444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America metal turned precision product manufacturing market represents a critical segment of the region’s industrial manufacturing landscape, encompassing the production of high-precision metal components through advanced turning processes. This specialized sector serves diverse industries including aerospace, automotive, medical devices, electronics, and defense, providing essential components that require exceptional dimensional accuracy and surface finish quality.

Market dynamics indicate robust growth driven by increasing demand for precision-engineered components across multiple end-use industries. The region’s manufacturing capabilities have evolved significantly, with companies investing heavily in advanced CNC turning equipment, multi-axis machining centers, and automated production systems to meet stringent quality requirements and delivery timelines.

Technological advancement continues to reshape the competitive landscape, with manufacturers adopting Industry 4.0 principles, IoT-enabled machinery, and advanced quality control systems. The market demonstrates strong growth potential, with industry analysts projecting a compound annual growth rate (CAGR) of 6.2% through the forecast period, driven by expanding applications in emerging technologies and increasing precision requirements.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 15%, and Mexico contributing 7% to the overall North American market. This distribution reflects the concentration of advanced manufacturing capabilities, skilled workforce availability, and proximity to major end-use industries across these markets.

The North America metal turned precision product manufacturing market refers to the specialized industrial sector focused on producing high-precision metal components through turning operations, utilizing advanced machining technologies to create parts with tight tolerances and superior surface finishes for critical applications across aerospace, automotive, medical, and electronics industries.

Precision turning encompasses various manufacturing processes including CNC turning, Swiss-type machining, multi-spindle turning, and automated turning operations. These processes enable manufacturers to produce complex geometries, maintain dimensional accuracy within microns, and achieve consistent quality across high-volume production runs.

Product categories within this market include shafts, pins, bushings, connectors, fasteners, medical implants, aerospace components, automotive parts, and electronic hardware. Each category demands specific material properties, dimensional tolerances, and surface finish requirements that drive technological innovation and manufacturing excellence.

Manufacturing capabilities encompass material expertise across various metals including stainless steel, aluminum, titanium, brass, copper, and exotic alloys. Advanced manufacturers maintain comprehensive quality management systems, certifications for critical industries, and capabilities for both prototype development and high-volume production.

Market leadership in North America’s metal turned precision product manufacturing sector is characterized by a combination of established manufacturers with decades of experience and innovative companies leveraging cutting-edge technologies. The competitive landscape features both large-scale operations serving major OEMs and specialized shops focusing on niche applications requiring exceptional precision.

Growth drivers include increasing demand for miniaturized components in electronics, expanding medical device applications requiring biocompatible materials, aerospace industry growth demanding lightweight yet strong components, and automotive sector evolution toward electric vehicles requiring specialized precision parts. These factors collectively contribute to sustained market expansion.

Technological integration has become a key differentiator, with leading manufacturers implementing advanced automation, real-time quality monitoring, and predictive maintenance systems. Industry data indicates that automated production lines can achieve 35% higher efficiency compared to traditional manual operations while maintaining superior quality consistency.

Supply chain considerations have gained prominence following recent global disruptions, with manufacturers focusing on supply chain resilience, local sourcing strategies, and inventory optimization. The market demonstrates strong fundamentals with diverse end-use applications providing stability against sector-specific downturns.

Industry transformation is evident through the adoption of advanced manufacturing technologies and quality management systems. Key insights reveal several critical trends shaping market development:

Market segmentation reveals diverse applications with medical devices representing the fastest-growing segment, driven by aging demographics and advancing healthcare technologies. The aerospace segment maintains strong demand for lightweight, high-strength components supporting both commercial and defense applications.

Primary growth drivers propelling the North America metal turned precision product manufacturing market include several interconnected factors that create sustained demand across multiple industry sectors.

Aerospace industry expansion continues driving demand for precision-turned components, with both commercial aviation recovery and defense spending supporting market growth. The sector requires components meeting stringent quality standards, often involving exotic materials and complex geometries that command premium pricing.

Medical device innovation represents a significant growth catalyst, with advancing surgical techniques, implantable devices, and diagnostic equipment requiring increasingly sophisticated precision components. The aging population demographic creates sustained demand for medical applications, with manufacturers achieving gross margins of 25-35% on specialized medical components.

Automotive sector evolution toward electric vehicles and advanced driver assistance systems generates new opportunities for precision component manufacturers. Electric vehicle powertrains require specialized components with different specifications than traditional internal combustion engines, creating market expansion opportunities.

Electronics miniaturization trends drive demand for smaller, more precise components in consumer electronics, telecommunications equipment, and computing devices. The proliferation of IoT devices and 5G infrastructure creates additional demand for precision-manufactured electronic hardware components.

Reshoring initiatives supported by government policies and supply chain risk mitigation strategies encourage domestic manufacturing investment, benefiting North American precision manufacturers through increased local sourcing preferences.

Significant challenges facing the North America metal turned precision product manufacturing market include both structural and cyclical factors that can impact growth trajectories and profitability.

Skilled labor shortage represents the most critical constraint, with experienced machinists and CNC programmers in high demand across the manufacturing sector. Industry surveys indicate that 68% of manufacturers report difficulty finding qualified technical personnel, leading to increased labor costs and production capacity limitations.

Capital intensity requirements for advanced CNC equipment, quality control systems, and automation technologies create barriers for smaller manufacturers seeking to compete in high-precision segments. The rapid pace of technological advancement can render equipment obsolete, requiring continuous capital investment to maintain competitiveness.

Raw material price volatility affects profitability, particularly for manufacturers working with specialized alloys and exotic materials required for aerospace and medical applications. Price fluctuations in steel, aluminum, and specialty metals can significantly impact project economics and long-term contract viability.

Regulatory compliance costs continue increasing, particularly for manufacturers serving aerospace, medical, and defense markets. Maintaining certifications such as AS9100, ISO 13485, and ITAR compliance requires substantial administrative overhead and quality system investments.

International competition from lower-cost manufacturing regions creates pricing pressure, particularly for commodity-type precision components where labor costs represent a significant portion of total manufacturing costs.

Emerging opportunities within the North America metal turned precision product manufacturing market present significant potential for growth-oriented manufacturers willing to invest in new technologies and market segments.

Advanced manufacturing technologies including additive manufacturing integration, hybrid machining processes, and artificial intelligence-driven quality control systems offer competitive advantages and new service capabilities. Early adopters of these technologies can capture premium pricing and expand their addressable market.

Sustainable manufacturing practices create opportunities for differentiation and cost reduction through energy-efficient equipment, waste minimization programs, and recycling initiatives. Environmental considerations increasingly influence customer sourcing decisions, particularly among large OEMs with sustainability commitments.

Nearshoring trends driven by supply chain resilience concerns create opportunities for North American manufacturers to capture business previously sourced from overseas suppliers. Companies positioned to offer competitive pricing while maintaining superior quality and delivery performance can benefit significantly from this trend.

Emerging applications in renewable energy, space exploration, and advanced medical technologies present new market segments with specialized requirements and premium pricing potential. The space industry alone is projected to grow at 8.4% CAGR, creating demand for precision components meeting space-grade specifications.

Digital service offerings including design optimization, rapid prototyping, and supply chain management services allow manufacturers to expand their value proposition beyond traditional machining services, creating additional revenue streams and stronger customer relationships.

Complex market dynamics shape the competitive landscape and growth trajectory of the North America metal turned precision product manufacturing market, influenced by technological advancement, customer requirements, and economic factors.

Supply and demand balance varies significantly across different market segments, with high-precision medical and aerospace applications experiencing strong demand growth while commodity segments face pricing pressure from international competition. This dynamic encourages manufacturers to focus on higher-value applications requiring specialized capabilities.

Technology adoption cycles create both opportunities and challenges as manufacturers must balance investment in new equipment with maintaining existing production capabilities. The transition to Industry 4.0 technologies requires substantial capital investment but offers significant productivity improvements, with advanced manufacturers reporting 20-30% efficiency gains from automation implementation.

Customer relationship evolution toward strategic partnerships rather than transactional purchasing creates opportunities for manufacturers to provide value-added services including design collaboration, supply chain management, and quality assurance programs. These relationships often result in long-term contracts and more predictable revenue streams.

Competitive differentiation increasingly relies on capabilities beyond basic machining, including rapid response times, quality certifications, specialized material expertise, and value-added services. Manufacturers investing in these differentiators can command premium pricing and build sustainable competitive advantages.

Economic sensitivity varies across end-use markets, with medical and defense applications providing more stability during economic downturns while automotive and general industrial applications experience greater cyclical volatility.

Comprehensive research methodology employed for analyzing the North America metal turned precision product manufacturing market incorporates multiple data sources and analytical approaches to ensure accuracy and completeness of market insights.

Primary research activities include extensive interviews with industry executives, manufacturing engineers, quality managers, and procurement professionals across various end-use industries. These interviews provide insights into market trends, technology adoption patterns, supplier selection criteria, and future requirements that drive market development.

Secondary research sources encompass industry publications, trade association reports, government statistics, company financial reports, and patent databases. This information provides quantitative market data, competitive intelligence, and technological trend analysis supporting primary research findings.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market forecasts and identify growth opportunities. The methodology incorporates economic indicators, industry capacity utilization rates, and end-use market demand patterns to create robust market projections.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research accuracy and reliability. MarkWide Research employs rigorous quality control procedures to maintain high standards for market intelligence and strategic insights.

Analytical frameworks incorporate Porter’s Five Forces analysis, SWOT assessment, and value chain analysis to provide comprehensive understanding of market dynamics, competitive positioning, and strategic opportunities within the precision manufacturing sector.

Regional market distribution across North America reflects the concentration of manufacturing capabilities, end-use industries, and technological expertise that drive demand for precision-turned metal products.

United States market dominance stems from the presence of major aerospace manufacturers, medical device companies, and automotive OEMs requiring precision components. Key manufacturing clusters in the Midwest, Southeast, and West Coast regions provide proximity to customers and access to skilled labor pools. The U.S. market benefits from strong defense spending, advanced healthcare infrastructure, and technology innovation centers.

Canadian market characteristics include strength in aerospace, mining equipment, and energy sector applications. The country’s precision manufacturing capabilities serve both domestic demand and export markets, with particular expertise in cold-weather applications and resource extraction equipment. Canadian manufacturers benefit from competitive currency exchange rates and trade agreements facilitating market access.

Mexican market growth is driven by automotive manufacturing expansion, electronics assembly operations, and aerospace component production. The region offers competitive labor costs while maintaining quality standards, making it attractive for high-volume precision component production. Mexico’s strategic location provides access to both North American and Latin American markets.

Cross-border trade patterns show significant integration among North American markets, with manufacturers leveraging regional advantages including specialized capabilities, cost structures, and proximity to end-use customers. Trade agreements facilitate this integration while maintaining quality and delivery standards.

Regional specialization trends emerge based on local industry concentrations, with certain areas developing expertise in specific applications such as medical devices, aerospace components, or automotive parts, creating centers of excellence that serve continental markets.

Competitive dynamics within the North America metal turned precision product manufacturing market feature a diverse mix of companies ranging from large integrated manufacturers to specialized precision machining shops serving niche applications.

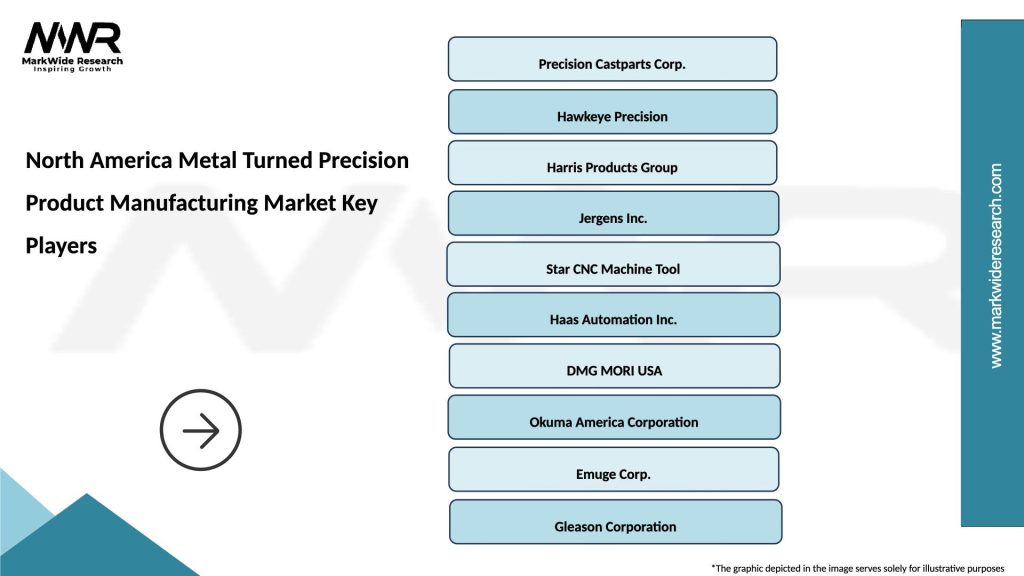

Market leaders include established companies with comprehensive capabilities, advanced equipment, and strong customer relationships across multiple industries:

Competitive strategies focus on technological differentiation, quality excellence, customer service, and specialized capabilities that create barriers to entry and sustainable competitive advantages. Leading companies invest heavily in advanced equipment, workforce development, and quality systems to maintain market position.

Market consolidation trends show larger companies acquiring specialized manufacturers to expand capabilities, geographic reach, or customer access. This consolidation creates opportunities for remaining independent companies to serve niche markets requiring specialized expertise or rapid response capabilities.

Innovation leadership emerges from companies investing in advanced manufacturing technologies, quality systems, and process optimization. These investments enable superior performance in precision, delivery, and cost-effectiveness that drive customer preference and market share growth.

Market segmentation analysis reveals distinct categories based on application, material type, precision level, and end-use industry, each with unique characteristics and growth dynamics.

By Application:

By Material Type:

By Precision Level:

Aerospace category represents the highest-value segment, with components requiring exceptional precision, material traceability, and comprehensive quality documentation. This segment commands premium pricing due to stringent certification requirements and critical application nature. Growth drivers include commercial aviation recovery, defense modernization programs, and space exploration initiatives.

Medical device category demonstrates the strongest growth trajectory, driven by aging demographics, advancing surgical techniques, and increasing demand for minimally invasive procedures. Manufacturers in this segment must maintain ISO 13485 certification and demonstrate biocompatibility for implantable components. The segment offers gross margins of 30-40% for specialized applications.

Automotive category faces transformation due to electric vehicle adoption and advanced driver assistance systems. Traditional engine components experience declining demand while electric powertrain components and sensor housings create new opportunities. This segment emphasizes cost competitiveness and high-volume production capabilities.

Electronics category benefits from 5G infrastructure deployment, IoT device proliferation, and consumer electronics innovation. Miniaturization trends require increasingly precise manufacturing capabilities while volume requirements drive automation investment. The segment shows strong growth potential with projected annual growth of 7.1%.

Industrial equipment category provides stability through diverse applications across manufacturing, energy, and infrastructure sectors. This segment values reliability, cost-effectiveness, and technical support, with opportunities in automation equipment and renewable energy applications.

Manufacturers participating in the North America metal turned precision product manufacturing market benefit from diverse opportunities for growth and profitability through strategic positioning and capability development.

Revenue diversification across multiple end-use industries provides stability against sector-specific downturns while enabling manufacturers to leverage specialized expertise across applications. Companies serving aerospace, medical, and automotive markets can balance cyclical variations and optimize capacity utilization.

Technology investment returns from advanced CNC equipment, automation systems, and quality control technologies deliver measurable improvements in productivity, quality, and cost competitiveness. Leading manufacturers report return on investment of 15-25% from comprehensive automation implementations.

Customer relationships in precision manufacturing often evolve into strategic partnerships involving design collaboration, supply chain integration, and long-term contracts. These relationships provide revenue predictability and opportunities for value-added services beyond basic machining.

Skilled workforce development creates competitive advantages through enhanced capabilities, quality improvement, and innovation potential. Companies investing in training and certification programs build sustainable competitive advantages while addressing industry labor shortages.

Supply chain stakeholders including material suppliers, tooling companies, and equipment manufacturers benefit from market growth through increased demand for specialized products and services supporting precision manufacturing operations.

End-use customers gain access to advanced manufacturing capabilities, quality assurance, and technical expertise that enable product innovation and competitive advantage in their respective markets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation acceleration represents the most significant trend transforming the precision manufacturing landscape, with companies implementing comprehensive automation strategies encompassing material handling, machining operations, quality inspection, and inventory management. Advanced manufacturers achieve productivity improvements of 25-35% through integrated automation systems.

Digital manufacturing integration includes IoT sensors, real-time monitoring systems, predictive maintenance algorithms, and data analytics platforms that optimize production efficiency and quality control. These technologies enable manufacturers to achieve consistent quality while reducing waste and downtime.

Sustainability initiatives gain prominence as manufacturers implement energy-efficient equipment, waste reduction programs, and environmentally friendly machining processes. Customer sustainability requirements increasingly influence supplier selection decisions, creating competitive advantages for environmentally conscious manufacturers.

Additive manufacturing integration creates hybrid production capabilities combining traditional turning operations with 3D printing for complex geometries, rapid prototyping, and low-volume specialized components. This integration expands addressable markets and service capabilities.

Supply chain localization trends driven by risk mitigation concerns encourage regional sourcing strategies and domestic manufacturing investment. MarkWide Research analysis indicates that 42% of manufacturers are actively pursuing supply chain localization initiatives to reduce dependency on distant suppliers.

Workforce development programs address skilled labor shortages through partnerships with technical schools, apprenticeship programs, and advanced training initiatives. Companies investing in workforce development gain competitive advantages in talent acquisition and retention.

Recent industry developments demonstrate the dynamic nature of the North America metal turned precision product manufacturing market, with companies pursuing growth strategies, technology investments, and market expansion initiatives.

Merger and acquisition activity continues as larger companies seek to expand capabilities, geographic reach, and customer access through strategic acquisitions. These transactions often focus on specialized manufacturers with unique capabilities or strong positions in growing market segments.

Technology partnerships between manufacturers and equipment suppliers accelerate the adoption of advanced manufacturing technologies, quality control systems, and automation solutions. These partnerships often include training programs, technical support, and collaborative development initiatives.

Facility expansions and new manufacturing investments reflect confidence in market growth prospects, with companies adding capacity in strategic locations to serve growing demand and improve customer proximity. Recent investments emphasize automation, energy efficiency, and advanced quality control capabilities.

Certification achievements including AS9100 aerospace quality standards, ISO 13485 medical device requirements, and ITAR defense compliance enable manufacturers to serve critical applications and command premium pricing for specialized capabilities.

Research and development initiatives focus on advanced materials processing, precision improvement techniques, and sustainable manufacturing processes that create competitive advantages and expand addressable markets.

Strategic recommendations for manufacturers seeking to capitalize on market opportunities include focused investments in technology, workforce development, and customer relationship enhancement.

Technology investment priorities should emphasize automation systems that improve productivity and quality consistency while reducing labor dependency. Companies should evaluate comprehensive automation solutions rather than piecemeal equipment upgrades to maximize return on investment and operational efficiency.

Market positioning strategies should focus on specialized capabilities and value-added services that create competitive differentiation and customer loyalty. Manufacturers should avoid competing solely on price in commodity segments and instead develop expertise in high-value applications requiring specialized knowledge and capabilities.

Workforce development initiatives represent critical investments for long-term competitiveness, with companies needing to establish training programs, apprenticeships, and retention strategies to address skilled labor shortages. Partnerships with technical schools and community colleges can provide sustainable talent pipelines.

Customer relationship enhancement through design collaboration, supply chain integration, and quality assurance programs creates sustainable competitive advantages and revenue predictability. Companies should invest in customer-facing capabilities that demonstrate value beyond basic manufacturing services.

Sustainability implementation should encompass energy efficiency, waste reduction, and environmental compliance initiatives that meet customer requirements while reducing operational costs. Early adoption of sustainable practices creates competitive advantages as environmental considerations become increasingly important in supplier selection.

Long-term market prospects for the North America metal turned precision product manufacturing market remain positive, supported by diverse growth drivers, technological advancement, and evolving customer requirements across multiple end-use industries.

Growth trajectory projections indicate sustained expansion driven by aerospace industry recovery, medical device innovation, automotive sector transformation, and emerging applications in space exploration and renewable energy. MWR forecasts suggest the market will maintain robust growth momentum with expanding opportunities in high-value applications.

Technology evolution will continue reshaping competitive dynamics, with advanced automation, artificial intelligence, and digital manufacturing technologies becoming standard capabilities rather than competitive differentiators. Companies must continuously invest in technology advancement to maintain market position.

Market consolidation trends are expected to continue as larger companies acquire specialized manufacturers to expand capabilities and market reach. This consolidation creates opportunities for remaining independent companies to serve niche markets requiring specialized expertise or rapid response capabilities.

Sustainability requirements will become increasingly important in customer sourcing decisions, with environmental performance becoming a key competitive factor alongside quality, delivery, and cost considerations. Manufacturers implementing comprehensive sustainability programs will gain competitive advantages.

Workforce challenges will persist, requiring continued investment in training, automation, and retention strategies. Companies successfully addressing these challenges will capture market share from competitors unable to maintain adequate production capabilities.

The North America metal turned precision product manufacturing market presents significant opportunities for growth and profitability through strategic positioning, technology investment, and customer relationship development. Market fundamentals remain strong with diverse end-use applications providing stability and growth potential across economic cycles.

Competitive success requires comprehensive strategies encompassing advanced manufacturing capabilities, quality excellence, customer service, and specialized expertise that create sustainable competitive advantages. Companies investing in automation, workforce development, and customer partnerships will capture disproportionate market share and profitability.

Future market leadership will belong to manufacturers successfully balancing technology investment, operational efficiency, and customer value creation while maintaining the flexibility to adapt to evolving market requirements and emerging opportunities. The precision manufacturing sector’s critical role in enabling innovation across aerospace, medical, automotive, and electronics industries ensures continued relevance and growth potential for well-positioned market participants.

What is Metal Turned Precision Product Manufacturing?

Metal Turned Precision Product Manufacturing refers to the process of creating high-precision components from metal materials using turning techniques. This manufacturing method is widely used in industries such as automotive, aerospace, and medical devices for producing intricate parts with tight tolerances.

What are the key players in the North America Metal Turned Precision Product Manufacturing Market?

Key players in the North America Metal Turned Precision Product Manufacturing Market include companies like Precision Castparts Corp., Swagelok Company, and Parker Hannifin Corporation, among others. These companies are known for their advanced manufacturing capabilities and extensive product offerings.

What are the growth factors driving the North America Metal Turned Precision Product Manufacturing Market?

The growth of the North America Metal Turned Precision Product Manufacturing Market is driven by the increasing demand for lightweight and high-strength components in industries such as aerospace and automotive. Additionally, advancements in manufacturing technologies and automation are enhancing production efficiency.

What challenges does the North America Metal Turned Precision Product Manufacturing Market face?

Challenges in the North America Metal Turned Precision Product Manufacturing Market include the high cost of raw materials and the need for skilled labor to operate advanced machinery. Furthermore, fluctuations in demand from key industries can impact production stability.

What opportunities exist in the North America Metal Turned Precision Product Manufacturing Market?

Opportunities in the North America Metal Turned Precision Product Manufacturing Market include the growing trend towards automation and smart manufacturing. Additionally, the rise of electric vehicles is creating demand for precision components, opening new avenues for manufacturers.

What trends are shaping the North America Metal Turned Precision Product Manufacturing Market?

Trends in the North America Metal Turned Precision Product Manufacturing Market include the adoption of additive manufacturing techniques and the integration of Industry Four-point-zero technologies. These innovations are aimed at improving production efficiency and reducing waste.

North America Metal Turned Precision Product Manufacturing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Machined Components, Fasteners, Bushings, Gears |

| Material | Aluminum, Stainless Steel, Brass, Titanium |

| End User | Aerospace, Defense, Electronics, Medical Devices |

| Technology | CNC Machining, Turning, Milling, Grinding |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Metal Turned Precision Product Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at