444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America medium-density fiberboard (MDF) market has been witnessing steady growth in recent years. MDF is a popular engineered wood product widely used in various applications due to its versatility and cost-effectiveness. It is made by breaking down hardwood or softwood residuals into wood fibers, which are then combined with resin and formed into panels under high temperature and pressure.

Meaning

Medium-density fiberboard (MDF) is an engineered wood product that is made by breaking down hardwood or softwood residuals into wood fibers, which are then combined with resin and formed into panels under high temperature and pressure. MDF offers several advantages over traditional wood, such as uniform density, consistent strength, and dimensional stability.

Executive Summary

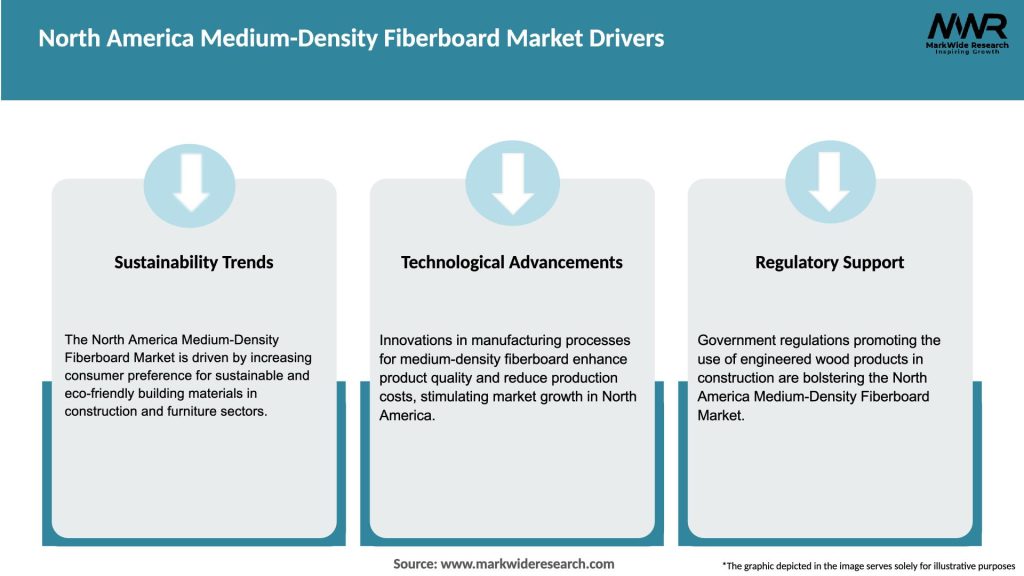

The North America medium-density fiberboard (MDF) market has been experiencing steady growth in recent years. The market is primarily driven by the increasing demand from the construction and furniture industries, as well as the growing preference for eco-friendly and sustainable building materials. However, the market also faces challenges in the form of volatile raw material prices and competition from substitute products.

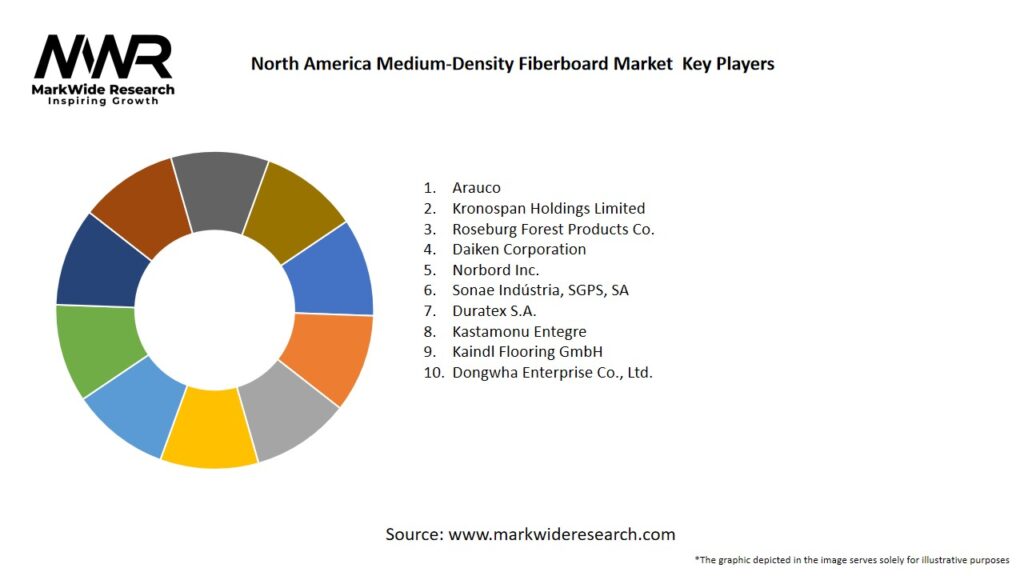

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America MDF market is characterized by intense competition among key players. The market players are focusing on product innovations, expanding their production capacities, and adopting strategic initiatives such as mergers and acquisitions to strengthen their market presence. Additionally, partnerships with distributors and retailers are helping companies reach a wider customer base and enhance their product visibility.

The dynamics of the North America Medium-Density Fiberboard (MDF) Market are influenced by several key factors:

Regional Analysis

The North America Medium-Density Fiberboard Market exhibits varied trends across different regions:

Competitive Landscape

Leading Companies in the North America Medium-Density Fiberboard (MDF) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

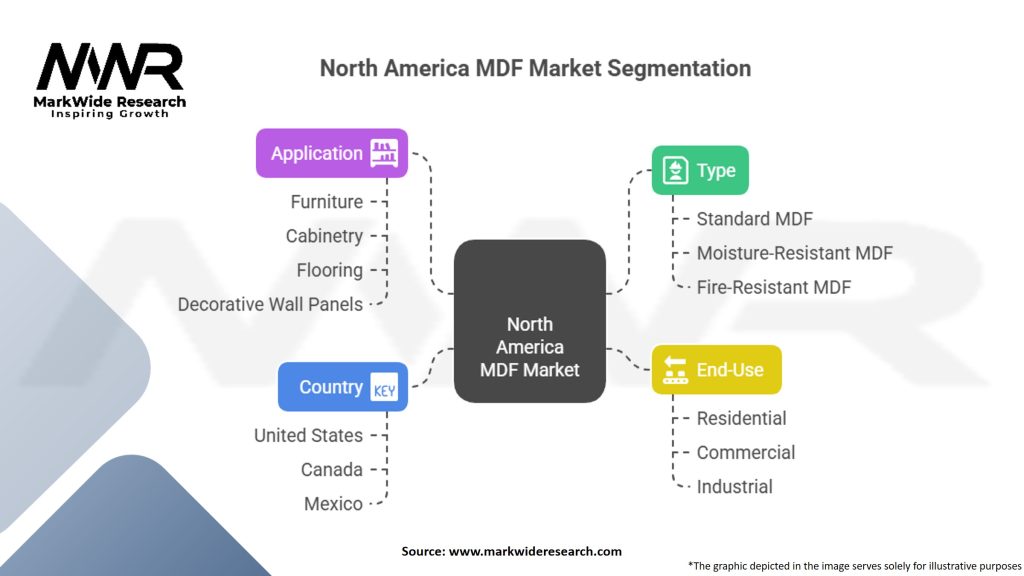

Segmentation

The North America Medium-Density Fiberboard Market can be segmented based on various criteria for deeper insights:

Segmenting the market based on these factors helps in understanding the demand patterns, identifying growth opportunities, and catering to specific customer requirements.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the North America MDF market. The construction and furniture industries, major consumers of MDF, experienced disruptions due to lockdowns, supply chain challenges, and reduced consumer spending. The temporary closure of construction sites and furniture stores led to a decline in demand for MDF during the initial phases of the pandemic.

However, as the economies gradually reopened and construction activities resumed, the demand for MDF started recovering. The focus on home renovations and interior refurbishments during the lockdown period contributed to the market’s rebound. The growing preference for home offices and remote working setups also drove the demand for MDF-based furniture.

While the market faced challenges during the pandemic, it also created opportunities for industry players to adapt to changing customer needs, invest in online sales channels, and develop innovative products suited for the post-pandemic lifestyle.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America medium-density fiberboard (MDF) market is expected to witness steady growth in the coming years. The increasing demand from the construction and furniture industries, coupled with the growing focus on sustainability, will drive the market’s expansion. Technological advancements, such as improved resin formulations and enhanced pressing techniques, will lead to the development of superior-quality MDF products with enhanced properties.

The market is expected to witness increased customization options, design flexibility, and a shift towards online sales channels. Emerging applications in packaging, automotive, and DIY projects will further contribute to market growth. However, the market will continue to face challenges in the form of volatile raw material prices and competition from substitute products.

Conclusion

The North America MDF market presents significant opportunities for industry participants and stakeholders. By embracing sustainability, investing in innovation, and strengthening distribution channels, companies can position themselves for future success in this dynamic market.

What is medium-density fiberboard in the context of the North America Medium-Density Fiberboard Market?

Medium-density fiberboard (MDF) is an engineered wood product made from wood fibers, wax, and resin, which are compressed under heat and pressure. It is widely used in furniture, cabinetry, and decorative applications due to its smooth surface and versatility.

Who are the key players in the North America Medium-Density Fiberboard Market?

Key players in the North America Medium-Density Fiberboard Market include companies like Georgia-Pacific, Arauco, and Norbord, which are known for their significant contributions to MDF production and innovation, among others.

What are the growth factors driving the North America Medium-Density Fiberboard Market?

The growth of the North America Medium-Density Fiberboard Market is driven by increasing demand for sustainable building materials, the rise in home renovation activities, and the growing furniture industry that favors MDF for its cost-effectiveness and ease of use.

What challenges does the North America Medium-Density Fiberboard Market face?

Challenges in the North America Medium-Density Fiberboard Market include competition from alternative materials like particleboard and plywood, as well as environmental concerns related to formaldehyde emissions from MDF production.

What opportunities exist in the North America Medium-Density Fiberboard Market?

Opportunities in the North America Medium-Density Fiberboard Market include the increasing trend towards eco-friendly products, advancements in manufacturing technologies, and the expansion of the construction sector that requires high-quality MDF for various applications.

What trends are shaping the North America Medium-Density Fiberboard Market?

Trends in the North America Medium-Density Fiberboard Market include a shift towards lightweight and high-density MDF products, the integration of smart technologies in manufacturing processes, and a growing emphasis on sustainable sourcing and production practices.

North America Medium-Density Fiberboard (MDF) Market:

| Segmentation | Details |

|---|---|

| Type | Standard MDF, Moisture-Resistant MDF, Fire-Resistant MDF, Others |

| Application | Furniture, Cabinetry, Flooring, Decorative Wall Panels, Others |

| End-Use | Residential, Commercial, Industrial, Others |

| Country | United States, Canada, Mexico |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Medium-Density Fiberboard (MDF) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at