444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America IT Asset Disposition (ITAD) market represents a critical component of the region’s technology lifecycle management ecosystem. This rapidly expanding sector encompasses the comprehensive management of end-of-life IT equipment, including secure data destruction, asset recovery, and environmentally responsible disposal practices. Market dynamics indicate robust growth driven by increasing regulatory compliance requirements, heightened cybersecurity concerns, and growing environmental sustainability initiatives across enterprises.

Enterprise adoption of ITAD services has accelerated significantly, with organizations recognizing the strategic importance of proper IT asset retirement. The market demonstrates strong momentum across various sectors, including healthcare, financial services, government, and manufacturing. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting increasing awareness of data security risks and environmental compliance obligations.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with significant growth potential. The market’s evolution reflects broader trends toward circular economy principles, with organizations increasingly viewing IT asset disposition as both a risk mitigation strategy and value recovery opportunity.

The North America IT Asset Disposition market refers to the comprehensive ecosystem of services and solutions designed to manage the secure, compliant, and environmentally responsible retirement of information technology equipment across organizations in the United States and Canada. This market encompasses the entire lifecycle of IT asset retirement, from initial assessment and data sanitization to physical destruction, refurbishment, and remarketing of recoverable assets.

ITAD services fundamentally address three critical organizational needs: data security protection through certified destruction processes, regulatory compliance adherence across multiple jurisdictions, and environmental stewardship through responsible recycling and disposal practices. The market includes specialized service providers, technology vendors, and integrated solutions that enable organizations to mitigate risks while maximizing asset value recovery during equipment retirement phases.

Market transformation within the North America ITAD sector reflects evolving enterprise priorities around data protection, environmental responsibility, and operational efficiency. Organizations increasingly recognize ITAD as a strategic business function rather than a simple disposal activity, driving demand for comprehensive service portfolios that address complex regulatory and security requirements.

Key market drivers include accelerating digital transformation initiatives, which generate higher volumes of retiring IT equipment, and strengthening data privacy regulations that mandate secure destruction protocols. Environmental sustainability concerns contribute significantly to market growth, with 72% of enterprises now prioritizing circular economy principles in their IT asset management strategies.

Service evolution demonstrates increasing sophistication, with providers expanding beyond basic disposal services to offer comprehensive asset lifecycle management, including inventory tracking, compliance reporting, and value recovery optimization. The market benefits from growing awareness of hidden costs associated with improper IT asset disposition, including regulatory penalties, data breach risks, and environmental liabilities.

Strategic insights reveal several fundamental trends shaping the North America ITAD market landscape:

Regulatory compliance requirements serve as the primary catalyst driving North America ITAD market expansion. Strengthening data protection legislation, including state-level privacy laws and federal security mandates, creates mandatory requirements for secure IT asset disposition. Organizations face significant penalties for non-compliance, with regulatory violations potentially resulting in substantial financial and reputational consequences.

Cybersecurity concerns intensify demand for certified data destruction services, as organizations recognize the persistent risks associated with improperly disposed IT equipment. High-profile data breaches involving retired assets have heightened awareness of security vulnerabilities, driving investment in comprehensive ITAD solutions that ensure complete data sanitization.

Environmental sustainability initiatives contribute significantly to market growth, with corporate responsibility programs increasingly prioritizing responsible e-waste management. Organizations seek to minimize environmental impact while meeting stakeholder expectations for sustainable business practices. Circular economy principles encourage asset reuse and recycling, creating opportunities for value recovery through refurbishment and remarketing services.

Digital transformation acceleration generates higher volumes of retiring IT equipment, as organizations upgrade infrastructure to support modern business requirements. Cloud migration initiatives, remote work implementations, and technology refresh cycles create substantial ITAD service demand across enterprise segments.

Cost considerations present significant challenges for organizations evaluating ITAD service adoption, particularly among small and medium enterprises with limited budgets. Comprehensive ITAD solutions require substantial investment, and organizations may delay proper asset disposition due to perceived high service costs relative to internal disposal alternatives.

Service provider fragmentation complicates vendor selection processes, as the market includes numerous specialized providers with varying capabilities and certifications. Organizations struggle to identify qualified ITAD partners that meet specific industry requirements and compliance standards, potentially delaying implementation of proper asset disposition programs.

Internal resistance to outsourcing IT asset disposition functions creates implementation barriers, as some organizations prefer maintaining direct control over sensitive equipment retirement processes. Concerns about data security during transportation and processing may limit adoption of third-party ITAD services, particularly among highly regulated industries.

Logistical complexities associated with multi-location asset collection and processing present operational challenges for large enterprises. Coordinating ITAD services across distributed facilities requires sophisticated project management capabilities and may result in implementation delays or increased costs.

Emerging technology integration presents substantial opportunities for ITAD service enhancement, including blockchain-based asset tracking, artificial intelligence-powered inventory management, and advanced data analytics for value optimization. These innovations can differentiate service providers while improving operational efficiency and customer transparency.

Industry vertical specialization offers significant growth potential, as different sectors require tailored ITAD approaches addressing specific regulatory and operational requirements. Healthcare, financial services, and government segments present particularly attractive opportunities for specialized service development.

Geographic expansion within North America provides growth opportunities, particularly in underserved markets and emerging metropolitan areas. As businesses across the region recognize ITAD importance, service providers can expand coverage areas and capture new customer segments.

Value-added service development enables ITAD providers to expand beyond basic disposal functions, offering comprehensive asset lifecycle management, sustainability reporting, and strategic consulting services. These enhanced offerings can improve customer retention while generating higher revenue per engagement.

Competitive intensity within the North America ITAD market continues increasing as established providers expand service portfolios while new entrants target specific market segments. This competition drives innovation in service delivery, pricing models, and customer experience enhancement, ultimately benefiting end-users through improved value propositions.

Technology evolution significantly impacts market dynamics, with advancing data destruction techniques, asset tracking capabilities, and process automation improving service efficiency and reliability. Providers investing in technology innovation gain competitive advantages through enhanced service quality and operational scalability.

Customer expectations continue evolving toward comprehensive solutions that address multiple organizational needs simultaneously. Modern ITAD engagements increasingly require integration with broader IT asset management strategies, sustainability reporting, and risk management frameworks.

Regulatory landscape changes create both opportunities and challenges, as new compliance requirements drive demand while potentially increasing operational complexity. Successful ITAD providers must maintain current knowledge of regulatory developments while adapting service offerings accordingly.

Comprehensive market analysis employed multiple research approaches to ensure accurate and reliable insights into the North America ITAD market landscape. Primary research included extensive interviews with industry executives, service providers, and end-user organizations across various sectors to understand current market conditions, emerging trends, and future growth prospects.

Secondary research encompassed detailed analysis of industry reports, regulatory documentation, financial statements, and market intelligence from authoritative sources. This approach provided quantitative data supporting qualitative insights while ensuring comprehensive market coverage across all relevant segments and geographic regions.

Data validation processes included cross-referencing multiple sources, conducting follow-up interviews for clarification, and employing statistical analysis techniques to ensure accuracy and reliability. Market sizing and growth projections utilized conservative estimation methodologies to provide realistic and achievable forecasts.

Expert consultation with industry specialists, regulatory authorities, and technology vendors provided additional perspective on market dynamics, competitive landscape evolution, and future development scenarios. This collaborative approach enhanced research depth while ensuring practical relevance for market participants.

United States dominance within the North America ITAD market reflects the country’s large enterprise base, stringent regulatory environment, and advanced technology adoption rates. The U.S. market benefits from mature ITAD service infrastructure, established provider networks, and strong awareness of data security and environmental compliance requirements.

California and Texas represent the largest state markets, driven by significant technology sector presence, large enterprise populations, and progressive environmental regulations. These states demonstrate above-average growth rates of approximately 9.1%, reflecting strong demand for comprehensive ITAD solutions across multiple industry verticals.

Canadian market growth shows substantial potential, with increasing regulatory focus on data protection and environmental stewardship driving ITAD service adoption. The Canadian market demonstrates accelerating growth at approximately 7.8% annually, supported by government initiatives promoting circular economy principles and responsible e-waste management.

Regional service distribution indicates concentration in major metropolitan areas, with MarkWide Research analysis showing urban markets accounting for approximately 85% of total demand. Rural and secondary markets present growth opportunities as ITAD awareness expands and service accessibility improves through provider network expansion.

Market leadership within the North America ITAD sector includes several established providers offering comprehensive service portfolios:

Competitive differentiation increasingly centers on service comprehensiveness, technology innovation, and industry specialization. Leading providers invest heavily in certification maintenance, process automation, and customer experience enhancement to maintain market position.

Strategic partnerships between ITAD providers and technology vendors create competitive advantages through integrated service delivery and expanded market reach. These alliances enable comprehensive solutions spanning equipment procurement through end-of-life disposition.

By Service Type:

By End-User Industry:

By Asset Type:

Data destruction services represent the fastest-growing segment, driven by increasing cybersecurity concerns and regulatory compliance requirements. Organizations prioritize certified destruction capabilities that provide verifiable proof of data sanitization, with demand growth exceeding 10.2% annually across enterprise segments.

Asset recovery services demonstrate strong value proposition appeal, as organizations seek to offset ITAD costs through equipment remarketing and refurbishment programs. This segment benefits from growing awareness of residual asset value and corporate sustainability initiatives promoting circular economy principles.

Healthcare sector demand shows exceptional growth potential, driven by stringent HIPAA compliance requirements and increasing digitization of medical records. Healthcare organizations require specialized ITAD services that address unique regulatory and security challenges while maintaining operational continuity.

Government segment expansion reflects increasing focus on cybersecurity and data protection across federal, state, and local agencies. Government ITAD requirements often include enhanced security protocols, specialized certifications, and detailed audit trails supporting compliance documentation.

Risk mitigation advantages provide substantial value for organizations implementing comprehensive ITAD programs. Proper asset disposition eliminates data breach risks, ensures regulatory compliance, and protects organizational reputation through certified destruction processes and detailed documentation.

Cost optimization opportunities enable organizations to recover value from retiring IT assets while reducing disposal costs. Professional ITAD services often generate positive return on investment through asset remarketing, tax benefits, and avoided compliance penalties.

Environmental stewardship benefits support corporate sustainability goals while meeting stakeholder expectations for responsible business practices. ITAD services enable organizations to minimize environmental impact through proper recycling and waste reduction initiatives.

Operational efficiency improvements result from outsourcing complex asset disposition processes to specialized providers. Organizations can focus on core business activities while ensuring professional management of IT asset retirement requirements.

Compliance assurance provides peace of mind through certified processes that meet regulatory requirements across multiple jurisdictions. Professional ITAD providers maintain current knowledge of evolving compliance standards while providing necessary documentation and audit trails.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with organizations increasingly prioritizing environmental impact reduction through comprehensive ITAD programs. Corporate sustainability reporting requirements drive demand for detailed environmental metrics and circular economy compliance documentation.

Technology advancement transforms service delivery through blockchain asset tracking, artificial intelligence-powered inventory management, and automated reporting systems. These innovations improve transparency, efficiency, and customer experience while reducing operational costs for service providers.

Industry specialization accelerates as ITAD providers develop sector-specific expertise addressing unique regulatory and operational requirements. Healthcare, financial services, and government segments demand specialized solutions that standard providers cannot adequately address.

Service integration expands beyond basic disposal functions to encompass comprehensive asset lifecycle management, including procurement support, inventory tracking, and strategic planning services. This trend reflects growing recognition of ITAD as a strategic business function rather than a tactical disposal activity.

Partnership evolution includes strategic alliances between ITAD providers, technology vendors, and consulting firms to deliver integrated solutions spanning entire IT asset lifecycles. These partnerships enable comprehensive service delivery while expanding market reach for all participants.

Regulatory enhancement continues shaping market evolution, with new data protection laws and environmental regulations creating additional compliance requirements. Recent state-level privacy legislation expands mandatory data destruction requirements while federal initiatives promote responsible e-waste management practices.

Technology innovation drives service improvement through advanced data destruction techniques, automated asset processing, and enhanced tracking capabilities. Leading providers invest significantly in technology development to maintain competitive advantages and improve operational efficiency.

Market consolidation accelerates as larger providers acquire specialized firms to expand service capabilities and geographic coverage. This trend creates more comprehensive solution providers while potentially reducing competition in certain market segments.

Certification expansion includes new industry standards addressing emerging security and environmental requirements. These certifications provide competitive differentiation while ensuring service quality and compliance across diverse customer segments.

Customer education initiatives increase awareness of ITAD importance and available solutions. Industry associations, service providers, and regulatory agencies collaborate to promote best practices and highlight risks associated with improper IT asset disposition.

Strategic positioning recommendations emphasize the importance of comprehensive service portfolio development addressing diverse customer needs across multiple industry verticals. Organizations should prioritize providers offering integrated solutions spanning entire asset lifecycles rather than basic disposal services.

Investment priorities should focus on technology innovation, certification maintenance, and geographic expansion to capture emerging opportunities while maintaining competitive positioning. Successful providers will differentiate through service quality, transparency, and customer experience rather than price competition alone.

Partnership development presents significant opportunities for market expansion and service enhancement. Strategic alliances with technology vendors, consulting firms, and industry specialists can provide competitive advantages while expanding addressable market opportunities.

Compliance focus remains critical as regulatory requirements continue evolving across multiple jurisdictions. Organizations must maintain current knowledge of compliance standards while investing in capabilities that ensure consistent adherence to emerging requirements.

MWR analysis suggests that organizations prioritizing sustainability integration, technology innovation, and industry specialization will achieve superior growth and profitability compared to providers focusing solely on cost competition.

Growth trajectory for the North America ITAD market remains robust, with MarkWide Research projecting continued expansion driven by increasing regulatory requirements, environmental sustainability initiatives, and growing awareness of data security risks. Market evolution will favor providers offering comprehensive solutions addressing multiple organizational needs simultaneously.

Technology integration will accelerate, with advanced tracking, analytics, and automation capabilities becoming standard service components rather than competitive differentiators. Organizations investing in technology innovation today will maintain advantages as market expectations continue evolving.

Industry specialization will intensify as different sectors develop unique ITAD requirements addressing specific regulatory and operational challenges. Providers developing vertical expertise will capture premium pricing while achieving higher customer retention rates.

Service evolution will expand beyond traditional disposal functions to encompass strategic consulting, sustainability reporting, and comprehensive asset lifecycle management. This transformation reflects growing recognition of ITAD as a critical business function requiring professional expertise and strategic planning.

Market maturation will result in consolidation among smaller providers while creating opportunities for innovative firms addressing emerging customer needs. Successful organizations will balance growth ambitions with service quality maintenance and regulatory compliance requirements.

The North America IT Asset Disposition market represents a dynamic and rapidly evolving sector driven by increasing regulatory requirements, environmental sustainability initiatives, and growing awareness of data security risks. Market growth reflects fundamental shifts in organizational priorities toward comprehensive risk management, environmental stewardship, and value optimization throughout IT asset lifecycles.

Strategic opportunities abound for organizations willing to invest in technology innovation, industry specialization, and comprehensive service development. The market rewards providers offering integrated solutions addressing multiple customer needs while maintaining high service quality and regulatory compliance standards.

Future success will depend on adaptability to evolving regulatory requirements, investment in technology advancement, and development of strategic partnerships enabling comprehensive solution delivery. Organizations prioritizing customer experience, transparency, and environmental responsibility will achieve superior growth and profitability in this expanding market landscape.

What is IT Asset Disposition?

IT Asset Disposition refers to the processes involved in the proper disposal of IT assets, including hardware and software, in a secure and environmentally responsible manner. This includes data destruction, recycling, and resale of equipment.

What are the key players in the North America IT Asset Disposition Market?

Key players in the North America IT Asset Disposition Market include Iron Mountain, Sims Recycling Solutions, and Dell Technologies, among others. These companies provide a range of services from data destruction to asset recovery.

What are the main drivers of the North America IT Asset Disposition Market?

The main drivers of the North America IT Asset Disposition Market include the increasing need for data security, regulatory compliance, and the growing emphasis on sustainable practices in technology disposal. Organizations are prioritizing secure data destruction to mitigate risks.

What challenges does the North America IT Asset Disposition Market face?

Challenges in the North America IT Asset Disposition Market include the complexity of compliance with various regulations and the potential for data breaches during the disposal process. Additionally, the rapid pace of technological change can lead to increased volumes of obsolete equipment.

What opportunities exist in the North America IT Asset Disposition Market?

Opportunities in the North America IT Asset Disposition Market include the expansion of e-waste recycling initiatives and the growing demand for refurbished IT equipment. Companies are increasingly looking for sustainable solutions that also provide cost savings.

What trends are shaping the North America IT Asset Disposition Market?

Trends shaping the North America IT Asset Disposition Market include the rise of circular economy practices, advancements in data sanitization technologies, and increased collaboration between IT asset disposition firms and manufacturers. These trends are driving innovation and efficiency in asset management.

North America IT Asset Disposition Market

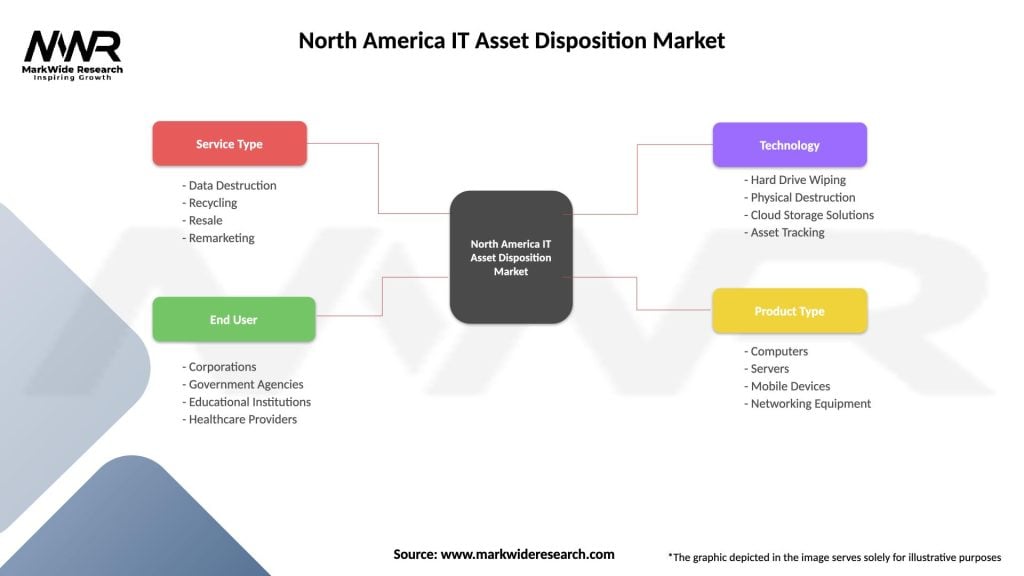

| Segmentation Details | Description |

|---|---|

| Service Type | Data Destruction, Recycling, Resale, Remarketing |

| End User | Corporations, Government Agencies, Educational Institutions, Healthcare Providers |

| Technology | Hard Drive Wiping, Physical Destruction, Cloud Storage Solutions, Asset Tracking |

| Product Type | Computers, Servers, Mobile Devices, Networking Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America IT Asset Disposition Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at