444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America nematicide market represents a critical segment of the agricultural chemicals industry, addressing one of the most persistent challenges facing crop production across the continent. Nematicides serve as specialized pesticides designed to control plant-parasitic nematodes, microscopic roundworms that cause substantial crop damage and yield losses. The market encompasses various product formulations including fumigants, organophosphates, carbamates, and biological nematicides, each targeting specific nematode species and application scenarios.

Market dynamics indicate robust growth driven by increasing awareness of nematode-related crop losses and the adoption of integrated pest management practices. The region’s diverse agricultural landscape, spanning from intensive row crop production in the Midwest to specialty crop cultivation in California and Florida, creates varied demand patterns for nematicide solutions. Growth rates demonstrate consistent expansion at approximately 5.2% CAGR, reflecting the essential role these products play in maintaining agricultural productivity.

Regional distribution shows the United States commanding approximately 87% market share, with Canada contributing the remaining portion. The concentration reflects the scale of agricultural operations and the prevalence of nematode-susceptible crops across American farmland. Technology adoption trends favor environmentally sustainable solutions, with biological nematicides experiencing 12.8% annual growth as growers seek alternatives to traditional chemical formulations.

The North America nematicide market refers to the comprehensive ecosystem of products, technologies, and services designed to combat plant-parasitic nematodes across agricultural operations in the United States and Canada. This market encompasses the development, manufacturing, distribution, and application of chemical and biological agents specifically formulated to reduce nematode populations and minimize their impact on crop yields and quality.

Nematicides function through various mechanisms including contact toxicity, systemic action, and biological antagonism. Chemical nematicides typically work by disrupting nematode nervous systems or cellular processes, while biological alternatives employ beneficial microorganisms or natural compounds to suppress nematode populations. The market includes both soil-applied and seed treatment formulations, each designed for specific crop systems and nematode pressure scenarios.

Market scope extends beyond product sales to include application services, technical support, and integrated management programs. Modern nematicide solutions often incorporate precision agriculture technologies, enabling targeted applications based on soil sampling, nematode identification, and economic thresholds. This comprehensive approach reflects the evolution from broad-spectrum treatments to sophisticated, data-driven pest management strategies.

Strategic positioning of the North America nematicide market reflects its essential role in maintaining agricultural competitiveness and food security. The market serves diverse crop segments including soybeans, corn, cotton, vegetables, fruits, and specialty crops, each presenting unique nematode challenges and solution requirements. Innovation drivers focus on developing more effective, environmentally compatible products that align with sustainable agriculture initiatives and regulatory requirements.

Competitive landscape features established agricultural chemical companies alongside emerging biotechnology firms specializing in biological solutions. Market leaders leverage extensive research and development capabilities, global distribution networks, and comprehensive technical support services to maintain market position. Product differentiation increasingly emphasizes mode of action diversity, environmental safety profiles, and integration with digital agriculture platforms.

Market evolution demonstrates a clear shift toward sustainable solutions, with biological nematicides gaining 23% market penetration over the past five years. This transition reflects changing grower preferences, regulatory pressures, and consumer demands for environmentally responsible production practices. Future growth projections indicate continued expansion driven by climate change impacts, evolving nematode resistance patterns, and increasing adoption of precision agriculture technologies.

Market intelligence reveals several critical insights shaping the North America nematicide landscape. Primary drivers include increasing nematode pressure due to climate change, continuous cropping systems, and the development of resistance to existing control methods. These factors create sustained demand for innovative nematicide solutions across diverse agricultural systems.

Primary growth drivers propelling the North America nematicide market stem from fundamental agricultural challenges and evolving production practices. Climate change impacts create favorable conditions for nematode proliferation, extending growing seasons and expanding the geographic range of problematic species. Rising temperatures and altered precipitation patterns contribute to increased nematode survival rates and reproduction cycles, intensifying pressure on crop production systems.

Intensive agriculture practices including continuous cropping, reduced tillage, and high plant populations create ideal environments for nematode population buildup. Modern farming systems often prioritize efficiency and cost reduction, sometimes at the expense of crop rotation and other cultural practices that naturally suppress nematode populations. Economic pressures on farmers to maximize yields from existing acreage drive demand for effective nematode control solutions.

Technological advancement in nematode detection and identification enables more precise treatment decisions, increasing the adoption of targeted nematicide applications. Soil testing services, molecular diagnostics, and precision agriculture platforms provide growers with detailed information about nematode species, population densities, and economic thresholds. Regulatory support for sustainable agriculture practices encourages the development and adoption of environmentally compatible nematicide solutions, particularly biological alternatives.

Market expansion benefits from increasing awareness of nematode-related yield losses and the economic benefits of effective control programs. Extension services, agricultural consultants, and industry education initiatives help growers understand the hidden costs of nematode damage and the return on investment from appropriate treatment programs.

Regulatory constraints represent significant challenges for the North America nematicide market, particularly regarding environmental safety and worker protection requirements. Registration processes for new nematicide active ingredients involve extensive testing and documentation, requiring substantial time and financial investments that may limit innovation and market entry for smaller companies. Evolving environmental regulations continue to restrict the use of certain chemical classes, forcing market participants to develop alternative solutions.

Economic barriers include the high cost of nematicide treatments relative to other pest management inputs, particularly for lower-value crops where treatment economics may not justify application costs. Price sensitivity among growers varies significantly based on crop values, nematode pressure levels, and expected yield responses, creating market segmentation challenges for product positioning and pricing strategies.

Technical limitations of existing nematicide technologies include limited residual activity, application timing constraints, and variable efficacy across different soil types and environmental conditions. Resistance development to chemical nematicides poses long-term sustainability concerns, requiring continuous investment in new active ingredients and resistance management strategies.

Market access challenges affect smaller agricultural operations that may lack the technical expertise or equipment necessary for proper nematicide application. Knowledge gaps regarding nematode identification, economic thresholds, and treatment timing can result in suboptimal product performance and reduced grower satisfaction, potentially limiting market expansion.

Emerging opportunities in the North America nematicide market center on technological innovation and sustainable agriculture trends. Biological nematicides represent the fastest-growing segment, offering environmentally compatible alternatives to traditional chemical treatments. These products appeal to growers seeking to reduce environmental impact while maintaining effective nematode control, creating substantial market expansion potential.

Precision agriculture integration presents significant opportunities for market growth through targeted application technologies, variable rate application systems, and data-driven treatment decisions. Digital platforms that combine soil testing, weather data, and predictive modeling can optimize nematicide applications, improving efficacy while reducing input costs and environmental impact.

Specialty crop markets offer high-value opportunities for premium nematicide products, particularly in vegetable, fruit, and ornamental production systems where crop values justify higher treatment costs. Organic agriculture expansion creates demand for OMRI-listed biological nematicides and other approved treatment options that align with organic certification requirements.

International expansion opportunities exist for North American companies to leverage their technological expertise and product portfolios in global markets facing similar nematode challenges. Strategic partnerships with biotechnology companies, research institutions, and agricultural service providers can accelerate product development and market penetration for innovative nematicide solutions.

Market dynamics in the North America nematicide sector reflect complex interactions between agricultural practices, regulatory frameworks, and technological innovation. Supply chain considerations include raw material availability, manufacturing capacity, and distribution networks that must adapt to seasonal demand patterns and regional application requirements. The market experiences significant seasonality, with peak demand occurring during spring planting seasons and pre-plant soil preparation periods.

Competitive dynamics involve both established agricultural chemical companies and emerging biotechnology firms competing across different market segments. Innovation cycles typically span 8-12 years from initial research to commercial launch, requiring sustained investment in research and development activities. Market leaders maintain competitive advantages through patent protection, regulatory expertise, and comprehensive technical support services.

Customer relationships play crucial roles in market success, with growers increasingly seeking integrated solutions that combine products, services, and technical expertise. Distribution channels include agricultural retailers, cooperatives, and direct sales to large farming operations, each requiring different marketing approaches and support services.

Technology adoption patterns demonstrate gradual acceptance of new solutions, with early adopters typically including progressive growers facing severe nematode pressure. Market education initiatives by manufacturers, extension services, and industry organizations help accelerate adoption of innovative nematicide technologies and application practices.

Comprehensive research methodology employed in analyzing the North America nematicide market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry stakeholders including manufacturers, distributors, agricultural consultants, and growers across diverse crop production systems and geographic regions.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and academic publications related to nematode management and agricultural chemical markets. Market sizing methodologies combine top-down and bottom-up approaches, utilizing crop acreage data, treatment rates, and product pricing information to develop comprehensive market estimates.

Data validation processes include cross-referencing multiple sources, conducting expert interviews, and performing sensitivity analyses to ensure data accuracy and consistency. Trend analysis incorporates historical data spanning multiple years to identify growth patterns, seasonal variations, and emerging market developments.

Forecasting models integrate various factors including agricultural trends, regulatory changes, technological developments, and economic indicators to project future market conditions. MarkWide Research analytical frameworks ensure comprehensive coverage of market segments, competitive dynamics, and growth opportunities across the North America nematicide landscape.

United States market dominates the North America nematicide landscape, accounting for the vast majority of consumption and representing diverse agricultural systems from intensive row crop production to high-value specialty crops. Midwest region leads in volume consumption, driven by extensive soybean and corn production facing significant nematode pressure from species including soybean cyst nematode and corn rootworm nematodes.

Southern states including Georgia, North Carolina, and Florida represent important markets for nematicide applications in cotton, peanuts, vegetables, and citrus production. Climate conditions in these regions favor nematode development and survival, creating sustained demand for effective control solutions. Specialty crop production in California generates significant demand for premium nematicide products, particularly in vegetable and fruit production systems.

Canadian market contributes approximately 13% of regional demand, with applications concentrated in prairie grain production and specialty crop areas in Ontario and British Columbia. Regulatory frameworks in Canada align closely with U.S. standards while maintaining some unique requirements for product registration and use patterns.

Regional preferences vary based on crop systems, nematode species prevalence, and local agricultural practices. Market penetration of biological nematicides shows regional variation, with higher adoption rates in areas with intensive specialty crop production and strong environmental stewardship programs. Distribution networks reflect regional agricultural structures, with cooperative systems more prevalent in certain areas and independent dealers serving others.

Market leadership in the North America nematicide sector involves established agricultural chemical companies with comprehensive product portfolios and extensive market presence. Competitive positioning depends on factors including product efficacy, regulatory approvals, distribution networks, and technical support capabilities.

Competitive strategies include product innovation, strategic acquisitions, partnership development, and market expansion initiatives. Research and development investments focus on new active ingredients, improved formulations, and sustainable solution development to address evolving market needs and regulatory requirements.

Product segmentation of the North America nematicide market reflects diverse application requirements and technological approaches to nematode management. Chemical nematicides remain the dominant segment, encompassing various active ingredient classes including organophosphates, carbamates, and fumigants, each offering specific advantages for different application scenarios.

By Product Type:

By Application Method:

By Crop Type:

Chemical nematicides continue to dominate market share due to their proven efficacy, broad spectrum activity, and established use patterns across diverse crop systems. Fumigant nematicides offer the most comprehensive nematode control but face increasing regulatory scrutiny and application restrictions, driving demand for alternative solutions with improved environmental profiles.

Biological nematicides represent the fastest-growing category, driven by sustainability trends and regulatory preferences for reduced-risk products. Microbial-based solutions utilizing beneficial bacteria, fungi, or other microorganisms show particular promise for integration with existing crop management systems. Natural product nematicides derived from plant extracts or other organic sources appeal to growers seeking environmentally compatible alternatives.

Seed treatment applications demonstrate strong growth potential due to their precision, reduced environmental exposure, and compatibility with modern planting systems. Systemic nematicides applied as seed treatments provide early-season protection while minimizing overall pesticide use and environmental impact.

Specialty crop applications command premium pricing due to higher crop values and specialized application requirements. Vegetable production systems often require multiple nematicide applications throughout the growing season, creating opportunities for comprehensive treatment programs and integrated management approaches.

Grower benefits from effective nematicide programs include significant yield improvements, enhanced crop quality, and reduced production risks. Economic returns from nematicide applications typically range from 3:1 to 8:1 return on investment, depending on crop values, nematode pressure levels, and treatment efficacy. Risk mitigation aspects include protection against yield losses that can exceed 20-30% in severely infested fields.

Manufacturer advantages include access to large, stable markets with recurring demand patterns and opportunities for product differentiation through innovation. Technology development investments create competitive advantages and patent protection for novel active ingredients and formulation technologies. Market expansion opportunities exist through geographic diversification and new crop segment penetration.

Distributor benefits encompass product portfolio diversification, technical service opportunities, and relationship building with grower customers. Value-added services including soil testing, application services, and technical support create additional revenue streams and customer loyalty. Seasonal demand patterns provide predictable business cycles and inventory management opportunities.

Research institution collaborations with industry participants enable access to funding, field testing opportunities, and technology commercialization pathways. Academic partnerships support fundamental research into nematode biology, resistance mechanisms, and sustainable management strategies that benefit the entire industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping the North America nematicide market, with growers, regulators, and consumers demanding environmentally responsible pest management solutions. Biological nematicides experience accelerated adoption as companies invest heavily in microbial technologies, natural product development, and sustainable formulation approaches.

Precision agriculture integration enables more targeted and efficient nematicide applications through soil sampling technologies, variable rate application systems, and data-driven treatment decisions. Digital platforms combining weather data, soil conditions, and nematode monitoring provide growers with sophisticated tools for optimizing treatment timing and placement.

Resistance management strategies become increasingly important as nematode populations develop tolerance to existing chemical treatments. Integrated approaches combining multiple modes of action, cultural practices, and biological controls help preserve the effectiveness of available nematicide options while reducing selection pressure for resistance development.

Regulatory evolution continues to influence product development priorities, with emphasis on reduced-risk active ingredients, improved environmental fate profiles, and enhanced worker safety characteristics. MWR analysis indicates that regulatory compliance costs now represent approximately 25-30% of total product development expenses for new nematicide technologies.

Recent innovations in the North America nematicide market reflect industry responses to evolving agricultural needs and regulatory requirements. Biotechnology advances include the development of novel microbial strains with enhanced nematode control efficacy and improved environmental persistence under field conditions.

Formulation improvements focus on enhanced delivery systems, extended residual activity, and reduced environmental impact through encapsulation technologies and controlled-release mechanisms. Application technology developments include precision placement systems, improved seed treatment formulations, and integration with existing farm equipment.

Strategic partnerships between established agricultural companies and biotechnology startups accelerate the development and commercialization of innovative nematicide solutions. Acquisition activities consolidate market participants while expanding product portfolios and technological capabilities.

Regulatory approvals for new active ingredients and expanded use patterns provide market participants with additional tools for nematode management. Research collaborations with universities and government agencies support fundamental research into nematode biology and sustainable management approaches.

Strategic recommendations for market participants emphasize the importance of balancing innovation investments with market realities and regulatory requirements. Product development priorities should focus on sustainable solutions that address both efficacy requirements and environmental stewardship goals, particularly biological nematicides and reduced-risk chemical alternatives.

Market positioning strategies should emphasize value creation through integrated solutions combining products, services, and technical expertise rather than competing solely on price. Customer education initiatives help growers understand the economic benefits of effective nematode management and proper application techniques for optimal results.

Technology investments in precision agriculture capabilities, digital platforms, and data analytics can differentiate market participants while improving customer outcomes. Partnership opportunities with biotechnology companies, research institutions, and agricultural service providers can accelerate innovation and market expansion.

Regulatory engagement remains critical for maintaining market access and influencing policy development that affects nematicide availability and use patterns. MarkWide Research recommends proactive participation in regulatory processes and industry initiatives that support sustainable nematode management practices.

Long-term projections for the North America nematicide market indicate continued growth driven by persistent nematode challenges and evolving agricultural practices. Market evolution will likely favor sustainable solutions that align with environmental stewardship goals while maintaining effective nematode control capabilities.

Technology advancement will continue to drive market development through improved biological nematicides, precision application systems, and integrated management approaches. Digital agriculture integration will enable more sophisticated treatment decisions and optimized resource utilization across diverse farming operations.

Regulatory trends suggest continued emphasis on environmental safety and reduced-risk products, creating opportunities for companies investing in sustainable nematicide technologies. Market consolidation may continue as companies seek to achieve economies of scale and expand technological capabilities through strategic acquisitions.

Climate change impacts will likely influence nematode distribution patterns and pressure levels, potentially expanding markets for nematicide applications while creating new challenges for product development and application strategies. Growth projections indicate sustained market expansion at approximately 4.8% CAGR over the next decade, reflecting the essential role of nematode management in maintaining agricultural productivity.

Market assessment of the North America nematicide sector reveals a dynamic industry positioned for continued growth despite regulatory and environmental challenges. Innovation drivers including sustainability demands, precision agriculture adoption, and evolving nematode pressure patterns create opportunities for companies developing next-generation nematicide solutions.

Success factors in this market include technological innovation capabilities, regulatory expertise, comprehensive distribution networks, and strong customer relationships built on technical support and proven results. Market participants must balance the need for effective nematode control with environmental stewardship requirements and changing grower preferences.

Future competitiveness will depend on the ability to develop and commercialize sustainable nematicide technologies that meet both efficacy and environmental requirements. Strategic positioning should emphasize integrated solutions that combine products, services, and digital technologies to deliver superior value to agricultural customers. The North America nematicide market represents a critical component of agricultural productivity, requiring continued innovation and investment to address evolving challenges while supporting sustainable crop production systems.

What is Nematicide?

Nematicides are chemical agents used to control nematodes, which are microscopic roundworms that can cause significant damage to crops. They are commonly used in agriculture to protect various plants, including vegetables and fruits, from nematode infestations.

What are the key players in the North America Nematicide Market?

Key players in the North America Nematicide Market include Corteva Agriscience, BASF, Syngenta, and FMC Corporation, among others. These companies are involved in the development and distribution of nematicides to enhance crop yield and protect against nematode damage.

What are the growth factors driving the North America Nematicide Market?

The North America Nematicide Market is driven by the increasing demand for high agricultural productivity and the rising prevalence of nematode-related crop diseases. Additionally, advancements in nematicide formulations and the growing trend of sustainable agriculture contribute to market growth.

What challenges does the North America Nematicide Market face?

The North America Nematicide Market faces challenges such as regulatory restrictions on chemical usage and the development of nematode resistance to certain products. These factors can hinder the effectiveness of nematicides and impact their adoption among farmers.

What opportunities exist in the North America Nematicide Market?

Opportunities in the North America Nematicide Market include the development of biopesticides and integrated pest management solutions. As farmers seek more environmentally friendly options, innovative nematicide products that align with sustainable practices are likely to gain traction.

What trends are shaping the North America Nematicide Market?

Trends in the North America Nematicide Market include the increasing use of precision agriculture technologies and the focus on reducing chemical residues in food production. Additionally, there is a growing interest in organic nematicides as consumers demand safer agricultural practices.

North America Nematicide Market

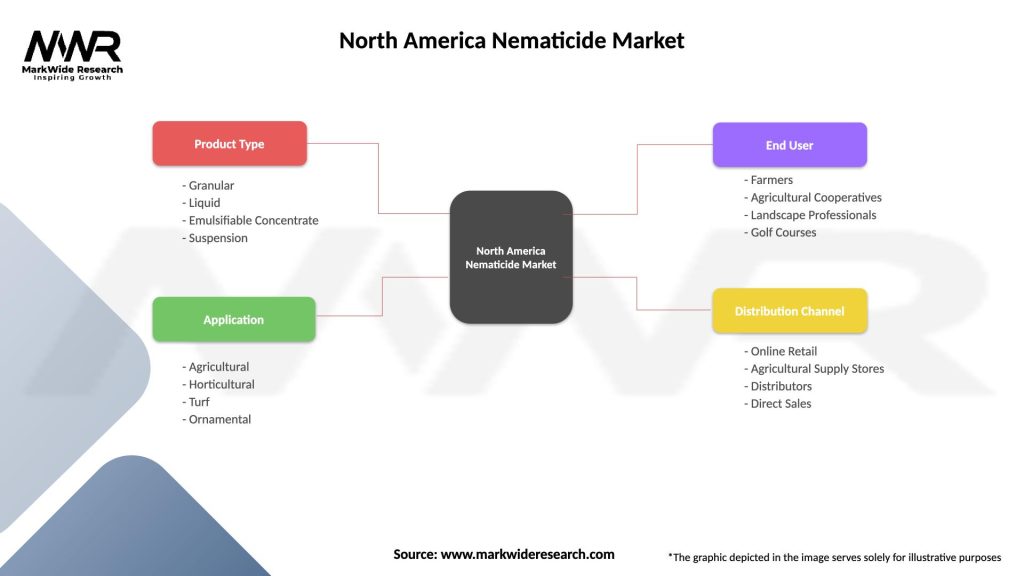

| Segmentation Details | Description |

|---|---|

| Product Type | Granular, Liquid, Emulsifiable Concentrate, Suspension |

| Application | Agricultural, Horticultural, Turf, Ornamental |

| End User | Farmers, Agricultural Cooperatives, Landscape Professionals, Golf Courses |

| Distribution Channel | Online Retail, Agricultural Supply Stores, Distributors, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Nematicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at