444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview: The North America oilfield auxiliary rental equipment market is a vital sector within the broader oil and gas industry. It involves the rental of auxiliary equipment and services to support oilfield operations, providing cost-effective solutions for exploration, drilling, and production activities.

Meaning: Oilfield auxiliary rental equipment refers to the temporary leasing of equipment and tools essential for oil and gas operations. This includes a wide range of auxiliary equipment such as drilling tools, pumps, generators, and wellhead equipment that are crucial for efficient and productive oilfield activities.

Executive Summary: The North America oilfield auxiliary rental equipment market is witnessing steady growth driven by the continuous demand for oil and gas. Rental services provide a flexible and economical approach for oilfield operators to access specialized equipment without significant upfront investments. However, market dynamics are influenced by fluctuating oil prices, technological advancements, and environmental considerations.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Restraints:

Market Opportunities:

Market Dynamics: The North America oilfield auxiliary rental equipment market operates within a dynamic environment shaped by factors such as oil price trends, technological advancements, regulatory changes, and environmental considerations. Staying abreast of these dynamics is essential for businesses to navigate challenges and capitalize on opportunities.

Regional Analysis: The North America oilfield auxiliary rental equipment market exhibits regional variations influenced by factors like shale reserves, exploration activities, and industry investments.

Competitive Landscape:

Leading Companies in North America Oilfield Auxiliary Rental Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

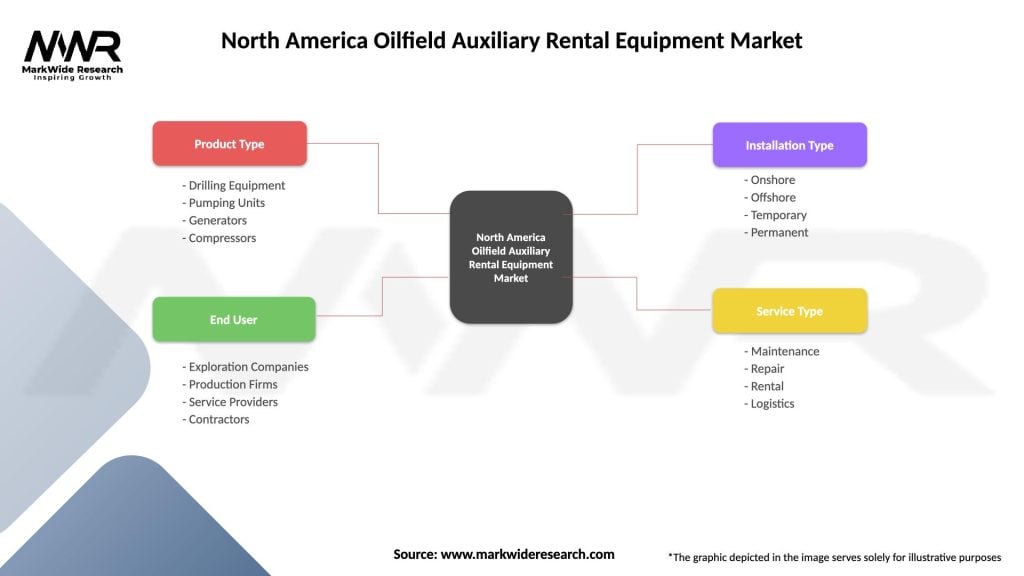

Segmentation: The North America oilfield auxiliary rental equipment market can be segmented based on equipment type, application, and geographical regions. This segmentation approach enables targeted solutions catering to specific industry needs.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats in the North America oilfield auxiliary rental equipment market, guiding strategic decision-making for industry participants.

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic has influenced the oil and gas industry, affecting exploration and production activities. The market experienced disruptions, primarily driven by reduced oil demand, fluctuating prices, and delays in projects. However, the gradual recovery in oil prices has contributed to a resurgence in exploration activities, positively impacting the demand for auxiliary rental equipment.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The North America oilfield auxiliary rental equipment market is expected to witness sustained growth, driven by factors such as technological advancements, increasing exploration activities, and the ongoing transition towards cleaner energy sources. The market’s resilience and adaptability will be crucial in navigating challenges and capitalizing on emerging opportunities.

Conclusion: In conclusion, the North America oilfield auxiliary rental equipment market plays a pivotal role in supporting the dynamic and capital-intensive oil and gas industry. The market’s adaptability to technological trends, commitment to environmental sustainability, and strategic partnerships will be instrumental in shaping its future trajectory. As the industry continues to evolve, the demand for flexible and cost-effective rental solutions is likely to remain a key driver of growth in the North America oilfield auxiliary rental equipment market.

What is Oilfield Auxiliary Rental Equipment?

Oilfield Auxiliary Rental Equipment refers to the various tools and machinery used in oilfield operations that are rented rather than purchased. This includes equipment such as generators, pumps, and drilling support systems that enhance operational efficiency.

What are the key players in the North America Oilfield Auxiliary Rental Equipment Market?

Key players in the North America Oilfield Auxiliary Rental Equipment Market include companies like United Rentals, Herc Rentals, and Sunbelt Rentals, which provide a range of rental equipment for oilfield operations, among others.

What are the main drivers of the North America Oilfield Auxiliary Rental Equipment Market?

The main drivers of the North America Oilfield Auxiliary Rental Equipment Market include the increasing demand for energy, the need for cost-effective solutions in oilfield operations, and advancements in rental technology that improve equipment efficiency.

What challenges does the North America Oilfield Auxiliary Rental Equipment Market face?

Challenges in the North America Oilfield Auxiliary Rental Equipment Market include fluctuating oil prices, regulatory compliance issues, and the need for continuous maintenance and upgrades of rental equipment to meet industry standards.

What opportunities exist in the North America Oilfield Auxiliary Rental Equipment Market?

Opportunities in the North America Oilfield Auxiliary Rental Equipment Market include the expansion of renewable energy projects, increased investment in oil and gas exploration, and the growing trend of digitalization in equipment management.

What trends are shaping the North America Oilfield Auxiliary Rental Equipment Market?

Trends shaping the North America Oilfield Auxiliary Rental Equipment Market include the rise of eco-friendly equipment options, the integration of IoT technology for real-time monitoring, and a shift towards more flexible rental agreements to meet varying project needs.

North America Oilfield Auxiliary Rental Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Drilling Equipment, Pumping Units, Generators, Compressors |

| End User | Exploration Companies, Production Firms, Service Providers, Contractors |

| Installation Type | Onshore, Offshore, Temporary, Permanent |

| Service Type | Maintenance, Repair, Rental, Logistics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North America Oilfield Auxiliary Rental Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at