444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America pet nutraceuticals market represents a rapidly expanding sector within the broader pet care industry, driven by increasing pet ownership and growing awareness of preventive healthcare for companion animals. Pet nutraceuticals encompass a wide range of products including dietary supplements, functional foods, and therapeutic treats designed to support pet health and wellness. The market has experienced remarkable growth momentum, with adoption rates increasing by 12.5% annually as pet owners increasingly prioritize their animals’ long-term health outcomes.

Market dynamics indicate strong consumer demand for natural and organic pet health solutions, particularly among millennial and Gen Z pet owners who view their pets as family members. The region’s sophisticated veterinary infrastructure and high disposable income levels have created favorable conditions for premium nutraceutical products. Joint health supplements currently dominate the market, accounting for approximately 35% market share, followed by digestive health and immune support products.

Regional distribution shows the United States leading market penetration with 78% regional market share, while Canada demonstrates the highest growth rate at 15.2% CAGR. The market benefits from established distribution channels, including veterinary clinics, pet specialty stores, and e-commerce platforms, which have collectively improved product accessibility and consumer education initiatives.

The North America pet nutraceuticals market refers to the commercial sector encompassing nutritional supplements, functional foods, and therapeutic products specifically formulated to support the health and wellness of companion animals including dogs, cats, and other pets across the United States and Canada.

Pet nutraceuticals combine the concepts of nutrition and pharmaceuticals, offering products that provide health benefits beyond basic nutritional requirements. These products typically contain bioactive compounds such as omega fatty acids, probiotics, antioxidants, glucosamine, chondroitin, and various vitamins and minerals designed to address specific health concerns or support overall wellness in pets.

Market scope includes various product categories such as joint and mobility supplements, digestive health products, skin and coat enhancers, immune system boosters, and cognitive support formulations. The market serves diverse distribution channels including veterinary practices, pet specialty retailers, farm and feed stores, and online platforms, catering to the evolving preferences of modern pet owners who increasingly seek proactive healthcare solutions for their companion animals.

Market transformation within the North America pet nutraceuticals sector reflects broader shifts in pet ownership patterns and healthcare philosophies. The market has evolved from basic vitamin supplements to sophisticated, condition-specific formulations backed by scientific research and veterinary endorsements. Consumer behavior analysis reveals that 68% of pet owners now consider nutraceuticals essential for their pets’ preventive healthcare regimens.

Product innovation drives market expansion, with manufacturers developing targeted solutions for age-related conditions, breed-specific health concerns, and lifestyle-related issues. The integration of human-grade ingredients and organic certifications has elevated product positioning, enabling premium pricing strategies that support sustained market growth.

Distribution evolution has significantly impacted market accessibility, with e-commerce channels experiencing 42% growth rate in pet nutraceutical sales. Traditional veterinary channels maintain importance for professional recommendations, while pet specialty retailers provide educational support and product demonstrations that enhance consumer confidence and adoption rates.

Competitive landscape features both established pharmaceutical companies and emerging specialty brands, creating dynamic market conditions that foster innovation and competitive pricing. The market benefits from increasing veterinary acceptance and recommendation of nutraceutical products as complementary therapies for various health conditions.

Consumer demographics reveal significant insights about market drivers and growth opportunities. Millennial pet owners represent the largest consumer segment, demonstrating willingness to invest in premium health products for their pets. This demographic’s preference for natural, organic, and scientifically-backed products has shaped product development strategies across the industry.

Market maturity varies significantly across product categories, with joint health supplements representing a mature segment while cognitive support and anxiety management products remain in early growth phases. This diversity provides opportunities for both market penetration and category expansion strategies.

Humanization of pets serves as the primary market driver, with pet owners increasingly treating their animals as family members deserving high-quality healthcare. This trend has elevated spending priorities and created demand for products previously considered luxury items. Preventive healthcare awareness has grown substantially, with pet owners recognizing the long-term benefits and cost savings associated with proactive health management.

Aging pet populations create sustained demand for age-related health support products. As veterinary care advances extend pet lifespans, owners seek solutions to maintain quality of life during senior years. Joint health supplements benefit particularly from this demographic shift, as mobility issues become more prevalent in older animals.

Veterinary recommendation increasingly supports nutraceutical adoption as veterinarians recognize these products’ therapeutic potential. Professional endorsement provides credibility and education that drives consumer confidence and repeat purchases. Scientific research backing product efficacy has strengthened veterinary acceptance and recommendation rates.

E-commerce growth has improved product accessibility and convenience, enabling subscription-based purchasing models that ensure consistent product use. Online platforms provide extensive product information, customer reviews, and competitive pricing that support informed purchasing decisions and market expansion.

Disposable income levels in North America support premium product positioning, with consumers willing to invest in high-quality health solutions for their pets. Economic stability and pet insurance adoption further support sustained spending on preventive healthcare products.

Regulatory complexity presents significant challenges for market participants, as nutraceutical products face varying regulatory requirements across jurisdictions. FDA oversight and state-level regulations create compliance burdens that particularly impact smaller manufacturers and new market entrants. The lack of standardized efficacy testing protocols creates uncertainty about product claims and marketing approaches.

Price sensitivity among certain consumer segments limits market penetration, particularly for premium products. Economic downturns or unexpected veterinary expenses can reduce discretionary spending on nutraceutical products, impacting sales volumes and market growth rates.

Veterinary skepticism regarding certain product categories or manufacturers can limit professional recommendations and consumer adoption. Some veterinarians remain cautious about recommending products without extensive clinical trial data, particularly for newer formulations or emerging health claims.

Product quality concerns arise from market fragmentation and varying manufacturing standards. Inconsistent product quality or contamination issues can damage consumer confidence and create negative publicity that impacts the entire market segment.

Competition from pharmaceuticals presents challenges as prescription medications often provide more immediate and measurable results for specific health conditions. Pet owners may prioritize proven pharmaceutical treatments over nutraceutical alternatives, particularly for acute health issues.

Product innovation opportunities abound in emerging health categories such as cognitive support, anxiety management, and breed-specific formulations. Personalized nutrition represents a significant growth opportunity as genetic testing for pets becomes more accessible and affordable, enabling customized supplement regimens based on individual health profiles and predispositions.

Functional food integration offers opportunities to incorporate nutraceutical benefits into regular pet food products, creating convenient delivery methods that ensure consistent consumption. This approach can expand market reach beyond traditional supplement buyers to include all pet food consumers.

Subscription service models provide opportunities for recurring revenue and improved customer retention. Automated delivery services ensure consistent product use while offering convenience and often cost savings that appeal to busy pet owners.

International expansion within North America, particularly in underserved Canadian markets, presents growth opportunities for established brands. Rural and remote areas often lack access to specialty pet products, creating opportunities for direct-to-consumer distribution models.

Professional channel development through enhanced veterinary education and support programs can increase professional recommendations and market credibility. Training programs, clinical studies, and professional incentives can strengthen relationships with veterinary practices and improve product positioning.

Supply chain evolution reflects increasing demand for transparency and traceability in ingredient sourcing. Manufacturers are developing direct relationships with ingredient suppliers and implementing quality assurance programs that support premium positioning and consumer confidence. Vertical integration strategies enable better cost control and quality management throughout the production process.

Technology adoption enhances product development and manufacturing efficiency. Advanced extraction techniques, microencapsulation technologies, and stability testing improve product efficacy and shelf life. Digital marketing strategies leverage social media and influencer partnerships to reach target demographics and build brand awareness.

Competitive intensity drives continuous innovation and competitive pricing strategies. Market leaders invest heavily in research and development to maintain technological advantages, while emerging brands focus on niche markets and specialized formulations to establish market presence.

Consumer education initiatives by manufacturers and retailers improve market understanding and adoption rates. Educational content, veterinary partnerships, and customer support programs help consumers make informed decisions and use products effectively for optimal results.

Seasonal demand patterns influence inventory management and marketing strategies, with joint health products showing increased demand during colder months and flea and tick prevention products peaking during warmer seasons. Understanding these patterns enables more effective resource allocation and promotional timing.

Primary research methodologies employed in analyzing the North America pet nutraceuticals market include comprehensive surveys of pet owners, veterinary professionals, and industry stakeholders. Consumer behavior analysis utilizes focus groups and in-depth interviews to understand purchasing motivations, product preferences, and satisfaction levels with current offerings.

Secondary research incorporates analysis of industry reports, regulatory filings, company financial statements, and trade association data to establish market baselines and identify trends. Market sizing methodologies combine top-down and bottom-up approaches to validate market estimates and growth projections.

Competitive intelligence gathering includes analysis of product portfolios, pricing strategies, distribution channels, and marketing approaches across major market participants. Patent analysis provides insights into innovation trends and technological developments that may impact future market dynamics.

Veterinary surveys assess professional attitudes toward nutraceutical products, recommendation patterns, and perceived efficacy across different product categories. This professional perspective provides crucial insights into market acceptance and growth potential.

Data validation processes ensure accuracy and reliability through triangulation of multiple data sources, expert interviews, and statistical analysis techniques. Quality assurance protocols maintain research integrity and support confident market projections and strategic recommendations.

United States market dominance reflects the country’s large pet population, high disposable income levels, and advanced veterinary infrastructure. California and Texas represent the largest state markets, driven by high pet ownership rates and consumer willingness to invest in premium pet health products. The U.S. market shows 85% penetration rate for basic vitamin supplements among dog owners.

Canadian market demonstrates strong growth potential with increasing pet ownership and evolving consumer attitudes toward pet healthcare. Ontario and British Columbia lead provincial markets, benefiting from urban populations and higher income levels. Canadian consumers show particular interest in natural and organic formulations, with 72% preference rate for certified organic products.

Regional distribution patterns reveal urban markets leading adoption rates, while rural areas present growth opportunities through improved distribution and education initiatives. E-commerce penetration varies significantly by region, with urban areas showing 58% online purchase rates compared to 31% in rural markets.

Regulatory differences between the U.S. and Canada create distinct market dynamics and product positioning strategies. Canadian regulations often require different labeling and health claims, necessitating market-specific product development and marketing approaches.

Cross-border trade influences market dynamics as consumers seek access to products not available in their domestic markets. Online purchasing enables cross-border transactions that expand effective market size and competitive dynamics for manufacturers and retailers.

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment fosters innovation and drives continuous product improvement across all market segments.

Competitive strategies vary significantly across market participants, with some focusing on professional channels and veterinary recommendations while others emphasize direct-to-consumer marketing and e-commerce optimization. Product differentiation occurs through ingredient quality, formulation innovation, and specialized health targeting.

Market consolidation trends show larger companies acquiring specialized brands to expand product portfolios and market reach. These acquisitions often provide access to innovative formulations, established customer bases, and specialized manufacturing capabilities.

By Product Type: The market segments into distinct categories based on health benefits and target conditions. Joint and mobility supplements represent the largest segment, followed by digestive health products, skin and coat enhancers, and immune support formulations. Each segment demonstrates unique growth patterns and consumer preferences.

By Animal Type: Dogs dominate market consumption due to their larger size and higher supplement dosage requirements. Cat supplements show strong growth as feline health awareness increases. Small animals including rabbits, birds, and exotic pets represent emerging market opportunities with specialized product requirements.

By Form: Product formats include tablets, soft chews, powders, liquids, and treats. Soft chews lead market preference due to palatability and ease of administration. Powder formulations offer flexibility in dosing and can be mixed with food for reluctant pets.

By Distribution Channel: Veterinary clinics maintain significant market share for professional-grade products, while pet specialty stores provide consumer education and product demonstrations. E-commerce channels show rapid growth with subscription services and competitive pricing advantages.

By Price Range: Premium products command higher margins and demonstrate strong growth among affluent consumers. Mid-range products capture the largest market volume, while economy segments serve price-sensitive consumers and first-time buyers.

Joint Health Supplements: This mature category benefits from aging pet populations and increased awareness of arthritis prevention. Glucosamine and chondroitin combinations dominate formulations, with newer ingredients like MSM and hyaluronic acid gaining popularity. Market penetration reaches 45% among senior dog owners.

Digestive Health Products: Probiotic and prebiotic supplements show rapid growth as gut health awareness increases. Multi-strain formulations provide competitive advantages, while specialized products for sensitive stomachs address specific consumer needs. This category demonstrates 28% annual growth rate.

Skin and Coat Enhancers: Omega fatty acid supplements lead this category, with fish oil and flaxseed oil formulations providing essential nutrients for healthy skin and coat. Seasonal demand patterns influence sales, with peak demand during shedding seasons and allergy periods.

Immune Support Products: Antioxidant-rich formulations and immune-boosting ingredients appeal to health-conscious pet owners. Vitamin C and E combinations with herbal extracts provide comprehensive immune support, particularly popular during seasonal transitions.

Cognitive Support Supplements: This emerging category targets aging pets and cognitive decline prevention. DHA and antioxidant formulations show promise for maintaining mental acuity, though market education remains crucial for category development.

Manufacturers benefit from strong market growth, premium pricing opportunities, and expanding consumer base. Product innovation capabilities enable differentiation and competitive advantages, while established brands enjoy customer loyalty and repeat purchase patterns. Manufacturing efficiency improvements and scale economies support profitability growth.

Retailers gain from high-margin products and customer loyalty associated with pet health purchases. Educational opportunities allow retailers to build customer relationships and provide value-added services. Cross-selling opportunities with related pet products increase transaction values and customer lifetime value.

Veterinarians benefit from additional revenue streams and enhanced client relationships through product recommendations. Professional credibility increases when recommending evidence-based nutraceutical products that support treatment outcomes. Client compliance often improves with nutraceutical recommendations compared to pharmaceutical prescriptions.

Pet owners gain access to preventive healthcare solutions that may reduce long-term veterinary costs and improve pet quality of life. Convenience factors such as online ordering and subscription services simplify pet health management. Product variety enables customized approaches to individual pet health needs.

Ingredient suppliers benefit from growing demand for high-quality, specialized ingredients. Innovation opportunities exist for developing new bioactive compounds and delivery systems that enhance product efficacy and differentiation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic ingredients dominate product development trends as consumers seek clean-label products for their pets. Sustainability considerations influence ingredient sourcing and packaging decisions, with eco-friendly options gaining market preference. Manufacturers increasingly highlight ingredient origins and processing methods to appeal to environmentally conscious consumers.

Personalization trends drive development of breed-specific and age-specific formulations that address unique health requirements. Genetic testing integration enables customized supplement recommendations based on individual pet health profiles and predispositions. This trend supports premium pricing and enhanced customer loyalty.

Functional food convergence blurs traditional boundaries between pet food and supplements. Fortified treats and foods provide convenient delivery methods for nutraceutical benefits, expanding market reach beyond traditional supplement buyers. This trend requires collaboration between food and supplement manufacturers.

Digital health monitoring integration with wearable devices for pets creates opportunities for data-driven supplement recommendations. Activity tracking and health metrics provide objective measures of product efficacy and support personalized dosing recommendations.

Subscription service adoption reflects consumer preference for convenience and consistent product supply. Automated delivery models ensure regular product use while providing cost savings and customer retention benefits for manufacturers and retailers.

Regulatory evolution continues shaping market dynamics as authorities develop more specific guidelines for pet nutraceutical products. FDA guidance documents provide clearer frameworks for product claims and manufacturing standards, supporting market legitimacy and consumer confidence.

Research investments by major manufacturers focus on clinical trials and efficacy studies that support product claims and veterinary recommendations. University partnerships enhance research capabilities and provide scientific credibility for product development initiatives.

Acquisition activity reflects market consolidation trends as larger companies acquire specialized brands and innovative technologies. Strategic partnerships between manufacturers and retailers create exclusive product lines and enhanced market positioning opportunities.

Technology adoption includes advanced manufacturing techniques, quality testing methods, and digital marketing platforms. Blockchain implementation for supply chain transparency and product authentication addresses consumer concerns about ingredient quality and sourcing.

International expansion by North American companies into global markets demonstrates industry maturity and growth ambitions. Export opportunities leverage established product development capabilities and brand recognition in emerging international markets.

Product development focus should prioritize evidence-based formulations with clinical trial support to enhance veterinary acceptance and consumer confidence. MarkWide Research analysis indicates that products with published efficacy studies achieve 40% higher veterinary recommendation rates compared to products without scientific backing.

Distribution strategy optimization requires balanced approach across professional and consumer channels. Veterinary channel development through education programs and professional incentives can significantly impact market penetration and brand credibility. E-commerce capabilities remain essential for reaching younger demographics and providing convenient purchasing options.

Quality assurance investments are crucial for maintaining consumer trust and regulatory compliance. Third-party testing and certification programs provide competitive advantages and support premium positioning strategies. Transparency in manufacturing processes and ingredient sourcing appeals to increasingly sophisticated consumers.

Market education initiatives should target both consumers and veterinary professionals to improve understanding of product benefits and appropriate usage. Digital content strategies leveraging social media and influencer partnerships can effectively reach target demographics and build brand awareness.

Innovation priorities should focus on emerging health categories such as cognitive support, anxiety management, and personalized nutrition solutions. Technology integration opportunities include smart packaging, dosing systems, and health monitoring applications that enhance product value and customer engagement.

Market evolution toward more sophisticated, scientifically-backed products will continue driving industry development. Personalized nutrition represents the next frontier, with genetic testing and health monitoring enabling customized supplement regimens that optimize individual pet health outcomes.

Technology integration will enhance product efficacy and customer experience through smart delivery systems, health monitoring applications, and data-driven recommendations. Artificial intelligence applications may enable predictive health analytics that recommend preventive interventions before health issues develop.

Regulatory maturation will provide clearer guidelines and standards that support market legitimacy while potentially creating barriers for lower-quality products. Professional channel growth will continue as veterinary acceptance increases and evidence-based products demonstrate therapeutic value.

Global expansion opportunities will emerge as North American companies leverage established expertise and brand recognition in international markets. MWR projections suggest the market will maintain strong growth momentum with compound annual growth rates exceeding 8% through the next five years.

Sustainability considerations will increasingly influence product development and consumer preferences. Environmental responsibility in ingredient sourcing, packaging, and manufacturing processes will become competitive differentiators as consumer awareness grows.

The North America pet nutraceuticals market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental shifts in pet ownership attitudes and healthcare approaches. Market fundamentals remain strong, supported by increasing pet humanization, aging pet populations, and growing awareness of preventive healthcare benefits.

Innovation opportunities abound across product categories, distribution channels, and technology integration, providing multiple pathways for market participants to achieve competitive advantages and sustainable growth. The convergence of traditional supplements with functional foods and personalized nutrition solutions creates exciting possibilities for market expansion and customer value creation.

Success factors for market participants include commitment to product quality, scientific validation, professional channel development, and consumer education initiatives. Companies that invest in research, maintain high manufacturing standards, and build strong veterinary relationships will be best positioned to capitalize on market opportunities and achieve long-term success in this promising sector.

What is Pet Nutraceuticals?

Pet nutraceuticals refer to products derived from food sources that provide health benefits beyond basic nutrition for pets. These products can include dietary supplements, functional foods, and herbal remedies aimed at improving the health and well-being of pets.

What are the key players in the North America Pet Nutraceuticals Market?

Key players in the North America Pet Nutraceuticals Market include companies like Nestlé Purina PetCare, Hill’s Pet Nutrition, and Bayer Animal Health, among others. These companies focus on developing innovative products that cater to the health needs of pets.

What are the growth factors driving the North America Pet Nutraceuticals Market?

The North America Pet Nutraceuticals Market is driven by increasing pet ownership, rising awareness of pet health, and a growing demand for natural and organic pet products. Additionally, the trend towards preventive healthcare for pets is contributing to market growth.

What challenges does the North America Pet Nutraceuticals Market face?

Challenges in the North America Pet Nutraceuticals Market include regulatory hurdles, the need for scientific validation of product claims, and competition from traditional pet food products. These factors can hinder market entry and product acceptance.

What opportunities exist in the North America Pet Nutraceuticals Market?

Opportunities in the North America Pet Nutraceuticals Market include the development of personalized pet supplements, expansion into e-commerce channels, and increasing demand for products targeting specific health issues such as joint health and digestive support.

What trends are shaping the North America Pet Nutraceuticals Market?

Trends in the North America Pet Nutraceuticals Market include the rise of plant-based ingredients, the incorporation of probiotics and prebiotics in pet products, and a focus on sustainability in sourcing and packaging. These trends reflect changing consumer preferences towards health and wellness for pets.

North America Pet Nutraceuticals Market

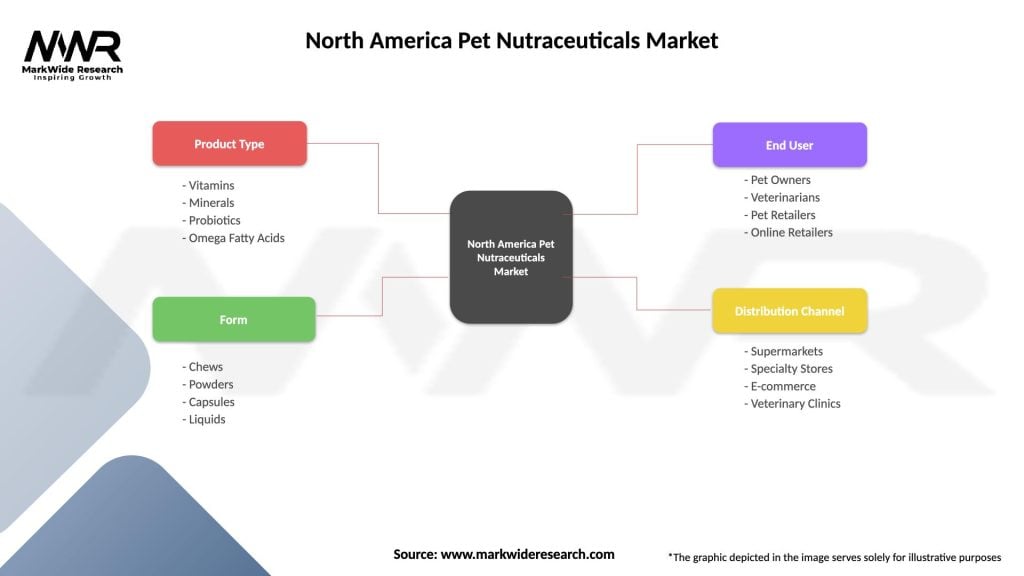

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Probiotics, Omega Fatty Acids |

| Form | Chews, Powders, Capsules, Liquids |

| End User | Pet Owners, Veterinarians, Pet Retailers, Online Retailers |

| Distribution Channel | Supermarkets, Specialty Stores, E-commerce, Veterinary Clinics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Pet Nutraceuticals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at