444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America outdoor lighting market represents a dynamic and rapidly evolving sector that encompasses residential, commercial, and municipal lighting solutions designed for exterior applications. This comprehensive market includes traditional lighting technologies alongside innovative LED systems, smart lighting solutions, and energy-efficient alternatives that are transforming how outdoor spaces are illuminated across the United States and Canada.

Market dynamics indicate robust growth driven by increasing urbanization, infrastructure development, and growing emphasis on energy efficiency. The market encompasses various product categories including street lighting, architectural lighting, landscape lighting, and security lighting systems. LED technology adoption has reached approximately 78% market penetration in new installations, reflecting the industry’s shift toward sustainable lighting solutions.

Regional distribution shows the United States commanding approximately 85% market share within North America, with Canada representing the remaining portion. Major metropolitan areas including New York, Los Angeles, Chicago, Toronto, and Vancouver serve as key demand centers, driving innovation and adoption of advanced outdoor lighting technologies.

Technology advancement continues to reshape the market landscape, with smart lighting systems experiencing 12.4% annual growth as municipalities and property owners seek connected solutions that offer remote monitoring, energy optimization, and enhanced functionality. Solar-powered outdoor lighting solutions have also gained significant traction, particularly in residential and commercial applications.

The North America outdoor lighting market refers to the comprehensive ecosystem of exterior lighting products, systems, and services designed to illuminate outdoor spaces including streets, parks, commercial properties, residential areas, and public infrastructure across the United States and Canada. This market encompasses traditional and advanced lighting technologies that provide safety, security, aesthetic enhancement, and functional illumination for various outdoor applications.

Outdoor lighting systems serve multiple purposes beyond basic illumination, including crime prevention, traffic safety, architectural enhancement, and recreational facility lighting. The market includes various product categories such as streetlights, floodlights, pathway lighting, decorative fixtures, and specialized applications like sports lighting and emergency lighting systems.

Market participants include lighting manufacturers, system integrators, municipal authorities, electrical contractors, and end-users ranging from homeowners to large commercial enterprises. The ecosystem also encompasses supporting services including installation, maintenance, energy management, and smart lighting platform providers.

Market transformation is occurring rapidly across North America’s outdoor lighting sector, driven by technological innovation, regulatory changes, and evolving consumer preferences. The transition from traditional lighting technologies to LED and smart lighting solutions represents the most significant shift in the industry’s recent history.

Key growth drivers include government initiatives promoting energy efficiency, increasing focus on smart city development, and growing awareness of outdoor lighting’s role in safety and security. Municipal retrofitting programs have accelerated LED adoption, with 68% of major cities having completed or initiated comprehensive street lighting upgrades.

Technology trends show increasing integration of IoT capabilities, wireless connectivity, and advanced control systems. Smart outdoor lighting solutions now account for approximately 23% of new installations, reflecting growing demand for connected infrastructure that can adapt to changing conditions and usage patterns.

Market challenges include initial investment costs for advanced systems, technical complexity of smart lighting integration, and varying regulatory requirements across different jurisdictions. However, long-term operational savings and performance benefits continue to drive adoption across all market segments.

Market segmentation reveals distinct patterns across different application areas and technology categories. The following insights highlight critical market dynamics:

Energy efficiency mandates represent the primary driver transforming North America’s outdoor lighting landscape. Federal, state, and provincial regulations increasingly require energy-efficient lighting solutions for public infrastructure, creating substantial demand for LED and advanced lighting technologies. These regulatory frameworks have accelerated market adoption and driven innovation across the industry.

Smart city initiatives continue expanding across major metropolitan areas, creating opportunities for connected outdoor lighting systems that integrate with broader urban infrastructure. Cities recognize outdoor lighting as a critical component of intelligent transportation systems, public safety networks, and environmental monitoring platforms. This integration drives demand for advanced lighting solutions with communication capabilities.

Infrastructure investment programs at federal, state, and local levels provide substantial funding for outdoor lighting upgrades and new installations. Government spending on transportation infrastructure, public facilities, and urban development projects creates consistent demand for outdoor lighting solutions across various application areas.

Security and safety concerns drive both public and private sector investment in outdoor lighting systems. Well-lit outdoor spaces contribute to crime prevention, pedestrian safety, and overall community well-being. This awareness translates into increased spending on comprehensive outdoor lighting solutions across residential, commercial, and municipal applications.

Technological advancement in LED efficiency, smart controls, and system integration capabilities continues reducing total cost of ownership while improving performance. These improvements make advanced outdoor lighting solutions increasingly attractive to cost-conscious buyers across all market segments.

High initial investment requirements for advanced outdoor lighting systems create barriers for some market participants, particularly smaller municipalities and budget-conscious property owners. While long-term operational savings justify these investments, upfront costs can delay adoption and limit market growth in price-sensitive segments.

Technical complexity associated with smart lighting systems and integration requirements can challenge organizations lacking technical expertise. The need for specialized installation, configuration, and maintenance capabilities may limit adoption among users preferring simpler solutions.

Regulatory variations across different jurisdictions create compliance challenges for manufacturers and installers operating in multiple markets. Varying standards, codes, and approval processes can increase costs and complexity for market participants.

Light pollution concerns and environmental regulations increasingly influence outdoor lighting design and installation practices. Requirements for dark-sky compliance and wildlife protection can limit lighting options and increase system complexity in certain areas.

Grid infrastructure limitations in some areas may constrain the deployment of high-power outdoor lighting systems or require additional electrical infrastructure investment. These limitations can increase project costs and complexity, particularly in rural or underdeveloped areas.

Smart city expansion presents significant opportunities for outdoor lighting manufacturers and system integrators. As more cities develop comprehensive smart infrastructure strategies, outdoor lighting systems serve as foundational elements for broader connected city initiatives, creating demand for advanced, integrated solutions.

Retrofit market potential remains substantial across North America, with millions of existing outdoor lighting fixtures requiring replacement or upgrade. This represents a multi-year opportunity for LED conversion, smart system integration, and energy efficiency improvements across various application areas.

Solar-powered solutions offer growing opportunities, particularly in remote locations, parking areas, and applications where grid connection is expensive or impractical. Improving solar technology efficiency and declining costs expand the addressable market for renewable energy-powered outdoor lighting.

Residential market growth continues as homeowners increasingly invest in outdoor lighting for security, aesthetics, and property value enhancement. The availability of affordable LED fixtures and smart home integration capabilities expands market opportunities in this segment.

Commercial and industrial expansion creates ongoing demand for specialized outdoor lighting solutions including security lighting, area illumination, and architectural lighting. Growing e-commerce and logistics sectors particularly drive demand for warehouse and distribution center lighting solutions.

Technology evolution continues reshaping market dynamics as LED efficiency improvements, smart controls, and system integration capabilities advance rapidly. These developments create both opportunities for innovation and challenges for companies maintaining competitive positioning in a rapidly changing landscape.

Competitive intensity has increased as traditional lighting manufacturers compete with technology companies, smart city solution providers, and specialized outdoor lighting firms. This competition drives innovation while pressuring margins and requiring continuous investment in research and development.

Supply chain considerations influence market dynamics, particularly regarding component availability, manufacturing capacity, and logistics costs. Global supply chain disruptions have highlighted the importance of supply chain resilience and local manufacturing capabilities.

Customer expectations continue evolving toward more sophisticated solutions offering enhanced functionality, energy efficiency, and integration capabilities. End users increasingly expect outdoor lighting systems to provide value beyond basic illumination, including data collection, communication capabilities, and adaptive functionality.

Regulatory environment remains dynamic with ongoing changes to energy efficiency standards, environmental requirements, and safety regulations. Market participants must continuously adapt to evolving regulatory frameworks while maintaining competitive positioning and profitability.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes extensive interviews with industry participants, including manufacturers, distributors, installers, and end users across various market segments and geographic regions.

Secondary research incorporates analysis of industry publications, government data, regulatory filings, and company reports to provide comprehensive market context. This approach ensures broad market coverage while identifying key trends, opportunities, and challenges affecting market development.

Data validation processes include cross-referencing multiple sources, expert consultation, and statistical analysis to ensure accuracy and reliability. Market sizing and forecasting methodologies incorporate both top-down and bottom-up approaches to provide robust market estimates.

Industry expert consultation provides qualitative insights into market dynamics, technology trends, and competitive positioning. These consultations help validate quantitative findings while providing context for market developments and future projections.

Continuous monitoring of market developments, regulatory changes, and technology advancement ensures research findings remain current and relevant. This ongoing process enables identification of emerging trends and market shifts that may impact future market dynamics.

United States market dominates North American outdoor lighting demand, representing approximately 85% of regional market activity. Major metropolitan areas including New York, Los Angeles, Chicago, Houston, and Phoenix drive significant demand for both municipal and commercial outdoor lighting solutions. Federal infrastructure programs and state-level energy efficiency initiatives continue supporting market growth across diverse geographic areas.

California leadership in energy efficiency standards and environmental regulations influences national market trends. The state’s aggressive LED adoption requirements and smart city initiatives serve as models for other jurisdictions, driving innovation and market development across the broader North American market.

Canadian market shows strong growth in urban areas including Toronto, Vancouver, Montreal, and Calgary. Provincial energy efficiency programs and federal infrastructure investment support outdoor lighting upgrades and new installations. Cold weather performance requirements create specific market opportunities for specialized outdoor lighting solutions.

Regional variations in climate, regulations, and infrastructure create diverse market conditions across North America. Northern regions require lighting solutions capable of operating in extreme cold conditions, while southern areas focus on heat management and hurricane resistance. These regional differences drive product specialization and market segmentation.

Cross-border trade in outdoor lighting products and components remains significant, with manufacturers serving both U.S. and Canadian markets from integrated supply chains. Regulatory harmonization efforts and trade agreements facilitate market access and reduce barriers for manufacturers operating across the region.

Market leadership includes established lighting manufacturers alongside technology companies and specialized outdoor lighting firms. The competitive landscape continues evolving as traditional players adapt to technological change while new entrants bring innovative solutions and business models.

Competitive strategies focus on technology innovation, energy efficiency, smart system integration, and comprehensive service offerings. Companies increasingly emphasize total cost of ownership benefits and long-term customer relationships rather than competing solely on initial product pricing.

By Technology:

By Application:

By End User:

LED lighting segment maintains market leadership with continued technology advancement and cost reduction. Efficiency improvements and extended operational life make LED solutions increasingly attractive across all application areas. Market penetration in new installations has reached 78%, with retrofit applications showing similar adoption trends.

Smart lighting category experiences rapid growth as cities and property owners seek connected solutions offering remote monitoring, energy optimization, and data collection capabilities. Integration with broader smart city initiatives drives demand for lighting systems that serve multiple functions beyond basic illumination.

Street lighting applications represent the largest market segment by volume, driven by extensive municipal infrastructure and ongoing retrofit programs. Government investment in LED conversion and smart city initiatives continues supporting growth in this category across North America.

Commercial outdoor lighting shows strong growth driven by business investment in security, safety, and aesthetic enhancement. Retail properties, office complexes, and industrial facilities increasingly recognize outdoor lighting as essential infrastructure supporting operations and customer experience.

Solar-powered solutions gain market share in applications where grid connection is expensive or impractical. Improving solar panel efficiency and battery technology expand the addressable market for renewable energy-powered outdoor lighting across various applications.

Manufacturers benefit from growing market demand driven by infrastructure investment, energy efficiency requirements, and technology advancement. The shift toward LED and smart lighting creates opportunities for companies with advanced technology capabilities and comprehensive product portfolios.

Installers and contractors experience increased business opportunities from retrofit programs, new construction projects, and maintenance contracts for advanced lighting systems. Specialization in smart lighting installation and integration provides competitive advantages in this growing market segment.

End users realize significant operational cost savings through energy-efficient lighting solutions and reduced maintenance requirements. Advanced lighting systems also provide enhanced functionality including improved safety, security, and aesthetic benefits that justify investment costs.

Municipalities gain from reduced energy costs, lower maintenance expenses, and improved public safety through comprehensive outdoor lighting upgrades. Smart lighting systems also provide data collection capabilities supporting broader smart city initiatives and operational optimization.

Property owners achieve multiple benefits including reduced operating costs, enhanced security, improved aesthetics, and increased property values through strategic outdoor lighting investments. Advanced systems also provide operational flexibility and integration capabilities supporting long-term value creation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend reshaping the outdoor lighting market. Cities and property owners increasingly seek lighting systems that provide connectivity, data collection, and integration capabilities beyond basic illumination. This trend drives demand for IoT-enabled fixtures and comprehensive lighting management platforms.

Energy efficiency optimization continues driving market development as organizations seek to minimize operational costs and environmental impact. Advanced LED technology, intelligent controls, and adaptive lighting systems enable significant energy savings while maintaining or improving lighting quality and functionality.

Sustainability focus influences product development and purchasing decisions across all market segments. Solar-powered lighting, recyclable materials, and long-life products gain market preference as environmental considerations become increasingly important to buyers and regulators.

Data-driven lighting emerges as cities and businesses recognize the value of information collected through smart lighting systems. Lighting infrastructure serves as a platform for traffic monitoring, environmental sensing, and public safety applications, creating new value propositions beyond traditional lighting functions.

Customization and flexibility become increasingly important as users seek lighting solutions tailored to specific applications and requirements. Modular systems, programmable controls, and adaptive functionality enable lighting systems to meet diverse and changing needs across various applications.

Technology partnerships between lighting manufacturers and technology companies accelerate smart lighting development and market adoption. These collaborations combine lighting expertise with advanced connectivity, data analytics, and system integration capabilities to create comprehensive solutions for smart city and commercial applications.

Regulatory updates continue shaping market development through updated energy efficiency standards, environmental requirements, and safety regulations. Recent changes include enhanced LED efficiency requirements and expanded smart lighting incentive programs across various jurisdictions.

Infrastructure investment programs at federal, state, and local levels provide substantial funding for outdoor lighting upgrades and new installations. MarkWide Research analysis indicates these programs have accelerated LED adoption and smart lighting deployment across North America.

Acquisition activity remains active as companies seek to expand capabilities, market reach, and technology portfolios. Strategic acquisitions focus on smart lighting technology, specialized applications, and regional market expansion to strengthen competitive positioning.

Product innovation continues with new LED efficiency improvements, advanced control systems, and integrated sensor capabilities. Recent developments include adaptive lighting systems that adjust automatically to environmental conditions and usage patterns, providing optimal performance while minimizing energy consumption.

Market participants should prioritize smart lighting capabilities and system integration expertise to capitalize on growing demand for connected outdoor lighting solutions. Investment in IoT technology, data analytics, and platform development will be essential for long-term competitive success in this evolving market.

Manufacturers should focus on developing comprehensive solutions that address total cost of ownership rather than competing solely on initial product pricing. Energy efficiency, operational life, and maintenance requirements increasingly influence purchasing decisions across all market segments.

Service providers can differentiate through specialized expertise in smart lighting installation, integration, and ongoing support. The complexity of advanced lighting systems creates opportunities for companies with technical capabilities and comprehensive service offerings.

End users should evaluate lighting solutions based on long-term value creation rather than initial costs alone. Advanced LED and smart lighting systems provide substantial operational savings and enhanced functionality that justify higher upfront investments through improved total cost of ownership.

Investors should consider the outdoor lighting market’s strong fundamentals including regulatory support, infrastructure investment, and technology advancement. Companies with strong smart lighting capabilities and comprehensive market coverage are well-positioned for continued growth in this expanding market.

Market growth is expected to continue at a robust pace driven by ongoing infrastructure investment, technology advancement, and regulatory support for energy-efficient lighting solutions. MarkWide Research projects the market will experience sustained expansion across all major segments through the forecast period.

Technology evolution will accelerate with continued LED efficiency improvements, advanced smart lighting capabilities, and integration with broader IoT ecosystems. Artificial intelligence and machine learning applications in lighting control and optimization represent emerging opportunities for market differentiation and value creation.

Smart city initiatives will drive increasing demand for connected outdoor lighting systems that serve multiple functions beyond basic illumination. Integration with traffic management, public safety, and environmental monitoring systems will create new market opportunities and revenue streams for lighting providers.

Sustainability requirements will continue influencing market development as environmental regulations become more stringent and organizations prioritize carbon footprint reduction. Solar-powered lighting and circular economy principles will gain importance in product development and market positioning.

Market consolidation may continue as companies seek scale advantages and comprehensive technology capabilities. Strategic partnerships and acquisitions will likely focus on smart lighting technology, specialized applications, and geographic market expansion to strengthen competitive positioning in this dynamic market.

North America’s outdoor lighting market stands at a transformational inflection point, driven by technological innovation, regulatory support, and evolving customer requirements. The transition from traditional lighting to LED and smart solutions represents the most significant market shift in decades, creating both opportunities and challenges for industry participants.

Market fundamentals remain strong with substantial infrastructure investment, energy efficiency mandates, and growing recognition of outdoor lighting’s role in safety, security, and smart city development. The combination of government spending, private sector investment, and technology advancement supports continued market expansion across all major segments.

Success factors for market participants include technology innovation, comprehensive solution capabilities, and focus on total customer value rather than initial product pricing alone. Companies that effectively combine advanced lighting technology with smart system integration and ongoing service support are best positioned for long-term success in this evolving market landscape.

What is Outdoor Lighting?

Outdoor lighting refers to the illumination of outdoor spaces, including residential, commercial, and public areas. It encompasses various types of lighting solutions such as landscape lighting, street lighting, and architectural lighting, aimed at enhancing safety, aesthetics, and usability of outdoor environments.

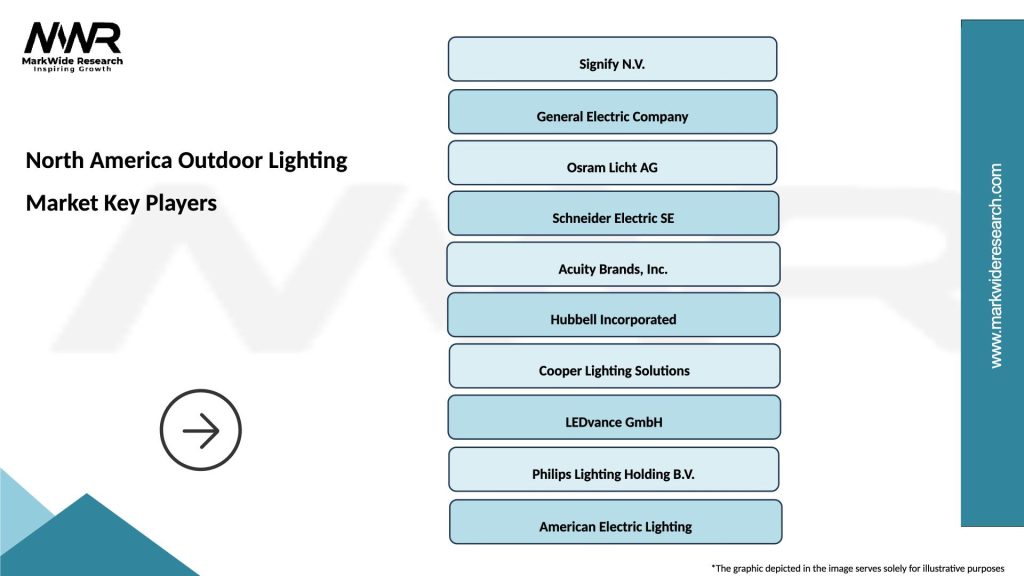

What are the key players in the North America Outdoor Lighting Market?

Key players in the North America Outdoor Lighting Market include Signify, Acuity Brands, and Cree, Inc. These companies are known for their innovative lighting solutions and extensive product portfolios, catering to both residential and commercial sectors, among others.

What are the main drivers of the North America Outdoor Lighting Market?

The main drivers of the North America Outdoor Lighting Market include the increasing demand for energy-efficient lighting solutions, the growing focus on smart city initiatives, and the rising awareness of safety and security in outdoor spaces. Additionally, advancements in LED technology are significantly contributing to market growth.

What challenges does the North America Outdoor Lighting Market face?

The North America Outdoor Lighting Market faces challenges such as high initial installation costs and the complexity of integrating smart lighting systems. Additionally, regulatory compliance and the need for ongoing maintenance can pose obstacles for widespread adoption.

What opportunities exist in the North America Outdoor Lighting Market?

Opportunities in the North America Outdoor Lighting Market include the expansion of smart lighting technologies and the increasing adoption of solar-powered lighting solutions. Furthermore, the growing trend of urbanization presents significant potential for innovative outdoor lighting applications.

What trends are shaping the North America Outdoor Lighting Market?

Trends shaping the North America Outdoor Lighting Market include the rise of smart lighting systems that integrate IoT technology, the shift towards sustainable and eco-friendly lighting solutions, and the increasing use of automated controls for energy management. These trends are driving innovation and enhancing user experience in outdoor lighting.

North America Outdoor Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | LED, Solar, Fluorescent, Halogen |

| Technology | Smart Lighting, Motion Sensors, Dimming Systems, Wireless Control |

| End User | Residential, Commercial, Industrial, Municipal |

| Installation | New Construction, Retrofit, Outdoor, Indoor |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Outdoor Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at