requirements. This trend favors flexible manufacturing capabilities and customized packaging designs that support individualized treatment approaches.

Regulatory harmonization efforts across North American markets facilitate cross-border trade and reduce compliance complexity for pharmaceutical glass packaging manufacturers. These initiatives support market integration and operational efficiency improvements.

Supply chain localization trends favor regional manufacturing capabilities and reduced dependence on global supply chains. Pharmaceutical companies increasingly prioritize supply security and shorter lead times in packaging supplier selection decisions.

Manufacturing capacity expansion initiatives across North America reflect growing pharmaceutical industry demand and supply chain resilience priorities. Major glass packaging manufacturers invest in new production facilities and technology upgrades to support market growth requirements.

Technology partnerships between glass packaging manufacturers and pharmaceutical companies accelerate innovation in specialized packaging solutions. These collaborative relationships focus on developing next-generation packaging that addresses evolving pharmaceutical industry requirements.

Regulatory compliance enhancements drive continuous improvement in quality management systems and manufacturing processes. Industry participants invest in advanced quality control technologies and documentation systems to meet evolving regulatory standards.

Sustainability initiatives include development of more energy-efficient manufacturing processes, increased use of recycled glass materials, and reduced packaging waste generation. These efforts support environmental responsibility while maintaining pharmaceutical packaging performance requirements.

Digital transformation efforts incorporate advanced analytics, automation technologies, and supply chain management systems to improve operational efficiency and customer service. These initiatives enhance manufacturing capabilities and market responsiveness.

Market consolidation activities include strategic acquisitions and partnerships that create larger, more capable market participants with expanded product portfolios and geographic reach. These developments reshape competitive dynamics and market structure.

Strategic positioning recommendations emphasize the importance of developing specialized capabilities in high-growth market segments such as biologics packaging and prefilled syringes. Companies should focus on differentiation strategies that leverage technical expertise and regulatory compliance capabilities rather than competing primarily on price.

Investment priorities should focus on manufacturing technology upgrades, quality system enhancements, and research and development capabilities that support innovation in pharmaceutical glass packaging. MarkWide Research analysis indicates that companies investing in advanced manufacturing technologies achieve superior market positioning and customer retention rates.

Partnership strategies should emphasize long-term relationships with pharmaceutical companies, biotechnology firms, and contract manufacturing organizations. These partnerships provide market stability and opportunities for collaborative innovation while reducing customer acquisition costs.

Geographic expansion opportunities exist in underserved regions and emerging pharmaceutical manufacturing hubs within North America. Companies should evaluate market entry strategies that balance growth potential with operational complexity and investment requirements.

Sustainability integration should become a core component of business strategy, with companies developing comprehensive environmental programs that address manufacturing processes, product design, and supply chain operations. These initiatives support competitive differentiation and regulatory compliance.

Digital transformation initiatives should focus on improving operational efficiency, customer service, and supply chain management capabilities. Investment in digital technologies can provide competitive advantages and support market expansion objectives.

Market growth projections indicate continued expansion of the North American pharmaceutical glass packaging market, with anticipated growth rates of 7.5% annually over the next five years. This growth trajectory reflects sustained pharmaceutical industry expansion, increasing demand for specialized packaging solutions, and growing emphasis on product quality and safety.

Technology evolution will drive significant changes in pharmaceutical glass packaging capabilities, with advances in glass formulations, surface treatments, and manufacturing processes creating new opportunities for performance improvement and cost optimization. These technological developments will enable enhanced product offerings that address evolving pharmaceutical industry requirements.

Regulatory landscape evolution will continue to influence market dynamics, with anticipated changes in pharmaceutical packaging standards, environmental regulations, and quality requirements. Market participants must maintain regulatory agility to adapt to evolving compliance requirements while supporting pharmaceutical industry needs.

Competitive dynamics will intensify as market participants invest in differentiation strategies, geographic expansion, and technology advancement. Success will depend on companies’ ability to develop specialized capabilities and maintain strong customer relationships while adapting to changing market conditions.

Sustainability focus will become increasingly important as pharmaceutical companies integrate environmental considerations into packaging selection decisions. Glass packaging’s inherent sustainability advantages position it favorably for long-term market growth as environmental consciousness continues to influence industry practices.

Innovation opportunities will emerge from the intersection of pharmaceutical industry trends and packaging technology advancement. Companies that successfully identify and capitalize on these opportunities will achieve sustainable competitive advantages and market leadership positions.

Market assessment reveals a robust and dynamic North American pharmaceutical glass packaging market characterized by steady growth, technological innovation, and evolving customer requirements. The market benefits from strong pharmaceutical industry fundamentals, regulatory support for quality packaging materials, and growing demand for specialized packaging solutions across therapeutic areas.

Strategic implications suggest that success in this market requires focus on quality excellence, regulatory compliance, and customer partnership development. Companies that invest in advanced manufacturing capabilities, specialized product development, and comprehensive customer service will achieve sustainable competitive advantages in this growing market.

Future prospects remain highly favorable, with MWR projecting continued market expansion driven by pharmaceutical industry growth, increasing demand for biologics packaging, and growing emphasis on product safety and quality. The market’s evolution toward more specialized and technologically advanced packaging solutions creates opportunities for companies with appropriate capabilities and strategic positioning.

Industry participants should focus on building long-term competitive advantages through technology investment, quality system enhancement, and strategic partnership development. The North America pharmaceutical glass packaging market offers significant opportunities for companies that can effectively navigate regulatory requirements, meet evolving customer needs, and maintain operational excellence in this critical healthcare industry segment.

What is Pharmaceutical Glass Packaging?

Pharmaceutical Glass Packaging refers to the use of glass containers and materials specifically designed for the storage and protection of pharmaceutical products, including liquids, powders, and injectables. This type of packaging is essential for maintaining the integrity and stability of medications.

What are the key players in the North America Pharmaceutical Glass Packaging Market?

Key players in the North America Pharmaceutical Glass Packaging Market include Schott AG, Gerresheimer AG, and Nipro Corporation, among others. These companies are known for their innovative glass packaging solutions tailored for the pharmaceutical industry.

What are the growth factors driving the North America Pharmaceutical Glass Packaging Market?

The North America Pharmaceutical Glass Packaging Market is driven by factors such as the increasing demand for biologics and injectables, the need for sustainable packaging solutions, and advancements in glass manufacturing technologies. Additionally, the rise in chronic diseases necessitates reliable packaging for pharmaceuticals.

What challenges does the North America Pharmaceutical Glass Packaging Market face?

Challenges in the North America Pharmaceutical Glass Packaging Market include the high cost of production and the risk of glass breakage during transportation and handling. Furthermore, regulatory compliance and the need for specialized packaging for sensitive products add complexity to the market.

What opportunities exist in the North America Pharmaceutical Glass Packaging Market?

Opportunities in the North America Pharmaceutical Glass Packaging Market include the growing trend towards eco-friendly packaging solutions and the increasing adoption of smart packaging technologies. Additionally, the expansion of the biopharmaceutical sector presents new avenues for growth.

What trends are shaping the North America Pharmaceutical Glass Packaging Market?

Trends in the North America Pharmaceutical Glass Packaging Market include the shift towards lightweight glass packaging, the integration of digital technologies for tracking and authentication, and the development of customized packaging solutions for specific pharmaceutical applications. These trends aim to enhance safety and efficiency in drug delivery.

North America Pharmaceutical Glass Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vials, Ampoules, Bottles, Jars |

| Packaging Type | Primary Packaging, Secondary Packaging, Tertiary Packaging, Blister Packs |

| End User | Pharmaceutical Companies, Biotechnology Firms, Contract Manufacturers, Research Institutions |

| Grade | Type I, Type II, Type III, USP |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Pharmaceutical Glass Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at