444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America pet diet market represents a dynamic and rapidly evolving sector within the broader pet care industry, encompassing specialized nutrition solutions for dogs, cats, and other companion animals across the United States and Canada. Pet nutrition has transformed from basic sustenance to sophisticated dietary management, with pet owners increasingly seeking premium, specialized, and therapeutic diet options for their beloved companions.

Market dynamics indicate substantial growth driven by humanization trends, where pets are considered family members deserving high-quality nutrition. The region demonstrates strong adoption of prescription diets, weight management formulas, and breed-specific nutrition solutions. Veterinary recommendations play a crucial role in driving demand for therapeutic and specialized pet diets, with approximately 68% of pet diet purchases influenced by professional veterinary guidance.

Consumer behavior patterns reveal increasing willingness to invest in premium pet nutrition, with natural ingredients, grain-free formulations, and limited ingredient diets gaining significant traction. The market encompasses various distribution channels including veterinary clinics, specialty pet retailers, and online platforms, creating a comprehensive ecosystem for pet diet solutions.

The North America pet diet market refers to the comprehensive sector encompassing specialized nutritional products designed to address specific health conditions, dietary requirements, and wellness needs of companion animals through veterinary-recommended or therapeutic feeding programs.

Pet diets differ significantly from regular pet food by incorporating targeted nutritional profiles, therapeutic ingredients, and scientifically formulated compositions designed to manage specific health conditions such as kidney disease, diabetes, obesity, food allergies, and digestive disorders. These products require veterinary oversight and are typically available through professional channels.

Therapeutic nutrition represents the core of this market, focusing on evidence-based formulations that support disease management, recovery, and long-term health maintenance. The market includes prescription diets, veterinary exclusive products, and specialized nutrition solutions that address both preventive and therapeutic needs of pets across different life stages and health conditions.

Market expansion in North America’s pet diet sector demonstrates robust growth trajectory, driven by increasing pet ownership, rising veterinary care expenditure, and growing awareness of nutrition’s role in pet health management. Premium positioning and therapeutic benefits create strong value propositions for both pet owners and veterinary professionals.

Key growth drivers include the aging pet population requiring specialized nutrition, increasing prevalence of pet obesity and related health conditions, and growing acceptance of preventive healthcare approaches. Veterinary channel dominance remains significant, with approximately 72% of therapeutic pet diets distributed through veterinary practices and specialty animal hospitals.

Innovation trends focus on personalized nutrition, advanced ingredient technologies, and condition-specific formulations. The market benefits from strong research and development investments, regulatory support for therapeutic claims, and increasing collaboration between pet food manufacturers and veterinary professionals in developing targeted nutrition solutions.

Market segmentation reveals diverse opportunities across multiple categories and applications:

Humanization of pets serves as the primary catalyst for market expansion, with pet owners increasingly viewing their companions as family members deserving premium healthcare and nutrition. This trend drives demand for sophisticated, science-based nutrition solutions that mirror human health and wellness approaches.

Veterinary recommendations significantly influence purchasing decisions, with pet owners demonstrating high trust in professional guidance for specialized nutrition needs. Preventive healthcare adoption encourages proactive nutrition management, with approximately 58% of pet owners now considering diet as a primary health maintenance tool.

Aging pet demographics create substantial demand for senior-specific nutrition solutions addressing age-related health challenges. Obesity prevalence in companion animals drives weight management diet adoption, while increasing awareness of food allergies and sensitivities expands the limited ingredient diet segment.

E-commerce growth enhances accessibility and convenience, enabling broader market reach and subscription-based delivery models. Educational initiatives by veterinary professionals and pet nutrition companies increase awareness of therapeutic diet benefits, driving informed purchasing decisions and long-term customer loyalty.

High product costs present significant barriers for price-sensitive consumers, particularly when long-term feeding programs are required for chronic conditions. Prescription requirements for therapeutic diets can limit accessibility and create purchasing friction for some pet owners.

Limited palatability of some therapeutic formulations challenges compliance, especially for pets with specific taste preferences or feeding behaviors. Veterinary channel dependency restricts distribution flexibility and may limit market penetration in underserved areas with limited veterinary access.

Regulatory complexities surrounding therapeutic claims and prescription diet classifications create compliance challenges for manufacturers and distributors. Consumer skepticism regarding premium pricing and therapeutic benefits may limit adoption among certain demographic segments.

Competition from regular premium foods marketed with health benefits can confuse consumers and potentially cannibalize specialized diet sales. Economic sensitivity during challenging financial periods may force pet owners to prioritize cost over specialized nutrition needs.

Personalized nutrition represents a significant growth frontier, leveraging genetic testing, health assessments, and individual pet profiles to create customized diet solutions. Technology integration through mobile apps, feeding monitors, and health tracking systems enhances customer engagement and compliance monitoring.

Expansion into emerging conditions such as cognitive health, anxiety management, and immune system support creates new therapeutic categories. Preventive nutrition programs targeting breed-specific predispositions offer proactive health management opportunities.

Subscription models and direct-to-consumer delivery services improve convenience and ensure consistent product availability. Partnership opportunities with veterinary practices, pet insurance companies, and animal hospitals create integrated healthcare approaches.

International expansion within North America, particularly in underserved rural markets, presents growth potential. Innovation in delivery formats including freeze-dried, fresh, and functional treat options diversifies product portfolios and addresses varying consumer preferences.

Supply chain evolution emphasizes quality control, traceability, and specialized manufacturing capabilities required for therapeutic diet production. Ingredient sourcing focuses on premium, functional components that support specific health outcomes while maintaining palatability and nutritional balance.

Research and development investments drive continuous innovation in formulation science, with approximately 15% of industry revenue typically allocated to product development and clinical studies. Regulatory compliance requires ongoing investment in quality assurance and documentation to support therapeutic claims.

Market consolidation trends show larger companies acquiring specialized diet manufacturers to expand therapeutic portfolios. Veterinary education programs enhance professional knowledge and confidence in recommending specialized nutrition solutions.

Consumer education initiatives increase awareness of nutrition’s role in pet health management, driving informed purchasing decisions. Digital transformation enables better customer communication, compliance monitoring, and personalized service delivery throughout the pet’s lifecycle.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the North America pet diet market landscape. Primary research includes extensive interviews with veterinary professionals, pet specialty retailers, and pet owners to understand purchasing behaviors, preferences, and market trends.

Secondary research encompasses analysis of industry reports, veterinary journals, regulatory filings, and company financial statements to validate market trends and competitive positioning. Quantitative surveys capture statistical data on market size, growth rates, and consumer preferences across different demographic segments.

Expert consultations with veterinary nutritionists, industry executives, and market specialists provide qualitative insights into emerging trends and future market directions. Data triangulation ensures accuracy by cross-referencing multiple sources and validation methods.

Market modeling utilizes statistical analysis and forecasting techniques to project future growth patterns and identify emerging opportunities. Regional analysis considers geographic variations in pet ownership patterns, veterinary care accessibility, and consumer spending behaviors across different North American markets.

United States dominance characterizes the North American pet diet market, representing approximately 85% of regional market share due to high pet ownership rates, advanced veterinary care infrastructure, and strong consumer spending on pet health and wellness.

California and Texas lead state-level consumption, driven by large pet populations, high disposable incomes, and concentration of veterinary specialty practices. Urban markets demonstrate higher adoption rates of premium and therapeutic diet solutions compared to rural areas.

Canada represents a growing segment with increasing awareness of pet nutrition importance and expanding veterinary care accessibility. Regional preferences vary, with coastal areas showing higher adoption of natural and organic diet options.

Distribution patterns reflect regional veterinary practice density, with metropolitan areas offering broader product availability and specialized nutrition counseling services. Market penetration continues expanding into previously underserved regions through e-commerce platforms and mobile veterinary services.

Market leadership is characterized by established veterinary nutrition companies with strong research capabilities and extensive distribution networks:

Competitive strategies focus on clinical research, veterinary education, and product innovation to maintain market position. New entrants typically target niche segments or innovative delivery methods to establish market presence.

Strategic partnerships with veterinary schools, research institutions, and specialty practices enhance credibility and market access. Innovation competition drives continuous product development and formulation improvements across the industry.

By Pet Type:

By Health Condition:

By Distribution Channel:

Therapeutic diets represent the premium segment with highest growth potential, driven by increasing prevalence of chronic conditions in aging pet populations. Weight management solutions show consistent demand growth, with approximately 35% of dogs and cats classified as overweight or obese requiring specialized nutrition intervention.

Digestive health formulations experience strong demand due to increasing recognition of gut health’s impact on overall wellness. Limited ingredient diets address growing food sensitivity concerns, particularly among urban pet populations exposed to environmental allergens.

Senior pet nutrition represents a rapidly expanding category as pet lifespans increase and age-related health management becomes more sophisticated. Breed-specific diets leverage genetic predisposition knowledge to provide targeted nutrition solutions.

Functional treats and supplement integration create hybrid products that combine therapeutic benefits with palatability and convenience. Fresh and frozen diet options appeal to consumers seeking minimally processed, natural nutrition solutions while maintaining therapeutic benefits.

Veterinary professionals benefit from enhanced treatment options, improved patient outcomes, and additional revenue streams through nutrition counseling and specialized diet sales. Therapeutic diets provide valuable tools for managing chronic conditions and supporting overall patient health.

Pet owners gain access to scientifically formulated nutrition solutions that can improve their pets’ quality of life, potentially reduce veterinary costs, and provide peace of mind regarding their companions’ health management.

Manufacturers enjoy premium pricing opportunities, strong customer loyalty, and reduced price sensitivity compared to regular pet food markets. Research investments create competitive advantages and support patent protection for innovative formulations.

Retailers benefit from higher margin products, increased customer engagement, and opportunities for education-based selling approaches. Subscription models provide predictable revenue streams and enhanced customer lifetime value.

Pet insurance companies can potentially reduce claim costs through preventive nutrition programs, while veterinary hospitals enhance their comprehensive care offerings and strengthen client relationships through nutrition expertise.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution drives demand for customized nutrition solutions based on genetic testing, health assessments, and individual pet characteristics. Technology integration enables smart feeding systems, health monitoring, and compliance tracking to optimize therapeutic outcomes.

Natural and clean label trends influence therapeutic diet formulations, with consumers seeking recognizable ingredients and minimal processing even in specialized nutrition products. Sustainability considerations impact ingredient sourcing and packaging decisions across the industry.

Preventive healthcare adoption shifts focus from treatment to prevention, with approximately 42% of pet owners now considering specialized diets for healthy pets to prevent future health issues. Breed-specific nutrition gains traction as genetic predisposition knowledge advances.

Subscription and convenience models reshape distribution, offering automated delivery and compliance support. Telehealth integration enables remote nutrition consultations and monitoring, expanding access to specialized diet guidance.

Innovation partnerships between pet food manufacturers and veterinary schools accelerate research and development of new therapeutic formulations. Acquisition activities consolidate market leadership as larger companies acquire specialized diet manufacturers to expand therapeutic portfolios.

Regulatory advancements provide clearer guidelines for therapeutic claims and prescription diet classifications, supporting market growth and consumer confidence. Clinical research investments demonstrate efficacy and safety of specialized nutrition interventions.

Technology partnerships integrate nutrition management with health monitoring devices and mobile applications. Distribution expansion includes new channels and delivery methods to improve accessibility and convenience.

Educational initiatives enhance veterinary professional knowledge and consumer awareness of therapeutic nutrition benefits. International expansion strategies extend successful North American approaches to global markets.

Investment priorities should focus on research and development capabilities, particularly in emerging therapeutic categories and personalized nutrition technologies. MarkWide Research analysis indicates that companies investing in clinical studies and veterinary education programs achieve stronger market positioning and customer loyalty.

Distribution strategy optimization requires balancing veterinary channel relationships with emerging direct-to-consumer opportunities. Technology integration should prioritize customer engagement tools and compliance monitoring systems to enhance therapeutic outcomes.

Product portfolio expansion should target underserved therapeutic categories and emerging health conditions while maintaining focus on core competencies. Partnership development with veterinary practices, pet insurance companies, and technology providers creates competitive advantages.

Market education initiatives remain crucial for driving adoption and supporting premium pricing strategies. Sustainability integration addresses growing consumer concerns while maintaining therapeutic efficacy and palatability standards.

Market expansion is projected to continue at a robust pace, driven by aging pet demographics, increasing health awareness, and advancing veterinary care standards. MWR projections indicate sustained growth across all major therapeutic categories, with weight management and digestive health leading expansion.

Innovation acceleration will focus on personalized nutrition, functional ingredients, and technology-enabled compliance monitoring. Distribution evolution will balance traditional veterinary channels with emerging digital platforms and subscription services.

Regulatory environment is expected to become more supportive of therapeutic claims while maintaining safety and efficacy standards. Consumer acceptance of premium pricing for specialized nutrition will continue growing as pet humanization trends strengthen.

Competitive landscape will likely see continued consolidation alongside emergence of innovative niche players targeting specific therapeutic categories. International expansion opportunities will extend successful North American approaches to global markets with similar pet care trends.

North America’s pet diet market represents a dynamic and rapidly evolving sector with substantial growth potential driven by pet humanization trends, aging pet demographics, and increasing awareness of nutrition’s role in health management. Therapeutic nutrition has evolved from a niche segment to a mainstream component of comprehensive pet healthcare.

Market fundamentals remain strong, supported by veterinary channel relationships, scientific research backing, and growing consumer willingness to invest in premium pet nutrition solutions. Innovation opportunities in personalized nutrition, technology integration, and emerging therapeutic categories provide multiple avenues for continued expansion.

Success factors for market participants include maintaining strong veterinary relationships, investing in research and development, and adapting to evolving consumer preferences for natural, convenient, and effective nutrition solutions. The market’s future trajectory appears positive, with sustained growth expected across all major segments and therapeutic categories throughout the forecast period.

What is Pet Diet?

Pet Diet refers to the nutritional regimen and food choices made for pets, including dogs, cats, and other domesticated animals. It encompasses various types of food such as dry kibble, wet food, raw diets, and specialized nutrition for health conditions.

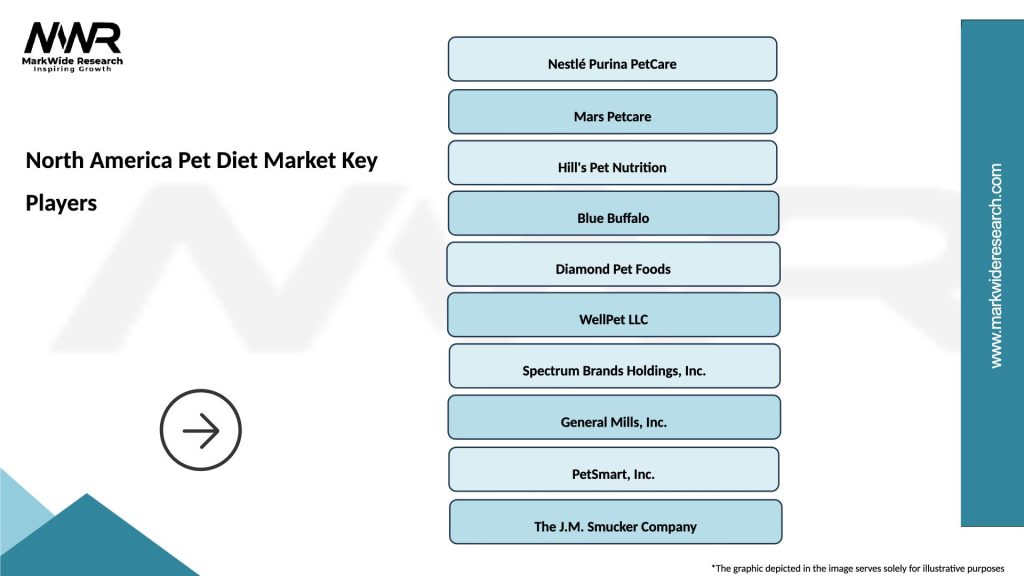

What are the key players in the North America Pet Diet Market?

Key players in the North America Pet Diet Market include Nestlé Purina PetCare, Mars Petcare, and Hill’s Pet Nutrition, among others. These companies dominate the market with a wide range of products catering to different pet dietary needs.

What are the main drivers of growth in the North America Pet Diet Market?

The main drivers of growth in the North America Pet Diet Market include the increasing pet ownership rates, rising awareness about pet health and nutrition, and the demand for premium and specialized pet food products. Additionally, trends towards natural and organic ingredients are influencing consumer choices.

What challenges does the North America Pet Diet Market face?

The North America Pet Diet Market faces challenges such as regulatory compliance regarding pet food safety, competition from private label brands, and fluctuating ingredient prices. These factors can impact product availability and pricing strategies.

What opportunities exist in the North America Pet Diet Market?

Opportunities in the North America Pet Diet Market include the growing trend of humanization of pets, which drives demand for high-quality and gourmet pet foods. Additionally, the rise of e-commerce platforms presents new avenues for distribution and consumer engagement.

What trends are shaping the North America Pet Diet Market?

Trends shaping the North America Pet Diet Market include the increasing popularity of grain-free and high-protein diets, as well as the rise of subscription-based pet food services. Innovations in packaging and sustainability practices are also becoming more prominent among consumers.

North America Pet Diet Market

| Segmentation Details | Description |

|---|---|

| Product Type | Dry Food, Wet Food, Treats, Raw Diet |

| End User | Pet Owners, Veterinarians, Retailers, Online Stores |

| Distribution Channel | Supermarkets, Pet Specialty Stores, E-commerce, Wholesale |

| Ingredient Type | Meat-Based, Grain-Free, Organic, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Pet Diet Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at