444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America oil and gas line pipe market represents a critical infrastructure component supporting the region’s extensive energy transportation network. This market encompasses the manufacturing, distribution, and installation of specialized pipes designed to transport crude oil, natural gas, and refined petroleum products across vast distances. Market dynamics are driven by ongoing pipeline expansion projects, replacement of aging infrastructure, and increasing energy production from unconventional sources including shale formations.

Regional demand continues to grow as North America maintains its position as a leading energy producer globally. The market benefits from substantial investments in pipeline infrastructure, with growth rates reflecting the region’s commitment to energy security and efficient transportation systems. Technological advancements in pipe manufacturing, including enhanced corrosion resistance and improved durability, are reshaping market opportunities and driving adoption of next-generation pipeline solutions.

Industry participants are experiencing robust demand driven by regulatory requirements for pipeline safety upgrades and environmental compliance initiatives. The market demonstrates strong fundamentals supported by North America’s position as a net energy exporter and the ongoing development of cross-border pipeline projects connecting major production regions with key consumption centers and export terminals.

The North America oil and gas line pipe market refers to the comprehensive ecosystem of specialized pipeline infrastructure designed for the safe and efficient transportation of hydrocarbon products throughout the United States, Canada, and Mexico. This market encompasses various pipe specifications, materials, and technologies specifically engineered to withstand the demanding conditions of oil and gas transmission systems.

Line pipes serve as the backbone of North America’s energy transportation network, facilitating the movement of crude oil from production sites to refineries, natural gas from wellheads to processing facilities, and refined products from manufacturing centers to distribution terminals. These specialized pipes must meet stringent industry standards for pressure resistance, corrosion protection, and environmental safety while maintaining operational integrity across diverse geographical and climatic conditions.

Market scope includes seamless and welded pipes manufactured from various steel grades, along with associated components such as fittings, valves, and protective coatings. The definition extends to both onshore and offshore applications, encompassing gathering systems, transmission pipelines, and distribution networks that collectively form North America’s comprehensive energy transportation infrastructure.

Strategic analysis reveals the North America oil and gas line pipe market is experiencing sustained growth driven by infrastructure modernization initiatives and expanding energy production capabilities. The market benefits from favorable regulatory frameworks supporting pipeline development while addressing environmental and safety concerns through advanced technology adoption.

Key growth drivers include the replacement of aging pipeline infrastructure, with approximately 35% of existing pipelines requiring upgrades or replacement within the next decade. Shale gas production continues to drive demand for new pipeline construction, particularly in regions such as the Permian Basin, Marcellus Shale, and Bakken Formation, where production growth necessitates expanded transportation capacity.

Market segmentation reveals strong demand across multiple applications, with transmission pipelines representing the largest segment due to long-distance transportation requirements. Technology adoption is accelerating, with smart pipeline solutions and advanced materials gaining traction among operators seeking to optimize performance and reduce maintenance costs.

Competitive landscape features established manufacturers leveraging economies of scale and technological expertise to serve major pipeline operators. The market demonstrates resilience through diversified applications and geographic distribution, with growth opportunities emerging from cross-border projects and export infrastructure development.

Market intelligence indicates several critical factors shaping the North America oil and gas line pipe industry landscape:

Industry trends demonstrate increasing focus on pipeline integrity management and predictive maintenance technologies. Operators are prioritizing solutions that enhance operational efficiency while meeting stringent environmental and safety requirements established by regulatory authorities.

Primary growth catalysts propelling the North America oil and gas line pipe market include infrastructure modernization requirements and expanding energy production capacity. Aging pipeline infrastructure across the region necessitates systematic replacement and upgrading programs, with many existing systems approaching or exceeding their designed operational lifespan.

Unconventional energy production continues driving demand for new pipeline construction, particularly in prolific shale formations where production growth outpaces existing transportation capacity. Regulatory mandates for pipeline safety improvements are accelerating adoption of advanced pipe specifications and monitoring technologies, creating sustained demand for high-performance line pipe solutions.

Export infrastructure development represents a significant growth driver as North America transitions to a net energy exporter position. LNG export facilities and crude oil export terminals require extensive pipeline connections, driving demand for large-diameter, high-pressure line pipes capable of handling increased throughput volumes.

Environmental compliance initiatives are driving adoption of advanced pipeline technologies designed to minimize environmental impact and enhance leak detection capabilities. Operators are investing in next-generation pipeline systems that incorporate smart monitoring technologies and improved materials to ensure long-term operational integrity and environmental protection.

Significant challenges facing the North America oil and gas line pipe market include regulatory complexities and environmental opposition to new pipeline projects. Permitting processes for major pipeline construction can extend project timelines significantly, creating uncertainty for manufacturers and operators while increasing overall project costs.

Environmental activism and community opposition to pipeline development present ongoing challenges for market growth. Legal challenges and regulatory delays can postpone or cancel planned projects, affecting demand forecasts and investment decisions throughout the supply chain.

Commodity price volatility impacts operator investment decisions and project economics, with periods of low oil and gas prices potentially delaying infrastructure investments. Steel price fluctuations affect manufacturing costs and project budgets, creating challenges for long-term contract planning and profitability management.

Technical challenges associated with extreme operating conditions, including high-pressure, high-temperature applications and corrosive environments, require specialized materials and manufacturing processes that increase costs. Skilled labor shortages in pipeline construction and maintenance sectors can constrain project execution capabilities and increase labor costs across the industry.

Emerging opportunities in the North America oil and gas line pipe market include the development of smart pipeline technologies and advanced materials that enhance operational efficiency and environmental performance. Digital transformation initiatives are creating demand for pipeline systems integrated with IoT sensors, predictive analytics, and automated monitoring capabilities.

Carbon capture and storage infrastructure development presents new market opportunities as the energy industry invests in carbon management technologies. Hydrogen transportation infrastructure represents an emerging application area as the region develops hydrogen economy initiatives and clean energy transportation systems.

Pipeline rehabilitation and upgrade projects offer substantial growth potential as operators seek to extend the operational life of existing infrastructure while improving safety and environmental performance. Trenchless installation technologies are creating opportunities for pipeline replacement projects in environmentally sensitive areas and urban environments.

International market expansion opportunities exist as North American manufacturers leverage technological expertise and production capabilities to serve global pipeline development projects. Strategic partnerships with international operators and engineering companies can facilitate market entry and technology transfer initiatives.

Complex market dynamics shape the North America oil and gas line pipe industry through the interaction of supply chain factors, regulatory requirements, and technological innovation. Supply chain integration between steel producers, pipe manufacturers, and pipeline operators creates interdependencies that influence pricing, delivery schedules, and product specifications.

Regulatory frameworks continue evolving to address safety, environmental, and security concerns while supporting energy infrastructure development. Industry standards for pipe specifications, testing procedures, and installation practices are becoming increasingly stringent, driving demand for high-quality products and specialized expertise.

Technology adoption cycles influence market dynamics as operators evaluate new solutions against existing infrastructure investments and operational requirements. Innovation diffusion occurs gradually as proven technologies gain acceptance and demonstrate measurable benefits in terms of safety, efficiency, and environmental performance.

Market competition intensifies as manufacturers differentiate through technological innovation, service capabilities, and supply chain optimization. Customer relationships and long-term partnerships become increasingly important as operators seek reliable suppliers capable of supporting complex, multi-year pipeline development projects.

Comprehensive research methodology employed in analyzing the North America oil and gas line pipe market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes structured interviews with industry executives, pipeline operators, manufacturers, and regulatory officials to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and technical publications to establish market baseline data and identify emerging trends. Quantitative analysis utilizes statistical modeling techniques to project market growth rates and segment performance based on historical data and identified market drivers.

Market segmentation analysis examines demand patterns across different applications, pipe specifications, and geographic regions to identify growth opportunities and competitive dynamics. Technology assessment evaluates emerging innovations and their potential market impact through expert interviews and technical literature review.

Validation processes ensure data accuracy through cross-referencing multiple sources and conducting follow-up interviews with key industry participants. MarkWide Research methodology emphasizes triangulation of findings across different data sources to provide comprehensive and reliable market intelligence for strategic decision-making.

United States market dominates the North America oil and gas line pipe sector, accounting for approximately 75% of regional demand driven by extensive shale production activities and pipeline infrastructure development. Key production regions including Texas, North Dakota, Pennsylvania, and Oklahoma generate substantial demand for gathering systems and transmission pipelines connecting production areas to processing facilities and markets.

Canadian market represents approximately 20% of regional demand, with significant growth driven by oil sands development and natural gas production in Alberta and British Columbia. Trans-border pipeline projects connecting Canadian production to U.S. markets create demand for large-diameter, high-pressure line pipes designed for long-distance transportation applications.

Mexican market accounts for the remaining 5% of regional demand but demonstrates strong growth potential as the country modernizes its energy infrastructure and develops domestic production capabilities. Energy sector reforms are attracting international investment in pipeline infrastructure and creating opportunities for North American pipe manufacturers.

Regional integration through cross-border pipeline projects enhances energy security and creates demand for specialized line pipes capable of meeting multiple regulatory jurisdictions’ requirements. Geographic diversification of production and consumption centers drives demand for extensive transmission pipeline networks connecting supply sources with demand centers across the continent.

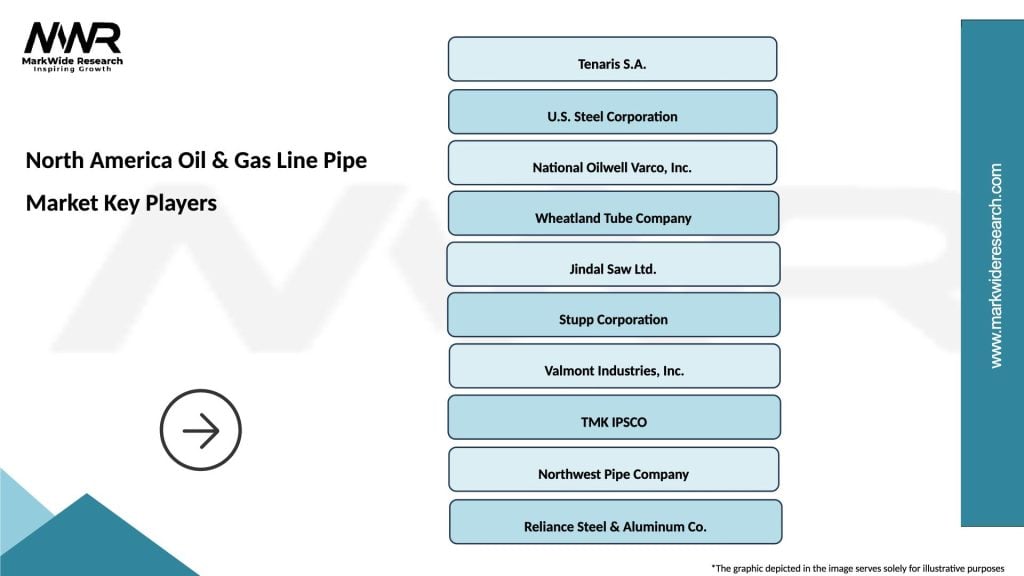

Market leadership in the North America oil and gas line pipe sector is characterized by established manufacturers with significant production capacity and technological expertise:

Competitive strategies emphasize technological innovation, supply chain optimization, and customer service excellence. Market participants are investing in advanced manufacturing technologies and quality control systems to meet increasingly stringent industry specifications and regulatory requirements.

Market segmentation reveals diverse applications and product categories within the North America oil and gas line pipe market:

By Product Type:

By Application:

By Material Grade:

Transmission pipeline segment represents the largest market category, driven by long-distance transportation requirements and large-diameter pipe specifications. Growth rates in this segment reflect ongoing infrastructure expansion and replacement projects connecting major production regions with consumption centers and export facilities.

Gathering system applications demonstrate strong growth driven by unconventional production development, particularly in shale formations where extensive collection networks are required to connect numerous production wells. Technology adoption in gathering systems emphasizes corrosion resistance and operational flexibility to accommodate varying production profiles.

Offshore applications require specialized pipe specifications designed to withstand marine environments and deepwater installation challenges. Market demand in this category is influenced by offshore exploration and production activities in the Gulf of Mexico and other North American offshore regions.

Smart pipeline integration is emerging across all categories as operators seek to enhance monitoring capabilities and operational efficiency. Advanced materials and coating technologies are gaining adoption across categories to improve durability and reduce maintenance requirements throughout the pipeline lifecycle.

Pipeline operators benefit from advanced line pipe technologies that enhance operational reliability, reduce maintenance costs, and improve environmental performance. Enhanced durability and corrosion resistance extend pipeline operational life while reducing the frequency and cost of maintenance interventions.

Manufacturers gain competitive advantages through technological innovation and production efficiency improvements that enable cost-effective delivery of high-quality products. Market diversification across multiple applications and geographic regions provides stability and growth opportunities in varying market conditions.

Energy companies achieve improved project economics through reliable pipeline infrastructure that ensures consistent transportation capacity and operational flexibility. Regulatory compliance benefits include meeting safety and environmental standards while maintaining operational efficiency and cost-effectiveness.

Communities and stakeholders benefit from enhanced pipeline safety and environmental protection through advanced technologies and improved operational practices. Economic development opportunities arise from pipeline construction projects and ongoing operational activities that support local employment and business development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend with pipeline operators implementing IoT sensors, predictive analytics, and automated monitoring systems to enhance operational efficiency and safety performance. Smart pipeline technologies are becoming standard requirements for new construction projects and major upgrade initiatives.

Environmental sustainability considerations are driving adoption of advanced leak detection systems, improved materials, and operational practices designed to minimize environmental impact. Carbon footprint reduction initiatives are influencing pipeline design and operational strategies across the industry.

Modular construction techniques are gaining adoption to reduce installation time and costs while improving quality control and safety performance. Prefabrication strategies enable more efficient project execution and reduced field construction requirements.

Advanced materials development focuses on enhanced corrosion resistance, improved mechanical properties, and specialized coatings designed for specific operating environments. Metallurgical innovations are enabling pipeline operation in increasingly challenging conditions while extending operational life and reducing maintenance requirements.

Recent industry developments demonstrate continued innovation and investment in North America’s oil and gas pipeline infrastructure. Major pipeline projects including the Trans Mountain Expansion, Line 3 Replacement, and various Permian Basin takeaway projects are driving substantial demand for line pipe products.

Technology partnerships between pipe manufacturers and technology companies are accelerating development of smart pipeline solutions and advanced monitoring capabilities. Research and development initiatives focus on next-generation materials and manufacturing processes that enhance performance while reducing costs.

Regulatory developments include updated safety standards and environmental requirements that influence pipe specifications and installation practices. Industry collaboration through trade associations and research organizations is advancing best practices and technological innovation across the sector.

Market consolidation activities include strategic acquisitions and partnerships that enhance manufacturing capabilities and market reach. Capacity expansion projects by major manufacturers are positioning the industry to meet growing demand while improving production efficiency and quality control.

Strategic recommendations for market participants emphasize the importance of technological innovation and operational excellence in maintaining competitive position. Investment priorities should focus on advanced manufacturing capabilities, quality control systems, and customer service excellence to differentiate in an increasingly competitive marketplace.

Market positioning strategies should emphasize specialized expertise in high-value applications such as sour service environments, high-pressure systems, and offshore installations. Geographic diversification across North American markets can provide stability and growth opportunities while reducing dependence on individual regional markets.

Technology adoption should prioritize smart pipeline solutions and advanced materials that provide measurable benefits in terms of safety, efficiency, and environmental performance. Partnership strategies with technology providers and engineering companies can accelerate innovation and market access.

MarkWide Research analysis suggests that companies focusing on sustainability, innovation, and customer relationships will achieve superior long-term performance in the evolving market landscape. Regulatory compliance and environmental stewardship should be integrated into core business strategies to ensure sustainable growth and stakeholder acceptance.

Long-term market prospects for the North America oil and gas line pipe industry remain positive, supported by continued energy production growth and infrastructure modernization requirements. Growth projections indicate sustained demand driven by replacement of aging infrastructure and expansion of transportation capacity to serve growing production and export markets.

Technology evolution will continue transforming the industry through smart pipeline systems, advanced materials, and improved installation techniques. Digital integration will become increasingly important as operators seek to optimize performance and reduce operational costs through data-driven decision making and predictive maintenance strategies.

Environmental considerations will play an increasingly important role in pipeline development and operation, driving adoption of technologies and practices that minimize environmental impact while maintaining operational efficiency. Regulatory evolution will continue shaping industry practices and technology adoption patterns.

Market expansion opportunities include emerging applications such as carbon capture and storage infrastructure and hydrogen transportation systems. International market development may provide additional growth opportunities as North American manufacturers leverage technological expertise and production capabilities to serve global markets.

The North America oil and gas line pipe market represents a critical component of the region’s energy infrastructure, supporting continued economic growth and energy security through reliable transportation systems. Market fundamentals remain strong, driven by ongoing production growth, infrastructure modernization requirements, and technological innovation that enhances operational performance and environmental compliance.

Industry transformation through digital technologies, advanced materials, and improved operational practices positions the market for sustained growth and enhanced value creation. Strategic opportunities exist for companies that can successfully integrate innovation with operational excellence while maintaining focus on safety, environmental stewardship, and customer satisfaction.

Future success in this dynamic market will depend on the ability to adapt to evolving regulatory requirements, embrace technological innovation, and maintain strong relationships with customers and stakeholders. MWR analysis indicates that companies positioning themselves as technology leaders and reliable partners will achieve superior performance in the competitive North America oil and gas line pipe market landscape.

What is Oil & Gas Line Pipe?

Oil & Gas Line Pipe refers to the pipes used for the transportation of oil and gas from production sites to processing facilities and end-users. These pipes are essential for the infrastructure of the energy sector, ensuring efficient and safe delivery of hydrocarbons.

What are the key players in the North America Oil & Gas Line Pipe Market?

Key players in the North America Oil & Gas Line Pipe Market include companies like Tenaris, Vallourec, and U.S. Steel, which manufacture and supply various types of line pipes for oil and gas applications, among others.

What are the growth factors driving the North America Oil & Gas Line Pipe Market?

The growth of the North America Oil & Gas Line Pipe Market is driven by increasing energy demand, advancements in drilling technologies, and the expansion of pipeline infrastructure to support shale gas production.

What challenges does the North America Oil & Gas Line Pipe Market face?

Challenges in the North America Oil & Gas Line Pipe Market include regulatory hurdles, environmental concerns regarding pipeline construction, and fluctuating oil prices that can impact investment in new projects.

What opportunities exist in the North America Oil & Gas Line Pipe Market?

Opportunities in the North America Oil & Gas Line Pipe Market include the development of new pipeline projects, the integration of smart pipeline technologies, and the increasing focus on sustainable energy solutions.

What trends are shaping the North America Oil & Gas Line Pipe Market?

Trends in the North America Oil & Gas Line Pipe Market include the adoption of advanced materials for enhanced durability, the use of automation in pipeline monitoring, and a growing emphasis on safety and environmental compliance.

North America Oil & Gas Line Pipe Market

| Segmentation Details | Description |

|---|---|

| Product Type | Seamless Pipe, Welded Pipe, Coated Pipe, Lined Pipe |

| End User | Exploration, Production, Transportation, Refining |

| Installation Type | Onshore, Offshore, Subsea, Above Ground |

| Material | Carbon Steel, Alloy Steel, Stainless Steel, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Oil & Gas Line Pipe Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at