444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America packaging automation market is witnessing significant growth due to the increasing demand for efficient and streamlined packaging processes across various industries. Packaging automation refers to the use of automated systems and equipment to perform packaging tasks, such as filling, labeling, sealing, and palletizing, without human intervention. This technology helps in improving operational efficiency, reducing labor costs, enhancing product quality, and ensuring faster time-to-market.

Meaning

Packaging automation involves the implementation of advanced machinery and software systems to automate packaging processes. It includes various technologies such as robotics, conveyors, sensors, and control systems, which work together to streamline the packaging workflow. By automating repetitive and labor-intensive tasks, companies can achieve higher productivity, better accuracy, and improved safety in their packaging operations.

Executive Summary

The North America packaging automation market is experiencing substantial growth driven by factors such as increasing consumer demand for packaged products, rising labor costs, and the need for faster production and delivery cycles. The market is characterized by the adoption of advanced technologies such as robotics, artificial intelligence (AI), and machine learning (ML) to enhance packaging efficiency. Companies are investing in packaging automation solutions to gain a competitive edge in the market and cater to evolving customer expectations.

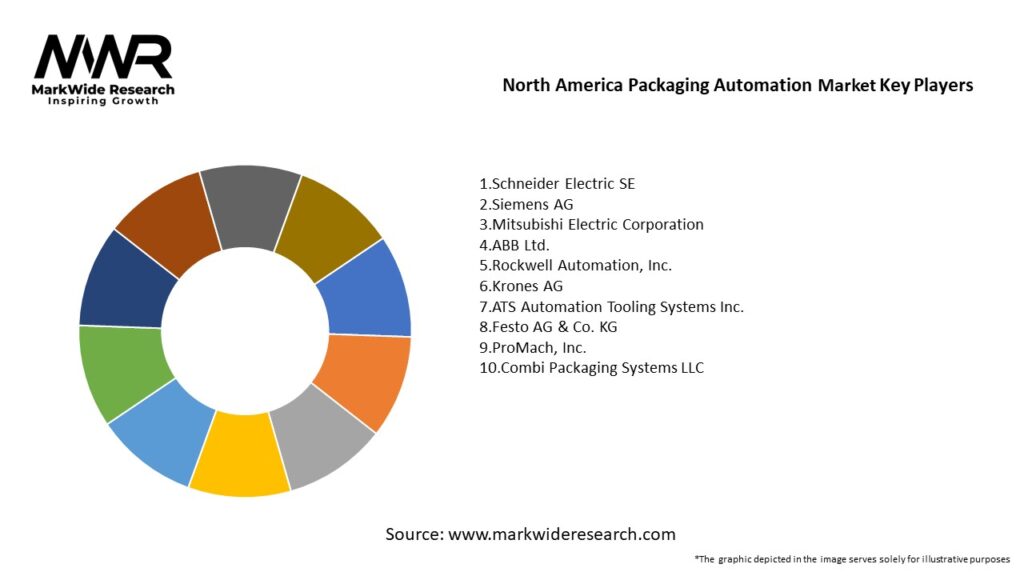

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America packaging automation market is driven by a combination of market forces, technological advancements, and changing consumer demands. The market dynamics are influenced by factors such as industry trends, regulatory requirements, competitive landscape, and economic conditions. Companies operating in the market need to adapt to these dynamics and leverage opportunities to stay competitive and drive growth.

Regional Analysis

The North America packaging automation market is segmented into the United States, Canada, and Mexico. The United States holds the largest market share due to its strong industrial base, technological advancements, and high consumer demand. Canada and Mexico are also witnessing significant growth in the packaging automation market, driven by expanding manufacturing sectors and increasing adoption of automation technologies.

Competitive Landscape

Leading Companies in the North America Packaging Automation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America packaging automation market can be segmented based on the following criteria:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the North America packaging automation market. While the initial disruption caused by lockdowns and supply chain disruptions affected the market, the pandemic also highlighted the importance of automation in maintaining operational continuity and meeting increased demand for essential goods.

During the pandemic, the e-commerce sector experienced significant growth as consumers shifted to online shopping. This led to increased demand for packaging automation solutions to handle the surge in online orders. Companies in the food and beverage, pharmaceutical, and essential goods industries invested in automation technologies to ensure uninterrupted supply chains and meet the rising demand.

The pandemic also brought attention to the need for touchless and hygienic packaging solutions. Automated packaging processes that minimize human contact and enable contactless delivery gained importance during the health crisis. Packaging automation technologies, such as robotic pick-and-place systems and smart packaging, emerged as viable options to address these concerns.

Overall, the Covid-19 pandemic accelerated the adoption of packaging automation in North America, as companies recognized the benefits of automation in ensuring business resilience, efficiency, and customer satisfaction during challenging times.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the North America packaging automation market looks promising, with continued advancements in technology and growing consumer demand for efficient packaging solutions. Automation will play a vital role in improving productivity, reducing costs, and meeting sustainability goals in the packaging industry.

The integration of robotics, AI, and IoT will enable intelligent packaging automation systems that can adapt to changing requirements, optimize operations, and deliver superior results. Customization, personalization, and sustainability will be key focus areas for companies as they strive to cater to evolving customer expectations.

The market is expected to witness increased collaboration between packaging automation providers, system integrators, and end-user industries to develop innovative solutions. Investments in research and development will further drive technological advancements and create opportunities for market growth.

Conclusion

In conclusion, the North America packaging automation market is poised for significant growth driven by factors such as increasing consumer demand, rising labor costs, and the need for efficient and sustainable packaging solutions. Companies that embrace automation and leverage advanced technologies will be well-positioned to capitalize on the opportunities and achieve long-term success in this dynamic market.

What is Packaging Automation?

Packaging automation refers to the use of technology and machinery to automate the packaging process, enhancing efficiency and reducing labor costs. It encompasses various systems such as robotic arms, conveyor belts, and automated packing machines used across industries like food and beverage, pharmaceuticals, and consumer goods.

What are the key players in the North America Packaging Automation Market?

Key players in the North America Packaging Automation Market include companies like Rockwell Automation, Siemens, and ABB, which provide advanced automation solutions. Other notable companies include Schneider Electric and KUKA, among others.

What are the main drivers of growth in the North America Packaging Automation Market?

The main drivers of growth in the North America Packaging Automation Market include the increasing demand for efficient packaging solutions, the rise of e-commerce, and the need for compliance with safety regulations. Additionally, advancements in technology, such as IoT and AI, are enhancing automation capabilities.

What challenges does the North America Packaging Automation Market face?

Challenges in the North America Packaging Automation Market include high initial investment costs and the complexity of integrating new technologies with existing systems. Additionally, there is a shortage of skilled labor to operate and maintain advanced automation equipment.

What opportunities exist in the North America Packaging Automation Market?

Opportunities in the North America Packaging Automation Market include the growing trend of sustainable packaging solutions and the increasing adoption of smart packaging technologies. Companies are also exploring automation in new sectors, such as cosmetics and personal care, to enhance efficiency.

What trends are shaping the North America Packaging Automation Market?

Trends shaping the North America Packaging Automation Market include the integration of robotics and AI for improved precision and speed, as well as the shift towards eco-friendly packaging materials. Additionally, the rise of customizable packaging solutions is becoming increasingly popular among consumers.

North America Packaging Automation Market

| Segmentation Details | Description |

|---|---|

| Product Type | Robotic Systems, Conveyor Systems, Automated Guided Vehicles, Packaging Machinery |

| Technology | IoT Integration, Machine Learning, Vision Systems, Artificial Intelligence |

| End User | Food & Beverage, Pharmaceuticals, Consumer Goods, Electronics |

| Application | Labeling, Filling, Sealing, Palletizing |

Leading Companies in the North America Packaging Automation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at