444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America personal care products packaging market represents a dynamic and rapidly evolving sector that serves as the backbone of the region’s thriving beauty and personal care industry. This market encompasses a comprehensive range of packaging solutions designed specifically for cosmetics, skincare, haircare, fragrances, and personal hygiene products across the United States, Canada, and Mexico.

Market dynamics indicate robust growth driven by increasing consumer demand for premium packaging solutions, sustainable materials, and innovative designs that enhance product appeal and functionality. The market is experiencing a significant transformation as brands prioritize eco-friendly packaging alternatives while maintaining aesthetic appeal and product protection capabilities.

Consumer preferences are increasingly shifting toward packaging that offers convenience, sustainability, and visual appeal, with 72% of consumers indicating that packaging design influences their purchasing decisions. The rise of e-commerce has further accelerated demand for protective yet attractive packaging solutions that can withstand shipping while creating memorable unboxing experiences.

Technological advancements in packaging materials and manufacturing processes are revolutionizing the industry, enabling the development of smart packaging solutions, biodegradable materials, and customizable designs that cater to diverse consumer segments and brand requirements.

The North America personal care products packaging market refers to the comprehensive ecosystem of packaging solutions, materials, and technologies specifically designed for beauty, cosmetics, skincare, haircare, and personal hygiene products distributed throughout the North American region. This market encompasses primary packaging that directly contacts products, secondary packaging for protection and branding, and tertiary packaging for distribution and logistics.

Primary packaging includes bottles, tubes, jars, compacts, pumps, and dispensers that house personal care formulations while ensuring product integrity, safety, and user convenience. These solutions must meet stringent regulatory requirements while providing optimal product preservation and consumer accessibility.

Secondary packaging encompasses outer cartons, boxes, and protective materials that enhance brand presentation, provide product information, and ensure safe transportation from manufacturing facilities to retail environments and ultimately to consumers.

Market scope extends beyond traditional packaging to include innovative solutions such as refillable containers, smart packaging with digital integration, sustainable bio-based materials, and customizable packaging systems that enable personalization and brand differentiation in competitive market segments.

The North America personal care products packaging market demonstrates exceptional growth potential driven by evolving consumer preferences, sustainability initiatives, and technological innovations that are reshaping packaging standards across the beauty and personal care industry.

Key growth drivers include the expanding premium beauty segment, increasing demand for sustainable packaging solutions, and the rise of direct-to-consumer brands that require distinctive packaging to establish market presence and consumer loyalty. The market benefits from strong consumer spending on personal care products and growing awareness of environmental sustainability.

Sustainability trends are fundamentally transforming market dynamics, with 68% of brands actively pursuing eco-friendly packaging alternatives including recyclable materials, refillable systems, and biodegradable components that align with consumer environmental consciousness and regulatory requirements.

Regional leadership is evident in the United States, which dominates market share due to its large consumer base, established beauty industry infrastructure, and concentration of major personal care brands. Canada and Mexico contribute significantly through growing middle-class populations and increasing adoption of premium personal care products.

Innovation focus centers on developing packaging solutions that combine functionality, sustainability, and aesthetic appeal while meeting diverse consumer needs across age demographics, lifestyle preferences, and cultural backgrounds throughout the North American market.

Market segmentation reveals diverse opportunities across multiple product categories, material types, and end-user applications that collectively drive comprehensive market growth and innovation throughout the North American region.

Consumer spending growth on personal care products continues to fuel demand for innovative packaging solutions as consumers increasingly view personal care as essential lifestyle investments rather than basic necessities, driving premium packaging adoption across all market segments.

Sustainability consciousness represents a fundamental market driver, with consumers actively seeking brands that demonstrate environmental responsibility through packaging choices. This trend is accelerating adoption of recyclable materials, refillable systems, and minimal packaging designs that reduce environmental impact while maintaining product quality and appeal.

E-commerce expansion has created unprecedented demand for packaging solutions that protect products during shipping while creating positive unboxing experiences that enhance brand perception and customer satisfaction. The shift toward online shopping requires packaging that balances protection, sustainability, and visual appeal.

Demographic shifts including aging populations seeking anti-aging products and younger consumers embracing skincare routines are driving demand for specialized packaging solutions that cater to specific product formulations and user preferences across diverse age groups and lifestyle segments.

Innovation in materials science enables development of advanced packaging solutions that offer superior product preservation, enhanced user convenience, and improved sustainability profiles while meeting cost-effectiveness requirements for mass market applications.

Regulatory support for sustainable packaging initiatives through government policies and industry standards encourages investment in eco-friendly packaging technologies and materials that align with environmental protection goals and consumer expectations.

High development costs associated with innovative packaging solutions pose significant challenges for smaller brands and manufacturers seeking to implement advanced packaging technologies while maintaining competitive pricing and profit margins in price-sensitive market segments.

Regulatory complexity across different North American jurisdictions creates compliance challenges for packaging manufacturers and brands operating in multiple markets, requiring significant investment in regulatory expertise and testing to ensure product approval and market access.

Supply chain disruptions affecting raw material availability and transportation logistics can impact packaging production schedules and costs, particularly for specialized materials and custom packaging solutions that require specific manufacturing processes and quality standards.

Consumer price sensitivity in certain market segments limits adoption of premium packaging solutions, as cost-conscious consumers may prioritize product value over packaging aesthetics, constraining market growth in price-competitive categories.

Technical limitations in sustainable packaging materials may compromise product protection, shelf life, or user experience compared to traditional packaging solutions, requiring ongoing research and development investment to achieve performance parity.

Infrastructure constraints for recycling and waste management systems in certain regions may limit the effectiveness of sustainable packaging initiatives, reducing consumer confidence in environmental benefits and slowing adoption rates.

Sustainable innovation presents substantial opportunities for companies developing breakthrough packaging materials and technologies that combine environmental benefits with superior performance characteristics, positioning them as industry leaders in the growing green packaging segment.

Digital integration opportunities include incorporating smart technologies such as augmented reality, product authentication, and consumer engagement features that transform packaging from passive containers into interactive brand touchpoints that enhance customer relationships.

Customization services offer significant growth potential as brands seek unique packaging solutions that differentiate their products in crowded markets, creating opportunities for specialized packaging providers offering personalization and limited-edition packaging capabilities.

Emerging market penetration in underserved regions within North America presents expansion opportunities for packaging manufacturers seeking to establish market presence and capture growing consumer demand for personal care products.

Partnership opportunities with beauty brands, retailers, and technology companies enable packaging manufacturers to develop integrated solutions that address multiple market needs while sharing development costs and market risks.

Circular economy initiatives create opportunities for companies developing refillable packaging systems, take-back programs, and closed-loop recycling solutions that align with corporate sustainability goals and consumer environmental expectations.

Competitive intensity continues to escalate as established packaging manufacturers compete with innovative startups and technology companies entering the personal care packaging space, driving continuous innovation and competitive pricing strategies across all market segments.

Technology convergence is creating new market dynamics as traditional packaging manufacturers integrate digital technologies, sustainable materials, and advanced manufacturing processes to create comprehensive solutions that address evolving customer needs and market requirements.

Consumer empowerment through social media and online reviews is increasing the importance of packaging design and sustainability credentials in purchasing decisions, with 78% of consumers researching packaging materials before making premium personal care purchases.

Supply chain evolution toward more localized and flexible manufacturing models is reshaping market dynamics, enabling faster response to consumer trends and reducing environmental impact through shortened transportation distances and improved inventory management.

Regulatory evolution continues to influence market dynamics as governments implement stricter environmental standards and safety requirements that drive innovation while creating compliance costs and market entry barriers for new participants.

Brand consolidation in the personal care industry is creating opportunities for packaging suppliers to develop strategic partnerships with major brands while also increasing competitive pressure to provide comprehensive solutions and competitive pricing.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the North America personal care products packaging market, combining quantitative data collection with qualitative industry expertise and stakeholder perspectives.

Primary research includes extensive interviews with industry executives, packaging manufacturers, personal care brands, retailers, and consumers to gather firsthand insights into market trends, challenges, and opportunities that shape industry development and strategic decision-making.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, trade publications, and academic studies to provide comprehensive market context and validate primary research findings through multiple independent sources.

Market modeling utilizes advanced analytical techniques to project market trends, assess competitive dynamics, and evaluate growth scenarios based on historical data, current market conditions, and identified growth drivers and restraints.

Data validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and statistical analysis techniques that confirm findings and eliminate potential biases or inconsistencies in market assessments.

Continuous monitoring of market developments, regulatory changes, and industry innovations ensures research findings remain current and relevant for strategic planning and investment decision-making throughout the dynamic personal care packaging market.

United States dominance in the North America personal care products packaging market reflects the country’s large consumer base, established beauty industry infrastructure, and concentration of major personal care brands that drive substantial packaging demand across all product categories and price segments.

Market distribution shows the United States accounting for approximately 75% of regional market share, driven by high consumer spending on personal care products, strong retail infrastructure, and the presence of major beauty conglomerates that require sophisticated packaging solutions for diverse product portfolios.

Canada represents a significant growth market with approximately 18% market share, characterized by increasing consumer awareness of sustainable packaging, growing demand for premium personal care products, and supportive regulatory environment for eco-friendly packaging innovations.

Mexico contributes approximately 7% of market share but demonstrates the highest growth potential due to expanding middle-class population, increasing urbanization, and growing adoption of international personal care brands that require standardized packaging solutions across North American markets.

Regional trends indicate convergence in consumer preferences for sustainable packaging, premium product presentation, and convenient packaging formats, creating opportunities for standardized solutions that can serve multiple markets while accommodating local regulatory requirements and cultural preferences.

Cross-border trade in packaging materials and finished products creates integrated market dynamics that benefit from NAFTA/USMCA trade agreements, enabling efficient supply chain optimization and cost-effective manufacturing strategies across the North American region.

Market leadership is distributed among several key players who have established strong positions through innovation, strategic partnerships, and comprehensive product portfolios that serve diverse customer needs across the personal care packaging spectrum.

Competitive strategies focus on innovation in sustainable materials, customization capabilities, and integrated service offerings that provide comprehensive solutions from design through manufacturing and logistics support for personal care brands.

Product type segmentation reveals diverse market opportunities across multiple packaging categories that serve different personal care product requirements and consumer preferences throughout the North American market.

By Material Type:

By Product Category:

By End-User:

Skincare packaging represents the largest and fastest-growing category, driven by increasing consumer focus on skincare routines, anti-aging products, and specialized treatments that require sophisticated packaging solutions to maintain product efficacy and user convenience.

Innovation trends in skincare packaging include airless dispensing systems, UV-protective materials, and multi-chamber containers that enable combination products and extended shelf life. These solutions address consumer demands for product freshness and optimal ingredient preservation.

Haircare packaging emphasizes durability and chemical resistance to accommodate diverse product formulations including sulfate-free shampoos, conditioning treatments, and styling products that require specialized container materials and dispensing mechanisms.

Color cosmetics packaging focuses on aesthetic appeal and functional design, with growing demand for refillable compacts, magnetic closures, and premium materials that enhance the user experience while supporting sustainability initiatives.

Fragrance packaging continues to prioritize luxury presentation and brand differentiation through unique bottle designs, premium materials, and innovative closure systems that create memorable consumer experiences and support premium pricing strategies.

Men’s grooming packaging represents an emerging high-growth category with 15% annual growth in packaging demand, driven by expanding product categories and increasing male consumer engagement with personal care routines and premium grooming products.

Brand differentiation through innovative packaging design enables personal care companies to establish unique market positions, command premium pricing, and build stronger consumer relationships in increasingly competitive market environments.

Sustainability leadership opportunities allow companies to align with consumer environmental values while potentially reducing material costs through efficient design and recycling programs that create positive brand associations and regulatory compliance advantages.

Supply chain optimization through strategic packaging partnerships enables brands to reduce inventory costs, improve product protection, and enhance distribution efficiency while maintaining quality standards and customer satisfaction levels.

Consumer engagement enhancement through smart packaging technologies and interactive features creates opportunities for brands to gather consumer data, provide product information, and build digital relationships that extend beyond traditional retail interactions.

Market expansion capabilities through versatile packaging solutions enable brands to enter new geographic markets, demographic segments, and distribution channels while maintaining consistent brand presentation and product quality standards.

Innovation collaboration between packaging suppliers and personal care brands accelerates product development timelines, reduces development costs, and creates competitive advantages through exclusive packaging solutions and technological partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable packaging revolution is transforming industry standards as brands and consumers prioritize environmental responsibility, driving adoption of recyclable materials, refillable systems, and biodegradable alternatives that reduce environmental impact while maintaining product quality and appeal.

Minimalist design aesthetics are gaining popularity as consumers gravitate toward clean, simple packaging designs that convey authenticity and sustainability while reducing material usage and production costs, creating opportunities for innovative design solutions.

Smart packaging integration is emerging as brands incorporate digital technologies including QR codes, NFC chips, and augmented reality features that enhance consumer engagement, provide product information, and enable brand storytelling through interactive experiences.

Personalization demand continues growing as consumers seek unique packaging experiences through customizable designs, limited-edition collections, and personalized labeling that create emotional connections and social media sharing opportunities.

Refillable systems adoption is accelerating as brands develop innovative refill programs and reusable packaging solutions that reduce waste while creating ongoing customer relationships and recurring revenue streams through subscription models.

Premium material usage is expanding beyond luxury segments as mass market brands adopt higher-quality packaging materials and finishes to differentiate products and justify premium pricing in competitive market environments.

Sustainability initiatives are driving major industry transformations as leading packaging manufacturers invest heavily in developing bio-based materials, improving recycling technologies, and creating closed-loop systems that align with corporate environmental commitments and consumer expectations.

Technology partnerships between packaging companies and technology firms are accelerating innovation in smart packaging solutions, digital printing capabilities, and automated manufacturing processes that improve efficiency while enabling customization and rapid market response.

Regulatory compliance efforts are intensifying as companies adapt to evolving environmental regulations, safety standards, and labeling requirements across North American jurisdictions, requiring significant investment in compliance systems and testing capabilities.

Merger and acquisition activity continues reshaping the competitive landscape as companies seek to expand capabilities, enter new markets, and achieve economies of scale through strategic consolidation and vertical integration initiatives.

Manufacturing modernization programs are upgrading production facilities with advanced automation, quality control systems, and flexible manufacturing capabilities that enable rapid product development and efficient small-batch production for niche markets.

Consumer research investments are increasing as companies seek deeper insights into packaging preferences, sustainability attitudes, and purchasing behaviors that inform product development and marketing strategies across diverse demographic segments.

Strategic focus on sustainability initiatives should be prioritized by all market participants, as environmental considerations are becoming fundamental to consumer purchasing decisions and regulatory compliance requirements throughout the North American market.

Investment in innovation capabilities including materials research, design technologies, and manufacturing processes will be essential for maintaining competitive advantages and meeting evolving customer needs in the dynamic personal care packaging market.

Partnership development with personal care brands, technology companies, and sustainability organizations can accelerate innovation while sharing development costs and market risks associated with new product introduction and market expansion initiatives.

Market diversification strategies should consider emerging segments such as men’s grooming, natural and organic products, and direct-to-consumer brands that offer growth opportunities beyond traditional market categories and distribution channels.

Digital transformation investments in smart packaging technologies, e-commerce optimization, and consumer engagement platforms will become increasingly important for maintaining relevance and competitive positioning in evolving market environments.

MarkWide Research analysis suggests that companies focusing on sustainable innovation while maintaining cost competitiveness will achieve the strongest market positions and growth opportunities in the evolving North American personal care packaging landscape.

Market evolution toward sustainability and innovation will continue accelerating as consumer environmental consciousness grows and regulatory requirements become more stringent, creating both challenges and opportunities for industry participants across all market segments.

Technology integration will become increasingly sophisticated as smart packaging solutions, digital printing capabilities, and automated manufacturing processes enable greater customization, improved efficiency, and enhanced consumer experiences that drive market differentiation.

Growth projections indicate continued market expansion driven by demographic trends, increasing personal care product adoption, and premiumization trends that support higher-value packaging solutions across diverse consumer segments and product categories.

Sustainability leadership will become a key competitive differentiator as companies that successfully develop and implement eco-friendly packaging solutions gain market share and premium pricing opportunities while meeting evolving consumer and regulatory expectations.

Regional integration across North American markets will continue strengthening through trade agreements and supply chain optimization, creating opportunities for standardized solutions while accommodating local market preferences and regulatory requirements.

Innovation acceleration in materials science, manufacturing technologies, and design capabilities will enable breakthrough packaging solutions that address current market limitations while creating new opportunities for market expansion and consumer engagement throughout the forecast period.

The North America personal care products packaging market represents a dynamic and rapidly evolving industry positioned for continued growth and transformation driven by sustainability initiatives, technological innovation, and changing consumer preferences that are reshaping packaging standards across the beauty and personal care sector.

Market fundamentals remain strong with robust consumer demand for personal care products, increasing adoption of premium packaging solutions, and growing environmental consciousness that supports sustainable packaging innovations and circular economy initiatives throughout the region.

Strategic opportunities abound for companies that can successfully balance sustainability requirements with performance standards, cost competitiveness, and aesthetic appeal while meeting diverse consumer needs across demographic segments and product categories in the North American market.

Future success will depend on companies’ ability to innovate continuously, adapt to regulatory changes, and respond to evolving consumer preferences while maintaining operational efficiency and competitive positioning in an increasingly complex and competitive market environment that rewards sustainability leadership and technological innovation.

What is Personal Care Products Packaging?

Personal Care Products Packaging refers to the materials and methods used to contain, protect, and present personal care items such as cosmetics, skincare, haircare, and hygiene products. This packaging plays a crucial role in branding, user experience, and product safety.

What are the key players in the North America Personal Care Products Packaging Market?

Key players in the North America Personal Care Products Packaging Market include Amcor, Berry Global, and Sealed Air. These companies are known for their innovative packaging solutions and commitment to sustainability, among others.

What are the growth factors driving the North America Personal Care Products Packaging Market?

The growth of the North America Personal Care Products Packaging Market is driven by increasing consumer demand for eco-friendly packaging, the rise of e-commerce, and the growing popularity of premium personal care products. Additionally, advancements in packaging technology are enhancing product appeal.

What challenges does the North America Personal Care Products Packaging Market face?

Challenges in the North America Personal Care Products Packaging Market include regulatory compliance regarding materials, the high cost of sustainable packaging solutions, and competition from alternative packaging formats. These factors can impact market dynamics and profitability.

What opportunities exist in the North America Personal Care Products Packaging Market?

Opportunities in the North America Personal Care Products Packaging Market include the growing trend of personalized packaging, innovations in biodegradable materials, and the expansion of online retail channels. These trends present avenues for companies to differentiate their products.

What trends are shaping the North America Personal Care Products Packaging Market?

Trends shaping the North America Personal Care Products Packaging Market include the shift towards sustainable packaging solutions, the use of smart packaging technologies, and the increasing demand for minimalistic designs. These trends reflect changing consumer preferences and environmental concerns.

North America Personal Care Products Packaging Market

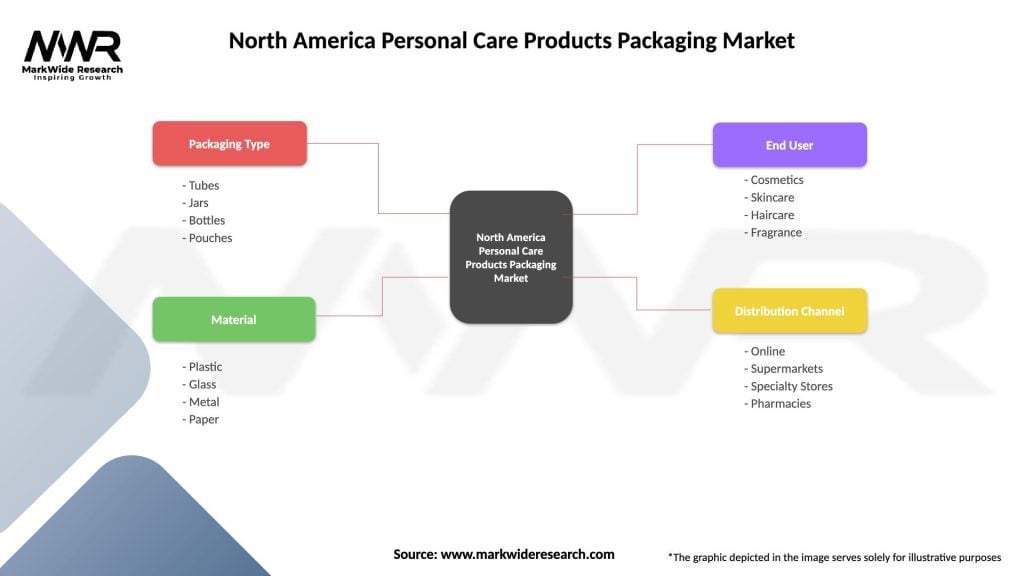

| Segmentation Details | Description |

|---|---|

| Packaging Type | Tubes, Jars, Bottles, Pouches |

| Material | Plastic, Glass, Metal, Paper |

| End User | Cosmetics, Skincare, Haircare, Fragrance |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Personal Care Products Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at