444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America lab-on-a-chip device market represents a revolutionary segment within the broader medical technology landscape, experiencing unprecedented growth driven by miniaturization trends and precision diagnostics demands. This sophisticated market encompasses integrated microfluidic systems that combine multiple laboratory functions on a single chip, enabling rapid, cost-effective, and highly accurate diagnostic testing across various healthcare applications.

Market dynamics indicate robust expansion across the region, with the United States leading adoption rates at approximately 68% market share, followed by Canada’s growing implementation in clinical laboratories and point-of-care settings. The technology’s ability to reduce sample volumes, minimize reagent consumption, and deliver faster results has positioned lab-on-a-chip devices as essential tools in modern healthcare infrastructure.

Healthcare transformation initiatives across North America have accelerated the integration of these miniaturized diagnostic platforms, particularly in response to increased demand for personalized medicine and rapid diagnostic capabilities. The market demonstrates strong momentum with projected growth rates of 12.5% CAGR through the forecast period, driven by technological advancements in microfluidics, biosensors, and integrated circuit design.

Regional adoption patterns reveal significant penetration in academic research institutions, clinical laboratories, and pharmaceutical companies, with emerging applications in environmental monitoring and food safety testing expanding the market’s scope beyond traditional healthcare boundaries.

The North America lab-on-a-chip device market refers to the commercial ecosystem encompassing the development, manufacturing, and distribution of integrated microfluidic platforms that miniaturize and automate laboratory processes on semiconductor chips. These sophisticated devices combine sample preparation, reaction, separation, and detection functions within microscale channels and chambers, enabling comprehensive analysis using minimal sample volumes.

Lab-on-a-chip technology represents the convergence of microelectronics, biotechnology, and analytical chemistry, creating portable diagnostic solutions that deliver laboratory-quality results in point-of-care settings. The market includes various device configurations, from simple diagnostic chips for specific biomarker detection to complex multi-parameter analysis platforms capable of performing dozens of simultaneous tests.

Market scope encompasses hardware components including microfluidic chips, detection systems, and supporting instrumentation, alongside software solutions for data analysis and result interpretation. The technology’s applications span clinical diagnostics, drug discovery, environmental monitoring, and food safety testing, representing a comprehensive approach to miniaturized analytical capabilities.

Strategic market positioning reveals the North America lab-on-a-chip device market as a high-growth segment within the broader medical device industry, characterized by rapid technological innovation and expanding application portfolios. The market benefits from strong healthcare infrastructure, substantial research and development investments, and favorable regulatory frameworks supporting medical device innovation.

Key growth drivers include increasing demand for point-of-care diagnostics, rising prevalence of chronic diseases requiring regular monitoring, and growing emphasis on personalized medicine approaches. The COVID-19 pandemic significantly accelerated adoption rates, with diagnostic applications experiencing 35% growth acceleration compared to pre-pandemic projections.

Competitive landscape features a mix of established medical device manufacturers, specialized microfluidics companies, and emerging technology startups, creating a dynamic ecosystem of innovation and market competition. Major players leverage advanced manufacturing capabilities, extensive distribution networks, and strategic partnerships to maintain market leadership positions.

Market challenges include high development costs, complex regulatory approval processes, and technical hurdles related to device standardization and manufacturing scalability. However, ongoing technological advancements and increasing healthcare digitization trends continue to drive market expansion and innovation opportunities.

Market intelligence reveals several critical insights shaping the North America lab-on-a-chip device landscape:

Primary growth catalysts propelling the North America lab-on-a-chip device market include fundamental shifts in healthcare delivery models and technological capabilities. The increasing emphasis on preventive healthcare and early disease detection has created substantial demand for rapid, accurate diagnostic solutions that can be deployed in various clinical settings.

Healthcare cost pressures continue driving adoption of cost-effective diagnostic alternatives, with lab-on-a-chip devices offering significant advantages in terms of reduced reagent consumption, faster turnaround times, and lower operational costs compared to traditional laboratory testing methods. Healthcare providers report 40% reduction in per-test costs when implementing appropriate microfluidic diagnostic platforms.

Technological convergence between microelectronics, biotechnology, and materials science has enabled the development of increasingly sophisticated devices capable of performing complex analytical procedures. Advanced manufacturing techniques, including 3D printing and precision molding, have improved device quality while reducing production costs.

Regulatory support from agencies like the FDA has facilitated market growth through streamlined approval processes for innovative diagnostic devices, particularly those addressing critical healthcare needs. The establishment of breakthrough device designation programs has accelerated the development timeline for promising technologies.

Aging population demographics across North America create sustained demand for diagnostic monitoring solutions, particularly for chronic disease management and routine health screening applications. The growing prevalence of diabetes, cardiovascular disease, and other conditions requiring regular monitoring drives consistent market demand.

Significant barriers continue to challenge market expansion despite strong growth fundamentals. High development costs associated with microfluidic device design, testing, and regulatory approval create substantial financial hurdles for emerging companies and limit the pace of innovation in certain market segments.

Technical complexity in device manufacturing and quality control presents ongoing challenges, particularly for companies seeking to scale production while maintaining consistent performance standards. The precision required in microfluidic channel fabrication and sensor integration demands specialized manufacturing capabilities and expertise.

Regulatory compliance requirements, while supportive of innovation, still represent significant time and cost investments for device developers. The need for extensive clinical validation studies and regulatory documentation can extend development timelines and increase market entry costs.

Market fragmentation across different application areas and technology platforms creates challenges for companies seeking to achieve economies of scale. The diverse requirements of clinical diagnostics, research applications, and industrial testing limit the potential for standardized platform approaches.

Competition from established diagnostic methods and technologies creates market resistance in certain applications where traditional approaches remain cost-effective or technically superior. Healthcare providers’ familiarity with existing testing protocols can slow adoption of new microfluidic solutions.

Emerging opportunities within the North America lab-on-a-chip device market present substantial growth potential across multiple dimensions. The expanding telemedicine and remote patient monitoring sectors create new applications for portable diagnostic devices capable of delivering laboratory-quality results in home healthcare settings.

Personalized medicine initiatives represent a significant opportunity area, with lab-on-a-chip devices uniquely positioned to enable rapid genetic analysis, biomarker profiling, and therapeutic monitoring applications. The growing emphasis on precision medicine approaches creates demand for sophisticated analytical capabilities in clinical settings.

Industrial applications beyond healthcare offer substantial market expansion opportunities, including environmental monitoring, food safety testing, and pharmaceutical quality control. These sectors benefit from the same advantages of miniaturization, cost reduction, and rapid analysis that drive healthcare adoption.

Technology integration opportunities with artificial intelligence, machine learning, and advanced data analytics create potential for enhanced diagnostic capabilities and automated result interpretation. The convergence of microfluidics with digital health technologies opens new market segments and value propositions.

Global market expansion through North American companies leveraging their technological leadership to enter emerging markets presents significant growth opportunities. The established regulatory frameworks and manufacturing capabilities in North America provide competitive advantages for international expansion.

Complex market forces shape the North America lab-on-a-chip device landscape through the interaction of technological innovation, regulatory evolution, and changing healthcare delivery models. The dynamic relationship between device capabilities and clinical needs drives continuous innovation and market adaptation.

Supply chain considerations play an increasingly important role in market dynamics, with companies focusing on securing reliable sources for specialized materials and components required for microfluidic device manufacturing. Recent global supply chain disruptions have highlighted the importance of domestic manufacturing capabilities and supply chain resilience.

Competitive pressures intensify as the market matures, with companies differentiating through technological innovation, application specialization, and strategic partnerships. The balance between innovation investment and market commercialization creates ongoing strategic challenges for market participants.

Healthcare reimbursement policies significantly influence market adoption rates, with favorable coverage decisions accelerating uptake while reimbursement uncertainties can slow market penetration. The evolution of value-based healthcare models creates new opportunities for cost-effective diagnostic solutions.

Technology convergence continues reshaping market boundaries, with traditional distinctions between diagnostic devices, research instruments, and analytical systems becoming increasingly blurred. This convergence creates both opportunities for market expansion and challenges for traditional business models.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research activities include extensive interviews with industry executives, healthcare professionals, and technology developers to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, regulatory filings, patent databases, and academic publications to understand technological developments and market evolution patterns. This approach provides historical context and identifies emerging trends that may impact future market development.

Quantitative analysis utilizes statistical modeling and market sizing techniques to project growth rates, market share distributions, and adoption patterns across different segments and geographic regions. Data validation through multiple sources ensures accuracy and reliability of market projections.

Qualitative assessment focuses on understanding market dynamics, competitive positioning, and strategic factors influencing market development. Expert interviews and industry surveys provide insights into factors that quantitative analysis alone cannot capture.

Technology assessment includes evaluation of patent landscapes, research and development activities, and emerging technological capabilities that may influence future market evolution. This forward-looking analysis helps identify potential disruptions and innovation opportunities.

United States dominance characterizes the North America lab-on-a-chip device market, with the country representing approximately 75% regional market share driven by advanced healthcare infrastructure, substantial research investments, and favorable regulatory environment. Major technology hubs including Boston, San Francisco, and Research Triangle Park serve as centers of innovation and commercialization activity.

California leadership in biotechnology and medical device development positions the state as a primary market driver, hosting numerous startups and established companies developing microfluidic technologies. The concentration of venture capital funding and academic research institutions creates a supportive ecosystem for innovation and market development.

Canadian market growth demonstrates strong momentum with increasing adoption in healthcare systems and research institutions. Government initiatives supporting medical technology innovation and healthcare digitization contribute to market expansion, with Ontario and Quebec leading regional adoption rates.

Regional distribution patterns reveal concentration in major metropolitan areas with established healthcare systems and research infrastructure. Cities like Toronto, Vancouver, Boston, New York, and Los Angeles represent key market centers with high adoption rates and innovation activity.

Cross-border collaboration between United States and Canadian companies, research institutions, and healthcare systems facilitates technology transfer and market development. Regulatory harmonization efforts and trade agreements support integrated market development across the region.

Market leadership is distributed among several key categories of companies, each bringing distinct capabilities and market positioning strategies to the North America lab-on-a-chip device market:

Competitive strategies include technology innovation, strategic partnerships, acquisition activities, and market expansion initiatives. Companies leverage their existing customer relationships, distribution networks, and regulatory expertise to accelerate market penetration and growth.

Innovation focus areas include enhanced sensitivity and specificity, reduced sample requirements, faster analysis times, and improved user interfaces. Companies invest heavily in research and development to maintain competitive advantages and address evolving market needs.

Technology-based segmentation reveals distinct market categories based on underlying microfluidic approaches and analytical capabilities:

By Technology:

By Application:

By End User:

Clinical diagnostics applications represent the largest market segment, driven by increasing demand for rapid, accurate diagnostic testing in healthcare settings. Point-of-care applications show particularly strong growth with 18% annual expansion as healthcare systems seek to improve patient outcomes through faster diagnosis and treatment initiation.

Genomics and molecular diagnostics constitute rapidly growing segments, benefiting from advances in personalized medicine and genetic testing capabilities. The integration of microfluidic technologies with next-generation sequencing platforms creates new opportunities for sample preparation and analysis automation.

Drug discovery applications demonstrate steady growth as pharmaceutical companies adopt microfluidic platforms for compound screening, toxicity testing, and pharmacokinetic studies. The ability to reduce sample and reagent consumption while increasing throughput makes these technologies attractive for drug development applications.

Environmental monitoring represents an emerging application area with significant growth potential, particularly for water quality testing and environmental safety applications. Regulatory requirements for environmental monitoring create sustained demand for portable, accurate analytical capabilities.

Research applications continue to drive innovation and technology development, with academic and commercial research institutions serving as early adopters of advanced microfluidic capabilities. These applications often lead to clinical and commercial implementations as technologies mature and prove their effectiveness.

Healthcare providers benefit significantly from lab-on-a-chip device implementation through improved diagnostic capabilities, reduced testing costs, and enhanced patient care delivery. The ability to perform complex analyses at the point of care enables faster clinical decision-making and improved patient outcomes.

Cost reduction advantages include decreased reagent consumption, reduced sample requirements, and lower operational costs compared to traditional laboratory testing methods. Healthcare facilities report 30-50% cost savings in appropriate applications while maintaining or improving diagnostic accuracy.

Patients experience improved healthcare delivery through faster diagnosis, reduced sample collection requirements, and enhanced access to advanced diagnostic testing. The convenience of point-of-care testing eliminates the need for multiple healthcare visits and reduces anxiety associated with waiting for test results.

Research organizations gain access to advanced analytical capabilities that enable new research approaches and accelerate discovery processes. The ability to perform high-throughput analysis with minimal sample requirements opens new research possibilities and improves research efficiency.

Technology companies benefit from growing market opportunities, innovation potential, and the ability to leverage existing capabilities in new application areas. The convergence of multiple technology disciplines creates opportunities for companies with complementary expertise to enter the market.

Healthcare systems achieve improved efficiency, better resource utilization, and enhanced capability to serve diverse patient populations. The scalability and portability of lab-on-a-chip devices enable healthcare delivery in remote or resource-limited settings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Miniaturization advancement continues driving market evolution with increasingly sophisticated devices capable of performing complex analytical procedures in smaller form factors. Advanced manufacturing techniques enable integration of multiple functions while reducing device size and cost.

Artificial intelligence integration represents a transformative trend, with machine learning algorithms enhancing diagnostic accuracy, automating result interpretation, and enabling predictive analytics capabilities. This integration creates new value propositions and market opportunities.

Point-of-care expansion accelerates across multiple healthcare settings, driven by demand for decentralized testing capabilities and improved patient care delivery. The trend toward home healthcare and remote monitoring creates new applications for portable diagnostic devices.

Multiplexing capabilities advance rapidly, with devices capable of performing multiple simultaneous analyses from single samples. This trend improves diagnostic efficiency while reducing sample requirements and testing costs.

Connectivity enhancement through wireless communication and cloud integration enables seamless data sharing, remote monitoring, and integration with electronic health records. These capabilities support telemedicine applications and improve healthcare coordination.

Sustainability focus drives development of environmentally friendly devices and manufacturing processes, responding to growing environmental consciousness in healthcare and research sectors. Companies increasingly emphasize sustainable materials and reduced waste generation.

Recent technological breakthroughs have significantly advanced lab-on-a-chip device capabilities and market opportunities. MarkWide Research analysis indicates that major developments in sensor integration and manufacturing processes have improved device performance while reducing production costs.

Strategic partnerships between technology companies, healthcare organizations, and research institutions continue reshaping the competitive landscape. These collaborations combine complementary expertise and resources to accelerate innovation and market development.

Regulatory milestone achievements include breakthrough device designations and expedited approval pathways for innovative diagnostic technologies. These developments reduce time-to-market and encourage continued investment in research and development activities.

Manufacturing innovations in 3D printing, precision molding, and automated assembly processes have improved device quality while reducing production costs. These advances enable broader market adoption and support scaling of production capabilities.

Clinical validation studies continue demonstrating the effectiveness and reliability of lab-on-a-chip devices across various applications, building confidence among healthcare providers and supporting market adoption. Published research results validate technology benefits and support regulatory approval processes.

Investment activities include significant venture capital funding for emerging companies and strategic acquisitions by established medical device manufacturers. These investments support continued innovation and market development across multiple application areas.

Strategic recommendations for market participants focus on leveraging technological capabilities while addressing key market challenges and opportunities. Companies should prioritize application-specific solutions that deliver clear value propositions to target customers while building sustainable competitive advantages.

Technology development priorities should emphasize user-friendly interfaces, improved reliability, and enhanced analytical capabilities. The integration of artificial intelligence and machine learning technologies offers significant opportunities for differentiation and value creation.

Market entry strategies should consider partnership approaches that combine technological capabilities with established distribution networks and customer relationships. Collaboration with healthcare systems and research institutions can accelerate adoption and provide valuable market feedback.

Regulatory strategy requires early engagement with regulatory agencies and comprehensive clinical validation programs to support approval processes. Companies should invest in regulatory expertise and maintain close relationships with regulatory authorities.

Manufacturing scalability planning should address quality control requirements, cost optimization opportunities, and supply chain resilience. Investment in advanced manufacturing capabilities and quality systems is essential for long-term market success.

International expansion opportunities should leverage North American technological leadership while adapting to local market requirements and regulatory frameworks. Strategic partnerships with local companies can facilitate market entry and accelerate adoption.

Long-term market prospects remain highly favorable for the North America lab-on-a-chip device market, with continued growth expected across multiple application areas and technology segments. MWR projections indicate sustained expansion driven by healthcare digitization trends, technological advancement, and growing demand for personalized medicine approaches.

Technology evolution will likely focus on enhanced integration capabilities, improved sensitivity and specificity, and expanded multiplexing capabilities. The convergence with artificial intelligence, machine learning, and advanced data analytics will create new market opportunities and value propositions.

Market expansion beyond traditional healthcare applications will continue, with environmental monitoring, food safety, and industrial applications representing significant growth opportunities. The versatility of microfluidic technologies enables adaptation to diverse analytical requirements across multiple sectors.

Regulatory environment evolution will likely support continued innovation while maintaining safety and efficacy standards. Streamlined approval processes and harmonized international standards will facilitate market development and global expansion opportunities.

Competitive landscape will continue evolving through strategic partnerships, acquisitions, and technology licensing agreements. The balance between innovation investment and market commercialization will determine long-term competitive positioning and market success.

Growth projections indicate sustained market expansion with anticipated growth rates of 11-14% CAGR over the next five years, driven by increasing adoption across healthcare, research, and industrial applications. The market’s maturation will likely lead to improved standardization and reduced costs, further accelerating adoption rates.

The North America lab-on-a-chip device market represents a dynamic and rapidly evolving segment within the broader medical technology landscape, characterized by strong growth fundamentals, technological innovation, and expanding application opportunities. The market’s success stems from the convergence of advanced microfluidics, biotechnology, and digital health technologies, creating sophisticated analytical capabilities in miniaturized, cost-effective platforms.

Market drivers including healthcare cost pressures, demand for point-of-care diagnostics, and personalized medicine trends continue supporting robust growth across multiple segments and applications. The region’s strong healthcare infrastructure, regulatory framework, and innovation ecosystem provide competitive advantages that position North America as a global leader in microfluidic technology development and commercialization.

Future success will depend on continued technological advancement, strategic market positioning, and effective addressing of key challenges including manufacturing scalability, regulatory compliance, and cost optimization. Companies that successfully navigate these challenges while delivering clear value propositions to target customers will capture the most significant opportunities in this expanding market. The integration of artificial intelligence, enhanced connectivity, and improved user interfaces will likely define the next generation of lab-on-a-chip devices and drive continued market evolution and growth.

What is Lab-on-a-chip Device?

Lab-on-a-chip devices are miniaturized systems that integrate multiple laboratory functions on a single chip, enabling rapid analysis and processing of biological and chemical samples. They are widely used in diagnostics, drug development, and environmental monitoring.

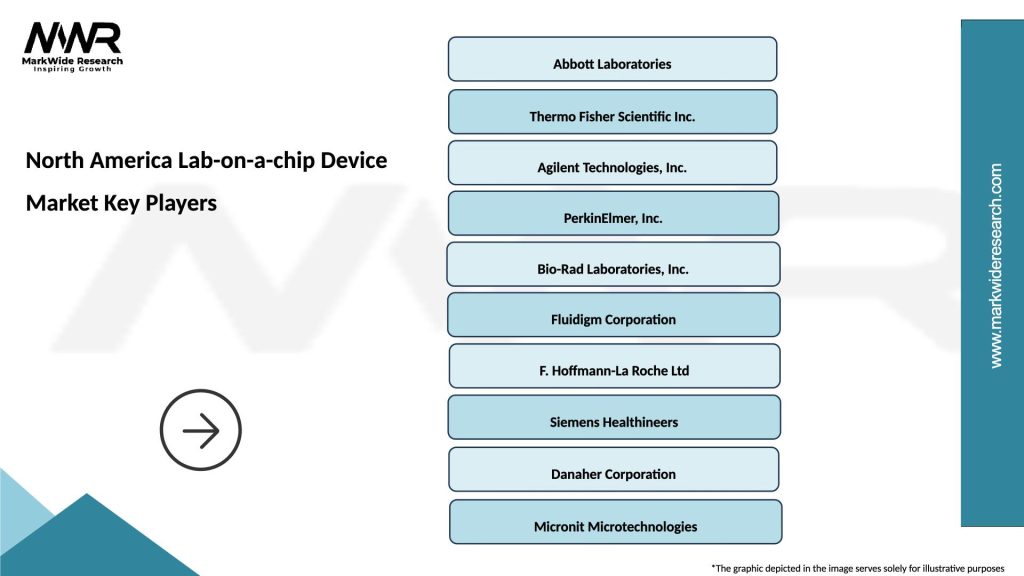

What are the key players in the North America Lab-on-a-chip Device Market?

Key players in the North America Lab-on-a-chip Device Market include Abbott Laboratories, Agilent Technologies, and Bio-Rad Laboratories, among others. These companies are known for their innovative technologies and extensive product portfolios in the lab-on-a-chip space.

What are the growth factors driving the North America Lab-on-a-chip Device Market?

The North America Lab-on-a-chip Device Market is driven by factors such as the increasing demand for point-of-care testing, advancements in microfluidics technology, and the growing prevalence of chronic diseases. These elements contribute to the rising adoption of lab-on-a-chip devices in healthcare.

What challenges does the North America Lab-on-a-chip Device Market face?

Challenges in the North America Lab-on-a-chip Device Market include high development costs, regulatory hurdles, and the need for skilled personnel to operate these advanced technologies. These factors can hinder market growth and innovation.

What opportunities exist in the North America Lab-on-a-chip Device Market?

The North America Lab-on-a-chip Device Market presents opportunities in areas such as personalized medicine, rapid diagnostics, and integration with digital health technologies. These trends are expected to enhance the capabilities and applications of lab-on-a-chip devices.

What are the current trends in the North America Lab-on-a-chip Device Market?

Current trends in the North America Lab-on-a-chip Device Market include the development of multi-analyte detection systems, miniaturization of devices, and the incorporation of artificial intelligence for data analysis. These innovations are shaping the future of lab-on-a-chip technologies.

North America Lab-on-a-chip Device Market

| Segmentation Details | Description |

|---|---|

| Product Type | Microfluidics, Biosensors, Assay Platforms, Integrated Systems |

| Technology | Optical, Electrochemical, Thermal, Acoustic |

| End User | Research Laboratories, Pharmaceutical Companies, Diagnostic Centers, Academic Institutions |

| Application | Drug Development, Disease Diagnosis, Environmental Monitoring, Food Safety Testing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Lab-on-a-chip Device Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at