444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America irrigation valves market represents a critical component of the region’s agricultural infrastructure, encompassing sophisticated water management systems that serve diverse farming operations across the United States, Canada, and Mexico. This dynamic market has experienced substantial growth driven by increasing agricultural productivity demands, water conservation initiatives, and technological advancement in precision farming. The market demonstrates remarkable resilience with projected growth rates of 6.2% CAGR through the forecast period, reflecting the essential nature of efficient irrigation systems in modern agriculture.

Market dynamics indicate strong adoption of smart irrigation technologies, with automated valve systems gaining significant traction among commercial farming operations. The integration of IoT-enabled irrigation valves has revolutionized water management practices, enabling farmers to optimize water usage while maximizing crop yields. Regional variations in agricultural practices, climate conditions, and regulatory frameworks create distinct market segments, with California, Texas, and the Midwest representing the largest consumption areas for advanced irrigation valve systems.

Technological innovation continues to reshape the landscape, with manufacturers developing increasingly sophisticated valve systems that incorporate pressure regulation, flow control, and remote monitoring capabilities. The market benefits from strong agricultural sector fundamentals, government support for water conservation technologies, and growing awareness of sustainable farming practices across North American agricultural communities.

The North America irrigation valves market refers to the comprehensive ecosystem of water control devices, systems, and technologies used to regulate water flow in agricultural irrigation applications across the United States, Canada, and Mexico. These specialized valves serve as critical components in irrigation infrastructure, enabling precise water distribution, pressure management, and flow control for various agricultural applications ranging from small-scale farming operations to large commercial agricultural enterprises.

Irrigation valves encompass a diverse range of products including gate valves, ball valves, butterfly valves, check valves, pressure reducing valves, and electronically controlled smart valves. These systems integrate with broader irrigation infrastructure including sprinkler systems, drip irrigation networks, center pivot systems, and micro-irrigation applications. The market includes both traditional mechanical valve systems and advanced electronic valve solutions that incorporate sensors, automation capabilities, and connectivity features for precision agriculture applications.

Strategic analysis reveals the North America irrigation valves market as a robust and evolving sector characterized by steady growth, technological innovation, and increasing adoption of precision agriculture technologies. The market demonstrates strong fundamentals driven by expanding agricultural production, water scarcity concerns, and regulatory support for efficient irrigation practices. Key growth drivers include the modernization of aging irrigation infrastructure, adoption of smart farming technologies, and increasing focus on sustainable water management practices.

Market segmentation shows diverse applications across crop types, irrigation methods, and farm sizes, with commercial agriculture representing the largest demand segment. The integration of digital technologies has created new opportunities for valve manufacturers, with smart irrigation systems showing adoption rates of 34% annually among progressive farming operations. Regional market dynamics vary significantly, with western states leading in advanced irrigation technology adoption due to water scarcity challenges and regulatory requirements.

Competitive landscape features established manufacturers alongside emerging technology companies, creating a dynamic environment for innovation and market expansion. The market benefits from strong agricultural sector performance, government incentives for water conservation technologies, and increasing awareness of precision agriculture benefits among farming communities across North America.

Fundamental market insights reveal several critical trends shaping the North America irrigation valves market landscape:

Primary growth drivers propelling the North America irrigation valves market include increasing agricultural productivity demands, water conservation imperatives, and technological advancement in precision farming systems. The growing emphasis on sustainable agriculture practices has created substantial demand for efficient irrigation valve systems that optimize water usage while maintaining crop yields. Climate variability and increasing frequency of drought conditions across key agricultural regions have intensified focus on water-efficient irrigation technologies.

Technological innovation serves as a significant market driver, with smart irrigation valve systems offering enhanced functionality including remote monitoring, automated control, and integration with farm management systems. The adoption of precision agriculture technologies has created new opportunities for advanced valve systems that can respond to real-time soil moisture data, weather conditions, and crop requirements. Government incentives and regulatory support for water conservation technologies provide additional momentum for market growth.

Economic factors including rising agricultural commodity prices, increasing farm profitability, and access to agricultural financing support capital investments in modern irrigation infrastructure. The growing recognition of irrigation efficiency as a competitive advantage drives adoption of advanced valve systems among progressive farming operations. Labor shortage challenges in agriculture also promote automation technologies, including smart irrigation valve systems that reduce manual intervention requirements.

Significant market restraints include high initial capital costs associated with advanced irrigation valve systems, particularly for smart technology solutions that require substantial upfront investment. Many farming operations, especially smaller agricultural enterprises, face budget constraints that limit adoption of premium valve technologies. The complexity of modern irrigation valve systems can create implementation challenges, requiring specialized technical expertise that may not be readily available in all agricultural regions.

Technical challenges include integration difficulties with existing irrigation infrastructure, compatibility issues between different system components, and maintenance requirements for sophisticated electronic valve systems. The agricultural sector’s traditionally conservative approach to technology adoption can slow market penetration of innovative valve solutions. Seasonal demand patterns create revenue volatility for manufacturers, with peak installation periods concentrated in specific months.

Regulatory complexity varies across different states and provinces, creating compliance challenges for valve manufacturers and potentially limiting market expansion. Economic uncertainty in agricultural markets can impact farmer investment decisions, affecting demand for irrigation infrastructure upgrades. The availability of skilled technicians for installation and maintenance of advanced valve systems remains limited in some rural agricultural areas.

Substantial market opportunities emerge from the growing adoption of precision agriculture technologies, creating demand for intelligent irrigation valve systems that integrate with farm management platforms. The expansion of specialty crop production, including organic farming and high-value horticultural crops, generates opportunities for specialized valve solutions tailored to specific irrigation requirements. Climate change adaptation strategies present opportunities for drought-resistant irrigation technologies and water-efficient valve systems.

Technological advancement creates opportunities for innovative valve designs incorporating artificial intelligence, machine learning, and predictive analytics capabilities. The development of wireless communication technologies enables new possibilities for remote valve control and monitoring systems. Integration with renewable energy systems, particularly solar-powered irrigation, presents opportunities for sustainable valve solutions that appeal to environmentally conscious farmers.

Market expansion opportunities include penetration into underserved agricultural segments, development of cost-effective valve solutions for smaller farming operations, and expansion into emerging agricultural regions. The growing interest in urban agriculture and controlled environment farming creates new market segments for specialized irrigation valve applications. Export opportunities to other regions experiencing similar agricultural modernization trends provide additional growth potential for North American valve manufacturers.

Complex market dynamics shape the North America irrigation valves market through the interaction of technological innovation, regulatory influences, and agricultural sector evolution. The market demonstrates cyclical patterns aligned with agricultural investment cycles, weather conditions, and commodity price fluctuations. Seasonal demand variations create distinct market rhythms, with peak activity during spring planting seasons and infrastructure upgrade periods.

Supply chain dynamics involve multiple stakeholders including valve manufacturers, irrigation system integrators, agricultural equipment dealers, and farming operations. The market benefits from established distribution networks and strong relationships between manufacturers and agricultural communities. Raw material availability and pricing fluctuations impact manufacturing costs and product pricing strategies across the valve industry.

Innovation cycles drive continuous product development, with manufacturers investing heavily in research and development to create next-generation valve technologies. Market consolidation trends affect competitive dynamics, with larger companies acquiring specialized valve manufacturers to expand product portfolios and market reach. The integration of digital technologies creates new business models and service opportunities beyond traditional valve manufacturing and sales.

Comprehensive research methodology employed for analyzing the North America irrigation valves market incorporates multiple data collection approaches including primary research interviews with industry stakeholders, secondary research analysis of market reports and industry publications, and quantitative analysis of market trends and growth patterns. The methodology ensures robust data validation through triangulation of information sources and cross-verification of market insights.

Primary research activities include structured interviews with valve manufacturers, irrigation system integrators, agricultural equipment dealers, and farming operation representatives across diverse geographic regions and agricultural segments. Survey methodologies capture quantitative data on market size, growth rates, technology adoption patterns, and purchasing behavior among target market segments. Focus group discussions provide qualitative insights into market trends, customer preferences, and emerging opportunities.

Secondary research analysis encompasses review of industry reports, government agricultural statistics, trade association publications, and academic research studies related to irrigation technology and agricultural water management. Market data analysis includes historical trend evaluation, competitive landscape assessment, and regulatory impact analysis. The research methodology incorporates statistical modeling techniques to project future market trends and validate growth assumptions through multiple analytical approaches.

United States market dominates the North America irrigation valves sector, accounting for approximately 78% market share due to extensive agricultural operations, advanced irrigation infrastructure, and strong adoption of precision farming technologies. California leads state-level demand with 22% regional market share, driven by intensive agricultural production, water scarcity challenges, and regulatory requirements for efficient irrigation systems. Texas, Nebraska, and Kansas represent additional key markets with significant irrigation valve consumption across diverse crop production systems.

Canadian market demonstrates steady growth with particular strength in prairie provinces where grain production and specialty crop farming drive irrigation infrastructure investment. The adoption of advanced valve technologies shows 15% annual growth in Canadian agricultural regions, supported by government programs promoting water conservation and agricultural modernization. British Columbia’s fruit and vegetable production sectors create demand for specialized irrigation valve applications.

Mexican market presents emerging opportunities with growing agricultural export sectors and increasing adoption of modern irrigation technologies. The market shows strong potential in regions focused on high-value crop production for North American export markets. Regional variations in agricultural practices, water availability, and regulatory frameworks create distinct market segments requiring tailored valve solutions and distribution strategies across the North American landscape.

Competitive market structure features established irrigation equipment manufacturers alongside specialized valve companies and emerging technology providers. The landscape demonstrates ongoing consolidation trends with larger companies acquiring innovative valve manufacturers to expand technological capabilities and market reach.

Market segmentation analysis reveals diverse categories based on valve type, application, irrigation method, and end-user segments. The segmentation framework provides comprehensive understanding of market dynamics and growth opportunities across different product categories and customer segments.

By Valve Type:

By Application:

Smart electronic valves represent the fastest-growing category, driven by increasing adoption of precision agriculture technologies and IoT-enabled irrigation systems. These advanced valve systems offer remote monitoring, automated control, and integration with farm management platforms, providing farmers with unprecedented control over irrigation operations. The category demonstrates strong growth potential with adoption rates increasing by 31% annually among progressive farming operations.

Pressure reducing valves show consistent demand growth due to their critical role in optimizing irrigation system efficiency and preventing equipment damage from excessive water pressure. These specialized valves enable precise pressure management across diverse irrigation applications, supporting water conservation objectives and system longevity. The category benefits from increasing awareness of pressure management importance in modern irrigation systems.

Traditional mechanical valves maintain significant market share due to their reliability, cost-effectiveness, and widespread familiarity among agricultural users. Gate valves and ball valves continue to serve essential functions in irrigation infrastructure, particularly in applications where advanced electronic features are not required. The category demonstrates steady demand with ongoing replacement needs for aging irrigation systems across North America.

Farmers and agricultural operators benefit from improved water use efficiency, reduced labor requirements, and enhanced crop yield optimization through advanced irrigation valve systems. Smart valve technologies enable precise water management, reducing operational costs while supporting sustainable farming practices. The integration of valve systems with precision agriculture platforms provides data-driven insights for optimizing irrigation scheduling and water application rates.

Valve manufacturers benefit from growing market demand, opportunities for technological innovation, and expansion into high-value smart irrigation segments. The market provides stable revenue streams through both new installations and replacement demand for aging irrigation infrastructure. Manufacturers can leverage technological advancement to differentiate products and capture premium pricing for advanced valve solutions.

Irrigation system integrators benefit from increased demand for comprehensive irrigation solutions that incorporate advanced valve technologies. The growing complexity of modern irrigation systems creates opportunities for specialized integration services and ongoing maintenance contracts. System integrators can develop expertise in smart irrigation technologies to capture higher-value projects and build long-term customer relationships.

Agricultural communities benefit from improved water conservation, enhanced agricultural productivity, and reduced environmental impact through efficient irrigation valve systems. The adoption of advanced valve technologies supports sustainable agriculture practices and helps farming communities adapt to changing climate conditions and water availability challenges.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the irrigation valves market, with IoT-enabled smart valves becoming increasingly sophisticated and affordable. These systems incorporate wireless connectivity, cloud-based monitoring, and mobile app control, enabling farmers to manage irrigation systems remotely and optimize water usage based on real-time data. The trend toward digitalization shows 42% adoption growth among commercial farming operations investing in precision agriculture technologies.

Sustainability integration drives demand for valve systems that support water conservation objectives and environmental stewardship practices. Manufacturers are developing valve solutions that minimize water waste, reduce energy consumption, and integrate with renewable energy systems. The sustainability trend influences product design, manufacturing processes, and marketing strategies across the irrigation valve industry.

Automation advancement continues to transform irrigation valve applications, with automated systems reducing labor requirements and improving irrigation precision. Advanced valve systems incorporate sensors, weather data integration, and predictive analytics to optimize irrigation scheduling and water application. The automation trend supports broader agricultural labor shortage challenges while improving operational efficiency and crop yield optimization.

Customization demand grows as farmers seek valve solutions tailored to specific crop requirements, soil conditions, and irrigation methods. Manufacturers are developing modular valve systems and application-specific solutions to address diverse agricultural needs. The customization trend creates opportunities for premium pricing and stronger customer relationships through specialized product offerings.

Recent industry developments demonstrate accelerating innovation and market evolution within the North America irrigation valves sector. Major manufacturers have launched next-generation smart valve systems incorporating artificial intelligence and machine learning capabilities for predictive irrigation management. These advanced systems can analyze weather patterns, soil moisture data, and crop growth stages to optimize irrigation scheduling automatically.

Strategic partnerships between valve manufacturers and precision agriculture technology companies have created integrated solutions that combine advanced valve control with comprehensive farm management platforms. According to MarkWide Research analysis, these partnerships have accelerated technology adoption and created new market opportunities for both valve manufacturers and agricultural technology providers.

Manufacturing investments in North American production facilities reflect growing market confidence and demand for locally manufactured valve systems. Several international valve manufacturers have established or expanded North American operations to serve the growing market and reduce supply chain risks. These investments support market growth while creating local employment opportunities in agricultural regions.

Regulatory developments include new water conservation standards and irrigation efficiency requirements in several states, driving demand for advanced valve technologies that meet stringent performance criteria. Industry associations have developed certification programs for smart irrigation systems, providing quality assurance and supporting market adoption of advanced valve technologies.

Strategic recommendations for market participants include prioritizing investment in smart valve technologies and IoT integration capabilities to capture growing demand for precision agriculture solutions. Manufacturers should focus on developing user-friendly interfaces and comprehensive support services to facilitate adoption among traditional farming operations. The integration of artificial intelligence and predictive analytics represents a key differentiator for next-generation valve systems.

Market positioning strategies should emphasize water conservation benefits, operational efficiency improvements, and long-term cost savings to address farmer concerns about initial investment costs. Companies should develop flexible financing options and demonstrate clear return on investment calculations to support adoption decisions. Building strong relationships with irrigation system integrators and agricultural equipment dealers remains critical for market success.

Innovation priorities should focus on developing cost-effective smart valve solutions that provide advanced functionality at accessible price points for smaller farming operations. Manufacturers should invest in wireless communication technologies, battery life optimization, and weather-resistant designs to improve system reliability and reduce maintenance requirements. The development of retrofit solutions for existing irrigation systems presents significant market opportunities.

Geographic expansion strategies should target underserved agricultural regions and emerging specialty crop markets where advanced irrigation technologies can provide competitive advantages. Companies should consider partnerships with local distributors and agricultural service providers to establish market presence and provide technical support. Export opportunities to international markets experiencing similar agricultural modernization trends offer additional growth potential.

Long-term market projections indicate continued robust growth for the North America irrigation valves market, driven by ongoing agricultural modernization, water conservation imperatives, and technological advancement in precision farming systems. MWR projects sustained growth momentum with smart valve technologies representing an increasing share of total market demand. The integration of artificial intelligence, machine learning, and predictive analytics will create new possibilities for autonomous irrigation management systems.

Technology evolution will focus on developing increasingly sophisticated valve systems that can adapt automatically to changing environmental conditions, crop requirements, and water availability. Future valve systems will incorporate advanced sensors, weather forecasting integration, and crop modeling capabilities to optimize irrigation decisions without human intervention. The convergence of irrigation technology with renewable energy systems will create sustainable solutions that appeal to environmentally conscious farmers.

Market expansion opportunities will emerge from growing specialty crop production, urban agriculture development, and controlled environment farming applications. The increasing focus on food security and sustainable agriculture practices will drive continued investment in efficient irrigation technologies. Climate change adaptation strategies will create demand for drought-resistant irrigation systems and water-efficient valve technologies.

Industry transformation will continue through consolidation trends, strategic partnerships, and the emergence of new business models based on irrigation-as-a-service concepts. The market will benefit from continued government support for water conservation technologies and agricultural modernization programs. Future growth will be supported by expanding agricultural production, increasing crop values, and growing recognition of irrigation efficiency as a competitive advantage in modern farming operations.

The North America irrigation valves market represents a dynamic and essential sector within the broader agricultural infrastructure landscape, characterized by steady growth, technological innovation, and increasing adoption of precision agriculture technologies. The market demonstrates strong fundamentals driven by water conservation imperatives, agricultural productivity demands, and ongoing modernization of irrigation infrastructure across diverse farming operations.

Key success factors for market participants include embracing digital transformation, developing cost-effective smart valve solutions, and building comprehensive support ecosystems that facilitate technology adoption among farming communities. The integration of IoT connectivity, automated control systems, and data analytics capabilities will continue to differentiate leading valve manufacturers and create value for agricultural customers seeking operational efficiency and sustainability benefits.

Future market evolution will be shaped by continued technological advancement, regulatory support for water conservation, and growing recognition of irrigation efficiency as a critical component of sustainable agriculture practices. The market presents substantial opportunities for companies that can successfully balance innovation with affordability, providing advanced valve solutions that deliver measurable benefits to farming operations of all sizes across the North American agricultural landscape.

What is Irrigation Valves?

Irrigation valves are devices used to control the flow of water in irrigation systems, ensuring efficient water distribution for agricultural and landscaping purposes. They play a crucial role in managing water resources and optimizing irrigation practices.

What are the key players in the North America Irrigation Valves Market?

Key players in the North America Irrigation Valves Market include Rain Bird Corporation, Hunter Industries, and Netafim, among others. These companies are known for their innovative products and solutions in the irrigation sector.

What are the growth factors driving the North America Irrigation Valves Market?

The North America Irrigation Valves Market is driven by factors such as the increasing demand for efficient water management in agriculture, the rise in sustainable farming practices, and advancements in irrigation technology. These elements contribute to the market’s expansion.

What challenges does the North America Irrigation Valves Market face?

Challenges in the North America Irrigation Valves Market include regulatory compliance issues, the high cost of advanced irrigation systems, and competition from alternative water management solutions. These factors can hinder market growth.

What opportunities exist in the North America Irrigation Valves Market?

Opportunities in the North America Irrigation Valves Market include the growing adoption of smart irrigation technologies and the increasing focus on water conservation. These trends are likely to create new avenues for innovation and investment.

What trends are shaping the North America Irrigation Valves Market?

Trends shaping the North America Irrigation Valves Market include the integration of IoT in irrigation systems, the development of eco-friendly materials for valve manufacturing, and the shift towards automated irrigation solutions. These innovations are enhancing efficiency and sustainability.

North America Irrigation Valves Market

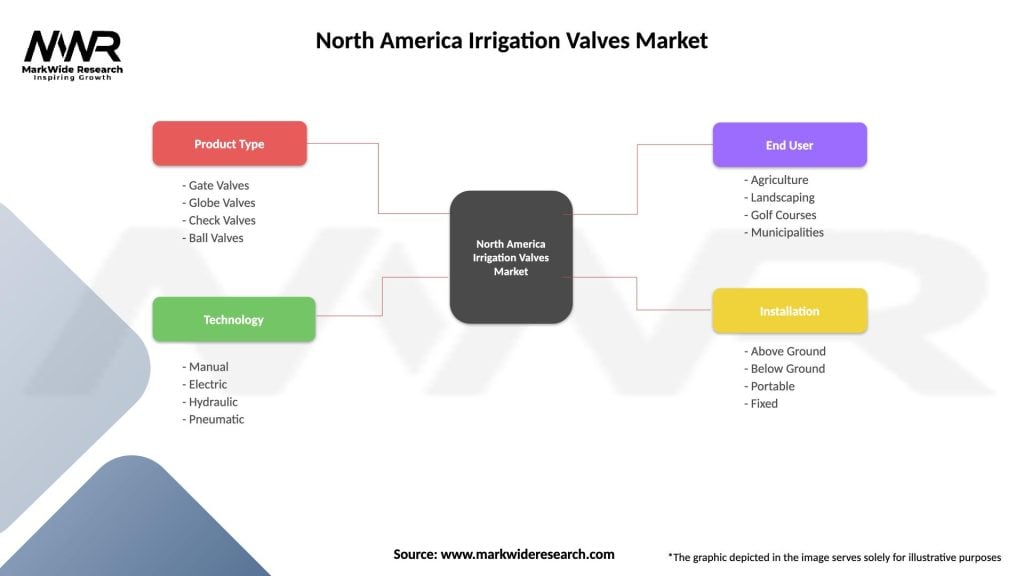

| Segmentation Details | Description |

|---|---|

| Product Type | Gate Valves, Globe Valves, Check Valves, Ball Valves |

| Technology | Manual, Electric, Hydraulic, Pneumatic |

| End User | Agriculture, Landscaping, Golf Courses, Municipalities |

| Installation | Above Ground, Below Ground, Portable, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Irrigation Valves Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at