444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America packaging automation solution market represents a dynamic and rapidly evolving sector that encompasses advanced technologies designed to streamline packaging processes across various industries. This market has experienced substantial growth driven by increasing demand for operational efficiency, labor cost reduction, and enhanced product quality in packaging operations. Manufacturing companies across the region are increasingly adopting automated packaging solutions to maintain competitive advantages and meet rising consumer expectations.

Market dynamics indicate that the packaging automation sector is experiencing unprecedented transformation, with companies investing heavily in robotic systems, intelligent conveyor systems, and integrated packaging lines. The market encompasses various technologies including robotic packaging systems, automated filling machines, labeling equipment, and comprehensive packaging line integration solutions. Growth projections suggest the market will expand at a robust CAGR of 8.2% through the forecast period, driven by technological advancements and increasing adoption across multiple industry verticals.

Regional distribution shows that the United States dominates the market with approximately 78% market share, followed by Canada and Mexico. The concentration of major manufacturing facilities, advanced technological infrastructure, and strong investment in industrial automation contribute to this regional leadership. Industry sectors driving demand include food and beverage, pharmaceuticals, consumer goods, and e-commerce fulfillment operations.

The North America packaging automation solution market refers to the comprehensive ecosystem of automated technologies, equipment, and integrated systems designed to enhance packaging processes across manufacturing and distribution operations. This market encompasses robotic packaging systems, automated filling and sealing equipment, intelligent sorting mechanisms, and complete packaging line automation solutions that reduce manual intervention while improving efficiency, accuracy, and throughput.

Packaging automation solutions integrate various technologies including artificial intelligence, machine learning, computer vision, and advanced robotics to create seamless packaging workflows. These systems are designed to handle diverse packaging requirements from primary packaging of individual products to secondary packaging for distribution and retail presentation. Modern solutions incorporate real-time monitoring, predictive maintenance capabilities, and adaptive programming to accommodate varying product specifications and packaging formats.

Technology integration within packaging automation encompasses end-to-end solutions that connect with existing enterprise resource planning systems, warehouse management systems, and quality control protocols. This comprehensive approach enables manufacturers to achieve consistent packaging quality, reduce waste, minimize labor costs, and maintain compliance with industry regulations and safety standards.

Strategic analysis of the North America packaging automation solution market reveals a sector characterized by rapid technological advancement and increasing adoption across diverse industry verticals. The market demonstrates strong growth momentum driven by evolving consumer preferences, regulatory requirements, and the imperative for operational excellence in competitive manufacturing environments. Key market drivers include labor shortage challenges, rising demand for sustainable packaging solutions, and the need for enhanced traceability and quality control.

Technology trends indicate significant advancement in collaborative robotics, artificial intelligence integration, and flexible automation systems capable of handling multiple product formats. The market is witnessing increased investment in smart packaging solutions that incorporate IoT connectivity, real-time monitoring, and predictive analytics capabilities. Adoption rates show that approximately 62% of large manufacturers have implemented some form of packaging automation, while medium-sized enterprises are rapidly following suit.

Competitive landscape features established automation providers alongside emerging technology companies offering specialized solutions for specific packaging applications. The market structure supports both comprehensive system integrators and niche solution providers, creating opportunities for innovation and customized implementations. Investment patterns indicate sustained growth in research and development activities focused on next-generation packaging automation technologies.

Market intelligence reveals several critical insights that define the current state and future trajectory of packaging automation solutions in North America. These insights provide valuable perspective on market dynamics, technological evolution, and strategic opportunities for industry participants.

Primary market drivers propelling growth in the North America packaging automation solution market stem from fundamental shifts in manufacturing requirements, consumer expectations, and operational challenges. These drivers create sustained demand for advanced automation technologies across multiple industry sectors.

Labor market dynamics represent a significant driver as manufacturers face persistent workforce shortages and rising labor costs. The packaging automation sector addresses these challenges by reducing dependency on manual labor while improving workplace safety and operational consistency. Demographic trends indicate that labor shortages will intensify, making automation investments essential for maintaining production capacity and meeting market demand.

E-commerce expansion continues driving demand for sophisticated packaging automation solutions capable of handling diverse product formats and customized packaging requirements. The growth of online retail has created unprecedented complexity in packaging operations, requiring flexible automation systems that can adapt to varying order profiles and shipping requirements. Consumer expectations for fast delivery and premium packaging presentation further accelerate automation adoption.

Regulatory compliance requirements across industries, particularly in pharmaceuticals and food and beverage sectors, necessitate precise packaging automation systems that ensure product safety, traceability, and regulatory adherence. Quality standards continue evolving, requiring advanced automation capabilities to maintain compliance while optimizing operational efficiency.

Implementation challenges present significant restraints for packaging automation solution adoption, particularly among small and medium-sized enterprises. High initial capital investment requirements create barriers for companies with limited financial resources, while complex integration processes can disrupt existing operations during implementation phases. Technical complexity associated with advanced automation systems requires specialized expertise that may not be readily available within organizations.

Customization limitations of standardized automation solutions may not adequately address unique packaging requirements across diverse product lines. Companies with highly specialized packaging needs often face challenges finding cost-effective automation solutions that accommodate their specific operational requirements. Flexibility constraints in some automation systems can limit adaptability to changing product specifications or packaging formats.

Maintenance requirements for sophisticated packaging automation systems demand ongoing technical support and specialized maintenance capabilities. Organizations must invest in training programs and technical resources to ensure optimal system performance and minimize downtime. Technology obsolescence concerns also influence investment decisions, as rapid technological advancement may render current systems outdated within shorter timeframes than traditional equipment.

Integration complexity with legacy systems and existing manufacturing infrastructure can create implementation challenges and unexpected costs. Companies operating with older manufacturing systems may face significant integration obstacles that require extensive system modifications or complete infrastructure upgrades.

Emerging opportunities in the North America packaging automation solution market reflect evolving industry needs and technological capabilities that create new avenues for growth and innovation. These opportunities span across technology development, market expansion, and application diversification.

Artificial intelligence integration presents substantial opportunities for developing next-generation packaging automation solutions with enhanced decision-making capabilities, predictive maintenance features, and adaptive programming. Machine learning applications enable systems to optimize packaging processes continuously, reduce waste, and improve overall equipment effectiveness through intelligent automation.

Sustainable packaging automation represents a growing opportunity as companies prioritize environmental responsibility and regulatory compliance. Automation solutions that optimize material usage, support biodegradable packaging materials, and minimize environmental impact align with corporate sustainability initiatives. Circular economy principles create demand for automation systems that facilitate packaging reuse and recycling processes.

Small and medium enterprise markets offer significant expansion opportunities as automation technology becomes more accessible and affordable. Modular automation solutions and flexible financing options can address the unique needs and constraints of smaller manufacturers, expanding the addressable market substantially. Cloud-based automation platforms reduce infrastructure requirements and enable cost-effective implementation for smaller operations.

Industry-specific solutions create opportunities for specialized automation providers to develop targeted offerings for sectors such as pharmaceuticals, cosmetics, and specialty foods. These vertical-specific solutions can command premium pricing while addressing unique regulatory and operational requirements.

Market dynamics within the North America packaging automation solution sector reflect complex interactions between technological advancement, economic factors, and evolving industry requirements. These dynamics shape competitive positioning, investment patterns, and strategic decision-making across the market ecosystem.

Technology evolution drives continuous market transformation as automation providers integrate advanced capabilities including computer vision, artificial intelligence, and collaborative robotics. The pace of technological change creates both opportunities for innovation and challenges for companies seeking to maintain competitive advantages. Innovation cycles are accelerating, with new capabilities emerging regularly to address evolving market needs.

Competitive intensity continues increasing as established automation providers face competition from technology startups and companies expanding from adjacent markets. This competitive pressure drives innovation, improves solution quality, and creates pricing pressures that benefit end users. Market consolidation trends indicate strategic acquisitions and partnerships as companies seek to expand capabilities and market reach.

Customer expectations are evolving toward comprehensive solutions that integrate seamlessly with existing operations while providing advanced analytics and monitoring capabilities. Service requirements extend beyond equipment supply to include ongoing support, training, and optimization services. Performance metrics increasingly focus on total cost of ownership rather than initial equipment costs.

Supply chain considerations influence market dynamics as companies seek automation solutions that enhance supply chain resilience and adaptability. Recent global disruptions have highlighted the importance of flexible automation systems capable of accommodating supply chain variations and operational adjustments.

Comprehensive research methodology employed for analyzing the North America packaging automation solution market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis with qualitative research to provide holistic market understanding.

Primary research activities include extensive interviews with industry executives, technology providers, end users, and market experts to gather firsthand insights on market trends, challenges, and opportunities. Survey methodologies capture quantitative data on adoption rates, investment patterns, and performance metrics across different industry segments and company sizes.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive positioning, and technological developments. Data triangulation processes validate findings across multiple sources to ensure accuracy and minimize bias in market analysis.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth, segment performance, and regional trends. Scenario analysis evaluates potential market developments under different economic and technological conditions to provide comprehensive market outlook. Expert validation processes involve review and feedback from industry specialists to ensure research findings align with market realities.

Regional market distribution across North America reveals distinct patterns of adoption, investment, and growth potential for packaging automation solutions. The United States maintains market leadership with approximately 78% regional market share, driven by advanced manufacturing infrastructure, technology innovation, and substantial industrial investment.

United States market demonstrates the highest concentration of packaging automation adoption across diverse industry sectors including food and beverage, pharmaceuticals, consumer goods, and automotive. Manufacturing hubs in the Midwest and Southeast regions show particularly strong demand for advanced packaging automation solutions. Technology centers in California, Massachusetts, and Texas drive innovation and serve as testing grounds for next-generation automation technologies.

Canadian market represents approximately 16% regional share with strong growth potential driven by manufacturing sector modernization and government initiatives supporting industrial automation. Key provinces including Ontario, Quebec, and British Columbia lead adoption efforts, particularly in food processing, pharmaceuticals, and natural resource industries. Cross-border integration with United States manufacturing operations creates opportunities for standardized automation solutions.

Mexican market accounts for approximately 6% regional share but demonstrates rapid growth potential as manufacturing operations expand and modernize. Maquiladora operations and automotive manufacturing facilities drive demand for cost-effective packaging automation solutions. Investment trends indicate increasing focus on automation as labor costs rise and quality requirements become more stringent.

Competitive landscape within the North America packaging automation solution market features diverse participants ranging from established industrial automation companies to specialized packaging technology providers and emerging robotics companies. This competitive environment fosters innovation while providing customers with comprehensive solution options.

Market positioning varies among competitors, with some focusing on comprehensive system integration while others specialize in specific packaging applications or technologies. Innovation strategies emphasize development of flexible, intelligent automation systems capable of handling diverse packaging requirements while providing advanced monitoring and optimization capabilities.

Market segmentation of the North America packaging automation solution market reveals distinct categories based on technology type, application, industry vertical, and end-user characteristics. This segmentation provides insight into market dynamics and growth opportunities across different market segments.

By Technology:

By Application:

By Industry Vertical:

Robotic packaging systems represent the fastest-growing segment within the market, driven by advances in collaborative robotics and artificial intelligence integration. These systems offer exceptional flexibility and can handle diverse packaging tasks with minimal reconfiguration. Adoption rates for robotic packaging solutions have increased by approximately 34% annually as companies recognize the versatility and long-term value of robotic automation.

Automated filling systems maintain strong market position particularly in liquid and powder packaging applications. Technology advancement in precision filling, contamination prevention, and multi-product capability drives continued investment in this segment. Pharmaceutical applications show particularly strong demand for high-precision filling systems with advanced validation and compliance capabilities.

Labeling and coding equipment experiences steady growth driven by traceability requirements and regulatory compliance needs. Digital printing integration and variable data printing capabilities create opportunities for enhanced product customization and anti-counterfeiting measures. Smart labeling technologies incorporating RFID and NFC capabilities represent emerging growth areas.

Conveyor systems serve as critical infrastructure components within packaging automation implementations. Intelligent conveyor technologies with integrated sorting, routing, and tracking capabilities demonstrate strong growth potential. Modular designs enable flexible system configurations that can adapt to changing operational requirements.

Industry-specific insights reveal that food and beverage applications drive the largest segment of packaging automation demand, accounting for approximately 42% of market adoption. Pharmaceutical packaging shows the highest growth rate due to increasing regulatory requirements and quality standards.

Operational efficiency represents the primary benefit for companies implementing packaging automation solutions, with typical efficiency improvements ranging from 25% to 60% depending on the application and existing processes. Labor cost reduction provides immediate return on investment while addressing workforce shortage challenges that affect many manufacturing operations.

Quality consistency achieved through automated packaging systems reduces product defects, customer complaints, and warranty costs. Precision control in packaging processes ensures consistent product presentation and reduces material waste. Traceability capabilities built into modern automation systems support regulatory compliance and enable rapid response to quality issues.

Scalability advantages allow companies to adjust production capacity efficiently without proportional increases in labor requirements. Flexible automation systems accommodate seasonal demand variations and product line extensions with minimal operational disruption. Data analytics capabilities provide insights for continuous process improvement and predictive maintenance.

Competitive positioning benefits include faster time-to-market for new products, enhanced customer service through consistent delivery performance, and improved profit margins through operational optimization. Sustainability benefits include reduced material waste, energy efficiency improvements, and support for environmentally friendly packaging materials.

Risk mitigation advantages encompass reduced workplace injuries, improved product safety, and enhanced business continuity through automated backup capabilities. Technology integration enables seamless connection with enterprise systems for comprehensive operational visibility and control.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the dominant trend transforming packaging automation solutions. AI-powered systems provide predictive maintenance capabilities, optimize packaging processes in real-time, and adapt to changing product requirements without manual intervention. Machine learning algorithms enable continuous improvement in packaging efficiency and quality control.

Collaborative robotics represents a significant trend as manufacturers seek flexible automation solutions that can work safely alongside human operators. Cobot applications in packaging operations provide the benefits of automation while maintaining operational flexibility and reducing safety concerns. Human-robot collaboration enables optimal utilization of both human skills and robotic precision.

Sustainable packaging automation gains momentum as companies prioritize environmental responsibility and regulatory compliance. Eco-friendly automation solutions optimize material usage, support biodegradable packaging materials, and minimize energy consumption. Circular economy principles influence automation design to facilitate packaging reuse and recycling processes.

Digital twin technology enables virtual modeling and optimization of packaging operations before physical implementation. Simulation capabilities reduce implementation risks, optimize system design, and enable predictive analysis of operational performance. Virtual commissioning reduces installation time and improves system reliability.

Cloud-based automation platforms provide scalable, cost-effective solutions particularly attractive to smaller manufacturers. Remote monitoring and control capabilities enable centralized management of distributed packaging operations. Software-as-a-Service models reduce upfront investment requirements and provide ongoing system updates.

Recent industry developments highlight the dynamic nature of the packaging automation solution market and indicate future direction for technology advancement and market growth. These developments reflect both technological innovation and strategic market positioning by industry participants.

Technology partnerships between automation providers and software companies create comprehensive solutions that integrate physical automation with advanced analytics and artificial intelligence capabilities. Strategic alliances enable companies to offer complete packaging automation ecosystems rather than individual components.

Acquisition activities demonstrate market consolidation trends as larger automation companies acquire specialized technology providers to expand capabilities and market reach. Vertical integration strategies enable comprehensive solution offerings from component manufacturing through system integration and ongoing support services.

Research and development investments focus on next-generation technologies including advanced robotics, artificial intelligence, and sustainable automation solutions. Innovation centers established by major automation providers accelerate technology development and customer collaboration in solution design.

Regulatory developments in food safety, pharmaceutical compliance, and environmental protection influence automation system requirements and create opportunities for specialized solutions. Industry standards evolution drives adoption of standardized interfaces and communication protocols that improve system interoperability.

Market expansion initiatives include development of solutions specifically designed for small and medium enterprises, creating new market opportunities and expanding the addressable market for packaging automation solutions.

Strategic recommendations for companies operating in the North America packaging automation solution market emphasize the importance of technology innovation, market positioning, and customer relationship development. MarkWide Research analysis suggests that successful companies will focus on comprehensive solution offerings rather than individual product sales.

Technology investment priorities should emphasize artificial intelligence integration, collaborative robotics, and sustainable automation capabilities. Companies that develop expertise in these areas will be well-positioned for long-term market success. Innovation partnerships with technology companies and research institutions can accelerate capability development and market differentiation.

Market expansion strategies should target small and medium enterprise segments through development of modular, cost-effective solutions with flexible financing options. Service capabilities including training, maintenance, and optimization services represent significant revenue opportunities and competitive differentiation factors.

Customer engagement approaches should emphasize consultative selling and long-term partnership development rather than transactional equipment sales. Industry expertise in specific vertical markets enables development of specialized solutions that command premium pricing and create customer loyalty.

Geographic expansion within North America should focus on emerging manufacturing regions and cross-border opportunities that leverage regional trade agreements and manufacturing integration trends. Digital transformation initiatives should incorporate remote monitoring, predictive analytics, and cloud-based service delivery models.

Future market trajectory for North America packaging automation solutions indicates sustained growth driven by technological advancement, evolving industry requirements, and changing competitive dynamics. Growth projections suggest the market will maintain a robust expansion rate of 8.2% CAGR through the forecast period, supported by increasing automation adoption across diverse industry sectors.

Technology evolution will continue emphasizing artificial intelligence integration, advanced robotics, and sustainable automation solutions. Next-generation systems will provide unprecedented flexibility, intelligence, and efficiency improvements that justify investment even in challenging economic conditions. Digital integration capabilities will become standard requirements rather than premium features.

Market expansion opportunities will emerge from small and medium enterprise adoption, new application areas, and geographic market development. Industry diversification beyond traditional manufacturing sectors will create new demand sources and application requirements. E-commerce growth will continue driving demand for flexible, high-speed packaging automation solutions.

Competitive dynamics will favor companies that develop comprehensive solution capabilities, strong service offerings, and deep industry expertise. Market consolidation trends may accelerate as companies seek to expand capabilities and market reach through strategic acquisitions and partnerships.

Regulatory influences will continue shaping market requirements, particularly in areas of sustainability, worker safety, and product quality. Companies that proactively address regulatory trends will gain competitive advantages and market positioning benefits. MWR projections indicate that sustainability-focused automation solutions will represent approximately 35% of new installations by the end of the forecast period.

The North America packaging automation solution market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological advancement, changing industry requirements, and competitive pressures. Market fundamentals remain strong with sustained demand across diverse industry verticals and increasing recognition of automation benefits among manufacturers of all sizes.

Technology trends emphasizing artificial intelligence, collaborative robotics, and sustainable automation create opportunities for innovation and market differentiation. Companies that successfully integrate these technologies while addressing specific industry needs will be well-positioned for long-term success. Market expansion into small and medium enterprise segments represents significant untapped potential that will drive future growth.

Strategic success in this market requires comprehensive solution capabilities, strong service offerings, and deep understanding of customer operational requirements. The shift from equipment sales to solution partnerships creates opportunities for sustained customer relationships and recurring revenue streams. Investment in technology development, market expansion, and customer engagement capabilities will determine competitive positioning in this evolving market landscape.

What is Packaging Automation Solution?

Packaging Automation Solution refers to the use of technology and machinery to automate the packaging process in various industries. This includes systems for filling, sealing, labeling, and palletizing products, enhancing efficiency and reducing labor costs.

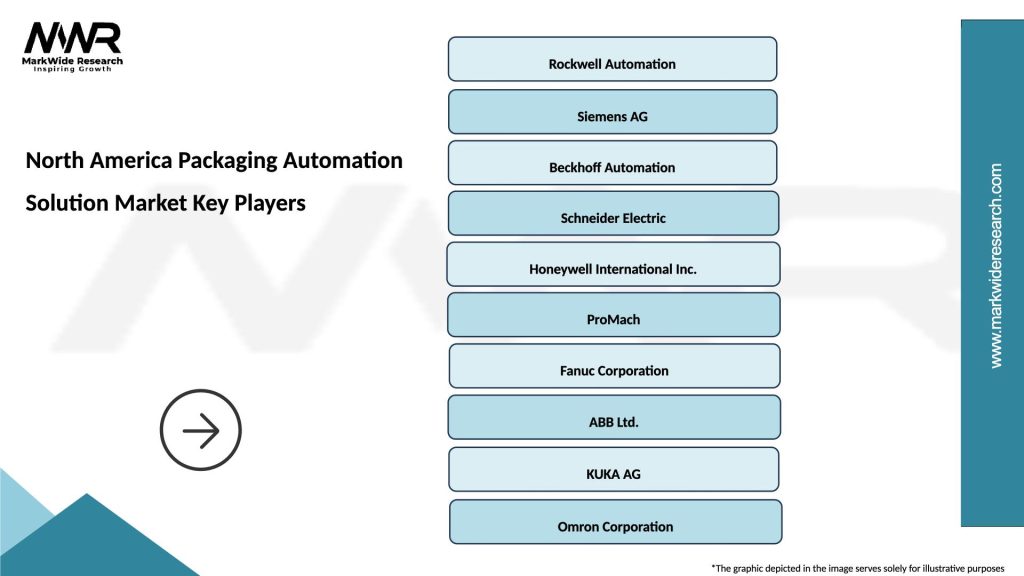

What are the key companies in the North America Packaging Automation Solution Market?

Key companies in the North America Packaging Automation Solution Market include Rockwell Automation, Siemens, and ABB, which provide innovative solutions for packaging processes across various sectors, including food and beverage, pharmaceuticals, and consumer goods, among others.

What are the main drivers of growth in the North America Packaging Automation Solution Market?

The main drivers of growth in the North America Packaging Automation Solution Market include the increasing demand for efficient packaging processes, the rise of e-commerce, and the need for compliance with safety and quality standards in industries such as food and pharmaceuticals.

What challenges does the North America Packaging Automation Solution Market face?

Challenges in the North America Packaging Automation Solution Market include high initial investment costs, the complexity of integrating automation with existing systems, and the need for skilled labor to operate advanced machinery.

What opportunities exist in the North America Packaging Automation Solution Market?

Opportunities in the North America Packaging Automation Solution Market include the growing trend of sustainable packaging solutions, advancements in robotics and AI technologies, and the increasing adoption of automation in small and medium-sized enterprises.

What trends are shaping the North America Packaging Automation Solution Market?

Trends shaping the North America Packaging Automation Solution Market include the shift towards smart packaging technologies, the integration of IoT for real-time monitoring, and the focus on reducing waste and enhancing sustainability in packaging processes.

North America Packaging Automation Solution Market

| Segmentation Details | Description |

|---|---|

| Product Type | Robotic Arms, Conveyors, Labeling Machines, Wrapping Machines |

| Technology | IoT, Machine Learning, Vision Systems, Automation Software |

| End User | Food & Beverage, Pharmaceuticals, Consumer Goods, Electronics |

| Packaging Type | Flexible Packaging, Rigid Containers, Cartons, Pallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Packaging Automation Solution Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at