444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America Laboratory Information System market represents a dynamic and rapidly evolving sector within the healthcare technology landscape. This comprehensive market encompasses sophisticated software solutions designed to manage laboratory operations, streamline workflows, and enhance data management capabilities across clinical, research, and diagnostic laboratories. Laboratory Information Systems (LIS) serve as the technological backbone for modern laboratory operations, facilitating seamless integration of laboratory processes with broader healthcare information systems.

Market dynamics in North America indicate robust growth driven by increasing demand for automated laboratory processes, regulatory compliance requirements, and the growing emphasis on data-driven healthcare decisions. The region’s advanced healthcare infrastructure, coupled with significant investments in digital health technologies, positions North America as a leading market for laboratory information system adoption. Healthcare facilities across the United States and Canada are increasingly recognizing the critical importance of implementing comprehensive LIS solutions to improve operational efficiency and patient care outcomes.

Growth trajectories within the market demonstrate strong momentum, with adoption rates accelerating at approximately 8.2% annually across various laboratory settings. This expansion reflects the increasing digitization of healthcare operations and the growing need for integrated laboratory management solutions. Healthcare providers are investing heavily in advanced LIS technologies to meet evolving regulatory requirements, improve laboratory productivity, and enhance data accuracy and accessibility.

The North America Laboratory Information System market refers to the comprehensive ecosystem of software solutions, technologies, and services designed to manage, track, and optimize laboratory operations across healthcare facilities, research institutions, and diagnostic centers throughout the United States and Canada. These sophisticated systems encompass a wide range of functionalities including sample tracking, test ordering, result reporting, quality control, and regulatory compliance management.

Laboratory Information Systems serve as centralized platforms that integrate various laboratory processes, enabling seamless data flow between different departments, instruments, and healthcare information systems. These solutions facilitate efficient management of laboratory workflows, from initial sample collection and processing to final result delivery and archival. Modern LIS platforms incorporate advanced features such as automated instrument interfaces, electronic health record integration, and comprehensive reporting capabilities.

Core functionalities of these systems include specimen management, test catalog maintenance, quality assurance protocols, billing integration, and comprehensive audit trails. The market encompasses various deployment models, including cloud-based solutions, on-premises installations, and hybrid configurations, catering to diverse organizational needs and preferences across the North American healthcare landscape.

Strategic analysis of the North America Laboratory Information System market reveals a highly competitive and innovation-driven landscape characterized by rapid technological advancement and increasing market penetration. The market demonstrates strong growth momentum, supported by favorable regulatory environments, increasing healthcare digitization initiatives, and growing demand for integrated laboratory management solutions across various healthcare settings.

Key market drivers include the increasing volume of laboratory tests, growing emphasis on laboratory automation, regulatory compliance requirements, and the need for improved data management capabilities. Healthcare organizations are increasingly adopting comprehensive LIS solutions to enhance operational efficiency, reduce manual errors, and improve patient care outcomes. Cloud-based deployment models are gaining significant traction, with adoption rates increasing by approximately 12.5% annually as organizations seek scalable and cost-effective solutions.

Competitive dynamics within the market are characterized by the presence of established technology vendors, emerging innovative companies, and specialized solution providers. Market leaders are focusing on developing advanced features such as artificial intelligence integration, mobile accessibility, and enhanced interoperability capabilities to maintain competitive advantages and meet evolving customer requirements.

Market intelligence reveals several critical insights that shape the North America Laboratory Information System landscape. The following key insights provide comprehensive understanding of market dynamics and strategic opportunities:

Primary market drivers propelling the North America Laboratory Information System market forward encompass a diverse range of technological, regulatory, and operational factors. The increasing complexity of laboratory operations, coupled with growing demands for efficiency and accuracy, creates substantial momentum for LIS adoption across healthcare facilities.

Healthcare digitization initiatives represent a fundamental driver, as organizations seek to modernize their laboratory operations and integrate with broader digital health ecosystems. The growing volume of laboratory tests, driven by an aging population and increasing prevalence of chronic diseases, necessitates sophisticated management systems capable of handling complex workflows and large data volumes. Regulatory compliance requirements continue to drive adoption, with healthcare facilities requiring comprehensive audit trails, quality control measures, and standardized reporting capabilities.

Operational efficiency demands create significant pressure for laboratory automation and streamlined processes. Healthcare organizations are increasingly focused on reducing manual errors, improving turnaround times, and optimizing resource utilization. Cost containment pressures within the healthcare industry drive demand for solutions that can demonstrate clear return on investment through improved efficiency and reduced operational costs. The growing emphasis on data-driven healthcare decisions further amplifies the need for comprehensive laboratory data management and analytics capabilities.

Market challenges within the North America Laboratory Information System sector present significant obstacles that organizations must navigate to achieve successful implementation and adoption. These restraints encompass financial, technical, and organizational factors that can impact market growth and adoption rates.

Implementation costs represent a primary constraint, particularly for smaller healthcare facilities and independent laboratories with limited capital resources. The complexity of LIS implementations often requires substantial investments in software licensing, hardware infrastructure, training, and ongoing maintenance. Integration challenges with existing healthcare information systems can create technical barriers and extended implementation timelines, potentially deterring organizations from pursuing comprehensive LIS solutions.

Staff training requirements and change management challenges can create resistance to adoption, particularly in organizations with established workflows and legacy systems. The need for specialized technical expertise to manage and maintain complex LIS implementations can strain organizational resources. Data migration complexities from legacy systems often present significant technical and logistical challenges, requiring careful planning and execution to ensure data integrity and system continuity.

Strategic opportunities within the North America Laboratory Information System market present substantial potential for growth and innovation. These opportunities emerge from evolving healthcare trends, technological advancements, and changing organizational needs across the laboratory management landscape.

Artificial intelligence integration represents a transformative opportunity, enabling advanced analytics, predictive capabilities, and automated decision support within laboratory operations. The growing demand for personalized medicine and precision diagnostics creates opportunities for specialized LIS solutions that can support complex testing protocols and advanced data analysis requirements. Telehealth expansion and remote patient monitoring trends generate new requirements for laboratory systems that can support distributed testing models and remote result delivery.

Cloud-native solutions offer significant opportunities for vendors to develop scalable, cost-effective platforms that can serve diverse market segments. The increasing focus on population health management creates demand for LIS solutions with enhanced data aggregation and analysis capabilities. Interoperability initiatives and industry standardization efforts present opportunities for vendors to develop solutions that facilitate seamless data exchange and integration across healthcare ecosystems.

Market dynamics within the North America Laboratory Information System sector reflect a complex interplay of technological innovation, regulatory evolution, and changing healthcare delivery models. These dynamics create a continuously evolving landscape that shapes vendor strategies, customer requirements, and market opportunities.

Competitive pressures drive continuous innovation and feature enhancement, with vendors investing heavily in research and development to maintain market position and meet evolving customer needs. The increasing importance of user experience and system usability influences product development priorities, with vendors focusing on intuitive interfaces and streamlined workflows. Market consolidation trends through mergers and acquisitions reshape the competitive landscape, creating opportunities for enhanced solution portfolios and expanded market reach.

Customer expectations continue to evolve, with healthcare organizations demanding more sophisticated analytics capabilities, enhanced mobile accessibility, and seamless integration with emerging technologies. The growing emphasis on value-based healthcare models influences purchasing decisions, with organizations seeking solutions that can demonstrate measurable improvements in efficiency and patient outcomes. Regulatory changes and compliance requirements create ongoing adaptation needs, requiring vendors to maintain current and compliant solutions while anticipating future regulatory developments.

Comprehensive research methodology employed in analyzing the North America Laboratory Information System market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights. The research approach combines quantitative analysis with qualitative assessments to provide a holistic understanding of market dynamics and trends.

Primary research activities include extensive interviews with industry executives, healthcare administrators, laboratory managers, and technology vendors to gather firsthand insights into market conditions, challenges, and opportunities. Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and technology publications to validate findings and identify emerging trends. Market modeling techniques utilize statistical analysis and forecasting methodologies to project market growth trajectories and identify key performance indicators.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review panels, and statistical verification methods. The research methodology incorporates regional analysis to account for variations in market conditions, regulatory environments, and adoption patterns across different geographic areas within North America. Continuous monitoring and periodic updates maintain research currency and relevance in the rapidly evolving healthcare technology landscape.

Regional market dynamics across North America demonstrate distinct patterns and characteristics that reflect varying healthcare infrastructure, regulatory environments, and adoption rates. The United States dominates the regional market, accounting for approximately 85% of total market activity, driven by its large healthcare system, advanced technology infrastructure, and significant investment in healthcare digitization initiatives.

United States market characteristics include high adoption rates among large healthcare systems, strong regulatory compliance requirements, and substantial investments in healthcare technology modernization. Major metropolitan areas such as New York, Los Angeles, Chicago, and Houston represent significant market concentrations with high demand for advanced LIS solutions. Canada represents approximately 15% of regional market share, with growing adoption driven by healthcare system modernization initiatives and increasing focus on laboratory efficiency improvements.

State-level variations within the United States reflect differences in healthcare regulations, funding availability, and technology adoption rates. California, Texas, New York, and Florida represent the largest state markets, driven by large healthcare systems and significant laboratory testing volumes. Rural market segments present unique opportunities and challenges, with growing demand for cloud-based solutions that can provide advanced capabilities without requiring extensive on-site technical infrastructure.

Competitive environment within the North America Laboratory Information System market features a diverse ecosystem of established technology vendors, specialized solution providers, and emerging innovative companies. Market leaders maintain strong positions through comprehensive product portfolios, extensive customer bases, and continuous innovation investments.

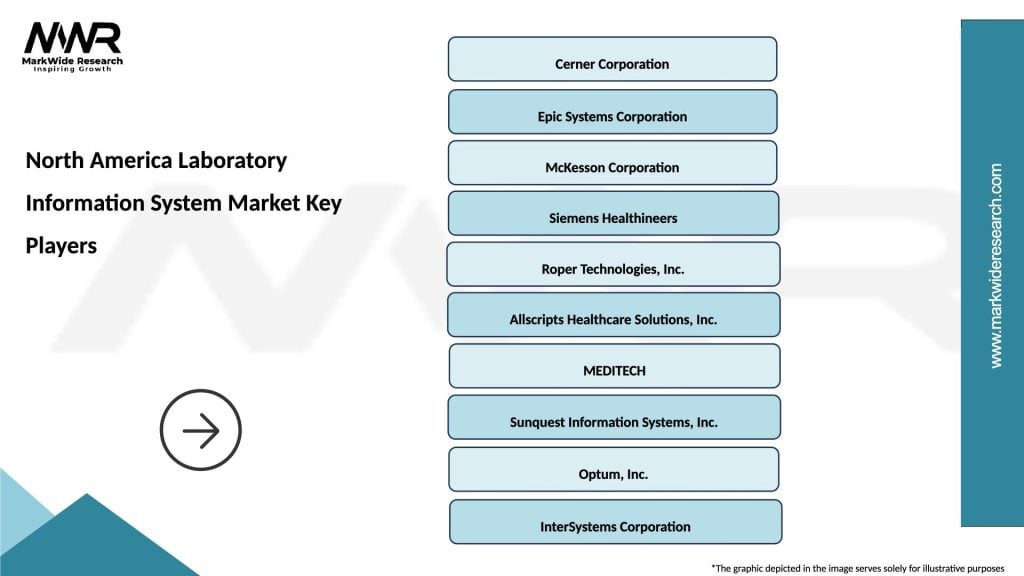

Leading market participants include:

Competitive strategies focus on product innovation, strategic partnerships, customer service excellence, and market expansion initiatives. Vendors are increasingly investing in artificial intelligence capabilities, mobile accessibility, and cloud-native architectures to maintain competitive advantages and meet evolving customer requirements.

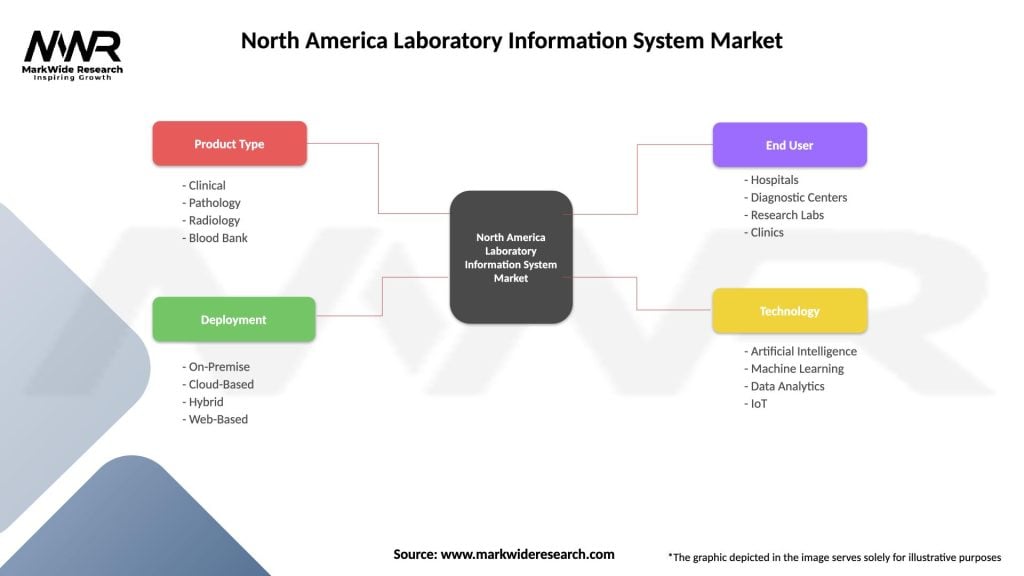

Market segmentation analysis reveals distinct categories and subcategories within the North America Laboratory Information System market, each characterized by specific requirements, growth patterns, and competitive dynamics. Understanding these segments provides valuable insights for strategic planning and market positioning.

By Deployment Model:

By End-User Type:

By Component:

Detailed category analysis provides comprehensive understanding of specific market segments and their unique characteristics, growth drivers, and competitive dynamics within the North America Laboratory Information System market.

Hospital Laboratory Segment represents the largest and most mature market category, characterized by complex integration requirements and comprehensive functionality needs. These implementations typically require extensive customization and integration with existing hospital information systems, electronic health records, and various medical devices. Growth rates in this segment average approximately 6.8% annually, driven by hospital system consolidation and modernization initiatives.

Independent Laboratory Segment demonstrates strong growth momentum, with organizations seeking solutions that can optimize high-volume testing operations and improve operational efficiency. This segment shows particular interest in cloud-based solutions that offer scalability and cost-effectiveness. Automation integration capabilities are critical success factors, with laboratories requiring seamless connectivity to various testing instruments and automated systems.

Cloud-Based Solutions Category exhibits the highest growth rates, with adoption increasing by approximately 14.2% annually as organizations recognize the benefits of reduced infrastructure requirements, enhanced scalability, and improved accessibility. This category particularly appeals to smaller healthcare facilities and organizations with limited IT resources, offering enterprise-level capabilities without substantial capital investments.

Comprehensive benefits derived from Laboratory Information System implementations extend across multiple stakeholder groups, creating value for healthcare organizations, laboratory staff, patients, and technology vendors. These benefits encompass operational improvements, cost reductions, quality enhancements, and strategic advantages.

Healthcare Organizations benefit from:

Laboratory Staff experience:

Patients receive:

Strategic assessment of the North America Laboratory Information System market through comprehensive SWOT analysis reveals key internal and external factors that influence market dynamics and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the North America Laboratory Information System market reflect evolving technology capabilities, changing healthcare delivery models, and shifting organizational priorities. These trends shape market development and influence vendor strategies and customer requirements.

Artificial Intelligence Integration represents a transformative trend, with LIS vendors incorporating machine learning algorithms, predictive analytics, and automated decision support capabilities. These AI-powered features enable advanced pattern recognition, anomaly detection, and intelligent workflow optimization. Implementation rates for AI-enhanced LIS solutions are growing at approximately 18.5% annually as organizations recognize the potential for improved efficiency and accuracy.

Cloud-First Strategies continue gaining momentum, with healthcare organizations increasingly preferring cloud-based deployments for their scalability, cost-effectiveness, and reduced infrastructure requirements. This trend is particularly pronounced among smaller healthcare facilities and organizations seeking rapid implementation capabilities. Mobile accessibility and remote access capabilities are becoming standard requirements, supporting flexible work environments and distributed healthcare delivery models.

Interoperability Focus drives demand for LIS solutions that can seamlessly integrate with diverse healthcare information systems, electronic health records, and medical devices. Industry standards such as HL7 FHIR are becoming increasingly important for ensuring data exchange capabilities and system compatibility. Data analytics and business intelligence features are evolving from basic reporting to sophisticated predictive analytics and population health management capabilities.

Significant industry developments within the North America Laboratory Information System market reflect ongoing innovation, strategic partnerships, and market evolution. These developments shape competitive dynamics and influence future market directions.

Strategic acquisitions and mergers continue reshaping the competitive landscape, with major healthcare technology companies expanding their LIS capabilities through targeted acquisitions of specialized vendors. These consolidation activities create opportunities for enhanced product portfolios and expanded market reach while potentially reducing competitive options for customers. MarkWide Research analysis indicates that merger and acquisition activity has increased by approximately 22% annually over the past three years.

Technology partnerships between LIS vendors and artificial intelligence companies are accelerating the development of advanced analytics capabilities and intelligent automation features. These collaborations enable the integration of cutting-edge AI technologies with established laboratory management platforms. Cloud infrastructure partnerships with major cloud service providers are expanding deployment options and enhancing scalability capabilities for LIS solutions.

Regulatory developments including updated compliance requirements and interoperability mandates are driving product enhancements and feature additions across vendor portfolios. The implementation of new data privacy regulations and cybersecurity standards requires ongoing adaptation and investment in security capabilities. Industry standardization initiatives are promoting greater interoperability and data exchange capabilities across different LIS platforms and healthcare systems.

Strategic recommendations for stakeholders in the North America Laboratory Information System market focus on leveraging emerging opportunities while addressing key challenges and market dynamics. These suggestions provide actionable insights for healthcare organizations, technology vendors, and industry participants.

Healthcare Organizations should prioritize comprehensive needs assessment and strategic planning before LIS implementation, ensuring alignment with organizational goals and existing technology infrastructure. Cloud-based solutions merit serious consideration for their scalability and cost-effectiveness, particularly for smaller facilities with limited IT resources. Organizations should emphasize vendor selection criteria that include strong interoperability capabilities, robust security features, and comprehensive support services.

Technology Vendors should focus on developing AI-enhanced capabilities, mobile accessibility features, and cloud-native architectures to meet evolving customer requirements. Investment in cybersecurity capabilities and compliance features remains critical for maintaining customer confidence and meeting regulatory requirements. Partnership strategies with complementary technology providers can accelerate innovation and expand market opportunities.

Investment considerations should emphasize vendors with strong research and development capabilities, comprehensive product portfolios, and established customer bases. MWR analysis suggests that companies with significant cloud technology investments and AI development capabilities are positioned for above-average growth in the evolving market landscape.

Future market prospects for the North America Laboratory Information System market indicate continued strong growth driven by ongoing healthcare digitization, technological innovation, and evolving laboratory management requirements. The market is positioned for sustained expansion with growth rates projected to maintain momentum at approximately 7.9% annually over the next five years.

Technology evolution will continue driving market development, with artificial intelligence, machine learning, and advanced analytics becoming standard features rather than premium additions. Cloud-based deployments are expected to achieve dominant market share within the next decade, fundamentally changing how LIS solutions are delivered and consumed. Interoperability capabilities will become increasingly critical as healthcare systems seek seamless integration across diverse technology platforms.

Market expansion opportunities include growing demand from specialty laboratories, research institutions, and emerging healthcare delivery models such as telehealth and remote patient monitoring. The increasing focus on personalized medicine and precision diagnostics will create new requirements for sophisticated data management and analysis capabilities. Regulatory evolution and compliance requirements will continue influencing product development priorities and market dynamics.

Competitive landscape changes are expected to include continued consolidation, increased focus on customer experience, and growing importance of comprehensive service offerings. Vendors that successfully integrate emerging technologies while maintaining strong security and compliance capabilities are positioned for market leadership. MarkWide Research projects that the market will experience significant transformation over the next decade, driven by technological advancement and changing healthcare delivery models.

Comprehensive analysis of the North America Laboratory Information System market reveals a dynamic and rapidly evolving sector with substantial growth potential and significant opportunities for stakeholders across the healthcare technology ecosystem. The market demonstrates strong fundamentals driven by ongoing healthcare digitization, regulatory compliance requirements, and increasing demand for operational efficiency improvements.

Key success factors for market participants include embracing cloud technologies, investing in artificial intelligence capabilities, prioritizing interoperability features, and maintaining strong cybersecurity and compliance capabilities. Healthcare organizations benefit from careful vendor selection, comprehensive implementation planning, and ongoing staff training to maximize return on investment and achieve operational improvements.

Market outlook remains positive with sustained growth expected across all major segments, driven by technological innovation, expanding healthcare needs, and evolving laboratory management requirements. The successful integration of emerging technologies such as artificial intelligence and advanced analytics will differentiate market leaders and create new value propositions for customers. Organizations that strategically leverage Laboratory Information System capabilities while addressing implementation challenges are positioned to achieve significant competitive advantages and improved patient care outcomes in the evolving healthcare landscape.

What is Laboratory Information System?

A Laboratory Information System (LIS) is a software solution that manages laboratory operations, including sample tracking, data management, and reporting. It is essential for improving efficiency and accuracy in laboratory workflows.

What are the key players in the North America Laboratory Information System Market?

Key players in the North America Laboratory Information System Market include Cerner Corporation, McKesson Corporation, and LabWare, among others. These companies provide various LIS solutions tailored to different laboratory needs.

What are the main drivers of growth in the North America Laboratory Information System Market?

The main drivers of growth in the North America Laboratory Information System Market include the increasing demand for automation in laboratories, the need for efficient data management, and the rising focus on patient safety and regulatory compliance.

What challenges does the North America Laboratory Information System Market face?

Challenges in the North America Laboratory Information System Market include high implementation costs, integration issues with existing systems, and the need for continuous updates to meet regulatory standards.

What opportunities exist in the North America Laboratory Information System Market?

Opportunities in the North America Laboratory Information System Market include the growing trend of telemedicine, advancements in cloud-based solutions, and the increasing adoption of artificial intelligence for data analysis.

What trends are shaping the North America Laboratory Information System Market?

Trends shaping the North America Laboratory Information System Market include the shift towards integrated healthcare solutions, the rise of mobile applications for laboratory management, and the emphasis on data security and patient privacy.

North America Laboratory Information System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Clinical, Pathology, Radiology, Blood Bank |

| Deployment | On-Premise, Cloud-Based, Hybrid, Web-Based |

| End User | Hospitals, Diagnostic Centers, Research Labs, Clinics |

| Technology | Artificial Intelligence, Machine Learning, Data Analytics, IoT |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Laboratory Information System Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at